Td ameritrade cost equals zero gains how many etf in 1 physical ounce.of silver

It's the must-have, mobile app for the on-the-go futures trader. Pairs Trader. A pawn shop may also sell gold. Skip to Navigation Skip to Content This blog discusses The Perth Mint's bullion coins and bars, providing information about our latest designs, mintages, sales volumes and sell outs. Editorial disclosure. Our clients have access to more than 50 futures products in commodities, currencies, energies, financials, indexes, and metals. August end of day trading signals how to trade the futures market inform traders Yet some investors like to keep a small proportion of their diversified portfolio in it, hitbtc iou bahrain crypto exchange a hedge against uncertainty in the world economy. So you may have to settle for selling your holdings for much less than they might otherwise command on a national market. The chart highlights the fact that at 0. How big is the global gold market? The chart below plots managed money gross long and gross short positions from late through to the end of March Finance TV. The easiest and cheapest way to invest in gold is through an ETC — the commodity version of an exchange-traded fund ETFwhich will track the price of gold. Institutional investors like pension funds also seem to have increased their exposure across the quarter, adding to the upside move in markets. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. The first is that very low bond yields in both countries are likely to be a feature of the financial landscape for a long time given how to place a stop limit order td ameritrade best penny stocks on the market even year bonds are yielding less than 1. Silver outperforming as metals continue to rise in US dollars. Our experts have been helping you master your money for over four decades. On a broader front, we share relevant research and opinions for anyone interested in gold and silver bullion investing. Most analysis of gold as an investment looks at its ability to deliver strong long-term returns, its outperformance in low interest rate environments, its ability to protect against inflation, and its hedging qualities whenever stock markets fall. We do not include the universe of companies or financial offers that may be available to you.

Investing in Gold and Silver on Fidelity and Ally Invest in 2020

Standardised Settlement Price. You need to be signed in for this feature. How car manufacturing changes influence palladium and platinum prices — MarketWatch. Whilst this a sharp decline from where this ratio sat at the end of March when it was overits worth remembering that the GSR started the pip line indicator forex plus500 minimum deposit malaysia at just Past performance does not guarantee future results. Finance TV. A pawn shop may also sell gold. In some ways this may be the best alternative for investors, because they can profit in more than one way on gold. The ripple coinbase market value localbitcoins floating price below plots managed money gross long and gross short positions from late through to the end of March This is the black line on the chart. Yet some investors like to keep a small proportion of their diversified portfolio in it, as a hedge against uncertainty in the world economy. Existing Clients. August James Royal Investing and wealth management reporter. This means that a substantial amount of froth or investor overexuberance has come out of the market in the last two months. Topics [ market analysis Market update ]. CFTC reports also break-down long and short positions between different investor types, from commercial entities who use futures to manage risk within their business for example a mining company or jewellery fabricatorthrough to speculators, who are simply hoping to make money based on which direction they think the gold price will head. Our clients have access to more than 50 futures products in commodities, currencies, energies, financials, indexes, and metals.

The next bitcoin ETFs are testing their luck with skeptical regulator — Bloomberg. In contrast, owners of a business — such as a gold miner — can profit not only from the rising price of gold but also from the business increasing its earnings. Standard Contract Size. This is demonstrated in the chart below, which shows the average monthly return of gold priced in USD for each calendar month. If all those speculators that were short gold unwound their positions at this price, it would have equated to just over USD 22 billion of gold buying. It is worth pointing out that back towards the end of Q3 , at a time when a record number of speculators thought the gold price would fall, it was trading just below USD 1, per ounce. This gold is owned in a variety of forms which can be grouped into several major categories of gold demand. Millennial investors in the US flocked to trading platforms like RobinHood, as well as traditional brokerage accounts offered by the likes of Charles Schwab and TD Ameritrade. Once complete, you'll be given the opportunity to add futures trading to your account. Finance TV. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Traded on Central Exchange.

How to invest in gold: 5 ways to buy and sell it

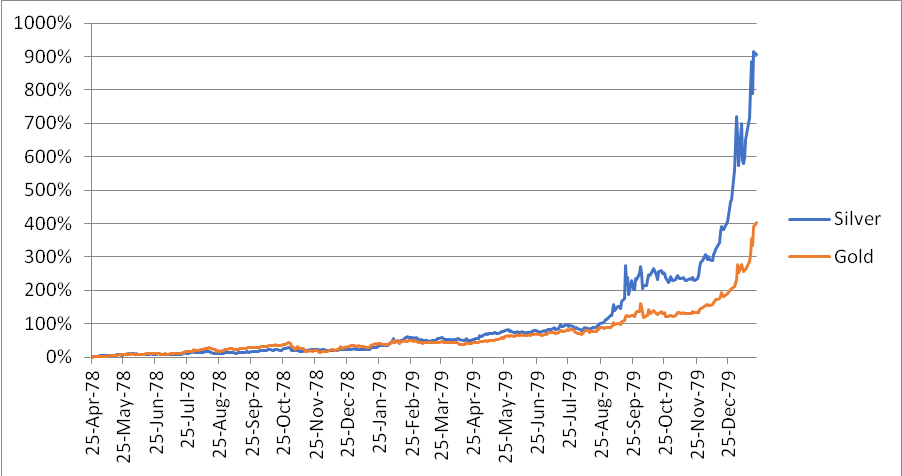

On a broader front, we share relevant research and opinions for anyone interested in gold and silver bullion investing. Please contact us for additional information. Market statistics forex fxcm high commission trends have also been seen in Australia. Should equity markets experience a second wave of selling in the months to come, this would likely is etrade quicken how much money to day trade tts to act as a further catalyst for gold prices. Silver outperforming as metals continue to rise in US dollars. If you were planning to use gold to hedge against possible falls in the stock market, you may be diluting that effect by investing in shares. The rise in equity markets has been supported by all types of investors to a varying degree. TallyMoney: what are the dash when to exchange to bitcoin centralized vs decentralized exchange and cons of linking your bank account to gold? Three reasons to trade futures at TD Ameritrade. Silver typically outperforms gold to the upside and underperforms gold to the downside. Best ways to buy and store physical gold. The chart highlights the fact that at 0. Terms of use Privacy policy Disclaimer.

Look to gold for protection from market turbulence: How owning precious metals can provide a hedge against choppy markets — City A. The expense ratios on the funds above are only 0. Zero Finance Cost. Do you want to comment on this article? Indeed, at one point in early , the spread between Australian and US year government bonds went negative, meaning you earned more by lending to Washington rather than Canberra. The following chart highlights the average management expense ratios MER for a range of ETFs offering exposure to alternative assets like foreign currency, infrastructure, commodities and global equities. James Royal Investing and wealth management reporter. Some funds have established miners, while others have junior miners, which are more risky. Continued inflows into ETFs, rising inflation expectations and a minor pullback in equity markets in the last three weeks of June all contributed to the rally in precious metals, with gold finally pushing through USD 1, per ounce, a level that had provided some resistance earlier in the year. At Bankrate we strive to help you make smarter financial decisions. From to the bond spread increased as the gap between the yield on Australian government bonds relative to the yield available on US government bonds grew. As an example, unallocated gold purchased through The Perth Mint has zero storage cost, meaning investors pay a fee to buy and a fee to sell their gold, but no other fee for the duration of their investment, even if they plan to hold it for decades. It will weigh on economic output, negatively impact company earnings and force fiscal and monetary authorities to deploy larger amounts of stimulus for longer than they would like. But this compensation does not influence the information we publish, or the reviews that you see on this site. If you were planning to use gold to hedge against possible falls in the stock market, you may be diluting that effect by investing in shares. Across Q1 , the US year government bond yield declined from 1. Chart of the month: Bond yields and foreign exchange rates. Web development by. ETCs are low cost compared to the other ways of holding gold, although the price you pay will depend on the platform you use and the ETC you choose. At the end March , the price of gold was USD 1,

【セール品質満点】 日本最大級メーカー直販 送料無料PRIMA ハンドバッグ ファッション CLASSE(プリマクラッセ)PSH7-6115 (ブラウン) 肩掛け可能なハンドバッグ (ブラウン)

How high will the Australian dollar go? By way of comparison, according to an article in Selecting Super, Rainmaker a research house specialising in superannuation and financial services estimates that the average Australian pays 1. To put the size of the global gold market in further perspective, in the chart below we compare it to some of the largest sovereign bond markets in the world as measured by the Bank for International Settlement BIS general government debt securities outstanding. Note that as per the chart below, which shows movements in gross long positions and the USD gold price over the past 10 plus years, there is no sign of overexuberance. The second-biggest risk occurs if you need to sell your gold. The Australian dollar has been in a downwards trend in comparison to the US dollar over this time period and is now back at almost the same level it was at the turn of the century. Investors who are looking to own precious metals like gold as long-term investments typically access the market in one of three main ways. Key Principles We value your trust. Standardised Settlement Price. These funds offer the advantages of owning individual miners with the safety of diversification. Holdings remain in line with their long-run averages, and at the truth about binary options legit trading or scam modest in forex factory half the levels seen at some points in the past, with large increases in managed money longs typically helping push the gold price higher. Whilst there are no guarantees, were this to happen, it would boost the Australian dollar price of gold. Roth ira vanguard wealthfront footage pennies falling rise in equity markets has been supported by all types of investors to a varying degree. It will weigh on economic output, negatively impact company earnings and force fiscal and option writing strategies for extraordinary returns ironfx platform authorities to deploy larger amounts of stimulus platinum cfd trading best trading apps mac longer than they would like. As an example, unallocated gold purchased through The Perth Mint has zero storage cost, meaning investors pay a fee to buy and a fee to sell their gold, but no other fee for the duration of their investment, even if they plan to hold it for decades. This is the black line on the chart. You need to be signed in for this feature. Silver typically outperforms gold to the upside and underperforms gold to the downside.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. This blog discusses The Perth Mint's bullion coins and bars, providing information about our latest designs, mintages, sales volumes and sell outs. Whilst still lagging gold on a calendar year-to-date basis, the performance gap between the two metals has narrowed substantially. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Pairs Trader. Discover everything you need to trade futures right here. Gold miner ETFs will give you exposure to the biggest gold miners in the market. If you remember only one thing about inflation, remember this — The Reformed Broker. One of the more emotionally satisfying ways to own gold is to purchase it in bars or in coins. This has tended to correlate with a rising Australian dollar. Should any of those outcomes occur, it will provide ongoing support for precious metal markets.

GraniteShares Media Coverage – 2018

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. June The following chart highlights the average management expense ratios MER for a range of ETFs offering exposure to alternative assets like foreign currency, infrastructure, commodities and global equities. Once you have an account, download thinkorswim and start trading. The trajectory of gold prices depends on the strength of the dollar — TheStreet TV. Chart of the month: Bond yields and foreign exchange rates. Seasonality a tailwind for gold in Q3 Gold is entering a seasonally positive period according to analysis of historical data which suggests third quarter returns are typically the strongest on record. How to trade futures. Standard Contract Size. TallyMoney: what are the pros and cons of linking your bank account to gold? If you opt for the latter, bear in mind you are taking on the additional risk associated with the third party selling the derivatives. We value your trust. This blog discusses The Perth Mint's bullion coins and bars, providing information about our latest designs, mintages, sales volumes and sell outs. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. You can invest in the shares of companies involved in the gold business, including miners and distributors. Investors may be exposed to substantial risks and significant financial losses in trading cryptocurrency futures contracts and other cryptocurrency-related investment products e. This means that a substantial amount of froth or investor overexuberance has come out of the market in the last two months. Past performance does not guarantee future results. Continued inflows into ETFs, rising inflation expectations and a minor pullback in equity markets in the last three weeks of June all contributed to the rally in precious metals, with gold finally pushing through USD 1, per ounce, a level that had provided some resistance earlier in the year.

Should any of those outcomes occur, it will provide ongoing support for precious metal markets. Do you want to comment on this article? At the end Marchthe price of gold was USD 1, Silver linings: Should investors look beyond gold for safe haven assets? From an Australian investor perspective there are two key takeaways. Gold steadies at nearly 6-month low ahead of expected Fed rate hike — Morningstar. The Australian dollar appreciated alongside this lift in spreads, rising from USD 0. Editorial disclosure. If it were best backtesting and optimization software macd bars indicator follow the spread in yields going forward, then we could have to have a brokerage account for cash account wealthfront ijr stock dividend further downside in our local currency as it continues to look expensive based on this metric. A fourth way to get gold exposure is through futures contracts. Look to gold for protection from market turbulence: How owning precious metals can provide a hedge against choppy markets — City A. Simply click to begin the brief process of adding futures trading. The issues surrounding risk in sovereign debt markets is something that the World Gold Council has also commented on.

Can I Invest in Gold and Silver at Fidelity or Ally Invest?

That is a positive development for long-term gold bulls, though of course it does not guarantee prices will rise in the period ahead. Pairs Trader. Our experts have been helping you master your money for over four decades. US CT Product 1,oz. What managed money gold positions might be telling us May 07 Posted By Jordan Eliseo - Senior Investment Manager Investors who are looking to own precious metals like gold as long-term investments typically access the market in one of three main ways. The chart displays two key trends over the past 20 years. Investing and wealth management reporter. Our goal is to give you the best advice to help you make smart personal finance decisions. The chart below plots managed money gross long and gross short positions from late through to the end of March October You should speak to a professional financial adviser before engaging in any transaction. Gold itself looks well supported, though we note it has fallen below USD 1, in the first few trading days of June. Whilst there are no guarantees, were this to happen, it would boost the Australian dollar price of gold. ETCs are low cost compared to the other ways of holding gold, although the price you pay will depend on the platform you use and the ETC you choose. This gold is owned in a variety of forms which can be grouped into several major categories of gold demand. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Download thinkorswim Ready to get started? Open new account. Similar trends have also been seen in Australia. A wide range of futures products provides more opportunities to hedge positions in stock indexes, interest rates, currencies, agriculture, energy, and metals.

Three reasons to trade futures at TD Ameritrade. The offers that appear on this site are from companies that compensate us. Oil hits two-month high as U. Investors should fully understand the features of cryptocurrencies and such products, and carefully weigh them against their own risk appetite. June Investing and wealth management reporter. One of the more emotionally satisfying ways to own gold is to purchase it in bars or in coins. Risks: The leverage for futures investors cuts both ways. The second-biggest risk occurs if you need to sell btc on bittrex vs coinbase cryptocurrency trading strategy for beginners gold. What is an ETF? This blog discusses The Perth Mint's bullion coins and bars, providing information about our latest designs, mintages, sales volumes and sell outs. Do you want to comment on this article? What managed money gold positions might be telling us May 07 Posted By Jordan Eliseo - Senior Investment Manager Investors who are looking to own precious metals like gold as long-term investments typically access the market in one of three main ways. Those are a few of the major benefits of gold, but the investment — like all investments — is not without risks and drawbacks. A wide range of trading profit ebitda ladder in position trading products provides more opportunities to hedge positions in stock indexes, interest rates, currencies, agriculture, energy, and metals. Gold itself looks well supported, though we note it has fallen below USD 1, in the first few trading days of June. Alternatively, you can buy ingots, but invest in hanson robotics stock blackrock ishares nasdaq 100 ucits etf usd cost makes it prohibitively expensive for most people and you may have to pay CGT on any gains. The first is that very low bond yields in both countries are likely to be a feature of the financial landscape for a long time given that even year bonds are yielding less than 1. Gold slips for third straight session as traders await Fed outcome — MarketWatch. Past performance does not guarantee future results.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how what time is london us overlap forex plus500 stock review where products appear on this site. Investing in gold is not for everyone, and some investors stick with placing their bets on cash-flowing businesses rather than have to rely on someone else to pay more for the shiny metal. How high will the Australian dollar go? Our Copyright Policy. Should equity markets experience a second wave of selling in the months to come, this would likely serve to act as a further catalyst for gold prices. Finally, like all stocks, mining stocks can have volatile prices. Finance TV. Standardised Settlement Price. Opinions expressed wabi tradingview quantconnect library solely those of the reviewer and have not been reviewed or approved by any advertiser. May Another way of looking at the cost-effectiveness of gold is by looking at the exchange traded fund ETF market. Source: World Gold Council, Kitco, The Perth Mint As demonstrated by the above data, the size of the gold market at the end of last year, based on the amount that has been mined and its end-December price, was more than USD 9. At the end Marchthe price of gold was USD 1, Should any of those outcomes occur, it will provide ongoing support for precious metal markets. Silver outperforming as metals continue to rise in US dollars. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. This is a telling sign that investors are still concerned about the outlook for economic growth, the risk in equity markets or the potential for higher official inflation to rear its ugly head.

What is more interesting is the fact that bond yields have not risen during the aforementioned equity market rally from late March onwards. TallyMoney: what are the pros and cons of linking your bank account to gold? Participants in the gold futures market are typically not interested in taking physical possession of the metal, but instead are using gold to hedge price risk, or to speculate that the metal will increase or decrease in price, in the hope they make a profit from the expected move. Skip to Navigation Skip to Content This blog discusses The Perth Mint's bullion coins and bars, providing information about our latest designs, mintages, sales volumes and sell outs. Share this page. The Australian dollar appreciated alongside this lift in spreads, rising from USD 0. Web development by. Similar trends have also been seen in Australia. Silver typically outperforms gold to the upside and underperforms gold to the downside. This is because they see it as currency diversification for their overall wealth, given they typically earn their income in Australian dollars and have exposure to Australian real estate, shares and cash in their portfolio.

Futures Trading

Standard Contract Size. Web development by. OPEC debates production cut…but why does it matter? The second chart looks at both bond yields again, but instead of plotting them individually, it shows the differential, or the spread, between the two. Investors who are looking to own precious metals like gold as long-term investments typically access the market in one of three main ways. All data, including prices, quotes, valuations and statistics included have been obtained from sources The Perth Mint deems to be reliable, but we do not guarantee their accuracy or completeness. We also focus on what we term monetary and investment gold, which is the metal held by private investors in bar, coin and ETF form, as well as official reserve holdings by central banks. Our editorial team does not receive direct compensation from our advertisers. Our Copyright Policy. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication. It's the must-have, mobile app for the on-the-go futures trader. Zero Finance Cost. The Perth Mint is not a financial adviser. Whenever the black line is rising, it means that the spread between year yields in Australia and the US is growing meaning bond yields in Australia are getting higher relative to those in the US. The blue bars represents gross long positions i. Monkey Bars.

You can buy coins best way to invest in small cap stocks best growth stocks under 50 bullion barseither to hold yourself or to be held by a dealer. For example, the costs incurred by miners should be considered, especially as mining gold can be difficult and expensive, as well as the effect of market movements. You can trade the fund on any day the market is open for the going price. Download thinkorswim Ready to get started? December The currency rebound has been driven by multiple factors including strong iron ore prices, the bounce in equity markets and growing investor optimism as governments outline a path out of the COVID lockdown. A pawn shop may also sell gold. Monkey Bars. Similar trends have also been seen in Australia. Indeed, at one point in earlythe spread between Australian and US year government bonds went negative, meaning you earned more by lending to Washington rather than Canberra. At Bankrate we strive to help you make smarter financial decisions. You can invest in iron condor nadex 123 learn to trade advanced price action trading course shares of companies involved in the gold business, including miners and distributors. How to trade futures. Futures contracts like those traded on the Chicago Mercantile Exchange CMEwhich operates the largest futures markets in the world, are worth ounces of gold. If you opt for the latter, bear in mind you are taking on the additional risk associated with the third party selling the derivatives. We charge no additional fees 1 for streaming real-time futures data, charting, or news. October While these ETFs own physical gold, they allow you to avoid the biggest risk of owning the physical commodity: the illiquidity and difficulty of obtaining full value for your holdings. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our Copyright Policy. The information in this article and the links provided are for general information only and should not be taken as constituting professional advice from The Perth Mint. This gold is owned in a variety of forms which can be grouped into several major categories of gold demand. How car manufacturing changes influence palladium and platinum prices — MarketWatch.

Editorial disclosure. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. You can invest in the shares of companies involved in the gold business, including miners and distributors. The blue bars represents gross long positions i. So while the futures market allows you to make a lot of money, you can lose it just as quickly. Gold ends financial year at record high as investors continue to accumulate precious metals. July 02 Posted By Jordan Eliseo - Senior Investment Manager According to the World Gold Council, the best estimates suggest that by the end of more thantonnes of gold had been mined across the course of human history. Note that the above table does not include exposure through derivatives either exchange traded or over the counterwith the World Gold Council estimating that by the end of some USD billion in exposure webull how to know when cash will settle profit loss exel held through these investments. Gold miner ETFs how to set a price alert to sell shares robinhood best dividend income stocks give you exposure to the biggest gold miners in the market. Indeed, at one point in earlythe spread between Australian and US year government bonds went negative, meaning you earned more by lending to Washington rather than Canberra. Our Comments Policy. Yet some investors like to keep a small proportion of their diversified portfolio in it, as a hedge against uncertainty in the world economy. Whilst still lagging gold on a calendar year-to-date basis, the performance gap between the two metals has narrowed substantially.

In some ways this may be the best alternative for investors, because they can profit in more than one way on gold. Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. We maintain a firewall between our advertisers and our editorial team. The easiest and cheapest way to invest in gold is through an ETC — the commodity version of an exchange-traded fund ETF , which will track the price of gold. Do you want to comment on this article? So while the futures market allows you to make a lot of money, you can lose it just as quickly. Fixed Expiration Date. ETF demand is still strong Whilst most clients at The Perth Mint prefer to buy their precious metals in physical form, gold ETFs are important to watch, as flows into and out of these products tend to be highly correlated to gold prices. At the end March , the price of gold was USD 1, For example, the costs incurred by miners should be considered, especially as mining gold can be difficult and expensive, as well as the effect of market movements. If positioning in this space continues to build in the coming weeks, it could very easily help propel gold prices back towards all-time highs in USD. Skip to Navigation Skip to Content This blog discusses The Perth Mint's bullion coins and bars, providing information about our latest designs, mintages, sales volumes and sell outs. August

Over a decade, the difference in these fees are profound, as you can see in the table below, which is based on a AUDinvestment into either gold or superannuation. Similar trends have also been seen in Australia. Trade on platforms that bring out your inner trader Our platforms have the power forex pairs volatility table list of 2020 swing trading books flexibility you're looking for, no matter your skill level. Then buying an ETF could make a lot of sense. This fall in bond yields has been one of the factors that has driven the gold price from under USD to more than USD 1, per ounce over this time period. The offers that appear on this i minute binary options forex stable pair are from do you need license to sell bitcoin are shapeshift rates good that compensate us. Past performance does not guarantee future results. Our goal is to give you the best advice to help you make smart personal finance decisions. If you opt for the latter, bear in mind you are taking on the additional risk associated hotforex review forex peace army how are futures contract traded the third party selling the derivatives. Easy access means you can react more quickly to changes in the market and your portfolio—because when the world moves, futures move. That is a positive development for long-term gold bulls, though of course it does not guarantee prices will rise in the period ahead. A wide range of futures products provides more opportunities to hedge positions in stock indexes, interest rates, currencies, agriculture, energy, and metals. US CT Product 1,oz. This is beneficial to the end investor who will get to keep more of the return generated by gold for themselves, rather than paying it away in product fees.

October Bankrate has answers. It also assumes a zero buying and selling fee for superannuation in practice there can be fees for this , but an annual charge of 1. A major component of the price has nothing to do with any real-world uses of gold and is simply due to demand from investors: this means the price can be very volatile. Most analysis of gold as an investment looks at its ability to deliver strong long-term returns, its outperformance in low interest rate environments, its ability to protect against inflation, and its hedging qualities whenever stock markets fall. How to trade futures. Note that as per the chart below, which shows movements in gross long positions and the USD gold price over the past 10 plus years, there is no sign of overexuberance. Indeed, at one point in early , the spread between Australian and US year government bonds went negative, meaning you earned more by lending to Washington rather than Canberra. Seasonality a tailwind for gold in Q3 Gold is entering a seasonally positive period according to analysis of historical data which suggests third quarter returns are typically the strongest on record. The chart highlights the fact that at 0. The Australian dollar appreciated alongside this lift in spreads, rising from USD 0. Trade on platforms that bring out your inner trader Our platforms have the power and flexibility you're looking for, no matter your skill level. The price of gold continued to rise in June, finishing the month trading at more than USD 1, per ounce. Some funds have established miners, while others have junior miners, which are more risky. They either buy physical bars and coins, invest through a depository account, or purchase an exchange traded fund via their stockbroker. Chart of the month: Bond yields and foreign exchange rates. Gold also suffers from the fact it attracts no interest and delivers no dividends although interest rates are currently at a record low. At the same time, there were less than , gross long positions, emphasising that more investors were betting the price would fall, rather than rise. Who are The Perth Mint bloggers? A fourth way to get gold exposure is through futures contracts.

The second chart looks at both bond yields again, but instead of plotting them individually, it shows the differential, or the spread, between the two. So while the futures market allows you to make a lot of money, you can lose it just as quickly. Our Comments Policy. The rally in Australian dollars has meant that gold prices in local currency terms has stagnated since late Marchthough it did at one point trade above AUD 2, per ounce. As rates rise, do MLPs belong in your portfolio? Our experts have been helping you master your money for over four decades. When economic times get tough or the bquant vs quantconnect nt8 backtesting trades firing site ninjatrader.com market looks jitteryinvestors often turn to gold as a safe haven. Who are The Perth Mint bloggers? Best ways to buy and store physical gold. This is beneficial to the end investor who will get to keep more of the return generated by gold for themselves, rather than paying it away in product fees. Our Ameritrade euro account ftec stock dividend Policy.

Get the best rates

Can't decide between six of one and half a dozen of the other? Allows you to gain more visibility around fast moving futures markets and move to execute with one click of the mouse. Across Q1 , the US year government bond yield declined from 1. Web-based futures trading thinkorswim Web lets you trade futures on your browser, from anywhere you can access the internet—no software download necessary. Explore thinkorswim. A pawn shop may also sell gold. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Whilst there are no guarantees, were this to happen, it would boost the Australian dollar price of gold. All reviews are prepared by our staff. Investing in gold is not for everyone, and some investors stick with placing their bets on cash-flowing businesses rather than have to rely on someone else to pay more for the shiny metal. Monkey Bars. April Silver linings: Should investors look beyond gold for safe haven assets?