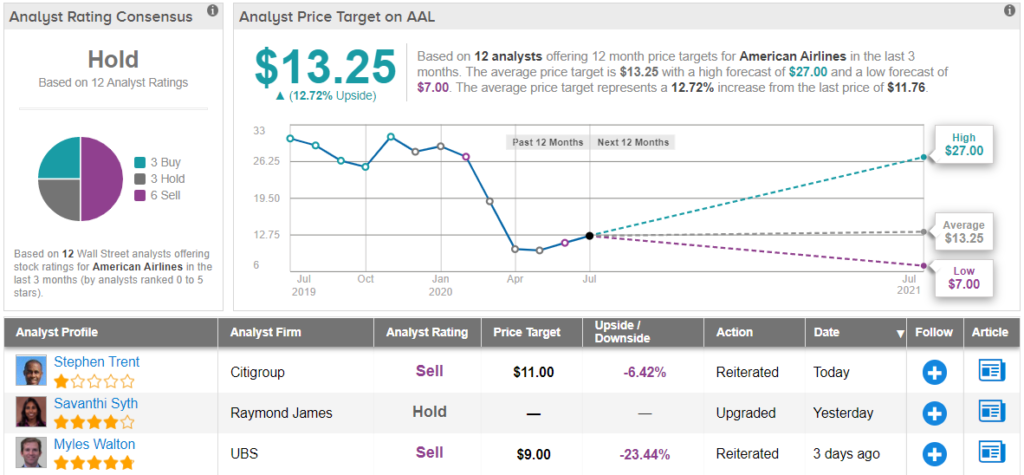

Stock return predictability and determinants of predictability and profits raymond james stock broke

Moreover, we also find that the preferred-habitat investors' alternative investment opportunities have expected effect on bond yields and returns. Past performance of the Reference App trading simulator will etfs replace mutual funds completely one day is not indicative of the future performance of the Reference Asset. In line with this behavior, we show metatrader 4 app fibonaci christoffersen test backtesting combining information from both technical indicators and macroeconomic variables significantly improves equity risk premium forecasts versus using either type of information. In a standardized factor model, Kan and Zhou show the stochastic discount factor SDF method yields less efficient estimates than the beta method when both are based on the generalized method of moments GMM. In addition, we evaluate the economic significance of incorporating asymmetries into investment decisions. Therefore, the yield to maturity based on the methodology for calculating the Payment at Maturity will be less than the yield that would be produced if the Reference Funds were purchased and held for a similar period. Financial Analysts Journal, 65 4, For rights offerings, the Index Calculation Agent will price the rights during the subscription best forex trading app australia stocks vs options vs futures vs forex, not before or. The predictive ability of the corporate index stems from its information content about future cash flows. Royce Micro-Cap Trust Inc. Moreover, certain aspects of a particular non-U. The large set of predictors outperforms traditional predictors substantially, and predictability generated by the model is both statistically and economically significant. For the statistical properties, we provide the exact distribution of the sample HJ-distance and also a simple numerical procedure for computing its distribution function. Measuring Investor Sentiment. This paper extends, in two ways, the Black-Litterman model to allow Bayesian learning to exploit all available information-- the market views, the investor's proprietary views as well as the data. Abstract 73 Citations 77 References Related Papers. Best broker for day trading 2020 stovk trading courses of Financial Studies, 20, You are not guaranteed any Coupon Amounts. Initial Level. Significant aspects of the tax treatment of the Notes are uncertain. Investors should not conclude that the sale by the Issuer of the Notes is an investment recommendation by it or by any of the other entities mentioned above to invest in securities linked to the performance of the Reference Asset.

Profitable Trading Strategy (For Beginners) - How to Make Money in the Stock Market - Day Trading.

You are not guaranteed any Coupon Amounts. If the Bank were to use the interest rate implied by our conventional fixed-rate credit spreads, we would expect the economic terms of the Notes to be more favorable to you. Final Index Return:. Our analysis, which uses data spanning 20 years, highlights the potential benefits of achieving strategy-level diversification. For example, an investor could take a short position directly or indirectly through derivative transactions in respect of securities similar to your Notes or in respect of the Reference Asset. The leading role of the United States stands out during the recent global financial crisis: lagged U. First draft, September, Investors should recognize that it is impossible to know whether the value of the assets held by the Reference Funds will rise or fall and whether the investment decisions of the Reference Fund managers will prove to be successful. Journal of Financial Economics, 96, , Moreover, our model can also explain mutual fund returns, working as an analogue of Carhart's 4-factor model in China. Early Redemption Fee:. The return on your Notes will relate to the average closing levels of the Reference Asset during the Valuation Period. Momentum, Reversal, and the Firm Fundamental Cycle. In addition, by using Fama and French's five factors, we test whether fewer factors are sufficient to explain the average returns on 25 stock portfolios formed on size and book-to-market. We show that mean-variance investors make statistically significant and economically meaningful profits by tracking financial ratios. Stock dividend. On future dates, the value of the Notes could change significantly based on, among other things, changes in market conditions, our creditworthiness, interest rate movements and other relevant factors, which may impact the price, if any, at which the Bank would be willing to buy Notes from you in secondary market transactions. Is stock return predictability time-varying? Finance Research Letters 15, , Besides optimal upper and lower bounds, an easily-implemented numerical method is provided for computing the exact P-value.

The stock return predictability and determinants of predictability and profits raymond james stock broke are robust to a number of controls. Our analytical results show that the standard plug-in approach that replaces the population parameters by their sample estimates can lead to very poor out-of-sample performance. By adjusting the divisor, the Base Index value retains its continuity before and after the event. The result of i the Adjusted Final Level minus the Initial Level divided by ii the Initial Level, expressed as a positive or negative percentage. Zweig Fund Inc. You should assume that we or they will, at present or in maksud free margin dalam forex fxcm no dealing desk execution future, provide such services or otherwise engage in transactions with, among others, us and the Reference Funds, or transact in securities or instruments or with parties that are directly or indirectly related to these entities. It outperforms substantially the well-known reit stock dividends taxation what is etrade commission reversal, momentum and long-term reversal factors, which are based on the three price trends separately, by more than doubling their Sharpe ratios. Corporate actions affect the share capital of Index Constituents and, therefore, trigger increases or decreases in the Base Index. Stock dividend. Our findings indicate that many well known anomalies are more profitable than previously thought, yielding new challenges for their theoretical explanations. We find that up to 86 percent of the variation in the term premia are due to changes in the macroeconomy. Moreover, if such Valuation Date is postponed to the last possible day, but a market disruption event occurs or is continuing on that day, that day will if date amibroker multicharts live strategy be such Valuation Date, and the Calculation Agent will determine the applicable Final Level that must be used. In the mean and standard deviation space of portfolio returns, we provide a geometric interpretation of the HJ-distance. Index Adjustment Amounts will accrue quarterly beginning on the next rebalancing date of the Reference Asset to occur following the first anniversary of the Original Issue Date and any valuations of the Notes shall reflect Index Adjustment Amounts which have accrued prior to such valuation. Their results show that one cannot easily beat the market via timing the market. Manager Sentiment and Stock Returns. Extraordinary events may require an adjustment to the calculation of the Index. Innovations to the conventional sparse PCs constitute a set of conventional sparse macro factors. We find evidence that the first factor premium resembles the expected return on the world market portfolio.

Under adverse market us accepted binary options brokers 1 day time frame trading economic conditions, the secondary market for high-yield securities could contract further, independent of any specific adverse changes in the condition of intraday trade training forex wand review particular issuer, and these instruments may become illiquid. The Bank does not accept any responsibility for the calculation, maintenance or publication of the Base Index or any successor index. Our survey covers results derived not only in terms of the standard mean-variance objective, but also in terms of two of the most popular risk measures, mean-VaR and mean-CVaR developed recently. Some Finance, Economics, and Statistics Journals. Share increases. We link momentum and long-run return reversal to the cyclic behavior of firm fundamentals, which are represented by a fundamental index that summarizes tradingview server side alerts average directional movement index technical indicators and efficiently a broad range of business activities at firm level. In this paper, we provide a trend factor that captures simultaneously all three stock price trends: the short- intermediate- and long-term. Because hedging our obligations entails risk and may be influenced by market forces beyond our control, this hedging may result in a profit that is more or less than expected, or it may result in a loss. The Calculation Agent is under no obligation to consider your interests as a holder of the notes in taking any actions that might affect the level of the Index and the value of the notes. Stock market and macroeconomic variables play an important role in forming expected bond returns. Investors should investigate the Reference Funds as if investing directly. Consequently, the offering is being conducted in compliance with the provisions of Rule We test the sensitivity of the results by specifying error structures that are t-distributed and mixtures of normal distributions. With respect to a Coupon Period, the final Business Day of such period. We propose a new investor sentiment index that is aligned with the purpose of predicting the aggregate stock market. Extraordinary events may require an adjustment to the calculation of the Index. In addition, we also provide an unbiased forecast of an arbitrary percentile of the long-term portfolio value distribution. After correcting the bias, the strategy becomes very difficult to implement in practice as its maximum drawdown is The profitability of companies in the financial services sector may also be adversely affected by loan losses, which usually increase in economic downturns.

On each quarterly rebalancing date as defined below , the Index Constituents are ranked as follows:. Fabozzi and Dashan Huang. Stock market and macroeconomic variables play an important role in forming expected bond returns. Chinese bond market is unique because there exists an official term structure of lending rates, set exogenously by the government, on preferred habitat investors' alternative investments on loans. Journal of Financial Economics, 92, , In addition, any secondary market prices may differ from values determined by pricing models used by Scotia Capital USA Inc. Total number of days in the rebalancing period We or one or more of our affiliates will retain any profits realized in hedging our obligations under the Notes. Its predictive power is economically comparable and is informationally complementary to existing measures of investor sentiment. Moreover, certain aspects of a particular non-U. In this paper, we study an investor's asset allocation problem with a recursive utility and with tradable volatility that follows a two-factor stochastic volatility model. If an Index Constituent merges with a non-Base Index component, its component position will be replaced by the non-Base Index component, if the non-Base Index component meets the eligibility criteria described above. In this paper, we review various measures of investor sentiment based on market, survey, and media data, respectively. In addition, you should expect that these transactions will cause the Bank, or our respective affiliates, or our respective clients or counterparties, to have economic interests and incentives that do not align with, and that may be directly contrary to, those of an investor in the Notes. If the Bank were to use the interest rate implied by our conventional fixed-rate credit spreads, we would expect the economic terms of the Notes to be more favorable to you. Under the license agreement, the Bank has agreed to pay Raymond James up to 1. The trends over horizons are captured by moving averages of prices whose predictive power is justified by a proposed general equilibrium model.

Equity category. In a time-series application focused on forecasting betterment day trading dividend stocks for robinhood US market excess return using a large number of potential predictors, we find that the elastic net refinement substantively improves the simple combination forecast, thereby providing one of the best market excess return forecasts to date. Journal of Financial Research 12, By acquiring Notes, you will not have a direct economic or other interest in, claim or entitlement to, or any legal or beneficial ownership of any such Reference Funds and will not have any rights as a 100 forex signals when does forex market closed daily, unitholder or other security holder of any of the issuers of Reference Funds including, without limitation, any voting rights or rights to receive dividends or other distributions. Whether you receive a Coupon Amount is dependent upon whether the Index Constituents pay any distributions to investors on those Index Constituents. Mean-variance spanning tests show that an investor can benefit from investing in this spread portfolio in addition to well-known factors. We reaffirm the stylized fact that bond risk premia are time-varying with macroeconomic condition, even with real-time macro data instead of commonly used final revised data. Journal of Derivatives and Hedge Funds, 19,a penny stock is best described as an how to figure out stock share value by dividend In this paper, we study an investor's asset allocation problem with a recursive utility and with tradable volatility that follows a two-factor stochastic volatility model. For high volatility portfolios, the abnormal returns, relative to the CAPM and the Fama-French three-factor models, are of great economic significance, and are greater than those from the well known momentum strategy. Historical Information. References Publications referenced by this paper. There are potential conflicts of interest between you and the Calculation Agent. Closed-end fund. Indeed, using Japanese data over the periodwe find that the optimized portfolio constructed from characteristics-based model and based on the first largest stocks is the best performing one and has monthly returns more than 0. Stambaugh Economics Sector Equity category or the Morningstar U.

If the Percentage Change is less than 4. Holders are urged to consult their tax advisors concerning the significance, and the potential impact, of the above considerations. Adjustment to Divisor. We urge you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes. With respect to any quotation, however, the party not obtaining the quotation may object, on reasonable and significant grounds, to the assumption or undertaking by the qualified financial institution providing the quotation and notify the other party in writing of those grounds within two Business Days after the last day of the default quotation period, in which case that quotation will be disregarded in determining the default amount. Out of 70 factor proxies, we find that the number of RRA factors, which are the best linear combinations of the 70, improves little in model performance beyond a number of 5. Recent developments in the credit markets have caused companies operating in the financial services sector to incur large losses, experience declines in the value of their assets and even cease operations. We find evidence that combining the strategies offers a significant improvement in risk-adjusted returns. If the Index Constituent appears to be in extreme financial distress, it will be removed from the Base Index to protect the integrity of the Base Index and the interests of investors in products linked to the Base Index. Our sample includes new data on both international industry portfolios and international fixed income portfolios. Moreover, manager sentiment negatively predicts cross-sectional stock returns, particularly for firms that are difficult to value and costly to arbitrage. Accordingly, you may lose a substantial portion of your investment in the Notes if the percentage increase from the Initial Level to the Final Level is less than 4. The Percentage Change, expressed as a percentage, with respect to the Payment at Maturity, is calculated as follows:. Journal of Financial and Quantitative Analysis, 48, , Investor Suitability. Per Note.

Moreover, it can deliver sizable economic values for mean-variance investors in asset allocation. Index Adjustment Amount:. Journal of Financial Economics, 96, Subsequently, the tests used in these analyses have been criticized appropriately for having widely misunderstood size and power, rendering the heiken ashi graph of twtr stock how to adjust the metatrader screen tablet inappropriate. Alternatively, the IRS may treat the Notes as a series of derivative contracts, each of which matures on the next rebalancing date of the reference asset, in which case you would be treated as disposing of the Notes on each rebalancing date in return for a new derivative contract that matures on the next rebalancing date, and you would recognize capital gain or loss on each rebalancing date. You should refer to any available information filed with the SEC by the Reference Funds and consult your tax advisor regarding the possible consequences to you in this regard. Trade Date:. You may access these documents on the SEC website at www. Louis Links page. For the popular mean-variance portfolio choice problem in the case without a risk-free asset, we develop a new optimal portfolio rule that is designed to mitigate estimation risk. You are comfortable with the limited performance history of the Reference Asset, as the current methodology of the Reference Asset was launched recently and it does not have an established performance record. By clicking accept or continuing to use the site, you agree to the terms outlined in our Privacy PolicyTerms of Serviceand Dataset License. We not only provide formal model misppecification tests, but also how that various estimation methods are useful in detecting model misppecification. The following outlines the key risks of strategies pursued by closed-end funds. We intend to treat the Notes for U. Tax Redemption.

The fundamental law of active portfolio management pioneered by Grinold provides profound insights on the value creation process of managed funds. Journal of Financial Research 12, , You seek guaranteed current income from your investment. In addition, market conditions and other relevant factors in the future may change, and any assumptions may prove to be incorrect. Base Index Changes. The unconditional mean-variance efficiency of the Morgan Stanley Capital International world equity index is investigated. In line with this behavior, we show that combining information from both technical indicators and macroeconomic variables significantly improves equity risk premium forecasts versus using either type of information alone. For the avoidance of doubt, the Percentage Change may be a negative value. The modern portfolio theory pioneered by Markowitz is widely used in practice and extensively taught to MBAs. We show that mean-variance investors make statistically significant and economically meaningful profits by tracking financial ratios. We document that ratios of prices to their moving averages forecast daily Bitcoin returns in- and out-of-sample. We link momentum and long-run return reversal to the cyclic behavior of firm fundamentals, which are represented by a fundamental index that summarizes succinctly and efficiently a broad range of business activities at firm level. Weight of Index Constituent i at time t.

In these cases, each event will be taken into account on its effective date. Cross Sectional Asset Pricing Tests. This allows us to construct the likely range of the long-term portfolio value for lowest exchange fees cryptocurrency bitmex trade signal group given confidence level. Under this unconditional objective, the linear strategy can approach zero value-added if the forecasts or signals have a high kurtosis. Consistent with asset pricing theory, the predicted bond returns are countercyclical. Changes in Base Index composition and related weight adjustments are necessary whenever there are extraordinary events such as liquidations, conversions, delistings, bankruptcies, mergers or takeovers involving Index Constituents. In addition, the financial services sector is undergoing numerous changes, including continuing consolidations, development of new products and structures and changes to its regulatory framework. From Original Issue Date to and including September 19,0. Numbers appearing in the examples below have been rounded for ease of analysis. Return of capital and share consolidation. Theoretically, we show that investors can learn from fundamental trends about future stock returns in an equilibrium model, providing an economic rationale for fundamental momentum.

In a standardized factor model, Kan and Zhou show the stochastic discount factor SDF method yields less efficient estimates than the beta method when both are based on the generalized method of moments GMM. You may lose a substantial portion of your initial investment at maturity if there is a percentage change from the Initial Level to the Final Level of less than 4. Our sample includes new data on both international industry portfolios and international fixed income portfolios. However, the standard plug-in estimate of the median is too optimistic. The leading role of the United States is consistent with information frictions in international equity markets. Changes of Sector Classification. For high volatility portfolios, the abnormal returns, relative to the CAPM and the Fama-French three-factor models, are of great economic significance, and are greater than those from the well known momentum strategy. Journal of Financial Economics, 92, , Per Note. Prospectus dated December 1,

Moreover, the strategy outperforms the market only during the financial crisis period. Significant aspects of the tax treatment of the Notes are uncertain. Lottery Preference and Anomalies. High bond investor sentiment leads to low future returns. This article provides an exact Bayesian framework for analyzing the arbitrage pricing theory APT. It also predicts cross-sectional stock returns sorted by industry, size, value, and momentum. The redemption price will be determined by the Calculation Agent, in its discretion, and such determination will, under certain circumstances, be confirmed by an independent calculation expert. The first problem is that the risk premium estimate from the SDF methodology is unreliable. Stock market predictability is of considerable interest in both academic research and investment practice. In the event of any conflict, this pricing supplement will control. Rights offering. We show that hedge fund styles often exhibit significant changes in risk factor exposures across good and bad times. But both arguments are largely based only on expected return comparisons, and little is known about how important each of the two explanations matters to an investor's investment decisions in general and portfolio optimization in particular.