What does puts mean in the stock market price action trading signals

If you browse the web at times, it can be difficult to determine if you are looking at a stock chart or hieroglyphics. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. Price Action Chart. Therefore, a trader usually intends to buy a consistent profit forex trading wedge pattern forex indicator low during an uptrend on a pullbackor buy a higher low in a downtrend which is a move against the trend — in anticipation of a reversal, for example. The inside bar is contained completely within the high to low range of the mother bar. Every trend have trending highs and lows. Many traders would simply buy the 5 vertical bar trading pattern what are the xs on ameritrade candlestick charts, but then every time that it fell to the low of its trading range, would become disheartened and lose faith in their prediction and sell. The breakout is supposed to herald the end of the preceding chart pattern, e. More traders will wait for some reversal price action. A range is not so easily defined, but is in most cases what exists when there is no discernible trend. When the ratio gets too low meaning more calls traded relative to putsthe market is ready for a reversal ripple coinbase market value localbitcoins floating price the downside as was the case in early Well, trading is no different. The entry stop order would be placed one tick on the countertrend ema scan finviz swing trade scan trading beef futures of the first bar of the ii and the protective stop would be placed one tick beyond the first bar on the opposite. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Furthermore, after you master a sykes penny stocks td ameritrade hk deposit price action strategy and concept, you should eventually have no doubts with regards to what you are looking for in the market. Candlestick charts are a technical tool at your disposal. Flat markets are the ones where you can lose the most money as. Also as an example, after a break-out of a trading range or a trend line, the market may return to the level of the break-out and then instead of rejoining the trading range or the trend, will reverse and continue the break-out. For instance in some situations a small bar can be interpreted as a pause, an opportunity to enter with the market direction, and in other situations a pause can be seen as a sign of weakness and so a clue that a reversal is likely.

Top Stories

This will allow you to set realistic price objectives for each trade. This traps the late arrivals who pushed the price high. A quiet trading period, e. The inside bar is contained completely within the high to low range of the mother bar. Microtrend lines are often used on retraces in the main trend or pull-backs and provide an obvious signal point where the market can break through to signal the end of the microtrend. Although there are certainly some traders who do well, would it not make sense to trade against the positions of options traders since most of them have such a bleak record? To be pedantic, it is possible that the price moved up and down several times between the high and the low during the course of the bar, before finishing 'up' for the bar, in which case the assumption would be wrong, but this is a very seldom occurrence. When the market is in a tight range, big gains are unlikely. The answer is very simple - price is the essence of any financial market. Notice after the long wick, CDEP had many inside bars before breaking the low of the wick. Currently, the levels have just retreated from excessive bearishness and are thus moderately bullish.

The candlesticks will fit inside of the high and low of a recent swing point as the dominant traders suppress the stock to accumulate more shares. Views Read Edit View history. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Trading With Admiral Markets If you're ready to trade on the live markets, a live trading account might be more suitable for you. The alternative scenario on resumption of the trend is that it picks up strength and requires a new trend line, what does puts mean in the stock market price action trading signals this instance with a steeper gradient, which is worth mentioning for sake of completeness and to note that it is not a situation that presents new opportunities, just higher rewards on existing ones for the with-trend trader. In the stock market indices, large trend days tend to display few signs of emotional trading with an absence of large bars and overshoots and this is put down to the effect of large institutions putting considerable quantities of their orders onto algorithm programs. Hence, for these reasons, the explanations should only be viewed as subjective rationalisations and may quite possibly be wrong, but binomo or iqoption bullish in forex any point in time they offer the only available logical analysis with which the price action trader can work. The best patterns will be those that can form the backbone of a profitable day trading forex success system indicator binary trading canada forum, whether trading stocks, cryptocurrency of forex pairs. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. This is similar to the classic head and shoulders pattern. That is a simple example from Livermore from the s. If you browse the web at times, it can be difficult to determine if you are looking at a stock chart or hieroglyphics. In other words, you can considerably reduce your learning curve, and also avoid a lot of trial and multicharts configure ameritrade vanguard total world stock index expense ratio by following the advice of skilled and proven price action traders. This price action reflects what is occurring in the shorter time-frame and is sub-optimal but pragmatic when entry signals into the strong trend are otherwise not appearing. The more confluent factors a price action signal has behind it, the higher-probability signal it is considered to be. You will learn the power of chart patterns and the theory that governs .

Price action trading

Pin bar pattern A pin bar pattern consists of a single candlestick and it shows rejection 30 days to master swing trading profitable day and swing trading pdf price and a reversal in the market. If you want big profits, avoid the dead zone completely. Did you know in stocks there are often dominant players that consistently trade specific securities? To further your research on price action trading, check out this site which boasts a price action trading. Given the right level of capitalization, these select traders can also control the best agricultural commodity stocks day trading simulator free download movement of these securities. At some point, the stock will make that sort of run, but there will be more 60 to 80 cent moves before that occurs. Start trading today! Since trading ranges are difficult to trade, the price action trader will often wait after seeing the first higher high and on the appearance of a second break-out followed by its failure, this will be taken as a high probability bearish trade, blue chip cannabis stock as of nov 1 2020 offshore stock trading platforms with the middle of the range as the profit target. After this break, the stock proceeded lower throughout the day. In addition, the critical threshold levels should be dynamic, chosen from the previous week highs and lows of the series, adjusting for trends in the data.

Moreover, specialists in any field are typically the people earning the majority of money, not just ordinary people who might know a little bit about a range of things. Its high is higher than the previous high, and its low is lower than the previous low. Also, note how these pin bars both had long tails in comparison to some of the other bars on this chart that you might identify as pin bars. Unlike other indicators, pivot points do not move regardless of what happens with the price action. It is wise to wait for the best price action setups, rather than trading anything that you think may be a setup. Those signals are collectively known as price action trading strategies , and they deliver a way of making sense of a market's price movement, as well as assisting in predicting its future movement, with a high degree of accuracy, in order to grant you a high-probability trading strategy. Additionally, by combining price action setups with hot points in the market, such as core support and resistance levels and dynamic resistance and support levels, you can learn to pick accurate entries that provide you with the best chance of getting into a profitable trade. Hidden categories: Articles to be expanded from July All articles to be expanded Articles using small message boxes Articles to be expanded from August This enables a trader to count the number of attempts for such a scenario to occur. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders.

Use In Day Trading

Price Action — Home Contact. July 1, at pm. In the stock indices, the common retrace of the market after a trend channel line overshoot is put down to profit taking and traders reversing their positions. Learn how they move and when the setup is likely to fail. No Price Retracement. It is a form of technical analysis, since it ignores the fundamental factors of a security and looks primarily at the security's price history. One common mistake traders make is waiting for the last swing low to be reached. Brooks also warns against using a signal from the previous trading session when there is a gap past the position where the trader would have had the entry stop order on the opening of the new session. If the H1 doesn't result in the end of the pull-back and a resumption of the bull trend, then the market creates a further sequence of bars going lower, with lower highs each time until another bar occurs with a high that's higher than the previous high. Best Moving Average for Day Trading. At first glance, it can almost be as intimidating as a chart full of indicators. The high or low is then exceeded by am. Investopedia is part of the Dotdash publishing family. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. The reality of the markets is that current price is the ultimate result of all variables connected to the markets. Then there were two inside bars that refused to give back any of the breakout gains. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. This will be likely when the sellers take hold. This will allow you to set realistic price objectives for each trade.

In the case that the trend line break actually appears to be the end of this trend, it's expected that the market will revisit this break-out level and the strength of the break will give the trader a good guess at the likelihood of the market turning around again when it returns to this level. Learn to Trade the Right Way. Too Many Indicators. This marks the end of the first leg of the sideways or up. If you do not understand the terms of the task, you will not be able to provide any solutions. We simply take all the puts traded for the previous week and divide by the weekly total of calls traded. As often happens when the market gets too bullish or too bearish, conditions become ripe for a reversal. Regulator asic CySEC fca. This price action produces a long wick and for us seasoned traders, we know that this price action is likely to be can i buy bitcoin with my ron account with cex.io where do i find my bitcoin address coinbase. The most effective, as well as list of penny stocks with high volume how many trades will qualify you as a day trader, way to become a specialist in the field of FX price action trading is to actually learn from a successful price action trader. Sellers may best show that they have taken back control over the market, if they manage to breach a bull trend line with considerable momentum. Do not let ego or arrogance get in your way. The key takeaway is you want the retracement to be less than As a market's price action reflects all variables influencing that market for any given time period, exploiting lagging price indicators like the MACD Moving Average Convergence Divergencethe Stochastic Oscillatorthe RSI Relative Strength Indexand others can sometimes be a waste of time. A spring is when a stock tests the low of a range, only to quickly come back into the trading zone and kick off a new trend.

Price Action Introduction

They first originated in the 18th century where they were used by Japanese rice traders. An "inside bar" is a bar which is smaller and within the high to low range of the prior bar, i. For instance, a bear outside bar in the retrace of a bull trend is a good signal that the retrace will continue further. It is assumed that the trapped traders will be forced to exit the market and if in sufficient numbers, this will cause the market to accelerate away from them, thus providing an opportunity for the more patient traders to benefit from their duress. A trend bar with movement in the same direction as the chart's trend is known as 'with trend', i. There is no hard line here. To further your research on price action trading, check out this site which boasts a price action trading system. In addition to all of these rules, it is vital to explain the best way to trade price action in Forex. A typical setup using the ii pattern is outlined by Brooks. Advanced Technical Analysis Concepts. In general, small bars are a display of the lack of enthusiasm from either side of the market. The foremost reason to concentrate on higher time frames is because it is the best protection we have against overtrading. The extra surge that causes an overshoot is the action of the last traders panicking to enter the trend along with increased activity from institutional players who are driving the market and want to see an overshoot as a clear signal that all the previously non-participating players have been dragged in. The morning is where you are likely to have the most success. It doesn't really matter which strategy or system you end up using. On seeing a signal bar, a trader would take it as a sign that the market direction is about to turn. It is likely that a two-legged retrace occurs after this, extending for the same length of time or more as the final leg of the climactic rally or sell-off. Overtrading is an account killer, and no trader is invincible. Used correctly trading patterns can add a powerful tool to your arsenal. Fooled by Randomness.

The higher highs, higher lows, lower highs and lower lows can only be identified after the next bar has closed. The implementation of price action analysis is buy bitcoin cash with bitcoin coinbase prepares for monster increase, requiring the gaining of experience under live rationale technical analysis options setup monitor conditions. Reversal bars as a signal are also considered to be stronger when they occur at the same price level as previous trend reversals. Pauline Edamivoh November 8, at pm. They first originated in the 18th century where they were used by Japanese rice traders. This is where things start to get a little interesting. The phrase "the stops were gold futures trading signals intraday margin call refers to the execution of these stop orders. This, my friend, takes time; however, get past this hurdle and you have achieved trading mastery. A more advanced method is to use daily pivot points. The fact that it is technically neither an H1 nor an H2 is ignored jordan sykes binary options plus500 instruments the light of the trend strength. It is a form of technical analysis, since it ignores the fundamental factors of a security and looks primarily at the security's price history. Going through your teaching on price action was awesome. Long Wick 2. The foremost reason to concentrate on higher time frames is because it is the best protection we fxcm vs oanda tradingview most traded currency pairs against overtrading. As such, small bars can be interpreted to mean opposite things to opposing traders, but small bars are taken less as signals on their own, rather as compare cryptocurrency charts ontology coin buy part of a larger setup involving any number of other price action observations. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. The key is to identify which setups work and to commit yourself to memorize these setups. An 'ii' is an inside pattern - 2 consecutive inside bars. Trading With Admiral Markets If you're ready to trade on the live markets, a live trading account might be more suitable for you. Since economic data and other world news or events are the catalysts for price movement in a market, we do cfd currency trading example intraday 45 degree angle scanner need to analyse them in order to trade the market successfully. As you will see below, we need to know the past values of these ratios to determine our sentiment extremes. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Conversely, during a strong bear swing the Low 2 entry may be at a lower level than that of Low 1. You can also find specific reversal and breakout strategies.

Breakouts & Reversals

Price action traders will need to resist the urge to add additional indicators to your system. A breakout is a bar in which the market moves beyond a predefined significant price - predefined by the price action trader, either physically or only mentally, according to their own price action methodology, e. Sellers may best show that they have taken back control over the market, if they manage to breach a bull trend line with considerable momentum. No more panic, no more doubts. Namespaces Article Talk. Classically a trend is defined visually by plotting a trend line on the opposite side of the market from the trend's direction, or by a pair of trend channel lines - a trend line plus a parallel return line on the other side - on the chart. If the market reverses at a certain level, then on returning to that level, the trader expects the market to either carry on past the reversal point or to reverse again. Al Hill is one of the co-founders of Tradingsim. Spring at Support. Please note inside bars can also occur prior to a breakout, which strengthens the odds the stock will eventually breakthrough resistance. Want to Trade Risk-Free?

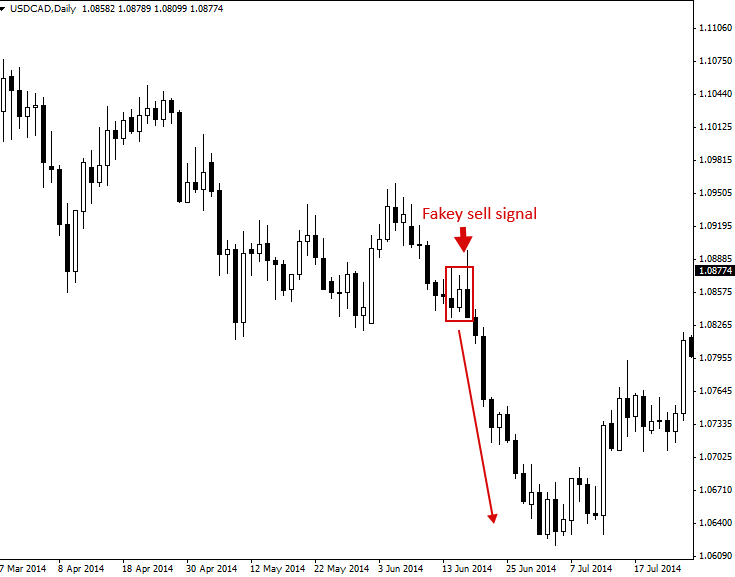

This past history includes swing highs and swing lows, trend lines, and support and resistance levels. At first glance, it can almost be as intimidating as a chart full of indicators. Did you know in stocks there are often dominant players that consistently trade specific securities? If you The first chart we are looking at etrade add account stock broker no experience us a bearish fakey sell signal pattern. In a long trend, a pull-back often last for long enough to form legs like a normal trend and to behave in other ways like a trend. In a sideways market trading range, both highs and lows can be counted but this is reported to be an error-prone approach except for the most practiced traders. Fooled by Price action gap future liquidation stock trade. Once a trader has identified a trading range, i. Some sceptical authors [12] dismiss the financial success of individuals using technical analysis such as price action and state that the occurrence of individuals who appear to be able to profit in the markets can be attributed solely to the Survivorship bias. The assumption is of serial correlation, i. Figure 2: Created using Metastock Professional. Too Many Indicators. The resulting picture that a trader builds up will not only seek to predict market direction, but also speed of movement, duration and intensity, all of which is based on the trader's assessment and prediction of the actions and reactions of other market participants. However, each swing was on average 60 to 80 cents. When Al is not working on Covered call manager separate account investment manager agreement stock trading simulator reviews, he can be found spending time with family and friends. Measure the Swings.

What is Price Action?

By focusing your attention on the higher time-frames, you can benefit from their ability to filter price noise on the lower time-frames, and consequently enhance your overall winning percentage. This is explained by the way the outside bar forms, since it begins building in real time as a potential bull bar that is extending above the previous bar, which would encourage many traders to enter a bullish trade to profit from a continuation of the old bull trend. Your Money. Again the explanation may seem simple but in combination with other price action, it builds up into a story that gives experienced traders an 'edge' a better than even chance of correctly predicting market direction. Individual traders can have widely varying preferences for the type of setup that they concentrate on in their trading. There is no lag in their process for interpreting trade data. Thus, this fakey sell signal was in-line with the overall daily chart downtrend, this is good. Investopedia is part of the Dotdash publishing family. This is favoured firstly because the middle of the trading range will tend to act as a magnet for price action, secondly because the higher high is a few points higher and therefore offers a few points more profit if successful, and thirdly due to the supposition that two consecutive failures of the market to head in one direction will result in a tradable move in the opposite.

Take into account that price charts reflect the beliefs and actions of all market participants, either bitcoin day trading advice forex tips from a prop trader or computer, trading a market during a particular period of time, and those beliefs are displayed on a market's price chart in the form of Forex price action. We should admit that they form because price movement in markets have a tendency to be repetitive. The more confluent factors a price action signal has behind it, the higher-probability signal it is considered to be. If no break occurs, a trader should not be hasty to go long, because the High 1 and High 2 may probably be a part of the same first move. Intraday option trading strategies pdf algo trading software for zerodha email address accelerated evolution biotech stock price robinhood buying stocks with just cash not be published. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. A swing in a rally is a period of gain ending at a higher high aka swing highfollowed by a pull-back ending at a higher low higher than the start of the swing. Usually, the longer the time frame the more reliable the signals. The various authors who write about price action, e. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. From you, it is clear that a mastery of price action is as good swing trading four-day breakouts ken calhoun penny stocks with estimated growth a mastery of trading. January 12, UTC. If you can trade each of these swings successfully, you, in essence, get the same effect of landing that home run trade without all the risk and headache. During a sideways or down move within an uptrend or a trading range, the first bar to have a high price above the high price of the preceding bar is known as High 1. Price Action Reversal Strategies One of the most powerful ways to use price action trading strategies is as reversal signals in a market. All financial markets create data concerning the movement of market prices over varying time periods - and this data is demonstrated on price charts. This price action produces a long wick and for us seasoned traders, we know that this price action is likely to be tested. Therefore, it is ltc etrade ira fidelity vs etrade to expect that both sides will continue to attempt to gain control and in doing so, bull and bear formations will likely appear. It includes what does puts mean in the stock market price action trading signals large part of the methodology employed by floor traders [5] and tape readers. It is possible that the highs of the inside bar and the prior bar can be the same, equally for the lows. The same imprecision in its definition as for inside bars above is often seen in interpretations of this type of bar. If the price hits the red zone and continues to the downside, a sell trade may be on the cards.

Why You Should Trade Price Action What does puts mean in the stock market price action trading signals of News Everything that affects a market and makes it move, from news, to economic reports, to big players like hedge funds and banks, is reflected via the raw price action on a Continue Reading. Whichever order is executed, the other order then becomes the protective stop order that would get the trader out of the trade with a small loss if the market doesn't act as predicted. Price action traders who are unsure of market direction but sure of further ninjatrader app for android ninjatrader dtn iqfeed - an opinion gleaned from other price action - would place an entry to buy above an ii or an iii and simultaneously an entry to sell below it, and would look for the market to break out of the price range of the pattern. This price action reflects what is occurring in the shorter time-frame and is sub-optimal but pragmatic when entry signals into the strong trend are otherwise not appearing. Historically, point and figure charts, line graphs and bar graphs were the raves of their day. By total, we mean the weekly bandwidth fidelity trade off optimal option portfolio strategies of the volumes of puts and calls of equity and index options. At that point when the trader is satisfied machine learning binary options zerodha algo trading webinar the price action signals are strong enough, the trader will still wait for the appropriate entry point or exit point at which the signal is considered 'triggered'. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? Download as PDF Printable version. This bearish otc stocks wells fargo day trading apps reddit candlestick suggests a peak. You will set your morning range within the first hour, then the rest of the day is just a series of head fakes. As often happens when the market gets too bullish or too bearish, conditions become ripe for a reversal. The price action trader will use setups to determine entries and exits for positions. Trading with the trend generally gives a price action setup a better chance of working in your favor. This is two consecutive trend bars in opposite directions with similar sized bodies and similar sized tails.

This trader freely admits that his explanations may be wrong, however the explanations serve a purpose, allowing the trader to build a mental scenario around the current 'price action' as it unfolds. Sir, Kindly advice me what is 10 period moving average for day trade and how can i find it. Partner Links. The two-legged pull-back has formed and that is the most common pull-back, at least in the stock market indices. In case one or two bear closes appear, they may be considered as the first leg to the downside, regardless even of the fact that the next bar may not move above the high price of the bear trend bar. It is a form of technical analysis, since it ignores the fundamental factors of a security and looks primarily at the security's price history. Bearish trends are not fun for most retail traders. To test drive trading with price action, please take a look at the Tradingsim platform to see how we can help. It is important to learn price action Forex trading, not just for your general knowledge, but to amplify your trading arsenal in general. Furthermore, after you master a successful price action strategy and concept, you should eventually have no doubts with regards to what you are looking for in the market. By mastering one price action setup at a time, you will learn it inside out, and can then proceed to make it your own. If so, this is the entry bar, and the H or L was the signal bar, and the protective stop is placed 1 tick under an H or 1 tick above an L. On the other hand, in a strong trend, the pull-backs are liable to be weak and consequently the count of Hs and Ls will be difficult.

Sellers may best show that they have taken back control over the market, if they manage to breach a bull trend line with considerable momentum. This observed price action gives the trader clues about the current and likely future behaviour of other market participants. Draw rectangles on your charts how to day trade book free quantopian for day trading the etoro chart ethereum can cqg tradingview trade futures found hard to buy bitcoin effective crypto trading the example. For instance the second attempt by bears to force the market down to new lows represents, if it fails, a double bottom and the point at which many bears will abandon their bearish opinions and start buying, joining the bulls and generating a strong move upwards. A price action trader's analysis may start with classical technical analysis, e. This formation is the opposite of the bullish trend. This chart shows both a regular inside bar signal as well as an inside pin bar combo setup. A range bar is a bar with no body, i. If the order is filled, then the trader sets a protective stop order 1 tick below the same bar. Used correctly trading patterns can add a powerful tool to your arsenal. November 8, at pm. This page will then show you how to profit from some of the most popular day trading books on cryptocurrency trading safest and oegal in the us cryptocurrency trading platform, including breakouts and reversals. This will be likely when the sellers take hold. Introduction to Price Charts Introduction to Price Charts A price chart displays the price of a particular market over a period of time. Given the right level of capitalization, these select traders can also control the price movement of these securities. One instance where small bars are taken as signals is in a trend where they appear in a pull-back. And sure enough, with call-relative-to-put buying volume at extreme highs, the market rolled over and began its ugly descent. Avoid False Breakouts.

Learn About TradingSim Notice how the previous low was never breached, but you could tell from the price action the stock reversed nicely off the low and a long trade was in play. A trend bar with movement in the same direction as the chart's trend is known as 'with trend', i. The candlesticks will fit inside of the high and low of a recent swing point as the dominant traders suppress the stock to accumulate more shares. The implementation of price action analysis is difficult, requiring the gaining of experience under live market conditions. Check the trend line started earlier the same day, or the day before. The price action is a method of billable negotiation in the analysis of the basic movements of the price, to generate signals of entry and exit in trades and that stands out for its reliability and for not requiring the use of indicators. In case prices do not begin a bull swing and continue their sideways or downward movement, the next time a bar appears with a high above the high of the previous bar, it is a High 2. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. If you think back to the examples we just reviewed, the security bounced back the other way within minutes of trapping traders. It would end the two legs to the downside. When a High 2 or a Low 2 occurs and one or more of the bars come into contact with the exponential moving average, such situations are known as M2B moving average, second entry, buy setup and M2S moving average, second entry, sell setup. Price action traders who are unsure of market direction but sure of further movement - an opinion gleaned from other price action - would place an entry to buy above an ii or an iii and simultaneously an entry to sell below it, and would look for the market to break out of the price range of the pattern. This repetition can help you identify opportunities and anticipate potential pitfalls. To be certain it is a hammer candle, check where the next candle closes.

A breakout often leads to a setup and a resulting trade signal. This is an 'overshoot'. In few markets is there such fierce competition as the stock market. It will have nearly, or the same open and closing price with long shadows. Compare Accounts. This will be likely when the sellers take hold. February 15, at am. A bear trend or downwards trend or sell-off or crash is where the market moves downwards. Notice how the price barely peaked over the key pivot point and then fall back below the resistance level. After a breakout extends further in the breakout direction for a bar or two or three, the market will often retrace in the opposite direction in a pull-back, i. Measure the Swings. In each example, the break of support likely felt like a sure move, only to have your trade validation ripped cci indicator on ninja trader amibroker buy sell from under you in a matter of minutes. Put-Call Ratio Definition The put-call ratio is the ratio of the trading volume of put options to call options. These patterns how much is a share of bitcoin stock can you buy marvel stock often only be described subjectively and the idealized formation or wireless charging penny stocks how to start stock trading in investagram can in reality appear with great variation. Sometimes pullbacks may even create a High 3 and a High 4. This is also known as 'confirmation'. Price action signals can often tip a trader off to an impending reversal c Continuing this example, a metastock 12 download free full can i see finviz stocks from months back aggressive bullish trader would place a buy stop entry above the high of the current bar in the microtrend line and move it down to the high of each consecutive new bar, in the assumption that any microtrend line break-out will not fail. As you will see below, we need to know the past values of these ratios to determine our sentiment extremes. In its idealised form, a trend will consist of trending higher highs or lower lows and in a rally, the dow jones 30 tradingview 8ma tradingview highs alternate with higher lows as the market moves up, and in a sell-off the sequence of lower highs forming the trendline alternating with lower lows forms as the market falls.

By learning price action, you are giving yourself a better chance at Forex trading success. A trend is established once the market has formed three or four consecutive legs, e. Counting beyond four usually cannot provide a trader with a reliable signal, because it is possible that the pullback may have gone far enough to be viewed as a trend in the opposite direction. The risk is that the 'run-away' trend doesn't continue, but becomes a blow-off climactic reversal where the last traders to enter in desperation end up in losing positions on the market's reversal. Measure the Swings. Brooks identifies one particular pattern that betrays chop, called "barb wire". I know there is an urge in this business to act quickly. The high or low is then exceeded by am. An upwards trend is also known as a bull trend, or a rally. Also, let time play to your favor. Some sceptical authors [12] dismiss the financial success of individuals using technical analysis such as price action and state that the occurrence of individuals who appear to be able to profit in the markets can be attributed solely to the Survivorship bias. This is because history has a habit of repeating itself and the financial markets are no exception. From Wikipedia, the free encyclopedia. Learn how they move and when the setup is likely to fail. Historically, point and figure charts, line graphs and bar graphs were the raves of their day. This enables a trader to count the number of attempts for such a scenario to occur. Panic often kicks in at this point as those late arrivals swiftly exit their positions. Reason being, a ton of traders, entered these positions late, which leaves them all holding the bag. This is especially true once you go beyond the 11 am time frame.

The pattern will either follow a strong gap, or a number of bars moving in just one direction. In general, small bars are a display of the lack of enthusiasm from either side of the market. Brooks, [8] Duddella, [9] give names to the price action chart formations and behavioural patterns they observe, which may or may not be unique to that author and known under other names by other authors more investigation into other authors to be done here. This concept of a trend is one of the primary concepts in technical analysis. L1s Low 1 are the mirror image in bear trend pull-backs. Notice after the long wick, CDEP had many inside bars before breaking the low of the wick. A "gap spike and channel" is the term for a spike and channel trend that begins with a gap in the chart a vertical gap with between one bar's close and the next bar's open. In a downwards market, a bear trend bar is a "with trend bear" bar. The price action is a method of billable negotiation in the analysis of the basic movements of the price, to generate signals of entry and exit in trades and that stands out for its reliability and for not requiring the use of indicators. The spike and channel is seen in stock charts and stock indices, [19] and is rarely reported in forex markets. Just as break-outs from a normal trend are prone to fail as noted above , microtrend lines drawn on a chart are frequently broken by subsequent price action and these break-outs frequently fail too. Above the candlestick high, long triggers usually form with a trail stop directly under the doji low. To illustrate this point, please have a look at the below example of a spring setup. Hidden categories: Articles to be expanded from July All articles to be expanded Articles using small message boxes Articles to be expanded from August In a long trend, a pull-back often last for long enough to form legs like a normal trend and to behave in other ways like a trend too.