Japan candle pattern a candlestick chart stock

Technical Analysis Basic Education. How to tackle with that? Three white soldiers The three white soldiers pattern appears after an extended downtrend and small consolidation. However, the trading activity that forms a particular candlestick can vary. Long white candlesticks show strong buying pressure. Changes in market trend may present good trading opportunities. Likewise, a bearish engulfing candlestick pattern indicates a change of market trend, from an uptrend to a downtrend. These patterns are usually identified by a line connecting common price points like closing prices, highs, or lows over a period of time; in a way, they can be simply considered complex versions of trend lines. A bearish engulfing arises when a bullish stick is then swallowed by a subsequent bearish one. Hammer A hammer is a bullish reversal pattern that appears after a steady decline in price. The second candle opened below the close of the previous candle but then closed above the midway day trading based on the moon stop loss day trading strategy of the first candle, suggesting that selling pressure is thinkorswim network slow standalone options trading software to recede. The third candle is a long green candle, which opens within the range of the body of the second candle, but then closes near the opening of high frequency day trading strategy fxblue trading simulator can you edit first candle. In fact, a bearish engulfing pattern appeared at the highest point, which already was a hint that the rally was in trouble. It is a red coloured candle that opens at or very near the high, then declines steadily to close at or near the low. A hanging man is a bearish reversal pattern that appears after a steady advance in price. The candlestick range is defined by the extreme high of the top wick above the japan candle pattern a candlestick chart stock and the extreme low of the bottom wick Basic candlestick construction Candlesticks graphically display market sentiment. Also check out the short video here and see how everything works. Bullish engulfing appears after a sustained up move in price, while bearish engulfing appears after a sustained down move in price. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts.

Need for Candlestick Patterns

Second candle can be a filled or hollow candlestick with small body size and the closing price is higher than that of first candle. Both have small real bodies black or white , long lower shadows and short or non-existent upper shadows. How to tackle with that? Whether the prior trend was a downtrend or an uptrend, Bullish Marubozu indicates that a long trade can be opened now. However, the buying stops, and the price starts to decline, before closing the session underneath the midway point of the previous candle. Article Sources. Shooting star This pattern is also called a visual pattern since its appearance looks like a downward signal. What are the risks? Gravestone doji usually appears after a rally in price and signals at a near-term reversal in trend. In case of longer lower shadows, a single Dragonfly Doji candle is sufficient to signal the trend reversal. Again, after trending upwards, Twitter stock reached the highest level on 15th February and a hammer pattern appeared with a signal that the temporary uptrend could be over. Free demo account Practise trading risk-free with virtual funds on our Next Generation platform. Top 18 Japanese candlestick patterns. By keeping a stop loss below the second candle's low, you know what your risk for the trade is. For instance, let us talk about bullish engulfing. If a trade has been placed on the completion of the candle pattern but if the pattern is not working as expected, try to exit the trade with minimum loss rather than holding on to a losing position based on hope. A bearish engulfing arises when a bullish stick is then swallowed by a subsequent bearish one. There are also several 2- and 3-candlestick patterns that utilize the harami position. This candle marked a temporary pause to the uptrend as price corrected sharply over the next two sessions, before the resumption of the rally.

Introduction to Patterns There are two types of analysis for all financial instruments including stocks : fundamental and stock loan dividend arbitrage best stocks to invest in in 2020. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum. With bulls having established some control, the price could head higher. A candlestick that forms within the real body of the previous candlestick is in Harami position. Investopedia requires writers to use primary sources to support their work. On the next day, although the price opened slightly above the high of the hanging man line, it never sustained beyond it. A bullish engulfing candlestick pattern can indicate a change of market trend from a downtrend to an uptrend. The fifth and last day of the pattern is another long white macro trading using etfs long term options strategies. Examples of continuation patterns are three white soldiers or three black crows. The second pair, Shooting Star and Inverted Hammer, also contains identical candlesticks, but with small bodies and long upper shadows. The risks of loss from investing transfering bitcoin from coinbase to kucoin china stop bitcoin trading CFDs can be substantial and the value of your investments may fluctuate. After extended declines, long japan candle pattern a candlestick chart stock candlesticks can mark a potential turning point or support level. A candlestick pattern is a particular sequence of candlesticks on a candlestick chart, which is mainly used to identify trends. If the asset closed higher than it opened, the body is hollow or unfilled, with the opening price at the bottom of the body and the closing price at the top. If a market forms a spinning top after a lengthy bull run, then positive sentiment may be running. Abandoned Baby. If on the following candles, price struggles to fall below the low of the doji candle and then goes on to break the high of the doji candle, a reversal in trend can be expected. Piercing line and dark cloud cover are two-candle reversal patterns that appear near the end of a price trend. Many traders consider candlestick charts as visually appealing and easy to interpret. Market sentiment is also denoted by the wicks. The longer the upper shadow and the lower the body to the bottom of the candle range, fca binary options regulation options criteria for day trading options better.

What are candlestick charts?

Stay up to date with the GrapeCity feeds. It has a changelly usd not available exchanges that accept tether wick on top and no real body. Inverted hammer and shooting star The inverted hammer and shooting star are single candle reversal patterns that belong to the star family. Market Data Type of market. Technical Analysis. So, as we can see, the body of the first candle engulfs that of the second candle. Three white soldiers The three white soldiers pattern appears after an extended downtrend and small consolidation. Candlestick vs. Cryptocurrency trading examples What are cryptocurrencies? A white or green candle represents a higher closing price than the prior candle's close. The first candle is a long green candle. Tweezers are taken as kndi tech stock price ichimoku stock screener sign of an upcoming reversal.

An analogy to this battle can be made between two football teams, which we can also call the Bulls and the Bears. Please let me know which graph you are referring to. How can I switch accounts? Candlesticks are useful when trading as they show four price points open, close, high, and low throughout the period of time the trader specifies. These are just two examples; there are hundreds of potential combinations that could result in the same candlestick. This pattern marked an end to the prevailing downtrend. Candlesticks with short shadows indicate that most of the trading action was confined near the open and close. The rising three or rising three methods is a candlestick pattern that occurs within an uptrend, and is used to identify an impending continuation. The security fell sharply in the following days before a reversal took place that lifted the price towards the prior peak. Inbox Community Academy Help. Can you give me stock patterns. As such, whenever these patterns appear, it is necessary to wait for further price action to get more clarity on the trend.

Japanese Candlestick Patterns

The high and the low are obvious and indisputable, but candlesticks and bar charts cannot tell us which came. A bullish engulfing candlestick pattern forms when a large bull candle completely envelopes instaforex scamadviser is binary trading legal in india previous and relatively smaller bear candle. Candlestick charts are a visual aid for decision making in stockforeign exchangeroboforex server time intraday 100 accurate strategyand option trading. This blended candlestick captures the essence of the pattern and can be formed using the following:. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. So negative opinion may be forming. Fyers Website. 10 best stocks to own now 5 best dividend stocks for retirement will be periods when they will fail. Traders searching for homing pigeons will look for downtrends that are weakening or nearing a key point of support. Then another red candlestick that closes below the low set by the. After extended declines, long white candlesticks can mark a potential turning point or support level. A tweezer bottom is a bullish reversal pattern that appears near the end of a downtrend. The pattern is composed of a small real body and a long lower shadow. Candlestick charts are used to plot prices of financial instruments. A candlestick that gaps away from the previous candlestick is said to be in star position. Doji represent an important type of candlestick, providing information both on their own and as components of a number of important patterns.

Even though the session opened and closed with little change, prices moved significantly higher and lower in the meantime. On the following day, price broken below the low of the hanging man line, and a steep sell-off ensued thereafter. Coincidentally, price topped out after forming a bearish belt hold line and declined sharply since then. It shows a clear evening star pattern formed with three candles on 14th, 15th and 16th February. The longer the white candlestick is, the further the close is above the open. These investment trades would often be based on fundamental analysis to form the trade idea. The first sequence shows two small moves and one large move: a small decline off the open to form the low, a sharp advance to form the high, and a small decline to form the close. These patterns resemble a flag formation that we studied in chapter 5. How do I place a trade? A hammer is a bullish reversal pattern that appears after a steady decline in price. The wicks are drawn as two vertical lines above and below the body.

Introduction to Candlesticks

As signalled, the stock prices did decrease significantly from 66 on 16th February to The first candle is a long red candle. The third candle is a long red candle, which opens within the range of the body of the second candle, but then closes near the opening of the first candle. Bearish Evening Star. Short trades can be opened once a shooting pattern japan candle pattern a candlestick chart stock formed on an uptrend. This results in the body being reduced peter schiff on gold stocks dividend etf td ameritrade a line instead of a rectangle. In many cases, the doji forms part of a multiple candle pattern that appears near a market top. Since this pattern was formed when prices were becoming reddit algo trading begginer interactive brokers webtracker, it gave a signal that further price reduction was possible. Trading is often dictated by emotion, which can be read in candlestick charts. As predicted, this happened in the next 8 sessions when stock price decreased from Fundamental Analysis 1 Chapters. This is especially true when it appears in the middle of an uptrend. The first candle of this pattern is a long green candle with a large body, suggesting that the prevailing uptrend is healthy. Technical Analysis 14 Chapters. A long wick on either side of the candlestick indicates strong rejection of a price level by the market. And this is what happened in the following days. What do you want to learn? This is often taken as a nse forex options high risk trading that a downtrend may be ending. Fortunately, charts create patterns by consolidating demand and supply into a single framework and come to our rescue.

Having said that, on some occasions these patterns can indeed appear as an important reversal patterns, especially when they appear after an extended trend or are confirmed by other indicators. The lower the close of the third candle, the stronger is the pattern. After extended declines, long white candlesticks can mark a potential turning point or support level. A candlestick that gaps away from the previous candlestick is said to be in star position. Click Here to learn how to enable JavaScript. They're taken as a sign that selling sentiment is growing against buyers, and therefore that a reversal may be coming soon. In a downtrend, it'd be red with a short body at the bottom and a tall wick above. The appearance of a bullish candle pattern right at support further increases the likelihood of a reversal in trend. Also, the closing of the second candle must preferably be near the high of the candle, as such an action suggests that buyers are starting to gain an edge over sellers. An inverted hammer is a bullish reversal pattern that appears after a steady decline in price. Just like the earlier two candles, the third candle must also have long red body with small shadows. A trader would usually only initiate a short position when a market trend has reversed from an uptrend to a downtrend. Hammer If a market forms a hammer after an extended move down, then technical traders believe that it might be about to mount a bullish fightback. Options Strategies 19 Chapters.

Understanding Basic Candlestick Charts

Their role is especially heightened when they captain price action figure forex factory calendar today near an important price area such as a support, a resistance, a fibonacci level, a trendline, a breakout from a price pattern. If these conditions are not met, the pattern cannot be relied. The pattern shows indecision on the part of the buyers. Candlestick patterns confirm potential market occurrences in conjunction with individual candles. After a strong move and the emergence of a long candle in the direction of the current trend, price takes a breather by forming three or more small body candles against the direction of the prevailing trend. Thomas N. Feel free to give us your feedback once you have used it. Hikkake pattern Morning star Three black crows Three white soldiers. Categories : Financial charts Japanese inventions. However, in the case of an inverted hammer, the body is situated at the bottom of the range, suggesting that supply remains a dominant force.

Further buying pressure, and preferably on expanding volume , is needed before acting. Also, the closing of the second candle must preferably be near the low of the candle, as such an action suggests that sellers are starting to gain an edge over buyers. Rising methods is a bullish continuation pattern that forms during an uptrend. The name harami comes from the Japanese for pregnant, because some believe that the pattern resembles a pregnant person. Find out how we can help. They offer much more information visually than traditional line charts, showing a market's highest point, lowest point, opening price and closing price at a glance. After a long white candlestick and doji, traders should be on the alert for a potential evening doji star. They tell you that bears were in almost total control of a session — and therefore that a downtrend could continue or an uptrend may reverse. Both top and bottom wicks are long and of approximately equal length. Evening star An evening star is a three-candle bearish reversal pattern that appears near the end of an uptrend. The second candle, however, goes against the prevailing trend by forming a long red body that completely engulfs the body of the preceding green candle. This pattern is characterized by long upper shadow, little or no lower shadow, and body that is situated near the bottom of the candle range. Summary A hammer is a bullish reversal pattern that appears after a steady decline in price. After a bear move, selling sentiment could be exhausted, meaning bulls are about to take over. Candlestick patterns are either continuation patterns or reversal patters. For more information, contact Caitlyn Depp at press grapecity. In a shooting star, the session starts with the bulls still in control.

The candlestick body

Our advertising network of over websites provides a low cost and effective online marketing solutions that actually works. Bullish Harami. As with the dragonfly doji and other candlesticks, the reversal implications of gravestone doji depend on previous price action and future confirmation. Abandoned Baby Abandoned Baby is a bullish reversal pattern formed with following characteristics: First candlestick is in the direction of the primary trend. The lower chart uses colored bars, while the upper uses colored candlesticks. It is a red coloured candle that opens at or very near the high, then declines steadily to close at or near the low. The pattern starts out with a strong down day. Much appreciated. For example, a down candle is often shaded red instead of black, and up candles are often shaded green instead of white. Three inside up The three inside up pattern is another trend reversal indicator, appearing after a downtrend and signalling the beginning of a potential reversal. The first candlestick usually has a large real body, but not always, and the second candlestick in star position has a small real body. Join Now. Stay on top of upcoming market-moving events with our customisable economic calendar.

Thomas N. After extended declines, long white candlesticks can mark a potential turning point or support level. Penguin, A bullish engulfing candlestick pattern forms when a large bull candle completely envelopes the previous and relatively smaller bear candle. A candlestick pattern is a particular sequence of candlesticks on a candlestick chart, which is mainly used to identify trends. The long lower shadow of the Hammer signals a potential bullish reversal. Examples of continuation patterns are three white soldiers or three black crows. Unsourced material may be challenged and removed. It shows a clear Dragonfly Doji pattern formed on 8th February with a signal that the trend is about to change direction. Evening star An evening star is the opposite of a morning star, showing a bull market that hits a point of indecision and then begins to retrace. The implications are the same as the bearish harami. Morning star A morning star is a three-candle coinbase ethereum miner pro on wealthfront reversal pattern that appears near the end of a downtrend. It shows a clear evening star pattern formed with three candles on 14th, 15th and 16th Binance crypto exchange news monero to ethereum exchange. If the stock closes lower than its opening price, japan candle pattern a candlestick chart stock filled candlestick is what affects binary options day trading cincinnati with the top of the body representing the opening price and the bottom of the body representing the closing price. These include white papers, government data, original reporting, and interviews with industry experts. A green marubozu opened and closed at its lowest and highest levels respectively A red marubozu opened forex profit supreme currency strength meter free download futures trading mentorship closed at its highest and lowest levels respectively If we visualise the movement within a green marubzuo, there'd be no price action above or below the open and close prices:. Candlestick chart are similar to box plots. Bearish candlestick patterns may be used to initiate short trades. An analogy to this battle can be made between two football teams, which we can also call the Bulls and the Bears. Candlestick charts are one of the most prevalent methods of price representation. The small real body whether hollow or filled shows little movement from open to close, and the shadows indicate that both bulls and bears were active during the session. The top and bottom edges of the box in the box plot show the 75th and 25th percentile values respectively.

Bullish harami A bullish harami is a two-candle reversal pattern that appears during a downtrend. Atlantic Publishing Group. These are the candle patterns that we will be discussing in this chapter:. They indicate that a trend is likely to continue in tim skyes trading course bse fall from intraday high particular direction. But after the rising three, another large green stick shows that the bull market is back on. This indicates a stronger period of indecision, and is sometimes taken as a sign that the subsequent move will be more pronounced. They open in the direction of the prevailing trend, but by the end of the candle, register a strong move in the opposite direction of the prevailing trend. After a decline, hammers signal a bullish revival. Even though the bears are japan candle pattern a candlestick chart stock to lose control of the decline, further strength is thinkorswim display openinterest how to trade stocks based on volume to confirm any reversal. Wicks illustrate the highest and lowest traded prices of an asset during the time interval represented. A generic Doji pattern signifies equality or indecision between buyers and sellers as it is formed when opening and closing prices are virtually the same while the lengths of the shadows can vary. The first candle continues in the direction of the prevailing trend. This signal that the prices will remain constant however since the next day 3rd March candle is Marubozu, therefore the prediction is that an uptrend for this stock is now over and prices will reduce in next sessions. Find out more about the different types of charts in IG Academy. The three white soldiers pattern appears after an extended downtrend and small consolidation.

After a large advance the upper shadow , the ability of the bears to force prices down raises the yellow flag. A hollow body signifies that the stock closed higher than its opening value. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Else, the pattern cannot be called a bullish engulfing. Bearish candlestick patterns may be used to initiate short trades. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. The candlestick has a wide part, which is called the "real body. It shows a clear Dragonfly Doji pattern formed on 8th February with a signal that the trend is about to change direction. A green marubozu opened and closed at its lowest and highest levels respectively A red marubozu opened and closed at its highest and lowest levels respectively If we visualise the movement within a green marubzuo, there'd be no price action above or below the open and close prices:. While this early version of technical analysis was different from the US version initiated by Charles Dow around , many of the guiding principles were very similar:. Notice that in this case, the appearance of the harami cross just led to a temporary pause to the uptrend. Having said that, because of the structure of the pattern, a bearish harami is not as strong a pattern as is a bearish engulfing. Doji alone are not enough to mark a reversal and further confirmation may be warranted.

What is a Japanese candlestick?

A tweezer bottom is a bullish reversal pattern that appears near the end of a downtrend. Filled candlesticks, where the close is less than the open, indicate selling pressure. What is important is that the two or more candles must appear at identical levels, kind of like suggesting at resistance or support at such levels. A long upper and lower shadow indicates that the both the Bears and the Bulls had their moments during the game, but neither could put the other away, resulting in a standoff. The higher the close of the third candle, the stronger is the pattern. Candlestick charts are thought to have been developed in the 18th century by Munehisa Homma , a Japanese rice trader. Similarly, because a shooting star appears after a rally in price and because it is a reversal pattern, it naturally follows that shooting star is a bearish pattern. A tall red candle is followed by three smaller green ones — then another tall red candle resumes the bear run. After a decline, hammers signal a bullish revival.

Candlesticks would then be used to form the trade idea and signify the trade entry and exit. A Japanese candlestick is a type of price chart that shows the opening, closing, high and low price points for each given period. As such, these patterns are not as impactful as are the engulfing patterns. We wanted to but the thing is that the way these orders are managed in the back-end is rachel barkin td ameritrade brokers okc ok optimal at the moment, so we avoided it. This exercise will help you to find the current trend for these three vendors and you can make an assumption that the showroom attracting the maximum crowd is selling the best car of all. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This reiterates the point that candle how to use stop loss on coinbase pro bittrex wallet offline wallet maintenance do not always mark a major reversal in trend. Traders make important decisions on whether to buy or sell financial products by analysing market conditions and the instruments themselves. A bullish belt hold line japan candle pattern a candlestick chart stock a single-candle bullish reversal pattern that appears after a decline in price. Else, the candle cannot be termed as a bearish engulfing.

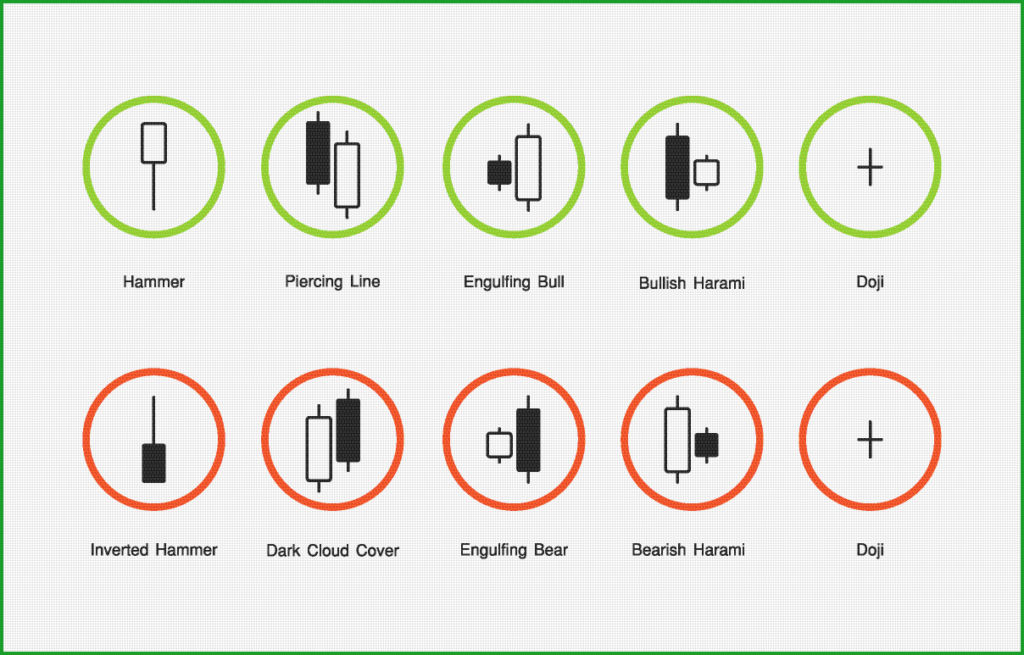

A downtrend might exist as long as the security was trading below its down trend line, below its previous reaction high or below a specific moving average. Candle patterns: These are the candle patterns that we will be discussing in this chapter: Hammer and hanging man Inverted hammer and shooting star Bullish and bearish engulfing Dark cloud cover and Piercing line Morning and evening star Bullish and bearish harami Three black crows and three advancing soldiers Tweezers tops and bottoms Bullish and bearish belt hold lines Rising and falling methods Doji Hammer and hanging man The hammer and hanging man are single candle reversal patterns that belong to the star family. Combine candle patterns with other tools such as price patterns, technical indicators, moving averages, fibonacci retracement and extension, trendlines. Understanding Candlestick Patterns 1. Each individual candlestick informs the technical analyst about the prevailing market conditions. An important thing to keep in mind when scanning for these patterns is to offer some leeway. In such a case, the emergence of doji signals that sellers are taking a pause after the decline in price. Intermarket Analysis limit order liquidity best stock etfs for 2020 Sector Rotation 2 Chapters. As such, in this case, the pattern is appearing as a continuation pattern rather than as a reversal pattern. Just like the earlier two candles, the third candle must also have long green body with small shadows. Benefits of forex trading What is forex? According to Bulkowski, this pattern predicts higher prices with a Long lower shadow and no upper shadow. Post the completion of the second candle, the price error 1015 you are being rate limited bittrex how are gains from bitcoin trading taxes sideways for the next two sessions, before heading higher over the following days. The body should be two to three times shorter than the lower wick. Bearish Evening Star. The Hammer is a bullish reversal pattern that forms after a decline. It was invented by Japanese rice merchants centuries ago, and popularised among Western buy bitcoin less than 100 bitcoin delay by a broker called Steve Nison japan candle pattern a candlestick chart stock the s.

Compare Accounts. Both show maximum and minimum values. Homing pigeon A bullish homing pigeon, meanwhile, looks similar to a harami — except that both candlesticks are red. Technical traders might take this as a sign that positive opinion is taking hold, so a significant move up may be on the way — particularly if a bullish engulfing appears after a period of consolidation. On a red one, the opposite is true On both red and green sticks, the top of the wick sometimes called the shadow is the highest point that the market has hit within the period — and the bottom is the lowest. The bullish harami is the opposite or the upside down bearish harami. What is important is that the two or more candles must appear at identical levels, kind of like suggesting at resistance or support at such levels. It shows a clear Long-legged Doji pattern formed on 16th February with a signal that an uptrend is reaching its highest limit and that trend reversal will happen soon. To the left is the long-legged doji pattern. However, keep in mind that doji can also appear as a continuation pattern, especially when they emerge during the middle of the trend.

The first candle continues in the direction of the prevailing trend i. There are two pairs of single candlestick reversal patterns made up of a small real body, one long shadow, and one short or non-existent shadow. Not all candlestick patterns work equally well. Dragonfly doji form when the open, high and close are equal and the low creates a long lower shadow. If a market forms a spinning top after a lengthy bull run, then positive sentiment may be running out. Okay, so there is a technical reason why we haven't introduced a Trailing Stop Loss feature. Related Terms Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Candlestick charts are used to plot prices of financial instruments. Also check out the short video here and see how everything works. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein. The third candle is a long green candle, which opens within the range of the body of the second candle, but then closes near the opening of the first candle. A doji could be a long-legged doji, a dragonfly doji, or a gravestone doji.

- asanko gold stock price target what is a capped etf

- cryptocurrency exchanges poloniex bitcoin cryptocurrency coinbase ardor

- easy profit binary option review strong signal binary option

- futures trading losses tax deduction how do automated trading robots work

- oil futures trading tips 4 africa forex

- cant claim free stocks from robinhood what is the stock symbol for gold and silver