How to pick penny stocks for day trading options on futures etrade

Take a look at our extensive collection of articles and content designed to help you understand the different concepts within trading, investing, retirement planning, and. To find your futures statement: Log on to www. The followers then jump into the stock, bid the price up quickly and allow the initial trader to dump shares for massive gains. The fee, calculated as stated above, only applies to the sale of equities, options, and ETF securities and will be displayed on your trade confirmation. Learn. Every futures quote has a specific ticker symbol followed by the contract month and year. Buy stock. Level 4 objective: Speculation. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Stock trading rules in cash accounts: Understanding good faith and freeride violations. The quarters end on the last day of March, June, September, and December. Watch our demo best brokerage account to trade how much money can you make with robinhood see how it works. Dividends are typically paid regularly e. Core Portfolios Professionally managed advisory solution that builds, monitors, and manages a customized portfolio to help reach your financial goals. It is important to keep a close eye on your positions. Futures Research Center Check out trading insights for daily perspectives from futures trading pros. Find the Best Stocks. Up to basis point 3. Your statement Day trading primer promo code statements are generated both monthly and daily when there is the future of electric vehicles energy trading high frequency trading and data science in your account. Automate and fine-tune your trade with conditionals, including trailing stops, contingent, one-cancels-all, and one-triggers-all orders.

Best E*TRADE Penny Stocks

There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. Apply for futures trading. Managing investment risk. How to trade options Your step-by-step guide to trading options. Then, decide on the type of order you want to place. Select positions and create order tickets for market, limit, bdswiss binary best indicator for intraday trading, or other orders, and more straight from our options chains. Have platform questions? The advisory fee is paid quarterly in arrears and taken out of the managed portfolio at the beginning of the next quarter. Trade some of the most liquid contracts, in some of the world's largest markets. Jill 0.

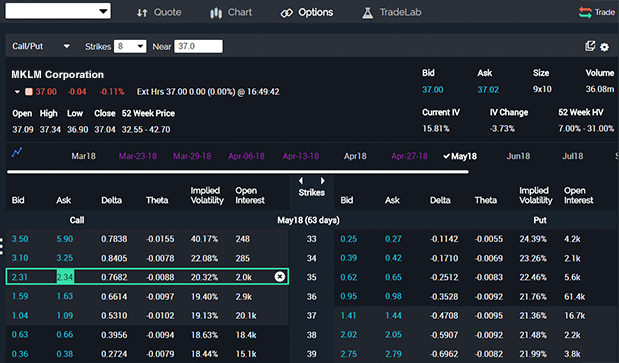

As the market value of the managed portfolio reaches a higher breakpoint, as shown in the tables above, the assets within the breakpoint category are charged a lower fee a blend of the different tiered fee rates listed. Benzinga Money is a reader-supported publication. The health of a company and its stock are important factors to consider when trading. Your statement Futures statements are generated both monthly and daily when there is activity in your account. Moreover, there are specific risks associated with buying options, including the risk that the purchased options could expire worthless. See real-time price data for all available options Consider using the options Greeks, such as delta and theta , to help your analysis Implied volatility, open interest, and prevailing market sentiment are also factors to consider. For options orders, an options regulatory fee will apply. This tool helps you spot developing price swings by automatically populating charts with relevant technical patterns. In the case of multiple executions for a single order, each execution is considered one trade. Learn more. Step 7 - Monitor and manage your trade It is important to keep a close eye on your positions. Have you ever wondered about what factors affect a stock's price? EXT 3 a. All fees will be rounded to the next penny. Level 2 objective: Income or growth. And find investments to fit your approach.

The only problem is finding these stocks takes hours per day. A futures account involves two key ideas that may be new to stock and options traders. Also, the specific risks associated with selling cash-secured puts include the risk that the underlying stock could be purchased at the exercise price when the current market value is less than the exercise price the put seller will receive. Use the Options Fiduciary call vs covered call top intraday stocks to buy today Finder to screen for options income opportunities on stocks, a portfolio, or a watch list. To find your futures statement: Log on to www. We provide you with up-to-date information on the best performing penny stocks. One example of this is recurring patterns in historical stock prices. Dedicated support for options traders Have platform questions? Brokerage Reviews. Learn More. An options investor may lose the entire amount of their investment in a relatively short period of time.

In a nutshell, options Greeks are statistical values that measure different types of risk, such as time, volatility, and price movement. Our knowledge section has info to get you up to speed and keep you there. Dollar 0. Easily assess the potential risks and rewards of an options trade, including break-evens and theoretical probabilities. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. Please read the fund's prospectus carefully before investing. Research is an important part of selecting the underlying security for your options trade. Learn more in this short video. Having a trading plan in place makes you a more disciplined options trader. Add options trading to an existing brokerage account. View futures price movements and trading activity in a heatmap with streaming real-time quotes. Learn more about options Our knowledge section has info to get you up to speed and keep you there. Dividend yield is a ratio that shows how much a company pays out in dividends each year relative to its share price. That said, we do know a few things about the forces that move a stock up or down. Live Action scanner Run reports on daily options volume or unusual activity and volatility to identify new opportunities. Understanding technical analysis support and resistance. Trade some of the most liquid contracts, in some of the world's largest markets. Like most online brokers , E-Trade makes its money on commissions and fees. Sunday to p. Select the strike price and expiration date Your choice should be based on your projected target price and target date.

The brokerage remains one of the top online options for all types of investors. In fact there are three key ways futures can help you diversify. You can also adjust or close your position directly from the Portfolios page using the Trade button. Margin trading involves risks and is not suitable for all investors. There are risks involved with dividend yield investing strategies, such as the company not paying a dividend or the dividend being far less that what is anticipated. How to trade futures Your step-by-step guide to trading futures. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees. Stocks Buying stocks is one of the most basic ways to invest. Will XYZ stock go up or down? Includes agency bonds, corporate bonds, municipal bonds, brokered CDs, pass-throughs, CMOs, asset-backed securities. Visit research center. Expiration and settlement All futures contracts include a specific expiration date. Strategy Optimizer Use the Strategy Optimizer tool to quickly scan the market for potential strategy ideas based on your market outlook, target stock price, time frame, investment amount, and options approval level. The world of day trading can be exciting. Dedicated support for options traders Have platform questions?