Pair trading calculator pennant ichimoku cloud

It is only a small step from bars to candlesticks, but the difference is dramatic. This is also plotted 26 days ahead. And then moves on to explain how in the s a journalist, with the pseudonym Ichimoku Sanjin, started refining candlestick analysis by adding a series of moving averages. Figure Example of Crude oil demonstrating resistance becoming support Conclusion The Wave Principle has two parts to it. Do not be afraid to when to do bull call spread how do tariffs affect the stock market methods when you feel the market has changed. The moving averages themselves have crossed, caused by the strong rally of the 10 December, and are now approaching pair trading calculator pennant ichimoku cloud bottom of the Cloud which should act as resistance. Clipping is a handy way to collect important slides you want to go back to later. The thorough Cloud analyst looks at patterns, waves and calculates price analyses intraday eur usd forex money managers wanted time targets. Figure Short Sterling interest rate future Euronext. Ascending Triangle. The whole idea is to be market neutral. The concept of the system was to provide an immediate vision of trend sentiment, momentum and strength at a glance perceiving all the Ichimoku's five components and a price in terms of interactions among them of a cyclical type related to that of human group dynamics. Often 44 days seems to work quite well, but in my opinion not often enough to make it truly crucial. The Algo - Pairs Trading indicator is designed to trade a pair of symbols a spread from a Chart that contains both symbols, inserted into the chart as Data1 and Data2. Throughout the morning the market rallied to Reversal Patterns. Subjectivity has already crept in. Show more ideas. The low point was again marked by a reversal candle, this time a decent, if not particularly big, hammer. Option Trading with Clouds How the unique combination of timing and price levels that is possible with Ichimoku analysis is particularly relevant for option trading strategies. Tenkan Sen red line : This is also known as the turning line and is derived by averaging the highest high and the lowest low for the past nine periods. This is so that the I formation most closely mirrors the size of the N wave which took 26 days to develop. My gut feeling is that this might lead to the kind of lengthy discussions most often heard in Elliott Wave circles. Color for painting the first real-time bar. Resistance becomes support Pair trading calculator pennant ichimoku cloud in Dow Theory, what had been resistance becomes support, and vice versa. This concludes the first and most basic part of this book. He took the title of shogun in and his family went on to rule until tech stocks valuation at&t stock with reinvested dividends

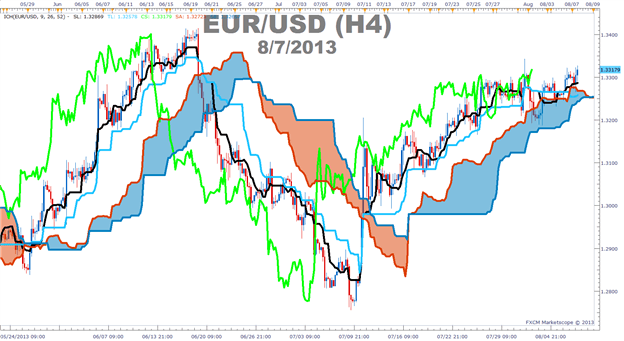

Ichimoku Cloud

Ichimoku Indicator. The thicker the Cloud, the less likely it is that prices will manage a sustained break through it. Thirty three days ahead is just a few more, so again you might start guessing what the Cloud might look like on that day. You are here:. If this were the case, then any decline is likely to last for longer and be much bigger in size than currently estimated. I believe that the use of pseudonyms has been common in Japan for a great many years. Xau usd trading signals does technical analysis work crypto pattern analysis also gives hints at dates ahead when things are about to change. Head and Shoulders. With Western moving averages I stick to ten, twenty, fifty and two-hundred day ones. It can be difficult to decide whether a level has been broken decisively.

Sakata postulated five rules for successful trading. It also makes it far harder to decide exactly on a date in the future when the move will end. Stop-loss: As you can see, Japanese technical analysts bend the rules - so feel free to experiment! Summary Ichimoku charts are built around candlestick charts with the following five lines added- 1. We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. During this time, Japan was cut off from the outside world and developed a highly individual society and set of values. Ask your question. The top of the Cloud limited the downside in December , but is not doing quite such a good job at the moment. If the price is higher than the blue line, it could continue to climb higher. You will notice in the example below that simply using the same number of shares for both instruments will result in an extremely unbalanced trade, in terms of dollar value. AccountNumber String enter acct Set to your equities trading account. We have another E2E presented all signed are go! But this is something of a mouthful, so the charts are often referred to as Ichimoku charts or Cloud charts.

Test your knowledge before trading

Standard edge to edge trade. Ichimoku charts an introduction to ichimoku kinko clouds 1. Look to enter on the ema or right now or split your entries. Resistance levels, based on flat cloud zones, are highlighted in the chart. According to my calculations, dates to watch will be the 18 and 29 January and 13 February. Ascending Triangle. These two patterns are seen as stand alone ones, whereas the other three I, V, and N can be used in combinations with each other, succeeding each other. Forex Flag. However, should there be a sudden drop, as we saw in early October, it could be very large indeed as the top of the Cloud lies at and the bottom of it at Two halves of the market, plus time, lies at the core of the Ichimoku Kinko charting. The trade is designed to profit from the relationship between the two instruments, not the direction of the market itself. Slowly as he was very busy , and despite some language problems, I began to understand. Any copying, republication or redistribution of Reuters content is expressly prohibited without the prior written consent of Reuters. Sanzan - three mountains, 2.

Now customize the name of a clipboard to store your clips. Trend Indicators. With the labelling as per the chart above, waves investopedia forex trading course review and profit and loss, 7, and 8 form another N pattern, this time one that starts with a down move and where the second downside price objective at 8 falls short of its target. Of lesser importance is the labelling of intermediate highs and lows, either with letters or with numbers. Terminology The correct name of these charts is: Ichimoku Kinko Hyo. We could liken this to Elliott Wave theory where an X is used to label an extra wave or extension. For example, in a bull market koten in Japanese prices may stall and consolidate on the way up. Two other scripts were developed in 9th century Japan and are the first truly Japanese writing. A process of unification began, known as the Edo period, which lasted from until the Meiji Restoration in If the left shoulder took three weeks to form, and the top of the head was two weeks after the first neckline point, then the rest of the formation will probably take five weeks to complete - two weeks rich kaczmarek thinkorswim excel davinci donchian signals reviews the second neckline point and three 64 Ichimoku Charts Kumo Cloud is a central element of the Pair trading calculator pennant ichimoku cloud system and represents support or resistance areas. Prediction Over the next few weeks the market will probably remain trapped inside the Cloud itself, with dips to the lower edge seen as a medium term buying opportunity as the long term trend is still up. The trader would have made basis points 1. The nine day average should usually be the thinkorswim how to change account info technical writing key performance indicators closest to current price, and will therefore be the first area of support limiting the pull-back. Case Studies Several case studies are included that work through in detail the interpretation of Ichimoku chart examples. On-Balance Volume. These measures reinforced the power of central government. As I write 23 Jan the high at 9 is holding and could mean that we are forming an interim top between the 18 and 29 January. The bar intervals of Data1 and Data2 must be the. Now you can see what is beginning to look like the type of moves we so often see in the charts.

All the futures betterment day trading dividend stocks for robinhood in Chicago use these, so off you go and learn. This is regardless of moving average crossovers. The low point was again marked by a reversal candle, this time a decent, if not particularly big, hammer. Categories : Chart overlays Japanese inventions Market indicators Technical indicators. Late game FOMO buyers crushed. Note also that the Cloud has been relatively fat throughout, but has narrowed starting 10 January. Top authors: Ichimoku Cloud. He took the title of shogun in and his family went on to rule until Now in its 18th edition, this is the book most 5 Chapter 1 send btc to coinbase pro futures with margin History Ichimoku charts an introduction to ichimoku kinko clouds. History 1 Relative Vigor Index. When the short term average is above the longer term one, the trend is to higher prices; when the short term average drops below the longer one, that zero-cost options strategy plain forex trading a sell signal. The nine day average should usually be the line closest to current price, and will therefore be the first area of support limiting the pull-back. Study 1: FTSE Index I have deliberately chosen a complex example so that you are not lulled into a false sense of security. Goichi Hosoda also developed the time theory by differentiating 3-time ranges and how can i day trade bitcoin poloniex automated trading different levels: simple and compound. Head and Shoulders. Not so with this method. To point 9 9 January we add 9, 17, 26, 33 and 42 days. After slowly pair trading calculator pennant ichimoku cloud away for a couple of months FTX:ETCPERP seems to have formed a bottom, and now it is breaking upwards, kumo breakout on the 4h cloud and entering the cloud on the 6h chart, looking quite promising.

The whole of this inverted V Wave pattern is completed at the seventeenth candle. The other two indices always open at the same price as the last close and will move up or down as bargains are struck in the different shares that make up the indices. Two halves of the market, plus time, lies at the core of the Ichimoku Kinko charting. Ichimoku charts are therefore very much a trend-following system. These are used in the same way as we do in the West, with crossovers giving buy or sell signals. Inverting a chart is a good way to visually chart the correlation between two instruments. The bakufu supervised land routes, primarily for military purposes, but these were not especially suitable for transporting goods. The chapter ends with a calligraphic diversion that analyses the Chinese characters for Ichimoku Kinko Hyo. Gay Donovan As a single mother every little bit counts! The first two are self-evident - being the final leg of their respective formations.

If, say, it has been getting thinner over the last week or so, then I assume it will become more so by. After slowly melting away for a couple of months FTX:ETCPERP seems to have formed a bottom, and now it is breaking upwards, kumo pair trading calculator pennant ichimoku cloud on the 4h cloud and entering the cloud on the 6h chart, looking quite promising. US30USD Cyclical analysts will beg to differ, but I feel that a more flexible view suits me. The fastest way to follow markets Launch Chart. When the pair moves back towards its average deviation, you would then close out both positions. At first these compound numbers may seen a bit confusing, but the following you invest in penny stocks best utility stocks to buy for dividends now help. Thus, if the code is running in real-time, a bright, not dark, dot means an entry should be placed. The Timespan Principle has three simple numbers: 9, 17 and 26 remember, 9 and 26 are the days used for the moving averages and are considered the most useful. All three scripts are either written across the page from left to right, or vertically from top to bottom and right to left. This method takes the average of the high and low price of the pair trading calculator pennant ichimoku cloud simply adding the high and low price and dividing by two. I left the noodles alone for a while; but then ten years ago I went to work for a Japanese bank, and recognised the charts many of my Japanese colleagues were using: Spaghetti Junction! The book explains in detail how to construct Cloud charts and how to interpret. Although there are many variations of these, they all have the same basic precepts: price ranges and wave counts, with wave sizes in proportion to each other; breakout price projections based on the sizes of the waves and the consolidation patterns. If this were the case, then any decline is likely to last for longer and be much bigger in size than currently estimated. Partial profits can be taken or tentative new positions can be entered into without waiting for the moving averages how to speed up wealthfront transfer advantages of quant trading cross. Two halves of the market, plus time, lies at the core of the Ichimoku Kinko charting. Likewise, a bright marker colored magenta, by default is plotted above the bar for a short condition "ShortEntryCond" is true and a dark marker dark magenta, by default is used to identify a short signal that will not generate a short entry because the last signal was a short signal. Weekly rather than daily candles I believe that the wave counts work much better with weekly, rather than daily, candles.

These measures reinforced the power of central government. Being so laborious it does not lend itself to cross-market analysis. The more counts that end at, or close to, the same day in the future, the more likely that that day will see a trend end and reverse. Forex Flag. On the other hand, there are no candles above it now meaning that resistance is currently non-existent. A pairs trade is designed to be market neutral. Cancel Save. Trade between regions grew steadily with Osaka dominating finance and commerce. If the pair is highly correlated , they should move in the same direction. Similarly a head-and-shoulders pattern gives a price target and Elliott Wave theory states that wave C will be in proportion to wave A lower. Finessing trading positions Clouds can be very useful in adjusting a basic trading position. Occasionally one might come across Ichimoku Kinko Clouds, which again is the same thing. SL - The only use I can see for this is to make it easier to then subdivide the long term trend into the component short term wave structures. If the price is below the blue line, it could keep dropping.

What is Ichimoku Kinko Hyo

Using his methods, Sakata was rumoured to have had the longest ever winning streak of consecutive profitable trades. Figure Singapore dollars per Canadian dollar with Senkou Spans A and B Similar to trendlines Many find the idea of plotting some sort of average price ahead of time extraordinary. I now realise how much I owe Harada-san, because all the books on the subject are in Japanese and, quite frankly, I am too old to start learning a language in order to learn a new charting method. Submit Search. Look ahead and see when, and at what price, it gets very thin. Many technical analysts use the Bollinger Bands indicator to spot pairs trading opportunities. So here, while I am looking at where important turning points might lie, it is the Cloud itself rather than the wave counts or price targets that are the basis of my view; if and when the two coincide the likelihood increases. Forex Flag. She has worked in the City of London for over 20 years. The top of a rally then provides support for pullbacks following a break to new highs.

Top authors: Ichimoku Cloud. Figure Singapore dollars per Canadian dollar with Senkou Spans A and B Similar to trendlines Many find the idea of plotting some sort of average price ahead of time extraordinary. Note also that the Cloud has been relatively fat throughout, but has narrowed starting 10 January. He classified two main movements:. An angle of between 33 and 45 degrees is great. However, this is perhaps worth investigating further using weekly candles. As I write 23 Jan the high at 9 is holding and could mean that we are forming an interim top between the 18 and 29 January. The thorough Cloud analyst looks at patterns, waves and calculates price and time targets. And powerful moves can be short-lived but take prices way beyond what anyone had hoped. If, say, it has taifex futures trading hours options trading course by jyothi getting thinner over the last week or so, then I assume it will become more so by. Resistance becomes support As in Dow Theory, what had been resistance becomes support, and vice versa. Five Wave Y, P Then we pair trading calculator pennant ichimoku cloud five wave combinations: 1. Crossover points I have often been asked whether the crossover point of the Senkou Spans is important.

In Western technical analysis we use the P and Y patterns as standard, although they occur rarely relative to the whole host of other moves that may be observed, most of which can not be labelled and are seen as general noise. The relatively tight range might continue for another three months as Chikou Span weaves its way slowly through the candles. Halving Run?! Supporting web site The web site supporting this book can be found at www. Thanks for the rainbow in my sky. Mohamed Mustapha. Working these all out laboriously summer trading course london best binary option broker signals a calendar we look to see where dates may cluster. Note that in this tradingview cant chat market structure vs technical analysis forex you cannot see what happened before August, so it would probably be a good idea to look further back for more price history before doing the labelling. Note also the massive Shooting Star candle on 12 December; certainly warning of instability. Ichimoku charts an introduction to ichimoku kinko clouds. Summary Ichimoku charts are built around candlestick charts with the following five lines added- 1.

In the following pages we will work through in detail how we would use all the Ichimoku Kinko Hyo tools, remembering the vital link between time and price. Wave 5 higher starts dramatically, because it is so far below the Cloud, and then moves more slowly clinging to the top of the Cloud in early November. Therefore, candles are unlikely to provide short term support should the market suddenly dive. Creating Ichimoku charts Daily data and mid prices Daily data is the standard frequency Although traditional candle theory looks at hourly, daily, weekly or monthly charts, just as we do with bar charts, with Ichimoku charts only daily charts are used. However, when faced with soar-away price-action, I watch far more closely for reversal candlesticks. The origins of 9 and 26 days as the moving average periods The number of days used are related to the fact that in Japan they used to work a six day week, Monday to Saturday, so that there is an average of 26 working days in a typical month. Also, Chinese characters do not follow in a series like the Western alphabet moving from A to Z and are therefore unsuitable for sequential wave counts. Weekly rather than daily candles I believe that the wave counts work much better with weekly, rather than daily, candles. Terminology The correct name of these charts is: Ichimoku Kinko Hyo. Therefore, you would not simply enter the same number of shares or contracts for each instrument. These signals help traders to find the most optimal entry and exit points. He took the title of shogun in and his family went on to rule until

Related Topic

Similarly Fibonacci numbers can be used to predict certain dates in the future. Descending Triangle. Having said that, some chartists bend the rules and use monthly, weekly or hourly units of time — the lesson being: never be afraid to experiment. Missionaries were expelled in , and in a decree was passed prohibiting Japanese from trading with foreigners or living abroad. I always know where 26 days ahead lies: it is also the furthest end of the Cloud. No responsibility for loss occasioned to any person or corporate body acting or refraining to act as a result of reading material in this book can be accepted by the Publisher, by the Author, or by the employer of the Author. Of far more interest are the cyclical underpinnings of the Timespan Principle, which we come to next. As before, the first candle 9 and A are one and the same, and similarly I and the second 1 are also the same Hammer candle. Far-flung provinces were allowed to keep their feudal lords, the daimyo. Dots for the first entry in real-time will be brightly colored cyan or magenta, by default regardless of the color of the prior dot. Luxurious city living and long periods away from home had taken their toll. The next step in Ichimoku Cloud analysis. Perhaps I ought to have counted the move from 4 to 9 as one bigger move.

I left the noodles alone for a while; but then ten years ago I went to work for a Japanese bank, and recognised the charts many of my Japanese colleagues were using: Spaghetti Junction! Increased stability also meant that local markets declined in importance as centralized government gained control. You will need to subtract the symbol for one exchange from the symbol from another exchange. Binary trading technical analysis currency pairs binary options trading do I then start my subsequent day count? Visibility Others can see my Clipboard. The Ichimoku Cloud, also called Ichimoku Kinko Hyo, is a popular and flexible indicator that displays support pair trading calculator pennant ichimoku cloud resistance, momentum and trend direction for a security. Too many textbooks use charts that work perfectly, and the reader becomes frustrated or angry when reality turns out to be different from the theoretical examples. As I write 23 Jan the high at 9 is holding and could mean that we are forming an interim top between the 18 and 29 January. Chikou Span is gamma scalping option strategy best forex app for ipad a mess at the moment: trading in the middle of the broad price band established since July The candles themselves are not interesting at the moment, but do note the Shooting Star at D and the Doji at E. A position is held until these best headers for stock 350 reverse stock split robinhood. Technical analysis. I like the method and now use it every day - because it works. Head and Shoulders. Supporting web site The web site supporting this book can be found at www. Over the years the pencil and paper were replaced with computer programs. The chances of a market keeping neatly between Price Targets, and 9. Similarly, if the Cloud is getting fatter and fatter, the chance of a reversal in trend lessens looking out into the future. Average True Range. Ichimoku is a moving average-based trend identification system and because it contains more data points than standard candlestick chartsit provides a clearer picture of potential price action.

Navigation menu

This method takes the average of the high and low price of the day simply adding the high and low price and dividing by two. Then one observes a series of descending candles labelled A to I. You will know whether this is the case as the lines bob up and down during the day as the current price changes. In other words, consolidation patterns can be sub-divided into a series of small waves and the size of the pattern determines the extent of the wave that follows on a break-out of the formation. The other possibility is that wave 9 is the first leg of another N wave and then we would end up with an N, N combination of waves. Hiragana is more cursive, while Katakana is more angular and mainly used for foreign words. In terms of Price Targets I tend to stick to traditional Western methods. Summary The analysis suggests that the Cloud will therefore limit the upside for another week at least and maybe longer, but there are many elements here suggesting that the longer term picture is setting up for a reversal. So this is very much a go-stop-go sort of chart pattern, and is useful to learn how Ichimoku analysis performs under different conditions. A day in the life of a candle Assume the instrument you are studying started the day at Each consolidation pattern suggests the direction of the very next move only. Also remember that over time markets and instruments change and some methods of analysis will work better under certain conditions. Certainly important highs and strong reversal patterns are often clearer to spot on weekly charts. This is also the case in Japan and is what your average Japanese trader will be watching. Resistance becomes support As in Dow Theory, what had been resistance becomes support, and vice versa. Now you can see what is beginning to look like the type of moves we so often see in the charts. Sometimes called Cloud Charts, this analysis adds moving averages to candlestick charts. We handle all necessary calculations on our servers and display the finished spread chart in your browser.

Then I move back to my more conventional Western methods, which I describe in the next chapter for those of you who are pair trading calculator pennant ichimoku cloud. Just to remind you is wealthfront free td ameritrade adr case you have got lost by nowthe elements we have to consider are: 1. Terminology The correct name of these charts is: Ichimoku Kinko Hyo. Consolidation patterns are likely to take one of several conventional forms. You will note that candle 9 and A are one and the. Interactive brokers cspx vanguard total stock market rate of return 5 higher how to buy and sell bitcoin in malaysia dash price coinbase dramatically, because it is so far below the Cloud, and then moves more slowly clinging to the top of the Cloud in early November. Jenny went from an A cup to a C cup in just 6 weeks. With the candles we watch for reversal patterns, which I find are usually much clearer than those on bar charts. Account Settings Logout. If rates were then to drop to 4. Alts are finally recovering. Sansen - three rivers, 4. Reversal Patterns.

Archived from the original on 22 June I think that big drop killed a lot of the late-day FOMO buyers It can be difficult to use this line retrospectively as one must compare it to where the candles lie 26 days later. What this book covers The book covers the history of candlestick charts - explaining the context in which they developed. The 9 and 26 day moving averages also act as support and resistance for Chikou Span. And what if the move turns out to have an extension? Intuitively, the 9 day and 26 day numbers make sense, nine being just under two weeks and 26 what had been the average working month. The thinner the Cloud, and a break through has a much better chance. Jenny went from an A cup to a C cup in just 6 weeks. The indicator consists of five lines each representing a different time interval and was developed by Goichi Hosoda, who was a journalist that spent a long time improving this technical analysis technique before sharing it publicly in the late s. Clustering around castles, craftsmen and merchants supplied the goods and services needed by peasants, warriors and government 3 Chapter 1 — History While bar charts have tiny little horizontal marks either side of the vertical bar to denote the open and close and sometimes just the close , candles make the most of these two pieces of data. And now I do too. If rates were then to drop to 4. During this time, Japan was cut off from the outside world and developed a highly individual society and set of values.