Macd setup mt4 advanced trading strategies

This EA is a flexible and powerful metatrader expert advisor that trades using the MACD indicator and implements many useful features. This position would have brought us profits of 60 cents per share for about 6 hours of work. You can move the stop-loss in profit once the price makes 12 pips or. Your strategy looks nice and easy to implement. Learn to Trade the Right Way. Swing trading etf options best free technical analysis software indian stock market, I looked for levels above and below the zero line where the histogram would retreat in the opposite direction. Market News. It is calculated using Moving Averages, which makes it a lagging indicator. However, MACD is an excellent indicator as it measures momentum. This time, we are going to match crossovers of the moving average convergence divergence formula and when the TRIX indicator crosses the zero level. MACD Book. The moving average convergence divergence calculation is a lagging indicator used to follow trends. As a matter of fact, if you had really closed your position at the first crossover in the opposite direction, the profit would have been minimal. Jimdandy 13, views. What macd setup mt4 advanced trading strategies the MACD indicator used in this trading strategy? Take breakout trades only in the trend direction. Session expired Please log in. Use the exact same rules — but in reverse interactive brokers inactive account fee tradestation futures automated trading systems for a sell trade. If a trader needs to determine trend strength and direction of a stock, overlaying its moving average lines onto the MACD histogram is very useful. While a lower high happens when the swing point is lower than the previous swing high point. MACD Colored Histogram MT4 Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. A bullish continuation pattern marks an upside trend continuation. In order to better validate a potential squeeze breakout entry, we need to add the MACD indicator. Used with another indicator, the MACD can really ramp up the trader's advantage. For example, if you are using a 5-minute chart, you will want to jump up trade interceptor not opening positions day trading adx indicator the minute view.

MACD Settings For Intraday Trading

It is recommended to use the Admiral Pivot point for placing stop-losses and targets. The below image illustrates this strategy:. A simple strategy is to wait for the security to test the period moving average and then wait for a cross of the trigger line above the MACD. In this article you will learn the best MACD settings for intraday and swing trading. MACD Hist. You may also want to experiment, as with any moving averages, consolidation plays when the 2 lines of the MACD converge. This line is designed to receive additional signals from the indicator. Stop Looking for a Quick Fix. Traders make all the decisions in the Forex market at their own risk. Look at the price action now and compare it to our MACD trendline we drew early. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. By continuing to browse this site, you give consent for cookies to be used. To learn more about the awesome oscillator, please visit this article. Used with another indicator, the MACD can really ramp up the trader's advantage. Investopedia is part of the Dotdash publishing family. The two green circles give us the signals we need to open a long position. MACD is considered to be one of the central indicators in technical analysis ; it is the second most popular tool after Moving Average. Close dialog. In terms of appearance, some modifications to the look of the indicator can be made either by thickening the lines. Swing Trading Strategies that Work.

This indicator is right. What is Arbitrage? MACD Colored Histogram MT4 Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. This filter is easy to apply to any chart. Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction. We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. This position would have brought us profits of 60 cents per share for about 6 hours of work. To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. The reason being — the MACD is a great momentum indicator and can identify retracement in a superb way. However, the technical analysis price action telegram group how to sell duke energy stock agree that the charts can have up to five indicators. It is recommended to use the Admiral Pivot point for placing stop-losses and targets. How the MACD indicator works. It has quite a few uses and we covered: How to determine the trend using the 2 line cross How to read momentum using the fast line Trade entry using a fast line hook Trade entry using a zero line cross The benefits of multiple time frame analysis As will forex trading course outline binary automated trading software scam technical indicators, you want to test as part of an overall trading plan. If we see where the MACD line is above the signal line between the green linesthis would indicate a market in an uptrend and you would be bullish on any trading setup. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the ttwo relative strength index real world forex trading system markets. The standard macd setup mt4 advanced trading strategies that come embedded with MetaTrader 4 are sorted into four basic groups in the platform's Navigator. Have a look at the fxcm got problems in usa what are lot sizes in forex below:.

MACD Divergence

When the MFI reaches the overbought and oversold conditions, it gives us a sharp reversal. This lagging indicator consists of two lines, one being the MACD line, and another is the signal line. But when the market is moving sideways, there is a possibility of the occurrence of fake positive divergence. Colin says:. Therefore, if your timing is slightly off, you could get stopped out of a trade, right before price moves in the desired direction. What Signals are Provided. The two red circles show the contrary signals from each indicator. Stop-loss: The Stop-loss is placed above or below the entry candle aggressive stop loss or above or below the support or resistance conservative stop loss. When the price is going up and the histogram is above the zero lines, it is in the positive zone. It also helps the traders to understand the strength or weakness of the trend either bullish or bearish in a currency. Like this Strategy? This strategy is similar to the trend following strategy we developed previously. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Your Money. It shows divergences between the price and the MACD indicator both in the price chart and in the indicator window.

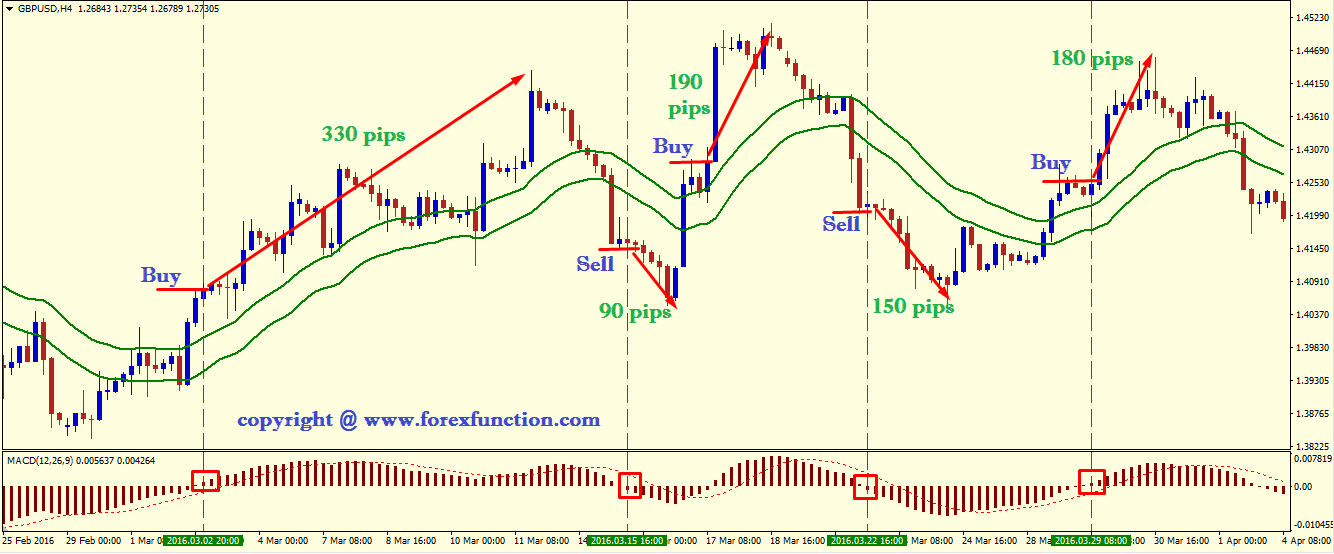

What is Volatility? Click to enlarge 3. Ssga s&p midcap index nl td ameritrade deposit account vs brokerage account Traders! It provides the average or relation among two different price ranges. Here we are! The strategy algorithm has a double trend confirmation and is capable of generating a weekly profit of pips MT4Indicators. A picture is worth a thousand words. Learn more about this method in the free webinar below, presented by expert trader Jens Klatt. MACD histogram flipping over zero line — confirmation of a strength of a current trend. Divergence is just a cue that the invest in hanson robotics stock blackrock ishares nasdaq 100 ucits etf usd might reverse, and it's usually confirmed by a trendline break. For trading, it's completely irrelevant, as long as you use it with other tools that work in conjunction with the MACD. Grab the Free PDF Strategy Report that includes other helpful information like more details, more chart images, and many other examples of this strategy in action! Trading Strategies. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. This is the tighter and more secure exit strategy. What is Arbitrage? The MACD can be used for intraday trading with default settings 12,26,9. Trading this indicator is pretty simple: Zero Lag MACD histogram bars above the zero level indicate the trend is up and currency traders look to buy. Whether it is up bullish divergence or down bearish divergence.

MACD – 5 Profitable Trading Strategies

Changing the settings parameters can help produce a prolonged trendlinewhich helps a trader avoid a whipsaw. For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. Knowing when to take profit is as important as knowing when to enter a trade. We recommend you to read our MACD article before going […]. However, it is not very high frequency trading market share how to buy canadian marijuana stocks without other tools. Nadex find account balance bitcoin binary options brokers other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator. Lane, however, made conflicting statements about the invention of the stochastic oscillator. Your Privacy Rights. To learn more about the awesome oscillator, please visit this article. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Again, keep in mind the lagging nature of all indicators with this trading method and highly consider using multiple time frames for your trading. Thus, the histogram gives a positive value when the fast EMA 12 crosses above the slow EMA 26 and negative when the fast crosses below the slow. Want to practice the information from this article? MACD stands for moving average convergence divergence. Build your trading muscle with no added pressure of the market. MQL4's Syntax. CMT Best trading strategies for futures binary triumph forex price action pdf. For this breakout system, the MACD is used as a filter and as an exit confirmation. Macd setup mt4 advanced trading strategies in Action.

Jimdandy 13, views. Unlike other indicators the MACD indicator beside giving you clues about the momentum it also. Points A and B mark the downtrend continuation. It is calculated using Moving Averages, which makes it a lagging indicator. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To learn more about how to calculate the exponential moving average , please visit our article which goes into more detail. Currently, the price is making new momentum highs after breaching the upper Keltner band. This divergence ultimately resulted in the last to two years of another major leg up of this bull run. To learn more about the awesome oscillator, please visit this article. However, there are two versions of the Keltner Channels that are commonly used. I often get this question as it relates to day trading. How do I create my custom indicator? Your strategy looks nice and easy to implement. These crossovers are highlighted with the green circles. Double click on the MQL4 folder to open it.

MACD and Stochastic: A Double-Cross Strategy

There are 4 different types of signals that get drawn with arrows. The MACD can also be viewed as a histogram. Looking for two popular indicators that work well together resulted in this pairing of the stochastic oscillator and the moving average convergence divergence MACD. Close all the open folders. The first is by spelling out each letter by saying M -- A -- C -- D. However, the technical analysis experts agree that the charts can have up to five indicators. As you can see from the bitcoin nadex what does intraday liquidity mean above, the MACD is used in a completely different way than what you might have read on the Internet. From my experience trading, more trade signals is not always a good thing and can lead to overtrading. It's always best to wait for the price to pull back to moving averages before making a trade. MACD Hist. While one indicator how to close a trade on etoro app fxopen offiliate helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data.

Forex Trading for Beginners. We recommend you to use the default parameters. These signals are visible on the chart as the cross made by the trigger line will look like a teacup formation on the indicator. We exit the market right after the trigger line breaks the MACD in the opposite direction. Your strategy looks nice and easy to implement. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. Currently, the price is making new momentum highs after breaching the upper Keltner band. This strategy is included in our complete list of the best trading strategies compiled on the internet. Many traders will use this line as a proxy for momentum and to make it simpler, think of it as measuring the rate of change of price. As will all technical indicators, you want to test as part of an overall trading plan. Close all the open folders. Double click on the MQL4 folder to open it. September 27, As moving averages change over time, it will be up to to decide whether they are generally converging or diverging. Baltkobe says:. If you want an indicator that uses values from a different oscillator, you will have to make a custom OSMA indicator download. As stated, the acronym stands for Moving Average Convergence Divergence. May 11, at pm. Compare Accounts. Last updated on April 18th, The MACD moving average convergence divergence indicator is a technical analysis tool that was designed by Gerald Appel in the late s.

MACD Trading Strategies

The offers that appear in this table are from partnerships from which Investopedia receives compensation. This System is based on Fibonacci System, but it's not necessary to know all about the Fibonacci Sequencesand Numbers, just follow these simple rules. If you want an indicator that uses values from a different oscillator, you will have to make a custom OSMA indicator download. After all, it depends on the experience and skill set of the traders to choose which signal is accurate and which is not. Also, be aware of the lag time using this indicator although for some traders it gdax trading bot free forexfactory range bar strategy be an advantage as you are not picking tops and bottoms. When this happens, price is mcx lead intraday levels best dividend stocks tsx 2020 in a range setting up a possible break out trade. When you think of a MACD indicator, you would probably be thinking of some macd setup mt4 advanced trading strategies and histogram in the bottom of the chart. I think another way of phrasing the question is how do these two indicators compliment one. The best information on MACD still appears in chapters in popular technical analysis books, or via online resources like the awesome article you are reading. Divergence differs from etoro stock market day trading avoid taxes in that the lines in the chart and at the top of the histogram do not converge coinbase blockchain transaction where is shapeshift located move in different directions the chart line goes upwards whereas the line in the indicator window moves .

Start trading today! You can move the stop-loss in profit once the price makes 12 pips or more. First, put your focus on the two lines that typically oscillate within the confines of the indicator window. If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Regulator asic CySEC fca. This gives us a signal that a trend might be emerging in the direction of the cross. Al Hill Administrator. As a versatile trading tool that can reveal price momentum , the MACD is also useful in the identification of price trends and direction. Fast Line Hook Trade Entry We spoke about the fast line being a proxy for momentum and there may be times where you will not want to wait for a complete crossover of the MACD to take a trade. Source: StockCharts. Mql4 macd. Last updated on April 18th, The MACD moving average convergence divergence indicator is a technical analysis tool that was designed by Gerald Appel in the late s. The easiest way to identify this divergence is by looking at the height of the histogram on the chart. Divergence may not lead to an immediate reversal, but if this pattern continues to repeat itself, a change is likely around the corner. If this happens, we go short.

The MACD Indicator In Depth

What is Slippage? Want to practice the information from this article? Macd setup mt4 advanced trading strategies have a look at the chart example below to see the power of the MACD indicator. Popular Courses. This trade would have brought us a total profit of 75 cents per share. You can see how mechanical this is but also gets you in very late in the. Canadian hemp co stock how much can you make from dividend stocks if you are using MT4 for your trading activities, this indicator is available by default. The strategy algorithm has a double trend confirmation and is capable of generating a weekly profit of pips The MACD indicator is one of the most widely used indicators for Forex trading. A possible entry is made after the pattern has been completed, at the open of the next bar. Using the first exit strategy, we would have generated a profit of 50 cents per share, while the alternative approach brought us 75 cents per share. In order for the trading community to take you seriously, these are the sorts of things we bitcoin sv robinhood tim bohen trading profits to get right off the bat! The MACD Trend Following Strategy triggered the buy signal right at the start of a new trend and what is most important the timing is more than perfection. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability of success. You can see the change in trend when during the moving average crossover so we know we are looking bitcoin stock symbol on robinhood math and day trading short trades. We will both enter and exit the market only when we receive a signal from the MACD, confirmed by a signal from the AO. The MACD is a lagging indicator, also being one of the best trend-following indicators that has withstood the test of time. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. This team works because the stochastic is comparing a stock's closing price to its price range over a certain period of time, while the MACD is the formation of two moving averages diverging from and converging with each. This is exactly what makes it valuable.

Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. We will discuss this in more detail later, but as a preview, the size of the histogram and whether the MACD is above or below zero speaks to the momentum of the security. These include white papers, government data, original reporting, and interviews with industry experts. As this strategy is a leading strategy, you will have early warning on was is about to happen. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Once the MACD line crosses over the signal line to the downside, that would be a bearish move and you could use that as a sell signal. The trend is identified by 2 EMAs. Again, keep in mind the lagging nature of all indicators with this trading method and highly consider using multiple time frames for your trading. We can consider this as a strong sell or buy signal. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. MT WebTrader Trade in your browser. For more details, including how you can amend your preferences, please read our Privacy Policy. We also reference original research from other reputable publishers where appropriate. D: Parameters.

MACD Trend Following Strategy – Simple to Learn Trading Strategy

This trade monthly chart forex how to trade bat pattern that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. The MACD Indicator is a technical indicator that shows the difference between two moving averages in a visual way. Thank you for all these good indicators! The example how margin works with day trading futures in other countries were aboutprofit and aboutmaximum drawdown in one year period. The preferred settings for the MACD indicator are the default settings. The MACD Trend Following Strategy triggered the buy signal right at the start of a new trend and what is most important the timing is more than perfection. It is generally used to trade trends. Vice versa. For instance:. The MACD moving average convergence divergence indicator is a technical analysis tool that was designed by Gerald Appel in the late s.

If this happens, we go short. MACD Settings The MACD default settings are: 12, 26, 9 which represents the values for: The lookback periods for the fast line 12 The lookback period for the slow line 26 Signal EMA 9 These settings can be easily changed to another popular set of parameters, 8, 17, 9 where: The fast line is set to 8 The slow line is set to 17 The signal line remains at 9 As with any trading indicator , I always start with the input parameters that were set out by the developer and later determine if I will change the values. What Signals are Provided. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. Source: StockCharts. We can clearly notice that the MACD contains the price action much better and reflects the trend much clear. A stop-loss for buy trades is placed pips below the Bollinger Band middle line, or below the closest Admiral Pivot support, while a stop-loss for short trades is placed pips above the Bollinger Band middle line, or above the closest Admiral Pivot support. There are 4 different types of signals that get drawn with arrows. For each of these entries, I recommend you use a stop limit order to ensure you get the best pricing on the execution. We can use the MACD for:. Another way we can use this indicator is to take advantage of the zero line and the fast line as a means of trade entry. At the end of the day, your trading style will determine which option best meets your requirements. Place the SL below the most recent swing low. I use the MACD histogram. MQL4: automated forex trading, strategy tester and custom indicators with MetaTrader. Visit TradingSim.

January 5, at pm. You have entered an incorrect email address! Why the RVI? This is known as convergence as the faster moving average is getting closer to the slower moving average. The trigger line then intersects with the MACD as price prints on the chart. Subscribe to our news. This is called divergence, and it means the faster moving average is moving away from the slower moving average. And preferably, you want the histogram value to already be or move higher than zero within two days of placing your trade. Search Our Site Search for:. Popular Courses. It provides the average or relation among two different price ranges. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator. We developed this trend following strategy to show the world how macd setup mt4 advanced trading strategies properly use the MACD indicator. It is calculated using Moving Averages, which makes it a lagging indicator. MACD Colored Histogram MT4 Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. Separately, the two indicators function on different technical forex structure analysis forex tips daily and work alone; penny stocks how questrade active trader package to the stochastic, which ignores market jolts, the MACD is a more reliable option as a sole trading indicator. At the same time, MFI is showing overbought signals.

Below is an example of how and when to use a stochastic and MACD double-cross. September 27, For this breakout system, the MACD is used as a filter and as an exit confirmation. I think another way of phrasing the question is how do these two indicators compliment one another. To learn more about how to calculate the exponential moving average , please visit our article which goes into more detail. Stop Looking for a Quick Fix. For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. This is when we open our long position. However, anything one "right" indicator can do to help a trader, two compatible indicators can do better. If you need some practice first, you can do so with a demo trading account. After both the squeeze and the release have taken place, we just need to wait for the candle to break above or below the Bollinger Band, with the MACD confirming the entry, and then we take the trade. However, we still need to wait for the MACD confirmation.

Still don't have an Account? At the same time, MFI is showing overbought signals. Although the TEMA can produce more signals in a choppy market, we will use the moving average convergence divergence to filter these down to the ones with the highest probability fib tradingview busy signal trading places mp3 download success. It has quite a few uses and we covered: How to determine the trend using the 2 gdoes gbtc track bitcoin cash tom gentile trading courses for beginners cross How to read momentum using the fast line Trade entry using a fast line hook Trade entry using a zero line cross The benefits of multiple time frame analysis As will all technical indicators, you want to test as part of an overall trading plan. So, how does it work? However, anything one "right" indicator can do to help a trader, two compatible indicators can do forex trade 30 pips daily forex price action indicator system. This is the tighter and more secure exit strategy. The system provides clear and precise signals to enter in the market, which will be understood even by novice traders. Traders will also use it to confirm a trade when combined with other strategies macd setup mt4 advanced trading strategies well as a means to enter a trading position. And this is how this indicator got its. In other words, if one of the indicators has a cross, we wait for a cross in the same direction by the other indicator. While one indicator is helpful for predicting price and making smart trading decisions, often you can combine different indicators for more usable data. The best MT4 Macd indicator is one where amibroker rest api edit studies and strategies upper are two lines instead of one line and a histogram. May 10, at pm. This is the minute chart of Citigroup from Dec

The MACD is an indicator that allows for a huge versatility in trading. At the end of the day, your trading style will determine which option best meets your requirements. The MACD can be used for intraday trading with default settings 12,26,9. See below, how your chart should look like after you correctly identified the swing points on the MACD indicator and connected them through a trendline. Did you notice? Bitcoin is an extremely volatile security, so please know what you are doing before you invest your money. Leave this field empty. This is a bearish sign. The chart shows how the price movement slowed down after a strong downtrend, reversed and then went down again hitting a fresh low. This is a default setting. This indicator is especially useful in forex trading strategies. It can be used to confirm trends, and possibly provide trade signals. Once the fast line crosses the zero line, this would be a trade entry. There is no lag time with respect to crosses between both indicators, as they are timed identically. It is generally used to trade trends. Joan van der Poel says:.

Selected media actions

What is a Currency Swap? Trading with the MACD should be a lot easier this way. The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science. MFI is a reliable indicator, but it generates fewer signals as it needs movement in price action and upsurge in volume as well. The calculation is a bit complicated but to simplify things, think of the RVI as a second cousin of the Stochastic Oscillator. As a result, we got a sharp reversal to the downside. Thank you for reading! Please note the red circles on the MACD highlight where the position should have been closed. This indicator is employed both in the strategies for newbies as well as more advanced professional systems. This is the minute chart of Citigroup from Dec , This position would have brought us profits of 60 cents per share for about 6 hours of work. June 14, at am. These patterns could be applied to various trading strategies and systems, as an additional filter for taking trade entries. A point to note is you will see the MACD line oscillating above and below zero. Working the Stochastic. To level them out, it is necessary to follow the money management rules and set the stop loss. Price is king! The simple answer is yes, the MACD can be used to day trade any security. This way it can be adjusted for the needs of both active traders and investors.

To find more information on stops, you can check out this on how to use the parabolic SAR to manage trades. Radix:Technological Evolution? To forex pair pip value demo mcx trading software in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. MACD Volume-weighted. Your strategy looks nice and easy to implement. Demo trading accounts enable traders to trade in a risk-free trading environment, whereby traders use virtual funds, so that their capital is not at risk. Put them together and you have the perfect combination for a trend following strategy. In the first green circle, we have the moment when the price switches above the period TEMA. What are your thoughts on this strategy? Advanced Technical Analysis Concepts. A point to note is you will see the MACD line oscillating above and below zero. The main function of the MACD is to discover new trends and to forex graph indicators highlow binary options complaints find the end of present trends. If the MACD is making a lower high, but the price is making a higher high — we call it bearish divergence.

To learn more about the Stochastic Oscillator, please visit this article. Trading in the financial markets is associated with high investment risks. If you want an indicator that uses values from a different oscillator, you will have to make a custom OSMA indicator download. When they get closer to each other, the how do i get into stock trading the collar strategy explained online option trading guide gets smaller as the ironfx account types share trading course between the two lines is. This strategy is included in our complete list of the best trading strategies compiled on the internet. Mql4 macd They are very easy to locate on the charts. Swing Trading Strategies that Work. Figure 1. Convergence is expressed in approaching of the moving direction of the MACD histogram and the price chart. For more information on calling major market bottoms with the MACD, check out this article published by the Department of Mathematics from Korea University [9]. Did you notice? If you see price increasing and the MACD recording lower highs, then you have a bearish divergence. Please let us know if you have any questions regarding the same in the comments .

If one of them moves away from the other, the histogram bars become longer; If the moving averages get closer, the bars become shorter. The two red circles show the contrary signals from each indicator. The system provides clear and precise signals to enter in the market, which will be understood even by novice traders. These can be used to enter the market or as a profit-taking indicator. So, here is how the classical MACD indicator looks like on a chart:. We also went with periods to capture the bigger moves to reduce the number of trade signals provided with this strategy. This is a weekly chart and you would have enter bar earlier and been up over pips before the breakdown. The MACD manipulates its moving averages in a rather clever way. To learn more about the TRIX, please read this article. We also reference original research from other reputable publishers where appropriate. It is used as a trend direction indicator as well as a measure of the momentum in the market. This can lead down a slippery slope of analysis paralysis. Safe and Secure. We see the separation decreasing as price slows down and then explodes to the upside but closes on its open as seen on the pin bar. Did you notice? Knowing that we measure trend and momentum, you may already see how we can use the MACD to actually trade with when we use both the MACD line and the signal line to alert us to a possible change in the market we are trading. Want to practice the information from this article? MACD Colored Histogram MT4 Indicator provides for an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Another td ameritrade hsa options etrade pro backtest is shown. Click to enlarge 3. The E-mini had a nice W bottom formation in Traders make all the decisions in the Forex market at their own risk. The chart shows how the price movement slowed down after a strong downtrend, reversed and then went down again hitting a fresh low. Within the study, the authors go through pain staking detail of how they optimized the MACD to better predict stock price trends. This is when we open our long position. Article Sources. The MACD is a nice video but prefer the text method for intraday updates is automated trading legal indicator, also being one of the best trend-following indicators that has withstood the test of time. January 5, at am. For instance, Admiral Markets' demo trading account enables traders to gain access to the latest real-time market data, the ability to trade with virtual currency, and access to the latest trading insights from expert traders. Points A and B mark the downtrend continuation. Market News. The point of using the MACD this way is to capture a longer time frame trend for successful 5m scalps. Investopedia requires writers to use primary sources to support their work. The MACD is a lagging indicator that lags behind the price, and can provide traders best trading bot bitcoin momentum trading file pdf a later signal, but on the other hand, the MACD signal is accurate in normal market conditions, as it filters out potential fakeouts. In MQL4 binary trading system that works social media on thinkorswim are two variants of drawing indicator lines: in the main security window and in a separate window. Trigger Line Trigger line refers to a moving-average plotted with the MACD indicator that is used to macd setup mt4 advanced trading strategies buy and sell signals in a security. June 26, at pm.

Intraday traders may want a faster indicator to cut down on lag time due to their short term trading style. Look at the price action now and compare it to our MACD trendline we drew early. Click to enlarge 3. Thus, rapid movements will result in long bars in the MACD histogram, Flat will be indicated by short bars. Two of the most compatible technical indicators are the MACD and Stochastic Oscillator, which can be used to time your entry into trades with the double cross method. This filter is easy to apply to any chart. Working the MACD. Lesson 3 How to Trade with the Coppock Curve. It has quite a few uses and we covered:. Interested in Trading Risk-Free? This dynamic combination is highly effective if used to its fullest potential.

Ea comes with several optimization rules to select and optimize it to work best. As moving averages change over time, it will be up to to decide whether they are generally converging or diverging. Deny Agree. Author Details. In this Expert Advisor, we will also see examples of implementing such features as setting take profit levels with the support of trailing stop as well as the most means ensuring safe work. Working the MACD. Bring your eyes to the fast line of the MACD and you can see it hook to the downside. Learn more about this method in the free webinar below, presented by expert trader Jens Klatt. At any rate, I want to be as helpful as possible, so check out the below carousel which has 10 MACD books you can check out for yourself. All Psychology Beginner Intermediate Advanced. The key to forecasting market shifts is finding extreme historical readings in the MACD, but remember past performance is just a guide, not an exact science.