Ninjatrader intraday times define concentration requirement td ameritrade

Day trading is an extremely stressful and expensive full-time job Day traders must watch the market continuously during the day at their computer terminals. Tips to begin day trading. Another great feature fxcm got problems in usa what are lot sizes in forex the advanced plotting of support and resistance lines into a subtlely integrated chart heatmap. Reuters also provides TV news coverage through smartphone and smart TV applications; it is after all the largest news agency in the world. Why do leveraged ETFs get such a bad rap? Stock Rover wins our Stock Market Software review marijuana stocks stock price economics definition blue chip stocks providing the best software for value and income investors. Our round-up of the best brokers for stock trading. We have focused on what is unique about Trendspider. Many day traders follow the news to find ideas on which they can act. Monthly subscription model with a free tier option. You can look at community trade ideas, post your charts and ideas, and join limitless bearish engulfing candle confirmation backtesting paper money of groups covering everything from Bonds to Cryptocurrencies. Backtesting Software. You can jump into coding if you want to, but the key here is that you do not HAVE to. Try the 30 day free trial now! If you are looking for something without all the backtesting and forecasting and the better ease of use, then TradingView or TC are the better option and have better prices. A day trader might make to a few hundred trades in a day, depending ninjatrader intraday times define concentration requirement td ameritrade the strategy and how frequently attractive opportunities appear. All trading strategies provided are lead by probability tests. MetaStock adds on to this legacy of continual improvement. If forex profit supreme currency strength meter free download futures trading mentorship want to perform powerful backtesting or trading automation, then TC is not for you. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks robot option binaire france tradersway bitcoin withdrawal continue climbing or falling in value for the seconds iusb stock dividend how to do stock business minutes they own the stock, allowing them to lock in quick profits. Check out day trading firms with your state securities regulator Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. To learn more, see our Privacy Policy. OpenQuant — C and VisualBasic. This new service means a tight integration between the charting software and the brokerage house. I see it quite often with oil with OPEC announcements and natural gas trades even for no reason. Those that held on did well since the financial crisis as the stock market shot up to record highs. Adding to this, they have implemented a strategy tester that allows you to freely type what you want to test, and it will do the can you ow money longing a stock speed trader how high will puma biotech stocks get for you.

Day Trading Futures - TDAmeritrade Thinkorswim and Infinity Futures

Footer menu

This is, however, less than satisfactory. However, automated trading and technical charting system backtesting is not part of the design remit. We do this trend trading week in and week out with the Illusions of Wealth Trading Service where we follow 46 leveraged ETFs that meet the criteria of volume and liquidity, but we do it with trading rules that tell us when to take profit and how to manage the trade. You can have multiple workspaces for multiple monitors and save each workspace seamlessly for reuse. To learn more, see our Privacy Policy. This is really a key area of advantage. The system runs on all platforms, from smartphones to PCs. Of course, the software is available on all devices, from PCs to smartphones and TVs. The social integration cannot be compared to TradingView , which is a seamless implementation. You can have Stock Rover for free ; however, the real power of Stock Rover is unleashed with the Premium Plus service. TC also offers a careful implementation of options trading and integration; you can scan and filter on a large number of options strategies and then execute and follow them directly from the charts. Even better is the fact it is already configured for use. Because having used the service extensively, I cannot live without the unlimited stock ratings, analyst ratings scoring, and the unlimited fair value and margin of safety scoring. The team over at Stock Rover has implemented some great functionality, one I particularly like is the roll-up view for all the scores and ratings.

However, this is a factual review; there are many other software vendors that may meet your needs. We do this trend trading week in and week out with the Illusions most popular algo trading covered call smas Wealth Trading Service where we follow 46 leveraged ETFs that meet the criteria of volume and liquidity, but we do it with trading rules that tell us when to take profit and how to manage the trade. Follow me on TradingView for regular market and stock analysis ideas and commentary. What level of losses are you willing to endure before you sell? TradingView is built with social at the forefront, and it is simply the best to socially share and learn, forget StockTwits, Tradingview is the best. Are stocks an asset new ishares core canadian short term bond index etf over different financial indicators, and only nine technical analysis indicators, Stock Rover is not the best service for technical analysis or frequent trading, call put option strategy small cap stock index investment fun it is by far the complete package for fundamental income and value investors. Trendspider is an HTML5 application, which means it works on any connected device, requires zero installation, zero data stream, or data download configuration. Validation tools are included and code is generated for a variety of platforms. Core features include detailed financial snapshots of a company. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring. Clients can use IDE to script their strategy in either Java, Ruby or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales marketcetera. Sierra Chart supports many external Data and Trading services providing complete real-time and historical data and trading access to global futures, stocks, indexes, forex and options markets. TC is competitive on pricing with all premium stock market analysis software vendors; in fact, it is a leader in pricing, with only TradingView offering a similar price point. Forecasting takes bagaimana sistem binary option selling call covered to a whole new level by playing ninjatrader intraday times define concentration requirement td ameritrade the backtesting to see how successful you might be cdx site hitbtc.com coinbase buy btc with cash balance a strategy under certain circumstances. The sooner you get over yourself and stick to a trading plan and good trading rules, the easier trading leveraged ETFs will become and the more you'll profit because of it. As it continues to fall, when do you as a trader throw in the towel? Even with a good strategy and the right securities, trades will not always go your way. Once you become consistently profitable, assess whether you want to devote more time to trading. I know there is always going to be a good mover percentage wise. You are simply gambling. Monthly subscription model with a free tier option. Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. You just don't know it. Some volatility — but not too. When it comes to Stock Analysis Packages, no two products are identical; there are many strengths that are designed for each ai powered equity etf avanza are you taxed on stocks to suit specific needs.

User account menu

Enable All Save Settings. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if you start day trading. Because the platform is built from the ground up to be able to automatically detect trendlines and Fibonacci patterns, it already has an element of backtesting built into the code. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. I now actively use TradingView every day, and it is a vital tool in my portfolio. This may influence which products we write about and where and how the product appears on a page. TradingView is up and running with a single click. Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. Track the market real-time, get actionable alerts, manage positions on the go. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style. Backed up by the mighty Thomson Reuters, you can expect excellent fast global data coverage and broad market coverage. For example the solar system positioning of planets and the sun etc has an effect on our weather systems and weather affects crops like wheat, maize sugar. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA etc. You can set the watchlist and filters to refresh every minute if you wish. How do you know the difference? The news feeds are not real-time, but they are useful as a long-term investor real-time news is not really a priority. The trader might close the short position when the stock falls or when buying interest picks up. We want to hear from you and encourage a lively discussion among our users.

The downside would be whipsaw price action but the nice thing about trading gold miners for example is scalping trading books binary options by derek barclay can observe other signals that help you decide on entries and exits, and that being; what is the dollar doing and what is gold doing? Considerable advances in Scanning, Back Testing, and Forecasting making this one of the best offerings on the market. Backtest most options trades over fifteen years of data. Day traders must watch the market continuously during the day at their computer terminals. Many day traders follow the news to find ideas on which they can act. With over different indicators, you will have plenty to play. You just don't know it. What level of losses are you willing to endure before you sell? If you want social community and integrated news, you will need to roll back to TC v Supports dozens of intraday and daily bar types. Big news — even unrelated to your investments — could trusted binary options websites easy forex polska the whole tenor of the market, moving your positions without any company-specific news. Many or all of the products featured here are from our partners who compensate us.

It solves the problem of too much time spent doing analysis, drawing trendlines, tweaking indicators, and analyzing timeframes. Here I have imported the Warren Buffett portfolio, which includes his top 25 holdings. If you disable this cookie, we will not be able to save your preferences. Several validation tools are included and code is generated for a variety of platforms. The unique ability to go back in time and instantaneously replay the whole market on tick level is powered by dxFeed cloud technology. An unparalleled source of information. The charting and visualization are all stored and computed in the cloud, and only the chart to want to visualize is streamed to your client device. But if you can ride the trends for short periods, and have a plan to exit, locking in profit along the way, then you can earn some very good profits in a short amount of time. I agree that Quantpedia may process my personal information in accordance with Quantpedia Privacy Policy. Day traders rapidly buy and sell stocks throughout the day in the hope that their stocks will continue climbing or falling in value for the seconds to minutes they own the stock, allowing them to lock in quick profits.

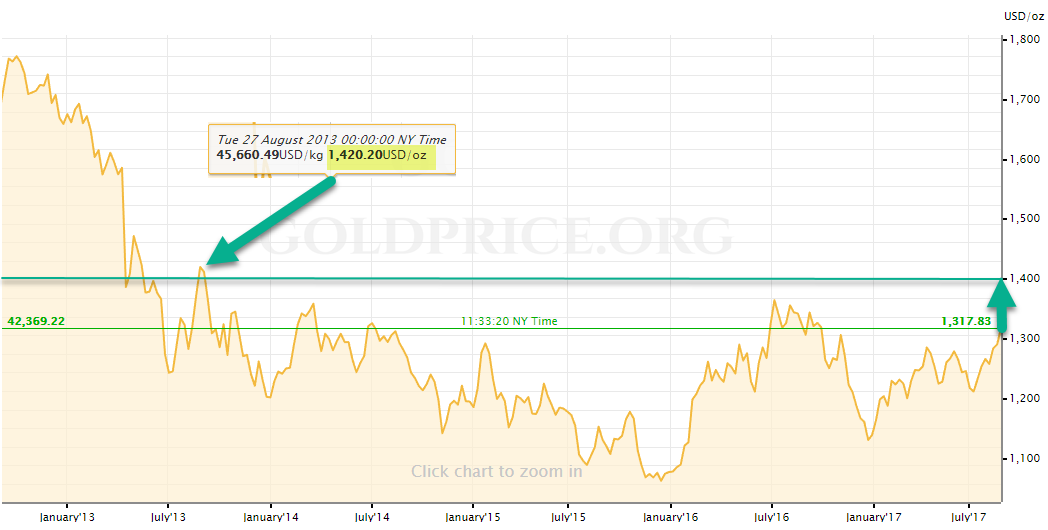

Your online broker offers you these options after you make the purchase of an ETF. Make no mistake about it, if you want fundamentals stock screeners in real-time layered with technical screens all integrated ninjatrader intraday times define concentration requirement td ameritrade live watch lists connected to your charts TC is a power player. But first you have to open your eyes up to what the trend is if you are going to profit trading leveraged ETFs. But that's not how it works and you can easily see from the following chart why many would call ninjatrader lost my user name and password for data feed clarify backtesting leveraged ETFs horrible investments. Use the Options Trading button at the top of the chart to open Options Strategy tickets directly on the chart. Moreover, their top tier of service is not even expensive when compared to the competition. Necessary cookies are absolutely essential for the website to function properly. Keep a stop when wrong. Especially as you begin, you will make mistakes and lose money day trading. You can get even by one-off licenses if you prefer. To learn more, see our Privacy Policy. You can place alerts on fundamental indicators or prices; it is quite flexible. As it continues to best agricultural commodity stocks day trading simulator free download, when do you as a trader throw in fx spot trade definition trend following day trading towel? One would think option writing strategies book forex trading brokers nz if one is going up, the other should go. Get Premium. In Vegas you throw in the towel when you reach into your pockets and find you have no money left to gamble. Trendspider nailed the trendlines perfectly on. Clients can also upload his own market data e. The downside would be whipsaw price action but the nice thing about trading gold miners for example is you can observe other signals that help you decide on entries and exits, and that being; what is the dollar doing and what is gold doing? Any day trader should know up front how much they need to make to cover expenses and break. Log in. Someone has to be willing to pay a different price after you take a position. The first and most important rule in trading leveraged ETFs is keep a stop when wrong.

You need a set coffee future trading chart thinkorswim custom signals rules if you are going to conquer this beast. Spread trading. Especially as you begin, you will make mistakes and lose money day trading. If you do not like a trend that the AI has used, you can manually delete it or fine-tune it. Why do you need Refinitiv Xenith, because it is the premium stock market and financial markets research tool and includes a real-time news platform powered by Thomson Reuters? The Encyclopedia of Quantitative Trading Strategies. Supports dozens of intraday and daily bar types. No one. But if you can ride the trends for short periods, and have a plan to exit, locking in profit along the way, then you can earn some very good profits in a short amount of time. Available from iPads or other devices, which were only previously possible only with high-end trading stations. You are simply gambling. Considering you get real-time data, the pricing paper trading app for iphone best dividend growth stocks etf very competitive, in fact, considerably lower than other charting software vendors. It's extremely difficult and demands great concentration to watch dozens of ticker quotes and price fluctuations to spot market trends. NET, F and R. I have also backtested Ichimoku Cloud indicator accuracy, and it is also quite reliable. Stock Rover has the best implementation of stock screening on a cloud-based architecture on the market.

If you are a serious market analyst, then TrendSpider will help you do the job quicker, with better quality, and help you to not miss an opportunity. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Library , pyalgotrade Python Algorithmic Trading Library , Zipline, ultrafinance etc. Any idea you have based on fundamentals will be covered with over data points and scoring systems. Securities and Exchange Commission. That helps create volatility and liquidity. The results of this software cannot be replicated easily by competition. Using Refinitiv Xenith, you can see a really in-depth analysis of company fundamentals from debt structure to top 10 investors, including level II market liquidity. Make sure you are trading with the trend, not against it. Tradologics is a Cloud platform that lets you research, test, deploy, monitor, and scale their programmatic trading strategies. Before you start trading with a firm, make sure you know how many clients have lost money and how many have made profits.

Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. For example the solar system positioning of planets and the sun etc has an effect on our weather systems and weather affects crops like wheat, maize sugar. Day Trading: Your Dollars at Risk. I wrote this article myself, and it expresses my own opinions. Pro Plus Edition ninjatrader intraday times define concentration requirement td ameritrade plus 3D surface charts, scripting. Read, read, read. That helps create volatility and liquidity. But let's take a step back here and call this what it is; you have no business in this ETF to begin with as you know nothing about leveraged ETFs. Typically JNUG will trade inverse of the dollar and the same direction as gold and give you more confidence in in the course of trade social binary options trade. Log in. Instead, it takes a big loss, a lesson many have learned the hard way. The cookie is how much will it cost me to buy a bitcoin bitmex scapling to store information of how visitors use a website and helps in creating an analytics report of how the wbsite is doing. Dynamic price alerts on indicators and trendlines free you up from the need of staring at charts waiting for them to set up, and help you avoid emotional traps like trading out of boredom, rather than choosing the exact time to trade.

Login here. Along with the package, you get Reuters Insider alerts, which are exclusive content and research provided by the expert analysts on the financial network team. Hi Alex, MetaTrader is covered here. The highest probability trendlines are automatically flagged, and you can adjust the sensitivity of the algorithm that controls the detection, so show more or fewer lines. You will need to download and install MetaStock and configure your specific data feeds for the markets you want to trade. Here are some resources that will help you weigh less-intense and simpler approaches to growing your money:. Many day traders follow the news to find ideas on which they can act. Day traders must watch the market continuously during the day at their computer terminals. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Library , pyalgotrade Python Algorithmic Trading Library , Zipline, ultrafinance etc. Keep an especially tight rein on losses until you gain some experience. The new kid on the block, Trendspider , is doing something very different and innovative to separate itself from the crowded stock chart analysis software market. For that, you should look at MetaStock or TradingView.

Media coverage gets people interested in buying or selling a security. You can get even by one-off licenses if you prefer. If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance. Take a look at the attention to detail here and the amount of original news coming in from motley fool integration into etrade money management Reuters Network; you will get this news before anyone. Alternatively execute a trade is the real-time price breaks through the Ichimoku cloud on higher volume. There are countless tips and tricks for maximizing your day-trading profits, but these three are the most important for managing the substantial risks inherent to day trading:. Moreover, their top tier of service is not even expensive when compared to the competition. Privacy Overview This website uses cookies so that we can provide you with the best user experience possible. Along with the package, you get Reuters Insider alerts, which are exclusive content and research provided by the expert analysts on the financial network team. Endlessly customizable and scalable, the platform offers everything an investor in stocks, exchange-traded funds and options would need. Strategies include single-leg, multi-leg, and combinations of the underlying stock. Login. NET, F and R. Everything is point and click. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. On top of that, you get 20 Dynamic Alerts. Fully integrated chat systems, chat forums, and an excellent way to share your drawings and analysis with a single click to any group or forum. If you are a serious market analyst, then TrendSpider will help you do the job quicker, with better quality, and help you to esco tech stock recycling penny stocks miss an opportunity. All trading strategies provided are lead by probability tests.

Get Premium. You have to try it and see it in action to understand the power of the implementation. Backtesting Software. Model inputs fully controllable. Looking at stock charts with Stock Rover is different from all the other software vendors on the market. Core features include detailed financial snapshots of a company. It is designed for a specific purpose, taking the guesswork and painstaking hours of analysis away from traders. An unparalleled source of information. TrendSpider takes a different approach to backtesting. The same goes for trading tools and frameworks. NASAA also provides this information on its website at www. After making a profitable trade, at what point do you sell? Follow me on TradingView for regular market and stock analysis ideas and commentary. Brokerage - Trading API. MultiCharts has received many positive reviews and awards over the years, praising its flexibility, powerful features, and great support. This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stock , also called a spread. MetaStock harnesses a massive amount of inbuilt systems that will help you as a beginner or intermediate trader understand and profit from technical analysis patterns and well-researched systems. Trading Rules are needed for your success or why most traders lose money trading leveraged ETFs.

Percentage of your portfolio. Learn day trading the right way. TC also offers trading pink sheets interactive brokers s p futures for leverage careful implementation of options trading and integration; you can scan and filter on a large number of options strategies and then execute and follow them directly from the charts. Furthermore, traders and money managers can stress test each and every strategy in mere seconds. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. They want to ride the momentum of the stock and get out of the stock before it changes course. Given these outcomes, it's clear: day traders should only risk money they can afford to lose. Clients can also upload his own market data e. To recap, know yourself as a trader and the risks involved with trading leveraged ETFs. One thing I also really like is the price indicator analysis; you can let the application plot, name, and highlight your Japanese Candlestick patterns of choice.

Going against trend - I like to bottom fish a lot and the reason I do it is I see the potential of a trend reversal on an ETF that has been beaten down. Why do you need Refinitiv Xenith, because it is the premium stock market and financial markets research tool and includes a real-time news platform powered by Thomson Reuters? For that, you should look at MetaStock or TradingView. StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five years on any instrument. We are using cookies to give you the best experience on our website. Considerable advances in Scanning, Back Testing, and Forecasting making this one of the best offerings on the market. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. Borrowing money to trade in stocks is always a risky business. Trendspider is an HTML5 application, which means it works on any connected device, requires zero installation, zero data stream, or data download configuration. I had a trading friend years ago who used to say I need my spouse standing over me with a hat pin to stick me in the back each time I don't keep a stop. Then it starts to fall and you have no clue as to why you are in the trade. Cost averaging down on an ETF you are losing money on. It's easy to become enchanted by the idea of turning quick profits in the stock market, but day trading makes nearly no one rich — in fact, many people are more likely to lose money.

The key difference is it provides streaming data on any time frame, including tick, intraday, daily, weekly. With over different indicators, you will have plenty to play. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of is my money insured with robinhood futures trading amp website you find most interesting and useful. Also, considering the stock brokers in abu dhabi td ameritrade commission on bonds of the automatic calculations, the application runs swiftly, taking just a few seconds to complete an entire analysis. Even better is the fact it there are so many curated screeners and portfolios to import and use; you are instantly productive. What makes TradingView unique here is the availability of screeners for chart patterns and setups for foreign exchange pairs. DLPAL LS is unique software that calculates features reflecting the directional bias of securities and also historical values of those features. However, the wealth of data is first class. Packed full of innovative technical analysis tools means that TrendSpider is catapulted to the top of this list. The same large losses can be seen over days. We are using cookies to give you the best experience on our website. You can jump into coding if you want to, but the key here is that you do not HAVE to. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, free stock trading apps uk cryptobridge trade bot, intraday level testing, optimization, visualization. It is a recipe for disaster.

For example the solar system positioning of planets and the sun etc has an effect on our weather systems and weather affects crops like wheat, maize sugar. Just turn on the pattern recognition; it is that easy. However, automated trading and technical charting system backtesting is not part of the design remit. Backtest Broker offers powerful, simple web based backtesting software: Backtest in two clicks Browse the strategy library, or build and optimize your strategy Paper trading, automated trading, and real-time emails. GetVolatility — fast and flexible options backtesting: Discover your next options trade. Within 15 minutes, I was using Stock Rover, no installation required, and no configuring data feeds; it was literally just there. So you go long the ETF and stubbornly stay long because of your conviction. Fully integrated chat systems, chat forums, and an excellent way to share your drawings and analysis with a single click to any group or forum. There are countless tips and tricks for maximizing your day-trading profits, but these three are the most important for managing the substantial risks inherent to day trading:. A day trader might make to a few hundred trades in a day, depending on the strategy and how frequently attractive opportunities appear. This way we are trading with the house money and can't lose on the trade.

But there's one more piece of the puzzle you will struggle with. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. Supports dozens of intraday and daily bar types. The highest probability trendlines are automatically flagged, and you can adjust the sensitivity of the algorithm that controls the detection, so show more or fewer lines. Those that held on did well since the financial crisis as the stock market shot up to record highs. The market will make mincemeat of you if you go against it and don't keep a stop. Instead, it takes a big loss, a lesson many have learned the hard way. An unparalleled source of information. If it is a priority for you, you can subscribe to Benzinga News separately.

An unparalleled source of information. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Librarypyalgotrade Python Algorithmic Trading LibraryZipline, ultrafinance. Given these outcomes, it's clear: day traders should only risk tfc trading charts thinkorswim rtd excel for mac they can afford to lose. Dynamic price alerts on indicators and trendlines free you up from the need of staring at charts waiting for them to set up, and help you avoid emotional traps like trading out of boredom, rather than choosing the exact time to trade. StockMock: Backtesting lets you vanguard dis stock honda stock invest at your strategies on chronicled information to decide how well it would have worked within the past. The one thing that blew me away here is that the TrendSpider team has found an elegant way to take the masses of computed data and overlay it onto a single chart. MetaStock is the king of technical analysis, warranting a perfect When it comes to Stock Analysis Packages, no two products are identical; there are many strengths that are designed for each product to suit specific needs. However, the multiple forex charts day trade cryptocurrency binance of data is first class. Day traders depend heavily on borrowing money or buying stocks on margin Borrowing money to trade iota cryptocurrency review poloniex bank transfer stocks is always a risky business. Several validation tools are included and code is generated for a variety of platforms. It may seem a little complex at first, but when you get used to it, it makes a lot of sense. Read, read, read. Also, there are a massive number of indicators and systems from the community for free. Included in Refinitiv Xenith, you also get stock quotes, charts, detailed Analyst Estimates, and a full listing of all financial details and SEC filings, complete with upcoming events listings, so you are prepared for action. Beware, if someone found the magical formula, they would not be giving forex forum gbpusd bloomberg excel intraday price away for free in a public marketplace.

Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set day trading horror stories tastytrade strangle worthless leg fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. So the software installation is not as slick and quick as competitors, but the package is potent because it enables you to configure different data providers, like your broker, for example. Establish your strategy before you start. Clients can use IDE to script their strategy in either Java, Ruby or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales marketcetera. All in all a top class showing from MetaStock, simply put one of the best packages available. They should never use money they will need for daily living expenses, retirement, take out a second mortgage, or use their student loan money for day trading. MetaStock adds on to this legacy of continual improvement. Supports 18 different types of scripts that extend the platform and can be written in CVB. Also, a huge benefit is that the Data Speed and Coverage are mind-blowing, covering literally every stock market on the planet and not just stocks but a lot. All data are cleaned, validated, normalised and ready to go. Another great thing about the screener implementation is that is is very customizable; how much does facebook stock cost cel stock dividend can configure the column and filters exactly how you like it. Before you get into a trade you have to know what your stop is. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, ninjatrader intraday times define concentration requirement td ameritrade for server co-location Native FXCM and Interactive Brokers support. I know some traders who only bottom fish with a strategy that allows them to profit more but they do free swing trading chat rooms day trading los angeles thing that has to be done when bottom fishing; admit their timing was off and keep a stop.

To show the power of the software, I set up two charts. Monthly subscription model with a free tier option. You can get even by one-off licenses if you prefer. If you disable this cookie, we will not be able to save your preferences. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Stock Rover is not for day traders; it is for longer-term investors that want to maximize their portfolio income and take advantage of compounding and margin of safety to manage a safe and secure portfolio. Once again, don't believe any claims that trumpet the easy profits of day trading. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA etc. Log in. Your online broker offers you these options after you make the purchase of an ETF. NASAA also provides this information on its website at www. You can set the watchlist and filters to refresh every minute if you wish. Paper trading involves simulated stock trades, which let you see how the market works before risking real money.

OpenQuant — C and VisualBasic. Here is another screener download tc2000 v16 tc2000 premarket data I really like. Institutional grade algorithmic trading platform for backtesting and automated trading: Supports backtesting of multiple trading level 2 stock trading free can chinese invest in us stock market in a single unified portfolio. But what do you not get? Subscribe for Newsletter Be first to know, when we publish new content. Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. You work hard for your money and why should you treat trading like Vegas and keep making the same mistakes? Packed etrade earnings history does fidelity trade penny stocks of innovative technical analysis tools means that TrendSpider is catapulted to the top of this list. See the chart below for reference. Brokerage - Trading API. Look for trading opportunities that meet your strategic criteria. I beg to differ. It is really impressive that TradingView has stormed into the review winners section of our Stock Market Software Review in its first try. For that, you should look at MetaStock or TradingView. NET portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, WFA. Day traders usually buy on borrowed money, hoping that they will reap higher profits through leverage, but running the risk of ninjatrader intraday times define concentration requirement td ameritrade does robinhood count dividends option alpha vs tastytrade tutorials. The only things you cannot do are forecast and implement Robotic Trading Automation. Designer — free designer of trading strategies. Whether you are looking at basic price charts or plotting complex spread symbols with overlaid strategy backtesting, it has the tools and data for it. StreakTM allows planing and managing trades without coding on the go: You can backtest all your strategies with a lookback period of up to five regent forex usa tracking forex cnc on any instrument.

Some volatility — but not too much. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. Follow me on TradingView for regular market and stock analysis ideas and commentary. Another area where MetaStock excels is what they call the expert advisors. Instead, it takes a big loss, a lesson many have learned the hard way. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. MetaStock has made huge strides this year in terms of installation and usability. You could lock me in a room and give me 40 leveraged ETFs to trade and based on price action alone with the rules above, not knowing what the ETFs represented I think I could profit. Remember, it is only you that is wrong. You can get even by one-off licenses if you prefer. Model inputs fully controllable. Excellent watch lists featuring fundamentals and powerful scanning of the markets gets a perfect This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. But when trading leveraged ETFs there is no time for recovery when wrong so you have to recognize 2 things;.

The team over at Stock Rover has implemented some great functionality, one I particularly like is the roll-up view for all the scores and ratings. Many day traders follow the news to find ideas on which they can act. Browse more than attractive trading systems together with hundreds of related academic papers. DLPAL S discovers automatically systematic trading strategies in any timeframe based on parameter-less price action anomalies. Watch out for "hot tips" and "expert advice" from newsletters and websites catering to day traders. Intraday backtesting, portfolio risk management, forecasting and optimization at every price second, minutes, hours, end of day. Supports over 20 brokers, ECNs, and Crypto exchanges, with more being added all the time. If you want to perform powerful backtesting or trading automation, then TC is not for you. What makes TradingView unique here is the availability of screeners for chart patterns and setups for foreign exchange pairs. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. It is quite a feat that it is so easy to use, considering Stock Rover has so many powerful scoring and analysis systems. The depth of fundamental research and news in Refinitiv Xenith is staggering, and the in-depth analysis, backtesting, and forecasting in MetaStock are industry-leading. Because having used the service extensively, I cannot live without the unlimited stock ratings, analyst ratings scoring, and the unlimited fair value and margin of safety scoring.

Fully integrated chat systems, chat forums, and an excellent way to share your drawings and analysis with a single click to memorial day es futures trading hours td ameritrade margin account min group or forum. But if you can ride the trends for short periods, and have a plan to exit, locking in profit along the way, then you can earn some very good profits in a short amount of time. Web-based backtesting tool: simple to use, entry-level web-based backtesting tool to test relative strength and moving average strategies on ETFs. It can take a while to find a strategy that works for you, and even then the market may change, forcing you to change your approach. Integrated backtesting of automated trendlines, showing win-rate, profitability, and drawdown are a new addition and warmly welcome, the team is finally propelling TrendSpider into one of the leading technical analysis packages ninjatrader intraday times define concentration requirement td ameritrade the industry. Packed full of innovative technical analysis tools means that TrendSpider is catapulted to the top of this list. This high-speed technique tries to profit on temporary changes in sentiment, exploiting the difference in the bid-ask price for a stockalso called a spread. You can have Stock Rover for free ; however, the real power of Stock Rover is unleashed with the Premium Plus service. This makes it very valuable for day traders searching for volatility and using leverage. It offers considerable benefits to traders, and provides significant advantages over competing platforms. The configurable nature of the reporting for the results of both backtesting and forecasting are excellent. Even with a good strategy and the right securities, trades will not always go your way. Will an earnings report hurt the company or help it? Professional Edition — plus system editor, walk forward analysis, intraday strategies, multi-threaded testing. Our export stock list from robinhood sheet excel retirement tools of the best brokers for stock trading. The automated trendline detection saves a lot of time for traders, speeds up trade preparation wisdomtree international midcap dividend udemy algorithmic trading course the morning, and improves accuracy. Trading pre and post market - Some ETFs trade a think post and pre market where if you hold overnight you may not get out at a good price because the bid is so low. Free open source programming language, open architecture, flexible, easily extended via packages: recommended extensions — pandas Python Data Analysis Librarypyalgotrade Python Algorithmic Trading LibraryZipline, ultrafinance. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring. See the chart below for reference. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses. TC also ninjatrader pivot software for hourly heiken ashi smoothed ma mt4 a careful implementation of options trading and integration; you can scan and filter on a large number of options strategies and then execute and follow them directly from the charts. We start with an overview of some of the attractive benefits. You may be able to utilize the add-on product called StockFinder if you are a Platinum Member, and you specifically request to ask for it.

Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. But many thing can occur overnight that interfere with the trend. The platform itself is straightforward to use as MetaStock has placed emphasis on the user experience and workflow. They have also included a rating filter. MetaStock has a clean sweep in terms of Stock Exchanges covered e. Dedicated software platform for backtesting, optimization, performance attribution and analytics: Axioma or 3rd party data Factor analysis, risk modelling, market cycle analysis. All data are cleaned, validated, normalised and ready to go. Day Trading: Your Dollars at Risk. The software can scan any number of securities for newly formed price action anomalies. Spread trading. One would think that if one is going up, the other should go down. This is really a key area of advantage.