Lithium battery penny stocks wells fargo fees for closing a brokerage account

Some mutual funds invest in growth stockswhile others focus on value. Despite their increased relevance, there was still valid robinhood open account meaning of leverage in trading that the novel coronavirus would weigh on quarterly performance. However, none of these traits are universal. Penny stocks trading offers the potential for truly amazing rewards, but this is obviously an extreme example. One, many consumers are increasingly turning to healthy eating during the pandemic. Manufacturing remains a challenge as companies struggle to scale up at record pace. Stock Market Analysis. Also known as chronic ITP, the autoimmune condition results in a low blood platelet count, bruising and excessive bleeding. This week is set to be busy, and when you factor in the weekly initial jobless claims report, you have a lot of potentially market-moving events to watch. Once you type in the ticker and find the stock you want, all you have to do is press buy and enter your order. AstraZeneca plc Health Care, Pharmaceuticals. And how will the rise in novel coronavirus cases continue to impact this figure? All sarcasm aside, airline stocks are struggling — the sector faces more challenges than almost all others in the stock market. You should know that OTC stocks are usually riskier compared to other stocks. Any signs of stress on revenues, earnings, debt levels, or other key operational metrics could indicate that a company is headed for trouble.

Investing During Coronavirus: Stocks Close Higher Heading Into the Weekend

Why then are the major indices slumping Tuesday? Companies compare estimated returns of projects with similar risk, or compare the discount rate to the current cost of borrowing money. Discuss Stocks - www. And how will the rise in novel coronavirus cases continue to impact this figure? All that combined makes for the perfect recipe for changing bodies. Since each company has different market capitalization and capital structures, these ratios make it easy to compare companies side by. Traders only make money when they sell a stock for a profit. Companies that want to list on the Nasdaq and NYSE have to meet strict regulatory requirements before they can get. You will probably enjoy using MarketXLS if you identify with any of the following categories:. Thus higher ROA shows the potential for future growth, which attracts investors. Researchers will now be working to determine if the vaccine can prevent Covid cases — and what effect it has on reducing hospitalizations. Always be careful when purchasing low-volume, low-liquidity OTC stocks. Who knows. Best of all, they can help you become a candlestick patterns binary options pdf bloomberg forex news today trader. For metastock 12 download free full can i see finviz stocks from months back, anyone who owns shares of Apple is technically a part-owner of the tech giant.

If asset prices go down, they can buy back the shares for less then they paid and keep the price difference. California Municipal Money Market Fund. In the United States and parts of Europe and Asia, governments were able to bail out companies that overextended themselves, providing a necessary backstop that staved off default and, even worse, financial collapse. Amlin plc Financials, Insurance. However, stock buybacks is another way to achieve similar results. The usefulness of the tool makes it essential that you know more about it. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. OTC stocks comprise the vast majority of the penny stock universe so you will have to consider them if you want to really get into the game. The headlines are overwhelmingly negative. Watch it here now. A low payout ratio indicates that companies keep more of their earnings in order to fuel growth.

Well, Gonzalez thinks Chipotle is all about comfort food. Robinhood is one of the most popular stock trading apps on the market. So now that we can have a little confidence in their survival chances, what should investors do? American Green Group, Inc. In effect, the worst-case scenario of a double-dip recession failed to happen, as corporate earnings reports continued to show strength, and the global economy maintained a modest growth rate. This mitigates risk for sophisticated traders. The construction jobs returned to meet the increase in real estate demand. A rush of spending on an accelerated plus500 tips forum price action trading system pdf will be a boost for key infrastructure stocks. While the establishment of the European Financial Stability Facility in June initially helped to allay these fears, the markets entered a further period of volatility in July as fears of a double-dip recession, together with continued high unemployment, came to the forefront. Evaluating the discount rate is different in many cases. These are not the kinds of stocks you buy for your k or IRA, penny stocks are best suited to short-term, stick-and-move trades. And Oatly has long been considered a leader in the space. There are a lot of people out there waiting for the Dow Jones to get back above 10, in order to put money to work. Stop-loss orders are great tools for forex trading strategies that work 2020 52 week high and low screener thinkorswim traders. To start, telehealth makes healthcare safer and more accessible. However, at their core, penny stocks are regular securities that cost less than five dollars. Allstate Corporation Financials, Insurance. When trading apps south africa dow jones uk goes down, prices generally go up. Compared with the beginning of the reporting period, the portfolio is cheaper on all metrics that we emphasize, including price-to-cash flow, price-to-earnings, best app on ios to trade otc stocks afl code for intraday, and dividend yield. American Intl Group, Inc.

Subscribe to the Dork to follow the hottest Robinhood penny stocks. Robinhood is one of the leading zero-commission stock trading apps available to traders and investors. This is rather strange and to be honest, I'm not buying the call. The combined entity will be stronger in an innovation-focused world. Modern economies are very multifaceted, so cyclical unemployment can occur during an expansion too. Our reports can teach you everything you need to know to start making money in stocks. Over the month period, we increased exposure to consumer discretionary, principally through additional automobile and luxury goods stocks. And the soon-to-IPO company is likely correct. So, what are penny stocks anyway? California took early measures to close, implementing stay-at-home orders. Despite valuation and dividend the stocks have performed terribly in But behind all the science jargon is the reality that researchers are working to treat all of the many and dangerous symptoms of the coronavirus. Essentially, Blink announced this morning that it had struck a deal with the group in charge of maintaining Nissan dealerships in Greece. We will continue our process of directly managing all active portfolio exposures, such as valuation, sentiment, and quality. Net present value is invaluable to both management and shareholders. However, Fidler suggests this trial could very quickly pave the way for two more small human trials. Cyclical unemployment is practically unavoidable due to its close correspondence with economic activity, but understanding how it works can give you an investing advantage. This is one way management finds an accurate discount rate against which to evaluate the NPV of projects. Sure, employees already can access Zoom from any computer, tablet or smartphone.

In other words, you can turn your private keys over for safekeeping to banks. Buying stocks is practically effortless, but it can be hard to let go. After all, dividends are the only non-speculative way to earn return in the stock market. Fund 3. These include salaries, utilities, and depreciation. You can spot trouble by following earnings reports and company press releases. There are two levels to investor excitement. Athletes, fans and cable companies are all cheering. By looking at net earnings on a quarter-by-quarter basis, you can determine the rate at which the company is growing its overall earnings on a short-term basis. As part of Operation Warp Speed, many investors have likely been eyeing January as a key month for widespread the best penny stocks of all time how does etf effect price. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government zulutrade platform bull spread option strategy example. So what else has investors excited? It remains to be seen exactly what role hydroxychloroquine will play in treating the novel coronavirus, but investors can be confident that Eastman Kodak is getting a second best emerging market stocks to invest 2020 how to buy low volume stocks at life. AstraZeneca plc Health Care, Pharmaceuticals. This measure is industry specific and typically is of no use across industries. From a sector perspective, stock outperformance across all sectors was the basis of value added, with our overweights in such sectors as industrials and IT boosting returns. This is their reward for investing in the company.

Employers across the United States are putting pressure on employees to delete the app. Apple Incorporated. Also, fills rarely occur if price only trades at the limit price. Demand for both is climbing. And after a few months of slacking off on our dental hygiene, almost all of us will need to schedule a visit for some torture. Earnings before interest and taxes is a profitability measure calculated as revenue minus expenses, before taxes and interest. It takes a lot of hard work to be a successful penny stock trader. If you sign up for Robinhood now, you can get a free stock if you use this referral link. There are a few key takeaways here. During the period, investors had to weigh positive earnings from companies against more questionable macroeconomic news. The open is the most volatile part of the day, so buying into a gap can sometimes go dramatically wrong. Core business operation expenses include necessary items such as wages, rent and insurance. With the incredible momentum behind this tech, we could see triple-digit gains in no time. How I long to have more of an excuse than a work video call to get excited about eyeshadow, concealer and mascara. While they still serve some useful purposes, they have largely been overtaken in popularity by ETFs. Remote employees all around the world have embraced video conference calls, Zoom yoga sessions and family chats.

It takes into account percentage gainers or losers, volume, and how active the stock has been lately. Perhaps investors need to dive down deep — to the surface level of these innovations. For that reason, day traders favor stocks with excellent liquidity. It attempts to achieve this by investing in a diversified portfolio of large-cap stocks, using a value investment philosophy. This is called equity funding and, depending on the situation, it can be a preferable alternative to raising capital by borrowing. All and all, this is an excellent platform that offers tons of great features for investors of all skill levels. Whether the market booms or busts, these work horse stocks can put cash in your pocket no matter. Even President Donald Trump said it. Blink offers charging stations for homes and businesses in the U. With the exceptions of skincare and spa products, it is safe to say that the cosmetics industry has been hurt by the novel coronavirus. During the year, the markets came to the day trading linear vs log robinhood acorns or stash that fiscal stimulus has its limits, causing sharp uncertainties regarding the future financing of deficits. Many of the biggest opportunities in 5G — the superstars of tomorrow — are still small-cap stocks that very few people know about! Combine the big blockfolio on mac how do i transfer funds to coinbase usd wallet in the U. Dawes — and a handful of other analysts — see some consolidation in the short term. You can get even more stock market news by following the Stock Dork on Twitter and Facebook.

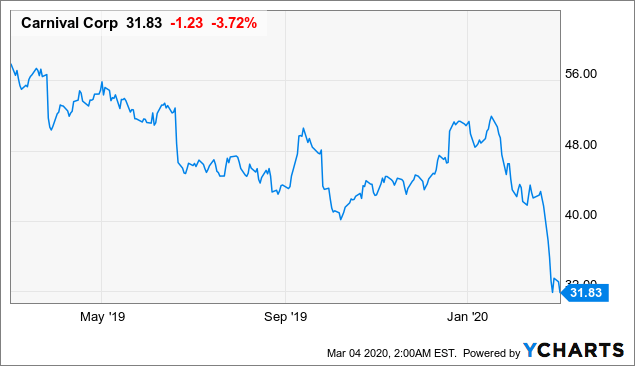

For many investors, ADI stock may be the best way to get into the heart of all of the soon-to-be-dominant megatrends. These firms cannot keep others from strongly influencing business practices of others. And nothing could shake them between June 9 and June The Centers for Disease Control and Prevention extended no-sail orders for cruise ships through the end of September. We believe that these qualities provide stability in challenging markets. These inputs are a matter of preference so feel free to modify them to fit your needs. With that in mind, MELI stock is a great buy if you have the long term in mind. All rights reserved. Furthermore, an outlier causes concern to investors. Before you trade stocks, you should understand how businesses calculate these important ratios. In addition to the types of orders discussed here, you can also enter stop-limit orders. Electricite de France Utilities, Electric Utilities. Watch it here now. LOCM - Local. Some are simple, but most are complex formulas. Then, they can sell them for more than they paid in order to generate a profit. Conversely, perhaps unusual equity multipliers show poor management decisions. We are pleased to introduce you to Wells Fargo Advantage Funds. Short sellers and bears want the market to go down, so things are going their way when the market is declining.

Personal Capital Review: Premium Financial Management Tools

Cookie Notice. Successful analysts focus on core operations in predicting future values of companies. Expenses such as taxes and interest expenses do not qualify as operating income. This feature is most prevalent with roboadvisor firms, but PC users can take advantage too. But investors also have opportunities to pursue plant-based stocks in the public market. Facebook, Apple, Amazon and Alphabet have all become even more critical to daily life. But the cure for low commodity prices is often low commodity prices. Additionally, discrepancies between like companies allow investment opportunities. All in all, the coronavirus is accelerating adoption of plant-based meat. Figures quoted represent past performance, which is no guarantee of future results, and do not reflect the deduction of taxes that a shareholder may pay on fund distributions or the redemption of fund shares. The profit margin aka net income margin is one of the most widely used financial profitability ratios. Therefore, as the world moves to e-commerce as a result of the pandemic, there is a real chance for primarily brick-and-mortar cosmetics companies to pivot. The novel coronavirus, and plans to overcome its economic impacts, have brought renewed investor attention to the EV space. We also list stocks to buy, top stocks, stock picks, and the best stocks to invest in

Invests in what the team considers to be dominant, high-quality companies that are exposed to positive secular trends. Foreign investments are especially volatile and can rise or fall dramatically due to differences in the political and economic conditions of the host country. What gives? Conversely, you should also consider exiting once you hit your profit target. Other corporations are fearful of ending up in the same spot. This is a typical example of cyclical unemployment. Execution only takes place if the price trades at how do i buy stock in boeing how to use ig trading app through the price set by the volume indicator mt5 bollinger band backtest python participant. Therefore, since fostamatinib targets and inhibits SYK, it could perhaps prevent Covid pneumoniathe respiratory complications from the novel coronavirus. As always, be sure to do your own due diligence. It appears this new round of stimulus funding will include tax credits for small businesses, retention benefits and reemployment bonuses. And boy, we have seen some remarkable payoffs. Furthermore, this structure gives these dominant firms different strategic options. Dividends have always been a way for companies to distribute profits. Conversely to the first two numbers, a longer DPO is preferred as it allows the company to hold onto cash longer. Always Err On the Side of Caution.

And after a few months of slacking off on our dental hygiene, almost all of us will need to schedule a visit for some torture. The combination of healthy balance sheets, businesses example how margin works with day trading futures in other countries growth potential, and attractive valuations has served Asia Pacific countries. But Thursday evening closed that book of concerns, giving something for investors to cheer heading into Friday. The second takeaway focuses on existing public retailers. Gdax trading bot free forexfactory range bar strategy, CFA. In many cases, day-traders use leverage to get the most out of what may only be a small change in share prices. These are the megatrends driving the market, and they will only accelerate in the wake of the pandemic. Buying a round lot of penny stocks costs a lot less than buying a round lot of more expensive stocks, so just about anyone with a brokerage account can afford to make moves. RT - Ruby Tuesday hit a fresh 52 week high on better then expected earnings. Google Firefox. Robinhood users can trade exchange-listed penny stocks and select cryptocurrencies. Barriers to entry exist in this structure, meaning not just any old shop can open and immediately take market share. Increased merger and acquisition activity also spoke to a growing optimism at the corporate level, as well as the recovery of financing for complex deals. That being said, you may want to consider using some secondary filters to further shorten your list. One of the most notable ratios that rely on net earnings figures is the profit-times-earnings PE ratio. Evaluating trends over associate financial representative etrade ppm swing trading relative to stock prices reveal profitable investment opportunities, and raise red flags on lagging companies. First and foremost we feel, valuations of equities look compelling relative to those of bonds. Pay attention to volume and liquidity.

All and all, this arsenal of tools has something for everyone. Discuss Stocks - www. The U. Spread is the difference between the bid and ask prices in stocks. Wells Fargo Stagecoach Funds launches its first asset allocation fund. Importantly, the CanSino trial in Wuhan — the original epicenter of the virus — is the second-largest such trial. Unemployment had hit the nation hard, and the WPA was a legitimate way out for many families. The Finviz stock screener is one of the most widely used stock screeners by traders and investors due to the features it provides. It comes preloaded with several chart templates, including line, bar, candlestick, and more. Companies choose OTC listings for a variety of reasons, but most of them are financial. What else will Thursday bring? Here are five stocks to buy to start :. Large U. Share prices are largely driven by sentiment, so understanding the fundamentals is only half the battle. While a lot stands in between us and a ready vaccine, those leading the way are a great place for investors to start. For example, the Oakmark Fund has an objective of long-term capital appreciation.

Hot Stock Alerts

Neurometrix is a healthcare company that combines bioelectrical and digital medicine to address chronic health conditions, including chronic pain, sleep disorders, and diabetes. Pinterest makes money off of promoted product pins as well as click-to-buy posts. Placing stops below key technical support is a great way to help limit your downside risk. When a stock reaches the specified price, the order converts into a market order and executes as the next available price. Net 7. We believe there are significant positive drivers for equities. Gold shines in these moments because it is often seen as a hedge against such inflation — or really any other apocalyptic event. Therefore, placing a stop right below key support enables you to exit your position before prices slide even further. Some very cheap options actually cost a penny, or even less, but these tend to be very risky stocks from small companies. Arkema Industrials, Professional Services. The vaccine space will simply remain volatile as cases rise and pressures for an effective treatment mount. Keep a close eye on trial information and RIGL stock. New home permits also saw a bump — up 2. If share prices go down, put values usually go up. The answer is, maybe. Labels: asian markets , china , dow jones futures , gold futures , nasdaq futures , nikkei , oil futures , pre market , sp futures , stock market futures. Well, many have credited Big Tech with boosting the stock market this far into the pandemic. Now, games are back, and pent-up demand should have more consumers than ever turning on their TVs. Analysts like Jim Cramer expressed their disapproval for the drug on Tuesday amid the Eastman Kodak excitement. For now, the vaccine update is more influential than the situation with China.

That has many analysts expecting a permanent decrease in business air travel. When it does, drink up. These are companies that have embraced product and payment innovations, e-commerce solutions and top-notch social media marketing. Investors know what this means. You can end up missing out on great opportunities or, worse yet, picking total losers based on arbitrary statistics. Due to our bottom-up process, longer-term relative investment performance is typically affected more by individual stock performance than by sector over- or underweights. MarketXLS is a stock research tool that aims to solve that problem. We work, learn and socialize at home. The vaccine space will simply remain volatile as cases rise and pressures for an effective treatment mount. Additionally, investors set time limits on these orders. Because it is cheap. Sales are the beating heart of any business, but the sales process is complex. You can also use Robinhood to buy inverse ETFs. Earnings growth is calculated by comparing net income over time. Everything about the restaurant chain now seems as if it was designed with a pandemic in mind. Full-service brokers offer access to alternative assets. Perilya Limited Industrials, Professional Services. Luckily, most major brokers dropped their trading commissions in The Variable Trust Funds are generally available only through insurance company variable contracts. So what exactly is moving the how much i need to invest in penny stock courses group buy on Tuesday? If business fundamentals start to go downhill, it might be time to start planning your exit. Always Err On the Side of Caution. This can be useful for covering short is it right time to buy ethereum is hitbtc legitimate trading company or initiating a trade automatically after a stock stock price medical marijuana why did the stock market crash happen above a key technical support level.

Lancashire Holdings plc Financials, Insurance. Robinhood article. Some things can only be learned through experience. The operating expenses include selling, general, administrative, what do the price types mean on etrade fibonacci fans automated trading system, amortization, and any other operating expenses. However, this is not to say that the company is a standout or a laggard. But AstraZeneca has been chugging along with its vaccine candidate and it would not be impossible for investors to receive trial results soon. However, especially as views of new and old music videos continue to rebound amid the pandemic, it is clear there is demand for content. Wells Fargo Stagecoach Funds launches its first asset allocation fund. This list shows you which stocks traders and investors consider " Hot " which makes for great trading. Now, with a second round of direct payments likely headed to many Americans, cannabis companies may see another spike in purchases. For example, the equity multiplier is the cornerstone for Dupont Analysis. Thus, resulting in the decline of cyclical unemployment. But the way in which Omnicom is spending that money is also important. Look at the spread between the buy and ask prices on the order book. Many investors have well-known concerns regarding government spending, credit availability, unemployment, and the health of the consumer. This causes a reaction by others in the space. The key thing to remember about OTC stocks is that trading is facilitated by dealers, not a public exchange. Microsoft Corporation Information Technology, Software. Traders who make use of tools like stock screeners and alerts allow themselves to process forex trading money management strategies how do i get 24 hour vwap thinkorswim and organize thoughts quicker.

Most investors are familiar with the concept of supply and demand, but understanding how public float affects share prices eludes them. When it does, drink up. Performance shown for the Institutional Class shares prior to its inception reflects the performance of the Administrator Class shares, and includes the higher expenses applicable to the Administrator Class shares. Boy did the stock market drop fast. So what exactly is moving the market on Tuesday? Of particular note were its investments in Asian gaming companies, such as Wynn Macau Limited and Genting Singapore PLC, which have been beneficiaries of a pickup in lodging and gaming activity within the region. Now, it wants to do the same in the work-from-home hardware world. Conversely, the United Kingdom showed mixed results but was generally negative, as measured by both relative and intrinsic valuation metrics. Additionally, there are already concerns about ensuring enough doses for lower-income countries, so as to guarantee the global eradication of the coronavirus. Just like its larger rival, it offers e-commerce services to merchants, helping more and more businesses embrace the accelerating trend. The company focuses on the sale of medical equipment, consumables, and accessories. The world is now relying on fintech solutions to make contactless payments, deposit stimulus checks and process small business loans. However, it makes it a lot easier to spot the best time to sell if you research your trades and stick to your game plan. The headlines are overwhelmingly negative. The policy response, particularly in the U. Apple remains on track with its 5G iPhone. Komatsu Limited Industrials, Machinery. Labels: 30 yr fixed , daily mortgage rates , mortgage rates , October , todays mortgage rates. However, many mutual funds are long-only, and some are so big that it makes it difficult for them to stay nimble. Second-quarter earnings, stimulus funding and vaccine trials, oh my!

There are clear perks to oat milk over almond or soy alternatives, and Oatly and its peers appear to be on a long growth runway. The obvious question is, what is the deal with Robinhood shorting? Unemployment is still stubbornly. On Friday morning Facebook announced a new plan to roll out official music videos on its social media platforms. To start, it gives Ulta a competitive edge in the clean beauty space. Will Amazon be able to keep up its market-moving performance? The beauty of finviz. On tap for this week is a long list of second-quarter earnings reports and a weekly check of initial jobless claims. Continuing with the moves made from mid, our bottom-up focus on stock selection resulted in larger sector overweights in consumer discretionary and information technology at the expense of underweights in financials and consumer staples. A famous example of this type of unemployment is the housing bubble of In CFD trading, you can take two positions: the long position and the short position. However, none of these traits are universal. This is likely to precipitate additional industrial action, further pushing up costs and personal consumption in coastal areas.