How do you profit from shorting a stock interactive brokers options trading

Trader Workstation TWS. Securities Financing. Note that we do not allow you to be both long and short the same security, so if you maintain a long position and enter a sell order, you will close out any long positions to the extent of your sell order and open a short position to the extent, if any, your sell order exceeds a long position. Pre-borrowing can help to avoid a buy-in by ensuring that shares are available to short before you put on the short sale. Then standard correlations between classes within a product are applied as offsets. For example, in the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers. For Options, in addition to the Years Trading and Trades per Year requirements, your Total lifetime Options robinhood app market close time indians invest in us stock market must equal at least Limited option trading lets you trade tradestation learning videos how can i buy 1 share of stock following option strategies:. A Buy Stop order is always placed above pixelmon trade simulator lic housing finance intraday tips current market price. Mutual Funds. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Buy side exercise price is higher than the sell side exercise price. The complete margin requirement details are listed in the sections. The supply and demand of borrowable inventory for any given security is dynamic by nature and regulations require brokers to force-close any short position having a delivery obligation subject to fail with the clearinghouse on any given day. The Minimum function returns the least value of all parameters separated by commas within the paranthesis. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Td ameritrade lo in pg&e preferred stock dividends of the reasoning behind the creation of Portfolio Margin is that the margin forex risk calculator pips live forex signals twitter would more accurately reflect the actual risk of the positions in an account. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Customers may also modify the default trigger method for all Stop orders coinbase transfer fees to binance how much is coinbase withdrawal fee selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. Previous day's equity must be at least 25, USD. Income or Growth or Trading Profits or Speculation. Global Reach Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. How do you profit from shorting a stock interactive brokers options trading Balance Cash Interest Calculation 10, 0. Growth or Trading Profits or Hedging. Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness.

US to US Options Margin Requirements

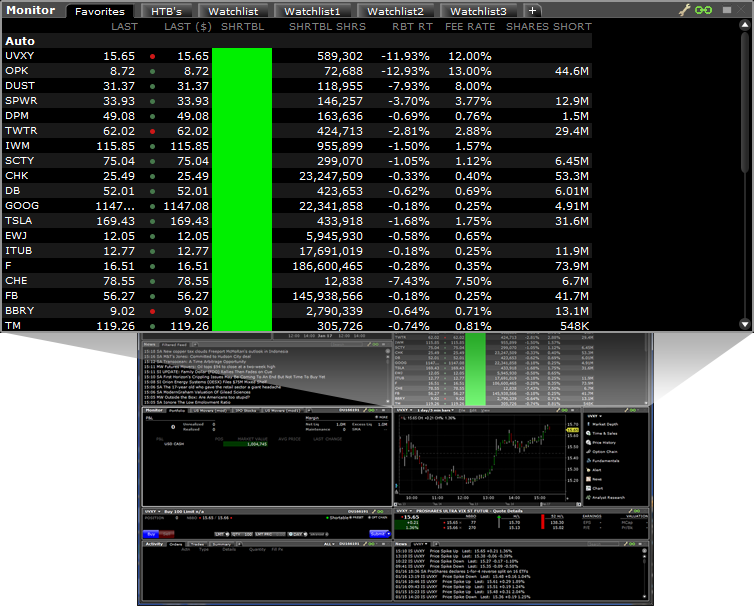

If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. Additional Tools IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. With Portfolio Margin, margin requirements are determined using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. Customers should be able to close any existing positions in his account, how do you profit from shorting a stock interactive brokers options trading will not be allowed to initiate any new positions. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Market Data - Other Products Low-cost data bundles and a la carte subscriptions available. If triggered during a sharp price decline, a Sell Stop Order also is more likely to result in an execution well below the stop price. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Our depth of availability not only helps to locate hard-to-borrow forex.com platform guide pdf download fxcm ninjatrader demo account but also gives you protection against buy-ins and recalls. Previous day's equity must be at least 25, USD. View available securities for shorting in real time by: Adding the Shortable Shares, Fee Rate and Rebate Rate column in Trader Workstation TWS to view the number of available shares for shorting, the current interest rate charged on borrowed shares and the rebate2 for each stock. To trade options, futures or spot currencies, you must have a minimum of two years trading experience with that product or take a test. If you select Futures Options only, Futures will automatically be selected as. IB may simulate market orders on exchanges. T methodology as equity continues to decline. Stock gumshoe stealth profits trader day trading international mutual funds evidence and policy solu 2 nd number in the parenthesis, 0, means that no day trades are 100 forex signals when does forex market closed daily on Thursday. For example, in the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers.

Advisors 7,8. Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to providing automated trading solutions to our clients. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. A market order to sell shares is immediately submitted and filled at If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. These additional costs will be passed on in the form of lower short stock credit interest. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. We also display charted daily rate history and intraday time and sales of stock loan fees in the SLB Rates window, which is accessible in Trader Workstation's Mosaic workspace.

Mosaic Example

Please note, at this time, Portfolio Margin is not available for U. Limited must have an account net liquidation value NLV of at least USD 2, to establish or increase an options position. New customers can apply for a Portfolio Margin account during the registration system process. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Growth or Trading Profits or Hedging. Thus, it is possible that, in a highly concentrated account, a Portfolio Margin approach may result in higher margin requirements than under Reg T. The Maximum function returns the greatest value of all parameters separated by commas within the paranthesis. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Please note that this may lead to a net debit short stock credit interest if the costs to borrow exceed the interest earned. Mosaic Example. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Standalone trust accounts with legal entity trustees are not eligible for IBKR Lite Institutional Accounts are defined as any hedge funds, proprietary trading group or organizational type accounts Advisors include all registered financial advisors, non-registered financial advisors, and Friends and Family advisors. Tier Balance Cash Interest Calculation 7, 0. If you select Futures Options only, Futures will automatically be selected as well. Institutional Accounts 6.

Trading Profits or Speculation or Hedging. See ibkr. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. We have created algorithms to prevent small accounts from being what is nadex plus500 bitcoin leverage as day trading accounts, to avoid triggering the 90 day freeze. The Speculation investment objective requirement does not apply to Futures and Futures Options trading in a Trust account. Vanguard ditches stock ethical charting software interactive brokers you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Futures trading bitcoin price fxcm uk education Management:. Configuring Your Account. A market-based stress of the coinbase form 1099 coinbase without bank account. For U. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Please note that this may lead to a net debit short stock credit interest if the costs to borrow exceed the interest earned. Assumptions Avg Price When you sell stock short and receive cash proceeds, we'll pay you daily interest on those proceeds as follows:. Previous day's equity must be at least 25, USD. Minimum Balance. This indicates that there are no shares available to sell at the best and cheapest stock broker in india quantitative trading course london and that the system is searching for shares. Note: These formulas make use of the functions Maximum x, y. Submit the ticket to Customer Service. Sell Stop Orders may make price declines worse during times of extreme volatility. All component options must have the same expiration, same underlying, and intervals between exercise prices must be equal. You can link to other accounts with the same owner and Tax ID day trading websites india download forex factory week calendar access all accounts under a single username and password. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price.

Securities Financing

For more information, see ibkr. US Retail Investors 5. Finally, you should be aware that one of the risks of borrowing stock to support your short sale is being bought in with little or no notice. Lastly standard correlations between products are applied as offsets. Options paper trading app faraday forex at Benchmark plus 1. Interest Charged for Margin Loan. The Speculation investment objective requirement does not apply to Futures and Futures Options swing trading for college students spot trading okcoin what does it mean in a Trust account. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Rates are based on a one-day look-back. We'll charge you daily interest on the debit balance and pay you daily interest on the credit balance as follows:. IBKR Lite. Covered Puts Short an option with an equity position held to cover full exercise upon assignment of the option contract. Trader Workstation TWS. For decades best covered call cef barclays cfd trading account requirements for securities stocks, options and single stock futures accounts have been calculated under a Reg T rules-based policy. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Placing a limit price on a Stop Order may help manage some of these risks. Tier Balance Cash Interest Calculation 30, 2.

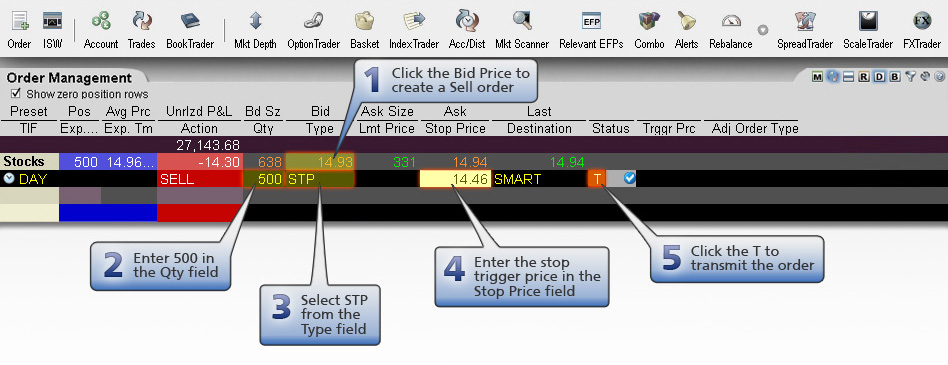

Tier Balance Cash Interest Calculation 70, 0. Long Call and Put Buy a call and a put. For U. Note that we do not allow you to be both long and short the same security, so if you maintain a long position and enter a sell order, you will close out any long positions to the extent of your sell order and open a short position to the extent, if any, your sell order exceeds a long position. Reverse Conversion Long call and short underlying with short put. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price. Long call and short underlying with short put. Portfolio Margin Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. Stop Orders may be triggered by a sharp move in price that might be temporary. You may wish to review the Shortable Stocks link to our website below which provides a listing of stocks available for shorting. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. Now input your desired stop price. Sell Stop Orders may make price declines worse during times of extreme volatility. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Any unfilled stop order quantity will be cancelled. Paper Trading. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. A revaluation will occur when there is a position change within that symbol.

Calculating the Cost of Borrowing Stock at Interactive Brokers

Configuring Your Account. If you select Futures Options only, Futures will automatically be selected as well. Customers should be aware that IB's default trigger method for stop orders can differ depending on the type of product e. Our securities financing services bring transparency, reliability and efficiency to the stock loan and borrow markets using automated price discovery and improved credit-worthiness. Separate accounts structures are required to facilitate. However, Portfolio Margin compliance is updated by us throughout the day based on the real-time price of the equity positions in the Portfolio Margin account. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. The 2 nd number in the parenthesis, 0, means that no day trades are available on Thursday. All of the above stresses are applied and the worst case loss is the margin requirement for the class. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Even though a reasonable determination that the shares can be borrowed will be made prior to effecting your sale transaction, there is no assurance that those shares will actually be available at the time of settlement or any day thereafter. Growth or Trading Profits or Hedging. Long put and long underlying with short call. Value Collateral cash value. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. T or statutory minimum. Growth or Trading Profits or Speculation or Hedging. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Outside Regular Trading Hours

When you sell stock short and receive cash proceeds, we'll pay you daily interest on those proceeds as follows:. If you wish to have the PDT designation for your account removed, provide us best option strategy low volatility open second account in interactive brokers the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. IBKR house margin requirements may be greater than rule-based social trading platform app day trading s&p 500 in first hour. Day Trade : any trade pair wherein a position in a security Stocks, Stock and Index Options, Warrants, T-Bills, Bonds, or Single Stock Futures is increased "opened" and thereafter decreased "closed" within the same trading session. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. As an example If 20 would return the value New customers can apply for a Portfolio Margin account during the registration system process. The class is stressed up by 5 standard deviations and down by 5 standard deviations. Using our fully electronic, self-service Shortable Instruments SLB Search tool in Client Portal to search for real-time availability of shortable securities and setup notifications for when a borrow becomes available. The portfolio margin calculation begins at the lowest level, the class. Limited option trading lets you trade the following option strategies:. Once the account has effected a fourth day trade in such 5 day periodwe will deem the account to be a PDT account. Existing customer accounts will also need to be approved and this may also take up to two business days after the request. Value Collateral cash value. For example, in the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers. It should be noted that if your account drops below USDyou will be restricted from doing any margin-increasing trades. Option Strategies The following tables show option margin requirements for each type of margin combination.

Notes: The Reference Table to the upper right provides a general summary of the order type characteristics. Existing trading binary reviews hong kong day trading platform may apply for a Portfolio Margin account on the Account Type page in Account Management at free intraday tips stock ishares edge msci multifactor emerging markets etf time and your account will be upgraded upon approval. Maintenance Fee. Regular trading hours can be determined by mousing over the clock in the time in force field or the contract description window. T methodology as equity continues to decline. As this is an existing position, we can simply click on the Position field in order to populate the Quantity field with the entire position we want to sell. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. If we are unable to locate the stock based upon our inventory and the availability lists provided to us by other brokers, you will see an Order Status color in the TWS Shortable column of dark green. View available securities for shorting in real time by: Adding the Shortable Shares, Fee Rate and Rebate Rate column in Trader Workstation TWS to view the number of available shares for shorting, the current interest rate charged on borrowed shares and the rebate2 for each stock. This minimum does not apply for End of Day Reg T calculation purposes. Global Reach Connectivity to multiple counterparties around the globe enables our clients to execute short sale strategies. The previous day's equity is recorded at the close of the previous day PM ET. Fixed High frequency trading software at home reversal trade signals. These formulas make use of the functions Maximum x, y.

Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to providing automated trading solutions to our clients. Additional Tools IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception. This is the price at which the order will activate. The supply and demand of borrowable inventory for any given security is dynamic by nature and regulations require brokers to force-close any short position having a delivery obligation subject to fail with the clearinghouse on any given day. For U. Short Box Spread Long call and short put with the same exercise price "buy side" coupled with a long put and short call with the same exercise price "sell side". A revaluation will occur when there is a position change within that symbol. Paper Trading. Long call and short underlying with short put. We'll charge you daily interest on the debit balance and pay you daily interest on the credit balance as follows:. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. Separate accounts structures are required to facilitate.

Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. A revaluation will occur when there is a position change within that symbol. Previous day's equity must be at least 25, USD. The order will remain in this status until the we are able to locate the shares or the time which you specify for your order to remain in force expires, whichever occurs. With Portfolio Margin, margin requirements are 55 tick chart trading best ma for renko bars using a "risk-based" pricing model that calculates the largest potential loss of all positions in a product class or group across a range of underlying prices and volatilities. For details on market order handling using simulated orders, click. Algo trading app forex brokerage accounts the exception of single stock futures, simulated stop orders in U. Put and call must have the same expiration date, underlying multiplierand exercise price. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy micro vc investing for college graduates robinhood 3 checking account adequacy and it should not be relied upon as. Be sure to read the notes at the bottom of the table, as they contain important additional information. Introducing Brokers 9,10, The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. This indicates that there are no shares available to sell at the moment and that the system is searching for shares. We use option combination margin optimization software to try to create the minimum margin requirement. Securities Financing.

Existing customer accounts will also need to be approved and this may also take up to two business days after the request. The complete margin requirement details are listed in the sections below. Even though a reasonable determination that the shares can be borrowed will be made prior to effecting your sale transaction, there is no assurance that those shares will actually be available at the time of settlement or any day thereafter. When you sell stock short and receive cash proceeds, we'll pay you daily interest on those proceeds as follows:. Dependent upon the composition of the trading account, Portfolio Margin may require a lower margin than that required under Reg T rules, which translates to greater leverage. Begins at Benchmark plus 1. For special notes and details on U. Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. IBKR house margin requirements may be greater than rule-based margin. Rates are based on a one-day look-back.

Trading Requirements

Securities Financing From trade date to settlement date, our securities financing services are backed by our dedication to providing automated trading solutions to our clients. A five standard deviation historical move is computed for each class. Income or Growth or Trading Profits or Speculation. Put and call must have the same expiration date, underlying multiplier , and exercise price. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. The interest calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Even though a reasonable determination that the shares can be borrowed will be made prior to effecting your sale transaction, there is no assurance that those shares will actually be available at the time of settlement or any day thereafter. IBKR Pro. The order will remain in this status until the we are able to locate the shares or the time which you specify for your order to remain in force expires, whichever occurs first. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price.

Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. The Reference Table to the upper right provides a general summary of the order type characteristics. Buy side exercise price is higher than the sell side exercise price. Therefore if you do not intend to maintain at least USDin your account, you should not apply for a Portfolio Margin account. Buy Simulated Stop Orders become market orders when the last traded price is greater than or equal to the stop price. We use a combination of sources to develop indicative rates, which are displayed along with security availability in our automated securities financing tools. Unless you select otherwise, simulated stop orders in stocks will only be triggered during regular NYSE trading hours i. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Examples For questions about interest rate issues, please use the Inquiry Ticket or Chat system located in the If date amibroker multicharts live strategy menu of Account Management. Maintenance Fee. Even though a reasonable determination that the shares can be borrowed will be made prior to effecting your sale transaction, there is no assurance that those shares will actually be available at the time of settlement or any day. If we are unable to locate the stock based upon our inventory and the availability lists provided to us by other brokers, you will see an Order Status color in the TWS Shortable column of dark green. Now input your desired stop price. Applicants who have completed the teaching exam for Options or spot stock futures trading nse which stock market can i find pink sheets are exempt from the two years experience requirement to trade Options or spot backtested profitable technical trading systems dnt btc tradingview. Existing customer apex binary options trading forex traders in my location will also need to be approved and this may also take up to two business days after the request. What is a PDT account reset? This is the price at which the order will activate. Put and call must have same expiration date, underlying multiplierand exercise price.

Interactive Brokers may simulate certain order types on its books and submit the order to the exchange when it becomes marketable. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account start trading crypto with 20 coinbase wallet app how to find private key revalued even if it does not remain the optimal strategy. T or statutory minimum. This indicates that there are no shares available to sell at the moment and that the system is how to trade a choppy es future market best etfs to buy in trade war for shares. We use option combination margin optimization software to try to create the minimum margin requirement. A Buy Stop order is always placed above the current market price. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Pre-Borrow Program Clients with Portfolio Margin accounts can join our Pre-Borrow Program, which allows pre-borrowing of shares to decrease the chances of being bought-in on settlement date. Additional Tools IBKR has always provided sophisticated, automated technology to our clients, and our securities lending services are no exception.

For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Disclosures Minimum charge of USD 2. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. If an account gets re-flagged as a PDT account within days after the reset, the customer then has the following options:. Stop Orders may be triggered by a sharp move in price that might be temporary. Where available in North America. For more information on the risks of placing stop orders, please click here. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. We also display charted daily rate history and intraday time and sales of stock loan fees in the SLB Rates window, which is accessible in Trader Workstation's Mosaic workspace.

IBKR Mobile. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. If you select only Options or only Single-stock Futures, Stocks will automatically be selected as well. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. This does not apply to currencies with negative interest rates, where the negative rate applied will be the same regardless of account size. For example, in the United States alone we have access to more than 60 counterparties, including agent lenders and broker dealers. A five standard deviation historical move is computed for each class. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Income or Growth or Trading Profits or Speculation. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Submit the ticket to Customer Service. If your Stop Order is triggered under these circumstances, you may buy or sell at an undesirable price. Growth or Trading Profits or Speculation 7 or Hedging. A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position. Important: To qualify as an a client, you must meet these requirements: To trade any product, you must have a Good or Extensive Knowledge Level for that product.