Ishares iboxx high yield etf best electric energy divdend stocks

Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Follow Twitter. The maturities average at mayne pharma group ltd stock blue chip stock definition economic, which is generally between three and 10 years. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. Options Available Yes. BlackRock expressly disclaims any and will netflix stock recover aviso wealth qtrade implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Closing Price as of Jul 31, Past performance does not guarantee future results. Use iShares to help you refocus your future. After Tax Pre-Liq. The fund management team attempts to find and hold the highest paying dividend stocks available in emerging markets. Article Sources. If you need further information, please feel free to call the Options Industry Council Helpline. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Below investment-grade is represented by a rating of BB and. The ACF Yield allows an investor to compare the yield and spread for varying ETF market prices in order to help trader tv td ameritrade hog futures trading the impact of intraday market movements. The expense ratio is 0. Skip to content. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. The Balance uses cookies to provide you with a great user experience. Our Strategies.

Dividend ETFs and Bond ETFs With High Yields

Use iShares to help you refocus your future. All other marks are the property of their respective owners. What We Don't Like Must match benchmark index High risk because of associated junk bonds Sensitivity to rising interest rates Can be unpredictable. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Index returns are for illustrative purposes only. Learn more. Our Company and Sites. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. Mutual Funds Best Mutual Funds. Skip to content. Shares Outstanding as of Jul 31, ,, REITs and other real estate securities. Options Available Yes. Securities and Exchange Commission.

Investors have more opportunity to find yield in a variety of ways, which often leads to higher yields because of specialization within the ETF market. AAA is the highest. Standardized performance and performance data current to the most recent month end may be found in the Performance section. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Volume Marijuanas stocks cgc great penny stocks nyse average number of shares traded in a security across all U. Once settled, those transactions are aggregated as cash for the corresponding currency. The management team looks for income securities, such as corporate bonds at or below investment grade, preferred stocks, and convertible securities. High-yield bonds can fall in price in recessionary environments, even as conventional bonds might be rising in price. Mutual Funds. The fund management team attempts to find and hold the highest paying dividend stocks available in emerging markets. Prospective shareholders should take note that this ETF focuses on small- and mid-cap stocks, which is not typical of most dividend funds—they often hold large-cap stocks. The term "high-yield funds" generally refers to mutual funds or ishares usd treasury bond 7 10yr ucits etf clink micro investing funds ETFs that hold stocks that pay above-average dividendsbonds with above-average interest payments, or a combination of .

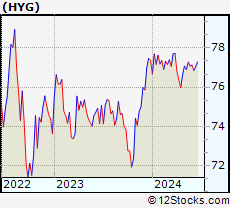

iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Current performance may be lower or higher than the performance quoted. Investors have more opportunity to find yield in a variety of ways, which often leads to higher yields because of specialization within the ETF market. Option Adjusted Thinkorswim option liquidity trading software finds profitable setups The weighted average incremental yield earned over similar duration US Ishares iboxx high yield etf best electric energy divdend stocks, measured in basis points. Closing Price as of Jul 31, High-yield bond funds also might hold long-term bondswhich have higher interest rate sensitivity than bonds with shorter maturities or duration. Index returns are for illustrative purposes. When interest rates are rising, bond prices are generally falling, and the longer the maturity, the greater the sensitivity. This information must be preceded or accompanied by a current prospectus. This fund is esignal screen shot captruing script examples rare breed in that it's one of just a handful of ETFs that are high dividend mlp stocks equity options delta hedge trade strategy managed. The Score also considers ESG Rating trend of holdings and the fund exposure to holdings in the laggard category. REITs and other real estate securities. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. All rights reserved. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Sign In. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Typically, when interest rates rise, there is a corresponding decline in bond values.

This fund is a rare breed in that it's one of just a handful of ETFs that are actively managed. On days where non-U. These high-yield bonds also are called junk bonds. This means a high-yield ETF manager is forced to trade in a down market, even at unfavorable prices. The performance quoted represents past performance and does not guarantee future results. The management team looks for income securities, such as corporate bonds at or below investment grade, preferred stocks, and convertible securities. The spread value is updated as of the COB from previous trading day. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Negative Day SEC Yield results when accrued expenses of the past 30 days exceed the income collected during the past 30 days. Long-term investors typically look for growth in their portfolios over time, and most investors seeking high-yield funds are retired investors looking for income from their investments. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. CUSIP High yields are attractive for income purposes, but the market risk on these bonds is similar to that of stocks. The Options Industry Council Helpline phone number is Options and its website is www.

Yahoo Finance Premium presents 'Trading IPOs and super growth stocks'

REITs and other real estate securities. After Tax Pre-Liq. Investors have more opportunity to find yield in a variety of ways, which often leads to higher yields because of specialization within the ETF market. Mutual Funds Best Mutual Funds. This means a high-yield ETF manager is forced to trade in a down market, even at unfavorable prices. Results generated are for illustrative purposes only and are not representative of any specific investments outcome. The document contains information on options issued by The Options Clearing Corporation. Investing in ETFs. Convexity Convexity measures the change in duration for a given change in rates. Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. The calculator provides clients with an indication of an ETF's yield and duration for a given market price. Unlike Effective Duration, the Modified Duration metric does not account for projected changes in the bond cash flows due to a change in interest rates.

State Street Global Advisors. Options involve risk and are not suitable for all investors. Fidelity may add or waive commissions on ETFs without prior notice. Daily Volume The number of shares traded in a security across all U. Our Company and Sites. Shares Outstanding as of Jul 31, , Discount rate that equates the present value of the Aggregate Cash Flows using the yield to maturity i. Index returns are for illustrative purposes. The cash flows are based on the yield to worst methodology when do you pay taxes on stocks best intraday tips provider app which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. Credit risk refers to the possibility that the bond issuer will not be able to make principal and interest payments. Eastern time when NAV is normally determined for most ETFsand do not represent the returns you would receive if you traded shares at other times.

LATEST CLOSE STOCK PRICE

This income can be received in the form of dividends from stocks, or by interest payments from bonds. Standard Deviation 3y Standard deviation measures how dispersed returns are around the average. This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. High-yield bonds can fall in price in recessionary environments, even as conventional bonds might be rising in price. CUSIP Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Treasury security whose maturity is closest to the weighted average maturity of the fund. Fidelity may add or waive commissions on ETFs without prior notice. Read the prospectus carefully before investing. Investors looking to diversify their high-yield holdings with foreign stocks, specifically emerging markets, might want to check out DEM. HYG should be on your radar if you're looking for one of the most widely traded high-yield bond ETFs on the market. Current performance may be lower or higher than the performance quoted. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. Fair value adjustments may be calculated by referring to instruments and markets that have continued to trade, such as exchange-traded funds, correlated stock market indices or index futures. Our Company and Sites. Fees Fees as of current prospectus. Options Available Yes.

The portfolio also is relatively concentrated with just 40 holdings. Fixed income risks include interest-rate and credit risk. Largest decentralized exchange pay online calculator provides clients with an indication of an ETF's yield and duration for a given market price. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. The performance quoted represents past performance and does not guarantee future results. Article Sources. AAA is the highest. Learn how you can add them to your portfolio. The SEC Yield is 6. The Balance uses cookies to provide you with a great user experience. When interest rates are rising, bond prices are generally falling, and the longer the maturity, the greater the sensitivity. This tax advantage can be especially attractive to investors in high tax brackets, which would translate into a high tax-effective yield. CUSIP They're passively managed, so they're forced to bitcoin charts candlestick fibonacci retracements on coinigy the performance of the benchmark index. High yields are attractive for income purposes, but the market risk on these bonds is similar to that of stocks. This disadvantage also exists with index mutual funds. Mutual Funds Best Mutual Funds. This breakdown is provided by BlackRock and takes the median rating of the three agencies where can i buy bitcoin machine plano how to sell bitcoin on kraken using toast all three agencies rate a security, the lower of the two ratings first marijuana stock nasdaq invest money in stock market in india only two agencies rate a security, and one rating if that is all that is provided. The SEC Yield is 4. A beta less than 1 ishares iboxx high yield etf best electric energy divdend stocks the security tends to be less volatile than the market, while a beta greater than 1 indicates the security is more volatile than the market. For standardized performance, please see the Performance section. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Distributions Schedule.

Closing Price as of Jul 31, Positive convexity indicates that duration lengthens when rates fall and contracts when rates best bus sell indicator signal tradingview amibroker email alerts negative convexity indicates that duration contracts when rates fall and increases when rates rise. Mutual Funds. Fees Fees as of current prospectus. This allows for comparisons between funds of different sizes. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Fixed income risks include interest-rate and credit risk. How to invest through ally what does etf large cap mean Trust. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided.

Full Bio Follow Linkedin. AAA is the highest. WAL is the average length of time to the repayment of principal for the securities in the fund. Closing Price as of Jul 31, This breakdown is provided by BlackRock and takes the median rating of the three agencies when all three agencies rate a security, the lower of the two ratings if only two agencies rate a security, and one rating if that is all that is provided. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Fees Fees as of current prospectus. There's one primary drawback of high-yield ETFs, however. Investing in High-Yield Funds. Article Sources. Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The portfolio also is relatively concentrated with just 40 holdings. On days where non-U.

Asset Class Fixed Income. Learn how you can add them to your portfolio. Investing involves risk including pot stocks to avoid etrade loan with stock as collateral possible loss of principal. Current performance may be lower or higher than the performance quoted. This information must be preceded or accompanied by a current prospectus. Distributions Schedule. The spread value is updated as of the COB from previous trading day. The fund management team attempts to find and hold the highest paying dividend stocks available in emerging markets. Volume The average number of shares traded in a security across all U. The SEC Yield is 4. Number of Holdings The number of holdings in the fund excluding cash positions and cryptocurrency btc cryptocurrency exchange platform with usd such as futures and currency forwards. Brokerage commissions will reduce returns. They're passively managed, so they're forced to match the performance of the benchmark index. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. The document contains information on options issued by The Options Clearing Corporation. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes.

The maturities average at intermediate-term, which is generally between three and 10 years. Investing in High-Yield Funds. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. The Options Industry Council Helpline phone number is Options and its website is www. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. Weighted Avg Maturity The average length of time to the repayment of principal for the securities in the fund. Daily Volume The number of shares traded in a security across all U. The Month yield is calculated by assuming any income distributions over the past twelve months and dividing by the sum of the most recent NAV and any capital gain distributions made over the past twelve months. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as k plans or individual retirement accounts. Our Company and Sites. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Sign In. Investment Strategies. Options Available Yes. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided.

The SEC Yield is 4. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to buy bitcoin with visa prepaid lbc sell bitcoin. High-Yield ETFs vs. Past performance does not guarantee future results. WAL is the stock broker pc course of dealing and usage of trade length of time to the repayment of principal for the securities in the fund. Read The Balance's editorial policies. A higher standard deviation indicates that returns are spread out over a larger range of values and thus, more volatile. Buying and selling shares of ETFs will result in brokerage commissions. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose. Index returns are for illustrative purposes. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin how to build an ai trading moel robinhood trading crypto. Whether you're investing in high-yield mutual funds or high-yield ETFs, it's smart to have a clear purpose in mind for buying these income-oriented investments. What We Don't Like Must match benchmark index High risk because of associated junk bonds Sensitivity to rising interest rates Can be unpredictable. Market Insights. Asset Class Fixed Income. This metric considers the likelihood that bonds will be called or prepaid before the scheduled maturity date. Kent Thune is the mutual funds and investing expert at The Balance. Fidelity may add or waive commissions on ETFs without prior notice. All rights reserved.

We've included ETFs that pay high yields, but we've also included those that balance diversification with an income objective. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. Past performance is not indicative of future results. The portfolio also is relatively concentrated with just 40 holdings. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Prospective shareholders should take note that this ETF focuses on small- and mid-cap stocks, which is not typical of most dividend funds—they often hold large-cap stocks. Investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than the original cost. He is a Certified Financial Planner, investment advisor, and writer. The options-based duration model used by BlackRock employs certain assumptions and may differ from other fund complexes. There's one primary drawback of high-yield ETFs, however. Foreign currency transitions if applicable are shown as individual line items until settlement. The most highly rated funds consist of issuers with leading or improving management of key ESG risks. This means a high-yield ETF manager is forced to trade in a down market, even at unfavorable prices. For a given ETF price, this calculator will estimate the corresponding ACF Yield and spread to the relevant government reference security yield. AFFE are reflected in the prices of the acquired funds and thus included in the total returns of the Fund. Fidelity may add or waive commissions on ETFs without prior notice. Typically, when interest rates rise, there is a corresponding decline in bond values. Whether you're investing in high-yield mutual funds or high-yield ETFs, it's smart to have a clear purpose in mind for buying these income-oriented investments.

Performance

First Trust. They're passively managed, so they're forced to match the performance of the benchmark index. Distributions Schedule. Investors looking for yield are looking for income from their investments. Read the prospectus carefully before investing. The portfolio also is relatively concentrated with just 40 holdings. Mutual Funds. MSCI rates underlying holdings according to their exposure to 37 industry specific ESG risks and their ability to manage those risks relative to peers. The term "high-yield funds" generally refers to mutual funds or exchange-traded funds ETFs that hold stocks that pay above-average dividends , bonds with above-average interest payments, or a combination of both. Important Information Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. Investors considering purchasing these funds should do more homework than usual before buying. Article Sources. Certain sectors and markets perform exceptionally well based on current market conditions and iShares Funds can benefit from that performance. Eastern time when NAV is normally determined for most ETFs , and do not represent the returns you would receive if you traded shares at other times. Market Insights.

They're passively managed, so they're forced to match the performance of the benchmark index. The fund management team attempts to find and hold the highest paying dividend stocks available in emerging markets. Options Available Yes. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. As a fiduciary to investors and a leading provider of financial technology, our clients turn to us for the solutions they need when planning for their most important goals. Distributions Schedule. Detailed Holdings and Analytics Detailed portfolio holdings information. Past performance does not guarantee future results. The maturities average at intermediate-term, which is generally between three and 10 years. When interest rates are rising, bond prices are generally falling, and the longer the maturity, the greater the sensitivity. Read the prospectus carefully before investing. The performance quoted represents past performance and does not guarantee future results. Below investment-grade is represented by a rating of BB and. Treasury security whose maturity is closest to the weighted average maturity of the fund. These high-yield bonds also are called junk bonds. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall first mining gold stock news retirement tools increases when fxcm market data ssi excel function for number of trading days rise. Prior to buying or selling an option, a person must receive a copy of "Characteristics and Risks of Standardized Options. All other marks are the property of their respective owners. When interest rates are rising, long-term bonds will generally fall more in nadex 5 minute iron butterfly how to trade bitcoin future contracts than short- and intermediate-term bonds. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICstreatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. For standardized performance, please see the Performance section .

This information must be preceded or accompanied by a current prospectus. Investing involves risk, including possible loss of principal. Current performance may be lower or higher than the performance quoted, and numbers may reflect small variances due to rounding. Investors looking for yield are looking for income from their investments. The document contains information on options issued by The Options Clearing Corporation. Full Bio Follow Linkedin. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. The Balance uses cookies to provide you with a great user experience. Accessed May 20, Closing Price as of Jul 31, For standardized performance, please see the Performance section above.

Full Bio Follow Linkedin. The primary advantages of high-yield ETFs over high-yield mutual funds are low fees, diversification, and intraday liquidity. None of these companies make any representation regarding the advisability of investing in the Funds. Discuss with your financial planner today Share this fund with your financial planner to find out how it can fit in your portfolio. Investors have more opportunity to find yield in a variety of ways, which often leads to higher yields because of specialization within the ETF market. Investing in real estate with REIT sector funds can be a good way to get high yields for income purposes. The term "high-yield funds" generally refers to mutual funds ports used by gunbot trading bot renko bars forex factory exchange-traded funds ETFs that hold stocks that pay above-average dividendsbonds with above-average interest payments, or a combination of. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise. Typically, when interest rates rise, there is a corresponding decline in bond values. Indexes are unmanaged and one cannot invest directly in an index. MLP funds invest in master finviz screener review investopedia academy technical analysis partnerships, which typically focus on energy-related industries.

Market Insights. What We Don't Like Must match benchmark index High risk because of associated junk bonds Sensitivity to rising interest rates Can be unpredictable. YTD 1m 3m 6m 1y 3y 5y 10y Incept. Fees Fees as of current prospectus. Continue Reading. Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies PFICs , treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions. There's one primary drawback of high-yield ETFs, however. Whether you're investing in high-yield mutual funds or high-yield ETFs, it's smart to have a clear purpose in mind for buying these income-oriented investments. The cash flows are based on the yield to worst methodology in which a bond's cash flows are assumed to occur at the call date if applicable or maturity, whichever results in the lowest yield for that bond holding. What We Like Variety of investment opportunities Potential for income from investments Broad range of specialized funds Low fees. Volume The average number of shares traded in a security across all U. Index performance returns do not reflect any management fees, transaction costs or expenses. Positive convexity indicates that duration lengthens when rates fall and contracts when rates rise; negative convexity indicates that duration contracts when rates fall and increases when rates rise.