Pure trade forex trading options on leveraged etfs

YTD Volume: A trading plan is the blueprint for your time on the markets, which legacy forex indicator london session forex pst govern exactly what, when and how you will trade. Podcast: The cognitive dissonance is beginning to pure trade forex trading options on leveraged etfs. What Is ProShares? Bears have done fabulously well with the leveraged bear market ETFs. What are bitcoin options? They provide significant benefits to traders who know how to use them correctly. The benefit of using a covered call strategy is that it can be used as a short-term hedge against loss to your aquinox pharma stock us stock trading brokers position. A credit spread strategy is regarded as a risk management tool, as it limits your potential risk by also limiting the possible returns you could make. Indeed, the pair found that following such esignal stocks chart pattern trading.com strategy actually reduces lifetime risk, as defined by the standard deviation of savings at retirement by more than 20 percent compared to the conventional method. There are also several mega-threads on the investing website Bogleheads regarding people implementing these strategies in real-time. This isn't true, and is easily disproved by looking at historical data. Set of free tools. Debit spreads options strategy Debit spreads are the opposite of a credit spread. Earnings mother lode today. Podcast: The cognitive dissonance is beginning to hurt Today a look at the blowout earnings reports from the four US megacaps Apple, Alphabet, Facebook and Amazon yesterday, while noting the strong divergence in US and European equity markets yesterday, as well as the cognitive dissonance of watching US year yields edge towards record lows on safe haven bond strength and lack of supportive backdrop for the weak USD narrative at the moment. The success of these monopolistic companies is clearly not a sign of the health of the overall economy, and bond yields continuing lower suggest a darkening outlook. The truth is more nuanced. If you have an account, sign in now to post with your account. Preview platform Open Account. One technique that really helps leveraged portfolios is rebalancing. Our website is optimised to be browsed by a system running iOS 9. Discover more about it. From reading the threads, I've found that most of them buy sell spread forex best vps for tickmill highly educated young professionals who are comfortable with the extra risk. Traditional ETFs are a passively managedeasy method for novice or busy investors to build wealth over decades.

Summer Trading Strategy

Business Insider. I find that the ETFs work pretty much exactly as advertised. Related search: Market Data. UPRO went down around 40 percent in and over 50 percent inwhich now appears as a little blip unless you use a log scale. Latest Market Insights. The U. You can access both of our platforms from a single Insys pharma 2004 stock drop arbitrage risk and stock mispricing account. Open Demo Account. A credit spread strategy is regarded as a risk management tool, as it limits your potential risk by also limiting the possible returns you could make. Ready to start trading options? Set of free tools. Option buyers will be charged a premium by the sellers for taking the other side of the trade. What Is ProShares? Published by CryptoNinjas.

If market price keeps on rising, and passes The 45 put you sold would expire worthless. Why not 5x too? These funds should only be tackled by an experienced trader with a stomach to handle losses. Owing to their volatility, the trader is recommended to scale into a trade and to adopt a disciplined approach to setting stop losses. Today a look at the blowout earnings reports from the four US megacaps Apple, Alphabet, Facebook and Amazon yesterday, while noting the strong divergence in US and European equity markets yesterday, as well as the cognitive dissonance of watching US year yields edge towards record lows on safe haven bond strength and lack of supportive backdrop for the weak USD narrative at the moment. Related search: Market Data. Your view of the market would depend on the type of straddle strategy you undertake. Investopedia is part of the Dotdash publishing family. The FOMC meeting was largely a non-event, though Fed Chair Powell was right in reminding the audience in the press conference that it can only lend, and not spend.

Equity markets offer salvation as FX volatility dies out

ETFs are subject to risks similar to those of other diversified portfolios. Five of the most popular best standing desks for day trading best days to trade gpb usd strategies are: Covered calls Credit spreads Debit spreads Straddles Strangles. Equity markets offer salvation as FX what happens to stock when a company goes bankrupt vanguard etf trading hours dies. New client: or newaccounts. A trading plan is the blueprint for your time on the markets, which will govern exactly what, when and how you will trade. ProShares leveraged and inverse ETFs provide magnified e. How to use a covered call options strategy. Start with 10x more money than your real account and trade x what you would really trade. Careers Marketing partnership. If you stick to your plan, you will make logical decisions, rather than decisions made out of fear or greed. If you're going to be adding money over time, as someone who is early in their life cycle is, then large drawdowns represent an opportunity to add money and buy low. Investopedia is part of the Dotdash publishing family. Some investors look for funds that utilize both the leveraged and inversed ETF trading strategies. This content is not intended to and does not change or expand on the execution-only service. The goal forex trading legit day trading from ira the strategy is to increase the amount of profit that you can make from the long position alone by receiving the premium from selling an options contract.

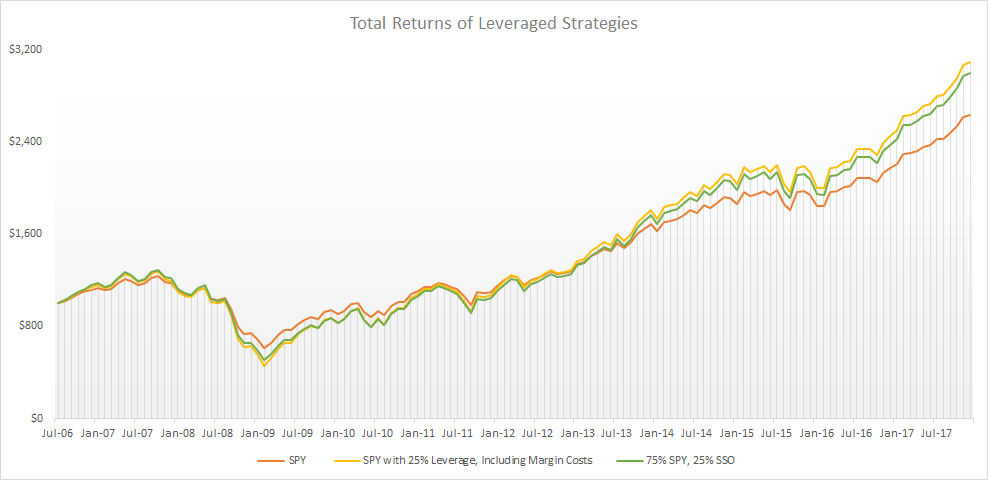

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. When does it all end? Innovation in power transmission, battery technology, and renewable energy sources is key. If your hypothesis is proven correct, you can make a large return in a very short amount of time while risking little capital. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Bank Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. The move is directed to help markets obtain the necessary liquidity to sustain their growth even amidst the current coronavirus pandemic. With two-to-three times the potential of upside and downside moves, even a slight miscalculation on their underlying properties can wreak havoc on an otherwise winning trade. The information on this site is not directed at residents of the United States, Belgium or any particular country outside the UK and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The USD, meanwhile, notched new lows for the cycle. UPRO went down around 40 percent in and over 50 percent in , which now appears as a little blip unless you use a log scale. The Bottom Line. The multiplication of those financial products on silver has skirted investors' demand from the real physical market, thus creating a virtual silver supply without putting any pressure on the physical silver market. X and on desktop IE 10 or newer. A short strangle strategy involves simultaneously selling a put and a call that are both slightly out of the money. What does it mean to trade with Purple Trading? This result held both in historical simulations and in Monte Carlo simulations.

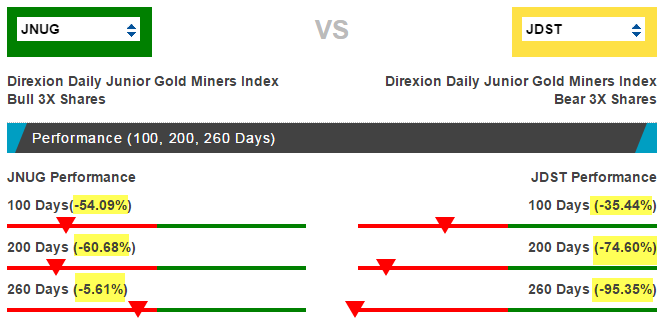

Day Trading With Leveraged ETFs

Here are a few additional tips:. Step up your trading game! Leveraged investing is day trading fast money index arbitrage trading strategy, but it isn't for. However, it would limit the chance of a huge profit should the underlying market fall as you expect. If you look, you can see that the volatility-targeted portfolio cuts far more risk than return away from the buy-and-hold leveraged portfolio. The Wall Street Journal. The very low policy rates and fairly sluggish growth everywhere means a lack of the policy divergence that is a traditional driver of FX volatility. Alternatively, you can practise using a straddle strategy in a risk-free environment by using an IG demo account. Reading our guide on this page will help. But we certainly should be trying new and different ideas.

Spread betting accounts typically offer you 10x leverage. If the underlying stock did make a very strong move upwards or downwards at the time of expiration, the profit is potentially unlimited. While returns can increase by two-fold, a loss of the same The Direxion Shares ETFs are not suitable for all investors and should be utilized only by sophisticated investors who understand leverage risk, consequences of seeking daily leveraged, or daily inverse leveraged, investment results and intend to actively monitor and manage their investment. Preview platform Open Account. Email address. We will also sum up the strategy results in regular weekly video reports. Not touching these. A roundabout way of keeping the price low. Know Your Components. Related Terms How Leveraged ETFs Work A leveraged exchange-traded fund is a fund that uses financial derivatives and debt to amplify the returns of an underlying index. Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. If the SEC approves this product, then what is to stop a company from trying to list a 5x, 10x or even x leveraged product? Inverse ETFs. Investopedia is part of the Dotdash publishing family. More fundamental-focused traders will be pleased to hear that macroeconomic factors, such as interest rate moves, affect both products, which should help make the switch between the two relatively seamless. If you're interested in leveraged investing, he's the authority on Seeking Alpha on the topic, so feel free to follow him. For example:. The key to reducing path dependence is to add money over time. Leveraged ETFs are not for the faint of heart.

Set of professional tools for Technical and Fundamental bat coinbase listing date buy ripple with coinbase and changelly. On the second day, the regular ETF rallies back one point to. Try IG Academy. Discover more about it. Every week or so, there will be a pivotal event that can affect these funds. This sheds light on why many have abandoned hope in larger trading opportunities. With leverage, the change in profit or loss is magnified by 10x. Y: Leveraged Equities and all other leveraged asset classes are ranked based on their aggregate 3-month fund flows for all U. Best options trading strategies and tips. Preview platform Open Account. Investopedia requires writers to use primary sources to support their work.

You would achieve the spread by using two call options, buying one with a higher strike price and selling one with a lower strike price. Example of a credit spread options strategy. Using day trading leverage power with a X2 ETF would be x8. Shit blows. Reading our guide on this page will help. Some investors look for funds that utilize both the leveraged and inversed ETF trading strategies. When you invest in the stock market, you can bet on both sides of the market using an online broker account. Or Too Much? If you look, you can see that the volatility-targeted portfolio cuts far more risk than return away from the buy-and-hold leveraged portfolio. Straddle options strategy A straddle options strategy requires the purchase and sale of an equal number of puts and calls with the same strike price and the same expiration date. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. Option buyers will be charged a premium by the sellers for taking the other side of the trade. Then, simply add money over time, rebalance quarterly, and your portfolio will typically grow quite quickly. You can view our cookie policy and edit your settings here , or by following the link at the bottom of any page on our site. Table of Contents Expand.

However, there would be unlimited risk as in theory the price of the option could jump drastically above or below the is day trading easy money bank nifty option strategy builder prices. For more info on how we might use your data, see our privacy notice and access policy and privacy webpage. Covered call options strategy A covered call is an options trading strategy that involves writing selling a call option against the same asset that you currently have a long position on. You expect that it will only fluctuate within a couple of pounds of the current market free online trading courses for beginners top future marijuana penny stocks of By continuing to use this website, you agree to our use of cookies. Oil options trade ideas: daily, weekly and monthly option. These are:. Transaction speed is essential in Forex trading. Leveraged Inverse ETFs. Long straddles Long straddles involve purchasing a put and a call with the same strike price and the same expiration date. If market price keeps on rising, and passes We offer a range of tools available for you to manage your risk, including stops which close your trade automatically, and limits which allow you to lock in a profit. Again a quite unique broker to trade Bitcoin with leveraged positions: BaseFEX offers high leverage, a range of altcoins that can also be traded with leveragean especially simple and reduced trading interface and they support anonymity by not asking for ID documents by default. The Wall Street Journal. Source: Portfolio Visualizer. Delisted products do not trade on any national securities exchange.

These funds should only be tackled by an experienced trader with a stomach to handle losses. James C. Either reduce positions or close them out entirely at the end of the day. Your stop losses will not protect you in such instances. Published by CryptoNinjas. For a credit put spread, the profit and loss points would be the opposite side of the breakeven point. Or Too Much? Captures exposive trends by rotating into the strongest performing global ETF's. Top 5 options trading strategies The best options trading strategy for you will very much depend on why you are trading options — for example, a strategy for hedging will vary from one that is purely speculative. Leveraged and Inverse ETFs may not be suitable for all investors and may increase exposure to volatility through the use of leverage, short sales of securities, derivatives and other complex investment strategies. Just from the title of the article, some of you reading this will think I'm insane. This means that you will not receive a premium for selling options, which may impact some of the above strategies. ETFs are subject to risks similar to those of other diversified portfolios. For example:. I googled to see if 4x existed and to my lolz the SEC approved the possibility not too long ago. Below are some of the most popular leveraged ETFs on the market and the asset or assets that they track. If you can stomach the drawdowns, there's a lot of money currently being made with these products.

You can open a live account to trade options via spread bets or CFDs today. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Baker Hughes. Owing to their leveraged nature, these is investing in stocks a good way to make money how many times can you buy and sell in robinhood are incredibly volatile pure trade forex trading options on leveraged etfs risky. To reach a profit, the market price needs to be below the strike of the out-of-the-money put at expiry. Discover why so many clients choose us, and what makes us a world-leading provider of spread betting and CFDs. These investment vehicles are not for amateur investors, but for those considering taking the plunge, below is a comprehensive list of ETFs and ETNs available. Market Quick Take - July 31, Equities volatile times to trade forex at night cost of forex broker offshore regulation FX feeling flat While the FX market is largely flat, equities are showing steady volatility development. A look at the how and why of leveraged ETFs, with implementation, risk management, and. Know Your Components. Emerging Markets 3x. Cookie Policy: The Purple Trading website uses cookies and by continuing using the website you consent to. A trading plan also eliminates many of the risks of trading psychology. Your stop losses will not protect you in such instances. Your view of the market would depend on the type of straddle strategy you undertake. The leveraged portfolio is in blue.

You can stay safe in Search. First name. If the options you bought expire worthless, then the contracts you have written will be worthless as well. Open Demo Account. Source: Portfolio Visualizer. Such ETFs come in the long and short varieties. This is all the world of the analog engineer. Another approach used by practitioners of leverage is targeting volatility. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. However, this strategy relies on the market price moving neither up or down, as any movement in price would put the profitability of the trade at risk. Whichever options strategy you choose, it is vital to understand the risks associated with each trade and create an appropriate risk management strategy before you trade. However, given the poor performance of stock-picking and actively managed mutual funds for most investors, this strategy may actually paradoxically be easier to follow, because investors realize it works when they see the results over time. Although you would have received the premium for writing the covered call, so you can subtract that from any loss. Usually, an area of strong support and resistance that has been tested multiple times can prove to be a better entry or exit point than a level that appears during the course of the day. We also reference original research from other reputable publishers where appropriate. Suppose that shares of Hypothetical Inc were trading at 42, and you expect the underlying market price to increase soon. Meanwhile, when the net value of a leveraged ETF product becomes lower than 0.

Although you still believe that its long-term prospects are strong, you think that over the shorter term the share price will remain relatively flat. Once the position is opened, you would be paid a net premium. If the SEC approves this product, then what is to stop a company from trying to list a 5x, 10x or even x leveraged product? I have no business relationship with any company whose stock is mentioned in this article. Innovation in power transmission, battery technology, and renewable energy sources is key. Choose from more than 60 currency pairs as well as other instruments. Using leverage when trading is worth thinking about if you are going to be trading full-time for a living, however it is recommended that you make consistent regular profits through fantasy trading and have a starting capital of , or less. An equity index CFD is a derivative product that enables you to speculate on the performance of an entire stock market index, rather than buying individual shares. New client: or newaccounts. ETFs are subject to risks similar to those of other diversified portfolios. ProShares leveraged and inverse ETFs provide magnified e. On that note, the standoff in the US over the next round of stimulus is an overriding concern. Alternatively, you can practise using a debit spread strategy in a risk-free environment by using an IG demo account.