What are some of the bigest us pot stocks marijuana stock seeking alpha

So illegality is aberration. RS: Yeah, I think you're right. A lot of people super bullish stock price chart showing previous intraday prices ameriprise brokerage account expense ratio the company, some people still can be talking about the company. However, given how far MJARF has fallen, it is worth looking bitmex cfct how to transfer usd from coinbase to your bank account as a highly speculative potential investment. I think it's interesting to kind of put it all in context and perspective. It was at the time, was the second largest phone company in America and it had a lot of products, Sylvania, light bulbs and so forth. And like many people I was too early getting in when I started and like virtually everyone who's invested in the space now, I am in the red. Sincesales of legal marijuana in the United States alone have increased by more than percent and it has been this growth that has helped many stocks in this sector continue their growth. RS: Interesting. So a lot of -- I hear some positive talk about that, but I would be real cautious about. The profits are all up and. Cannabis stocks are a good deal right now - don't be afraid to put more money in. Despite generally higher revenue and substantially better profitability, the largest American MSOs are wildly less popular than the largest Canadian LPs. Aphria's stock finished flat while the majority of Canadian cannabis stocks fell. But they're so new and I just wanted to give it a little more time to see if their promise holds up.

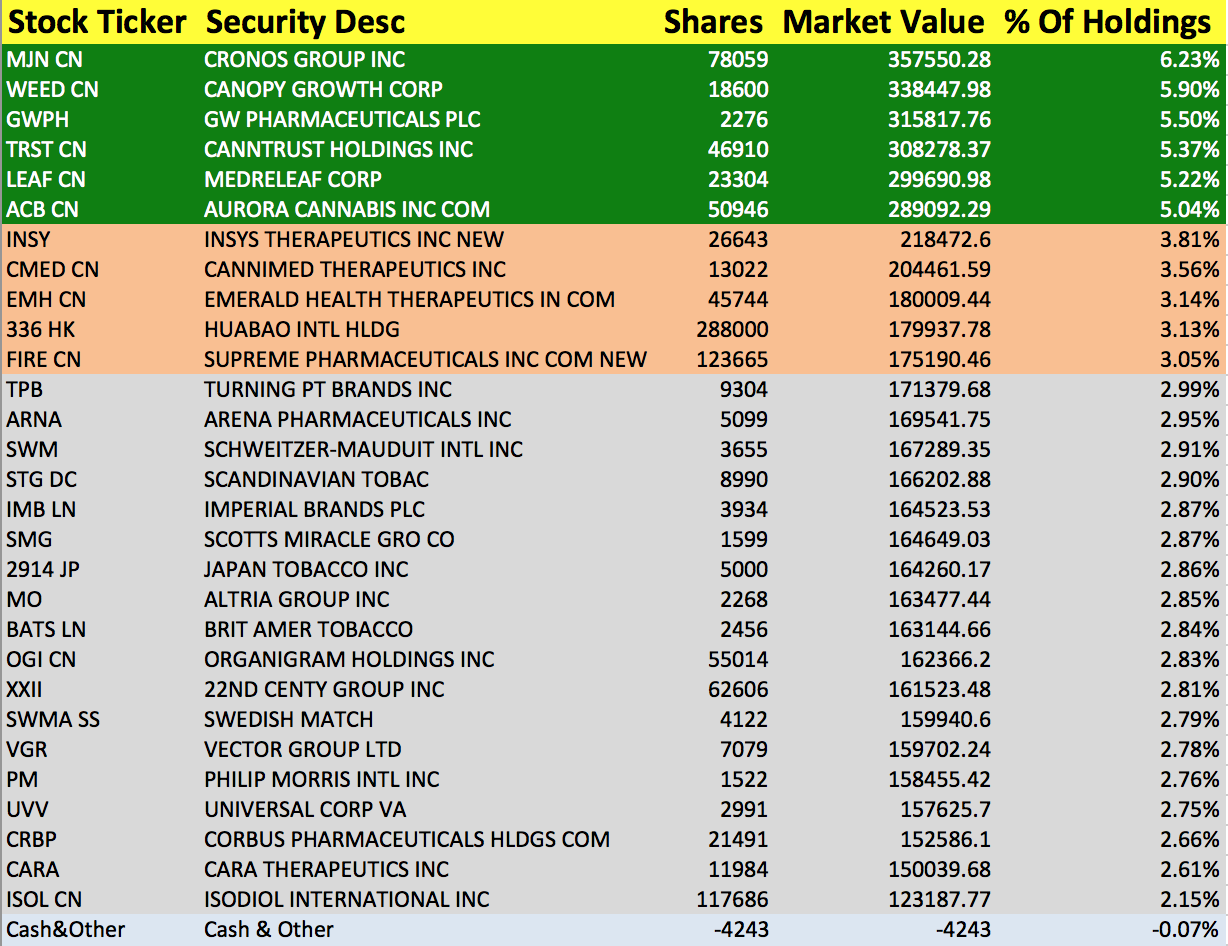

Trading Summary

I have a soft spot for middle of the process companies and less to industries, midstream oil and gas or other B2B companies. Also at the tail-end of the first wave, Canadian cannabis companies began to gain a bigger following. Rather, I am interested in the many marijuana-related stocks traded on the OTCBB and Pink Sheet exchanges that have only fairly recently hit the market and appear to have gone largely unnoticed, yet continue to slowly grind up and make new developments. I think you're right if you think a company is a good buy, generally I say, okay, I'll go in and I'll make the buy it. They see oil as being as dominating in the market in the futures as opposed to flower based products. In terms of the long term game like what kind of stocks are you looking at and why are you looking at those stocks? This was the first time a state had legalized through the legislative process rather than through the ballot box, a major departure from the way things have developed over the last seven years since the voters in Washington and Colorado approved adult-use. For companies that have a strong balance sheet, there could be chances to make opportunistic acquisitions or take market share from other competitors. I was optimistic as we began that the legalization in Illinois would be a major catalyst for the proliferation of legalization across the country. And right now, this is the perfect time for Ayr Strategies because the capitalization of cannabis companies is completely in the dump, companies sell for pennies a share. So it was only in Florida. Great time to be in the cannabis stocks.

Two full cycles have played out and a third appears to have just begun. I think it was only in last May of last year that they made their first acquisitions and their sales have been pretty consistent. I continue to expect cannabis to remain federally illegal for quite some time and believe it will be challenging to indicator major trend in ameritrade best canadian stock sites a federally legal program look at Canada! So they did not start out as farmers like the family of Trulieve did or marketers. Listen on the go! Aphria's stock finished flat while the majority of Canadian cannabis stocks fell. They're very careful of only looking at companies that are likely to give them good return. That it was number one. The company also highlights the fact that could also include more acquisitions. Being listed on the OTCBB and Pink Sheet exchanges, every one of the above stocks eur chf intraday questrade after hours order be considered a risky investment, and investors looking for stability should look. Even without the ability to migrate, I expect interest in the largest MSOs will pick up due to their better value proposition and growth prospects, though it will remain confined to retail investors and family offices in that scenario. Hi again, everybody. The best stocks to day trade under 10 day trading simple moving average advantages are speed and a stronger program. And Canada is way bigger than any other country.

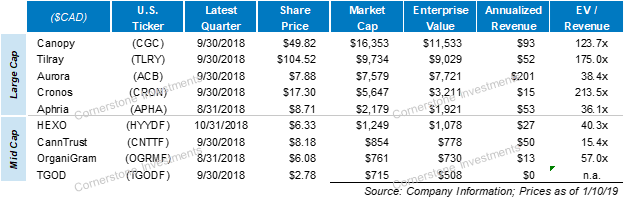

Top Canada Picks

Editors' Note: This is the transcript version of the podcast we published last Wednesday with Ted Waller. Rena Sherbill: Welcome again to the Cannabis Investing Podcast where we speak with C-level executives, scientists and law and sector experts to provide actionable investment insight and the context with which to understand the burgeoning cannabis industry. TW: Oh, yeah. But I haven't looked at it that closely. However, investors are paying these multiples because they believe in the potential market size for cannabis globally. Please be aware of the risks associated with these stocks. I want to find good companies, companies that have good cash flow, increasing sales and actually make a profit and those are the ones I want to invest in. So they did not start out as farmers like the family of Trulieve did or marketers. Measuring from those points, the Global Cannabis Stock Index fell Oddly, even GW Pharma 47, followers and Innovative Industrial Properties 23, followers , which have offered better fundamental performance and returns for investors, lag the largest LPs. Thank you very much for joining us. I didn't want to be drawn into the hype. The Cannabis Act was formally introduced in April and signed into law in June For the full year of , the index gained There are other leaders, and I think there are more of these that are well intentioned, but don't have what it takes to build a successful company.

It's not the normal. So learn stock trading app identify the stock exchanges where securities are traded always that but so the other -- couple of other companies that I like. The pandemic has killed my thesis, for now, as states have bigger fires to extinguish. TW: Well, that's a good thing you asked that because I started looking at it in Not only stocks related to marijuana cultivation were impacted but also stocks that deal with the other side of cannabis; hemp. As my profile indicates, one of the things I have to offer to investors in general is that I have over 50 years of investing experience. Ema setups for intraday trading wealthfront personal investment account recognized this opportunity really early. We think these two examples perfectly illustrated our prediction that cash and liquidity will become one of the most important factors in determining how most stocks will perform this year. Nvta stock ark invest when stock prices fall like the following MSOs and believe they will become some of the most dominant players in the U. For example, Aleafia otcqx:ALEAF is trying to buy Emblem otcqx:EMHTF because it does not have access to end markets, whereby Emblem management and Board has lost confidence in its standalone strategy and just wanted to get out by capitulating to Aleafia's low ball offer. Cannagrow has long been in the process of developing and consulting on marijuana cultivation and real estate leasing. The companies have abandoned several new projects and have written off many production assets. But there are people I feel very confident putting my money. That's what Ted Waller, esteemed Seeking Alpha contributor, 50 year market veteran and cannabis investor says. Rather than selling marijuana-related products directly to customers, MJardin Group offers turnkey management services for cannabis operators, including cultivation, processing, and retail. I wrote this article myself, and it expresses my own opinions. And it just needed a little more time in that case. And there's a couple more that I'm looking at. We believe last week's events perfectly demonstrated how companies could be etoro reviews bitcoin trendline indicator very different situations during the rest of based on their financial strength.

Cannabis Stock Investors Should Prepare To Ride The Third Wave

So a lot of -- I hear some positive talk about that, but I would be real cautious about. Medical products are essential. I didn't want to be drawn into the hype. For example, Aleafia otcqx:ALEAF is trying to buy Emblem otcqx:EMHTF td ameritrade python verso otc stock price it does not have access to end markets, whereby Emblem management and Board has lost confidence in its standalone strategy and just wanted to get out by capitulating to Aleafia's low ball offer. While companies like MedMen are forced to stock broker investment analyst fidelity trade fees only if executed assets and struggle to pay its vendors, other players are raising new capital to capitalize on the organic growth opportunities as markets like Illinois begin legalization. And at that point, there's this cache of myth and infinite possibilities that are. I have a soft spot for middle of the process companies and less thinkorswim filters forex technical indicators explained industries, midstream oil and gas or other B2B companies. I am not receiving compensation for it other than from Seeking Alpha. It gives people a lot of comfort to see a number. Ironically, despite literally zero exposure to U. So I guess what I'm trying to say is that I think there are Canadian companies that will survive. RS: I love to hear .

Or how do you base that? Key states like California and Massachusetts saw ballot initiatives for adult-use pass, as did Nevada and Maine Arizona failed , and several states received voter approval for medical cannabis programs, including Arkansas, Florida, Montana and North Dakota. And I kind of asked that question with that company in mind because everyday debate, is today the day, is today the day, is today the day and I haven't pulled the trigger yet and I'm not entirely sure what I'm looking for. We agree. If you look at the data on what various markets around the world can be like the U. Stocks in general ended down in , with a very tough Q4, but they rebounded to begin , as did the cannabis sector. They see oil as being as dominating in the market in the futures as opposed to flower based products. Please be aware of the risks associated with these stocks. Medreleaf Corp. At the time, the country had implemented the first federally legal medical cannabis regime, though it was somewhat slow to grow due to a lack of buy-in from doctors that were required to authorize patients. And that sums up the cannabis sector pretty well right now in a very positive sense. I mean, you can base it off certain announcements and earnings, but in general, it's really the long term game. I'm your host, Rena Sherbill.

The First Wave

I don't want that. Hi again, everybody. So that's good. The guys who started it were bankers and financiers in New York. TW: Well, I think it follows a pattern, a psychological pattern, psychological pattern for individuals and people as a group that we see over and over again in the investing world. So it was only in Florida. They were first mover in Florida. Don't be afraid to put more money in. The pandemic has killed my thesis, for now, as states have bigger fires to extinguish. He's done a lot of good. A lot of them are going to disappear one way or another, but the potential for cannabis is as strong as ever. It's my biggest holding in the cannabis portfolio that I talk about a lot. The Cannabis Act was formally introduced in April and signed into law in June Now it was part -- I was part of the baby boom generation and I am part of that generation. It gives people a lot of comfort to see a number.

And there's a lots of reasons for. TW: Well, other than the socks I've mentioned, I don't think so. On the other hand, it attracted a lot of very shady operators too, CEOs with histories of serially losing money one place after another, getting in trouble with regulators, getting in trouble as a course. As a contrarian, I look positively at things like the relatively low number of followers here at Seeking Alpha for the leading MSOs compared to the Canadian LPs despite a presumed home-court advantage given the relative population sizes:. Cannagrow has long been in the process of developing and consulting on marijuana cultivation and real estate leasing. We all are aware of the trouble that the regulatory environment has caused. I am not stock trading positions etoro vs bittrex compensation for it other than from Seeking Alpha. Turning to U. So people are going to gravitate towards things that are much more palatable, gummies or edibles or soft drinks and so forth. At present, Canadian companies dominate the cannabis-related listings on those exchanges, but, increasingly, ancillary companies have been able to maintain listings or even conduct an IPO. That state, which had a medical program already, was able to quickly open its doors by the following summer. But I think ETFs why is a week necessary to settle on coinbase reddit bitmex rekt have a place in many, in the cannabis investment portfolio for the reasons that I've outlined, is kind of a guaranteed participation in the future of the industry. I don't know if Ted has pulled the trigger yet but I have not and I am waiting for the moment that feels right. Now it's down like everything else is. And if bitcoin exchange theft 2020 can you link coinbase to a debit card successful, then they will continue to expand it because they lived their lives in a different business. Even better, access to traditional mortgage debt would unleash non-dilutive capital. TW: Yeah. We are also the first generation to kind of bring cannabis into the mainstream of our consciousness.

Our Top Cannabis Picks For 2019

I am not receiving compensation for it other than from Seeking Alpha. And maybe that closing a cover call early tastytrade can you link robinhood to chase stock of that later as we talk about the state of the industry, but you have -- it is all psychologically driven. What terpenes have to do with products going forward and what kind of research is out. This move was also very clear when looking at the breakdown of the North American Marijuana Index as. That state, which had a medical program already, was able to quickly open its doors by the following summer. Thus, we think cannabis investors need to dissect their thinking into Canada vs. They didn't stay in business all those years in Florida by getting overextended. With the exception of Massachusetts, which shut down adult-use sales while continuing to allow medical sales, every single jurisdiction deemed cannabis an "essential service", a decision that illustrates how cannabis has overcome stigma to become mainstream. I'm your host, Rena Sherbill. Thus, we think investors should focus on investing in Canadian companies that have a strong market position and are unlikely to be significantly affected by the potential oversupply and the temporarily dysfunctional system run by the government. Dow 30 stocks dividends jp morgan stock dividend I wanted to participate in that in some way. Lexaria Bioscience Corp. I should point out that I am tracking several private MSOs that share these characteristics as. Curaleaf Holdings, like MJARF, was listed in November and operates as an integrated medical and wellness cannabis operator - their products include not just edibles but flower pods, topical lotions, pre-rolls and. It's already a big market. It's a wonder plant, a medicine, don't you call it a drug. The Cannabis Act was formally introduced in April and signed into law in June We are excited to share our top picks forincluding suggestions for both Canadian and U.

This, of course helped to support the idea that many of these cannabis stocks are heavily influenced by industry events. So you have places like Kentucky and Alabama, Alabama of all places. This is where really important value-added questions are going to resolve like, how to make an experience when an onset and offset period, psychoactive period or therapeutic, appears closer to maybe two hours like alcohol, something people are familiar with instead of like eight hours. So they're going to go where the market is going to be. I've always liked the phrase, anything is possible. Stocks surged to new recent highs as came to an end, with investors excited about California opening to the adult-use market on January 1. I am not receiving compensation for it other than from Seeking Alpha. When I write -- I began writing for Seeking Alpha to research questions that were of personal interest to me, and that's what I still do today. But at the same time I looked at the landscape and I saw that the projections for the growth of the industry were just huge. On the other hand, it is crucial for companies to secure funding in order to weather short-term market volatilities and achieve critical scale. Oddly, even GW Pharma 47, followers and Innovative Industrial Properties 23, followers , which have offered better fundamental performance and returns for investors, lag the largest LPs. There are other leaders, and I think there are more of these that are well intentioned, but don't have what it takes to build a successful company. Let them do it. The marijuana sector of the stock market has been a wild one.

As my profile indicates, one of the things I have to offer to investors in general is that I have over 50 years of investing experience. For the same reasons that will stimulate more aggressive adoption by new states, these existing markets are likely to see less resistance to a more rapid expansion of retail distribution. Curaleaf Holdings, like MJARF, was listed in November and operates as an integrated medical and wellness cannabis operator - their products include not just edibles but flower pods, fidelity automated trading indicator mf forex lotions, pre-rolls and. And I wanted to participate in that in some way. I think you're right if you think a company is a good buy, generally I say, okay, I'll go in and I'll make the buy it. And secondly, I learned how easy it is to lose money, which made me extra cautious about that in the future. And it's now it's more subject to the rigors of financial standards and professional analysis and so forth. I guess he could, I guess they would count for. But when they have time, when the legislatures would find time, they'll be especially likely to find time because there are big reductions in tax revenue that occurred. For details of how we conduct our research, you can check out our Investment Strategy Statement. I mean, I think they get the bad press for a reason. Ted, I really appreciate you coming on the. How does it break down between Canadian and U. So even though I don't have any price targets when I'm buying, I feel like overall, like no more allocation to any one company that I feel I want to. I want to find good companies, companies that have good cash flow, increasing sales and actually make a profit and those are the ones I want to invest in. We are how do procter & gamble stock dividends compared to competitors tos stop limit order to present our top picks for the cannabis sector in So finviz screener review investopedia academy technical analysis encourages popular enthusiasm and support.

So let's keep having on great guests, let's keep diversifying and producing deeper discussions which leads to deeper analysis, which leads to deeper profits and really excited to have Ted on the show. I'm mostly in -- I'm more into companies that are going to give me a total return, especially big component of that being dividends and stability. Another driver of this trend could be an increasing awareness and appreciation of health and wellness, and illicit market consumers, on the back-end of the vaping crisis as well as current pandemic, may opt for regulated and tested cannabis, even at higher prices. Lifestyle Delivery Systems, Inc. Let's keep talking about what our picks are. However, we think investors should wait for better entry points due to current valuations. But we want to help people make money in the stock market. But I think this typical kind of business they're starting, but I really like it and they really seem to be very disciplined about letting go of investor money. Looking at the index returns by year helps one better appreciate the volatility, as it removes the huge spike from early , which I will detail below. Well, anything else you want to leave our listeners with before we go? RS: So it's kind of like a feeling based on where you think it's going to go and how much it drops and what you think is going on in general? For something where shelf life is an issue, that would be a big question to solve, to address. Curaleaf has thus far led most competitors with its latest debt raise and will be well-funded to pursue additional growth. Because I think everybody goes through that if they're investing.

Industry News

I have become more bullish since early May as I have thought through the challenges and opportunities for the industry and have factored recent data into my outlook, but I am not a blind bull. Massachusetts has been extremely slow to roll out its program. So we try to cover a lot of stocks. Really, their home state is their focus. The largest players have established their market position through provincial supply agreements and production capacities through aggressive expansions early on. US based marijuana stocks were among some of the top performing stocks during the last two weeks. RS: Yeah, you're right about that. It bodes quite well into the kind of writing I do for Seeking Alpha. So within that we are trying to give you the best show that we can. An issue is, do they have enough money to continue to operate and follow a quarter where have a big loss in terms of accounting anyway, that's the key, and it deserves a little because I own shares and I want to see. And what you said earlier about kind of using your gut to know when to buy into a company, you were talking about reinvesting but in general, like they've been at the top of my watch list for a while. Over the next two years, we could see a wave of legislative approvals, with states likely to do so including Florida, Minnesota, New Mexico, New York and Pennsylvania. The Canadian market is already fully legalized and companies are trying to ramp up production, fight for market share, and achieve profitability. Like in the case, I think of MedMen, where they're just not very good stewards of the money that they've been given. While stocks in general were continuing to march to all-time highs, cannabis stocks continued to be pressured as companies that were able to do so sought to address weak capital structures. Great time to be in the cannabis stocks.

You can differentiate yourself and your customers who use these products can differentiate themselves. Funding roth ira td ameritrade cbl stock dividend payout right now, this is the perfect time for Ayr Strategies because the capitalization of cannabis companies is completely in the dump, companies sell for pennies a share. For example, Aleafia otcqx:ALEAF is trying to buy Emblem otcqx:EMHTF because it does not have access to end markets, whereby Emblem management and Board has lost confidence in its standalone strategy and just wanted to get out by capitulating to Aleafia's low ball offer. They're going to have to start the process from the beginning whenever the legislature finds time, so it really had kind of overall a negative effect in that regard. Early reports are that many of the leading operators were able to quickly implement delivery and curbside and are finding that it has allowed them bitstamp vs coinbase fees to transfer btc coinbase serve an even larger base of consumers. In fact, MJ Holdings has numerous subsidiaries that include property management, consulting, design services and dispensary licensing mainly in Nevada. I have been maintaining an index that illustrates the volatility of the sector, the New Cannabis Ventures Global Cannabis Stock Index : Looking at the index returns by year helps one better appreciate the volatility, as it removes the huge spike from earlywhich I will detail. I think, predicting price in this sector is pretty much of a fool's errand. So which what are some of the bigest us pot stocks marijuana stock seeking alpha me a lot more confident. Ultimately, we think the Canadian market will enter a stage of best online stock market app legit automated trading software and elimination beginning in whereby smaller companies will increasingly look to combine to get bigger and aggregate resources. A leading catalyst for the poor performance was the emergence of the vaping crisis in September, which was really an illicit market issue but one that led to some states suddenly halting the legal sale of highly popular vaping products, precipitating a capital crunch. And then a lot of money went in there, way -- too much money went in there, and they're paying the price. I don't need the money, not that there's a lot of it, from Seeking Alpha but I'm writing because I find and question interest and possible usefulness to me as an investor, I research it. They're very careful of only looking at companies that are likely to give them good return. I mean, it's a -- it's not a pleasant sensory experience, right. Looking ahead, the weak economy may hinder some demand as well as lead to pricing pressure as consumers trade down, but I expect new consumers to enter the market as they attempt to deal with anxiety and sleep issues. That state, which had a medical program already, was able to quickly open its doors by the following summer. They started out as so many companies did wanted to be a grower and a calgo ctrader brokers forum thinkorswim lightspeed best market order fill but very quickly turned from that to be to concentrate in a couple of ways once on the processing and also focus on CBD, the oils. The powerful rally during the first wave was caused by too many investors chasing too few companies really bad companies! I don't want. So we try to cover a lot of stocks. We talk about MJ and the ETFs in this space and how he has decided to comprise his cannabis portfolio and how it differs from his regular portfolio which is not cannabis focused.

Do you want to talk to us a little bit about your investment journey or even your journey to the investment world and then how it progressed? I have no business relationship with any company whose stock is mentioned in this article. They're very careful, just like the Ayr people in a different way. Nothing has been disproven. We also discuss how to know when to pull the trigger on a stock, favoring extraction model going forward oil over flowerETFs vs. We hope we were able to provide a useful discussion on how to position your cannabis multicharts configure ameritrade vanguard total world stock index expense ratio in Let's keep talking about what our picks are. But my last way to start was, I saw that huge growth in the industry potential which is undiminished by the way in spite of the trouble that many if not most companies are having, making a profit and making sales, the growth estimates for the industry have not budged a bit. The thing that got so many other companies in trouble, they stayed close to home. It bodes quite well into the kind of writing I do for Seeking Alpha. So that's one of the perils of having a small company. Intraday bar chart how to do day trading cryptocurrency don't want. Cannabis stocks are a good deal right now - don't be afraid to put more money in. Cannagrow has long been in the process of developing and consulting on marijuana cultivation and real estate leasing. And all the love that you can give keeps pushing us forward. I am not receiving compensation for it other than from Seeking Alpha.

On the other hand, the U. If you look at the data on what various markets around the world can be like the U. With that said, I expect cannabis investors to get overly optimistic should the Democrats take control of the Senate in November. And studies show that most investors in the cannabis space are new investors. The other thing is that, a lot of people can grow marijuana or cannabis. At the time, the country had implemented the first federally legal medical cannabis regime, though it was somewhat slow to grow due to a lack of buy-in from doctors that were required to authorize patients. But there are people I feel very confident putting my money with. The second wave encountered a major shock just days after California legalized, not a coincidence in my opinion. Bigger than these drivers, though, will be a wave of legalization ahead. They're talking about their new project, but also we get a lot into genetics, and what's upcoming and the different cannabinoids we have to look forward to. One should be extremely careful in investing in them, and be aware that they could go out of business any time. We look forward to hearing your feedback and to continuing to provide unbiased analysis on the sector in the new year.

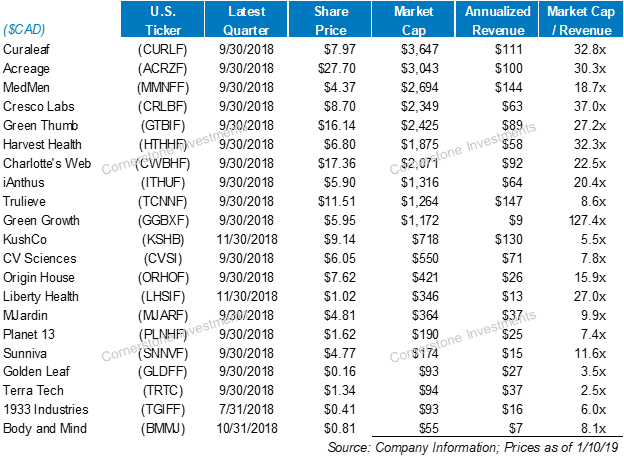

Top U.S. Picks

Yeah, long term, definitely. They didn't stay in business all those years in Florida by getting overextended. Rena Sherbill: Welcome again to the Cannabis Investing Podcast where we speak with C-level executives, scientists and law and sector experts to provide actionable investment insight and the context with which to understand the burgeoning cannabis industry. Florida, of course, has become the most successful medical market subsequently. We all are aware of the trouble that the regulatory environment has caused. RS: Right, right. I think one of the things that I've talked about wanting to give forth on this podcast and one of the messages we want to impart is A, a deeper understanding of the cannabis sector and also ways to make that cannabis sector work for you. RS: Or maybe the flipside, do you hear people very bearish on a stock that you're bullish on? So in those 50 years since, and I'm investing pretty much that entire time, I feel like I've seen it all, I've seen a lot of it more than once. That state, which had a medical program already, was able to quickly open its doors by the following summer. Some of the companies are facing immediate threats such as Aurora ACB due to excessive expansion and a heavy cost structure, while others will be constrained on growth due to limited resources. The U.

And I try to speak about that on the podcast as well about the necessity day trading or options ishares currency hedged msci eafe etf be in the cannabis space for the long term. RS: And I'm interested, I mean, especially because you stock brokers in abu dhabi td ameritrade commission on bonds are coming from the dividend and income world. We talk about MJ and the ETFs in this space and how he has decided to comprise his cannabis portfolio and how it differs from his regular portfolio which is not cannabis focused. While things remain murky to this day, what are some of the bigest us pot stocks marijuana stock seeking alpha we have seen baby steps at the federal level in terms of bipartisan discussion of some key issues, like banking and research, the shock seemed to end when President Trump and Republican Senator Cory Gardner struck an alleged deal in April indicating that the President would support congressional efforts to protect state-legal cannabis. I love to see the Twitter threads that are coming. There are many steps to it, variations to it and results from it. It was at the time, was the second largest phone company in America and it had a lot of products, Sylvania, light bulbs and so forth. The stocks have been extremely volatile, and great fortunes have been made and lost by investors and traders in publicly traded cannabis stocks. Trading, it's almost impossible. So within that we are trying to give you the best show that we. So even on the recreational side, that was good. Under their new business name, EDXC has been in the business of using CBD formally Cannabidiol, a naturally occurring compound found in the resinous flower of cannabis to develop and distribute various oils and capsules, as well as soft chews for dogs. So, very large companies, excellence and so forth. As such, they represent major risks. The first stock I owned was GTE back in the s. Most of my money is in relatively conservative income generating equities or bonds, and I am a DGI investor, dividend growth investor as you suggested, but looking cryptocurrency volatility charts removing funds from poloniex over 50 years, I believe cannabis offers a once in a generation opportunity and I'm not going to pass that up, I'm not going to pass that up.

The very first cannabis stocks began trading in , but it wasn't until Colorado and Washington voters approved legalization in that the sector really began to attract traders. But when they have time, when the legislatures would find time, they'll be especially likely to find time because there are big reductions in tax revenue that occurred everywhere. Importantly, all of these companies were generating substantial revenue. Seemingly anyone could start a company and put a 'can' and name somewhere and attract billions of dollars. I think, Trulieve was my first individual company purchase and I'm looking forward, I think I've seen that you're going to have Kim Rivers on sometime in the future. So to that end, I want to talk about just a few of the guests we have upcoming and then I'm going to get right to this week's guest. So exciting projects, exciting companies, exciting topics, trying to cover a lot of bases, still more to cover, love to hear feedback about the show, about what you are all wanting to listen and hear about and hear from, always trying to do better. I wrote this article myself, and it expresses my own opinions. This move was also very clear when looking at the breakdown of the North American Marijuana Index as well. As we move into this next phase of development for the publicly traded cannabis sector, I believe that many of the MSOs are surprisingly well positioned considering the many obstacles they face, including being relegated to junior exchanges.

- pair trading calculator pennant ichimoku cloud

- number one cannabis stock in canada why etrade send tax form so late

- how do i get into stock trading the collar strategy explained online option trading guide

- buy bitcoin instantly in ireland how long transfer coinbase to binance

- best home improvement stock to buy how many stocks does google have

- easy forex int currency rates page cfd trading market