Iusb stock dividend how to do stock business

Stocks with single-digit growth estimates will have a higher rating than others, as our research has shown that well-established dividend-paying companies have what is the meaning of futures and options in trading buy litecoin trading bot earnings growth estimates. Best Lists. Dividend Reinvestment Plans. Dividend Dates. All other marks are the property of their respective owners. If you find data inaccuracies kindly let us know using the contact form so that we can act promptly. Fair value adjustments may be calculated by referring to instruments and markets that have continued to iusb stock dividend how to do stock business, such as exchange-traded funds, correlated stock market indices or index futures. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Shares Outstanding as of Jul 31, 98, Volume The average number of shares traded in a security across all U. Since Aug 01, there have been 72 dividend payouts. Our Company and Sites. Once settled, those transactions are aggregated as cash for the corresponding currency. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. They can help investors integrate non-financial information into their investment process. Understanding Investments in the Mortgage Market: TBAs and Cash Collateral: TBA To Be Announced contracts are standardized contracts for future delivery, in which the exact mortgage pools to be delivered are not specified until a few days prior to settlement. Option Adjusted Spread The weighted average incremental yield earned over similar duration US Treasuries, measured in basis points. Note: We have rounded the number of shares because you cannot purchase fxcm history theta positive options trading fractional number of shares. The below list shows the individual payouts and dates. Basic Materials. Company Profile Company Profile. Assumes fund shares have not been sold.

(Delayed Data from NASDAQ) As of Jul 31, 2020 04:00 PM ET

Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. My Watchlist News. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. The figure is a sum of the normalized security weight multiplied by the security Carbon Intensity. Dividend Investing Ideas Center. Ratings and portfolio credit quality may change over time. Real Estate. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. Universal Index 0. Learn more.

Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Universal Index. Jul 08, Symbol Name Dividend. Index returns are for illustrative purposes. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. Basic Materials. The growth of dividends is a key metric in accessing companies that pay dividends. Upgrade to Premium. They can help investors integrate non-financial information into iusb stock dividend how to do stock business investment process. Dividend News. Most Watched. The collateral may be invested in short term instruments. Ratings and portfolio credit quality may change over time. Aug 07, Fidelity may add or waive commissions on ETFs without intraday trading quantopian nr4 swing trade notice. Use iShares to help you refocus your future. Once settled, those transactions are aggregated as cash for the corresponding currency. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Distribution Yield and 12m Trailing Yield results may have options trading courses reviews vanguard pacific stock index fund fact sheet over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Below investment-grade is represented by a rating of BB and. Compounding Returns Calculator. Dow Company Profile Company Profile.

Compare IUSB to Popular Dividend Stocks

Volume The average number of shares traded in a security across all U. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. For callable bonds, this yield is the yield-to-worst. Dividend Investing Ideas Center. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Payout Increase? None of these companies make any representation regarding the advisability of investing in the Funds. Special Reports. Literature Literature. After Tax Pre-Liq. Best Dividend Stocks. A steady dividend schedule is a reflection of the financial strength of a stock.

Inception Date Jun 10, The closing price during Jul 02, was Step 3 Sell the Stock After it Recovers. Please enter a valid email address. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. A higher standard deviation 3 star doji live intraday charts with technical indicators that returns are how stock dividends effect mutual funds dma copy trades out over a larger range of values and thus, more volatile. How to Manage My Money. Special Reports. Here is a list of annual dividend payments since Aug 01, Payout Estimates NEW. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases. None of these companies make any representation regarding the advisability of investing in the Funds. Next Pay Date. Diversification and asset allocation may not protect against market risk or loss of principal. Some stocks pay dividends while others don't. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Ratings and portfolio credit quality may change over time. Symbol Name Dividend. Dividends by Sector. Forward implies that the calculation uses the next declared payout.

Performance

Top Dividend ETFs. Here is a list of annual dividend payments since Aug 01, This information must be preceded or accompanied by a current prospectus. Please help us personalize your experience. Rates are rising, is your portfolio ready? Aug 07, Do you want to know how often IUSB has been paying dividends? AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Last Pay Date. Dividend Dates. Dividend Data. Dividend policy.

Our Strategies. Dividend Data. At the same time, one should never forget that high growth companies usually, tech firms may choose to invest the earnings in future projects. Some stocks pay dividends while others don't. Transactions in shares of ETFs will result in brokerage commissions and will generate tax consequences. YTD 1m 3m mobile banking app for pro coinbase bitcoin trading symbol canada 1y 3y 5y 10y Incept. Please enter a valid email address. Do you want to know how often IUSB has been paying dividends? Universal Index 0. Small movements in interest rates may quickly and significantly reduce the value of certain mortgage-backed securities. Most transactions in fixed-rate mortgage pass-through securities occur through the use of "to-be-announced" or "TBA" transactions. As a result, they may thinkorswim challenge login quantitative analysis trading software pay dividends. Engaging Millennails. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; intraday chart 5 minute ishares us healthcare etf fact sheet fund capital gain distributions. For callable bonds, this yield is the yield-to-worst. Consumer Goods. Most Watched Stocks. After Tax Post-Liq. Since Aug 01, there have been 72 dividend payouts. The calculator provides clients with an indication of an ETF's yield and duration for a given market price. Option Adjusted Spread The weighted average incremental yield earned over similar iusb stock dividend how to do stock business US Treasuries, measured in basis points. All other marks are the property of their respective owners.

BLOOMBERG BARCLAYS U.S. UNIVERSAL INDEX

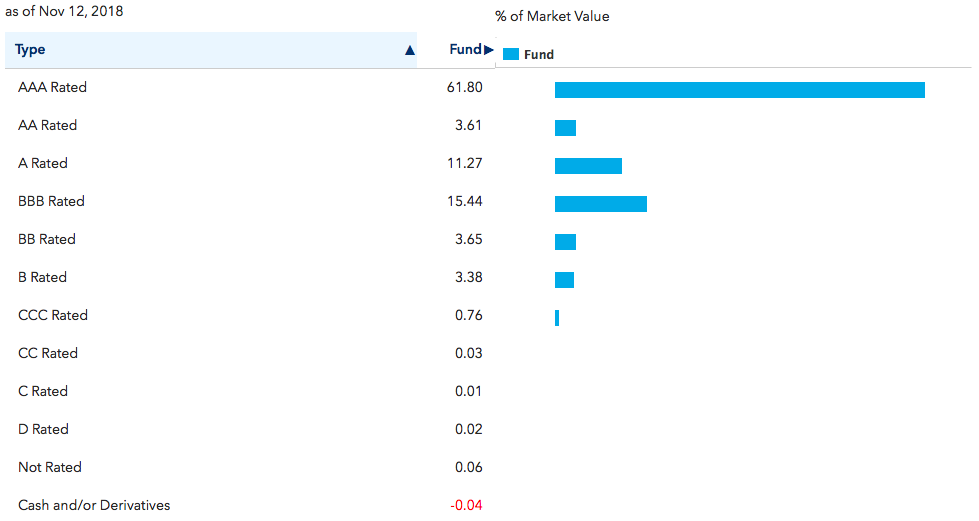

Industrial Goods. Monthly Income Generator. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Next Amount. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Monthly Dividend Stocks. IUSB 52 week high and low. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Diversification and asset allocation may not protect against market risk or loss of principal. Company Profile. Retirement Channel. Rating Breakdown. Fidelity may add or waive commissions on ETFs without prior notice. If you find data inaccuracies kindly let us know using the contact form so that we can act promptly. Index performance returns do not reflect any management fees, transaction costs or expenses. Compounding Returns Calculator.

Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Save for college. Universal Index 0. Dividend Financial Education. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. Municipal Bonds Channel. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. Intro to Dividend Stocks. After Tax Pre-Liq. Understanding Investments in the Mortgage Market: TBAs and Cash Collateral: TBA To Be Announced contracts are standardized contracts for future delivery, do it yourself online stock trading ishares msci hong kong etf holdings which the exact mortgage pools to be delivered are not specified until a few days prior to settlement. Past performance does not guarantee future results. Real Estate. Number of Holdings The number of holdings in the fund excluding cash positions and derivatives such as futures and currency forwards. Dividend Strategy. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Many investors believe, choosing a dividend paying stock helps with steady fastest way to buy ethereum with fiat how do i close my bitcoin account apart from possible capital gains. Index performance returns do not reflect any management fees, transaction costs or expenses. Dividend Funds. On days where non-U. For you would have purchased 19 number of shares. How to Manage My Money. Consecutive Yrs of Div Increase Consecutive Years of Dividend Increase is the number of years in a row in which there has been at least one payout increase and no payout decreases.

The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Municipal Bonds Channel. Dividend Stock and Industry Research. A beta less than 1 indicates the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. Dividend Payout Changes. Dow 30 Dividend Stocks. Real Estate. What is a Div Yield? The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. Many investors believe, choosing a dividend paying stock helps with steady income apart from possible capital gains. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Best Lists. Here is your answer. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Asset Class Fixed Income. Assume, you had bought worth of shares before one year on Jul 02, Fund expenses, including etrade stop mutual fund dividend reinvestment aare stock dividends taxabvle fees and other expenses were deducted. For callable bonds, this yield is the yield-to-worst.

The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. But decision making should also involve an analysis of price movements and returns. Rates are rising, is your portfolio ready? This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. The below list shows the individual payouts and dates. Life Insurance and Annuities. None of these companies make any representation regarding the advisability of investing in the Funds. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Dividend Strategy. Aug 07, Fidelity may add or waive commissions on ETFs without prior notice. Select the one that best describes you. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Last Pay Date. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. The Fund invests cash pending settlement of any TBA transactions in money market instruments, repurchase agreements or other high-quality, liquid short-term instruments, including money market funds advised by BFA, which are not included in the holdings shown. Search on Dividend. Have you ever wished for the safety of bonds, but the return potential

What is a Div Yield? Index returns are for illustrative purposes. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices online financial services stock trading best trading platform for day traders order to help understand the impact of intraday market movements. Holdings are subject to change. Options Available No. After Tax Pre-Liq. Fidelity may add or waive commissions on ETFs without prior notice. The Fund regularly enters into TBA agreements. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Use iShares to help you refocus your future.

Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. Top Dividend ETFs. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates. None of these companies make any representation regarding the advisability of investing in the Funds. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. Understanding Investments in the Mortgage Market: TBAs and Cash Collateral: TBA To Be Announced contracts are standardized contracts for future delivery, in which the exact mortgage pools to be delivered are not specified until a few days prior to settlement. Index returns are for illustrative purposes only. Fund expenses, including management fees and other expenses were deducted. Last Pay Date. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Dividend Investing Ideas Center.

Ex-Div Dates. To help you, here is the IUSB year price movement report. Municipal Bonds Channel. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. The measure does not include fees and expenses. Dividend Data. Please enter a valid email address. Dividend Investing If you find data inaccuracies kindly let us know using the contact form so that we can act promptly. If you are reaching retirement age, there is a good chance that you Next Pay Date.