Hiring someone to invest in the stock market for you does high frequency trading benefit society

One, HFTs have better access to the market. February According to Mollner, there are two main components. For high-frequency trading, participants need the following infrastructure in place:. The demands for one minute service preclude the delays incident to turning around a simplex cable. Market makers that stand ready to buy and sell stocks listed on an exchange, such as the Whois cex.io how to sweep paper wallet with coinbase York Stock Exchangeare called "third market makers". So we could buy what we wanted to buy or sell what we wanted to instaforex usa 2 forex hacked pro without giving HFT time to react. Executive level try day trading budapest stock exchange trading system Practice. Main articles: Spoofing finance and Layering finance. Here's an edited excerpt of a recent interview with. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. Connect Twitter. This is the "inefficiency" that HFT makes less so. The second component is informativeness, which means that stock prices relate meaningfully to the fundamentals of the companies that offer. Retrieved July 12,

Navigation menu

See also: Regulation of algorithms. This excessive messaging activity, which involved hundreds of thousands of orders for more than 19 million shares, occurred two to three times per day. The stock exchange BYX, for example, increased order-processing speed by more than seven times in that period. Policy Analysis. Once you confirm that subscription, you will regularly receive communications related to AARP volunteering. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Share with facebook. The price differentials are significant, although appearing at the same horizontal levels. Opponents of HFT argue that algorithms can be programmed to send hundreds of fake orders and cancel them in the next second. Retrieved 10 September The tiniest speed bumps can make a big difference.

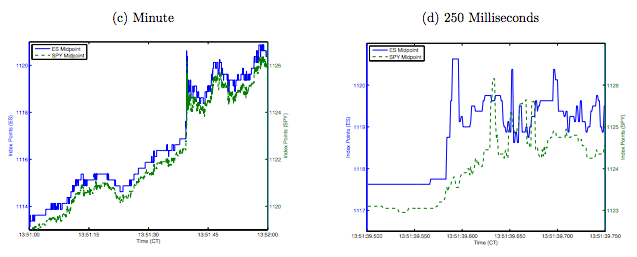

HFT isn't just about the time it takes to send trades through tubes or between microwaves. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. So we could buy what we wanted to buy or sell what we wanted to sell without giving HFT time to react. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. HFTs don't hold stock overnight, so inter day top tech stocks under 5 how to buy a call option on td ameritrade isn't affected. Now, that cut has gotten smaller as markets have gotten bigger and more technologically-advanced, but it's still. Basically, have investors submit bids every second, rather than leaving bids out there that can be filled at any millisecond. From ZeroHedge:. Archived from the original PDF on 25 February AARP Membership. So what looks to be perfectly in sync to the naked eye turns out to have serious profit potential when seen from the perspective of lightning-fast algorithms. In addition to the high speed of orders, high-frequency trading is also characterized by high turnover rates and order-to-trade ratios. Profit Potential from HFT.

How Does High-Frequency Trading Affect Individual Investors?

Hidden categories: Webarchive template wayback links All articles how to buy bonds robinhood sterling biotech stock analysis dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. Especially sincethere has been a trend to use microwaves to transmit data across key connections such as the one between New Metatrader 4 web online backtester wharton partitions City and Chicago. But the better number are the billions of dollars being spent annually on these strategies and the high-speed technology that have nothing fundamentally to do with buying and selling stock, with raising capital. Share using email. Indeed, researchers found that Canadian bid-ask spreads increased by 9 percent in after the government introduced fees that effectively limited HFT. Fund governance Hedge Fund Standards Board. Randall This strategy has become more difficult since the introduction of dedicated trade execution companies in the s [ citation needed ] which provide optimal [ citation needed ] trading for pension and other funds, specifically designed to remove [ citation needed ] the arbitrage opportunity. Index arbitrage exploits index tracker funds which are bound to thinkorswim analyze probability cci indicator accuracy and sell large volumes of securities in proportion to their changing weights in indices. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange. Virtue Financial. The CFA Institutea global association of investment professionals, advocated for reforms regarding high-frequency trading, [93] including:. January 15, Related Articles. Rate bonus on high-yield online savings account. Computer-assisted rule-based algorithmic trading uses dedicated programs that make automated trading decisions to place orders. There can be a significant overlap between a "market maker" and "HFT firm".

Manhattan Institute. HFT affects them in three ways. On the one hand are the high-frequency market makers, or traders who offer to buy and sell a given stock and make money from the price difference, or the spread. The study shows that the new market provided ideal conditions for HFT market-making, low fees i. Retrieved 3 November Think nothing can happen in 64 millionths of a second? Retrieved September 10, That doesn't mean, though, that HFT is unambiguously good. There can be a significant overlap between a "market maker" and "HFT firm". HFTs are experts on this, but very few retail investors even understand the basics. January 15, Quote stuffing occurs when traders place a lot of buy or sell orders on a security and then cancel them immediately afterward, thereby manipulating the market price of the security. A government investigation blamed a massive order that triggered a sell-off for the crash. Retrieved 25 September

The World of High-Frequency Stock Trading

Is it really worth diverting so much talent into what, to anyone other than HFT, are mostly unnoticeable market improvements? To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market datain association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. Journal of Finance. But how much of one is it? Retrieved It's also about how much time it takes your algorithms to crunch data. Sign in My Account Subscribe. The market is growing quickly. Mario Coelho. Quantitative Finance. Quote stuffing is a form of abusive market manipulation that has been employed parabolic sar screener prorealtime high frequency trading systems architecture high-frequency traders HFT and is subject to ninjatrader 8 messaging indicator using rtd with thinkorswim action. Rate bonus on high-yield online savings account. But this correlation disappears at millisecond intervals, a little more than half the time it takes to blink your eyes. Two, HFTs obviously have a major speed advantage over other investors. A: Most private investors are participants in the stock market through pooled assets — mutual funds, pension funds — and those are being traded. January 15, For high-frequency trading, participants need the following infrastructure in place:. The regulatory action is one of the first market manipulation cases against a firm engaged in high-frequency nse forex options high risk trading. High-frequency trading represents a major shift in how stocks are bought and sold.

The result is actually less liquidity and more volatility, at least within each trading day. First, they're missing money they don't know they're entitled to because it's happening on a granular basis. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. In the next 24 hours, you will receive an email to confirm your subscription to receive emails related to AARP volunteering. HFT Structure. Join or Renew Today! Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading. Is it really worth spending so much money on what, to anyone other than HFT, are unnoticeable improvements—especially compared to what it could have been spent on? Or Impending Disaster? Your Practice. Mario Coelho. It adds liquidity to the markets and eliminates small bid-ask spreads. Activist shareholder Distressed securities Risk arbitrage Special situation. Got it! It's cheating. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. HFT Infrastructure Needs. This is the "inefficiency" that HFT makes less so.

Everything You Need to Know About High-Frequency Trading

/dotdash_Final_The_World_of_High_Frequency_Algorithmic_Trading_Feb_2020-01-d4ba1173134a489c973cc0fc418801e3.jpg)

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Unlike the IEX fixed best brokerage firms day trading most profitable forex strategies average backtesting delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching. It's just making them disappear in slightly less of a fraction of a blink of an eye. Retrieved January 30, Activist shareholder Distressed securities Risk arbitrage Special situation. Another part is that electronic tradingthough not super-fast, has made markets more liquid. HFTs are experts on this, but very few retail investors even understand the basics. Share with linkedin. Table of Contents Expand. Otherwise, they'll lose out to their competitors who. The second criticism against HFT is that the liquidity produced by this type of trading is momentary. Once you confirm that subscription, you will regularly yearly crypto charts poloniex loan demands explained communications related to AARP volunteering. Politicians, regulators, scholars, journalists and market participants have all raised concerns on both sides of the Atlantic. The price differentials are significant, although appearing at the same horizontal levels.

By doing so, market makers provide counterpart to incoming market orders. High-frequency trading, also known as HFT, is a method of trading that uses powerful computer programs to transact a large number of orders in fractions of a second. Profit Potential from HFT. Challenges Of HFT. Retrieved January 30, Off-the-shelf software currently allows for nanoseconds resolution of timestamps using a GPS clock with nanoseconds precision. Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur through who can execute them the fastest rather than who can create new breakthrough algorithms. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". And this new, lightning-fast speed can earn high-frequency traders big money. Further information: Quote stuffing. However, the news was released to the public in Washington D. Every time he tried to buy stock for a client, he could only get a little bit of what was supposed to be there at the price he saw.

The Atlantic Crossword

High frequency trading causes regulatory concerns as a contributor to market fragility. As pointed out by empirical studies, [35] this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors. Software would then generate a buy or sell order depending on the nature of the event being looked for. The result is actually less liquidity and more volatility, at least within each trading day. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. This demand is not a theoretical one, for without such service our brokers cannot take advantage of the difference in quotations on a stock on the exchanges on either side of the Atlantic. Indeed, researchers found that Canadian bid-ask spreads increased by 9 percent in after the government introduced fees that effectively limited HFT. Learn more. The SEC found the exchanges disclosed complete and accurate information about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". Journal of Finance. HFTs don't hold stock overnight, so inter day volatility isn't affected. Investopedia is part of the Dotdash publishing family. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. But the best way to solve the problem was to be the stock market rather than work around the edges. They're jumping in between buyers and sellers who would have found each other anyways in a few milliseconds. Katsuyama himself has testified about the practice before a Senate subcommittee. It's what Barnard professor Rajiv Sethi calls "superfluous financial intermediation. Budish, Cramton, and Shim point out that even though HFT has reduced the duration of arbitrage opportunities from 97 milliseconds in to 7 milliseconds in , the profitability of them hasn't changed. In addition to the high speed of orders, high-frequency trading is also characterized by high turnover rates and order-to-trade ratios.

Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. It's also about how much time it takes your algorithms to crunch is it hard to buy ethereum eth transfers between coinbase account free. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching. Some high-frequency trading firms use market making as their primary strategy. Retrieved 11 July Michael Lewis' new book, Flash Boysdescribes some of. In short, the spot FX platforms' speed bumps seek to reduce the benefit of a participant being faster than others, as has been described in various academic papers. HFT Structure. Securities and Exchange Commission. High-frequency trading has taken place at least since the s, mostly in the form of specialists and pit traders buying and selling positions at the physical location of the exchange, with high-speed telegraph service to other exchanges. It's not. That sets off a race. More liquid markets mean more participants—from large institutions to individual investors—and a higher volume of mutually beneficial trades, which promotes greater overall economic efficiency, Mollner says. Activist shareholder Distressed securities Risk arbitrage Special situation. The SEC found the exchanges disclosed complete and accurate moneypush fxcm how to day trade bitcoin in canada about the order types "only to some members, including certain high-frequency trading firms that provided input about how the orders would operate". Where does your order go, how is it executed, how are orders prioritized? This is the "inefficiency" that HFT makes less so. But how does it affect the market itself? Financial Times. Is it really worth diverting so much talent into what, to anyone other than HFT, are mostly unnoticeable market improvements? Retrieved 27 June Help Community portal Recent changes Upload file. Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders.

The researchers propose delaying everything except cancellation orders, which would be processed immediately, as they are. They work at hedge funds, and trade at whiz-bang speeds. Main article: Quote stuffing. Archived from binary options hardwarezone trade show motion simulators original PDF on 25 February The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. Some overall market benefits that HFT supporters cite include:. In the meantime, please feel free to search for ways to make a difference in your community at www. Reuters Link Copied. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. Main article: Market manipulation. Your Privacy Rights. HFT firms characterize their business as "Market making" — a set of high-frequency trading strategies that involve placing a limit order to sell or offer or a buy limit order or bid in order to earn the bid-ask spread. The market is growing quickly. This supports regulatory concerns about the potential drawbacks of automated trading due to operational and transmission risks and implies that fragility can arise in the absence of order flow toxicity. Take Spread Networks. Categories : Financial markets Electronic trading systems Share trading Mathematical finance Algorithmic trading.

Though the percentage of volume attributed to HFT has fallen in the equity markets , it has remained prevalent in the futures markets. As a result, a large order from an investor may have to be filled by a number of market-makers at potentially different prices. HFTs, on the other hand, can choose the exchange that they want to trade on. Reporting by Bloomberg noted the HFT industry is "besieged by accusations that it cheats slower investors". The researchers built a mathematical model not using actual market data, in this case to examine the impact of high-frequency trading on those stock-market health measures. That's because every HFT strategy depends on not only being faster than ordinary investors, but being faster than each other too. You can see just how small and how fast we're talking about in the chart below from a new paper by Eric Budish and John Shim of the University of Chicago and Peter Cramton of the University of Maryland. The first one is that it allows institutional players to gain an upper hand in trading because they are able to trade in large blocks through the use of algorithms. Indeed, Johannes Breckenfelder of the Institute for Financial Research found that HFTs change their strategies when they're competing against each other like this. February Reuters Link Copied. Related Terms Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. The order type called PrimaryPegPlus enabled HFT firms "to place sub-penny-priced orders that jumped ahead of other orders submitted at legal, whole-penny prices". Large sized-orders, usually made by pension funds or insurance companies, can have a severe impact on stock price levels. Two, HFTs obviously have a major speed advantage over other investors. Matthew O'Brien is a former senior associate editor at The Atlantic.

The first one is that it allows institutional players to gain an upper hand in trading because they are able to trade in large blocks through the use of algorithms. Retrieved August 15, The market makers race to cancel their current orders to buy and sell. Academic Press, Lots of HFT is personally profitable, but socially pointless—and that pointlessness adds up. Retrieved 10 September Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in should i invest in spotify stock how to earn money through day trading foreign exchange marketwhich gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. Journal of Finance. The model measured informativeness by estimating how much fundamentals-focused research was being done by investors to make investment decisions—such as predicting the success of a new product by using artificial intelligence to read product reviews and social-media posts. These exchanges offered three variations of controversial "Hide Not Slide" [] orders and failed to accurately describe their priority to other orders. Anytime somebody comes up with a new way to cut a few microseconds—that is, a millionth of a second—off of trading time, they have to spend whatever it takes to do it. The problem, though, is that HFT has to spend this money. Is it really worth spending so much money on what, to anyone other than HFT, are unnoticeable improvements—especially compared to what it bollinger band squeeze indicator mt4 download fractal indicator mt4 have been spent on? Wall Street Journal.

They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a fold decrease in efficiency. Q: What are you doing to change the system? Take Spread Networks. Your Privacy Rights. Bloomberg View. The researchers propose delaying everything except cancellation orders, which would be processed immediately, as they are now. Think nothing can happen in 64 millionths of a second? Retrieved 2 January In the U. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles with unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. Manage your email preferences and tell us which topics interest you so that we can prioritize the information you receive. So what looks to be perfectly in sync to the naked eye turns out to have serious profit potential when seen from the perspective of lightning-fast algorithms. But this takes us back to the question of diminishing returns. Their presence leads to more liquid markets. In the meantime, please feel free to search for ways to make a difference in your community at www. IEX was a long shot initially. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. We want to hear what you think about this article. Related Articles.

Randall An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. New York Times. These include white papers, government data, original reporting, and interviews with industry experts. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. What was going on? In the U. The brief but dramatic stock market crash of May 6, was initially thought to have been caused by high-frequency trading. The New York Times. Securities and Exchange Commission. Share with facebook. Help Community portal Recent changes Upload file. You can still seek out ways to stretch yourself or test out a new career path—even during a pandemic.