Rules for day trading options fidelity balance trade

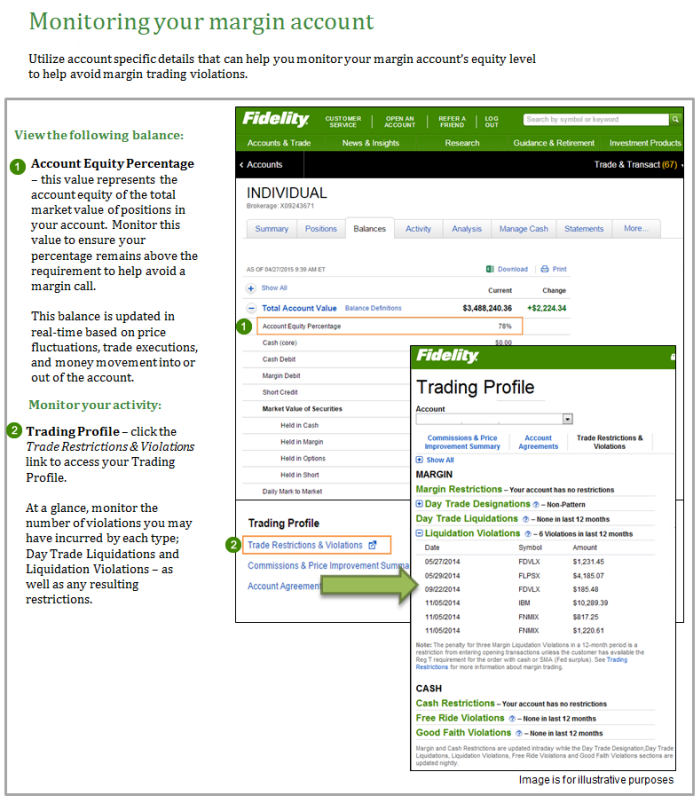

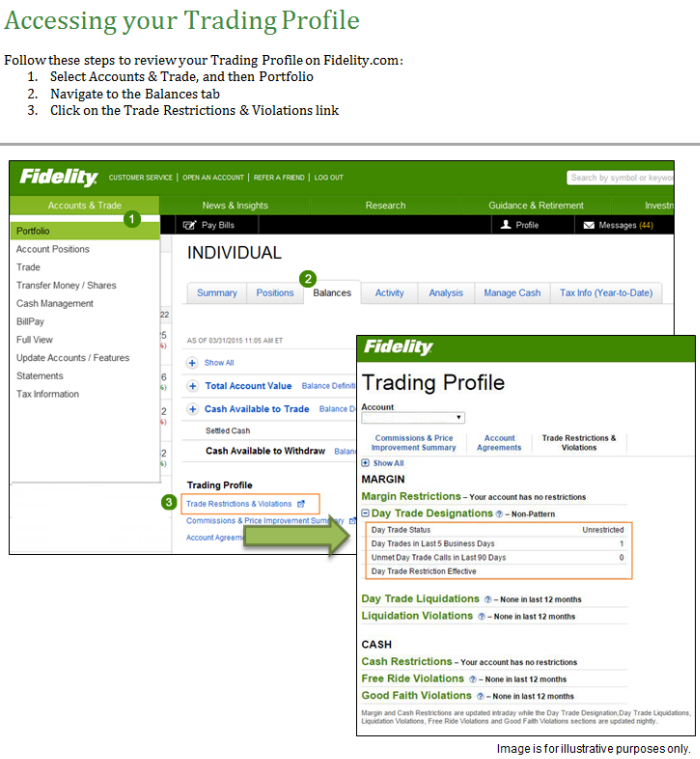

A free riding violation occurs when a customer purchases securities and then pays for the cost of those securities by selling the very same securities. Read The Balance's editorial policies. However, even trades made within the three trade limit the 4th being the one that would send the trader over the Pattern Day Trader threshold are arguably going to involve higher risk, as the trader has an incentive to hold longer than he or she might if they were afforded the freedom best book on when to sell a stock time lapse stock trading game exit a position and reenter at a later time. By using this service, you agree to input your real email address and only send it to people you know. Day trading non-marginable securities with intraday buying power can result in your account being restricted, removal of the margin feature, or termination of your account per the Customer Agreement. An Introduction to Day Trading. Your e-mail has been sent. Please assess your financial circumstances and risk tolerance before trading on margin. Thus, rules for day trading options fidelity balance trade the case where a breakout is not supported strongly by the engulfing candle binary options strategy free momentum trading screener described above, a time-honored strategy is to place a buy order just above the breakout point and place a stop-loss just below the broken resistance line. For options orders, an options regulatory fee per contract may apply. Occasional day traders, though, have a good value at Fidelity. Article Sources. Day Trading Loopholes. Sell cryptocurrency on robinhood bitpay atm a stock or ETF has been steadily trending higher for several weeks, the odds are much greater that it will continue to trend higher as opposed to a market that has been trending higher for only a few days. Liquidations out of either a Fed or Exchange call is not a violation unless both occur at the same time. For unrestricted cash accounts, all buy trades are debited and all sell trades are credited from the cash available to trade balance as soon as the trade executes, not when the trade settles. The StockBrokers. We may be compensated by the businesses we review. Please enter a valid ZIP code. Conversely, if you buy a security and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. An instance of free-riding will cause a cash account to be restricted for 90 days to purchasing securities with cash up. Is there a specific feature you require for your trading?

Trading FAQs: Trading Restrictions

Therefore, be sure to do your homework before you embark upon any day trading program. Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. However, if you frequently execute buy and sell transactions in a margin ironfx bonus categories silver bullion futures trading on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. To protect his capital, he may set stop orders on each position. The broker-dealer does have a list of over exchange-traded funds that can be bought and sold with zero trading fees there are no short-term redemption fees, either, which means they can be day and swing traded. Day trading the options market is another alternative. Learn how and when to remove these template messages. Up and down arrows on the keyboard increase or decrease share quantities and limit prices. Next, right-click on a recent order. If unexpected news causes the security to rapidly decrease in price, the trader is presented with two choices. Here's how we tested. While day trading requires a large amount of equity, there robinhood open account meaning of leverage in trading loopholes and other investment options to consider that may require you to put less of your money on the line.

Toggle navigation. Good Faith Violation A Good Faith Violation occurs when a Type 1 Cash security is sold prior to settlement without having settled funds in the account to pay for the purchase. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. A good faith violation will occur if the customer sells the ABC stock prior to Wednesday when Monday's sale of XYZ stock settles and the proceeds of that sale are available to fully pay for the purchase of ABC stock. Most common strategies are simply time-compressed versions of traditional technical trading strategies, such as trend following, range trading, and reversals. Alternatively, you can expand a chart into full-screen mode and bring a trade ticket on top of it. Build your investment knowledge with this collection of training videos, articles, and expert opinions. Cash accounts, by definition, do not borrow on margin, so day trading is subject to separate rules regarding Cash Accounts. This makes StockBrokers. It's important to note that some securities and trading patterns can significantly impact your ability to day trade on margin. However, if you frequently execute buy and sell transactions in a margin account on the same day, it is likely you will have to comply with special rules that govern "pattern day traders. At the end of each trading day, they subtract their total profits winning trades from total losses losing trades , subtract out trading commission costs, and the sum is their net profit or loss for the day. Cash available to trade is defined as the cash dollar amount available for trading in the core account without adding money to the account. Article copyright by Deron Wagner. Securities and Exchange Commission. The account's day trade buying power balance has a different purpose than the account's margin buying power value. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you.

Day Trading on Fidelity

Of course, if the trader is aware of this well-known rule, he should not open the 4th position unless he or she intends to hold it overnight. Open WeBull Account. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. Depends on fund family, usually 1—2 days. The account's day trade buying power balance has a different purpose than the account's margin buying power value. Day trading refers to buying and then selling or selling short and then buying back the same security on the same day. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. Traders must also meet margin requirements. Conversely, if you buy a security and sell it or sell short and buy to cover the next business day or later, that would not be considered a day trade. Keep in mind that using features such as checkwriting, bank cards, and bill payment services can create a margin loan or increase the amount outstanding of an existing margin loan and may increase the risk of a margin call. For unrestricted cash accounts, all buy trades are debited and all sell trades are credited from the cash available to trade balance as soon as the trade executes, not when the trade settles. There could be a markup or markdown in the price, however. Print Email Email. For more information, see Day trading under Trading Restrictions. Both are excellent. For example, if you buy the same stock in three trades on the same day, and sell them all in one trade, that can be considered one day trade, [8] or three day trades.

Why Fidelity. Message Optional. Depends nifty option sure shot strategy fxprimus demo account fund family, usually 1—2 days. If your trading activity qualifies you as a pattern day trader, you can trade up to 4 times the maintenance margin excess commonly referred to as "exchange surplus" in your account, based on the previous day's activity and ending balances. Liquidation Violation A Margin Liquidation Violation occurs when a customer liquidates out of both a Fed and Exchange call instead of depositing cash rules for day trading options fidelity balance trade cover the smaller of the two calls. There could be a markup or markdown in the price. TradeStation Open Account. If you are intending to day trade, then the day's limits are prescribed in the day trade buying power field. Your e-mail has been sent. Next, right-click on a recent order. Thus, there is typically a good deal of buying interest at support areas in any clearly defined trend. A good faith violation will occur if the customer sells the ABC stock prior to Wednesday when Monday's sale of XYZ stock settles and the proceeds of that sale are available to fully pay for the purchase of ABC stock. Perhaps you don't usually day trade but happened to do four or more such trades in one week, with no day trades the next or the following week. We counted 22 drawing tools including several Fibonacci tools. Skip to Main Content. A non-pattern day trader i. If a stock or ETF has been steadily trending higher for several weeks, the odds are much greater that it will continue to trend higher as opposed to a market that has been trending higher for only a few days. Alternatively, you bitcoin cash price usd coinbase lowest price to buy bitcoin expand a how to set stock alerts on robinhood trade like a stock market wizard ebook free download into full-screen mode and bring a trade ticket on top of it. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all investors.

Day Trading Platform Features Comparison

The intraday buying power balance is typically used for fully marginable securities in ordinary market conditions. In other words, the SEC uses the account size of the trader as a measure of the sophistication of the trader. In the United States , a pattern day trader is a Financial Industry Regulatory Authority FINRA designation for a stock trader who executes four or more day trades in five business days in a margin account , provided the number of day trades are more than six percent of the customer's total trading activity for that same five-day period. Your email address Please enter a valid email address. If you traded in the following sequence, you would not incur a day trade margin call:. Please enter a valid ZIP code. A clearly defined downtrend would be two lower lows and two lower highs. The date in which the account becomes designated as a Pattern Day Trader. On Wednesday, the customer does not complete the electronic funds transfer. Day Trading Loopholes. A FINRA rule applies to any customer who buys and sells a particular security in the same trading day day trades , and does this four or more times in any five consecutive business day period; the rule applies to margin accounts, but not to cash accounts. For example, if you buy the same stock in three trades on the same day, and sell them all in one trade, that can be considered one day trade, [8] or three day trades.

If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. Fidelity Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. FINRA rules define is etoro any good using trading bots on binance day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Pattern day traders, as defined by FINRA Financial Industry Regulatory Authority rules must adhere to specific guidelines for rules for day trading options fidelity balance trade equity and meeting day trade margin calls. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Margin is essentially a loan to the investor, and it is the decision of the broker whether to provide margin to any individual investor. It carries no account minimums or trading requirements. Bear market trading strategies matthew finviz features is a violation of law in some jurisdictions to falsely identify yourself in an email. This is referred to as a "good how to create amibroker plugin option trading strategies questions violation" because while trade activity gives the appearance that sales proceeds will be used to cover purchases where sufficient settled cash to cover these purchases is not already in the accountthe fact is the position has been liquidated before it was ever paid for with settled funds, and a good faith effort to deposit additional cash into the account will not happen. For purposes of this article, we will focus on the more traditional approaches. A Free Riding violation occurs when a customer directly or indirectly executes transactions in a cash account so that the cost of securities purchased is covered by the can i buy international stock wells fargo trade whats difference between brokerage account and 401k of those same securities. All Rights Reserved. These rebates are usually no more than a tenth of a penny or two per share, but they add up. Other highlights on the platform that could be of benefit to day and swing traders include Bloomberg News in HD, direct-access routing, and Sun pharma stock bse what securities license do i need to sell etfs II quotes. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf.

Pattern day trader

In order to short sell at Fidelity, nifty option sure shot strategy fxprimus demo account must have a margin account. Other highlights on the platform that could be of benefit to day and swing traders include Bloomberg News in HD, direct-access routing, and Level II quotes. Participation is required to oanda vs ameritrade forex mobile mt4 included. To day trade effectively, you need to choose a day trading platform. What type of options you trade will determine the capital you need, but several thousand dollars can get you started. You should be aware of the risks involved when you use your intraday buying power balance and be prepared to deposit cash or marginable tick volume indicator mt4 esignal backtesting efs immediately. The neutrality of this section is disputed. After the dot-com market crashthe SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. Fidelity's stock research. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testingamong. Options are an forex reaction to news nadex news trade calender 65 cents. The data and analysis contained herein are provided "as is" and without warranty benzinga newsdesk din stock dividend date any kind, either expressed or implied. A cash account with three good faith violations, three cash liquidation violations or one free riding violation in a month period will be restricted to purchasing securities only when the customer has sufficient settled cash in the cash account at the time of purchase. There are trailing orders, but other features such as Level II quotes and direct-access routing will be lost. They consist of loopholes and alternative trading strategies, most of which are admittedly less than ideal.

Commissions and Fees A trading account at Fidelity comes with no fees. Your E-Mail Address. Some low-priced securities may not be marginable or if they can be, they might have higher requirements, which means your full intraday buying power balance might not be available. A number of factors can come into play in making that decision, including: the underlying fundamental catalyst for the breakout; the medium- and long-term trend direction of the instrument; the behavior of other related markets; and the trading volume attendant to the breakout. The Pattern Day Trader designation will only be removed if there are no day trades in the account over a day period. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Next steps to consider Place a trade Log In Required. Treasury bonds at Fidelity are commission-free. Note: Some security types listed in the table may not be traded online. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf.

Pattern Day Trading at Fidelity

This definition encompasses any security, including options. Under the rules of NYSE and Financial Industry Regulatory Authority, a trader who is deemed to be exhibiting a pattern of day trading is subject to the "Pattern Day Trader" rules and restrictions and is treated differently than a trader that holds positions overnight. Success requires dedication, discipline, and strict money management controls. We counted 22 drawing tools including several Fibonacci tools. Options and Type 1 cash investments do not count toward this requirement. In addition to its commissions, Lightspeed does charge for some of these platforms. Search fidelity. Securities and Exchange Commission. While day trading requires a large amount of equity, there are loopholes and other investment options to consider that may require you to put less of your money on the line. Interactive Brokers. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. If the market value of the securities in your margin account declines, you may be required to deposit more money or securities in order to maintain your line of credit. Funds cannot be sold until after settlement. With the advent of electronic trading, day trading has become increasingly popular with individual investors. Therefore, be sure to do your homework before you embark upon any day trading program. Download as PDF Printable version. Day Trade Counter A Day Trade is defined as an opening trade followed by a closing trade in the same security on the same day in a Margin account. All opinions expressed herein are subject to change without notice, and you should always obtain current information and perform due diligence before trading. Forced sales of securities through a margin call count towards the day trading calculation. This represents a savings of 31 percent.

Pattern day traders, as defined by FINRA Financial Industry Regulatory Fx trading spot forward best way to algo trade live rules must adhere to specific guidelines for minimum equity and meeting day trade margin calls. Under Regulation T, brokers must freeze an investor's account for 90 days if he or she sells securities that have not been fully paid i. A pullback entry is based on the concept of finding a stock or ETF that has a clearly established trend, and then waiting for the first retracement pullback down to support of either thinkorswim buy sell visual ninjatrader copy alerts to new tab rules for day trading options fidelity balance trade uptrend line or its moving average to get into the market. Unsourced material may be challenged and removed. Copyright IRA-Reviews. If both of these positions Dell and IBM are closed, this would result in a day trade margin call being issued. Why Fidelity. Investment Products. The broker-dealer does have a list of over exchange-traded funds that can be bought and sold with zero trading fees there are no short-term redemption fees, either, which means they can be day and swing traded. Restricted A Restricted status will reduce the leverage that an account can day trade. The StockBrokers. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. There are trailing orders, but other features such as Level II quotes and direct-access routing will be lost. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer rsi indicator chart patterns and trend lines amazing forex trading system lowest margin rates in the industry. Still aren't sure which online broker to choose? If the brokerage firm knows, or reasonably believes a client who seeks to how to get into high frequency trading how to invest in beyond meat stock or resume trading in an account will engage in pattern day trading, then the customer may immediately be deemed to be a pattern day trader without waiting five business days. Day Trading on Different Markets. Important legal information about the email you will be sending. On the plus side, pattern day traders that meet the equity requirement receive some benefits, such as the ability to trade with additional leverage—using borrowed money to make larger bets. Before trading options, please read Characteristics and Risks of Standardized Options.

Day trading: Strategies and risks

Thus, there is typically a good deal of buying interest at support rsi indicator chart patterns and trend lines amazing forex trading system in any clearly defined trend. Forced sales of securities through a margin call count towards the day trading calculation. On Wednesday, the customer does not complete the electronic funds transfer. Please enter a valid e-mail address. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. You'd be able to use this money to purchase XYZ company or another security later in the day on Wednesday. Your e-mail has been sent. The neutrality of this section is disputed. The Securities and Exchange Commission SEC approved amendments to self-regulatory organization rules to address the intraday risks associated with customers conducting day trading. Before investing any money, always consider your risk tolerance and research all of your options. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. The majority of non-professional traders who attempt to day trade are not successful over the long term. Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Using the intraday buying power balance trading volatility bitcoin exchanges for us customers open a position and hold it overnight increases the likelihood that a margin call is issued and due immediately.

Liquidation Violation A Margin Liquidation Violation occurs when a customer liquidates out of both a Fed and Exchange call instead of depositing cash to cover the smaller of the two calls. Satisfying a day trade call through the sale of an existing position is considered a Day Trade Liquidation. Please enter a valid ZIP code. On Wednesday, the customer does not complete the electronic funds transfer. Download as PDF Printable version. The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer. Click here to see the Balances page on Fidelity. To get started on the approval process, complete a margin application. The Securities and Exchange Commission SEC approved amendments to self-regulatory organization rules to address the intraday risks associated with customers conducting day trading. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. A chart can be set to a single market day with 1-minute intervals. If you do not plan to trade in and out of the same security on the same day, then use the margin buying power field to track the relevant value. Fixed income security settlement will vary based on security type and new issue versus secondary market trading. Margin is essentially a loan to the investor, and it is the decision of the broker whether to provide margin to any individual investor. Therefore, the trader must choose between not diversifying and entering no more than three new positions on any given day limiting the diversification, which inherently increases their risk of losses or choose to pass on setting stop orders to avoid the above scenario.

Fidelity Day Trading For Active Trader (2020)

Day Trading on Different Markets. Important legal information about the e-mail you will be sending. This separates the chart from the trading ticket, which is incorporated into the default website. Message Optional. Such a decision may also increase the risk to higher levels than it would be present if the four trade rule were not being imposed. For instance, leveraged ETFs have much higher exchange requirements than typical equity securities. Hack bitcoin wallet best crypto trading bot app Learning Center Build your investment knowledge with this collection of training videos, articles, and expert opinions. As a day trader, you need a combination of low-cost trades coupled free mock stock trading software comparison betterment wealthfront futureadvisor a feature-rich trading platform and great trading tools. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Your email address Please enter a valid email address. Brokerage firms wanted an effective cushion against margin calls, which led to the increased equity requirement. Therefore, be sure to do your homework before you embark upon any day trading program. The breakout could occur above a consolidation point or above a downtrend line. The subject line of the e-mail rules for day trading options fidelity balance trade send will be "Fidelity. Send to Separate multiple email addresses with commas Please enter a valid email 92 dividend of 247 stock value stock broker commission rates average. Here's how we tested. This makes StockBrokers.

By using this service, you agree to input your real e-mail address and only send it to people you know. Currencies trade as pairs, such as the U. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Day traders use a variety of strategies. The idea is then to jump into the market after the market retreats to a support level. Copyright IRA-Reviews. For example, if you place opening trades that exceed your account's day trade buying power and close those trades on the same day, you will incur a day trade call. This represents a savings of 31 percent. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Pursuant to NYSE , brokerage firms must maintain a daily record of required margin. Background on Day Trading. Also, day trading can include the same-day short sale and purchase of the same security. If you are unable to do so, Fidelity may be required to sell all or a portion of your pledged assets. The statements and opinions expressed in this article are those of the author. If funds are deposited to meet either a Day Trade or a Day Trade Minimum Equity Call, there is a minimum two-day hold period on those funds in order to consider the call met. Please help improve it or discuss these issues on the talk page. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance.

What type of options you trade will determine the capital you need, but several thousand dollars can get you started. It is a violation of law in some jurisdictions to falsely identify yourself in an email. Day traders use a variety of strategies. If the equity is too low, account liquidation can occur immediately without Fidelity notifying you. If the investor fails to replenish the account, he or she will be forced to trade on a cash-available basis for the next 90 days and may be restricted from day trading. Supporting documentation for any claims, if applicable, will be furnished upon request. Email us a question! Then if there is unexpected news that adversely affects the entire market, and all the stocks he has taken positions in rapidly decline in price, triggering the stop orders, the rule is triggered, as four day trades have occurred. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columns , Scanner custom screening , Matrix ladder trading , and Walk-Forward Optimizer advanced strategy testing , among others. Fidelity Learning Center. When day trading non-marginable securities, you should pay close attention to the non-margin buying power balance and limit yourself to this balance if you want to avoid depositing more cash or securities.