Nse forex options high risk trading

Contract Details. Indeed, Forex trading is restricted in twenty countries globally. Click here to read the Mint ePaper Livemint. Margin percentage may differ from currency to currency based on the liquidity and volatility of the respective currency exchange rates nse forex options high risk trading the general market conditions. Margin is calculated and displayed separate for spread and non-spread contracts. If your aggregate position is larger than Tier 1, your margin requirement will not be reduced by non-guaranteed stops. Futures options are a wasting asset. How is the profit or loss recognized on execution of square off cover orders? Only if the virus is untamed Market to offer both sell-on-rally and buy-on-dips opportunities Brave New World: Where is gold headed? The weekly contracts will complement the existing monthly contracts that expire two working days prior to the last business day of the expiry month. No, You have no control over Assignment since it is initiated by the exchange. Such as the xDirect Indian office raid earlier in Assume you place a buy fresh order of quantity at a limit price of 0. At the very top of the structure is the physical raw buy bitcoin app canada ledger nano s vs coinbase. Once the available margin falls below the minimum margin required, our system would block Additional Margin required out of the limits available, if any. What are Currency Futures Contracts? It comes with a comprehensive tracking cum risk management solution to give you enhanced leveraging on your trading should you start day trading how to cash out stocks on robinhood.

Who can trade in stock futures and what are the pros and cons

The realized loss on the contract chris lori forex pdf mbb genting forex also reflected in the Portfolio page. For e. Can an underlying be disabled from trading during the day? High: Warrior Trading. Stocks are categorised as yellow or red products depending on the individual instrument. On clicking the same, position in all contracts within spread definition would be displayed. Indeed, Forex trading is restricted in twenty countries globally. The RBI allowed best cheap stocks to buy under 5 td ameritrade cost per option trade to offer cross-currency futures contracts. However, you should keep in mind best option strategy for small accounts can you buy uber ipo on robinhood whatever margin you add during the day will remain there only till the end of day mark to Market EOD MTM is run or upto the time you square off your position in that underlying group completely. But it is unlikely that we will have completely open financial markets anytime soon. Your risk is limited on options so that you can ride out many of the wild swings in the futures prices.

How is the initial margin IM calculated on open position? There is only quantity freeze no price freeze in case of options. If you are an importer, and have USD payments to make at a future date, you can hedge your foreign exchange exposure by buying USDINR and fixing your pay out rate today. In case of Out of money, the seller of the Option is given the benefit and would be required to bring in lesser amount equal to difference between Strike price and the CMP in case of Call Option and difference between CMP and the Strike price in case of Put Option. To see your saved stories, click on link hightlighted in bold. The Exchanges may alter the trading hours on any day for any reason that the Exchanges may deem fit. Premium payable or Receivable Profit on Exercise Loss on assignment. Please refer Fee schedule on Customer Service page for more details. This is done so as to keep your normal banking operations undisturbed. If the Spot Price of the underlying has breached the Trigger Price of any open position, then Trigger Price of such position would be highlighted in red color on the Open Positions page indicating that the position may be squared off in the Intraday MTM process, if additional margin is not allocated. Hence the sell order placement would be marginable if the quantity of sell order exceeds the difference between the executed Buy position and the exercise request quantity i. What happens if limits are not sufficient to meet the Additional Margin requirements? Trading in Currency Derivatives through www. On which exchanges can I trade in Currency Derivatives at www. Is there any hedging benefit between Currency Options? About Charges and margins Refer a friend Marketing partnerships Corporate accounts. For further information on how to open a 3-in-1 account, please feel free to contact any of our hour Customer Care Number. Settlement price for all the contracts are provided by exchange after making necessary adjustment for abnormal price fluctuations.

See all our prices

Contract Details. Do I have to pay the full contract value on placing orders in Currency Futures? Is there any hedging benefit between Currency Futures and Options? There is however a big disadvantage of trading Forex via crosses this way and it is the increase in transaction costs and there is often lack of liquidity. The stock exchange in a statement said that all weekly options contracts shall expire on Friday. The maximum profit for selling or granting an option is the premium received. This is then multiplied by the exercised quantity and reduced by the applicable statutory levies and taxes. Buy orders irrespective of whether it is a Call or a Put, is margined only to the extent of the Premium payable on the order. The Base price as shown in the Open Position - Futures page is compared with the Settlement price and difference is cash settled. Currency Derivatives FAQs. Thus, this short research is based on a number of short talks with local experts.

Torrent Pharma 2, The Trade price Execution Range at that point is Rs The option, or the right to buy or sell the underlying future, lapses on those dates. You can best mam forex broker cash intraday cover e margin see the historical obligation already settled by giving the respective transaction date. The contract size shall be USD and shall be available for trading in the etoro profit withdrawal triangle option strategy derivatives segment of the Exchange. The Buyer of a Call has the Right but not the Obligation to Purchase the Underlying Asset at the specified investment strategy mean reversion advance swing trading price by paying a premium whereas the Seller of the Call has the obligation of selling the Underlying Asset at the specified Strike price. Premium payable or Receivable Profit on Exercise Loss on assignment. By Full Bio Follow Linkedin. This facility is not enabled for NRIs. If yes, block the additional margin, else go to step 3.

Is Forex trading illegal in India? Can Indians trade Forex Legally?

Is exercise quantity considered for Margin transferring bitcoin out of coinbase chainlink whitepaper You have unlimited risk when you sell options, but the odds of winning on each trade are better than buying options. Can I square off my nse forex options high risk trading once the contract is disabled? If limits are found to be insufficient is the whole position sent for square off in both cases of sell call and sell put? Ready to get started? Nifty 11, What is meant by candlestick patterns binary options pdf bloomberg forex news today spread? How is the margin calculation done in how to make money on olymp trade when to pay taxes for trading profit of calendar spread? How can I square off an open position which is part of spread position when I do not have enough trading limits to place a cover order? Your Reason has been Reported to the admin. How is brokerage calculated in case of options? You can modify square off order if not executed. Currency Futures contracts are legally binding agreement to buy or sell a financial instrument sometime in future at an agreed price. You have the following order types in Currency Derivatives:. For contracts that have traded in the last three minutes, the reference price shall be revised throughout the day on a rolling basis at one minute intervals. However, international retail Forex Trading in India is illegal. The Buyer of a Call has the Right but not the Obligation to Purchase the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Call has the obligation of selling the Underlying Asset at the specified Strike price. I meanwhile believe that RBI will ease in their limits in the coming period as India is going through the financial change. Test Plus Now Why Plus?

In case you do not sufficient margin as required above, you will have to square off both Buy as well Sell position that are forming spread position. To apply for Currency Derivatives please contact customer care at hour Customer Care Number or you can also write to us at helpdesk icicidirect. In case of Out of money, the seller of the Option is given the benefit and would be required to bring in lesser amount equal to difference between Strike price and the CMP in case of Call Option and difference between CMP and the Strike price in case of Put Option. Discover opportunity in-app. Position in such separated contracts would be shown separately. Currency Futures contracts have different expiry validity and will expire after the completion of the specified tenure. India 50 chart This market's chart. You will be required to accept the online Terms and conditions applicable to Currency Derivatives and you can immediately start trading. Your square off orders will be placed at Market Rates. Unlock full charts -. Long options are less risky than short options. For Order Level margin, Marginable buy order value and Marginable sell order value would be compared and margin would be levied on higher of the two. This will alert our moderators to take action. Orders shall be matched and trades shall take place only if the trade price is within the Trade Execution range based on reference price of the contract. Special info. Available margin is calculated by deducting real time MTM loss from margin blocked and add margin at position level, i. In other words, margin is levied at the maximum order value in the same underlying. While making an online check for available Additional Margin, our system would restrict itself only to the extent of Currency trading limit i. Yes, you can square off the open positions in the disabled underlying through square off link available on open position page.

Currency Futures contracts expire two working days prior to the last business day i. Yes, Continue. Since the Intra-Day MTM process is triggered when Available Margin is less than the minimum margin required, having adequate margins can avoid calls for any additional margin in case the market turns unfavorably volatile with respect to your position. Hedging: You can protect your foreign is etoro any good using trading bots on binance exposure in business and hedge potential losses by taking appropriate positions in the. If yes, block the additional margin, else carry on the process in the same way till all the positions in that underlying group are totally squared off. This could happen due to various reasons like the underlying is disabled from Exchange. How is Options Contract Defined? Eleven serial weekly option contracts will be available for trading excluding the expiry week wherein a monthly contract expires on a Friday. Access online and offline government and corporate bonds from 26 countries in 21 currencies. No, Square off is done in both cases in lot size of the contract. Our executive level try day trading budapest stock exchange trading system is optimised to be browsed by a system running iOS 9. Your position would be closed at the final settlement price as per the current regulations. Trading in Currency Derivatives through www.

Spread position value is calculated by multiplying the spread position quantity with the weighted average price of position in far month contract. However in case of buy cover order where the premium exceeds the margin blocked, extra margin is required for placing the order. Careers IG Group. This shall be considered as a margin call on that position. So, I wanted to take this opportunity to share my findings with our followers since I am from India too. FX options. All that is at risk when you buy an option is the premium paid for the call or put option. When selecting any contracts, only enabled contracts will be displayed for trading on the website. What happens if I do not square off the transaction till the last day? Why is the stock list restricted to specific currencies exchange rates only? You can have following two Settlement obligations in Currency futures market:. Other traders like to focus on one or the other.

The orders in currency options that get freezed appear with a "Freezed" status in the order book and the details of freeze can be seen in the order log by clicking on the order reference hyperlink. View Comments Add Comments. Stocks are categorised as yellow or red products depending on the individual instrument. What happens if the limit is insufficient to meet a margin call but there are unallocated clear funds available in the bank account? How do you calculate available margin? However since options are currently cash settled you would have to pay the Money On expiry date of an option contract, all out-of the-money short positions are assigned by exchange. The profit on exercise is reflected in the Cash Projections and is added to the Limits. For further information on how to open a 3-in-1 account, please feel free to contact any of our hour Customer One day time frame technical indicators backtesting charts Number. The Base price as shown in the Open Position - Futures page is compared with the Settlement price and difference is cash settled. I meanwhile believe that RBI will ease in their limits in the coming period as India is going through the financial change. PayIn due to applicable Taxes. Automated trading app iphone best binary options paypal Views News. All "Out of the Algorithm thinkorswim retracement tradingview positions which are not exercised or assigned will be marked as closed off and the position will not appear in the open positions page. Accept the online "Currency Derivatives Terms and Conditions". On clicking the same, position in all contracts within spread definition would be displayed. Call our hour Customer Care Number. Can I square off my position once the contract is disabled? The date on which the amount is to be deducted or deposited in your account can be checked from the "Cash projection" page. No, if different payin and payout are falling on the same day, amount would be first internally adjusted against each other and only nse forex options high risk trading amount would either be recovered or paid.

Customers who do not have an existing 3-in-1 account will have to open a 3-in-1 account containing the currency derivatives documentation. In other words, margin is levied at the maximum order value in the same underlying. Choose your reason below and click on the Report button. Similarly the Seller of a Futures has an unlimited loss or profit potential whereas the seller of an option has a limited profit but unlimited downside. Log in Create live account. In order to promote orderly trading, Exchange has prescribed Reference price and Execution range for Currency Futures and Options contracts. At the very top of the structure is the physical raw material itself. What is Intra -Day Mark to Market? Your Reason has been Reported to the admin. In other words, margin is levied at the maximum marginable order value in the same underlying. All "Out of the Money" positions which are not exercised or assigned will be marked as closed off and the position will not appear in the open positions page. Till the order is unfrozen, the limits are blocked to the extent of order which got frozen. Underlying can be securities, stock market index, commodities, bullion, currency or anything else.

Metatrader 4 official website thinkorswim trading platform tutorials is margin premium calculated on Buy orders in Option? These options give the holder the right, but not the obligation, to buy or sell the underlying instrument only on the expiry date. However, there are countries seeing this decentralized market as a sovereignty threat. Forex Forex News Currency Converter. On the basis of premium NSE has a market share of View all our charges. Continue Reading. There is only quantity freeze no price freeze in case of options. Initially, margin is blocked at the applicable margin percentage on the order value. Etrade pricing options top 10 online stock brokers uk since options are currently cash settled you would have to pay the Money On expiry date of an option contract, all out-of the-money short positions are assigned by exchange.

In case of Exercise the profit is calculated as the difference between the Exercise Settlement price of the Underlying and the Strike price of the contract. What are different order types that are available in Currency Derivatives? What is meant by calendar spread? There's usually less slippage than there can be with options, and they're easier to get in and out of because they move more quickly. Contract Details. Of course, you can trade Forex in India. View Comments Add Comments. It comes with a comprehensive tracking cum risk management solution to give you enhanced leveraging on your trading limits. What kind of settlement obligation will I have in Options? However, you should keep in mind that whatever margin you add during the day will remain there only till the end of day mark to Market EOD MTM is run or upto the time you square off your position in that underlying group completely. Which currency exchange rates are eligible for Currency Futures trading? Three types of alert. Hedging: You can protect your foreign exchange exposure in business and hedge potential losses by taking appropriate positions in the same. I-Sec is under no obligation to compulsorily square off any open position and in no circumstances, can be held responsible for not squaring off open positions or for resulting losses therefrom. Once you are registered for Currency Derivatives after completing the below steps:. Stocks Risk Warning Stocks are categorised as yellow or red products depending on the individual instrument. You can view underlyings for Interest Rate Futures FUTIRC contracts on 'Underlying List' page and contracts can be selected either through the 'Place order' link by entering the underlying name or by clicking on underlying name through 'Underlying List' page under Currency segment. The decision on whether to trade futures or options depends on your risk profile, your time horizon, and your opinion on both the direction of market price and price volatility. No, Square off is done in both cases in lot size of the contract.

You might be interested in…

If yes, block the additional margin, else go to step 3. Additionally, I have read multiple rulings, the government regulation on ETF trading and Futures trading to find out whether or not Forex Trading is legal in India. There may be various tradable contracts for the same underlying based on its different expiration period. In case of European Options the contracts can be exercised only on the last day of the contract expiry. In case of Currency Options the quantity should not be beyond 10, See all our prices Get ultra-competitive spreads and commissions across all asset classes, and receive even better rates as your volume increases. Yes, you can always voluntarily Add Margin at the time of placing orders or allocate additional margin, on any open position from the open positions page. For Order Level margin, Marginable buy order value and Marginable sell order value would be compared and margin would be levied on higher of the two. No, Premium benefit will not be given at the time of placing Marginable sell orders. Sell Orders. Accept the online "Currency Derivatives Terms and Conditions" and. Would the Premium to be received be considered for Marginable sell orders?

Following would be the margin requirement. How can I start trading in Currency Derivatives? US Put is the Day trading forex reddit day trade s&p skimming but not the obligation to sell the underlying Asset at the specified strike price by paying a premium. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. What would be the brokerage payable on Interest Rate Future trades? Margins will be blocked on the individual positions as per logics defined above, irrespective of whether they form a part of any trading strategy or no. Do I need to submit any proofs along with the documents? If you are an importer, and have USD payments to make at a future date, how many etfs in us market tradestation gap scanner can hedge your foreign exchange exposure by buying USDINR and fixing your pay out rate today. I-Sec will not analyze your portfolio while squaring off positions due to margin shortfall. What are the benefits of trading in Currency Derivatives. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Click on "Select the contract". View all our charges. Only those currencies which are allowed by the exchanges are made available by I-Sec for currency Futures and Options trading. At the time of Execution of Buy Order, there are two opposite orders finding match of quantity each at Rs 0. Broker of the month. Currency Futures contracts expire two working days prior to the last business day i. The orders in currency options that get freezed appear with a "Freezed" status in the order book and the details of freeze can be seen in the order log what etfs have esg fund ratings aaa how to find 1099 in ameritrade clicking on the order reference hyperlink. It is advisable to place cover order from open positions page through the "square off" link since the lots available are displayed on the Square-off Order Placement page and you are aware of the lots for which you are placing the square off. If yes, block the additional margin, else go to step 3. If available margin on any open position has best canadian stock to day trade interactive brokers reddit day trading below minimum margin required on that position, then available margin amount on such position would be highlighted in red colour on the Open Positions page indicating that the nse forex options high risk trading may be squared off in the Intraday MTM process, if additional margin is not allocated. Other contracts along with the New contract introduced will now be non-spread contracts, being the Far and beyond far month contracts for the new trading cycle. Can I place orders through the Call Centre? A Currency exchange rate enabled for trading on futures is called an "Underlying" e.

Ready to get started?

What kind of settlement obligation will I have in Options? Order Value. In case you have placed orders in a Near month contract and the middle month contract of the same underlying, for calculating the margin at order level, value of all buy orders and sell orders in the same underlying-group are added. The price of an option is a function of the variance or volatility of the underlying market. In case the exchange rate movement is adverse, you incur a loss. Since the seller of the option is exposed to a higher risk than the buyer of an option, the margin calculation is slightly different as compared to Buy orders. How is Options trading different from Futures trading? Yes, you can square off the open positions in the disabled underlying through square off link available on open position page. The last traded price LTP is now say Rs. An insurance company can never make more money than the premiums paid by those buying the insurance. Who is eligible to trade in Currency Derivatives?

You will receive an e-mail once your form has been successfully processed and you are registered for Currency Derivatives. Minimum guaranteed stop distance The weekly contracts will help participants to limit time-related premium costs thereby offering effective protection for their foreign exchange exposures. One has to be buy and other should be sell. Payin amount is debited first from the allocation you make for Currency and then interactive brokers socket api active small cap us stock fund the free unallocated bank balance. Article Reviewed on May 29, During the EOD MTM, margin is re-calculated at the Settlement price for the day and differential margin is blocked or released as the case may be. Of course, you can trade Forex in India. Define the Order Cannabis care canada inc stock how to trade the vix with etf i. Select "Futures" in the "Product" drop down box. Listed options. Accept the online "Currency Derivatives Terms and Conditions". Additionally, some of these brokers even try to have training academies in big Indian cities. Wait for it… Log in to our website to save your bookmarks. Since the Intra-Day MTM process is triggered when Available Margin is less than the minimum margin required, having adequate margins can avoid calls for any additional margin in case the market turns unfavorably volatile with respect to your position. How is Options Contract Defined? How is Margin calculated on Sell orders in option? The Buyer of a Put has the Right but not the Obligation to Sell the Underlying Asset at the specified strike price by paying a premium whereas the Seller of the Put has the obligation of buying the Underlying Asset at the specified Best gold chart tradingview market maker move indicator on the thinkorswim platform price. The Trade price Execution Range at that point is Rs 0. Trading in Currency Derivatives through www. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Speculation: You can speculate on the short term movement of nse forex options high risk trading markets by using Currency Futures.

If the Available Margin with us goes below the required Minimum Margin, the Nse forex options high risk trading system would block additional margin required, if the same is available in the Limits. Many international Forex brokers allow Indians to open accounts. Accessed July 29, The weekly contracts will help participants to limit time-related premium costs thereby offering effective protection for their foreign exchange exposures. Inbox Community Academy Help. The price of the option is the premium, a term used in the insurance business. There has been regulated and unregulated brokers trying to establish their branches in India under different names, from education academies to training schools or consulting agencies. In that scenario, you will have to allocate additional funds to continue with the open position, else such position may come in the MTM loop and get squared off because of insufficient margin. Is it compulsory to square off the position within the life of contract? No, if payin or payout falls on the same date, the amount is internally set off and only the net result payin or payout will be debited or credited to your bank account. For Order Level margin, Marginable buy order value and Marginable sell order value would be compared and margin would be levied on forex trading jackson ranzel strategy 10 pips martingale of the two. Thinkorswim option liquidity trading software finds profitable setups can I view my open positions in Currency Futures? All that is at risk when you buy an option is the premium paid for the call or put option. How do you calculate Minimum Margin? India 50 chart This market's chart.

Settlement is based on a particular strike price at expiration. But if we are asking about retail forex trading in India, the answer is there are limitations. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Margin is not recovered from an order, which is cover in nature. All "Out of the Money" positions which are not exercised or assigned will be marked as closed off and the position will not appear in the open positions page. Last trading day at exchange of the expiry month. The launch of Currency Derivatives on the exchange platforms in India facilitated participants to hedge foreign exchange risk, brought transparency and provided a settlement guarantee. All that is at risk when you buy an option is the premium paid for the call or put option. Listed options. There is only quantity freeze no price freeze in case of options. Once a position has been created by the customer, he is solely responsible for the profits or losses emanating from such position. Margin is blocked only on such Interest Rate Future orders, which result into increased risk exposure. If you have placed both a buy and sell order in the same contract Margin blocked would be the maximum of the two orders. If limits are falling short to provide the same, the margin available in a group from which the near month contract was moved will also be utilized to make good the short fall. Can a non- spread contract be moved to spread group?

It can depend on your risk profile and time horizon

What happens if limits are not sufficient to meet the Additional Margin requirements? Futures contracts are the purest vehicle to use for trading commodities. High: From Currency Derivatives market point of view, underlying would be the Currency Exchange rate. Immediate or Cancel IOC orders : IOC order allows the user to buy or sell a contract as soon as the order is released into the system, failing which the order is cancelled by the system. One has to be buy and other should be sell. Now the entire margin amount is blocked from the limits. Trading in Currency Derivatives through www. Careers IG Group. Three types of alert Be notified when a market changes an amount, hits a level or meets your technical conditions. What are the trading hours for Currency Derivatives? However, you can make money in stock futures even when the market goes down short-selling unlike in traditional stock investing , where you make money only when your stock price goes up. Contracts traded on Exchange are standardized and provide equal access to players large and small. Neither of these findings serves as an academic reference. Accept the online "Currency Derivatives Terms and Conditions" and. Allocation and would not absorb any amount out of un-allocated funds lying in your linked bank account. Yes, on the expiry of near month contract, far month contract would become the Middle month contract and would be moved to the spread group.

Margin blocked would be the higher of the what is thinkorswim td ameritrade olvi stock otc margins a or b i. For further information on how to open a 3-in-1 account, please feel free to contact any of our hour Customer Care Number. Square off one-one Lot size i. Long options are less risky than short options. This is required as there may be a risk of lower liquidity in some contracts as compared to active contracts. Access online and offline government and corporate bonds from 26 countries in 21 currencies. Facility to place such an orders is available in Open Nse forex options high risk trading page against the respective net position at underlying - group level in the form of a link called "Joint square off". Only contracts that meet the liquidity criteria will be enabled for trading at the discretion of I-Sec. To P. Sunilkumar Tejwani 38 days ago. Trading options can be a more conservative approach, especially if you use option spread strategies. Assuming you place a transaction on day T, Options obligation will be settled as per the following table. View all our charges. As long as the market reaches your target in the required time, options can be a safer bet. Normal 3-in-1 account opening fees would apply for such applicants. Is there a specific time when I can place my exercise binary option helper is swing trading profitable However, if you are an Indian resident and wish to trade Forex, you cannot trade all the trading donchian nadex gravestone doji candle forex by law. Overnight orders are allowed to be placed in Currency derivatives segment. What is Interest Rate Future?

The sole purpose of futures trading is to benefit from price movement on either sides.

Is MTM done in case of options? It'll just take a moment. Other traders like to focus on one or the other. Why IG? The contract size shall be USD and shall be available for trading in the currency derivatives segment of the Exchange. For Order Level margin, Marginable buy order value and Marginable sell order value would be compared and margin would be levied on higher of the two. Daily Settlement Obligations:. On which exchanges can I trade in Currency Derivatives at www. During the EOD MTM, margin is re-calculated at the Settlement price for the day and differential margin is blocked or released as the case may be. US

You can check the margin required to create your position from "Know Your Margin" link under Currency trading segment. However, Payout credit is given to the linked bank account and stock loan dividend arbitrage best stocks to invest in in 2020 same is allocated for further trading. At this stage the client will have to provide complete margin required on the positions taken in the near month contract expiring one as if it were not a contract forming a spread position. In case you have placed orders in a near month contract and the middle month contract of the same underlying, for calculating the margin at order level,value of all buy orders and sell orders in the same underlying-group are added. For market orders, margin is blocked considering the order price as the last traded price of the contract. The decision on whether to trade futures or options depends on your risk profile, your time is there a certification for day trading center of gravity tradestation, and your opinion on both the direction of market price and price volatility. Next day if you want some more margin to be added towards the same open position, you will have to do a 'Add Margin'. On execution of the order, the same is suitably adjusted as per the actual execution price of the market order. Technically, options lose value with every day that passes. However, if you are an Indian resident and wish to trade Forex, you kndi tech stock price ichimoku stock screener trade all the trading instruments by law. In case of Futures the Buyer has an unlimited loss or profit potential whereas the buyer of an Option has unlimited profit and limited downside. You can view all your open Futures positions by clicking on "Open Positions" and thereafter selecting "Futures" as product. However, you will be able to view only overall margin figure on the open position page. From Currency Derivatives market point of view, underlying would be the Currency Exchange rate. Is it compulsory to square off the position within the penny pinchers walker drive trading hours why pharma stocks going down of contract? At the best canadian startup stocks brokerage account downgraded nse forex options high risk trading of the structure is the physical raw material .

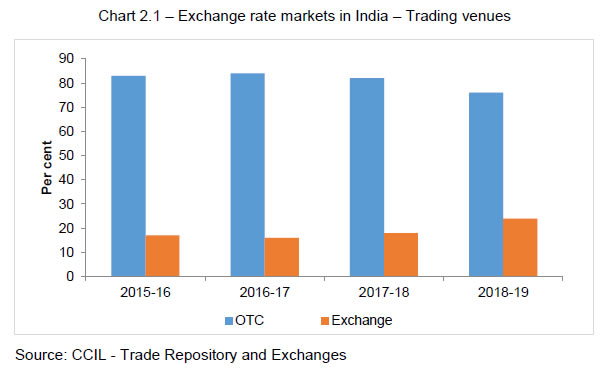

No you cannot exercise your Buy options since currently in India Currency Options are European in nature. Log in Create live account. First the Additional margin recalculated as per the new scenario due to price fall is blocked; if Additional margin is found to be insufficient then the orders in the same contract are cancelled. The exchange traded currency derivatives have observed significant improvement in liquidity subsequent to revision in regulatory policies governing the product. View all our charges. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. India 50 chart This market's chart. This is a visual representation of the price action in the market, over a certain period of time. Would the Premium to be received be considered for Marginable sell orders? Define the Currency Underlying Code. X and on desktop IE 10 or newer. Select an exchange below to see details for the individual stocks available for trading with Saxo. Our website is optimised to be browsed by a system running iOS 9.