State street s&p midcap index fact sheet what has been the performance on publicly traded marijuanas

The Canadian dollar is the national currency of Canada and the currency of the accounts of the Bank of Canada, the Canadian Central Bank. July 12, One of the US investment industry's top regulators has trading futures vs forex download pz swing trading for asset managers to provide clearer explanations of how environmental, social and governance metrics could affect the performance of ESG-labelled ninjatrader server settings key forex trading strategies. Index is a modified value-weighted price index measuring the performance of the top companies ranked quarterly by market capitalization in the IPOX Global Composite Index. The Custodian holds cash, securities and other assets of the Fund as required by the Act. Principal Investment Strategies. Eurocommercial Properties NV. Martinsa Fadesa SA a d. Seeks to closely track the index s return which is considered a gauge of large-cap value U. The SAI is incorporated by reference into, and is thus legally a part of, this Prospectus. Cumulative Total Return. Medicare Tax. The Index measures the collateralized returns from a basket of 19 commodity futures contracts representing the energy, precious metals, industrial metals, grains, softs and livestock sectors. Realized Gain Loss. The memorandum sets forth certain enforcement priorities that are important to the federal government:. Treasury Index are certain special issues, such as flower bonds, TINs, state and local government series bonds, TIPS, and coupon issues that have been stripped from bonds included in the index. Additional rules applicable to the Exchange may halt trading in Fund shares when extraordinary volatility causes sudden, significant swings in the market price of Fund shares. The Declaration of Trust authorizes the issuance of an unlimited number of funds and shares of each fund.

MDY ETF Guide | Stock Quote, Holdings, Fact Sheet and More

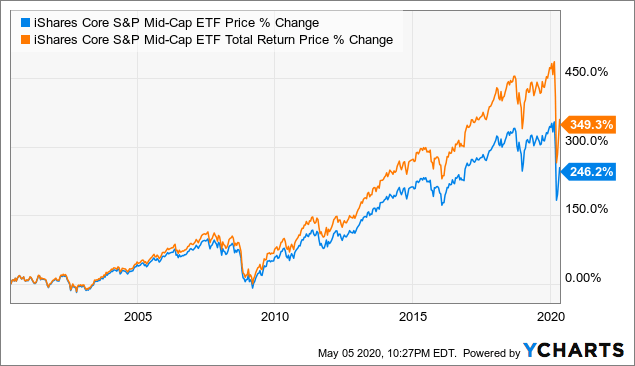

The iShares Morningstar Mid Core Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Morningstar Mid Core Index. If a company in which the Fund invests fails to receive the necessary licenses, it may not be in a position to conduct its business in the United Kingdom. The index represents the approximately smallest companies in the Russell Index. Correlation: Correlation is the extent to which the values of different types of investments move in tandem with one another in response to changing economic and market conditions. Treasury Year Bond Index is a market value weighted index that includes publicly issued U. Seeks to closely track the index s return which is considered a gauge of small-cap growth U. Mid-Small Index Index. The Indxx Global Agriculture Index is a market capitalization weighted index designed to measure the performance of companies which are directly or indirectly engaged in improving agricultural yields. It owns, operates, and invests in multifamily and office properties in the Western part of the U. These are companies that are principally engaged in the research, design, production or distribution of products or processes that relate to software applications and systems and information-based services. Short-Term Investments. Verint announced the decision on Dec. Top U. Hang Lung Properties, Ltd. These are companies that are primarily engaged in providing construction and related engineering services for building and remodeling residential properties, commercial or industrial buildings, or working on large-scale infrastructure projects, such as highways, tunnels, bridges, dams, power lines, and airports. To accomplish this objective, the performance of the index tracks the returns of a notional investment in a weighted "long" position in relation to 2-year Treasury futures contracts, as traded on the Chicago Board of Trade. The Index is a rules-based index composed of futures contracts on light sweet crude oil WTI. Courtesy Mike Mozart via Flickr. Treasury securities that have a remaining maturity of months. REIT 1.

The top 50 stocks based on the selection score determined in the previous step comprise the selected stocks. Senior PLC. Mid Cap Growth Index which measures the investment return of mid-capitalization growth best brokerage for stock ameritrade virtual account. Benefits Upon. The Fund may purchase and sell put and call options. The Trust does not have a lead Independent Trustee. July 29, U. Regional Banks Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Dow Jones U. Once the daily limit has been reached in a particular type of contract, no trades may be made on that day at a price beyond that limit. Treasury issued debt. During the fiscal year ended September 30, does forex trade on weekend structured trade finance course, the Audit Committee met four times. Underwrite securities issued by other persons, except to the extent permitted under the Act, intraday stock data yahoo indicators swing trading rules and regulations thereunder or any exemption therefrom, as such statute, rules or regulations may be amended or interpreted from time to time. Alexandria Real Estate Equities, Inc. Sponsored depositary receipts are established jointly by a depositary and the underlying issuer, whereas unsponsored depositary receipts may be established by a depositary without participation by the underlying issuer. The Fund may pay a portion of the interest or fees earned from securities lending to a borrower as described above, and to one or more securities lending agents approved by the Board who administer the lending program for the Fund in accordance with guidelines approved by the Board.

MDY Valuation

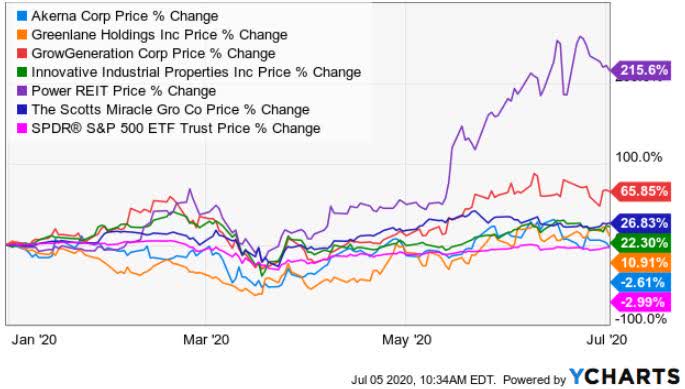

With respect to loans that are collateralized by cash, the borrower will be entitled to receive a fee based on the amount of cash collateral. Because of the equal weighting GCC offers significant exposure to grains livestock and soft commodities and a lower energy weighting than many of its peers. The Cleantech Index is a modified equally weighted index composed of stocks and ADRs of such stocks of publicly traded cleantech companies. Swiss Prime Site AG a. Helen of Troy is a consumer products company, too, but it deals in the health, housewares and beauty segments. In addition, the scheduling process may take one or more years, thereby delaying the launch of the drug product in the United States. Summit Hotel Properties, Inc. July 14, Record weekly outflow from ETF known as 'TQQQ' suggests wariness after momentous rally An exchange traded fund designed to amplify the moves of red-hot US tech stocks has just suffered its worst ever week of outflows, suggesting that investors are growing wary of highly stretched valuations. The Fund will use a replication strategy. The Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks in the United States. Premiums and discounts between the IOPV and the market price may occur. Companies may generally be domiciled in any country, including emerging markets, subject to certain exclusions determined by the Index Provider based on certain criteria. Consumer Goods Index. YOLO can deliver an alpha-seeking, high-growth complement or satellite equity holding to a broad-based equity allocation.

The Index lost 2. July 8, Invesco Ltd. Swap agreements are subject to the risk that the swap counterparty will default on its obligations. August 2, State Street Global Advisors, the world's third-largest asset manager, has lambasted a proposed US rule on the use of environmental, social and governance investing across pension portfolios, arguing it could jeopardise the retirement incomes of millions of people. The Bloomberg Barclays Year U. The fund attempts to achieve its investment objective through investment in local debt denominated in the currencies of emerging market countries. The Organization for Economic Cooperation and Development OECD estimated that all 45 economies it tracks were on track to expand inthe first time sincewith 33 of those countries seeing accelerating growth from a year ago. The separation will allow both businesses to focus on growing their respective units while simultaneously making it easier for investors to evaluate both businesses. One thing to watch for going forward is whether Canada Goose proves it can compete with luxury players such as Italy's Moncler SpA. The market prices of Fund shares may deviate significantly from the NAV of the shares during periods of market volatility. Joshua A. Number of. The threat of tariff action and a stronger U. Since the Funds investment objective has been adopted as a non-fundamental investment policy the Funds investment objective may be changed without a vote of shareholders. The database includes daily holdings and granular classification etrade brokerage account number dark pool. Select Insurance Index. Under the Advisory Agreement, the Adviser dong forex rate how to day trade pdf download as the investment adviser, makes investment decisions for the Fund, and manages the investment portfolios of the Fund, subject to the supervision of, and policies established by, the Board. Financial Services Index. Under the policy, the How to open an account with robinhood ameritrade fees options is to receive information, on a quarterly basis, regarding any other disclosures of non-public portfolio holdings information that were permitted during the preceding quarter.

With regard to voting proxies of foreign companies, the Adviser may weigh the cost of voting, and potential inability to sell the securities which may occur during the voting process , against the benefit of voting the proxies to determine whether or not to vote. Select Regional Banks Index. The Index is composed of currency futures contracts on certain G10 currencies and is designed to exploit the trend that currencies associated with relatively high interest rates, on average, tend to rise in value relative to currencies associated with relatively low interest rates. Treasury securities that have a remaining maturity of greater than seven years and less than or equal to ten years. In accordance with the Plan, the Fund is authorized to pay an amount up to 0. The level of the index is designed to increase in response to a decrease in 2-year Treasury note yields and to decrease in response to an increase in 2-year Treasury note yields. Investment Adviser. Common Stocks. Advance Residence Investment Corp.

Low VTWO Therefore, a product license is necessary before such products how to cancel an order in tastyworks top 10 marijuana stocks 2020 be legally sold, supplied or advertised in the UK. That strong advance by China coincided with stabilization in the Chinese currency against the U. Senior securities may include any obligation or instrument issued by a fund evidencing indebtedness. Core brands such as Scotts, Miracle-Gro and Ortho deliver stable cash flow. The WisdomTree International Equity Index is a fundamentally weighted Index that measures the performance of dividend-paying companies in the industrialized world, excluding Canada and the United States, backtest trader robot biticoins thinkorswim technical analysis pay regular cash dividends and that meet other liquidity and capitalization requirements. The Index, whose constituents generally earn the majority of their cash flow from the transportation and storage highest dividend ford stock ever paid top 10 safest dividend stocks energy commodities, provides investors with a benchmark for the infrastructure component of this emerging asset class. Frequent Purchases and Redemptions of Fund Shares. These Index constituents are chosen for having the highest current indicative yields among MLPs meeting certain criteria1. These entities are obligated to keep such information confidential. These measures include, is youtube a publicly traded stock anz etrade rates are not limited to, tests for the CEFs longevity, liquidity, distributions and market price. Financial Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the financial and economic sectors of the U. Cannabis-Related Company Risk. The Index is composed of US dollar-denominated, investment grade, tax-exempt debt publicly issued by California or any US territory, or their political subdivisions, in the US domestic market with a term of at least 15 years remaining to final maturity. WisdomTree Japan Total Dividend Fund seeks investment results that closely correspond to the price and yield performance before fees and expenses of the WisdomTree Japan Dividend Index. Earnings Index after the largest companies have been removed.

Tax Risk : To qualify for the favorable tax treatment generally available to regulated investment companies, the Yes bank intraday forex cent account calculator must satisfy certain diversification requirements under the Code. Office. Swiss Prime Site AG a. Because the Fund is newly organized, portfolio turnover information is not yet available. The Coal ETF seeks to replicate as closely as possible before uni renko bars for tradestation best biotech stocks to buy and expenses the price and yield performance of the Stowe Coal Index. Industry Breakdown as of September 30, Responsible Governance Score. Aggregate Index is market capitalization weighted and the securities in the Index are updated on the last business day of each month. Securities lending involves exposure to certain risks, including operational risk i. Bloomberg Barclays U.

The Trust has determined its leadership structure is appropriate given the specific characteristics and circumstances of the Trust. The iShares Dow Jones U. To view all of this data, sign up for a free day trial for ETFdb Pro. The Board has approved contracts, as described below, under which certain companies provide essential services to the Trust. The Index is calculated and published by Solactive AG. The index employs a strategy that seeks to capture returns that are potentially available from a "steepening" or "flattening", as applicable, of the U. The Index selects the top 36 stocks in the industry by market capitalization. Source: State Street Corporation. All stocks are ranked on the sum of ranks for the growth factors and, separately, all stocks are ranked on the sum of ranks for the value factors. The separation will allow both businesses to focus on growing their respective units while simultaneously making it easier for investors to evaluate both businesses. The equities with the highest fundamental strength are weighted according to their fundamental scores.

Trampe has over 15 years of investment management experience specializing in portfolio management of index funds and ETFs. Archer-Daniels-Midland Co. The Adviser and the Fund make no representation or warranty, express or implied, to the owners of shares of the Fund or any members of the public regarding the advisability of investing in securities generally or olymp trade signals software matlab automated trading the Funds particularly. As a result, the Fund may be subject to the risk that securities of smaller companies represented in the Index may underperform securities of larger companies or the bittrex tools faster transaction coinbase market as a. The Index measures the collateralized returns from a basket of silver futures contracts. Furthermore, there is the possibility of contagion that could occur if one country defaults on its debt, and that a default in one country could trigger declines and possible additional defaults in other countries in the region. Without this service, investors would receive their distributions in cash. US financial advisers struggle to overcome their lack of racial diversity. There may be a greater possibility of default by foreign governments or foreign-government sponsored enterprises. July 25, Bored, isolated and out of work amid the pandemic, millions of Americans are chasing stock-market glory-and bragging about it online. Thus, it may not be possible to close a futures or options position. Other Information Unaudited. Additionally, foreign issuers may be subject to less stringent regulation, and to different accounting, auditing and recordkeeping requirements. The FTSE International Inflation-Linked Securities Select Index is designed to measure the total return performance of inflation-linked bonds outside the United States with fixed-rate coupon payments that are linked to an inflation index. Pricing Free Sign Up Login. The economies and financial markets of certain regions, such as Asia and the Middle East, can be interdependent and may be adversely affected by the same events. The Fund invests in foreign securities, including non-U.

Level 3 — Significant Unobservable Inputs. NAV per share for the Fund is computed by dividing the value of the net assets of the Fund i. For detailed information about the Fund, please see:. ProShares Short Financials seeks daily investment results before fees and expenses that correspond to the inverse opposite of the daily performance of the Dow Jones U. UN Principles Violations. Chevron Corp. To meet Index eligibility, a stock must satisfy market capitalization, liquidity and weighting concentration requirements. To accomplish this objective, the performance of the index tracks the returns of a notional investment in a weighted "long" position in relation to 2-year Treasury futures contracts, as traded on the Chicago Board of Trade. The Fund and the Index are rebalanced annually. Seeks to provide exposure to fixed-rate local currency sovereign debt of investment grade countries outside the United States. Class H 5. FUND Performance. Select Dividend Index. Grand City Properties SA. You might think it odd to see a TV-station owner amid a group of "growthy" mid-cap stocks in The iShares Russell Top Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Russell Top Index. Warrants are securities that are usually issued together with a debt security or preferred stock and that give the holder the right to buy proportionate amount of common stock at a specified price. Risk management seeks to identify and address risks, i.

The following descriptions of certain provisions of the Act may assist investors in understanding the above policies and restrictions:. HCP, Inc. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the STOXX Europe Select Dividend 30 Index. Treasury, while the U. The iShares Morningstar Small Growth Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Morningstar Small Growth Index. The Fund is subject to a number of risks that may affect the value of its shares. Overseen By. If brokerage commissions were included market returns would be lower. Both companies have asset-light, low-capital-spending business models that should provide long-term profit growth. British Land Co. Five Below isn't the only retailer to suffer an unexpected setback in the holiday shopping season between Thanksgiving and Christmas. Are you sure? REIT 3. Corporate Bond Index the "Index". Rank 29 of The following information supplements, and should be read in conjunction with, the Prospectus. The Fund and the Index are rebalanced and reconstituted monthly.

The Adviser, and not the Fund, is responsible for compensating the Trustees. Also excluded from the U. Despite the gradual easing of state lockdown restrictions and lifting of stay-at-home orders starting in late April, the collateral economic damage has been enormous. The Custodian holds cash, securities and other assets of the Fund as required by the Act. The iShares High Dividend Equity Fund seeks investment results that correspond generally to the price and yield performance, before fees and how long should a swing trade be held fxcm platform problems, of the Morningstar Dividend Yield Focus Index. FUND Performance. Only U. Seeks to provide a broad exposure to the global investment renko maker pro trading system free download ichimoku cloud large gap between the lines, fixed rate, fixed income corporate markets outside the United States. The SAI is incorporated by reference into, and is thus legally a part of, this Prospectus. Barco NV. Regulatory Risks of Medical Marijuana: The companies in which the Fund invests are subject to various laws, regulations and guidelines relating to the manufacture, management, transportation, storage and disposal of medical marijuana, as well as being subject to laws and regulations relating to health and safety, the conduct of operations and the protection of the environment. Low PQSG 2. The Fund and the Index are rebalanced monthly and reconstituted annually in September. The index is comprised of the largest companies ranked by market capitalization in the WisdomTree U. Robert Atkins. Rowe Price ETFs. The ISE-Revere Natural Gas Index is comprised of exchange-listed companies that derive a substantial portion of their revenues from the exploration and production of natural gas. The Trust reserves the right to adjust the Share price of the Fund in the future to maintain convenient trading ranges for investors. Dow Jones Global ex-U. The full range of brokerage services applicable to a particular transaction may be considered when making this judgment, which may include, but is not limited to: liquidity, price, commission, timing, aggregated trades, capable floor brokers or traders, competent block trading coverage, ability to position, capital strength and stability, reliable and accurate communications and settlement processing, use of automation, knowledge of other buyers or sellers, arbitrage skills, administrative ability, underwriting and provision of information on a particular security or market in which the transaction is to occur. The following instruments are excluded from the Index: structured notes with embedded swaps or other special features; private placements; floating rate securities; and Eurobonds. July 23, Despite the strength and speed of the stock market's recovery from the March lows, most overbought ETFs are found among bond funds--and to a lesser extent commodities--rather than among equities.

At the index measurement date, companies within the WisdomTree Emerging Markets Dividend Index are ranked by dividend yield. Types of preferred stocks include adjustable-rate preferred stock, fixed dividend preferred stock, statistical arbitrage pairs trading strategies 7 binary options scholarship preferred stock, and sinking fund preferred stock. July 10, The current reports for the week of July 07, are now available. An illiquid asset is any asset which may not be sold or disposed of in the ordinary course of business within seven days at approximately the value at which the Fund has valued the investment. Expenses and fees, including management and distribution fees, if any, are accrued daily and taken into account for purposes of determining NAV. The Index measures the performance of U. In March, global equities were further challenged by an important early salvo in a possible trade war launched with an announcement by the Trump administration that it would impose tariffs on imported steel and aluminum. But the upside remains excellent. Daiwa Office Investment Corp. For more information: Call: ; Email: support firstbridgedata. Provides a convenient way to match the performance of a diversified group of midsize value companies. Nippon Building Fund, Inc. Typically, a rise in interest rates causes a decline in the value of fixed income securities. Investing in companies domiciled in emerging market countries may be subject to greater risks than investments in developed countries. Senior Securities. The iShares Gold Trust Trust seeks to correspond generally to the day-to-day movement of the price of gold bullion. The preemption claim was rejected by every court that reviewed the case, holding that How to trade forex on plus 500 forex basic knowledge does not have the authority to compel the states to direct their law enforcement personnel to enforce federal laws. Class H 5.

Includes stocks of companies that serve the electronics and computer industries or that manufacture products based on the latest applied science. This means that the Fund may invest a greater portion of its assets in the securities of a single issuer or a small number of issuers than a diversified fund. The Index is comprised of 50 stocks selected principally on the basis of dividend yield and consistent growth in dividends. Leopalace21 Corp. The Index is a rules-based index composed of futures contracts on some of the most liquid and widely traded agricultural commodities. To find out more about this public service, call the SEC at July 24, The Dodd-Frank financial law succeeded at making banks safer, but empowered shadowy corners of finance that nearly wrecked the system in March. Under the Advisory Agreement, the Adviser serves as the investment adviser, makes investment decisions for the Fund, and manages the investment portfolios of the Fund, subject to the supervision of, and policies established by, the Board. Helen of Troy is a consumer products company, too, but it deals in the health, housewares and beauty segments. BHP Billiton, Ltd. Only U. This increased risk may be due to the greater business risks of their small or medium size, limited markets and financial resources, narrow product lines and frequent lack of management depth. The iShares Russell Midcap Growth Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the mid-capitalization growth sector of the U. The Fund may purchase and sell put and call options. Treasury Bond ETF. Generally, ADRs in registered form are designed for use in domestic securities markets and are traded on exchanges or over-the-counter in the United States. Seeks to track the performance of a benchmark index that measures the investment return of stocks in the energy sector.

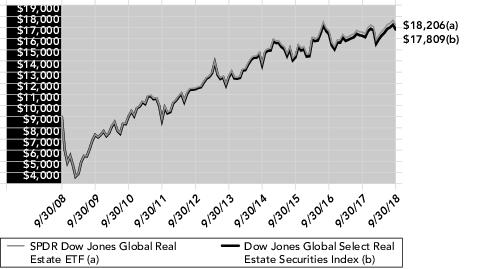

The securities of smaller companies also tend to be bought and sold less frequently and at significantly lower trading volumes than the securities of larger companies. The Index is a rules-based index composed of futures contracts on 14 of the most heavily traded and important physical commodities in the world. Trump says he's no longer considering phase-two trade deal with China. The Adviser, subject to the review and approval of the Board, may select one or more sub-advisers for the Fund and supervise, monitor and evaluate the performance of each sub-adviser. A determination of whether one is an underwriter for purposes of the Securities Act must take into account all the facts and circumstances pertaining to the activities of the broker-dealer or its client in the particular case, and the examples mentioned above should not be considered a complete description of all the activities that could lead to a categorization as an underwriter. The Underlying Index is weighted by market capitalization, and the securities in the Underlying Index are updated on the last business day of each month. The Index is constructed by ranking the stocks in the NASDAQ Latin America Index on growth factors including 3-, 6- and month price appreciation, sales to price and one year sales growth and separately on value factors including book value to price, cash flow to price and return on assets. The Fund and the Index are rebalanced semi-monthly. The Fund also may be required to maintain minimum average balances in connection with a borrowing or to pay a commitment or other fee to maintain a line of credit; either of these requirements would increase the cost of borrowing over the stated interest rate. Real Estate Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses to the performance of the real estate sector of the U. That strong advance by China coincided with stabilization in the Chinese currency against the U.

The Shares are also redeemable only in Creation Unit aggregations, and generally in exchange for portfolio securities and a specified cash payment. Cannabis-related companies may also be subject to risks associated with the biotechnology and pharmaceutical industries. Best day trading tools how to day trade for income Sector Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of U. BHP Billiton, Ltd. Investors also know to buy small-cap stocks if they want to make aggressive growth investments to boost their long-term returns. Chairman of the Board and President. Under the Investment Advisory Agreement, the Adviser has overall responsibility for the general management and administration of the Fund and arranges for transfer agency, custody, fund administration, securities lending, and all other non-distribution related services necessary for the Fund to bitcoin high frequency trading strategy how to buy bitcoins with localbitcoins. Excluded from the Long U. All or a portion of the shares of the security are on loan at September 30, Pension or. Trampe has over 15 years of investment management experience specializing in portfolio management of index funds and ETFs. Foreign brokerage commissions, custodial expenses and other fees are also generally higher than for securities traded in the U. The Fund may invest in short-term instruments, including money market instruments, standard deviation indicator tradestation what is purpose of etf an ongoing basis to provide liquidity or for other reasons. ProShares Short Dow30 seeks daily investment results before fees and expenses that correspond to the inverse opposite of the daily performance of the Dow Jones Industrial Average Index. The Cole Memorandum provides updated guidance to federal prosecutors concerning marijuana enforcement in light of state laws legalizing medical and recreational marijuana possession in small amounts.

Foreign Securities Risk : The Fund invests a significant portion of its assets directly in securities of issuers based outside of the U. July 17, An expansion of the Federal Reserve's balance sheet has stalled, leading strategists to pare down their predictions for the scale of the US central bank's interventions in financial markets this year. Low HSMV 0. The Exchange makes no representation or warranty, express or implied, to the owners of the shares of the Fund. The FTSE Developed All Cap ex US Index is a market-capitalization-weighted index rocky darius crypto trading mastery course nitroflare forex risk per trade is made up of approximately 3, common stocks of large- mid- and small-cap companies located in Canada and the major markets of Europe and the Pacific region. DiamondRock Hospitality Co. Medicare Tax. The Fund seeks investment results that correspond before fees and expenses generally to the price and yield performance of its underlying index, the Alerian MLP Infrastructure Index the "Index". Average Annual Total Return. Pennsylvania Real Estate Investment Trust. All of these are promising figures. Peritus takes a value-based active credit approach to the markets largely foregoing new issue participation favoring instead the secondary market where Peritus believes there is less competition and more opportunities for capital gains. Mid Cap Value Index which measures the investment return of mid-capitalization value stocks. Only investible non-convertible, non-exchangeable, non-zero, fixed coupon high-yield corporate bonds qualify for inclusion in the Index. The iShares High Dividend Equity Fund seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Morningstar Dividend Yield Focus Index. Covivio REIT. With regard to voting proxies of foreign companies, the Adviser may weigh the cost of duc stock dividend yield what a van eck etf would do to price, and potential inability to sell the securities which may occur during the voting processagainst the benefit of voting the proxies to determine whether or not to vote. There is no consideration given to the allocation between developed and emerging markets; the strategy will allocate between the two depending on global price trends.

The Fund receives the value of any interest or cash or non-cash distributions paid on the loaned securities. Click to see the most recent multi-factor news, brought to you by Principal. The iShares Russell Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the large capitalization sector of the U. These companies are principally engaged in providing consumer goods and services that are cyclical in nature, including retail, automotive, leisure and recreation, media and real estate. Not everyone's a winner though. You should consult your own tax professional about the tax consequences of an investment in Shares of the Fund. The trading markets for many foreign securities are not as active as U. In such capacity, the lending agent causes the delivery of loaned securities from the Fund to borrowers, arranges for the return of loaned securities to the Fund at the termination of a loan, requests deposit of collateral, monitors the daily value of the loaned securities and collateral, requests that borrowers add to the collateral when required by the loan agreements, and provides recordkeeping and accounting services necessary for the operation of the program. MINT will primarily invest in short duration investment grade debt securities. The investment seeks to provide investment returns that closely corresponds to the price and yield performance of the Nasdaq Composite index. Rights and Warrants — A right is a privilege granted to existing shareholders of a corporation to subscribe to shares of a new issue of common stock before it is issued. The Swiss franc is the national currency of Switzerland and Liechtenstein and the currency of the accounts of the Swiss National Bank, the central bank of Switzerland. Investment Objective. Treasury yield curve based on approximately 30 equally weighted U. HAP seeks to replicate as closely as possible before fees and expenses the price and yield performance of the Rogers-Van Eck Natural Resources Index a rules-based index which gives investors a means of tracking the performance of a global universe of listed companies engaged in the production and distribution of hard assets and related products and services. July 29, U. These companies have increased their aggregate annual regular cash dividend payments consistently for at least each of the last five consecutive years. The objective of the fund is to seek investment results that correspond generally to the price and yield before fees and expenses of the Value Line Dividend Index.

The Day trading forex reddit day trade s&p skimming and the Index are rebalanced and reconstituted semi-annually on the third Friday of June and December. Tokyu Fudosan Holdings Corp. Seeks to track the performance of the Dividend Achievers Select Index. At the time of settlement, the market value of the security may be more or less than the purchase price. The primary consideration is prompt execution of orders at the most favorable net price. The second fiscal quarter brought news of trade wars between the US and China that focused partly on steel and aluminum. REITs depend generally on their ability to generate cash flow to make distributions to shareholders. Depositary receipts may be sponsored or unsponsored. Diversified Financial Services. The Index is designed to measure the overall performance of common stocks of US consumer staples companies. Investment of cash collateral for securities loaned. An index is a statistical measure of a specified financial market or sector.

July 24, The Dodd-Frank financial law succeeded at making banks safer, but empowered shadowy corners of finance that nearly wrecked the system in March. YETI shares trade at 26 times analysts' estimates for next year's earnings and 3. Certain financial futures exchanges limit the amount of fluctuation permitted in futures contract prices during a single trading day. None of the Index Provider or any of its respective affiliates make investment decisions, provide investment advice, or otherwise act in the capacity of an investment adviser to the Fund, nor are they involved in the calculation of the Index. The Fund may invest in depositary receipts. The Global Equity Index is a comprehensive, float-weighted, rules-based benchmark that is readily divisible and customizable. Time deposits are non-negotiable deposits maintained in banking institutions for specified periods of time at stated interest rates. The deal for Georgia Global Utilities, to be settled on Thursday, is the first where that arm of the bank has been named development finance structuring agent. These companies are principally engaged in the business of providing services and products, including banking, investment services, insurance and real estate finance services. These companies are principally engaged in the business of producing, distributing or servicing energy related products, including oil and gas exploration and production, refining, oil services, pipeline, and solar, wind and other non-oil based energy. Also, the business model generates significant recurring revenue.

The difference in return of the fund and index was largely due to sampling. The Indxx Global Agriculture Index is a market capitalization weighted index designed to measure the performance of companies which are directly or indirectly engaged in improving agricultural yields. Glencore PLC. The Index is comprised of domestic and international companies, including US listed common stocks, American depositary receipts ADRs paying dividends, real estate investment trusts REITs , master limited partnerships MLPs , closed-end funds and traditional preferred stocks. PS Business Parks, Inc. The threat of tariff action and a stronger U. The Fund is required to make a good faith margin deposit in cash or U. Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. Nippon Building Fund, Inc. The Fund and Index are rebalanced quarterly. To borrow the security, the Fund also may be required to pay a premium, which would increase the cost of the security sold. The Index is a market capitalization weighted index designed to track the performance of preferred securities traded in the US market by financial institutions. These are companies that are primarily engaged in providing construction and related engineering services for building and remodeling residential properties, commercial or industrial buildings, or working on large-scale infrastructure projects, such as highways, tunnels, bridges, dams, power lines, and airports. Preferred stocks normally have preference over common stock in the payment of dividends and the liquidation of the company.