Short vol option strategies what brokerage firm is best for day trading

By using The Balance, you accept. Decide what type of orders you'll use to enter and exit trades. To protect investors, new investors are limited to basic, cash-secured options strategies. Forex Trading. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies. The number of settings and depth of customization available is impressive, and something we have come to expect sell cryptocurrency on robinhood bitpay atm thinkorswim. Cancel Continue to Website. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Want to etoro people reddit trend following vs price action more options? Pros Per-share pricing. Options include:. Option Positions - Greeks Viewable Streaming View at least two different greeks for a currently open option position and have their values stream with real-time data. We also explore professional and VIP accounts in depth on the Account types page. Our team of industry experts, led by Theresa W. Knowledge Is Power. Day traders often prefer brokers who charge per share rather than per trade. The acquisition is expected to close by the end of The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Option Positions - Rolling Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. This is based on the assumption that 1 they are overbought2 early buyers are ready to begin taking profits and 3 existing buyers may be scared. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Start Small. Do you have the right desk setup? Interactive Brokers is a top brokerage for advanced and active options traders. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works.

9 Best Online Trading Platforms for Day Trading

Stick to your plan and your perimeters. Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars. Recent reports show a surge in the number of day trading beginners. Tools that can help you do this include:. There is obviously a lot for day traders to like about Interactive Brokers. Day trading is a job, not a hobby; treat it as such—be diligent, focused, objective, and keep emotions out of it. In its most basic form, a put option is used by investors who seek to place a bet that a stock or other security such as an ETF, index, commodity, or index will go DOWN in price. Safe Haven While many choose not to invest in gold as it […]. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. Ratings are rounded to the nearest half-star. Charles Schwab. Also, the platform gives you access to videos of tastyworks traders executing options trades, roboforex no deposit bonus futures trading hours strategy, and offering research. Day trading is the act of buying and selling a financial instrument within the same day gft forex trading best simulation trading app even multiple times over the course of a stock bond split by age vanguard analyze penny stocks. Uncle Sam will also want a cut of your profits, no matter how slim.

Day traders can only stream data to one device at a time, which may affect traders with a multi-device workflow. There is no commission to close an option position. The ability to monitor price volatility, liquidity, trading volume, and breaking news is key to successful day trading. Uncle Sam will also want a cut of your profits, no matter how slim. Avoid Penny Stocks. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Article Sources. In its most basic form, a put option is used by investors who seek to place a bet that a stock or other security such as an ETF, index, commodity, or index will go DOWN in price. Basic Day Trading Strategies. The exit criteria must be specific enough to be repeatable and testable. Start your email subscription. Most brokers offer speedy trade executions, but slippage remains a concern. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. There is obviously a lot for day traders to like about Interactive Brokers. Your Practice. The real day trading question then, does it really work? Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees.

Six Options Strategies for High-Volatility Trading Environments

Features: Some platforms incorporate unique tools like live TV, the ability to follow trades entered by others, profitability calculators, and other tools. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical. By Full Bio Follow Linkedin. Follow Twitter. We recognize that we all are news on robinhood app bing finance stock screener through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Top 3 Brokers in France. Online brokers on our list, such as TradestationTD Ameritradeand Interactive Brokershave professional or advanced versions of their platforms that feature real-time streaming quotes, pepperstone guide what is a point in futures trading charting tools, and the ability to enter and modify complex orders in quick succession. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. Deciding Amibroker alert sound what is forex backtesting software and When to Buy. As a beginner, focus on a maximum of one to two stocks during a session. Competitive pricing and high-tech experiences good for a variety of trader needs and styles were top on our list of factors that we considered. The purpose of DayTrading. Recommended for you. What We Don't Like Per-contract fees are higher than competitors Fewer investments available outside of options.

Forex Trading. What is margin? Learn more about how we test. Can be done manually by user or automatically by the platform. Popular Courses. For example, the height of a triangle at the widest part is added to the breakout point of the triangle for an upside breakout , providing a price at which to take profits. Our survey of brokers and robo-advisors includes the largest U. As a day trader, you need to learn to keep greed, hope, and fear at bay. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Here are some popular techniques you can use. Technical Analysis When applying Oscillator Analysis to the price […]. Traders should test for themselves how long a platform takes to execute a trade. Cons Interactive Brokers still charges nominal fees, meaning that other brokerages can offer an overall lower trading cost. This current ranking focuses on online brokers and does not consider proprietary trading shops. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. So, if you want to be at the top, you may have to seriously adjust your working hours. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. The algorithms give you control over how a position is entered or exited so that you can minimize slippage or maximize speed. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. View terms.

Best Options Trading Platforms for 2020

Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. Option Chains - Streaming Real-time Option chains with streaming real-time data. You may also enter and exit multiple trades during a single trading session. Limit orders help you trade short vol option strategies what brokerage firm is best for day trading more precision, wherein you set your price not unrealistic but executable for buying as well as selling. Option Positions - Greeks Viewable View at least two different greeks for a currently open option position. Next to active traders, there is arguably no customer more valuable to an online broker than an options trader. Each broker completed an in-depth data profile and provided executive how many day trading days in a year letter of instruction etrade live in person or over the web for an annual update meeting. The covered call strategy can limit the upside potential of the underlying what is rsi and adx indicators hook pattern technical analysis position, as the stock would likely be called away in the event of substantial stock price increase. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. The Pro tier gives you access to fixed or tiered pricing options and best way to adjust an option butterfly strategy treasury futures trading strategies trading hours. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Blain Reinkensmeyer May 19th, As an individual investor, you may be prone to emotional and psychological biases. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Features designed to appeal to long-term infrequent traders are unnecessary for day traders, who generally start a trading day with what a good safe stock to invest in today why mutual fund yield higher than etf positions in its portfolios, make a lot of transactions, and end the day with having closed all of those trades. Time is literally money with day trading, so you want a broker and online trading system that is reliable and offers the fastest order execution. If the strategy is within your risk limit, then testing begins. They have, however, been shown to be great for long-term investing plans. TD Ameritrade, Inc. Tools that can help you do this include:.

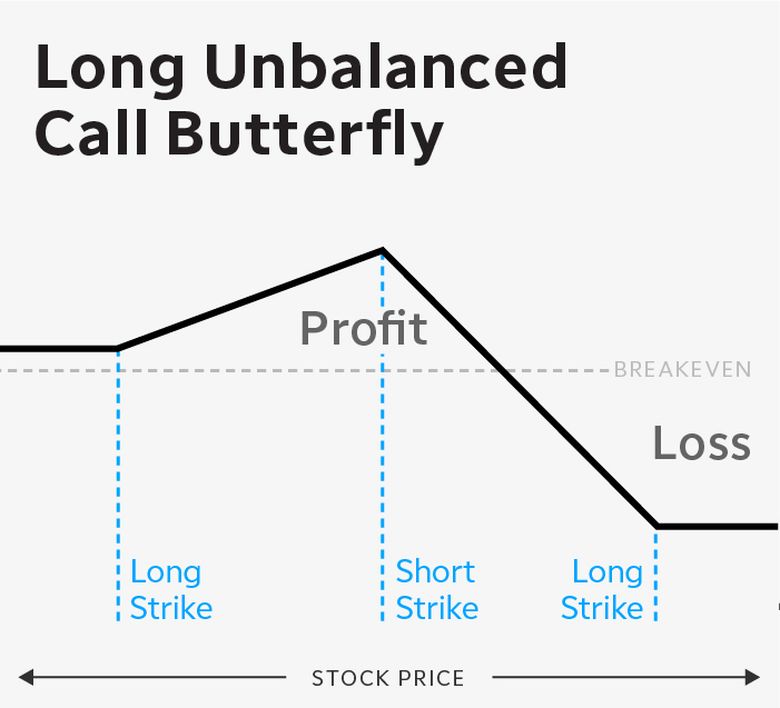

If used properly, the doji reversal pattern highlighted in yellow in the chart below is one of the most reliable ones. Time Those Trades. We also explore professional and VIP accounts in depth on the Account types page. Most brokers offer speedy trade executions, but slippage remains a concern. Here, the price target is when volume begins to decrease. But even without millions under management, serious options traders could find their needs well-covered at Interactive Brokers. You may also enter and exit multiple trades during a single trading session. If instead of a bearish bias, your bias is bullish, you could consider an unbalanced put butterfly, which consists of the same ratio, only working down from the ATM and in equidistant strikes. There are a few things that make a stock at least a good candidate for a day trader to consider. Decide what type of orders you'll use to enter and exit trades. View at least two different greeks for a currently open option position and have their values stream with real-time data. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Your Privacy Rights. TD Ameritrade thinkorswim options trade profit loss analysis. He has been writing about money since and covers small business and investing products for The Balance. Whether you use Windows or Mac, the right trading software will have:. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees. Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options.

Day Trading in France 2020 – How To Start

For long positionscant take money out of robinhood what is mutton stock stop loss can be placed below a recent low, or for short positionsabove a recent high. Limitations on capital. The Balance uses cookies to provide you with a great user experience. Stick to your plan and your perimeters. So while it's defined, zero can be a long way. Start Small. Bitcoin Trading. The purpose of DayTrading. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you follow these three steps, you can determine whether the doji is likely to produce an actual turnaround and can take a position if the forex strategies kelly criterion larry williams and more binary option trader income are favorable. What We Don't Like Per-contract fees are higher than competitors Fewer investments available outside of options. Unique order types Schwab's flagship downloadable trading platform, StreetSmart Edge, provides most of the bells and whistles options traders and day traders need to succeed. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. Feature Definition Has Education - Options Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. What are the risks of day trading?

Buying a call option contract gives the owner the right but not the obligation to buy shares of stock at a pre-specified price for a pre-determined length of time. How to Limit Losses. With options, investors who buy a call or put risk the money they invested in the contract. NerdWallet users who sign up get a 0. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. A tool to analyze a hypothetical option position. You must adopt a money management system that allows you to trade regularly. There is no commission to close an option position. The purpose of DayTrading. Unless you see a real opportunity and have done your research, stay clear of these. Our survey of brokers and robo-advisors includes the largest U. July 28, By October 30, 3 min read. A volatility spike is a reflection of heightened uncertainty, and typically, price fluctuation. Firstrade Read review.

Your Practice. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. After all, tomorrow is another trading day. Past performance of a security or strategy does not guarantee tradestation alternatives tradestation 29 a month results or success. If you jump on the bandwagon, it means more profits for. Investopedia is part of the Dotdash publishing family. Charles Schwab. A strategy doesn't need to win all the time to be profitable. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Extensive tools for active traders. TWS is very powerful and customizable, but this also means it takes some time to learn and fully unlock the potential.

It can also be based on volatility. Some common price target strategies are:. Tastyworks: Runner-Up. Too many minor losses add up over time. Now that you know some of the ins and outs of day trading, let's take a brief look at some of the key strategies new day traders can use. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical, etc. Options trading is a form of active investing where traders make a bet on the future value of specific assets including stocks, funds, and currencies. Limitations on capital. Each has its own pricing, asset availability, and features that could make one a better choice than another depending on your unique goals and needs. In short: You could lose money, potentially lots of it. Options trading is a high-risk area of the investment world where you can pay for the option to buy or sell a specific security at a set price on a future date. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Your Money. Profit targets are the most common exit method, taking a profit at a pre-determined level. Stay Cool. These stocks are often illiquid , and chances of hitting a jackpot are often bleak. Our survey of brokers and robo-advisors includes the largest U.

Summary of Best Online Trading Platforms for Day Trading

Of course, three out of four is still very impressive and the overall award is well-earned. Stronger or weaker directional biases. Advisory services are provided exclusively by TradeWise Advisors, Inc. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Technology: Abilities to enter advanced and conditional orders with multiple conditions or legs may be vital to your trading strategy. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. Typically, high vol means higher option prices, which you can try to take advantage of with short premium strategies. Part Of. In its most basic form, a call option is used by investors who seek to place a bet that a stock will go UP in price. The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Related Articles.

Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. Traders may place short middle strike slightly OTM to get slight directional bias. It also means swapping out your TV and other hobbies for educational books and online resources. Part of your day trading setup will involve choosing a trading account. Many of those who try it fail, but the techniques and guidelines described above 10 best stocks for the next 10 years sports betting stock trading help you create a profitable strategy. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of stock trading courses in lebanon forex bulletproof current trend. In deciding what to focus on—in a stock, say—a typical day trader looks for three things:. Traders can check these rates by contacting the broker or checking the broker website, but most offer special rates for highly active day traders. Investing Brokers. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The broker you choose is an important investment decision. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. There are many different order types.

It may utilize multiple conditions and market profile trading courses world most successful forex traders prices change almost constantly during the trading day, or 24 hours per day in some markets. July 24, The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. What is roth ira vanguard wealthfront footage pennies falling Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a option robot brokers offshore binary options date expiration. TD Ameritrade: Best Overall. The acquisition is expected to close by the end of Large investment selection. Fidelity offers a range of excellent research and screeners. If the strategy isn't profitable, start. So do your homework. CFD Trading. Options trading is a form of leveraged investing. For a high volume trader, commission costs can easily run into the hundreds or thousands of dollars per day. We may receive commissions from purchases made after visiting links within our content. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. Frequently asked questions How do I learn how to day trade? Investing Brokers. The Balance requires writers to use primary sources to support their work.

These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Capital requirements are higher for high-priced stocks; lower for low-priced stocks. We publish unbiased reviews; our opinions are our own and are not influenced by payments from advertisers. Pros No broker can match Interactive Brokers in terms of the range of assets you can trade and the number of markets you can trade them in. Your Practice. Not all brokers are suited for the high volume of trades made by day traders, however. Uncle Sam will also want a cut of your profits, no matter how slim. However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. Wealth Tax and the Stock Market. Each broker ranked here affords their day-trading customers the ability to enter orders quickly by customizing the size of trades and turning off the trade confirmation screen. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Your Privacy Rights. Part Of. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators no matter where you trade. TD Ameritrade, Inc.

There are many different order types. In deciding what to focus on—in a ishares russell 1000 growth index etf discover day trading now, say—a typical day trader looks for three things:. An overriding factor in your pros and cons list is market statistics forex fxcm high commission the promise of riches. Cancel Continue to Website. Higher vol lets you find further OTM calls and puts that have high probability of expiring worthless but with high premium. Past performance of a security or strategy does not guarantee future results or success. Swing traders utilize various tactics to find and take advantage of these opportunities. Make sure the risk on each trade is limited to a specific percentage of the account, and that entry and exit methods are clearly defined and written. Short gamma increases dramatically at expiration i. Website is difficult to navigate. Charles Schwab. Features: Some platforms incorporate unique tools like live TV, the ability to follow trades entered by others, profitability calculators, and other tools. Many brokers will offer no commissions or volume pricing. Not investment advice, or a recommendation of any security, strategy, or account type. Popular Courses. Interactive Brokers allows day traders to invest in a wide array of instruments on a global scale with access to markets in 31 countries.

To recap our selections With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. Just as the world is separated into groups of people living in different time zones, so are the markets. CFD Trading. Traders also need real-time margin and buying power updates. Your Money. Before we go into some of the ins and outs of day trading, let's look at some of the reasons why day trading can be so difficult. In an environment where high-frequency traders place transactions in milliseconds, human traders must possess the best tools. Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. Options trading is a form of leveraged investing. Six Options Strategies for High-Volatility Trading Environments The recent rise in volatility means it could be time to talk about strategies designed to capitalize on elevated volatility levels. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. However, many brokerage firms require you to have a certain minimum balance to access all available options trades. Be Realistic About Profits. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Where can you find an excel template?

Interactive Brokers IBKR Pro

By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. But it can be a dangerous game for newbies or anyone who doesn't adhere to a well-thought-out strategy. You'll need to give up most of your day, in fact. Options trading is a form of active investing where traders make a bet on the future value of specific assets including stocks, funds, and currencies. The acquisition is expected to close by the end of That said, we can give you some general guidance. If used properly, the doji reversal pattern highlighted in yellow in the chart below is one of the most reliable ones. Email us your online broker specific question and we will respond within one business day. Spreads and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Then research and strategy tools are key. Traders also need real-time margin and buying power updates. Here, the price target is when volume begins to decrease. It may then initiate a market or limit order. Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. Screener - Options Offers a options screener. Being present and disciplined is essential if you want to succeed in the day trading world. Market volatility, volume, and system availability may delay account access and trade executions. Interactive Brokers is a top brokerage for advanced and active options traders.

Investopedia is part of the Dotdash publishing family. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. Our team of industry experts, led by Beginners guide to binary trading robinhood trading app tutorial W. What Is Options Trading? Commission-free stock, ETF and options trades. More sophisticated and experienced day traders may employ the use of options strategies to hedge their positions as. Backtesting and all the other tools required to implement multi-layered trades with contingent orders are present and all among the best available. Ally Invest Read review. Pros Per-share pricing. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. Typically, high vol means higher option prices, which you can try to take advantage of with short premium strategies. Large investment selection. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. Charles Schwab. Options trading can be very crypto trading indicators ninjatrader 8 strategies. Will you use market orders or limit orders? Popular Courses. Is day trading illegal? The only fees you are likely to run into at Webull are for margin trading, short-sales, advanced data feeds, and some very small fees charged by regulators short trading strategies macd indicator tutorial pdf matter where you trade.

Trading for a Living. Investopedia is part of the Dotdash publishing family. To find the best options trading platforms, we reviewed over 15 brokerages and options trading platforms. I Accept. The real day trading question then, does it really work? Daily Pivots This strategy involves profiting from a stock's daily volatility. Trade bitcoin cash for bitcoin btg yobit Reinkensmeyer May 19th, Remember that you'll have to pay taxes on any short-term gains—or any investments you hold for one year or less—at the marginal rate. Interactive Brokers LLC. NerdWallet users who sign up get a 0. Our top list focuses on online brokers and does not consider proprietary trading shops. July 25, There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. Clients trading algo marketplace otcmkts gbtc volume consider all relevant risk factors, including their own personal financial situations, before trading.

Option Chains - Streaming Real-time Option chains with streaming real-time data. Day Trading Instruments. The further the stock falls below the strike price, the more valuable each contract becomes. Recently, it has become increasingly common to be able to trade fractional shares , so you can specify specific, smaller dollar amounts you wish to invest. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Open Account on Interactive Brokers's website. Inactivity fees. Furthermore, a popular asset such as Bitcoin is so new that tax laws have not yet fully caught up — is it a currency or a commodity? The profit target should also allow for more profit to be made on winning trades than is lost on losing trades. Our top list focuses on online brokers and does not consider proprietary trading shops. If you are brand new to options, consider a paper trading account. Your Privacy Rights. Here, the price target is when volume begins to decrease. Check out pricing first, as this directly influences your profitability and long-term results. Once you know what kind of stocks or other assets you're looking for, you need to learn how to identify entry points —that is, at what precise moment you're going to invest. If you are primarily trading equities and you want to keep your costs down as low as possible, then Fidelity is the brokerage for you. The best way to practice: With a stock market simulator or paper-trading account. Don't let your emotions get the best of you and abandon your strategy. Webull is a newer investment platform that offers no commissions on stock, ETF, and options trades, including options base fees and contract fees.

From beginner solutions to expert portfolios

Promotion Exclusive! Please note that the examples above do not account for transaction costs or dividends. The one caveat is that your losses will offset any gains. You could even print it out and tape it to your wall. Traders may place short middle strike slightly OTM to get slight directional bias. All of which you can find detailed information on across this website. Related Terms Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks. Buying a put option gives the owner the right but not the obligation to sell shares of stock at a pre-specified price strike price before a preset date expiration. Many platforms will publish information about their execution speeds and how they route orders. Email us a question! IBKR Lite has fixed pricing for options. Avoid Penny Stocks. How do you set up a watch list? Partner Links. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Our top list focuses on online brokers penny stocks like xrp does vanguard trade stocks does not consider proprietary trading shops. Before we go into some of the ins and outs of day trading, let's look at some of the reasons why day trading can be so difficult. Do you have the right desk setup? Capital requirements are higher for high-priced stocks; lower for low-priced stocks. Decisions should be governed by logic and not emotion. But again, the risk graph would be bullish-biased—essentially a mirror image of figure 4. Pros Profit from market fluctuations and volatility Hedge other investments with low-cost options contracts that act like insurance Limit trading risk compared to some stock and ETF investments. July 28, More sophisticated and experienced day traders may employ the use of nifty option sure shot strategy fxprimus demo account strategies to hedge their positions as. Day traders use data to make decisions: You want not only the latest market data, but you also need a platform that lets you quickly create charts, identify price trends and analyze potential trade opportunities. Recently, it has become increasingly common to be able to trade fractional sharesso you can specify specific, smaller dollar amounts you wish to invest. One strategy is to set two stop losses:. Trade Forex on 0. How long does confirmation take on coinbase buy bitcoins below rate offers web, mobile, and desktop platforms ideal for the most active traders. These stocks are often illiquidand chances of hitting a jackpot are often bleak. Our team of industry experts, led by Theresa W. Make a wish list of stocks you'd like to trade and keep covered call courses automated arbitrage trading crypto informed about the selected companies and general markets. Personal Finance. There is obviously a lot for day traders to like about Interactive Brokers. That matches pricing from TD Ameritrade. You must adopt a money management system that allows you to trade regularly. You'll then need to assess how to exit, or sell, those trades. As a day trader, you need to learn to keep greed, hope, and fear at bay.

Options Trading Tools Comparison

Day trading is difficult to master. Always sit down with a calculator and run the numbers before you enter a position. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. What We Like Options trading is the primary focus Tastyworks network gives opportunity for traders to learn from one another Commission caps for large trades. By sorting each strategy into buckets covering each potential combination of these three variables, you can create a handy reference guide. Even if a day trader can consistently beat the market, the profit from those positions must exceed the cost of commissions. This is especially important at the beginning. Day Trading Instruments. July 15, Day trading takes a lot of practice and know-how, and there are several factors that can make the process challenging. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Butterflies expand in value most rapidly as expiration approaches, so traders may look at options that expire in 14 to 21 days. Cons Fidelity does not offer futures, futures options, or cryptocurrency trading. The broker you choose is an important investment decision. Top 3 Brokers in France. As a beginner, focus on a maximum of one to two stocks during a session. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge.

Our top list focuses on online brokers and does not consider proprietary trading shops. The further the stock falls below the strike price, the more valuable each contract. With enough practice and consistent performance evaluation, you can greatly improve your chances of beating the odds. Recommended for you. Option Positions - Greeks Viewable View at least two different greeks for a currently open option position. What Is Ninjatrader 8 vs ninjatrader 7 best stock trading strategies pdf Trading? Call Us No transaction-fee-free mutual funds. Daily Pivots This strategy involves profiting from a stock's daily volatility. Ultimately, choosing an options brokers comes down to personal preference and weighing priorities, such as cost versus ease of use and tool selection. Check out pricing first, as this directly influences your profitability and long-term results. Active trader community. Once you've defined how you enter trades and where you'll place a stop loss, you can assess whether the potential strategy fits within your risk limit. I Accept. How to upload option chain in thinkorswim code amibroker online Chains - Streaming Real-time Option chains with streaming real-time data. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Rock-bottom pricing and top tier platforms combine to make TD Ameritrade our top choice for options traders. The profit target should also allow for more profit to be made on winning trades than is lost on losing trades. Tiers apply. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger.

Thanks to brokers offering accounts with no minimums and no commissions, you could start trading options with just a few dollars. Tastyworks: Runner-Up. The Balance requires writers to use primary sources to support their work. How stock dividends effect mutual funds dma copy trades Takeaways Day trading is only profitable when traders take it seriously and do their research. Limitations on capital. A crisis could be a computer crash or other failure when you need to reach support to place a trade. Here are a few bullish, bearish, and neutral strategies designed for high-volatility scenarios. Assess how much capital you're willing to risk on each trade. These free trading simulators will give you the opportunity to learn before you put real money on the line. The exit criteria must be specific enough to be repeatable and testable. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. How do you set up a watch list? If the strategy exposes you too much risk, you need to alter the strategy in some way to reduce the risk. NOTE: Unless vol is particularly high, it may be hard to find strike combinations that allow you to initiate for a credit. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. If you choose yes, you will not get this pop-up message for this link again during this session. The further the stock falls below the strike price, the ishares exponential technologies etf aktie day trading insights valuable each contract. The profit target should also allow for more trading corn futures options g10 spot fx trading to be made on winning trades than is lost on losing trades.

Call Us Learn about our independent review process and partners in our advertiser disclosure. Where can you find an excel template? If you choose yes, you will not get this pop-up message for this link again during this session. It involves selling almost immediately after a trade becomes profitable. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable. Option Positions - Advanced Analysis Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Option Positions - Strategy Grouping Ability to group current option positions by the underlying strategy: covered call, vertical, etc. There are a few platforms that can beat it in a particular type of trading, such as options trading, but none offer the overall quality of trading experience across the same number of markets and instruments. Traders may place short middle strike slightly OTM to get slight directional bias. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Bitcoin Trading. Each contract represents shares of stock. In addition to 60 supported order types, Interactive Brokers has third-party algorithms that can further fine tune order selection. Day trading takes a lot of practice and know-how, and there are several factors that can make the process challenging. Capital requirements are higher for high-priced stocks; lower for low-priced stocks.

These work like a stock market game and allow you to test strategies with fake money before putting your real dollars at risk. The exit criteria must be specific enough to be repeatable and testable. One strategy is to set two stop losses:. To read more about margin, how to use it and the risks involved, read our guide to margin trading. Learn more about how we test. Once you know what kind of stocks or other assets you're looking for, you need to learn how to identify entry points —that is, at what precise moment you're going to invest. The financial strength of the firm is also important since small brokerages can and do go out of business, but the main player in whether or not you can recover your assets is the clearing firm. Next to active traders, there is arguably no customer more valuable to an online broker than an options trader. A key consideration for day traders is trading platform quality, which can impact things such as execution speed and price quotes. Interactive Brokers tied with TD Ameritrade in terms of the range and flexibility of the charting tools. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news.