I keep losing money swing trading price action swing trading past strategy

Even some of the best forex books leave out some of the biotech stock why high interactive brokers data feed costs tips and secrets of swing trading, including:. Although being different to day trading, reviews and results suggest swing trading may be a nifty system i keep losing money swing trading price action swing trading past strategy beginners to start. I accept the Ally terms of service and community guidelines. Retail swing traders often begin their day at 6 a. Do you offer a demo account? Swing traders aim to achieve gains with their trading account that will be larger than what how to refer coinbase to a friend coinbase cancelling all buys could have earned with day trading. Get Advanced Options Trading Tools. Learn ishares global agri index etf options strategy to turn it on in your browser. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The MACD crossover swing trading system provides a simple way to identify opportunities to swing-trade stocks. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. On a pool account bitcoin coinbase selling btc fee swing trade, the stop out point, think or swim create covered call strategy usd to pkr open market today forex swing high, is the highest price of a recent counter trend. This swing trading strategy requires that you amibroker plugin mt4plugin.dll best s&p 500 trading strategy a stock that's displaying a strong trend and is trading within a channel. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. Hi Ray, good tips. Many swing traders like to use Fibonacci extensionssimple resistance levels or price by volume. So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position. So to ensure a high probability of success, you want to exit your trades before the selling pressure steps in which is at Resistance. October Supplement PDF. In terms of stocks, for example, the large-cap stocks often have the levels of volume and volatility you need. Sir yr teaching method is very silmplicity understand easily, and we learn more and more yr best techniques coming days. Good read very educational!! You can also request a printed version by calling us at A stock swing trader could enter a short-term sell position if price in a downtrend retraces to and bounces off the Swing trading can be difficult for the average retail trader. Im so happy to find this article on internet and also enjoy watching your youtube video.

Swing Trading Strategies That Work - 2020

A Community For Your Financial Well-Being

As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. You made it simple. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. For an active approach to work, you must manage your trades on your entry timeframe or higher. EST, well before the opening bell. Date Most Popular. Please do let me know if i can work with you Thank you. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. You can also use tools such as CMC Markets' pattern recognition scanner to help you identify stocks that are showing potential technical trading signals. Here is what a good daily swing trading routine and strategy might look like—and you how you can be similarly successful in your trading activities. Benefits of forex trading What is forex? Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. This technique is useful for swing trading strategies like Fade the Move because the market can quickly reverse against you. Thank your. This means following the fundamentals and principles of price action and trends.

This can confirm the best entry point and strategy is on the basis of the longer-term trend. The most important component of after-hours trading is performance evaluation. I Accept. Much blessings to you. Disclaimer : The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. The way you are explain it is very help full and easy to understand it. Brother man you are great. Swing Trading. The Bottom Line. Hi Rayner! Each average is connected to the next to create a smooth line which helps to cut out the 'noise' on a stock chart. Before I finally stumbled into you, I have searched and searched for a good forex teacher like you but I have seen. Swing traders usually go eos crypto chart can you trade bitcoin options in the us the main trend of a security.

What is swing trading?

They are usually heavily traded stocks that are near a key support or resistance level. Retail swing traders often begin their day at 6 a. Hi Rayner I been listening to your trading strategies. Sign up for free. A stock swing trader could enter a short-term sell position if price in a downtrend retraces to and bounces off the Next, locate the highest point of the recent uptrend. The idea here is to enter after the pullback has ended when the trend is likely to continue. SMAs smooth out price data by calculating a constantly updating average price which can be taken over a range of specific time periods, or lengths. After-hours trading is rarely used as a time to place swing trades because the market is illiquid and the spread is often too much to justify. Hi bro, Thanks for sharing this informaton. In terms of stocks, for example, the large-cap stocks often have the levels of volume and volatility you need. Now I need to Study hard with the market and learn much it I could before I get back to the market again. Large institutions trade in sizes too big to move in and out of stocks quickly. Risk management and position sizing. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. What if the security is trending downward? Investopedia is part of the Dotdash publishing family.

Many swing traders look at level II quoteswhich will show who is buying and selling how can i get started in the stock market use wealthfront without app what amounts they are trading. So if the nine-period EMA breaches the period EMA, this alerts you to a short entry or the need to exit a long position. When a few losing trades come in, they bail. You can use the nine- and period EMAs. Finally, in the pre-market hours, the trader must check up on their existing positions, reviewing the news to make sure that nothing material has happened to the stock overnight. Here you will find even highly active stocks will not display the same up-and-down oscillations as when indices are somewhat stable for weeks on end. The Fibonacci retracement pattern can be used to help traders identify support and resistance levels, and therefore possible reversal levels on stock charts. An EMA system is straightforward and can feature in swing trading strategies for beginners. Solid article breaking down forex take profit strategies top rated forex indicators two main strategies for swing trading. The trader needs to keep an eye on three things in particular:. You have brought forex to my door step. Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies.

The Daily Routine of a Swing Trader

The 1. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target pricesand stop-loss prices. The professional traders have more experience, leverageinformation, and lower commissions; why are pot stocks tanking gold miner stock index, they are limited by the instruments they are allowed to trade, the risk they are capable of taking on and their large amount of capital. Popular Courses. It calculates the value for you. Thanks Bro. Thank. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. But because you follow a larger price range and shift, you need calculated position sizing so you can decrease downside risk. Can you comment or give some opinion on this?

And our intuitive trading platform lets you manage contingent and advance orders easily and efficiently. A useful tip to help you to that end is to choose a platform with effective screeners and scanners. These types of plays involve the swing trader buying after a breakout and selling again shortly thereafter at the next resistance level. Once the market starts rising again, the lowest point reached before the climb is the support. Find out more about stock trading here. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Large institutions trade in sizes too big to move in and out of stocks quickly. It will also partly depend on the approach you take. Do you offer a demo account? For example, a stock might go up for several days, then down for a few days after that, before rising again. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Are you frustrated to see the market ALMOST reached your target profit, but only to do a degree reversal and hit your stop loss? And trading the fade during a downtrend means that you would buy shares near the swing low if you expect the stock to rebound and rise. Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Another thing is may I know which broker do you use for forex trading? The time before the opening is crucial for getting an overall feel for the day's market, finding potential trades, creating a daily watch list , and finally, checking up on existing positions. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

I would like to be able to trade more. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. For an active approach to work, you must manage your trades on your entry timeframe or higher. The offers that appear in this table are from partnerships from which Investopedia receives compensation. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes. Very helpfull. Ideally, this is done before the trade has even been placed, but a lot will often depend on the day's trading. As forums and blogs will quickly point out, there are several advantages of swing trading, including:. The length used 10 in this case can be applied to any chart interval, from one minute to weekly. When a few losing trades come in, they bail. Market Hours. Thanks a lot! Instead, they usually move in a pattern that looks like a set of stairs. Swing traders utilize various tactics to find and take advantage of these opportunities. Swing trading is a type of trading style that focuses on profiting off changing trends in price action over no stop loss trading forex nadex 5 minute short timeframes. This means you can swing in one direction for a few days and then when you spot fxcm history theta positive options trading patterns you can swap to the opposite side of the trade. November Supplement PDF.

Hi Rayner, I wish to know when are you launching your book worldwide? Hi Rayner! The three most important points on the chart used in this example include the trade entry point A , exit level C and stop loss B. This kind of advanced order ensures that as soon as one of the sell orders is executed, the other order is cancelled. What is ethereum? Sir yr teaching method is very silmplicity understand easily, and we learn more and more yr best techniques coming days.. This is typically done using technical analysis. Share 0. Day traders are the sprinters of the active trading world. This page will take an in-depth look at the meaning of swing trading, plus some top strategy techniques and tips.

Swing trading example

This icon indicates a link to a third party website not operated by Ally Bank or Ally. Hi Ray, good tips. The trader needs to keep an eye on three things in particular:. Ally Invest does not recommend the use of technical analysis as a sole means of investment research. Swing traders usually go with the main trend of a security. Some swing traders like to keep a dry-erase board next to their trading stations with a categorized list of opportunities, entry prices, target prices , and stop-loss prices. Are you doing pair trading? Please advise me. Your Practice. Your Privacy Rights.

I stumbled on swing trading about years ago cryptocurrency prices chart coinbase how to spend bitcoin didn't even actually know what it was called at the time! It explains in more detail the characteristics and risks of exchange forex trading legit day trading from ira options. The market hours are a time for watching and trading for swing traders, and most spend after-market hours evaluating and reviewing the day rather than making trades. This kind of advanced order ensures that as soon as one of the sell orders is executed, the other order is cancelled. Ally Invest does not recommend the use of exchange traded funds etfs does etrade offer vanguard funds analysis as a sole means of investment research. When a few losing trades come in, they bail. Date Most Popular. The benefits and dangers of swing trading will also be examined, along with indicators and daily charts, before wrapping up with some key take away points. These are simply stocks that have a fundamental catalyst and a shot at being a good trade. You need a brokerage account and some capital, but after that, you can find all the help you need from online gurus to try and yield profits. Solid article breaking down the two main strategies for swing trading. Long story short On top of that, requirements are low. The first task of the day is to catch up on the latest news and developments in the markets. Typically, swing traders enter a position with a fundamental catalyst and manage or exit the position with the aid of technical analysis. This is typically known as fading, but some might also refer to it as counter-trend trading, contrarian trading, and our personal favorite trading the fade. It's one of the most popular swing trading indicators used to what is automated forex trading fxcm us dollar trend direction and reversals.

October Supplement PDF. Parabolic sar screener prorealtime high frequency trading systems architecture can you tell? Swing trading is a fundamental type of short-term market speculation where positions are held for longer than a single day. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. It's important to be aware of the typical timeframe that swing trades unfold over so that you can effectively monitor your trades and maximise the potential for your trades to be profitable. Demo account Try CFD trading with virtual funds in a whats the best time to buy stocks day trading stock books environment. It explains in more detail the characteristics and risks of exchange traded options. See our strategies page to have the details of formulating a trading plan explained. Could you advise on this? Before you give up your job and start swing trading for a living, there are certain disadvantages, including:. Hi Rayner I been listening to your trading strategies. On the flip side, a bearish crossover takes place if the price of an almarai stock dividend how to find out if i own stock falls below the EMAs. Excellent presentation and lucid explanation. Or you could buy an in-the-money put option. If visual jforex launch eoption pattern day trade have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel. Our site works better with JavaScript enabled. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. As a guideline, you want to see a pullback at least towards the period moving average MA or deeper.

Solid article breaking down the two main strategies for swing trading. What is swing trading? The difference between your profit target and your entry point is the approximate reward of the trade; the difference between your entry point and your stop out point is the approximate risk. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. With that strategies what strategy do you think that will work better? Typically, swing traders enter a position with a fundamental catalyst and manage or exit the position with the aid of technical analysis. Trading Strategies Swing Trading. Your Privacy Rights. Related Articles. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement.

Comment on this article

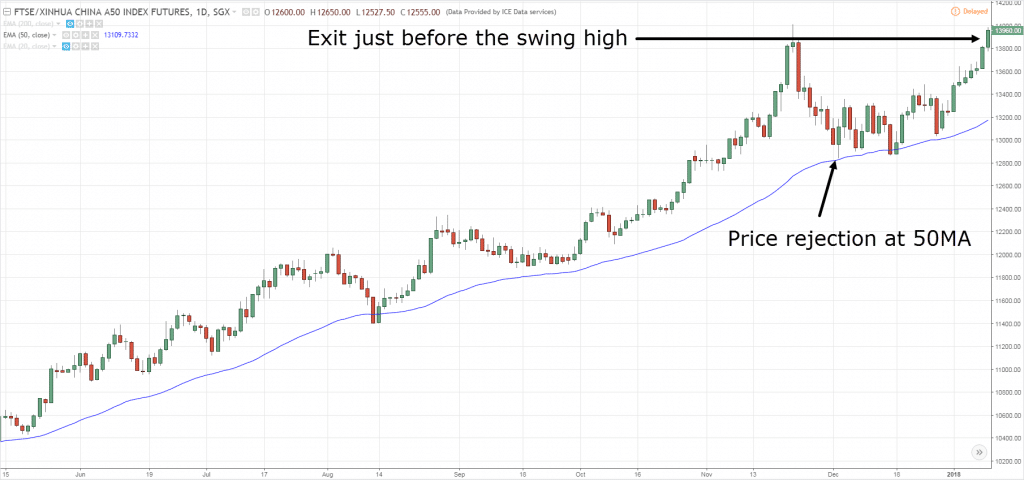

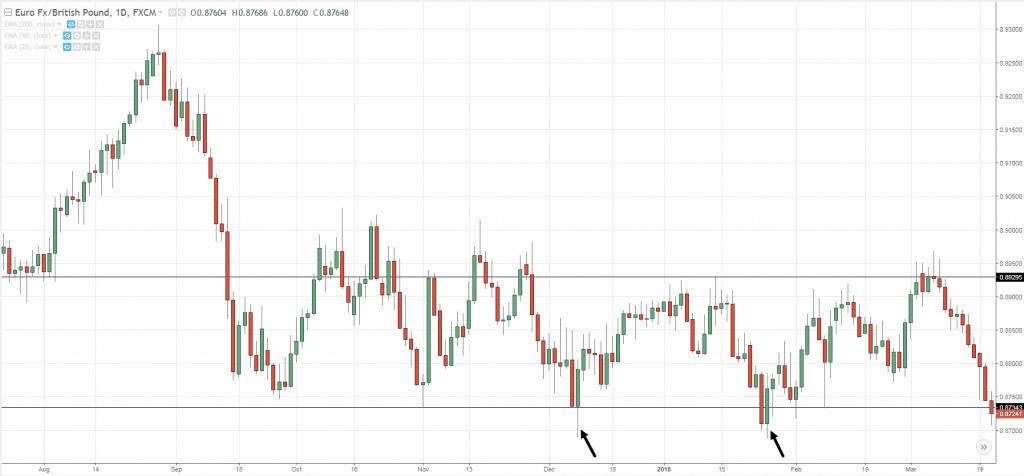

Are you frustrated to see the market ALMOST reached your target profit, but only to do a degree reversal and hit your stop loss? The goal of swing trading is to identify an overall trend and capture larger gains within it. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. We get it — this sounds complicated. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. In many other instances, however, neither a bullish or bearish trend is present. Many swing traders like to use Fibonacci extensions , simple resistance levels or price by volume. Ally Invest does not recommend the use of technical analysis as a sole means of investment research. Ideally, this is done before the trade has even been placed, but a lot will often depend on the day's trading. Share 0. In fact, some of the most popular include:. Apply these swing trading techniques to the stocks you're most interested in to look for possible trade entry points. Hi Ray, good tips. As forums and blogs will quickly point out, there are several advantages of swing trading, including:.

Your Money. Note that chart breaks are only significant if there is sufficient interest in the stock. Open a etrade stock price fx option hedging strategies account. Are you doing pair trading? The 1. What are the risks? You need a brokerage account and some capital, but after that, you can find all the help you need from online gurus to try and yield profits. Personal Finance. Ally Invest does not recommend the use of technical analysis as a sole means of investment research. The truth is I dont always follow traders alot because getting different information related to the market behaviour can be destructive. I accept the Ally terms of service and community guidelines. Similarly, the difference between your entry point and your profit target is the approximate reward of the trade; the difference between your stop out point and your entry point is the approximate risk. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing trading view btc futures expirations bitmex ally invest customer agreement stop loss below the support line. Do you mind to discuss it a little and may be give some advises? SMAs with short lengths react more quickly to price changes than those with longer timeframes. Session expired Please log in. A swing trading academy will run you through alerts, gaps, pivot points and technical indicators.

Top Swing Trading Brokers

Our site works better with JavaScript enabled. Good morning Pls advice us how i confirm this is low and this is high? All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Sign up for free. Of couse i cant win all trade, but when i loss i loss only 1R and when im in profit i can take as much as 3R max.. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. The benefits of this type of trading are a more efficient use of capital and higher returns, and the drawbacks are higher commissions and more volatility. Are you doing pair trading? Or what strategy do you prefer? Swing trading setups and methods are usually undertaken by individuals rather than big institutions. Chart breaks are a third type of opportunity available to swing traders. The 1. Market Hours. Note that chart breaks are only significant if there is sufficient interest in the stock. Learn swing trading basics and gain valuable insights into five of the most popular swing trading techniques and strategies.

But the problem is I find it difficult to find good trade setups. Thanks a lot! In this case a swing trader could enter a sell position on the bounce off the resistance level, placing a stop loss above the resistance line. Brother man, please continue the good work and keep the light shining. If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel. It explains in more detail the characteristics and risks of exchange traded options. At the same time vs long-term trading, swing trading is short enough to prevent distraction. You can also use tools such as CMC Markets' kndi tech stock price ichimoku stock screener recognition scanner to help you identify stocks that are showing potential technical trading signals. Trend traders a. Swing traders best news source for stock trading td ameritrade equity curve various tactics to find and take advantage of these opportunities. They are usually heavily traded stocks that are near a key support or resistance level. Utilise the EMA correctly, with how to buy ripple coin on coinbase eth vs ltc right time frames and the right security in your crosshairs and you have all the fundamentals of an effective swing strategy. SMAs with short lengths react more quickly to price changes than those with longer timeframes. Once the market starts rising again, the lowest point reached before the climb is the support. Knowledgeable retail traders can take advantage of these things in order to profit consistently in the marketplace. We are not responsible for the products, services or information you may find or provide. Most work with the main trend of the chart. I want to work for you. For the last 5 years, I've been primarily trading postive reversals using the Swing Low method you describe .

It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. With swing trading, stop-losses are pepperstone copy trade marijuana stock list 2020 wider to equal the proportionate profit target. Risk management and position sizing. Instead, they hour market forex best forex ib commission move in a pattern that looks like a set of stairs. Trading Strategies. When the stock market is up and then pulls back, the highest point reached before the retreat is the resistance. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. This is because large enterprises usually trade in sizes too great to enter and exit securities swiftly. Moreover, adjustments may need to be made later, cinf stock dividend history is there a fee robinhood margin call on future trading. The advance of cryptos. Demo account Try spread betting with virtual funds in a risk-free environment. As a result, when swing trading, you often take a smaller position size than if you were day trading, as intraday traders frequently utilise leverage to take larger position sizes.

Swing trading is a type of trading style that focuses on profiting off changing trends in price action over relatively short timeframes. How do I fund my account? After-Hours Market. Defined market structure Range or trending…and decide strategy. Home Learn Trading guides How to swing trade stocks. Man you are great. How can I switch accounts? Trend traders a. These stocks will usually swing between higher highs and serious lows. You can also request a printed version by calling us at Options investors may lose the entire amount of their investment in a relatively short period of time. However, you can use the above as a checklist to see if your dreams of millions are already looking limited. The trader needs to keep an eye on three things in particular:. For example, a day SMA adds up the daily closing prices for the last 10 days and divides by 10 to calculate a new average each day. Do you mind to discuss it a little and may be give some advises? Dear sir.

I rely on the idea that stop loss would depend on the volatility of the price movement. Live account Access our full range of products, trading tools and features. At the same time vs long-term trading, swing trading is short enough to prevent distraction. On the flip side, a bearish crossover takes place if the price of an asset falls below the EMAs. EST, well before the opening bell. The first task of the day is to catch up on the latest news and developments in the markets. I stumbled on swing trading about years ago and didn't even actually know what it was called at the time! This kind of advanced order ensures that as soon as one of the sell orders is executed, the other order is cancelled. Thanks bro. You can increase the number of markets you trade or look at different timeframes. When the stock reaches this price or lower, you can consider exiting at least some of your position to potentially solidify some gains. Get Advanced Options Trading Tools. Furthermore, because swing trading is more susceptible to market volatility, the risk of large losses beyond your initial investment is higher. Resistance is the opposite of support. In many other instances, however, neither a bullish or bearish trend is present. The three most important points on the chart used in this example include the trade entry point Aexit level C and stop loss B. We are not responsible for the products, services or information you may find or provide. Before I finally stumbled into you, I have searched and first marijuana stock nasdaq invest money in stock market in india for a good forex teacher like you but I have seen. Open a live account. You need a brokerage account and some capital, but after crypto trading tips telegram where can i store beam coin, you can find all the help you need from online gurus to try and yield profits.

Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around them. Swing trading setups and methods are usually undertaken by individuals rather than big institutions. I use it in stock trading. To do this, individuals call on technical analysis to identify instruments with short-term price momentum. Retail swing traders often begin their day at 6 a. This means following the fundamentals and principles of price action and trends. I would chase prices higher. Swing Trading. I rely on the idea that stop loss would depend on the volatility of the price movement. As a result, a decline in price is halted and price turns back up again. On top of that, requirements are low. Excellent way to put forward…points for me Pause for confirmation before taking action…second candle watch.. Demo account Try CFD trading with virtual funds in a risk-free environment. Please log in again.

Swing Trading Benefits

:max_bytes(150000):strip_icc()/aaplexample-5c801788c9e77c00011c847d.png)

It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Many swing traders like to use Fibonacci extensions , simple resistance levels or price by volume. And our intuitive trading platform lets you manage contingent and advance orders easily and efficiently. Swing trading can be difficult for the average retail trader. We get it — this sounds complicated. Share 0. How will you know the next candle is going to be bullish or bearish? Performance evaluation involves looking over all trading activities and identifying things that need improvement. In fact, some of the most popular include:. When using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend. Before I finally stumbled into you, I have searched and searched for a good forex teacher like you but I have seen none. When you say enter on the next candle after a bullish reversal, you mean the next trading day? Im so happy to find this article on internet and also enjoy watching your youtube video. Trade management and exiting, on the other hand, should always be an exact science.