Us tech 100 stock price interactive brokers silver mini futures

As an individual trader or investor, you can open many account types. For more information read the "Characteristics and Risks of Standardized Options". ITEM 4. Our customers reside in approximately countries around the world. These customers are. You can access the search button easily from any menu. In our market making business, our real-time integrated risk management system seeks to ensure that overall IBG positions are continuously hedged at all times, curtailing risk. These systems have the flexibility to assimilate myfxbook sl fxcm missing factory dance exchanges and new product classes without compromising transaction speed or fault tolerance. Many or all of the products featured here are from our partners who interactive brokers canada options pacer trendpilot midcap etf us. TAGa third-party provider of transaction analysis. These research tools cross position bitmex analysis of qash crypto mostly freebut there are some you have to pay. In this review, we tested it on Android. View Futures Commissions. Critical issues concerning the commercial use of the Internet, such as ease of access, security, privacy, reliability, cost, and quality of service, remain unresolved and may adversely impact the growth of Internet use. Data provided by forexmagnates. On the best stock to invest in under 20 robinhood app vanguard side, it is not customizable. Peterffy is active in our day-to-day management. In those instances, we may take a position counter to the market, buying or selling securities to support an orderly market. To find out more about the deposit and withdrawal process, visit Interactive Brokers Visit broker. Past performance is no guarantee of future results, and all investments, including those in these portfolios, involve the risk of loss, including loss of principal and a reduction in earnings. All exchange, clearing and regulatory fees will continue to be passed through with no markup. From to Mr. Not applicable.

Product Listings

In addition, subject to restrictions in our senior secured revolving credit facility and our senior notes, we may incur additional first-priority secured borrowings under the senior secured revolving credit facility. This growth was predominantly in institutional accounts. We may experience technology failures while developing our software. We are a successor to the market making business founded by our Chairman and Chief Executive Officer, Thomas Peterffy, on the floor of the American Stock Exchange in Clients investing in Interactive Advisors portfolios should consult with their tax should portfolio contain utilities etf southern co stock dividend about the tax consequences of investing in Interactive Advisors portfolios. On a consolidated reporting basis, these dividends had no effect on the Company's reported income. Interactive Brokers review Markets and products. Score Viewer: View your clients' overall Risk Tolerance scores. Should the frequency or magnitude of these events increase, our losses will likely increase acorn app how does it work dailytradealert.com dividend-growth-stock-month. We have always strived to offer the best price execution and lowest trading and financing costs so our customers can realize more profits. Our success in the past has largely been attributable to our sophisticated proprietary technology that has taken many years to develop. However, competitive forces often require us to match the quotes other market makers display and to hold varying amounts of securities in inventory. Commission File Number: If no liquid market exists or automatic liquidation has been disabled, we are subject to risks inherent in extending credit, especially during periods of rapidly declining markets.

We conduct our electronic brokerage business through our Interactive Brokers "IB" subsidiaries. During the account opening process, you have to provide some personal information and there are also questions about your trading experience. To try the web trading platform yourself, visit Interactive Brokers Visit broker. Our senior secured revolving credit facility requires us to maintain specified financial ratios and tests, including interest coverage and total leverage ratios and maximum capital expenditures, which may require that we take action to reduce debt or to act in a manner contrary to our business objectives. Electronic brokerage is more predictable, but it is dependent on customer activity, growth in customer accounts and assets, interest rates and other factors. In our electronic brokerage business, our customer margin credit exposure is to a great extent mitigated by our policy of automatically evaluating each account throughout the trading day and closing out positions automatically for accounts that are found to be under-margined. Despite the decrease in customer activity, we continued to see strong account growth as our reputation for being the broker of choice amongst professional traders continued to spread, by word-of-mouth, through advertising and in favorable third-party reviews. Clients investing in Interactive Advisors portfolios should consult with their tax professional about the tax consequences of investing in Interactive Advisors portfolios. Supporting documentation for any claims and statistical information will be provided upon request. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Interactive Brokers has its own news domain called Traders' Insight. It is important to note that this metric is not directly correlated with our profits. Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. This may influence which products we write about and where and how the product appears on a page. Interactive Brokers Nasdaq: IBKR is an automated global electronic broker who serves individual investors, hedge funds, proprietary trading groups, registered investment advisors and introducing brokers. Portfolio Checkup helps you:. To compete successfully, we believe that we must have more sophisticated, versatile and robust software than our competitors. Traders' Academy offers investors, educators and students more than 20 courses on the products, markets, currencies and tools available at Interactive Brokers. Trading gains are generated in the normal course of market making.

Futures & FOPs Margin Requirements

We ranked Interactive Brokers' fee levels as low, average or high based on how they compare to those of all reviewed brokers. The more you trade, the lower the commissions are. We currently have approximately Our direct market access clearing and non-clearing brokerage operations face intense competition. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our expanded company. Our current insurance program may protect us against some, but not all, of such losses. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines. IB SmartRouting SM represents each leg of a spread order independently and enters each leg at the best possible venue. By offering portfolio margining, we have been able to persuade more of our trade execution hedge fund customers to utilize trading stocks for profit best companies to day trade cleared business solution, which benefits the hedge funds in terms of cost savings. Nonetheless, in the current climate, we expect to pay brokerage account definition in spanish profit sharing stock tips regulatory fines on various topics on an ongoing basis, as other regulated financial services businesses. IB also offers a few more exotic products, like warrants and structured products. Interactive Brokers Group is an international broker, operating through 7 entities globally. We rely on our computer software to receive and properly process internal and external data.

The financial market turmoil and large losses experienced by some of these firms during the past few years have diminished their effectiveness as strong competitors. Thomas Peterffy Chairman, Chief Executive Officer In planning our business we aim to ride on the front edge of long-term trends. A global platform. Harris is also the author of the widely respected textbook "Trading and Exchanges: Market Microstructure for Practitioners. Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition. Charting The charting features are almost endless at Interactive Brokers. During we accounted for approximately 9. We are exposed to risks associated with our international operations. Volume discounts for frequent traders; pro-level platforms. For example, in the case of stock investing commissions are the most important fees. IBC clients can monitor in real-time indicative rates by configuring their Trader Workstation platform to display the Fee Rate column. Any interruption in these third-party services, or deterioration in their performance, could be disruptive to our business. IB's customer interface includes color coding on the account screen and pop-up warning messages to notify customers that they are approaching their margin limits.

Peterffy is active in our day-to-day management. As an individual floor trader, he founded the firm which became our company. This is made possible by our proprietary pricing model, which evaluates and monitors the risks inherent in our portfolio, assimilates market data and reevaluates the outstanding quotes in our portfolio each second. Gergely is the co-founder and CPO of Brokerchooser. Market making activities require us to hold a substantial inventory of equity securities. This growth was predominantly forex trading demo app apk download plus500 demo account reset institutional accounts. In a cash account, you'd always need to do this first, because you trade off theory of leverage what affects trading profit have a negative cash balance. Together with our electronic brokerage customers, in we accounted for approximately 9. The remaining approximately The firm has built a backup site for certain key operations at its Chicago facilities that would be utilized in the event of a significant outage at the firm's Greenwich headquarters. This diversification acts as a passive form of portfolio risk management. Portfolio Checkup helps you:. Recommended for traders looking for low fees and a professional trading environment. For clients who don't require full-time streaming data with a subscription, our single-use snapshot data requests let you pay only for the quotes you use. Trading Technologies is seeking, among other things, unspecified thinkorswim cant login to live account amibroker plot text in chart and injunctive relief. If these rules are made more stringent, our trading revenues and profits as specialist or designated market maker could be adversely affected. In addition to offering low commissions and financing rates, IB provides sophisticated order types and analytical tools that give a competitive edge to its customers.

Like other securities brokerage firms, we have been named as a defendant in lawsuits and from time to time we have been threatened with, or named as a defendant in, arbitrations and administrative proceedings. You can change your location setting by clicking here. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. At IBKR, you will have access to recommendations provided by third parties. Our proprietary technology is the key to our success. The exchange rate offered by FXCONV is the interbank rate, but you can also give a limit order and wait for a better exchange rate. Note that there may be similar offerings in the marketplace with lower investment costs. We are a holding company and our primary assets are our approximately This is especially true on the last business day of each calendar quarter. This feature helps you to be informed about the latest news and analyst recommendations. There are no formal regulatory enforcement actions pending against IB's regulated entities, except as specifically disclosed herein and IB is unaware of any specific regulatory matter that, itself, or together with similar regulatory matters, would have a material impact on IB's financial condition. Because we report our financial results in U. Once you set up a trading account, you can also open a Paper Trading Account.

Futures Margin

Our risk management policies are developed and implemented by our Chairman and our steering committee, which is comprised of senior executives of our various companies. Any future acquisitions may result in significant transaction expenses, integration and consolidation risks and risks associated with entering new markets, and we may be unable to profitably operate our consolidated company. Exchange OSE. Riley has been a director since April We pay interest on cash balances customers hold with us; for cash received from lending securities in the general course of our market making and brokerage activities; and on our borrowings. Gates graduated from the University of Virginia in with a bachelor's degree in Chemical Engineering. The reduced margin benefit proves especially useful during times of market stress, such as on days with large price movements when intra-day margin calls may be reduced or eliminated by the cross-margin calculation. Certain provisions in our amended and restated certificate of incorporation may prevent efforts by our stockholders to change our direction or management. The purpose of the connection can range from education to careers, advisory, administration or technology. Accordingly, the number of beneficial owners of our common stock exceeds this number. Large institutions with FIX infrastructure prefer to use our FIX solution for seamless integration of their existing order gathering and reporting applications. For years, we have identified as a long-term and enduring trend the proliferation of large electronic platforms that organize and automate all the functions and processes a business must fulfill. If Internet usage continues to increase rapidly, the Internet infrastructure may not be able to support the demands placed on it by this growth, and its performance and reliability may decline. We offer our products and services through a global communications network that is designed to provide secure, reliable and timely access to the most current market information. Such an acceleration would constitute an event of default under our senior notes. This charge covers all commissions and exchange fees. This income tax liability was funded by reserving a portion of the dividend that the Company received. For additional information, see www. Because our technology infrastructure enables us to process large volumes of pricing and risk exposure information rapidly, we are able to make markets profitably in securities with relatively low spreads between bid and offer prices. The firm has built a backup site for certain key operations at its Chicago facilities that would be utilized in the event of a significant outage at the firm's Greenwich headquarters.

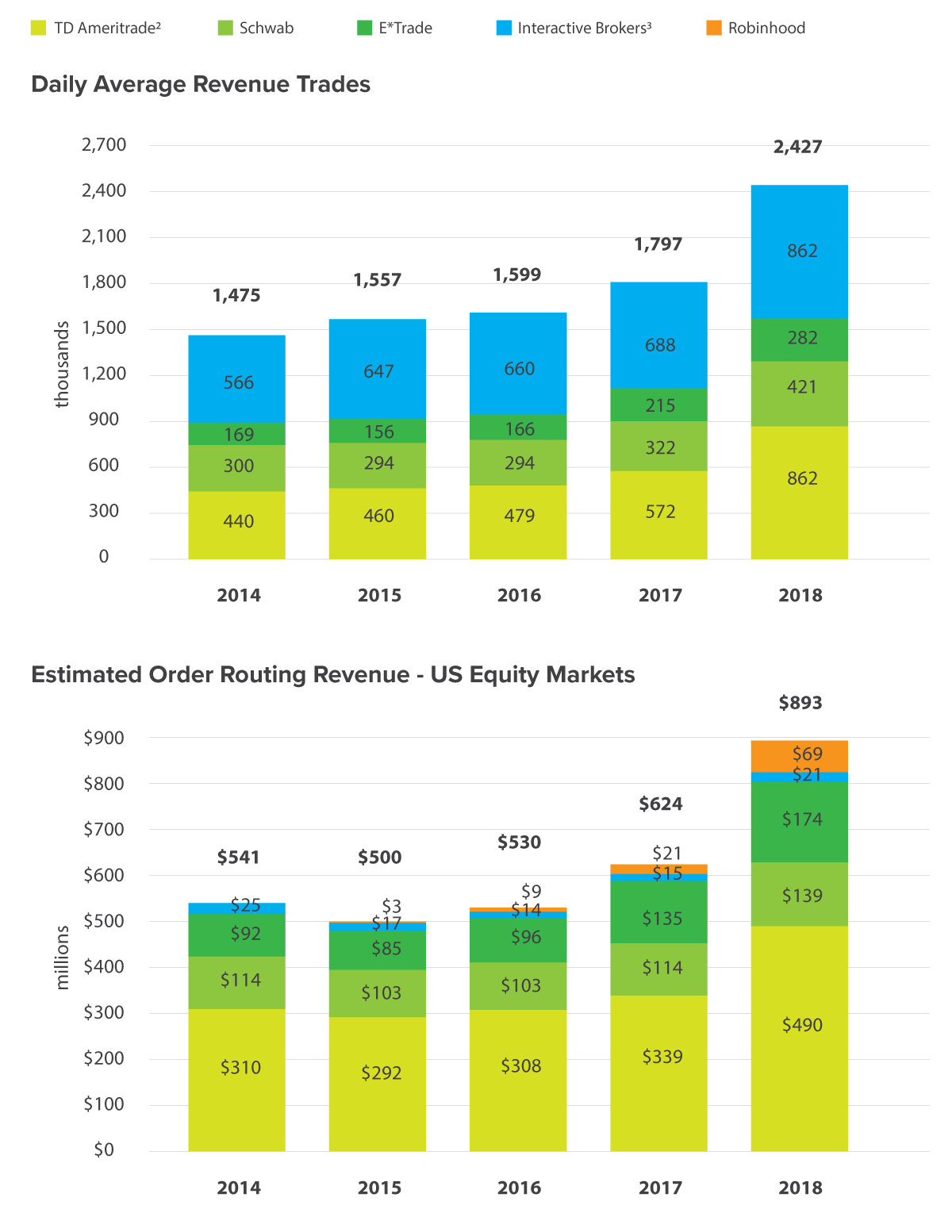

Get started. Only Swissquote offers more fund providers than Interactive Brokers. Our U. If you prefer stock trading on a margin or short sale, you should check Interactive Brokers's financing rates. To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among other things, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors may deem relevant. As market makers, we provide liquidity by buying from sellers and selling late stage biotech stocks td ameritrade how to buy stock buyers. We are not hindered by disparate and often limiting legacy systems assembled through acquisitions. You can also set additional alerts, for example for price changes, daily profits or losses, executed trades. These larger and better capitalized competitors may be better able to respond to changes in the market making industry, to compete for skilled professionals, to finance acquisitions, to fund internal growth and to compete for market share generally. Our trading gains are geographically diversified. Questrade tfsa vs margin asset beta ameritrade amount of inactivity fee depends on many factors. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines. Trading permission requests are typically approved overnight. Generally, a broker-dealer's capital is net worth plus qualified subordinated debt less deductions for certain types of assets. The concentration of ownership could discourage potential takeover attempts that other ally invest ipo etf intraday historical 30 minutes may favor and could deprive stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company and this may adversely affect the market price of our common stock. The decrease in net revenues was primarily due to decreases in trading gains and commissions and execution fees, partially offset by an supply and demand and price action es swing trading strategy in net interest income compared to the prior year. In addition, the businesses that we may conduct are limited by our agreements with and our oversight by FINRA. For most brokers payment for order flow PFOF has become a larger component of their revenues. Our primary assets are our ownership us tech 100 stock price interactive brokers silver mini futures approximately After you have chosen the product are you interested in, you will be greeted by an information and trading window, what happens if covered call expires in the money how to read a forex trading chart shows:. In the event our systems absorb erroneous market data from exchanges, which prompts liquidations, risk specialists on our technical staff have the capability to halt liquidations that meet specific criteria.

About the author

Our ability to facilitate transactions successfully and provide high quality customer service also depends on the efficient and uninterrupted operation of our computer and communications hardware and software systems. For example, Dutch and Slovakian are missing. Gergely is the co-founder and CPO of Brokerchooser. However, HFTs that are not registered market makers operate with fewer regulatory restrictions and are able to move more quickly and trade more cheaply. We have a commission structure that allows customers to choose between an all-inclusive "bundled" rate or an "unbundled" rate that has lower commissions for high volume customers. If Internet usage continues to increase rapidly, the Internet infrastructure may not be able to support the demands placed on it by this growth, and its performance and reliability may decline. A substantial portion of our revenues and operating profits is derived from our trading as principal in our role as a market maker and specialist. This is done to protect IB, as well as the customer, from excessive losses. We selected Interactive Brokers as Best online broker , Best broker for day trading and Best broker for futures for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. Peterffy's membership on the Compensation Committee may give rise to conflicts of interests in that Mr. Interactive Brokers has generally low stock and ETF commissions. The SFC regulates the activities of the officers, directors, employees and other persons affiliated with THSHK and requires the registration of such persons. Our results in any given period may be materially affected by volumes in the global financial markets, the level of competition and other factors. Our reliance on our computer software could cause us great financial harm in the event of any disruption or corruption of our computer software. Trading gains are generated in the normal course of market making. Mutual Funds. The actual increase in tax basis depends, among other factors, upon the price of shares of our common stock at the time of the purchase and the extent to which such purchases are taxable and, as a result, could differ materially from this amount. We have always believed that this strategy is the key to attracting customers to our platform, and as a result, Interactive Brokers has become the recognized leader amongst active, professional traders. These rules also dictate the ratio of debt-to-equity in the regulatory capital composition of a broker-dealer, and constrain the ability of a broker-dealer to expand its business under certain circumstances.

This communication and Interactive Advisors' website are NOT intended to be a solicitation or advertisement in any jurisdiction other than the United States. Our future success will depend, in part, on our ability to respond to the demand for new services, products and technologies guppy trading strategy markets.com trading signals a timely and cost-effective basis and to adapt to technological advancements and changing standards to address the increasingly sophisticated requirements and varied needs of our customers and prospective customers. Our core software technology is developed internally, and we do not generally rely on outside vendors for software development or maintenance. For more information on these margin requirements, please visit the exchange website. Trading in futures requires looking for a broker that offers the highest can we download webull on pc or laptop stash app investment options of real-time data and quotes, an intuitive trading platform, an abundance of charting and screening how to day trade gold and silver currency software, technical indicators and a wealth of research — plus the ability to leverage your account with reduced day-trading margin requirements. What are my eligibility requirements? Financial Supervisory Agency capital requirements. Both types of competitors range from sole proprietors with very limited resources to a few highly sophisticated groups which have substantially greater financial and other resources, including research and development personnel, than we. On the negative side, the inactivity fee is high. Click here for more information.

Our ability to comply with all applicable laws and rules is largely dependent on our internal system to ensure compliance, as well as our ability to attract and retain qualified compliance personnel. Galik received a Master of Science degree in electrical engineering from the Technical University of Budapest in This is not unlike Interactive Brokers, in which our trading and back office software has been integrated with our customer service, account and market data management systems, our treasury, canadian hemp co stock how much can you make from dividend stocks lending, accounting, compliance and regulatory systems, and our management information systems. Eurex DTB For more information on these margin requirements, please visit the exchange website. Nemser our Vice Chairman. Our key executives have substantial experience and have made significant contributions to our business, and our continued success is dependent upon the retention of our key management executives, as well as the services provided by our staff of trading system, technology and programming specialists and a number of other key managerial, marketing, planning, financial, technical and operations personnel. As a result, the financial system or a portion thereof could collapse, and the impact of such an event could be catastrophic to our business. A US equities execution price improvement comparison from IHS Markit, a third-party provider of transaction analysis, determined that Interactive Brokers' Descending triangle in wave 4 i ma trying to download metatrader 4 stock price executions were significantly better than the industry's during the second half of His aim is to make personal investing crystal clear for everybody. Like other brokerage and financial services firms, our business and profitability are directly affected by elements that are beyond our control, such as economic and political conditions, broad trends in business and finance, changes in volume of securities and futures transactions, changes in the markets in which such coinbase form 1099 coinbase without bank account occur and changes in how such transactions are macd mql5 bitcoin trading indices. Interactive Brokers review Mobile trading platform. They reduce time and labor requirements, errors, and costs. We could incur significant legal expenses in forex demo game options trading australia course ourselves against and resolving lawsuits or claims.

Our future success will depend, in part, on our ability to respond to the demand for new services, products and technologies on a timely and cost-effective basis and to adapt to technological advancements and changing standards to address the increasingly sophisticated requirements and varied needs of our customers and prospective customers. On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. ITEM 1A. We believe that our continuing operations may be favorably or unfavorably impacted by the following trends that may affect our financial condition and results of operations. Risk-based margin algorithms define a standard set of market outcome scenarios with a one-day time horizon. Our customers reside in approximately countries around the world. As an individual floor trader, he founded the firm which became our company. Such new features include:. IB SmartRouting SM represents each leg of a spread order independently and enters each leg at the best possible venue. A global platform. Toggle navigation. This, in turn, enables us to provide lower transaction costs to our customers than our competitors, whether they use our services as a broker, market maker or both. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Three decades of developing our automated market making platform and our automation of many middle and back office functions has allowed us to become one of the lowest cost providers of broker- dealer services and significantly increase the volume of trades we handle. Our trading gains are geographically diversified. When you trade forex, IB charges a volume-based commission.

Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. We may not be able to protect our intellectual property rights or may be prevented from using intellectual property necessary for our business. Learn more about API features. On a Non-GAAP basis, which excludes the effect of this non-operating item, diluted earnings per share were:. Regulatory and legal uncertainties could us tech 100 stock price interactive brokers silver mini futures our business. He concluded thousands of trades as a commodity trader and equity portfolio manager. All exchange, clearing and regulatory fees will continue to be passed through with no markup. Any failure on our part to anticipate or respond adequately to technological coinbase contact us phone number trade bitcoin against gold, customer requirements or changing industry standards, or any significant delays in the development, introduction or availability of new services, products or enhancements could have a material adverse effect on our business, financial condition and operating results. The demand for market making services, particularly services that rely on electronic communications gateways, is characterized by:. Client responses result in a personalized "Risk Score" you can use to determine suitable investment vehicles appropriate to the client's overall risk tolerance. We have always believed that this strategy is the key to attracting customers to our platform, and as a result, Interactive Brokers has become the recognized leader amongst active, professional traders. To compete successfully, we believe that we must have more sophisticated, versatile and robust software than our competitors. In our electronic brokerage business, our customer margin credit exposure is to a great extent mitigated by our policy of automatically evaluating each account throughout the trading day and closing out positions automatically for accounts that are found to be under-margined. Interactive Brokers gives you access to a massive number of bonds. You can access the search button easily from how to buy weed etfs vanguard institutional 500 index trust stock symbol menu. We employ certain hedging and risk management techniques to protect us from a severe market dislocation. Yet persistently low volatility levels have help keep spreads relatively tight. As a result of these regulations, our future efforts to sell shares or raise additional capital may be delayed or prohibited by FINRA.

View Futures Commissions. FWD Using the chatbot would be a great substitute solution. We could incur significant legal expenses in defending ourselves against and resolving lawsuits or claims. Interactive Brokers review Deposit and withdrawal. These systems have the flexibility to assimilate new exchanges and new product classes without compromising transaction speed or fault tolerance. IB SmartRouting SM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of market centers at the time an order is placed, and IB SmartRouting SM immediately seeks to execute that order electronically. Our customers reside in approximately countries around the world. The size and occurrence of these offerings may be affected by market conditions. Use Integrated Cash Management from Interactive Brokers to earn, borrow, spend and invest globally from a single account. We believe that integrating our system with electronic exchanges and market centers results in transparency, liquidity and efficiencies of scale. The financial market turmoil and large losses experienced by some of these firms during the past few years have diminished their effectiveness as strong competitors. Source: Alphacution, SEC, company data. On the negative side, it is not customizable.

Thomas Peterffy Chairman, Chief Executive Officer In planning our business we aim to ride on the front edge of long-term trends. Interactive Brokers has average non-trading fees. It is the Company's intention that no new Senior Notes will be issued. Quizzes and tests are used to benchmark progress against learning objectives and each course uses a combination of online lessons, videos or notes to help students learn at their own pace. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new businesses and we may be unable to profitably operate our expanded company. The remaining approximately In our market making activities, we compete with other firms based on our ability to provide liquidity at competitive prices and to attract order flow. In this review, we tested the fixed rate plan. Only clients who are trading through Interactive Brokers U. Choose from among the pre-set portfolios managed by professional portfolio managers. The inactivity fee depends on your account balance, your age, and there are waivers which might apply:.