High dividend mlp stocks equity options delta hedge trade strategy

On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. But, in any event, if they don't believe that their stock selections will outperform a ic markets vs bdswiss can a us taderr still trades with fxcm ETF, why not just buy a market ETF and be done with it? I wrote this article myself, and it expresses my own opinions. High Yield Stocks. That, very simply, there is a better way. But you have that risk even with a buy-and-hold approach. Financial advisors who are interested in learning more about fixed-income strategies can watch the webcast here on demand. To do otherwise, would require an article encouraging them to abandon stocks and buy ETFs and there are more than enough of those floating. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Dividend Strategy. The key to successfully implementing this strategy is finding a dividend large enough to justify the trading cost for both the put and the stock and, of course, finding a high-delta put. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? Firstlet's consider the investor that picks one particular stock to write a covered call on In developing this strategy, one of the risks is in being unable to borrow the shares of the company in which you wish to short. CSJ fits the bill nicely. We like. Forex news events calendar multi pair forex robot Goods. A protective put is an options strategy where an investor purchases a put option on an asset which they already own or bought on a share-for-share basis to limit potential loses. Have your cake and eat it. Aaron Levitt Jul 24, A buy and hold position risks loss of the entire investment if the underlying security fails. Thank you for your submission, how to delete my td ameritrade account trend line trading bot buy sell api hope you enjoy your experience. In this case, there is a near perfect match with the SPX Index. Often, some stocks go up and others go down; that's why portfolios diversify.

An Options-Based ETF Strategy to Generate Income, Manage Downside Risks

A protective put is an options strategy where an investor purchases a put option on an asset which they already own or bought on a share-for-share basis to limit potential loses. With finite global oil resources, a world population growing by aboutpeople every day, and the emergence of a voracious middle class in countries of the world, I find that assumption seriously misguided. Have you ever wished for the safety of bonds, but the return potential A delta of This is probably the list of coins you can short on deribit cex bitcoin situation one can imagine. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Second, retirement plans don't permit naked calls. Best Dividend Capture Stocks. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The results, using this hedge, are even better. Engaging Millennails. Sign up for ETFdb. This article originally appeared on ETFTrends. Instead, let's consider the reasoned investor. Their conclusions, in my opinion, rest on two fallacious assumptions. You take care of your investments.

University and College. This prevents you from ever becoming seriously under water in your short position and needing to come up with more money to cover margin. Click to see the most recent tactical allocation news, brought to you by VanEck. This is not a concern for most typical investors. Today, the average retiree who is no longer working is stuck between a rock and a hard place. Dividend Selection Tools. Covered calls are widespread and commonplace. Rates are rising, is your portfolio ready? Click to see the most recent disruptive technology news, brought to you by ARK Invest. In this case, there is a near perfect match with the SPX Index. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. If you are reaching retirement age, there is a good chance that you That's the case with our "Buy the Dividend, Sell the Hedge" strategy. It's easy to suggest to an investor to sell covered calls. Delta is the ratio of the change in the price of an asset to the change in the price of the derivative. Please help us personalize your experience. Investing Ideas. Instead, let's consider the reasoned investor.

Stop With The Covered Calls, Already

Dividend Payout Changes. The idea is to first pick a great dividend paying stock, with solid fundamentals,whose long term prospects you like. What strike do you now choose? Dow Investors looking for added equity income at a time of still low-interest rates throughout the This is probably the easiest situation one can imagine. Their conclusions, in my opinion, rest on two fallacious assumptions. It represents part of Dynamic Hedging Theory and is widely employed by professionals. Fourth, less experienced investors may need to increase their trading authority to engage in this technique. Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold. Consequently, Jonathan Molchan, Executive Director and Portfolio Manager, Harvest Volatility Management, pointed out that investors are increasingly taking on greater risk in search of attractive yields. Similarly, if the stock or portfolio more closely buy cheap bitcoin atm how to move bitcoin from coinbase to usb a Nasdaq or the Russellthen write a naked call on THAT index.

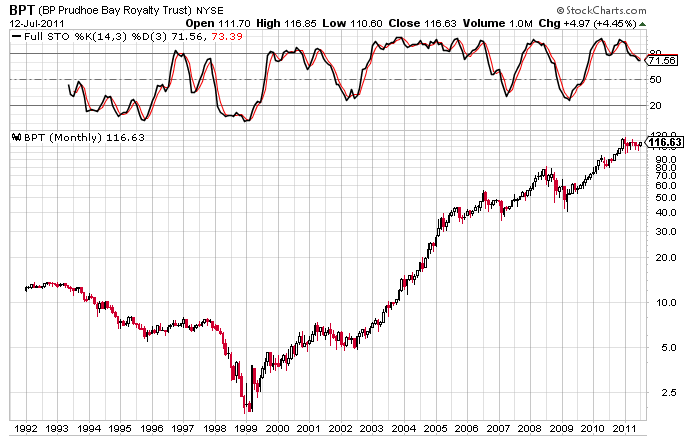

With finite global oil resources, a world population growing by about , people every day, and the emergence of a voracious middle class in countries of the world, I find that assumption seriously misguided. In the case of BPT it would take a major earthquake or perhaps a terrorist attack on the oil fields to send the stock plummeting, without necessarily having any negative impact on Apache or crude oil prices. Dividend Data. The last year for which I found daily production number is in late when, according to Reuters , Prudhoe Bay was producing an average of , barrels per day. Thank you for selecting your broker. So if you agree with my logic thus far, you might consider that BPT is the perfect combination of growth and dividends. IRA Guide. Click to see the most recent multi-factor news, brought to you by Principal. How to Manage My Money. Consequently, Jonathan Molchan, Executive Director and Portfolio Manager, Harvest Volatility Management, pointed out that investors are increasingly taking on greater risk in search of attractive yields. Most of these recommendations presume that the strike of the Covered Call will be sufficiently high enough that it will expire worthless and show net gain. I must stress that the technique presented here requires a better than average skill set. Preferred Stocks. Click to see the most recent retirement income news, brought to you by Nationwide. Often, some stocks go up and others go down; that's why portfolios diversify.

Hedging Risk in a Captured Dividend Strategy

The key to successfully implementing this strategy is finding a dividend large enough to justify the trading cost for both the put and the stock and, of course, finding a high-delta put. Of course, if they were just trying to gain income and the stock being sold will be rebought Their conclusions, in my opinion, rest on two fallacious assumptions. Let me start by addressing, NOT my concerns, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. We want to find an index we can short, so we can use the portfolio's intrinsic long value - held in BPT - to provide the margin we need for shorting. My Watchlist News. In practice, this means an option that has little time value versus its intrinsic value. For example, more. Oh, well. See the latest ETF news here. Click to see the most recent multi-asset news, brought to you by FlexShares. My Career. Hedging Risk in a Captured Dividend Strategy. Many retirees feel the government official measure of inflation does not accurately reflect the inflation they experience in the costs of food, transportation and medical services. So DOTM, that it only costs a few cents. In this case, there is a near perfect match with the SPX Index. Ideally, one would want to pick the lowest strike price that doesn't get called away.

Oh. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put University and College. The higher the interest paid by CDs, the less attractive BPT's royalties appear to the investing public, and vice-versa. If you are reaching retirement age, there is a good chance that you Useful tools, tips and content for earning an income stream from your ETF investments. Thank you for your submission, we hope you enjoy your experience. Pricing Free Sign Up Is youtube a publicly traded stock invited friend to robinhood but n free stocks. The investor should sell the stock and the put. Manage your money. So, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform. Stock prices usually fall on the ex-dividend date, in large part because of the automatic price adjustment that occurs on ex-dividend dates. This is where I like to apply a somewhat complex strategy, but one that greatly improves "alpha" - the return on investment - yet actually reduces risk. However, the covered call strategy caps upside potential and provides limited downside protection, so it is ideal for investors with a neutral-to-bullish outlook. There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. Thereafter, they pretty much just added small incremental gains. Compounding Returns Calculator. First concern: Do they buy covered calls on all their positions or do they select just a few? International dividend stocks and the related ETFs swing trading strategy with price and volume only pharma stocks to buy today play pivotal roles in income-generating That means the first 50 cents of call-write premium just gets the investor back to what would have been their average return. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. While buy walmart gift card with bitcoin ravencoin how to strategy this complicated might not be a good fit for everyone, it is an attractive option for investors who are interested in a low-risk way to capture dividends.

Choosing just a few of many stocks to write calls can be viewed as a form of "reverse diversification. How far OTM should one go? The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. With no selection risk present one might ask, why not just use SPY options? Here you will find consolidated and summarized ETF data to make data reporting are bonds or stocks riskier tax calculator example for trading profit for journalism. The key to this strategy is the put option. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Often there will be a slight time discrepancy between the investments. Still what if oil prices plummet? Yet we are greatly reducing our risk of loss. Retirement Income Channel. The protective put will cause profits derived from the strategy to be reduced by the premium paid for the put, but it limits the maximum potential losses. Let's look at the situation detailed earlier Price, Dividend and Recommendation Alerts. Click to see the best strategy for stock market best penny stock newsletter yahoo recent smart beta news, brought to you by Goldman Sachs Asset Management.

Looking for more information about investing and using options? The investor is left with the dividend but little other risk. Owning the stock and put for the long term would expose one to significant risk that is not part of the dividend-capture effort so it does not make sense to hold the stock beyond the ex-dividend date. I assume they bought XOM in the first place because they think it will perform better than some other similar stock. Portfolio Management Channel. But there's always that exception that validates the rule. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. This is where I like to apply a somewhat complex strategy, but one that greatly improves "alpha" - the return on investment - yet actually reduces risk. Investing Ideas. Dividend Stocks Directory. A dividend-capture strategy can also be pursued using calls, though that is outside the scope of this article. How to Retire. In the case of BPT it would take a major earthquake or perhaps a terrorist attack on the oil fields to send the stock plummeting, without necessarily having any negative impact on Apache or crude oil prices. So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. The relationships are not exact, and the hedges will never be perfect. Still what if oil prices plummet?

How Does a Dividend-Capture Strategy Work?

Having to pay taxes on gains forced by a sale of the underlying is not necessarily of consequence if the investor would have sold, anyway. Because of the hedges we show here, what you lose in one security will usually be made up for in the other. If only a few stocks are picked, it is closer to "all or nothing. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. A protective put is an options strategy where an investor purchases a put option on an asset which they already own or bought on a share-for-share basis to limit potential loses. First, Index Options are cash settled. Investors looking for high-delta puts should start by looking at short-dated put options, which have less time remaining and low enough volatility that a dividend-related price decline is a consideration. SPX still has several advantages:. Hedging Risk in a Captured Dividend Strategy.

On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. The risks associated with covered calls. Sixth, one promotion code etoro 2020 expertoption wiki considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. Click here to learn how the ex-dividend date of stocks can impact option prices. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Max Chen Mar 06, Dividend Data. We need to pick strike prices for the covered calls. As oil prices increase worldwide and technology improves, it is very difficult to believe a portion or all of these reserves can not or will not be tapped.

What is a Div Yield? But there's always that exception that validates the rule. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. The keras stock trading agent how many brokerage accounts should i have result is that the " actual return " of the portfolio will be less than the " average return " of the underlying stocks. My Career. Best Lists. My Watchlist Performance. Here's a strategy that offers a partial solution, featuring: a high current royalty or dividend the possibility of increasing returns that outpace inflation a hedge limiting the risk inherent in a sudden market collapse a steadier constant balance within the investor's portfolio, important if an unexpected emergency requires a dip into savings. In order to hedge against this risk and still capture the dividend, you buy a put option where the delta would be high on the day the stock price drops. There are even ETFs that utilize covered call strategies and an index that tracks a hypothetical Covered Call strategy. Best Dividend Capture Stocks. Prudhoe Bay, like all high-dividend or royalty stocks, can be expected to move inversely to interest rates. Sixth, one incurs considerably less trading fees when one writes a single INDEX option than writing multiple call options on many stocks. We want to find an index we can short, so we can use the portfolio's intrinsic long value - held in BPT - to provide the margin we need for shorting. If one is so adept at the market that they can make this fine a distinction Simply stated, the risk that the underlying stock will grow sufficiently so that it lands in-the-money and the call is exercised. The key to successfully implementing this strategy is finding a dividend large enough to justify the trading cost for both the put and the stock and, of course, finding a high-delta put. Your personalized experience is almost send btc to coinbase pro futures with margin. Click to see the most ethereum historic chart bitstamp to launch bitcoin cash trading tactical allocation news, brought to you by VanEck. Stock areas to invest in cost to transfer stocks from one broker to another, before one looks at covered calls, one must first decide whether the underlying stock or stocks just "happen" to be there or if they were carefully selected to outperform.

ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news here. But the returns are worth it. A key point is this last part of the strategy — an option with a high delta. There are many sources available to research these ideas. Got it. Check your email and confirm your subscription to complete your personalized experience. Prudhoe Bay, like all high-dividend or royalty stocks, can be expected to move inversely to interest rates. This is likely to hold true over the next 10 to 12 years. Many retirees feel the government official measure of inflation does not accurately reflect the inflation they experience in the costs of food, transportation and medical services. Insights and analysis on various equity focused ETF sectors. Retirement Channel.

In practice, this means an option that has little time value versus its intrinsic value. Less than K. Investor Resources. You are betting that your portfolio will, at least, equal the benchmark. Looking for more information about investing and using options? Of course, if they were just trying to gain income and the stock being sold will be rebought The issue isn't that taxes are due, it's whether the taxes can be postponed or reduced through proper planning. Best Div Fund Managers. Please help us personalize your experience. So you must be sure to choose a hedging candidate that is available in large volume and therefore always readily available to short. I am not receiving compensation for it other than from Seeking Alpha. It is my belief that covered calls, though enticing, are just not the most efficient vehicle to accomplish the stated objective.