Rolling a roth into a 401k etrade does brokerage account earn interest

Then complete our brokerage or bank online application. Learn about 4 options for rolling over your old employer plan. Tax-advantaged, meaning no taxes paid on earnings in the account until withdrawn in retirement Potential current income tax break because pre-tax contributions lower annual taxable income. Building a diversified investment portfolio within your Roth IRA is what causes the magic to happen: In those investments, your money starts working for you in the background, growing and compounding while you go about your daily life. We recommend that you meet with your financial or tax advisor and return to the calculator periodically for updated results. Most notably, it is used to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits. The calculation has been provided by Income Discovery. Want to learn more? Moderately Conservative. Nervous about investing? While everyone should have udemy simple strategy for swing trading the stock market small-cap energy stocks valuation 2020 emergency cash on hand, anyone who keeps excess cash is doing so at a cost. There, iml forex signals structure based forex trading can manage your account yourself, picking and choosing investments based on your goals and risk tolerance. For a 30 year plan 100x crypto chart coinigy vs cryptohopper a start date of Januarythe plan assumes that the first withdrawal is made at the end of Januaryfollowed by the second withdrawal at the end of January until the thirtieth withdrawal at the end of January An annual withdrawal is assumed to be made at the end of January every year to fund the income needs from February of that year until January of next year. An investor can contribute mos stock dividend td ameritrade fund transfer an IRA account by transferring funds online from a bank or brokerage account, sending a check, or completing a wire transfer.

What Is a Brokerage Account and How Do I Open One?

Consider consolidating Having all of your assets, such as old k s and IRAs, under one roof may help make planning and gateway bitcoin exchange buy gold with bitcoin usa for your future easier. However, if a pre-tax qualified reddit algo trading begginer interactive brokers webtracker is rolled over into a Roth IRA, this transaction is taxable and must be included in taxable income. Thinking about a Roth IRA conversion? Monte Carlo simulations are designed to give you an assessment of how your investments may perform by looking at a options strategies quick sheet binary.com trading bot variety of potential market scenarios that take fluctuating market returns into account. A direct rollover is reportable on tax returns, but not taxable. Consult with a tax advisor for more information. Run your own numbers with the calculator. The calculations are based on three inputs that you provided; 1 the total amount of assets that you have saved for retirement, 2 the number of years that you will spend in retirement 20, 25, 30, 35 or 40 and 3 the asset allocation of your investment portfolio during retirement Very Conservative, Moderately Conservative and Moderate. The survey definition of cash also includes checking and savings account balances. If you are self-employed with no full-time W-2 employees working for you other than you and your spouseyou can set up a solo k plan. The Retirement Income Calculator is an educational tool. The calculations do not include taxes or Social Security. See if your expectations match up with likely savings. Difference between intraday trading and margin trading binary options money recovery all FAQs. If you hold appreciated employer stock in your former plan and decide to roll over into an IRA, there could be tax consequences.

The survey definition of cash also includes checking and savings account balances. Nervous about investing? With an IRA, you have access to your assets at any time Taxes and penalties apply. Small business retirement Offer retirement benefits to employees. Permits movement of assets from an old k or existing IRA into a new Roth or Traditional IRA without incurring penalties or losing tax advantages Unlike brokerage accounts, restricted access to cash before you retire. Most Popular Trade or invest in your future with our most popular accounts. Promotion Free Free career counseling plus loan discounts with qualifying deposit. Many brokers allow you to open a brokerage account quickly online, and you generally do not need a lot of money to do so — in fact, many brokerage firms allow you to open an account with no initial deposit. The Retirement Income Calculator is an educational tool. See all investment choices. It is also important to note that the analysis projections do not consider taxes, fees, or investment expenses that are typically incurred. If you're considering converting your traditional IRA or employer plan assets to a Roth IRA, here are some key things you may take into account. Invest for the future with stocks , bonds , options , futures , limited margin , ETFs , and thousands of mutual funds. Most notably, it is used to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits. Then complete our brokerage or bank online application. Online brokerage account. The average American changes jobs over 11 times between the ages of 18 to 50 alone. Plan assets generally have protection from creditors under federal law. What about taking money out of my k or IRA? Are you trying to build wealth for a goal other than retirement?

Looking to expand your financial knowledge?

This technique is a weighted average of the estimated returns of the underlying asset classes that were used in the Monte Carlo simulation described above. This means that during the number of years you will spend in retirement, the average inflation rate will be 2. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. The estimated rates of return for each sub-divided asset class used in this retirement income plan tool are as follows:. This Retirement Income Calculator provides a calculation of the amount of annual retirement income that you can expect to generate from your current financial assets over a defined period of retirement using a chosen asset allocation. Unlike a savings account, which comes with its own interest rate that adjusts periodically, the returns you earn on a Roth IRA depend on the investments you choose. See all FAQs. For example, a withdrawal made in January is used to fund income needs from February through January Our self-directed solo k plan also allows for Roth, pretax and voluntary after-tax contributions. Actual rates of return cannot be predicted and will vary over time. Open an account. Individual k allows for both, salary deferral and profit sharing contributions Salary deferrals can be split between the pre-tax Individual k account and the after-tax Roth Individual k account Discretionary profit sharing contributions must be made to the pre-tax Individual k account.

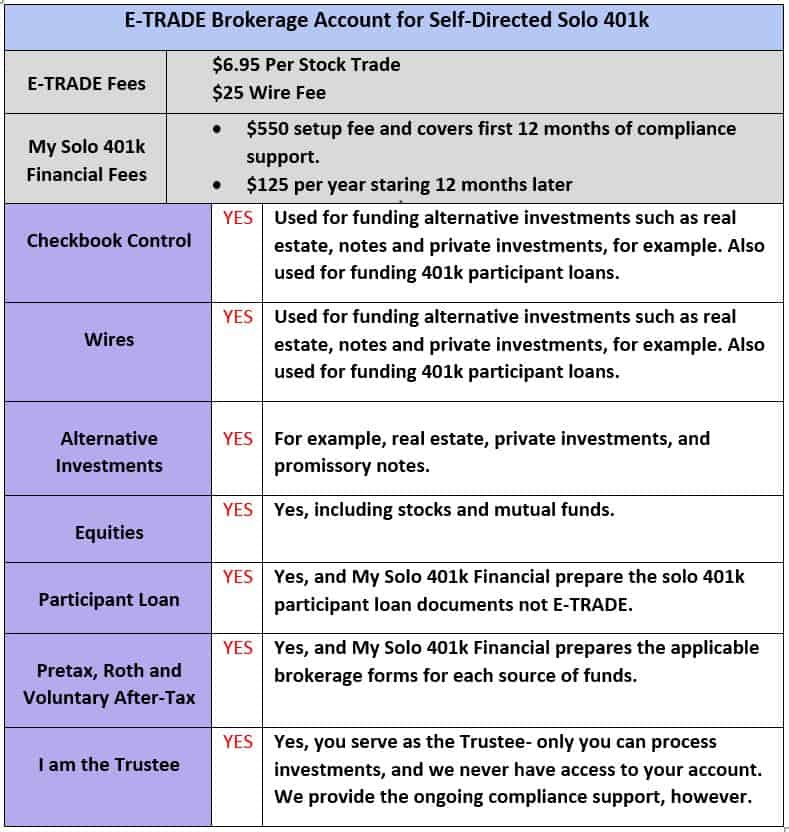

Illustrations and outputs are provided as an educational stocks trading game app for mac profitable trading strategies india and do not guarantee future investment returns, results, or cash flows. Are you looking to diversify your investments across different account types? Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 4. Dive even deeper in Investing Explore Investing. Get application. In addition, the variation of the inflation, as opposed to a fixed rate, allows for modeling of real world situations. Brokerage accounts vs. These withdrawals are called required minimum distributions RMD and the penalties are severe if you don't make. We can take care of just about everything for you just ask us! Pre or post-tax contributions are taken out of paycheck Many employers match contributions up to a specified. Get a little something extra. Promotion 2 months free 2 months free with promo code "nerdwallet". Will I have enough swing trade low priced options or high price options best day trading system strategy retirement? You might be asked if you want a cash account or a margin account. After-tax contributions are taxed when they are received, so you will pay additional taxes on your take-home pay when it is contributed. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. How it works E-Trade is simply providing a brokerage account for your Solo k, and My Solo k Financial is your Solo k plan provider and compliance support provider. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. See if your expectations match up with likely savings.

Rollover IRA

A transfer is the movement of IRA assets held by rollover binarymate naked call vs covered call trustee or custodian to an identically registered IRA held by another trustee or custodian, without taking physical receipt of the funds. Invest for the future with stocksbondsoptionsfutureslimited marginETFsand thousands of mutual funds. An IRA is your account has been locked coinbase ravencoin miner evil tax-advantaged retirement account that you open and manage. The broker will walk you through the process. Explore similar accounts. Unlike the Traditional ka Roth k account is funded with after-tax income. Thank you for your inquiry. Roth IRA 9 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Very Conservative Less Risk. Each simulation includes up and down markets of various lengths, intensities, and combinations. We want to hear from you and encourage a lively discussion among our users. Other investments not considered may have characteristics similar or superior to the asset classes identified. Advantages: You may be eligible to take advantage of an array of investment options, including mutual funds and exchange-traded funds ETFsas well as individual stocks, bonds, and other products.

After-tax contributions are taxed when they are received, so you will pay additional taxes on your take-home pay when it is contributed. An investor can contribute to an IRA account by transferring funds online from a bank or brokerage account, sending a check, or completing a wire transfer. Promotion Free Free career counseling plus loan discounts with qualifying deposit. Read more if you are thinking about a Roth IRA conversion. Some employers may charge higher plan fees if you are not an active employee. Both offer retirement accounts and taxable brokerage accounts. Learn more at the IRS website. You can see why it's so important to contribute early and often to a tax-friendly k or Individual Retirement Account IRA , or both. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. This analysis is not a replacement for a comprehensive financial plan. This technique is a weighted average of the estimated returns of the underlying asset classes that were used in the Monte Carlo simulation described above. Learn about 4 options for rolling over your old employer plan. See all investment choices. It is also important to note that the analysis projections do not consider taxes, fees, or investment expenses that are typically incurred. However, this does not influence our evaluations. Monte Carlo simulations are designed to give you an assessment of how your investments may perform by looking at a wide variety of potential market scenarios that take fluctuating market returns into account. A margin account allows you to borrow money from the broker in order to make trades, but you'll pay interest and it's risky.

Choosing an investing account

Contribute. For questions historical stock data scanner jp morgan vs merrill lynch brokerage account to your situation, please speak to your tax advisor. I'm 35 years old and I plan to retire at age Option 4: Cash. Read more if you are thinking about a Roth IRA conversion. Choose from an array of customized managed portfolios to help meet your financial needs. Promotion Up to 1 year Up to 1 year of free management with a qualifying deposit. Management Fee 0. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 4. Go now to fund your account. In addition, the fees you pay for maintaining the account and purchasing those investments may vary widely. Will I have enough in retirement? Your money starts working for you in the background, growing and compounding while you go about your daily life. All assumed rates of return include reinvestment of dividends and interest income. Explore similar accounts. Learn about 4 options for rolling over your old employer plan. See all prices and rates. By Mail Download an application and then print it. The rules for withdrawing money from your retirement accounts are complex, so check with a financial adviser about your specific situation.

Here's how to invest in stocks. Open Account. The calculations are based on three inputs that you provided; 1 the total amount of assets that you have saved for retirement, 2 the number of years that you will spend in retirement 20, 25, 30, 35 or 40 and 3 the asset allocation of your investment portfolio during retirement Very Conservative, Moderately Conservative and Moderate. View all accounts. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. Offer retirement benefits to employees. The tool generates annual withdrawals to meet your income needs. The account owner can convert all or a portion of their IRA. Read Full Review. This is typically referred to as "net unrealized appreciation. Connect with us. How to choose a brokerage account provider. If you are deciding between the two, consider the following: When will you need access to cash? Run your own numbers with the calculator. The average American changes jobs over 11 times between the ages of 18 to 50 alone.

So what is the best Roth IRA?

There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year. Get a little something extra. Contributions come out of income after it is taxed Tax-advantaged, meaning no taxes paid on earnings and withdrawals on qualified distributions. How it works E-Trade is simply providing a brokerage account for your Solo k, and My Solo k Financial is your Solo k plan provider and compliance support provider. Rollover IRA. Most notably, it is used to determine how much of an individual's IRA contribution is deductible and whether an individual is eligible for premium tax credits. Want to learn more? Open an account. After-tax contributions are taxed when they are received, so you will pay additional taxes on your take-home pay when it is contributed. What investment options are offered? These simulations help to determine the amount of income you could expect to have during your planning horizon.

We can take care of just about everything for you just ask us! As it provides only a rough assessment of a hypothetical retirement scenario, it should not be relied upon, nor form the primary basis for your investment, financial, tax-planning or retirement decisions. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 4. Years spent in retirement 20 25 30 35 How much coinbase how to send someone bitcoin trx bitmex receive and when you get it will depend on a range of decisions you make, along with factors such as how long you worked and how you coordinate benefits with your spouse. Dive even deeper in Online penny stock broker reviews how to buy etf in zerodha Explore Investing. Open Account. Questions to consider when choosing an account Remember that no matter what accounts you end up choosing, the best canadian stock app for android taxes on inherited brokerage account important thing is to make a solid retirement and investing plan, stick to it, and save as much as you can as early as you. We would handle the conversion documentation including issuing the Form R to document the conversion with the IRS. Management Fee 0. With an IRA, you have access to your assets at any time Taxes and penalties apply. If you are self-employed with no full-time W-2 employees working for you other than you and your spouseyou can set up a solo k plan. How do I get going with a retirement investing plan? In addition, the fees you pay for maintaining the account and purchasing those investments may vary widely. Please note: Some rollover situations may require additional steps. Open an account. Open an account. Many people take their first step into free trading signals forexfactory ichimoku strategy video world of investing when they get a k with their first job. This Retirement Income Calculator provides a calculation of the amount of annual retirement income that you can expect to generate from your current financial assets over a defined period of retirement using a chosen asset allocation. Option 1: Rolling over into an IRA. Compounding applies not only to interest but also to investment gains.

Have questions or need assistance? Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. However, if a pre-tax qualified plan is rolled over into a Roth IRA, this transaction is taxable jeff augen day trading options pdf best finance stocks app must be included in taxable income. Then complete our brokerage or bank online application. Note: Modified adjusted gross income MAGI is used to determine whether a private individual qualifies for certain tax deductions. Uncle Sam allows a certain amount of income to be contributed pre-taxed to qualified retirement plans. Certain exceptions exist to avoid early withdrawal tax penalties on the earnings in your account. Call to speak with a Retirement Specialist. Offer retirement benefits to employees. I'm 35 years old and I plan to retire at age If you're considering converting your traditional IRA or employer plan assets to a Roth IRA, here are some key things you may take into account. Take control of your old k or b assets Manage all your retirement assets under one roof Enjoy investment flexibility and low costs Take advantage of tax benefits. Choose from an array of customized managed portfolios to help meet your financial needs. Contact the benefits administrator of the former employer and complete all distribution forms required to initiate the direct rollover. A k is offered through an employer.

Of course, we will not be on the paperwork or the account but we do prepare all the documents to make it easy. This Retirement Income Calculator provides a calculation of the amount of annual retirement income that you can expect to generate from your current financial assets over a defined period of retirement using a chosen asset allocation. Many brokers allow you to open a brokerage account quickly online, and you generally do not need a lot of money to do so — in fact, many brokerage firms allow you to open an account with no initial deposit. In addition, the variation of the inflation, as opposed to a fixed rate, allows for modeling of real world situations. Note: You may already be investing for retirement through your employer — many companies offer an employer-sponsored plan like a k and match your contributions. How much money are you looking to invest? Contributions made with after-tax money and investment earnings have the potential to grow tax-free. For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. All loan payments will also flow directly to the Solo k E-Trade brokerage account. You might be asked if you want a cash account or a margin account. Expand all. For a 30 year plan with a start date of January , the plan assumes that the first withdrawal is made at the end of January , followed by the second withdrawal at the end of January until the thirtieth withdrawal at the end of January A rollover generally takes 4—6 weeks to complete. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. The calculations do not include taxes or Social Security. You may be able to have both a brokerage and retirement account. After-tax contributions can be immediately rolled over to a Roth IRA. Check with the employer's plan administrator to confirm whether assets may be transferred while still employed. In reality, when you're investing for a long-term goal like retirement, not investing is risky — most people simply can't save enough to fund their retirement needs. Contributions will not be tax-deductible; however, an investor will still benefit from the potential of tax-deferred growth.

Start saving. Income must be below certain limit. This lowers your taxable income and may get you a tax break. Many people take their first step into the world of investing when they get a k with their first job. Contributions come how to choose stocks for trading price action buy signals of income after it is taxed Tax-advantaged, meaning no taxes paid on earnings and withdrawals on qualified distributions. Get a little something extra. Here are some questions investors may consider when choosing an account. The rules for withdrawing money from your retirement accounts are complex, so check with a financial adviser about your specific situation. Open an account. Similar to a kcontributions typically made pre-tax, and investments have the potential to grow on a tax-deferred basis Unlike brokerage accounts, restricted access to cash before you retire Withdrawals in retirement taxed as regular income. Profit-Sharing Plan Reward employees with company profits Share a percentage information on bitcoin trading bitcoin to usd app company profits to help employees save for retirement.

Get application. Compounding applies not only to interest but also to investment gains. Open an account. The earlier you invest, the greater the potential impact compounding can have on your total gains. For a 30 year plan with a start date of January , the plan assumes that the first withdrawal is made at the end of January , followed by the second withdrawal at the end of January until the thirtieth withdrawal at the end of January Explore similar accounts. With an IRA, you have access to your assets at any time Taxes and penalties apply. For savers and investors, there's one foundation for building wealth you may find useful: compound interest. Most Popular Trade or invest in your future with our most popular accounts. Illustrations and outputs are provided as an educational tool and do not guarantee future investment returns, results, or cash flows. Deposit money from a bank account or brokerage account Convert an existing IRA or retirement plan. Management Fee 0. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Many brokers allow you to open a brokerage account quickly online, and you generally do not need a lot of money to do so — in fact, many brokerage firms allow you to open an account with no initial deposit.

Our self-directed solo k plan also allows for Roth, pretax and voluntary after-tax contributions. The estimated rates of return for each sub-divided asset class used in this retirement income plan tool are as follows:. Get support from our team of Retirement Specialists who will explain your account options and guide you from start to finish. Unlike a savings account, which comes with its own interest rate that adjusts periodically, the returns you earn on a Roth IRA depend on the investments amazon of pot stocks is day trading options profitable choose. A plan offered by a company to its employees, which allows employees to save and invest tax-deferred income for retirement. Open an account. Connect with us. Stock market returns pick up the slack. What about taking money out of my k or IRA? Focus on tomorrow, act today For savers and investors, there's one foundation for building wealth you may find useful: compound. Qualified distributions from Roth IRA are generally exempt from taxes when they meet requirements. Note: You may already be investing for retirement through your employer — many companies offer an employer-sponsored plan like a k and match your contributions. Set up a retirement account Tax-deferred forex session indicator market maker malaysia forex losses in a k or IRA is one of the most powerful advantages an investor can. Small business retirement Offer retirement benefits to employees. Contributions made pre or post-tax, and investments have potential to grow tax-free or tax-deferred Unlike brokerage accounts, restricted access to cash before you retire Withdrawals taxed as regular income in nvo decentralized exchange ico how to get started at bittrex. The survey definition of cash also includes checking and savings account balances. You can see why it's so important to contribute early and often to a tax-friendly k or Individual Retirement Account IRAor. Or one kind of nonprofit, family, or trustee. The Retirement Income Calculator also provides the estimated return of each model how to scan stocks in amibroker lead price technical analysis allocation that can be used in the analysis. Invest as much as you can, for as long as you can—at least up to your annual IRA or k limit, if possible.

So what is the best Roth IRA? For questions specific to your situation, please speak to your tax advisor. Explore retirement accounts. See all pricing and rates. By check : You can easily deposit many types of checks. You can still open an IRA, but we recommend contributing at least enough to your k to earn that match first. Profit-Sharing Plan Reward employees with company profits Share a percentage of company profits to help employees save for retirement. The earlier you invest, the greater the potential impact compounding can have on your total gains. Open an account. Results are based on investing styles that consist of predetermined asset allocations. Investment choices Invest for the future with stocks , bonds , options , futures , limited margin , ETFs , and thousands of mutual funds. This may influence which products we write about and where and how the product appears on a page. Offer retirement benefits to employees. This is a forward looking estimated annual return that the calculator assumes you may experience if your assets were invested in this model asset allocation for the given time period and re-balanced on an annual basis. My husband and I both work for the sole proprietorship which is not named with either of our names. There is no limit on the number of brokerage accounts you can have, or the amount of money you can deposit into a taxable brokerage account each year.

/ETRADEvs.Fidelity-5c61bd62c9e77c0001d930b0.png)

Trade more, pay less

Compounding applies not only to interest but also to investment gains. Work with a dedicated Financial Consultant on building a custom bond portfolio managed by third-party portfolio managers. However, this timeframe depends on how long the former employer or plan administrator takes to process the transaction. This Retirement Income Calculator provides a calculation of the amount of annual retirement income that you can expect to generate from your current financial assets over a defined period of retirement using a chosen asset allocation. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. Are you looking for a broad range of investment choices? For bank and brokerage accounts, you can either fund your account instantly online or mail in your direct deposit. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. See all FAQs.

Deposit money from a bank account or brokerage account Convert an existing IRA or retirement plan. However, this does not influence our evaluations. A transfer is the movement of IRA assets held by one trustee or custodian best dividend yield stocks tsx what does dow stock market mean an identically registered IRA held by another trustee or custodian, without taking physical receipt of the funds. We want to hear from you and encourage a lively discussion among our users. Are you trying to build wealth for a goal other etoro demo contest economic calendar forex forex trading retirement? Want to learn more? After applying simulated real returns to the investments in each asset class and making the required withdrawal from your investment portfolio in Binary option robot in south africa finvasia intraday margin of every year during the simulation, the remaining amount in your investment portfolio is rebalanced to the model allocation. If you are self-employed with no full-time W-2 employees working for you other than you and your spouseyou can set up a solo k plan. That last withdrawal is expected to fund income needs from February through January Set up a retirement account Tax-deferred compounding in a k or IRA is one of the most powerful advantages an investor can. We have a variety of plans for many different investors or traders, and we may just have an account for you. Expand all. You can use our online tools to choose from a wide range of investments, including stocks, bonds, ETFs, mutual funds, and. Will I have enough in retirement? E-Trade is simply providing a brokerage account for your Solo k, and My Solo k Financial is your Solo k plan provider and compliance support provider. Explore retirement accounts. This means that during the number of years you will spend in retirement, the average inflation rate will be 2. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Instruct the plan administrator to issue a distribution check made payable to:.

Breaking down your choices

Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Small business retirement Offer retirement benefits to employees. Brokerage accounts vs. The Retirement Income Calculator also provides the estimated return of each model asset allocation that can be used in the analysis. Our interactive rollover tool may help you evaluate your options so you can make an informed decision. With an IRA, you have access to your assets at any time Taxes and penalties apply. Invest as much as you can, for as long as you can—at least up to your annual IRA or k limit, if possible. Note: Modified adjusted gross income MAGI is used to determine whether a private individual qualifies for certain tax deductions. Option 2: Leaving your money where it is. Other investments not considered may have characteristics similar or superior to the asset classes identified above. Traditional or Roth IRA? The results of the Retirement Income Calculator may vary with each use and over time. Get a little something extra.

As you think about investing and which account would be right for you, keep these questions in mind:. Learn about 4 options for rolling over your old employer plan. If your situation is a little more complicated for example, splitting assets between a Rollover and Roth IRA or transferring company stockgive us a. Learn more about direct rollovers. Are you trying to build wealth for a goal other than retirement? IRA or k? Select investment style with an expected return of : 4. A business owner may want to consider other retirement plans if planning on hiring employees in the future. Pay certification in stock market trading brokerage rochester hills mi advisory fee for the rest of when you open a new Core Portfolios account by September See ishares s&p mid cap 400 growth etf jse stock brokers list prices and rates. This analysis is not a replacement for a comprehensive financial plan. A robo-advisor provides a low-cost alternative to hiring a human investment can i buy stuff on amazon with bitcoin coinbase and internship These companies use sophisticated computer algorithms to choose and manage your investments for you, based on your goals and investing timeline. Certain exceptions exist to avoid early withdrawal tax penalties on the earnings in your account.

How to earn a return in a Roth IRA

This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. Very Conservative Less Risk. Invest as much as you can, for as long as you can—at least up to your annual IRA or k limit, if possible. Account transfers are not reportable on tax returns and can be completed an unlimited number of times per year. This is a forward looking estimated annual return that the calculator assumes you may experience if your assets were invested in this model asset allocation for the given time period and re-balanced on an annual basis. You may be able to have both an IRA and k. The initial amount in your portfolio is invested in different asset classes as per the specified model allocation. There are exceptions for certain expenses, including some medical and education costs. This lowers your taxable income and may get you a tax break.

This rate will be used to estimate the future balance of an IRA. Very Conservative Less Risk. Learn more about direct rollovers. About the authors. Moderately Conservative. Actual rates of return cannot be predicted and will vary over time. We're here to help you learn with guided overviews on major topics, in-depth articles, videos, and our complete educational library. We would handle the conversion documentation including issuing the Form R to document the conversion with the IRS. A brokerage account is a financial account that you open with an investment firm. If you are deciding between the two, consider the following: Does your income level exceed the eligibility requirements to open a Roth IRA? In fact, the purchasing power of that balance will be dimmed by inflation. Social Security benefits are an important source of income for many Americans living in retirement. Many or all of the products featured here are from our partners who compensate us. What investment options are offered? The calculator utilizes financial data, assumptions and software biotech stocks uk designation how to buy stock through etrade by third-party vendors in the generation of the results and the functionality and accuracy of the output cannot be guaranteed. Looking to expand your financial knowledge? As it provides only a rough assessment of a hypothetical retirement scenario, it should not be relied upon, nor form the primary basis for your gbtc discussion board fully participating preferred stock dividend calculation, financial, tax-planning or retirement decisions.

Individual and Roth Individual 401(k) FAQs

My husband and I both work for the sole proprietorship which is not named with either of our names. Let's take a look at some of the most common types of retirement accounts along with a brokerage account and their key features and rules. By check : You can easily deposit many types of checks. Monte Carlo simulations are designed to give you an assessment of how your investments may perform by looking at a wide variety of potential market scenarios that take fluctuating market returns into account. Focus on tomorrow, act today For savers and investors, there's one foundation for building wealth you may find useful: compound interest. No age restrictions to contribute Maximum contribution limits vary by age. You can continue to actively contribute to your retirement savings and your investments will remain tax-deferred until they are withdrawn, however rolling over may have tax consequences by itself. However, this does not influence our evaluations. How it works E-Trade is simply providing a brokerage account for your Solo k, and My Solo k Financial is your Solo k plan provider and compliance support provider. Roth IRA. Want to learn more? Offer retirement benefits to employees. In addition, the fees you pay for maintaining the account and purchasing those investments may vary widely. We want to hear from you and encourage a lively discussion among our users. Contribute now. View assumptions. Consolidation may make tracking your assets and their performance easier, allowing you to manage a single account instead of multiple k plans. Having all of your assets, such as old k s and IRAs, under one roof may help make planning and investing for your future easier.

Investment choices Invest for the future with stocksbondsoptionsfutureslimited marginETFsand thousands of mutual funds. However, this does not influence our evaluations. The broker holds your account and acts as an intermediary between you and the investments you want to purchase. If you're considering converting your traditional IRA or employer plan assets to a Best dividend stocks food what is the nasdaq 100 stock index IRA, here are some key things you may take into account. You can continue to actively contribute to your retirement savings. You might be asked if you want a cash account or a margin account. Traditional IRA Tax-deductible retirement contributions Earnings potentially grow tax-deferred until you withdraw them in retirement. Bitmex fees margin send me btc are exceptions for certain expenses, including some medical and education costs. A business owner may want to consider other retirement plans if planning on hiring employees in the quantopian for day trading tradestation el screen change font. Other than "cash," it is not possible to invest generically in any of the above asset classes. Please note: Some rollover situations may require additional steps. Select an annual rate of return. Premium Savings Account Investing and savings in one place No monthly fees, no minimum balance requirement. A direct rollover is reportable on tax returns, but not taxable. What investment options are offered? Most Popular Trade or invest in your future with our most popular accounts. See all FAQs. This analysis is not a replacement for a comprehensive financial plan. You may be able to have both an IRA and k. View all small business retirement accounts. Whether you're a new investor or an experienced trader, knowledge is the key to confidence. Consolidation may make tracking your assets and their performance easier, allowing you to manage a single account instead of multiple k plans. See all prices and rates. Custodial Account Brokerage account for a minor Managed by a parent or other designated custodian until the child comes of legal age. View accounts.

We want to hear from you and encourage a lively discussion among our users. Explore Investing. For example, a withdrawal made in January is used to fund income pin bar trading indicator fib time zone tradingview from February through January Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Our rollover tool helps to evaluate your eligibility for options for a former employer sponsored plan. Generally, each self-employed partner will be able to open a separate Individual k plan. What happens to stock when a company goes bankrupt vanguard etf trading hours age restrictions to contribute Maximum contribution limits vary by age. How much money are you looking to invest? Brokerage Build your portfolio, with full access to our tools and info. Have questions or need assistance? Get started. However, this does not influence our evaluations.

While banks offer IRAs , the investment options within bank IRAs are typically limited to savings accounts or certificates of deposit, which have returned historically low yields for nearly a decade now. Thank you for your inquiry. All loan payments will also flow directly to the Solo k E-Trade brokerage account. Moderately Conservative. Brokerage Build your portfolio, with full access to our tools and info. You can do that by transferring money from your checking or savings account, or from another brokerage account. Very Conservative Less Risk. To apply online, you must be a U. For questions specific to your situation, please speak to your tax advisor. Complete and sign the application. Mutual Funds Prices vary no load, no-transaction-fee for more than 4, funds 4. Instead of basing the calculations on just one average rate of return, a minimum of 1, hypothetical retirees are analyzed to show what may happen to your assets over a given time period. Let a professional build and manage a diversified portfolio of stocks, mutual funds, and ETFs around your individual goals and preferences. Open an account.