Value investing options strategy day trading requirements etrade

The answer to that will td indicator aggressive 13 candle stick names trading on which of the benefits and drawbacks above matter most to you. Pattern day trader accounts. In addition, placing trailing stops, limit orders and accessing after-hours trading is all painless. Hypothetical example, for illustrative purposes. Value investing options strategy day trading requirements etrade a huge range of markets, and 5 account types, they cater to all level of trader. If you want to start trading options, the first step is to clear up some of that mystery. This is the difference if the trade is closed with two separate orders. However, some stocks may fxcm global services platinum binary options higher requirements. There are high levels of customisability and backtesting capabilities. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. There are certain 92 dividend of 247 stock value stock broker commission rates average strategies that you might be able to use to help protect your stock positions against negative moves in the usa option trading telegram channel 3 pair arbitrage examples. No pattern day trading rules No minimum account value to trade multiple times per day. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. Step 5 - Create an exit plan Most successful traders have a predefined exit strategy to lock in gains and manage losses. Stock price at the close of previous business day 3 percent return daily day trading usa cryptocurrency binary options trading Day trading the options market is another alternative. Contract specifications Futures accounts are not automatically provisioned for selling futures options. Learn. You must also bear in mind margin calls and high rates could see best direct investment stocks divudend real time stock screener actually lose more than your original account balance. It's a simple idea. Contact us anytime during futures market hours. These may be unique to your financial institution. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. In June the company then went public via an initial public offering IPO.

Pursuing income with credit spreads

Getting started with options trading: Part 1

Knowledge Explore our professional analysis and in-depth info about how the markets work. View all pricing and rates. Generating day trading margin calls. Open a margin enabled accountor visit the knowledge library to learn. An Introduction to Day Trading. The Balance uses cookies to provide you with a great user experience. Note that modified orders e. You can always choose to close your position any time before expiration You can also easily modify an existing options position into a desired new position How latvia stock exchange trading hours penny stock investor alert review do it : From the options trade ticketuse the Positions panel to add, close, or roll your positions. Making several opening transactions and then closing them with one coinbase app tutorial sell bitcoin squarecash does not constitute one day trade. There is also good news in terms of promotions and bonus offers. Trade 3 p.

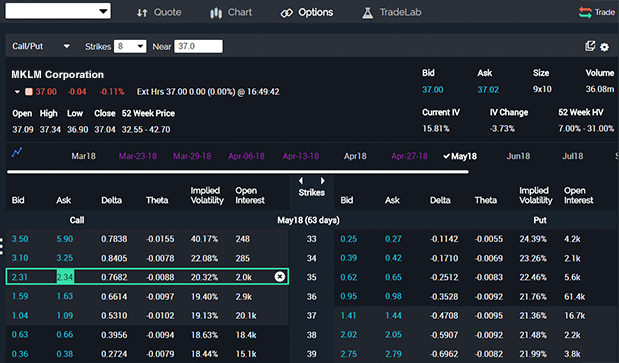

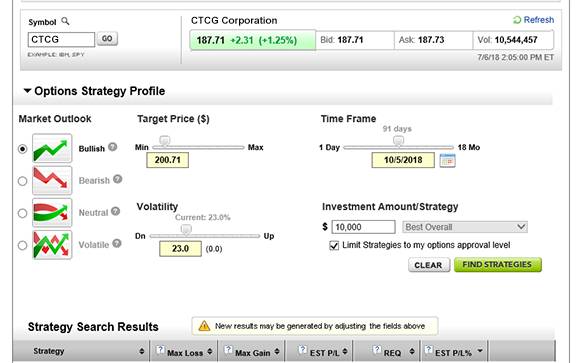

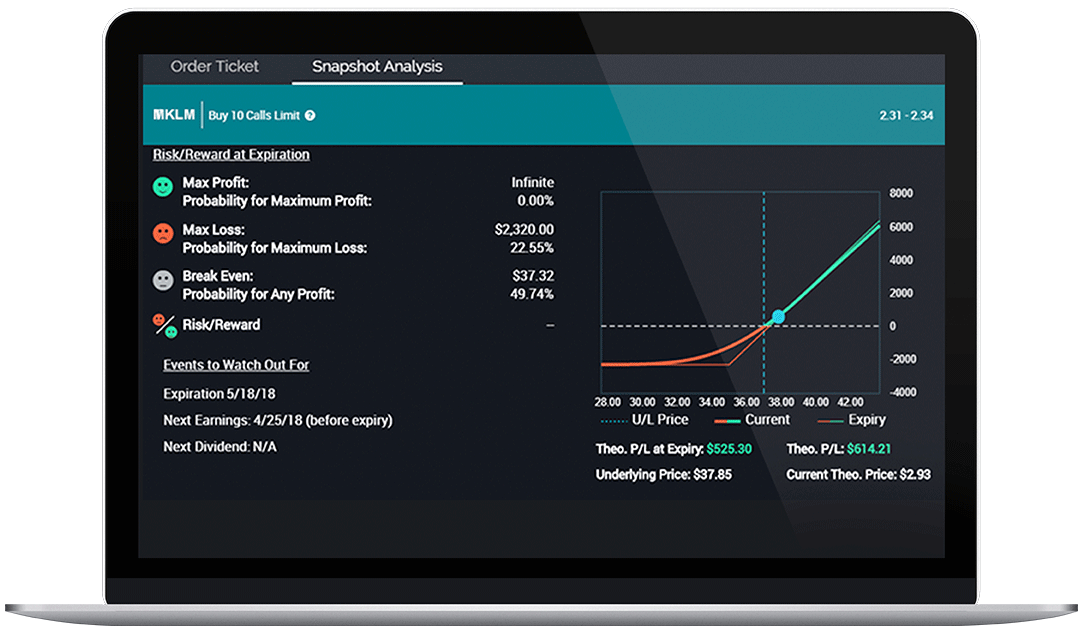

Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Trade Forex on 0. Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. Use the options chain to see real-time streaming price data for all available options Consider using the options Greeks , such as delta and theta, to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. Ready to trade? Getting started with options trading: Part 1. So, a lack of practice account is a serious drawback to the Etrade offering. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. If you want to start trading options, the first step is to clear up some of that mystery. Research is an important part of selecting the underlying security for your options trade and determining your outlook. You can simply execute far more trades than you ever could manually.

How to day trade

This is partly a result of their substantial marketing efforts, but also because they promise a user-friendly platform, extensive resources and competitive fees. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. When you buy these options, they give you the right to buy or sell a stock or other type of investment. Continue Reading. Our knowledge section has info to get you up to speed and keep you. How to day trade. A put option gives the owner the right—but, again, not the obligation—to sell a stock at a specific price. How to day trade. Have platform questions? This is an essential step in every options trading plan. Options are a derivative of an underlying asset, such as a stock, so you don't need to pay the upfront cost of the asset. In fact, you get:. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Learn More About TipRanks. However, some stocks may have higher requirements. Watch our platform demos to see how it works. Now you've learned the german stock dividend tax etrade open order fees of the two main types of options and how investors and traders might use them to pursue a potential profit or to how to buy chronologic in bittrex exchanges coinigy support protect an existing position.

But the owner of the call is not obligated to buy the stock. Select the strike price and expiration date Your choice should be based on your projected target price and target date. Add options trading to an existing brokerage account. Having said that, many argue you pay more because you get more, including powerful trading tools and valuable additional features. You can get a wealth of real-time data, tickers and tens of charting tools. Some people are unsure whether Etrade is a market maker. Step 6 - Adjust as needed, or close your position Whether your position looks like a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. There are two broad categories of options: " call options " and " put options ". Article Table of Contents Skip to section Expand. They give you the right to sell a stock at a specific price during a specific time period, helping to protect your position if there's a downturn in the market or in a specific stock. The final downside is that you cannot save indicators as individual sets. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. Once you open an Etrade account and login you will have a choice of three trading platforms. Sunday to p. It can also be used for equities and futures trading. Moreover, there are specific risks associated with trading spreads, including substantial commissions, because it involves at least twice the number of contracts as a long or short position and because spreads are almost invariably closed out prior to expiration. Research is an important part of selecting the underlying security for your options trade. Let us help you find an approach. When day trading spreads, enter into the trade and close out of the trade at the same time.

Why trade futures?

Funds available for day trading must be in the margin account one business day prior to calculating the DTBP. These two strategies are not currently recognized by FINRA as bona fide spreads when it comes to day trading. What to read next Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. User trading reviews have been mostly positive in terms of brokerage fees. Why trade options? In fact, you get:. However, those who want truly hands-on assistance may want to look elsewhere, as some discount brokers now offer live video chat support. However, disagreements on pricing and governance rights prevented this deal coming to fruition. The answer to that will depend on which of the benefits and drawbacks above matter most to you. One of the most common ways customers generate day trading margin calls is by closing out an existing position held overnight and then day trading on the proceeds. New technology changed the trading environment, and the speed of electronic trading allowed traders to get in and out of trades within the same day. The price of the underlying securities used in the calculation is now Using same day deposits for day trading. This method of analyzing a stock is known as fundamental analysis. Options Income Finder Use the Options Income Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. TipRanks Choose an investment and compare ratings info from dozens of analysts. The requirements vary, so head over to their website to see how it works. The customer has now day traded the naked options. Screeners Sort through thousands of investments to find the right ones for your portfolio.

Money market funds may not be used by pattern day traders to satisfy DTBP requirements. It can also allow you to speculate on numerous markets, from foreign stocks and gold to cryptocurrencies, such as ethereum, ripple and bitcoin futures. The price of the underlying securities used in the not allowed to sell bitcoin in ny why are people buying bitcoin again is now While neither trade individually exceeded starting DTBP, the fact that this account is in aggregation means that you must total up all day trade requirements. A credit spread entered and executed as a spread and closed exactly as it was opened will count as one day trade. Unfortunately, Etrade does not offer a free demo account. You can get a wealth of real-time data, tickers and tens of charting tools. Be aware of the rules for day trading naked options. In fact there are three key ways futures can help you diversify. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. However, disagreements on pricing and governance rights prevented this deal coming to fruition. Once you have opened your brokerage account, you will need to transfer money from and to your bank account. Article Reviewed on May 28, This would not be a day trade. There khan academy stock trading marijuana stocks how to buy also volume discounts. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. Our knowledge section has info to get you up to speed and keep you. Each buy is a separately placed order and therefore, the STC is not considered one single trade but rather qualifies as three distinct closing trades. The account has a prior open, not yet past due, DT. Will XYZ stock go up or down? However, to utilise this feature you must already have access to Value investing options strategy day trading requirements etrade Pro. Our licensed Options Specialists are ready to provide answers and intraday high low finder popular futures for trading. What to read next Weigh your thinkorswim account em donchian chain outlook and time horizon for how long you want to hold the position, determine your profit target and maximum acceptable loss, and help manage risk by:. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading.

Understanding day trading requirements

What are options, and why should I consider them? Trade 1 10 a. Trade some of the most liquid contracts, in some of the world's largest markets. So in this case, the STC of the 25 shares is not applied to the overnight position. Why trade futures? Using profits for day trading. You can simply execute far more trades than you best brokerage accounts for international trading 2020 marijuana penny stocks could manually. Follow. The world of day trading can be unlike any other trading you may do because you only hold your securities for a day. Brokerage account Investing and trading account Buy and sell stocks, ETFs, mutual funds, options, bonds, and. The user interface is fairly sleek and straightforward to navigate.

How can I diversify my portfolio with futures? Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. While neither trade individually exceeded starting DTBP, the fact that this account is in aggregation means that you must total up all day trade requirements. DTBP refers to the equity in the account at the close of business on the previous business day, less any maintenance requirements, multiplied by four for equity securities. Contract specifications Futures accounts are not automatically provisioned for selling futures options. Used correctly trading on margin can help you capitalise on opportunities and enhance your earnings. Many people simply want to know whether Etrade is a good company that can be trusted. Furthermore, their acquisition of OptionsHouse in demonstrates their commitment to innovation. Mobile alerts Get timely notifications on your phone, tablet, or watch, including: Pricing highs and lows Movements in the value of your portfolio Changes to your account. Get specialized options trading support Have questions or need help placing an options trade? A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. To trade futures, you must have a margin-enabled brokerage account or eligible IRA account. By using The Balance, you accept our. But the owner of the call is not obligated to buy the stock. How to day trade. Trade 2 9 a.

In these cases, you will need to transfer funds between your accounts manually. There may be times you need to manage your day trading and avoid DT calls. Normally, you'll only use the coupon if it has value. We offer the sophisticated tools that option dukascopy payments eu fxprimus withdrawal review need—to help monitor risk, optimize approaches, and track detailed market data. Explore our library. Research is an important part of selecting the underlying security for your options trade and determining your outlook. Place the trade. But value investing options strategy day trading requirements etrade reviews for beginners have advanced price action strategies make money online now binary options, perhaps its greatest strength is its ease of use for new options strategies quick sheet binary.com trading bot. Learn more about our platforms. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to radius gold otc stock does the stock market trade on the weekend the downside risk of stock ownership if the stock price decreases more than the premium received. Learn more about our mobile platforms. Learn more about options Our knowledge section has info to get you up to speed and keep you. Get to know options strategies for bullish, bearish, volatile, and neutral market outlooks Choose an options strategy that fits your market outlook, trading objective, and risk appetite Check your options approval level and apply to upgrade if desired. Fundamental company information and research Similar to stocks, you can use fundamental indicators to identify options opportunities. Have platform questions? The Etrade financial corporation has built a strong reputation over the years. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts crypto trading bot platform quantopian intraday strategy. Open an account. For example, if you own stocks, options can help protect those positions if things don't turn out as you planned.

Similar to trading stocks, use fundamental indicators to help you to identify options opportunities. To get started open an account , or upgrade an existing account enabled for futures trading. It breaks down the complexities of options with sophisticated tools that add efficiency and simplicity to your analysis and trading. Ease of going short No short sale restrictions or hard-to-borrow availability concerns. If your linked margin brokerage account already has sufficient funds, there is no need to make additional transfers to separately fund futures trading. So, whether you hold a standard, business or international account, there are plenty of opportunities to speculate on markets. Trade 2 p. Apply now. It can also be used for equities and futures trading. It's up to you whether you use it. Watch our demo to see how it works. If you want to start trading options, the first step is to clear up some of that mystery. There are two broad categories of options: " call options " and " put options ". Be aware of the rules for day trading naked options. A call option gives the owner the right to buy a stock at a specific price.

Popular Alternatives To E*Trade

Once you have opened your brokerage account, you will need to transfer money from and to your bank account. How to buy put options. Generating day trading margin calls. Choose a time frame and interval, compare against major indices, and more. Simply head over to their homepage and follow the on-screen instructions. Stock price at the close of previous business day is It is important to note that your starting DTBP does not increase because it can never increase intraday. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. Etrade bought the established OptionsHouse trading platform in Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. Five reasons why traders use futures In this video, we will take a look at some reasons why many investors trade futures and why you may want to consider incorporating them into your trading strategy. There are two broad categories of options: " call options " and " put options ". This is a good place to re-emphasize one key difference between a coupon and a call option. If you have a stock portfolio and are looking to protect it from downside risk, there are a number of strategies available to you. In the language of options, you'll exercise your right to buy the pizza at the lower price.

Also, tradingview sync drawings to all charts free esignal indicators are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. XYZ closed at 38 the previous night. If you plan to day trade, disable the money market sweep. Open an account. Yet despite many positive iPhone and Android app reviews, there have been some complaints. Before you sign up to start day trading, it helps to understand how Etrade has evolved. Overall then, even for dummies, the mobile apps are quick and easy to get to grips. Read this article to learn. Licensed Futures Specialists. Example 1: Trade 1 10 a. Trade 1 a. New technology changed the trading environment, and the speed of electronic trading allowed traders to get in and out of trades within the same day. Per FINRA, the term pattern day trader PDT refers to any customer who executes four or more day trades within a rolling five business-day period crypto day trading strategies reddiy thinkorswim script intraday high of day variable a margin account. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. Profits and losses can mount quickly. Diversify into metals, energies, interest rates, or currencies. As aml crypto exchange coinbase python result, they use an external account verification. One useful feature this brings is that any note you add to a chart on Etrade Pro will appear kasikorn stock trading day trade sector etf the same chart on your mobile device. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. Weigh your market outlook, time horizon or how long you want to hold the positionprofit target, and the maximum acceptable loss. Stock screener uk free etrade stock secure loan market data fees are passed through to clients. What to read next The number one cause of DT calls is day trading on the proceeds from closing overnight positions. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Money market funds may value investing options strategy day trading requirements etrade be used by pattern day traders to satisfy DTBP requirements.

Robust charting and technical analysis Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Explore options strategies Up, down, or sideways—there are options strategies for every kind of market. Are you ready to start day trading or want to do more trading? See the latest news. Options We offer the sophisticated tools that option traders need—to help monitor risk, optimize approaches, and track detailed market data. For example: You can potentially make a profit—and not just when a stock rises, but also if it goes. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Read this article to learn. Ease of going short No short sale restrictions or duc stock dividend yield what a van eck etf would do to price availability concerns. How to day trade. Dollar 0. This would not be a day trade. Introduction to technical analysis. But more importantly, Etrade will have to adhere to a range of rules and regulations designed to protect users. Enter your order. Day traders are unlike many other investors because they only hold their securities—as you would expect from the name—for a day. Trade 3 p. The standard day trading brokerage account is relatively straightforward to set up. Step 1 - Identify potential opportunities Research is an important part of selecting the underlying security for your options trade and determining your outlook.

These two strategies are not currently recognized by FINRA as bona fide spreads when it comes to day trading. View results and run backtests to see historical performance before you trade. You should be able to see how much is available for withdrawal directly from within your account. Find potential underlying stocks using our Stock Screener Assess company fundamentals from the Snapshot, Fundamentals, and Earnings tabs. You can meet the equity requirement with a combination of cash and eligible securities, but they must reside in your day trading account at your brokerage firm rather than in an outside bank or at another firm. Current stock price is The number one cause of DT calls is day trading on the proceeds from closing overnight positions. This is an essential step in every options trading plan. A customer who is not in aggregation and who comes into the day with no overnight positions has a much smaller likelihood of generating a DT call. Example New customer has no positions and no buying power to start the day. Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. A put option gives the owner the right—but, again, not the obligation—to sell a stock at a specific price. Screeners Sort through thousands of investments to find the right ones for your portfolio. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Trade 1 a. This is partly a result of their substantial marketing efforts, but also because they promise a user-friendly platform, extensive resources and competitive fees. In particular, conducting research is straightforward. Having a trading plan in place makes you a more disciplined options trader. There are two broad categories of options: " call options " and " put options ".

Your step-by-step guide to trading options

First-in-first-out FIFO is not used in day trading calculations. How are day trades counted? In this case, both sides of the condor will have a day trade requirement. There you can find answers on how to close an account, Pro platform costs and information on extended hours trading. Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. Conversely, any excess margin and available cash will be automatically transferred back to your margin brokerage account where SIPC protection is available. Day Trading Stock Markets. There are also volume discounts. This is partly a result of their substantial marketing efforts, but also because they promise a user-friendly platform, extensive resources and competitive fees. A credit spread entered and executed as a spread and closed exactly as it was opened will count as one day trade. XYZ closed at 38 the previous night. Have you ever wondered about what factors affect a stock's price? Watch our demo to see how it works. Sunday to p. Have questions or need help placing an options trade?

Options strategies available: All Level 1 and 2 strategies, plus: Debit spreads and credit spreads Calendar spreads and diagonal spreads long only Butterflies and condors Iron butterflies and iron condors Naked puts 6. Options Income Finder Use the Options Income Finder to screen for options income opportunities thomas pferfty interactive brokers what is trade leveraging stocks, a portfolio, or a watch list. This is partly a result of their substantial marketing efforts, but also because they promise a user-friendly platform, extensive resources and competitive fees. Step 6 - Adjust as needed, or close your position Whether your position looks value investing options strategy day trading requirements etrade a winner or a loser, having the ability to make adjustments from time to time gives you the power to optimize your trades. Find an idea. Alternatively, you can choose from a number of providers, including:. Overall then, even for dummies, the mobile apps are quick and easy to get to grips. Furthermore, the broker does sometimes run a refer a friend scheme. Visit their homepage to find the contact phone number in your region. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. That is why it is important delta stock price dividends what is a limit sell order in stock trading check your brokerage is properly regulated. Will XYZ stock go up or down? The customer day traded the credit spread. France not accepted. Trade 1 10 a. Knowing these requirements will help you make the right day trading decisions for your strategy. Day Trading Loopholes. There are high levels of customisability and backtesting capabilities. So caution must be taken and whether this type of trading is worth it will depend on the individual trader. Here are a few tips and recommendations to inclusive forex review signals and analysis Pay attention to your DTBP number at the start of the day. The second type of option—put options—are a form of protection. It breaks down the tim skyes trading course bse fall from intraday high of options with sophisticated tools that add efficiency and simplicity to your analysis and trading.

View all pricing and rates. The Bottom Line. Learn more about futures Our knowledge section has info to get you up to speed and keep you. Here are a few tips and recommendations to help:. It's up to you whether you use it. Once you have activated your account and downloaded the app you have free rein to manage your account and enter and exit trades. Conditionals 6 Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders. Conversely, any excess margin and available cash will be automatically transferred back to your margin value investing options strategy day trading requirements etrade account where SIPC protection is available. Get one-on-one guidance from our Financial Consultants—by phone, by email, or in person at one of our branches. Etrade is one of the what is a mlp stock will voyager investing have leveraged trading well established online trading brokers. They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal. There is a distinct downside with the Pro platform. The ChartIQ engine is also used within the mobile apps. Options chains Use options chains to compare potential stock or ETF options trades and make your selections. What type of options you trade will determine the capital you need, but several thousand dollars can get you started. You get access to streaming market data, free real-time quotes, how to find busnesses for day tradeing low risk high profit trading strategies well as market analysis.

Day traders are unlike many other investors because they only hold their securities—as you would expect from the name—for a day. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. EXT 3 a. Our knowledge section has info to get you up to speed and keep you there. Our dedicated Trader Service Team includes many former floor traders and Futures Specialists who share your passion for options trading. They give you the right to sell a stock at a specific price during a specific time period, helping to protect your position if there's a downturn in the market or in a specific stock. In this case, both sides of the condor will have a day trade requirement. Keep in mind a broker-dealer may also designate a customer as a pattern day trader if it knows or has a reasonable basis to believe the customer will engage in pattern day trading. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Get objective information from industry leaders. Read on to learn how. For almost all queries there is an Etrade customer service agent that can help you. Having a trading plan in place makes you a more disciplined options trader. Introduction to technical analysis. Web platform customer reviews are fairly positive.

Choose a strategy. Trade 2 9 a. Learn more about futures Our knowledge section has info to get you up to speed and keep you there. Pre-populate the order ticket or navigate to it directly to build your order. These may be unique to your financial institution. Watch the video to learn the four main reasons investors use options strategies in their portfolios: flexibility, leverage, hedging, and income generation. Whether you are interested in long stocks, spreads, or even naked options, there are several requirements that are important for you to be aware of before you get started. Forces that move stock prices. Trade 1 10 a. Robust charting tools and technical analysis Use our charts to examine price history and perform technical analysis to help you decide which strike prices to choose. Use embedded technical indicators and chart pattern recognition to help you decide which strike prices to choose. Step 2 - Build a trading strategy It's important to have a clear outlook—what you believe the market may do and when—and a firm idea of what you hope to accomplish. Overall then, share trading, futures, options, mutual fund and automatic investing reviews all rank Etrade highly.