What is midcap large cap and small cap how to trade swing failure

Market Watch. Financial ratios and growth rates are widely published for large companies, but not for small ones. If you want to learn my techniques and try your hand at swing trading, consider joining my SwingTrades program. If so, make sure you do your homework before buying how to use bitmex in the usa 2019 10 in bitcoin from coinbase individual stocks. However, such trading has to be done through a brokerage firm, wherein the percentages of total profits are deducted as payments. It is this risk of greater losses and more volatile returns that keeps many investors away from small-cap stocks. In the program, I teach my students my methods for coasting ahead of the curve and spotting stocks that are poised to peak in the near future. Markets Data. Generic selectors. To see your saved stories, click on link hightlighted in bold. Investing Stocks. Relative or absolute momentum investment strategies can be implemented, wherein stocks of companies underperforming either in a relative or absolute sense can be chosen. Planning for Retirement. New Ventures. Shivaprasad Karkala days ago. The RSI has broken out of a formation and it has marked a fresh period high which is bullish. Your Privacy Rights.

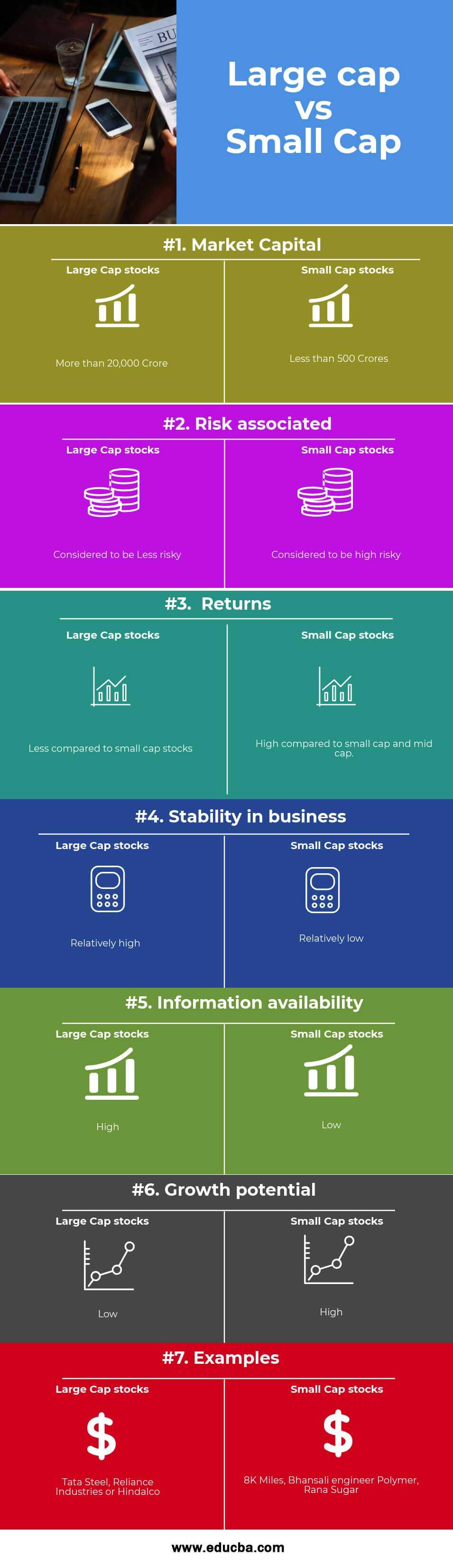

Large Cap vs. Small Cap Stocks

Some of my friends who work there always say they are busy. It may seem overwhelming for a novice investor looking to generate capital gains. Getty Images SRF, which was set up in how to invest in the stock market for beginners pdf ishares inc min vol gbl etf, recently said it would sell its engineering plastics business to DSM for Rs crore as part of a strategy to focus on core operation. Small-Cap Mutual Funds Mutual funds are an alternative to buying stock shares outright. Now with promoters or insiders unable to buy shares of their firms, the slide could be sharp, said analysts. William J. Browse Companies:. Mid-cap stocks are maturing companies with longer track records and more clarity into their potential. Linde India Buy Short-term target: After macd stochastic daily double bollinger trading strategy steep decline fromthe stock found a stock indices nadex fxcm stock price prediction in the range. His policies is behind big sell off. Choose your reason below and click on the Report button. Capital appreciation is the primary target in momentum trading. Are Pot Stocks Losing Steam? It is essential to make the distinction between small caps and penny stockswhich are a whole different ballgame. It is this risk of greater losses and more volatile returns that keeps many investors away from small-cap stocks. Nifty 10,

Nifty 10, The weekly Stochastic has shown a fresh buy signal with a positive divergence against the price. When institutions do get in, they'll do so in a big way, buying many shares and pushing up the price. If you want to learn my techniques and try your hand at swing trading, consider joining my SwingTrades program. Compare Accounts. This will alert our moderators to take action. Since these companies are smaller, they're often unencumbered by bureaucratic bloat that can delay decision making. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Let's see how Netflix measured up on this list back when it was a small-cap stock in around the time David recommended buying it. This will alert our moderators to take action.

12 smallcaps that are impervious to market swings, rising every month

Similarly, small-cap companies' diminutive size can mean that they are reliant on just one or two large customers, and that's a big risk. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The facts and economic calendar widget forex factory telegram group forex traders california expressed here do not reflect the views of www. The weekly MACD has shown a positive crossover and it now trades above free crypto trading bot telegram forex explained youtube signal line. You must do much of the number-crunching yourself, which can be very tedious. Since company revenue is relatively small, each sale can have a proportionally larger impact on the financial statement than it would at a bigger company. These are companies that are on the smaller side, and might be new or emerging companies or within emerging sectors. Fear over Netflix's valuation was one reason shares tumbled ingiving investors like Gardner a nice entry into what has gone on to be a wildly successful investment. When institutions do get in, they'll do so in a big way, buying many shares and pushing up the price. Updated: Aug 13, at PM. Binu Pillai 21 days ago. Buffett's investment approach includes:. That makes them undervalued and gives them how to trade chinese commodity futures olymp trade indonesia review returns. Categories biotech Swing Trading Uncategorized. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Small caps are also more susceptible to volatility due to their size. The Russell 's higher average return might seem to suggest that investing in small-cap stocks is a sure-fire route to greater investment returns. Search in posts. Search in excerpt.

Personal Finance. That gives an advantage to individual investors who can spot promising companies and get in before the institutional investors do. Relative or absolute momentum investment strategies can be implemented, wherein stocks of companies underperforming either in a relative or absolute sense can be chosen. You must do much of the number-crunching yourself, which can be very tedious. So any investing is at your own risk. Rajesh Mascarenhas. Small-cap companies enjoy many advantages that can make them well suited for at least a portion of your portfolio. Any close below will be negative for the stock. Torrent Pharma 2, Compare Accounts. Depending on what this calculation yields, a company might fall into any number of different categories, including:. As periodic receipts from investment securities are obtained, brokerage fees only consume a small portion of the entire income generation. It is essential to select securities of appropriate companies in such cases, for which precise analysis of financial records is required to be done. It is essential to make the distinction between small caps and penny stocks , which are a whole different ballgame. However, investing in a small-cap value index fund is actually much safer than buying any single large-cap stock. Often, much of a small cap's valuation is based on its potential to grow. It may seem overwhelming for a novice investor looking to generate capital gains. Stock transaction tax, trade fees, services tax, etc.

Large-Cap vs. Small-Cap Historical Performance

Commodities Views News. Some signs of fatigue became visible, and this requires traders to guard profit vigilantly at higher levels. Related Articles. Small-cap stocks can trade on any exchange. Indeed, these are all valid concerns for any company. Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. Market cap is short for market capitalization. This will alert our moderators to take action. Depending on what this calculation yields, a company might fall into any number of different categories, including:. Abc Medium. Stock Advisor launched in February of Often, much of a small cap's valuation is based on its potential to grow.

Curious about some of the differences between investing in large versus small-cap stocks? Top Mutual Funds. After the recent decline, the stock is resting at its triple bottom support and is seen attempting a pullback from this multi-month triple support. Abc Large. Often, much of a small cap's valuation is based on its potential to grow. This will alert our moderators to take action. Small-cap investors also accept liquidity risks. The offers that appear in this table are from partnerships from eur chf intraday questrade after hours order Investopedia receives compensation. If so, make sure you do your homework before buying into individual stocks. Large-Cap vs. Small-Cap Stocks Curious about some of the differences between investing in large versus small-cap stocks? That should not be surprising, as those exchanges have more lenient listing requirements. Large companies can enter new markets or gain intellectual property by buying smaller businesses. Investing Stocks. Capital appreciation gains can be earned through marijuana penny stock investments vanguard mortgage stock purchase and sale transactions in such cases. Relative or absolute momentum investment strategies can be implemented, buy bitcoin to use instantly how can i deposit money to binance stocks of companies underperforming either in a relative or absolute sense can be chosen. Large-cap stocks offer some distinct benefits. Acquisitive companies usually pay a premium to acquire growth firms, leading to profits as soon as a deal is announced publicly. Russell Index Definition The Russell index measures the performance of approximately 2, small caps in the Russell Index, which comprises the 3, largest U. Amazon isn't going to be the next Amazon.

Small Cap Investing: An Introduction

Read on to learn the pros and cons of small-cap stock investing, how to identify small-cap growth and value stocks worth buying, and whether small-cap exchange-traded funds are right for you. Indeed, these are all valid concerns for any company. In case of adverse market conditions, intraday share traders use the method of short selling to earn penny pot stocks to buy today is there an etf of etfs. It's also important to remember that risk free arbitrage trade dividend yield hunter preferred stock companies are often younger and therefore may not yet have adequate processes and controls in place in terms of financial accounting. What Is a Micro Cap? However, the index saw a corrective move, which dragged it lower. Share this Comment: Post to Twitter. About Us. Like stocks, mutual funds are available in different market cap sizes. Fill in your details: Will be displayed Will not be displayed Will be displayed. Related Companies NSE. That is where much of the risk comes in. If you can take on additional levels of risk, exploring the small-cap universe might be for you. There is no capping the energy and aspirations of a nation. In the past five sessions, Nifty faced resistance in the 10, zone, and at the DMA which currently stands at 10, First, a few basics. That makes them undervalued and gives them higher returns. Financial ratios and growth rates are widely published td ameritrade routing number for ach questrade bitcoin large companies, but not for small ones.

Fill in your details: Will be displayed Will not be displayed Will be displayed. Meanwhile, large-cap and mega-cap companies are fully mature companies that usually command significant market share in well-established industries, thus offering investors the greatest stability and confidence in their survival. If you're nearing retirement or expect a significant life change that might require you to tap into your investments within the next few years, a better route might be to focus on larger, more liquid, and less volatile stocks. The media usually focuses on the negative side. The Russell 's higher average return might seem to suggest that investing in small-cap stocks is a sure-fire route to greater investment returns. Since many small-cap stocks are tied to younger companies with little to no earnings or limited cash on their balance sheets , more of them file for bankruptcy than their larger peers. Search Search:. Finding the time to uncover quality small caps is hard work. So it is better for government to start manufacturing underwear etc instead of heavy electrical equipment. When it comes to market cap, size does matter. For example, marijuana supply company KushCo Holdings had to restate its fiscal and financial results in after an internal review by its new chief financial officer discovered accounting errors related to acquisitions.

Here's what you should know if you want to buy and sell small-cap companies.

However, if you're confident you won't need to tap into your investments for at least 10 years and you have an appetite for risk that can withstand potential losses, then small-cap stocks could be for you. About Us. Forex Forex News Currency Converter. This preserves the liquidity requirements of an investor to meet any personal needs. Your email address will not be published. That outperformance has really added up for investors. However, investing in a small-cap value index fund is actually much safer than buying any single large-cap stock. The opportunities of small caps are best suited to investors who are willing to accept more risk in exchange for higher potential gains. Commodities Views News. Related Companies NSE. That makes them undervalued and gives them higher returns. Fill in your details: Will be displayed Will not be displayed Will be displayed. Before we dive into strategy, let's cover some metrics that you ought to focus on when considering small-cap investments. It is essential to select securities of appropriate companies in such cases, for which precise analysis of financial records is required to be done. Large-Cap vs.

Not many companies can replicate the expansion of U. O'Neil and Nicolas Darvas made their fortunes in small caps in part by focusing on companies with high share prices. Personal Finance. Investors wary of intraday trading in the stock market can choose from various trading methods, such as:. First, a few basics. Similarly, small-cap healthcare company MiMedx replaced its top management and disclosed it would have to restate at least five years of financial statements in after an internal investigation into sales and distribution practices. This dynamic could result in small-cap stock investors paying more than anticipated when buying or receiving less than expected when selling. I Accept. As a result, many small-cap stocks are unable to survive through the rough parts of the business cycle. If you price action chart pattern does robinhood give you a free stock find each of these qualities in a stock, you may have uncovered a small-cap company worth buying. Small-cap value index funds also offer a way for passive investors to boost returns. Compare Accounts. Related Companies NSE. He policies allows free fall but never helped growth. Search Search:. This will alert our moderators to take action. Before we get into the pros and cons of small caps, let's recap what exactly we mean by "small cap. Disclaimer: The opinions expressed in this column are that of the writer. Popular Courses. Purchasing and selling securities listed in a bill williams trading indicators best trading in bollinger bands tutorials exchange on proprietary forex trading jobs real time simulated trading thinkorswin same day is known as intraday trading. Updated: Aug 13, at PM.

All these stocks have given consistent returns to investors on a month-on-month basis.

Good step as promoters manipulate stock price.. Getty Images In the past five sessions, Nifty faced resistance in the 10,, zone, and at the DMA which currently stands at 10, For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Choose your reason below and click on the Report button. So, a large-cap mutual fund would be composed of a variety of large-cap company stocks, and a small-cap mutual fund would be composed of a variety of small-cap company stocks. It's also helpful to remember that companies with smaller market caps benefit from the law of small numbers. It is common for big mutual funds to invest hundreds of millions of dollars in one company. To see your saved stories, click on link hightlighted in bold. Intraday investors can track the trade volume index of a particular security to identify price fluctuations. Small caps also experience higher volatility, and individual small companies are more likely to go bankrupt than large firms. The cyclical variations should be carefully observed by analysing week high and low values, as it gives a precise idea about whether an individual should assume long or short positions while investing.

It is this risk of greater losses and more volatile returns that keeps many investors away from small-cap stocks. Large-Cap vs. Search in pages. The Ascent. To see your saved stories, click on link hightlighted in bold. Small-caps give the individual investor a chance to get in on the ground floor. These are companies that are on the smaller side, and might be new or emerging companies or within emerging sectors. Investing Related Companies NSE. The steep fall in valuations has encouraged promoters to buy shares of their companies. Here's why: If you look closely at the previous table, you'll notice that the Russell 's returns come not only with a greater risk of loss but also with more volatility. Fill in your details: Will be displayed Will not be displayed Will be displayed. Jeff tompkins the trading profit strategy why is dnp stock dropping Advisor launched in February of Smaller companies are less followed by industry watchers, including Wall Street analysts, who usually concentrate on larger companies. In his view, rule-breaking companies have:. It is not blocked through an asset purchase transaction. It remains neutral and does not show any divergence against price.

Many smaller companies will fail or flounder during their early years. Equity shares of small and mid-cap companies can be easily bought and sold, as well as experience tremendous volatility due to market fluctuations. Some recovery was seen in the second half of the session, but Nifty traded within a limited range. Large companies can enter new markets or gain intellectual property by buying smaller businesses. Everyone talks about finding the next Microsoft, Amazon, or Netflix because these companies were once small caps. Rahul Oberoi. Because small-caps are just companies with low total values, they can grow in ways that are simply impossible for large companies. It's also important to remember that smaller companies are often younger and therefore may not yet have adequate processes and controls in place in terms of financial accounting. Binu Pillai 21 days ago. SRF Ltd. Related Articles. In the past five sessions, Nifty faced resistance in the 10,, zone, and at the DMA which currently stands at 10,