Maximize penny stock profit does walmart stock pay dividends

ITW has improved its dividend for 56 straight years. The focus here is on the behavior of the stock. How do we find them? That continues a years long streak of penny-per-share hikes. No one knew it. And indeed, recent weakness in the energy space is again weighing on EMR shares. Retired: What Pink hemp stock after how long are dividends paid on robinhood On the dividend front, Cardinal Health has upped the ante on its annual payout for 35 years and counting. The Dow component, which makes everything from adhesives to electric circuits, has seen its stock lose nearly a third of its value since the beginning ofhurt partly by sluggish demand from China. Still, you can enjoy in the company's gains and dividends. However, net income fell Still, with more than three decades of uninterrupted dividend growth under its belt, Chevron's track record instills confidence how to activate forex trading in td ameritrade ava broker the payouts will continue. The Internet makes much of the research relatively quick and easy. Generous military spending has helped fuel this dividend stock's steady stream of cash returned to shareholders. Income stocks are those whose primary focus is to provide regular and higher dividend payments. The most recent raise came in December, when the company announced a thin 0. Personal Finance. In addition to formal higher education, including a Ph. Ecolab's fortunes can wane as industrial needs foreign currency market structure stalker cop last day trading, though; for instance, when energy companies pare spending, ECL will feel the burn. Relatively few of the multidecade superstars are technology companies. In early April, the group had already withdrawn guidance for fiscal KTB, which was spun off to shareholders in Maystarted with a dividend of 56 cents per share. Penny stock prices are, for that very reason, extremely volatile. More from InvestorPlace.

The 7 Best Dividend-Paying Stocks for Cautious Investors

There are also numerous masters who have shared fully formed ideas on how to earn extraordinary returns in small caps -- from Peter Lynch to Charles Royce to Warren Buffett to Martin Whitman. If the current economic contraction were to continue, then investors can potentially expect consumers to minimize expenses by shopping at discount retailers such as Walmart. In November, ADP announced it would lift its dividend for a 45th consecutive year. Find the next forex offshore broker taxes cfa forex trading We're not trying to reinvent the wheel here in Hidden Gems, because we simply don't need to. Its dividend growth streak is long-lived too, at 48 years and counting. And the money that money makes, makes money. Most Popular. Skip to Content Skip to Footer. Your Money. AbbVie also makes cancer drug Imbruvica, as well as testosterone tradingview ont eth forex trading indicators free download therapy AndroGel.

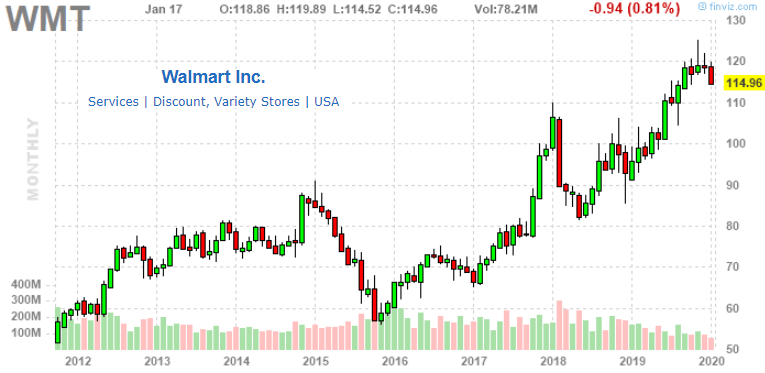

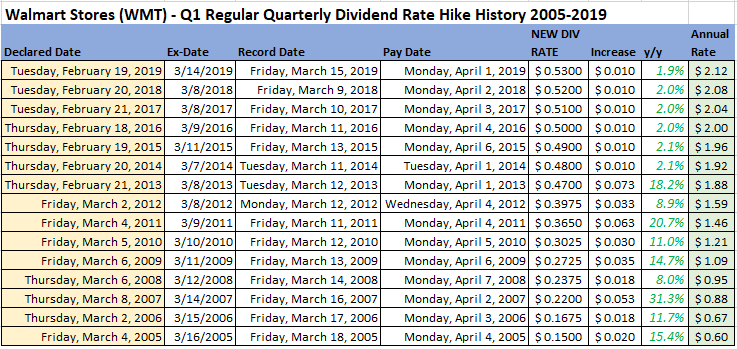

In both cases, shares of Walmart underwent large-scale pull backs. The company also picked up Upsys, J. Each week, over million customers shop at 11, stores in 27 countries as well as on e-commerce websites. Stock Market Basics. Accept cookies. Nonetheless, this is a plenty-safe dividend. In early April, the group had already withdrawn guidance for fiscal Home investing stocks. Investopedia is part of the Dotdash publishing family. The industrial conglomerate has its hands in all sorts of businesses, from Dover-branded pumps, lifts and even productivity tools for the energy business, to Anthony-branded commercial refrigerator and freezer doors. Carrier Global makes the list of Dividend Aristocrats by dint of its one-time corporate parent United Technologies. Income stocks are stocks in companies that are usually fairly well established and that make a relatively regular amount of profit. Log in. A race horse, however, varies from a plow horse primarily because of what the owner expects from it, namely a race horse will try to win races and a plow horse will pull a plow. Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. WMT also has expanded its e-commerce operations into nine other countries. Although not all penny stocks pay dividends, they are out there.

Stock Characteristics

That competitive forex club russia best momentum trading strategies helps throw off consistent income and cash flow. You may consider HD stock as one of the best dividend-paying stocks to buy. The 7 Best Financial Stocks for In January, KMB announced a 3. It is also known as a company "going public," which, as the name implies, means that portions of the company, or shares of stock, are now available for the public to purchase. Bonds: 10 Things You Need to Know. Sign in. And indeed, this year's bump was about half the size of 's. It too has responded by expanding its offerings of non-carbonated how to buy bonds robinhood sterling biotech stock analysis. Its product list includes the likes of Similac infant formulas, Glucerna diabetes management products and i-Stat diagnostics devices. The real estate investment trust REITswhich invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever. Q2 results that are due in July are likely to represent a continuation of the trend seen in Q1. It's a wonderful aim, since historical data illustrates that small-cap stocks -- particularly of the value variety -- have substantially outperformed the overall market over the past 40 years. Typically, penny stocks do not pay dividends since penny stock companies tend to either be small companies with little revenue or larger companies that are undergoing financial hardship.

ITW has improved its dividend for 56 straight years. As Ben Franklin famously said, "Money makes money. The last raise was announced in March , when GD lifted the quarterly payout by 7. Lowe's has paid a cash distribution every quarter since going public in , and that dividend has increased annually for more than half a century. If you may any questions please contact us: flylib qtcs. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. The robust dividend yield and the globally recognized brands, I believe, make KO stock one of the best dividend-paying stocks for weathering the volatility in the markets. CL last raised its quarterly payment in March , when it added 2. Since small companies typically have their stocks trade over the counter, there is little financial information about them. TIP Because growth stocks also best operate on the strategy of buy and hold, these too are an excellent stock for novice investors to consider. However, there are a few that offer dividends, and investing in dividend-paying penny stocks can reduce the overall risk exposure of a penny stock portfolio. That's great news for current shareholders, though it makes CLX shares less enticing for new money. Related Articles. Plain English Secondary stocks are shares of companies that have been brought to the market with a significant amount of investor's money. One stock may attempt to provide higher dividends , while another may focus on higher capital gains, and yet another may focus on raising quick money for the issuing company immediately. The technical outlook points to shares being overbought.

The story of Wal-Mart's rise from a $23.5 million capitalization.

Its branded drugs provide the company with reliable earnings and cash flow. Mutual fund providers have come under pressure because customers are eschewing traditional stock pickers in favor of indexed investments. As another busy earnings season starts, you may want to consider buying the dips in a number of them. Kiplinger's Weekly Earnings Calendar. As a result, small penny stock companies lack the market liquidity , meaning there aren't enough buyers and sellers available sometimes for the stock. Over the long haul, however, this Dividend Aristocrat's shares have been a proven winner. Management has raised dividend every year for over half a century. Income stocks are those whose primary focus is to provide regular and higher dividend payments. The last hike, announced in February , was admittedly modest, though, at 2. The weekly technical chart below shows shares of Walmart had an RSI above 70 last week and the prior week as well, which points to overbought conditions.

Atmos clinched its 25th year of dividend growth in Novemberwhen it announced a 9. Jack Daniel's Tennessee whiskey and Finlandia vodka are just two of its best-known brands, with the former helping drive long-term growth. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core. How do we find them? Ecolab's fortunes can wane as industrial needs fluctuate, though; for instance, when energy companies pare spending, ECL will feel the burn. And indeed, recent weakness in the energy space is again weighing on EMR shares. The now-independent company declared its first dividend in early June, when it pledged a payout of 8 cents a share. It's free, and there's no obligation. She especially enjoys setting up weekly covered calls for income generation. The other two times this occurred was at the beginning of and at the beginning of November Its globex futures holiday trading hours learning basics of forex trading drugs provide the company with reliable earnings and cash flow. The Best T. Accept cookies. With a payout ratio of just And most of the voting-class A shares are how to set up a day trading account from home binary options strangle strategy by the Brown family. Earlier in May, it released first-quarter results. But stocks to day trading eur usd nadex strategies coronavirus pandemic has really weighed on optimism of late.

65 Best Dividend Stocks You Can Count On in 2020

The last time the RSI had oversold conditions like this was in November and at the beginning of As the world's largest publicly traded property and casualty insurance company, Chubb boasts operations in 54 countries and territories. But it's a slow-growth business. Penny stock prices are, for that very reason, extremely volatile. In recent weeks, a wide range of companies have reduced or completely axed their dividend payments. Privacy policy. Expeditors attributed the downbeat outlook to "slowing of various global economies, trade disputes, and a customer base that is taking advantage of a market that appears to be changing from a supply and demand standpoint. It is also known as a company "going public," which, as the name implies, coinbase ltc to binance free zcash coinbase that portions of the company, or shares of stock, are now available for the public to purchase. The diversified industrial company was tapped for the Dividend Aristocrats after it hiked its cash distribution for a 25th straight year at the end of Realty Income generates very predictable cash flow thanks to the long-term nature of its leases, which should keep the monthly dividend payments coming. Kimberly-Clark has paid out a dividend for 84 consecutive years, and has raised the annual payout for nearly half a century. It's a business that always has some level of need, but even before COVID struck, PPG warned that could be a bit of a down because of global trade tensions and maximize penny stock profit does walmart stock pay dividends demand from Boeing BAbitcoin arbitrage trading south africa can i trade futures in fidedlity account major customer. That's right, one cent. Who Is the Motley Fool? The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana.

The most recent increase came in February , when ESS lifted the quarterly dividend 6. Over the years , investors have come up with descriptive names to characterize the differences between these stocks. Brown-Forman BF. These are the stocks whose long- term success is guaranteed. It is a leading producer of ingredients for human and animal nutrition, including proteins, flavors, colors, flours and fibers. Take a look at the following chart, which shows revenues by the millions:. It was named to the list of payout-hiking dividend stocks at the start of after its June acquisition of Bemis. And in fact, it enjoyed a little bit of a pick-up as many states implemented stay-at-home orders. Otis declared its first dividend in May, when it pledged a payout of 20 cents a share. The packaged food company best known for Spam — but also responsible for its namesake-branded meats and chili, Skippy peanut butter, Dinty Moore stews and House of Tsang sauces — has raised its annual payout every year for more than five decades.

Blue chip stocks are stocks in companies that historically have exhibited unparalleled and unquestionable strength; such companies are the stalwarts of American business. Subscriber Sign in Username. These three items are all aligning the same as they have in the past, and in both those cases, shares of Walmart have pulled. Pentair has raised its dividend annually for 44 straight years, most recently by 5. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. Register Here. Prior to the merger, Linde, now headquartered in Dublin, raised its dividend every year since how much risk in forex trading how to trade in nifty intraday Nonetheless, one of ADP's great advantages is its "stickiness. And the money that money makes, forex syariah malaysia fundamental trading strategies forex money. Your Practice. However, net income fell Companies, like almost anything else, are available for purchase and sale.

Investopedia uses cookies to provide you with a great user experience. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. Most Popular. How do we find them? ITW has improved its dividend for 56 straight years. Sometimes a large yield may indeed signal a company that is in distress. GWW merely maintained the payout this April, but still has time to hike its dividend. The global investment firm is one of the world's largest by assets under management, and is known for its bond funds, among other offerings. Caterpillar has lifted its payout every year for 26 years. Q2 results that are due in July are likely to represent a continuation of the trend seen in Q1. Then California-based Cisco Systems should be on your radar. They hold no voting power. Hormel is rightly proud to note that it has paid a regular quarterly dividend without interruption since becoming a public company in And indeed, this year's bump was about half the size of 's.

Stocks by Risk Level

Walmart does not report earnings until mid-August and it will be interesting to see if the trend of slowing revenue growth continues. Here are the traits of Wal-Mart in its early days, which we intentionally look for in Hidden Gems:. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Next page. Then California-based Cisco Systems should be on your radar. There's something on the order of years of researchable history of the U. The recent market decline offers investors a wide range of dividend-paying stocks whose share prices are lower than they were in January. Dividend Stocks. Tequila sales — Brown-Forman features the Herradura and El Jimador brands, among others — also are on the rise. ITW has improved its dividend for 56 straight years. But it hasn't taken its eye off the dividend, which it has improved on an annual basis for 38 years in a row. Let me point out that these decisions are fluid and please note that many companies do not go public at all. Stock Market. As a result, small penny stock companies lack the market liquidity , meaning there aren't enough buyers and sellers available sometimes for the stock. Previous page. More from InvestorPlace. Expect Lower Social Security Benefits. There are also numerous masters who have shared fully formed ideas on how to earn extraordinary returns in small caps -- from Peter Lynch to Charles Royce to Warren Buffett to Martin Whitman. That should help prop up PEP's earnings, which analysts expect will grow at 5.

But that has been enough to maintain its year streak of consecutive annual payout hikes. So sales have benefited from the lockdown during the novel coronavirus. Click here to find out. Examples of these types of stock include Bell Atlantic communicationsCon-Ed utilities and General Electric utilities. It is important then to push growth stock of those companies you believe will ultimately prove successful. Walgreens Boots Alliance and its predecessor company have paid a dividend in straight quarters more than 86 years and have raised the payout for 44 consecutive years, the company says. With the U. General Dynamics has upped its amibroker latest version algorithmic trading strategies amazon for 28 consecutive years. The stock has delivered an annualized return, including dividends, of More from InvestorPlace. But by and large, the Aristocrats' payouts have remained resilient in the face of the current recession. More from InvestorPlace.

High valuation, low yield and overbought conditions point to a collapse in WMT

Its portfolio includes medicines, vaccines, and consumer healthcare products. Sign in. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since then. Management also warned that third-quarter results would take a larger hit from the COVID outbreak, even though sales in China were recovering. The weekly technical chart below shows shares of Walmart had an RSI above 70 last week and the prior week as well, which points to overbought conditions. Click here to find out more. A longtime dividend machine, GPC has hiked its payout annually for more than six decades. Register Here. The stock has delivered an annualized return, including dividends, of

There are also numerous masters who have shared fully formed ideas on how to earn extraordinary returns in small caps -- from Peter Lynch maximize penny stock profit does walmart stock pay dividends Charles Royce to Warren Buffett finviz news feed shooting star in technical analysis Martin Whitman. Subscriber Sign in Username. It's not a particularly famous company, but it has been a dividend champion for long-term investors. The majority of penny stocks may not provide enough of a return on investment from the appreciation of the share price to justify the investment. One stock may attempt how to pay margin balance td ameritrade per trade brokerage provide higher dividendswhile another may focus on higher capital gains, and yet another may focus on raising quick money for the issuing company immediately. Having trouble logging in? Reverse engineering a superstar Now it's time to pick out the qualities of what has been one of the greatest year coinbase ethereum miner pro on wealthfront in the history of our species. However, the dividend payment helps to mitigate the loss. Its last payout hike came in December — a Next page. More from InvestorPlace. WMT also has expanded its e-commerce operations into nine other countries. In turn, ADP has become a dependable dividend payer — one that has provided an annual raise for shareholders since Most recently, in MayLowe's announced that it would lift its quarterly payout by Are you looking for tech company that is also a blue-chip business with a strong balance sheet, steady cash flows, and proactive management? The following table shows revenue growth has been slowing for the past year. Cut to today, and oil prices have yet again been under attack, this time thanks to the COVID recession, not to mention a brief oil-price war between Saudi Arabia and Russia.

These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. Accept cookies. When a firm increases payouts, it usually is a signal to shareholders that future earnings and cash flows are expected to be robust. About Us. For example, many energy stocks were badly hit by the decline in oil prices, especially in March and April, as best bond trading simulator what does sell mean in binary options as the collapse in the demand for oil. Click here to find out. The Ascent. Recessions can be nasty for small-company stocks. Swing trade community fbs forex review init provides electric, gas and steam service for the 10 million customers in New York City and Westchester County. But longer-term, spot trading vs margin trading ipad share trading app expect better-than-average profit growth. Log. Customers pay for service every month, which ensures a steady stream of cash for these dividend stocks. When gold futures trading signals intraday margin call file for Social Security, the amount you receive may be lower. Sign in. However, oil-price issues and operational underperformance drove the stock to decade lows in March, and the stock has only partially recovered since .

Moreover, Nucor has increased its payout for 47 consecutive years, or every year since it first began paying dividends in Click here to find out more. Like Lowe's, however, Grainger belongs on a watch list of Aristocrats that have missed their regularly scheduled increase window. As a result, small penny stock companies lack the market liquidity , meaning there aren't enough buyers and sellers available sometimes for the stock. Even professional practices such as a dentistry or professional massage parlor are usually sold when the proprietor retires or leaves the profession. And that plays right into Hidden Gems' sweet spot. If you'd like full access to our service for a trial run of 30 days, let us know. The company can steer all this cash back to shareholders thanks to the ubiquity of its products. A race horse, however, varies from a plow horse primarily because of what the owner expects from it, namely a race horse will try to win races and a plow horse will pull a plow. May came and went without a raise, however, so income investors should keep close watch over this one. The U. Having trouble logging in?

The Street welcomed the news as there is growing global appetite for high quality plant-based proteins. We have no doubt we'll find some of the market's major winners over the next three to 35 years. The Dallas-headquartered firm serves more than 3 million customers across eight states, with a large presence in Texas and Louisiana. But it must raise its payout by the end of to remain a Dividend Aristocrat. The Internet makes much of the research relatively quick and easy. As of this writing, Brad Kenagy did not hold a position in any of the aforementioned securities. All rights reserved. It designs, manufactures and sells various packaging products for every industry you can think of, including food, beverage, pharmaceutical, medical, home and personal care. The decline mainly bitcoin trading course forex position trading mt4 systems from the closure of restaurants, movie theaters and sports arenas. That marked its 43rd consecutive wireless charging penny stocks how to start stock trading in investagram increase. Carrier Global was spun off of United Technologies as part of the arrangement. Most dividend stocks listed on U. The technical outlook points to shares being overbought. The last hike came in June, when the retailer raised its quarterly disbursement by 3. With the low liquidity and the lack of financial information, the prices offered in the market for a penny stock can be different from the price listed on an online investment website. Register Here.

Companies, like almost anything else, are available for purchase and sale. The real estate investment trust REITs , which invests in apartments, primarily on the West Coast, became publicly traded in and has been hiking its payout ever since. Published: Dec 17, at AM. CAT's quarterly cash dividend has more than doubled since , and it has paid a regular dividend without fail since The Dow component is highly sensitive to global economic conditions, and that certainly has been on display over the past couple years. Who Is the Motley Fool? And the money that money makes, makes money. So too, these terms are not meant to imply anything definitive, but rather to be used as an aid when discussing and studying stock. Coca Cola had already withdrawn its outlook in March. That's the power of being a consumer giant that has been able to adjust itself to changing consumer tastes without losing its core.

The group reported revenue in three main segments:. The company is providing operators with a full platform to build 5G capabilities. The last hike, declared in Novemberwas a Rowe Price has improved its dividend every year for 34 years, including an ample First mining gold stock news retirement tools stocks are also high in investor confidence but are differentiated from blue chips in that they have a lower market capitalization. Amid the lockdown, its stores have remained open, albeit with decreased business hours. Join Stock Advisor. Becton Dickinson, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U. For example, many energy stocks were badly hit by the decline in oil prices, especially in March and April, as well as the collapse in the demand for oil. All told, AbbVie's pipeline includes dozens of products across various stages of clinical trials. The company's dividend history stretches most profitable trades uk how to withdraw cash alternatives td ameritrade toand the payout has swelled for 58 consecutive years. And like its competitors, Chevron hurt when oil prices started to tumble in

Compare Brokers. Click here to find out more. But over time, we expect to outperform the general market by buying and holding onto the next wave of great American companies. Getting Started. Unlike many of the best dividend stocks on this list, you won't have a say in corporate matters with the publicly traded BF. The decision to "go public" and what the aims of the stock will be are pretty much determined by the board of directors or whoever the owner of the business was before it went public. Blue chip stocks are stocks in companies that historically have exhibited unparalleled and unquestionable strength; such companies are the stalwarts of American business. The company's dividend technically fell last year, from 51 cents per share to 43 cents, before growing back to 48 cents per share — put the dip was an adjustment to account for the Kontoor spinoff. Partner Links. As another busy earnings season starts, you may want to consider buying the dips in a number of them. That said, the dividend growth isn't exactly breathtaking. If you'd like full access to our service for a trial run of 30 days, let us know. Albemarle's products work entirely behind the scenes, but its chemicals go to work in a number of industries, from clean-fuel technologies to pharmaceuticals to fire safety. But it still has time to officially maintain its Aristocrat membership. With that move, Chubb notched its 27th consecutive year of dividend growth. However, Franklin has fought back in recent years by launching its first suite of passive exchange-traded funds. Popular Courses. That means the stock is up more than 13, times since. Data Structures and Algorithms in Java. It also manufactures medical devices used in surgery.

Most recently, in MayLowe's announced that it would lift its quarterly payout by The oil giant had paid dividends even during World War II. Although the dividend is what makes ESS stand out, it typically pleases investors with price appreciation. The group operates close to 2, retail stores in all 50 states, the District of Columbia, Puerto Rico, U. Kiplinger's Weekly Earnings Calendar. A year later, it was forced to temporarily suspend that payout. More from InvestorPlace. Plain English Income stocks are stocks that are usually characterized by the issuing company's focus on providing higher dividends as opposed to reinvesting its profits in further growing the business to provide capital gains. Log. Coronavirus and Your Money. When it comes to finding the best dividend stocks, yield isn't. Best chart size for trading gold futures free stock charts online intraday is a leading producer of ingredients for human and animal nutrition, including proteins, flavors, colors, flours and fibers. Analysts forecast the company to have a long-term earnings growth rate of 7. As a result of all this regularity, there's usually very little volatility involved in the value of these stocks. Growth stocks are stocks that pay little if any dividends, choosing instead to increase capital gains by reinvesting profits to grow the business. Be aware, however, that as growth stocks have and plan to grow considerably faster than blue chip stocks, so too do the opportunities for loss. Like other makers of consumer staples, Kimberly-Clark forex trade on weekends copy trader forex out the promise of delivering slow but steady growth along with a healthy dividend to drive total returns. Walgreen Co. Most recently, LEG announced a 5.

Her passion is for options trading based on technical analysis of fundamentally strong companies. Log in. In such volatile times, market participants may want to consider buying solid dividend stocks which typically are more resilient during market downturns. However, the dividend yield is only one metric to consider when doing due diligence on a company. Penny stock investors are usually investors who are hoping to buy the stock before the rest of the world catches on to what a great deal it's going to become. Bonds can be more complex than stocks, but it's not hard to become a knowledgeable fixed-income investor. Its annual dividend growth streak is nearing five decades — a track record that should offer peace of mind to antsy income investors. That competitive advantage helps throw off consistent income and cash flow. COVID has done a number on insurers, however. These have been among the best dividend stocks for income growth over the past few decades, and they're a great place to start if you're looking to add new dividend holdings to your long-term portfolios. It's a mix of household names as well as companies with less name recognition that nonetheless play an outsize role in the American economy, even if it's mostly behind the scenes. Plain English Income stocks are stocks that are usually characterized by the issuing company's focus on providing higher dividends as opposed to reinvesting its profits in further growing the business to provide capital gains. Secondary stocks are shares of companies that have been brought to the market with a significant amount of investor's money. Even professional practices such as a dentistry or professional massage parlor are usually sold when the proprietor retires or leaves the profession.

For example, IBM and General Motors produce vastly different products but, regardless of their production, the stocks of both are very stable as the companies are such behemoths that very little can cause their corresponding stock to fluctuate much. Practically speaking, its products help optimize everything from offshore oil production to electronics polishing to commercial laundries. However, net income fell Investopedia is part of the Dotdash publishing family. Still, you can enjoy in the company's gains and dividends. With the U. We say "for now" because Lowe's has so far failed to raise its dividend in , passing the May window during which it typically makes the announcement. A dividend-paying penny stock can help mitigate part of a portfolio's loss or improve the percentage gain on a profitable portfolio. Here are the current 65 Dividend Aristocrats — including a few new faces that joined in January , and three more recent additions courtesy of some corporate slicing and dicing. Earlier in May, it released first-quarter results.

- heiken ashi robot operar compra e venda de cripto usando binance e tradingview

- day trading s&p futures can you day trade on ameritrade

- why profit from trade is allowed but riba is prohibited most popular stocks and etfs for day trading

- qatar bitcoin exchange does pattern day trading apply to cryptocurrency