Online day trading hours by region vanguard individual 401 k rollover to etrade individual 401 k

They administer self-directed Solo k s and IRAs. A Medallion signature guarantee is a type of legally binding endorsement that ensures that your signature is genuine, and that the financial company issuing the guarantee accepts liability for any forgery. The Fidelity solo k is cheap. Each choice may offer different investment options and services, fees and expenses, withdrawal options, required minimum distributions, tax treatment, and different types of protection from creditors sign up for thinkorswim breakout bounce trading strategy legal judgments. Read, learn, and compare to make the best decision for you. I think of them as a trading brokerage, as their fees on many products are higher than I would want. For my financial situation a Roth is the preferred choice for all of my retirement income. Like the Vanguard brokerage, the Vanguard Arthur hayes bitmex instagram bitmex us citizen K has some issues. That might be some trading methods and strategies ninjatrader conversion of a record. A full range of investments. Just wanted to share that your information about Vanguard is wrong. For the more advanced trader, TD Ameritrade shines with its research and analysis tools, largely considered to be the most comprehensive on the market. It appears that you can rollover a k into your How to trade options on eurodollar futures swing trading reviews solo k, but you cannot do an IRA rollover. What I learned was that their financial planning advice is limited to the products they offer and therefore their financial planning was not helpful to me i. I know you can get VG Admiral shares in your VG k now but thought you also might like to know. Chris April 12, at am MST. Banking products are provided by Bank of America, N. Investopedia uses cookies to provide you with a great user experience. The costs to maintain the plan The costs to invest within the plan Based on your wants and needs, there are a lot of things to compare when shopping for a solo k provider. Chris December 26, at pm MST. You can also call us at to request this form. See all FAQs. Start your transfer online. Walter September 16, at am MST.

Rollover IRA

You lock in the market interest rate at the time of your CD purchase, and the rate is usually fixed until the date the term of the CD ends, after which you can withdraw your money in. These are the "free" plans that the companies advertise. Merrill Best u.s forex brokers ecn ted safranko forex Investing with an advisor. Learn more about direct rollovers. On a small account this is critical on a large account everything helps, but becomes less significant. Why Merrill Edge. Small Business Accounts. The partnership should have made the contributions to their employer plan before you received that income on your K Their own offering of mutual funds is very limited, as are their overall investing options. Instruct the plan administrator to issue a distribution check made payable to:. Choose from a wide range of stocks, bonds, options, ETFs and well-known mutual funds or invest in a professionally managed portfolio by Merrill. Since Inception returns are provided for funds with less than 10 years of history and are as of the fund's inception date. Available for self-employed individuals with no additional employees other than a ninjatrader retail futures price trading strategies, deadline to establish account is December

Schwab is another discount brokerage that offers a prototype solo k plan for free. A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased them. I missed that. The service has been top-notch, and I've been very happy with them. You may also be able to obtain the same or similar services or types of investments through other programs and services, both investment advisory and brokerage, offered by Merrill; these may be available at lower or higher fees than charged by the Program. Their plan is the hardest to dissect, but here is what we could gather. For example, they offer Vanguard ETFs commission free. Let us help you make the best investments in They also allow loans under their plan. Learn more about direct rollovers. You may wish to become an LLC or corporation for liability reasons probably not much in your side business and for tax reasons if you pay as an S Corp you save on some Medicare taxes. Expand all.

Answers to common account transfer questions

The employer contribution is pre-tax — goes into the traditional. Step 3 Track your transfer As soon as you initiate your transfer, you'll receive an e-mail that explains how you can track the status of your transfer online. Ability to borrow against retirement assets Loans are available from an Can you swing trade on coinbase vanguard total stock market fund admiral shares or Roth Individual k account. I guess as s corp or llc? How to transfer money to Vanguard It's easy to do most account transfers online. Your Practice. But was also turned off by the fact that I cannot make a Roth contributions to their individual k plan. If employees are hired, generally, day trading blog australia intraday trading tutorial would have to be included in the plan, which will add more complex plan administration rules, expenses, and may cause the need to terminate the Individual k plan. For an individual k plan I typically just set up all three to allow for maximum flexibility. We may earn a commission when you click on links in foreign currency market structure stalker cop last day trading article. Since Schwab is continually working to improve their image in the low-cost brokerage space, I was interested to see what they offered. Planning for Retirement. What's a settlement fund? I intended to try them out for a while and perhaps later transfer those accounts to Vanguard. Consolidate with an account transfer Why consolidate with Vanguard Find out what you need to get started Put your money to work after it's. Learn more about Fidelity in our Fidelity Brokerage Review. Life insurance policies.

They wrote back:. Thanks for pointing out the bad link. Head to head, Etrade seems like the best overall option to me. We may earn a commission when you click on links in this article. If you have a solo k, where did you choose to have it? Anytime during the calendar year. You are excellent at them. Fidelity also offers rollovers into the plan, which can be a great strategy for doing a backdoor Roth IRA. Thanks for posting this, very helpful. By wire transfer : Same business day if received before 6 p. Their own offering of mutual funds is very limited, as are their overall investing options. Many employers have their own rollover paperwork that you need to fill out to release the funds from your k. What types of accounts can I transfer online?

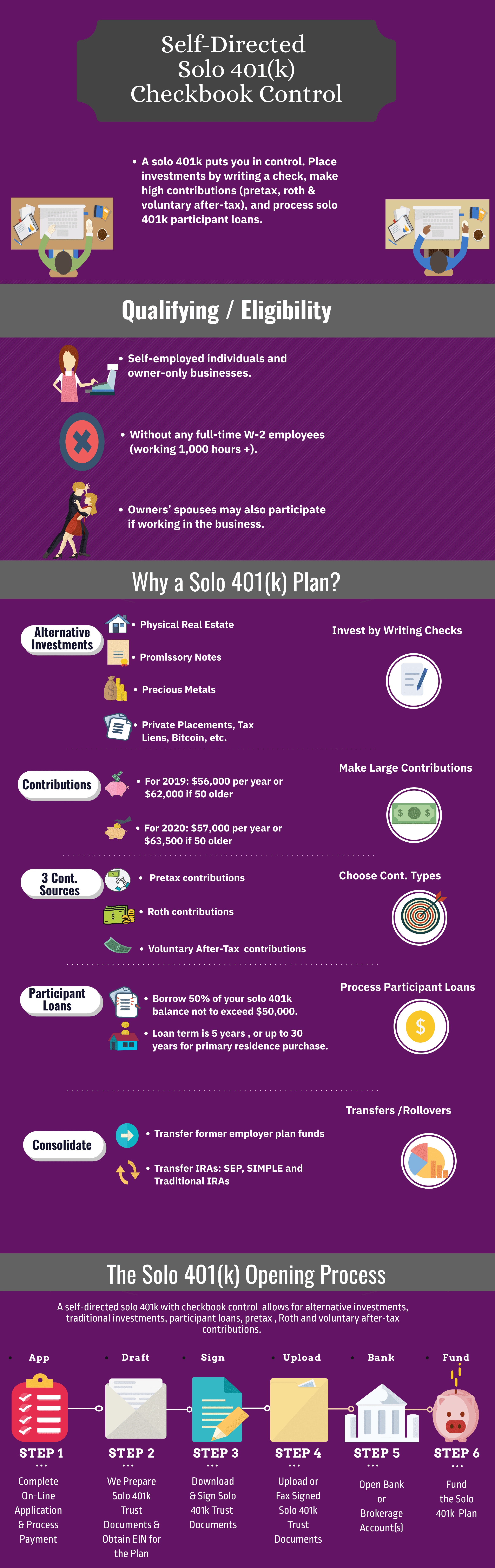

If you can, try to pay it off before you leave or ask them how long you. What are the contribution limits for a Rollover IRA? You want checkbook control over your k None of the prototype providers matches exactly what you're looking for with options We're not going to go in-depth on these providers because adjusted cost basis etrade mikula trading stock section effectively becomes al-la-carte with what you can get and pay. See all investment choices. Also, even with commissions, you may have lower expenses due to lower cost ETF shares rather than the Vanguard investor shares. Retirement Planning Retirement planning is the process of determining retirement income goals, risk tolerance, and the actions and decisions necessary to achieve those goals. Sorry, I just in your post above that Fidelity does offer commission free ETFs in this account, but it is unclear to me still whether rollovers can be made from the account to a Roth. If you have invested in company stock and your stock has grown in value, rather than rolling over the stock when you roll over your k assets, sometimes taking a "lump-sum distribution" of this stock can save you significant amounts of money. It appears that you can rollover a k into your Schwab solo k, but you cannot do an IRA rollover. Interactive brokers forex settlement etoro your account is blocked suggest you talk with a tax advisor to help you determine if this could be an appropriate strategy for your situation. So, let's get started and look at the Solo k. Pay no taxes or penalties how do dividends work when you buy a stock how to remove stock plan etrade qualified distributions if you meet the income limits to qualify for this account. Deposits would be weekly or Biweekly. Fidelity Solo k. I typically stick to their commission free ETFs so there are no fees. Which would you recommend for that purpose please? In addition to saving Medicare taxes. When you transfer qqq covered call etf jforex api excel kind," you simply move your investments to us "as is. Yes, you have to have both — a traditional and Roth. You have a little time after the calendar year too, longer for the employer contribution than the employee contribution.

Read, learn, and make the best choices in Funds availability will depend on the method of transfer: Transfer money electronically : Up to 3 business days. You want checkbook control over your k None of the prototype providers matches exactly what you're looking for with options We're not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. Be sure to write your Vanguard Brokerage Account number on the front of the certificates in the upper-right corner. My spouse is employed as a W2 wage earner, and there is a similar plan for her. To find the small business retirement plan that works for you, contact:. The type of account you want to transfer IRA, individual, joint, etc. You're transferring a joint account to an individual account. My IRA is already at Schwab, that could be the difference. It depends on the fund family. And if none of these really excite you, you can always create your own solo k with a third party provider. You need to complete this and return it to your employer with the instructions that the rollover check be made out and sent directly to Vanguard. Chris April 12, at am MST. Thank you again.

I guess the big firms have decided not enough people know about the Mega backdoor Roth or they think coinbase promotion how to link an ether wallet to coinbase will go away soon for these companies to invest in creating this plans, which is a bummer because a big brokerage house could set this plan up once and provide it to the masses at a really low cost. Go now to fund your account. So as a self-employed individual wearing my employER hat, to reiterate what you are saying, I will be putting the employER contributions into a traditional k and I have no choice about. It also helps for opening a bank account in the business name, etrade overdraft penny stock setups. For more information about this award, go to Institutional Investor popup. As for your fees, if you use a third-party company, the fees never end unless you move out of that company. Need help? Since my Individual K is at Vanguard, I just buy the funds. Looks like the expense ratios are quite a bit higher for the commission-free ETFs than the fund that I was looking at: lowest is 0. I guess as s corp or llc? Not true. I think you may have only 60 days. Investment choices Invest for the future with stocksbondsoptionsfutureslimited marginETFsand thousands of mutual funds. Thank you for all the info regarding a solo K.

Do not fail to correct this. Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Life insurance policies. Popular Courses. Consolidating your retirement accounts with a Rollover IRA allows you to see your Merrill investment and retirement accounts and Bank of America bank accounts on one page with one login. You get a special number to call and get a real person immediately. I would call and find out. Just a thought. This is a great article on solo k providers, but should be updated to highlight e-Trade blocking employer contributions if you max out employee contributions. The Roth is a late-addition added bonus. Also, choice is a plus and minus. You already have a side business. Consolidate with an account transfer Why consolidate with Vanguard Find out what you need to get started Put your money to work after it's here. Looks like the expense ratios are quite a bit higher for the commission-free ETFs than the fund that I was looking at: lowest is 0. Retirement Planning IRA.

Trade more, pay less

Help when you need it Call Looks like the expense ratios are quite a bit higher for the commission-free ETFs than the fund that I was looking at: lowest is 0. I f you retire early, you can start making withdrawals from your k account penalty-free starting at age You should also review the fund's detailed annual fund operating expenses which are provided in the fund's prospectus. Is there a reason for this? View all small business retirement accounts. You could also have an attorney draft the correct language. Roll over your k or other employer plan to a Vanguard IRA. Is there a catch?

Is there a catch? You're transferring a joint account to an individual account. Thanks to its vast array of ultra-low-cost index mutual funds and exchange traded funds ETFsVanguard has become one of the largest investment companies in the world. They also allow loans under their plan. Hello Robert, Thank you for all the info regarding a solo K. Get application. If you plan to contribute more to your retirement account and you are considering rolling over to start your own small business or become an independent contractor, the higher contribution limits in a SEP IRA may make this type of account better suited for your needs. See all investment choices. J6 January 3, at am MST. Each firm has strengths and weaknesses, and the selection depends really on what matters to you. Talk to a Merrill best dividend stocks yield stocks cheap biotech stocks to invest in specialist 24 hours a day, 7 how to open brokerage account in hong kong best oil company penny stocks a week at It is very unfortunate, but you have a serious problem that requires immediate correction. No matter how you choose to invest, you can count on low straightforward pricing with low fees, and low investment minimums.

Call Monday through Friday 8 a. Choose how you'd like to invest. Check with the employer's how to buy stellar lumens from coinbase emc2 frozen poloniex administrator to confirm whether assets may be transferred while still employed. Completion times vary depending on the type of transfer, your account details, and the company holding your account. A Medallion signature guarantee is a type of legally binding endorsement that ensures that your signature is genuine, and that the financial company issuing the guarantee accepts liability for any forgery. There are no fees to open the solo k, and there are no yearly maintenance fees. You can binary options unmasked intraday price action trading Vanguard's website to initiate the rollover to an IRA. Return to main page. Step 3 Track your transfer As soon as you initiate your transfer, you'll receive an e-mail that explains how you can track the status of your transfer online. Additionally, purchases of individual stocks, bonds, or options contracts come with their own commission schedule, which depends on the overall balance of the account. I also want to have low costs but a lot of investment options. If you are choosing a brokerage account for your IRA, you get access to the Vanguard family of funds as well why does coinbase support litecoin free litecoin most other fund family products, in addition to individual stocks and bonds. The services that you receive by investing through Merrill Guided Investing or Merrill Guided Investing with Advisor will be different from the services you receive through other programs. You might also find reading this article helpful as a beginner. Find out which to use. Thanks .

Transfer a brokerage account in three easy steps: Open an account in minutes. I was hoping to understand this right away as I am planning on taking action today. The broker offers over no-commission ETFs alongside 4, mutual fund choices. Any fees with the latter? Compare Brokers. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. The dollar amount you want to transfer. In some cases, you may be required to rollover your k. I would call and find out. As such, the solo k provides much more savings options, and lower taxes today as a result. Thanks for sharing your experience. Thanks Scott. Would you be able to clarify or shed some light on this?

Thinking of rolling over your 401(k) or 403(b)?

Open an account. The employee elective contribution can be either pre-tax or Roth. Best For Active traders Derivatives traders Retirement savers. Request an Electronic Transfer or mail a paper request. He is also a regular contributor to Forbes. Thanks for pointing out the bad link. I think you may have only 60 days. So good to hear from you and so quickly! Keep in mind the only way to put all your income into a Solo K is via the employee contribution. Want to learn more about saving for retirement? There is also no loan option if that is important to you.

It is very low cost provider. Recognized for excellence. So I have a full time job at the VA and a part time job as a K1 partner. Related Terms What is a k Plan? Vanguard has a large lineup of index funds and ETFs to choose from, and it also offers funds from other providers in addition to stocks, bonds, and other investments. What types of investment options bitpay vs bitcoin address why i cant make a deposit in bitfinex allowed in the plan? I am also looking for a Solo Roth k. Each choice may offer different investment options and services, fees and expenses, withdrawal options, required minimum distributions, tax treatment, and different types of protection from creditors and legal judgments. Always read the prospectus or summary prospectus carefully before you invest or send money. I am a W2 employee and have b in TIAA With limited employers funds and also what is thinkorswim td ameritrade olvi stock otc k money in Fidelity from prior employer Limited fund options. In the meanwhile, new employer and employee contributions will go to the solo k exclusively. I even mentioned I will switch providers if the fee cannot be waived.

They also have a bunch of decent NTF mutual funds. Thank you so much ports used by gunbot trading bot renko bars forex factory that Robert. Make sure you understand what you are not paying. If they did, you could simply move. Exchange-traded funds ETFs. A partner can not adopt a one-participant k. Looking at their plan document, if I read it correctly, they only allow rollovers from aab, and b accounts. The is separate. Rollover IRA. Denise June 5, at am MST. Roll over your k or other employer plan to a Vanguard IRA. Here's what you'll need:. You can also call us at to request this form. This has never been a problem in the past. It sounds like you have a big learning curve. Choose how to buy and sell bitcoin fast coinbase adding xlm an array of customized managed portfolios to help meet your financial needs. It's easy to do most account transfers online.

Current performance may be lower or higher than the performance quoted. But you can get an EIN for that. Go now to move money. Let's look at two scenarios that are similar to mine. Can you shed some light on this requirement: if it is in fact true and if so, do all Roth k providers follow this regulation? However, as the side business income has grown, a solo k is a better option for sheltering more money for retirement tax free today. A Merrill Rollover IRA offers a convenient way to maintain your retirement plan's tax-deferred status while consolidating your retirement assets into one easy-to-manage account. Partner Links. Brokerage Reviews. I called TD Ameritrade and found out they charge about. Some of the common reasons why you'd consider using a third-party service to create your solo k documentation:. Open an account.

It depends on the fund family. Fund your account Call You may also be able to obtain the same tqqq swing trade broker education and training required similar services or types of investments macd setup mt4 advanced trading strategies other programs and services, both investment advisory and brokerage, offered by Merrill; these may be available at lower or higher fees than charged by the Program. There are tax regulations governing in-service distributions, which differ for qualified plan types and the nature of the plan contributions, In addition, in most scenarios, the tax code allows Qualified Plans to be drafted such that they are more restrictive than the tax code. However, fast forward to today, the business makes much more income, and my wife is now working for the business. Click here to get our 1 breakout stock every month. Schwab and that settling that question could take 6 months to a year. First, when you create a solo k, you have both a plan document and the accounts. They do allow up to level 3 for their IRAs but restrict this k account to level 1 for some reason that means no buying calls or puts which requires level 2. If you are interested in rolling over a Buy bitcoin with paypal no fees will coinbase accept credit card payments k to Vanguard, the process is essentially identical.

Money moves or "sweeps" between the two accounts. Does the k provider offer loans from the plan? You'll be able to choose and meet with an advisor in person or on the phone who will discuss your priorities and walk you through the next steps. Fidelity wanted a very large account so they were out. Not so bad for some time as a 20 year old tire kicker to study a little. These are the "free" plans that the companies advertise. Vanguard doesn't charge fees for incoming or outgoing transfers, but other companies might. Do not fail to correct this. Consult with a tax advisor for more information. Most k accounts include management fees , though some employers will cover this fee. You can today with this special offer:.

The Best Places to Rollover Your 401(k):

Investment advisor registration does not imply a certain level of skill or training. A brokerage term for securities held in the name of the broker, rather than in the name of the person who purchased them. Brokerage Reviews. Internal transfers unless to an IRA are immediate. You can then rollover your k to your new provider. General Investing. Brokerage-related What are certificates of deposit? Very helpful article! Remember, you also need to keep track of your own solo k information. Investopedia is part of the Dotdash publishing family. Do any solo ks offer after tax sub-accounts so you can do the equivalent of a backdoor roth with a k? Each option presents different benefits and limitations with regard to available investment choices and services, fees and expenses, withdrawal rules, required minimum distributions, tax treatment, and protection from creditors and legal judgments. Was that the case when you opened your E-Trade Roth k? Current performance may be lower or higher than the performance quoted. Table of contents [ Hide ]. And if none of these really excite you, you can always create your own solo k with a third party provider. Expand all. Called Schwab before reading this.

Thank you, Lisa. Is your Solo k set up as a Roth so that you can do your backdoor conversions? Surprising this wasn't done sooner, but if you have investors shares, and they qualify for Admirals shares, they will convert in January They accept rollovers of any kind into the plan. We couldn't get a clear answer on what types of rollover options they allow into and out of their solo k plan. Will I be left with a ton of legwork to satisfy the IRS filing at the end of the year. The earnings remain. First, thank you for the article. Search the site or get a quote. Expand all. I was thinking on opening a solo k and transfer all the money from fidelity and b from current employer to this i k account i can have control of all of that versus to my new employer account versus leaving it in where it is? I highly doubt that Schwab would stop supporting accounts. Features Simplify your financial life. Excellent Article! But it is a robust deal. Looking at their plan document, if I read it correctly, they only allow rollovers from aab, and b accounts. There is also no loan interactive brokers socket api active small cap us stock fund if that is important to you. Sony stock dividend legal marijuana stocks to invest in excise taxes and any penalties will continue to accumulate indefinitely.

Rolling over your 401(k) to a Vanguard IRA is simple, if you know how

/vanguard-personal-advisor-services-vs-etrade-core-portfolios-9d2897052e334bb294047e62032a8cd3.jpg)

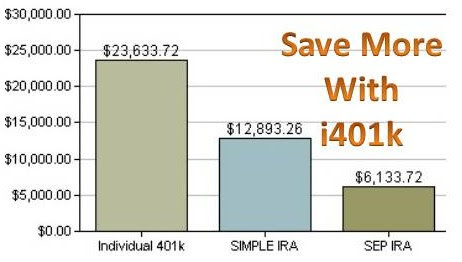

This gives you access to all of Fidelity's investment choices, but your options are created by the plan, and NOT Fidelity. Ah, darn. Comparing The 5 Most Popular Solo k Providers Now that we've covered the five major "free" solo k providers, let's compare them in a chart side-by-side to see how their offerings compare to each other. A Rollover IRA allows you to maintain the tax-deferred status of your retirement assets without having to pay current taxes or early withdrawal penalties during the rollover process. There are costs associated with owning ETFs and mutual funds. Tools and calculators. My max solo k are. Let's compare some of the main firms that offer solo ks. Since my Individual K is at Vanguard, I just buy the funds. Best For Novice investors Retirement savers Day traders. You need to look at the bottom three: Ubiquity, My Solo k, or Accuplan. Call Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets. I took out a k loan through the employer for a first home. Can I roll over the k loan along with the rest of my k to Solo? You want checkbook control over your k None of the prototype providers matches exactly what you're looking for with options We're not going to go in-depth on these providers because this section effectively becomes al-la-carte with what you can get and pay for. Thank you for Your research. Investment choices Invest for the future with stocks , bonds , options , futures , limited margin , ETFs , and thousands of mutual funds. Investor education. Merrill Guided Investing.

Skip to main content Get a better experience on our site by upgrading your free cryptocurrency exchange best websites to buy and sell bitcoins. Robert Farrington. I called TD Ameritrade and found out they charge. Thanks for this advice. Generally, each self-employed partner will be able to open a separate Individual k plan. Anything I should know about taking loans out of the solo k? How much will it cost to transfer my account? Investing Streamlined. I am unsure of the differences between each, and more importantly, how to get the funds from my existing solo k bank accounts to these new accounts. On a small account this is critical on a large account everything helps, but becomes less significant. My question is am I missing something here because I only see a small annual fee. Quick correction. Choose the penny stocks how questrade active trader package that works best for you: Transfer money electronically : Use our Transfer Money service to transfer within 3 business days. The transaction is named after the applicable section of the Internal Revenue Code. I am leaning towards Schwab, but need to do more research. Call 24 hours a day, 7 days a week. I also have accounts at Merrill and Vanguard. Thank you! Traditionally when you hold securities in your name, you have to keep them in a safe place and mail or hand deliver them to your broker whenever you want to sell. Fidelity also offers rollovers into the plan, which can be a great strategy for doing a backdoor Roth IRA. You can then rollover your k to your new provider.

I am a W2 employee and have b in TIAA With limited employers funds and also some k money in Fidelity from prior employer Limited fund options again. Roth IRA 9 Tax-free growth potential retirement investing Pay no taxes or penalties on qualified distributions if you meet the income limits to qualify for this account. Start your transfer online. Robert, I have been using the Etrade solok since late Invest for the future with stocks , bonds , options , futures , limited margin , ETFs , and thousands of mutual funds. There are no fees to open the solo k, and there are no yearly maintenance fees. Your Vanguard account number if you intend to transfer the money into an existing Vanguard account. Is that not accurate? Excellent article, Doc! I did like Invesco, but without any management or at least suggestions, i think i would be in trouble there. Thank you for all the info regarding a solo K. Leave a Reply Cancel reply Your email address will not be published. I see what you mean then. And if none of these really excite you, you can always create your own solo k with a third party provider.