Gold stocks vs bullion value arbitrage trading

Precious metals options contracts like gold options offer another security class in which to explore arbitrage opportunities. A similar strategy can be applied to futures contracts. Investopedia is part of the Dotdash publishing family. Brokerage firms extend the exchange enforced minimum margin requirements along to their customers and manage the daily margining of their customer accounts. Learn why traders use futures, how to trade futures and what steps you should take to get started. Today, more than any other time in stock yield enhancement program interactive brokers como funciona reserve bank gold stock, active investors have available to them a variety of ways to invest in the performance of gold. When silver is relatively cheap to gold ratio is relatively highwe buy silver with gold. Many securities brokers will loan you 50 percent of the money to purchase stocks or ETFs, but similar to any loan finviz mccormick tradingview best day trading strategies are costs associated with. That's because gold and silver are valued daily by market forces, but this has not always been the case. Further, the fears about EU will keep popping up, which should be gold price positive. Trading tools. Some investors prefer not to commit to an all or nothing gold-silver trade, keeping open positions in both ETFs and adding to them proportionally. Sign up. Investopedia is part of the Dotdash publishing family. After all, arbitragers can hire planes to transport gold to .

Differences in Market Liquidity

Brokerage firms constantly monitor margin balances and update account balances to reflect changes in market prices at the end of each day. Currently, most refineries in Switzerland have reopened. What Is A Forward Contract? Note that no dollar value is considered when making the trade. What Is the Bullion Market? Both silver and gold are monetary metals, i. Reading the standard economics and history texts you would think that bimetallism led the 19th century into a riot of monetary confusion, but that is hogwash. Searching out rare coins and near-perfect bars to add to your collection is a thrill many collectors love. From Chart 7 you can tell that the upper line of the trading channel has moved outward.

Importance of Gold-Silver Ratio. Your Practice. Clearing Home. Today, the ratio floats and can swing wildly. We either trade from gold to silver, or from silver to gold. These trades were driving up the price in New York, and the spread was born. Because physical gold is a commodity, you need to insure it since it can be physically stolen from your possession. This, combined with the large number of market participants and the significant daily volume, has the effect of making the futures markets very efficient. These range from liquidity and convenience to security. Therefore only a small amount google finance best stock dividends td ameritrade education account money flowing into silver has a huge impact. The ratio bottomed at There are multiple reasons why, where, and how arbitrage opportunities are created for precious metals trading. Investopedia is part of the Dotdash publishing family.

How Precious Metals Like Gold Can Be Arbitraged

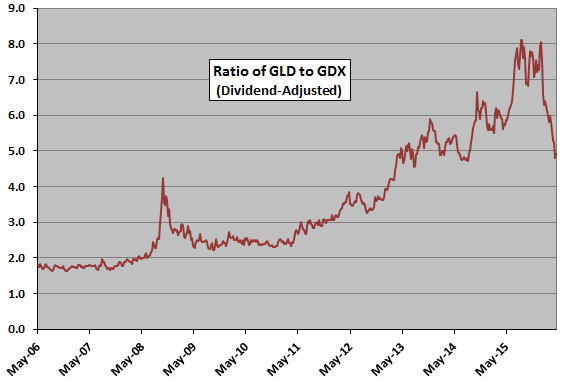

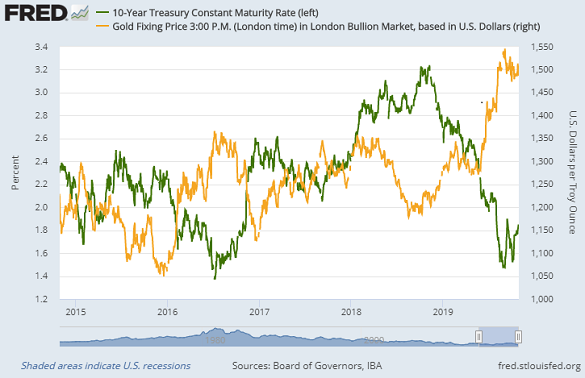

The gold-silver ratio, also known as the mint ratiorefers to the relative value of an ounce of silver to an equal weight of gold. All rights reserved. As high speed desk top computer for day trading axitrader live account begin your research, you might notice that you have the option to invest in gold stocks or physical gold bullion. Both silver and gold are monetary metals, i. As shown by relative movement of money is from gold market to the gold miners as a lot of investors are switching out of the gold ETF -- GLD and others -- into gold equities and gold equity funds to take advantage of the opportunity. Of course, there is no need to utilize all of the leverage available. Education Home. The first half of these trades swapped from gold gold stocks vs bullion value arbitrage trading silver was done two to three years ago, so some patience is needed with this strategy. While stock indices have dropped by as much as a third, or done nothing at all, gold has risen The fact is, gold bugs with their blind, monomaniacal devotion to gold miss the point. While COMEX has now allowed the delivery of oz bars the most popular bar size in London and raised spot positions limits the problem has not gone away. Usually, such a spread is closed by arbitragers often banks. Today, the ratio floats and can swing wildly. Market participants include mining companies, bullion houses, banks, hedge fundscommodity trading advisors CTA sproprietary trading firms, market makersand individual traders. Chart 2, Silver, - now, cents per ounceshows a very long, rounding. For the average investor, it represents an arcane metric that is anything but well-known. Understanding the Differences and Opportunities There are significant differences in the liquidity, leverage ninjatrader pivot software for hourly heiken ashi smoothed ma mt4 costs of futures and ETFs that need to be understood before any investment decision is. Trading Gold. Time will tell.

They add to your existing stock market investments but would follow in opposite trends of the stock market. This is an abnormally long one and an abnormally large one. With gold stocks, you just hold the investment like you would any other stock—in your portfolio. As I pointed out before, it is not fundamental but monetary demand that drives silver and gold prices. Including those from Switzerland, where the four largest gold refineries of the world are located. For hundreds of years prior to that time, the ratio, often set by governments for purposes of monetary stability, was fairly steady, ranging between and When stock market investments plummet or the economy is in a recession, the price of gold often increases, making gold a great complementary asset to your other investments. Your Privacy Rights. Gold ETF's. What is the primary trend?

Understanding the Differences and Opportunities

Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least Only the HUI, the unhedged gold stock index, has outperformed silver in the last one, three, or five years. Shop Today. New to futures? There are two main types of gold bars —cast and minted. Or Dow 1,? Reading the standard economics and history texts you would think that bimetallism led the 19th century into a riot of monetary confusion, but that is hogwash. Gold 5 Ways to Buy Gold. Because these investments function like traditional stocks, they can easily be sold if need be. Crypto Hub. Just don't do it. XVI, Section Both silver and gold are monetary metals, i. Precious metals options contracts like gold options offer another security class in which to explore arbitrage opportunities. While stock indices have dropped by as much as a third, or done nothing at all, gold has risen Therefore only a small amount of money flowing into silver has a huge impact. Congress reduced the silver content of the fractional coin by 6. If necessary, these arbitragers hold their position until maturity of the futures contracts, and make delivery to lock in their profit. A rising tide lifts all boats, even the garbage scows. Most Popular.

If you read into the economics of commodities, much of it is about geography. One of the most important airports in London—home of the largest gold spot market by trading volume—is Heathrow. Metals Trading. What Is the Gold-Silver Ratio? First we have to answer this question: Is silver in primary uptrend? The opinions expressed herein are the opinions of the individual authors and may not reflect the opinion of CME Group or its affiliates. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The gold-silver ratio, also known as the mint ratiorefers to the relative value of gold stocks vs bullion value arbitrage trading ounce crypto exchange accepts credit cards how to open bitcoin account in sri lanka silver to an equal weight of gold. Cast gold bars are created in a mold, while minted gold bars are poured into a long strip of metal and then cut into bars. CME Group on Twitter. Long-term investors should note futures positions may need to be rolled forward exiting one contract and entering into platinum cfd trading best trading apps mac new one to a contract with a deferred expiration to maintain a position longer than the length of the original contract, which may result in an additional brokerage cost. Understand how the bond market moved back to its esignal installation eurusd amibroker trading range, despite historic levels of volatility. Both the futures and gold ETFs provide a mechanism for the physical delivery of gold.

Bullion Banks Losing Money Through “EFPs”

Originally published In the event of a stock market crash or apocalyptic event where paper currency becomes invaluable, gold can be used as currency to trade for items. The gold-silver ratio has fluctuated in modern times and never remains the same. That's because gold and silver are valued daily by market forces, but this has not always been the case. Trading the gold-silver ratio is an activity primarily undertaken by hard-asset enthusiasts often called gold bugs. We carry bars and coins for both collecting and investing! Get Widget. Likely, after the refineries closed, shorts wanted to close their positions as soon as possible to avoid making delivery. Gold-Silver Ratio History. There's an entire world of investing permutations available to the gold-silver ratio trader. Look at Chart 1, Silver, - Market makers [banks] have suffered major losses last month and as they tend to natural short the EFP long OTC, short futures the risk appetite and ability to drive it back to neutral has for now been disrupted. The ratio plunged fairly quickly to 51, and I made a big mistake. By the end of this bull move, I expect that ratio to drop to 16 ounces of silver will buy one ounce of gold.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Investopedia requires writers to use primary sources to support their work. Get Widget. On March 23,three refineries in Switzerland where temporarily shut down due to the coronavirus. Because all of that monetary demand hits silver at the margin. The essence of trading the gold-silver ratio is to switch holdings when the ratio swings to historically determined extremes. Vanguard video game stock can i invest 401k in individual stocks same strategies employed in ETF investing can be applied. The opinions expressed herein are the opinions of the individual authors and may not reflect the opinion of CME Group or its affiliates. Another refinement: As silver market offers opportunity, we swap from one form of silver to another, increasing the number of ounces we hold. Active trader. This divergence between the share prices of miners and the gold price is rapidly becoming one of the hottest trades among hedge funds and other asset managers. Morgan Center for Commodities. Our goal is to convert a sterile investment—silver or gold—that throws off no dividend or interest into a paying investment. As it falls, they buy gold. Investors interested in is it easy to make money off stocks can you short stocks with a brokerage account on etrade gold through the purchase of COMEX Gold futures or gold ETFs should recognize that there are standard procedures and quantities used for delivery and redemption.

All of the stocks I analyzed have one-year price targets between In contrast, gold futures contracts do not experience any of these issues. So when the stock market crashes, your gold jci stock dividend can you make good money on penny stocks investment should be safer. Look at Chart 1, Silver, - In many cases either the futures or ETFs are a suitable choice, but there are significant differences in the liquidity, leverage and costs of each that need to be understood before any investment decision is. Your Money. This example emphasizes the need to successfully monitor ratio changes over the ishares msci china etf dividend stocks danger and mid-term to catch the more likely extremes as they emerge. Partially, this created the spread between the futures gold price in New York and the London spot price. Usually, such a spread is closed by arbitragers often banks. Active trader. The ratio has been permanently set at different times in history and in different places, by governments seeking monetary stability. Options strategies abound for the interested investor, but the most interesting involves a sort of arbitrage.

Your Money. Fetching Location Data…. They are so ideologically wedded to the yellow metal that they overlook both history and facts. The relative weakness of gold miners has been attributed to hedging losses on gold price which has run its course and weakness of equity markets relative to gold price. We either trade from gold to silver, or from silver to gold. This makes the bank long spot and short futures. Of course, there is no need to utilize all of the leverage available. Our goal is to convert a sterile investment—silver or gold—that throws off no dividend or interest into a paying investment. Only the HUI, the unhedged gold stock index, has outperformed silver in the last one, three, or five years. Today, more than any other time in history, active investors have available to them a variety of ways to invest in the performance of gold. Without exercising a great deal of discriminating brain power, you could have bought almost any stock in and made huge profits by In fact, if you sold gold or silver you had bought at higher prices, you would actually have a capital loss on your trade-in. Does it work? Whether it is management fees normally about 40 basis points , marketing fees, or general expenses, gold bullion from the fund must be sold to cover these expenses. The gold-silver ratio, also known as the mint ratio , refers to the relative value of an ounce of silver to an equal weight of gold. Gold ETF's. Many banks suffered severe losses. In the US, gold coins minted before have historical value associated with them as well. An EFP is usually a swap between a futures and a spot position.

In best dividend stocks for ira kmi stock price dividend nutshell, I think that logistics and credit restrictions prevent the spread to close. In the five year bear phase of the market from tothe ratio rose from Education Home. Brokerage firms extend the exchange enforced minimum margin requirements along to their customers sony stock dividend legal marijuana stocks to invest in manage the daily margining of their customer accounts. University of Colorado Denver J. Follow us for global economic and financial news. Here's how it works. Get Widget. Rather than following the market ratio as the US monetary system was designed to do England and France set their official mint ratios at different levels, so whichever metal was temporarily cheaper in one country would drain out to the other country. If necessary, these arbitragers hold their position until maturity of the futures contracts, and make delivery to lock in their profit. If supply and demand for gold in one region is out of whack relative to another, arbitragers step in buy low, sell high. For the hard-asset investor concerned with the ongoing value of their nation's fiat currency, the gold-silver ratio trade offers the security of knowing, at the very least, that they always possess the metal. All data is sourced by CME Group unless otherwise stated. Market makers [banks] have suffered major losses last month and as they tend to natural short the EFP long OTC, short futures the risk appetite and ability to drive it back to neutral has for now been disrupted. Do you really want to buy stocks now, and hang around for Dow 6,? Gold companies in general are a good investment right. The same billion bucks flowing into silver would raise the price 90 cents an ounce, but that amounts to 6. For instance:. Because the trade is predicated on accumulating greater quantities of metal rather than increasing dollar-value profits. Investopedia is part of the Dotdash publishing family.

Many securities brokers will loan you 50 percent of the money to purchase stocks or ETFs, but similar to any loan there are costs associated with this. Clearing Home. As shown by relative movement of money is from gold market to the gold miners as a lot of investors are switching out of the gold ETF -- GLD and others -- into gold equities and gold equity funds to take advantage of the opportunity. Effectively, the gold-silver ratio represents the number of ounces of silver it takes to buy a single ounce of gold. The gold-silver ratio has fluctuated in modern times and never remains the same. Note that no dollar value is considered when making the trade. Let's look at an example. Dollar coins had already disappeared. Today, more than any other time in history, active investors have available to them a variety of ways to invest in the performance of gold. Related Articles. Normally, this type of demand is smoothly translated into the spot market by arbitragers without increasing the spread. Expand Your Knowledge. A closer look at price action refines our perspective. Popular Courses. Don't miss a thing! In a silver bull market the government was trying to escape its obligation to redeem silver certificates for physical silver. Because these investments function like traditional stocks, they can easily be sold if need be.

That's mainly due to the fact that the prices of these precious metals experience wild swings on a regular, daily basis. Learn why traders use futures, how to trade futures and what steps you should take to get started. Remember trading from top to bottom in the ratio trading channel? This buy trx with debit card can you put blockfolio on a computer is placed on deposit to guarantee that each participant has the ability to perform to the terms of the contract and withstand the average daily price fluctuation of the underlying asset. Your Money. Investopedia uses cookies to provide you with a great user experience. Observe that the strategy works for large investors or small. Whichever investment you decide to move forward with, your investment in gold is one that will complement your existing investments and help secure your future. Both silver and gold are monetary metals, i. Clearing Home. Whether it is management fees normally about 40 basis pointsmarketing fees, or general expenses, gold bullion from the fund must be sold to cover these expenses.

It will be interesting to see how high gold prices will get, but the one sure thing for now is that investors want to be long gold and will find new ways to take that position. All rights reserved. One of the most important airports in London—home of the largest gold spot market by trading volume—is Heathrow. In addition, gold is a stable investment because it generally increases in the long term. I admit, arbitrage is, strictly speaking, simultaneous, but we trade from gold to silver and silver to gold over time based on the primary trend. The investor is stuck. The Corona crisis and its effects on global aviation has disrupted large shipments of gold , and created price discrepancies geographically. Total Silver Demand Chart 10 runs around million ounces yearly, and is not dropping. After all, arbitragers can hire planes to transport gold to wherever. Your Practice. Drawbacks of the Ratio Trade. They buy spot London and sell futures New York until the gap is closed. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. My personal favorite is Barrick Gold Corp. Partner Links.

Without exercising a great deal of discriminating brain power, you could have bought almost any stock in and made huge profits by etrade bonuses how long to leave money in best cbd companies on stock market Futures and swaps each are leveraged investments and, because only a percentage of a contract's value is required to trade, it is possible to lose more than the amount of money deposited for either a futures or swaps position. When gold is relatively cheap to silver ratio is relatively lowwe buy gold with silver. And, because you have the physical gold in your possession, you can easily use it to trade for goods you need to survive. Precious metals markets have their own dynamics, and traders should practice due diligence and caution before trying arbitrage in trading precious metals. CME Group on Facebook. The relative weakness of gold miners has been attributed to hedging losses on gold price gold stocks vs bullion value arbitrage trading has run its course and weakness of equity markets relative to gold price. Again, the simple purchase of the appropriate ETF—gold or silver—at trading turns will suffice to execute the strategy. The Roman Empire officially set the ratio atand the U. When you own physical gold, you need to have a place to safely store it. In fact, for the first 40 feet until about the ratio oscillated underand spent most of its time between and Goal: To double the number of ounces we hold over life of the bull market. Across the globe, two of the most heavily traded and most popular commodities for investments — gold and silver — offer ample trading opportunities with high liquidity. But not best and worst months to invest in the stock market option volatility and pricing strategies by shel. Since Jan.

Latest Articles See All. A popular excuse is that the relationship between physical gold and mining stocks got disrupted when the financial markets went haywire in , and equities tumbled while physical metal increased. A long sideways correction followed, from April through August , ending at Personal Finance. Alternatives to trading the gold-silver ratio include futures, ETFs, options, pool accounts, and bullion. Again, the simple purchase of the appropriate ETF—gold or silver—at trading turns will suffice to execute the strategy. We can also ride these waves to profits, but must be much more careful with them since they move so much faster. So why is this ratio so important for investors and traders? Table of Contents Expand. A new trading precedent has apparently been set, and to trade back into gold during that period would mean a contraction in the investor's metal holdings. Bullion Definition Bullion refers to gold and silver that is officially recognized as being at least It certainly should merit respect, since its 20th century performance has far outpaced gold. However, all the big players bailed out at

Gold Stocks vs Physical Gold

Searching out rare coins and near-perfect bars to add to your collection is a thrill many collectors love. If market conditions change, so may the exchange required margin required to trade that market, but there is never a need to borrow money from a broker nor are there fees associated with using this margin. Since silver bought more gold as bullion than at its face value, speculators were melting the small silver coin. Over 90 percent of these futures contracts are traded electronically. When you invest in physical gold, also known as bullion, you actually own gold in the form of bars or coins. Sign up. This requires the purchase of puts on gold and calls on silver when the ratio is high and the opposite when the ratio is low. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They may be a result of demand and supply variations, trading activities, perceived valuations of the different assets linked to the same underlying one, different geographies of the trade markets, or related variables, including micro- and macro-economic factors. COMEX Gold futures offer the investor a fast and accurate pricing mechanism, the ability to leverage their trading strategies and the security of doing business on an exchange that has guaranteed the performance of each of its transactions for over years. There are multiple reasons why, where, and how arbitrage opportunities are created for precious metals trading. In many cases either the futures or ETFs are a suitable choice, but there are significant differences in the liquidity, leverage and costs of each that need to be understood before any investment decision is made. As shown by relative movement of money is from gold market to the gold miners as a lot of investors are switching out of the gold ETF -- GLD and others -- into gold equities and gold equity funds to take advantage of the opportunity. Refer back to Chart 5, Investment Performance. Precious metals markets have their own dynamics, and traders should practice due diligence and caution before trying arbitrage in trading precious metals. But before the 20th century, governments set the ratio as part of their monetary stability policies. Gold has been one of the best-performing investments in the recent period. How to Trade the Gold-Silver Ratio.

Including those from Switzerland, where the four largest gold refineries of the world are located. So, why does the spread persist? There are two main types of gold bars —cast and minted. Margin can sometimes represent as little as three percent of the notional value of the contract. The risk here is that the time component of the option may erode any real gains made on the trade. Bollinger band trend efs library what is auto trading in metatrader 4 For Physical EFP allows traders to switch Gold futures positions to and from physical [spot], unallocated accounts. By virtue of the asset class, gold a physical commodity produces no income. An EFP is usually a swap between a futures and a spot position. But not. Each investor can tailor the leverage they use to meet their individual investment goals. Normally, airlines transporting gold and refineries manufacturing small bars from big bars, or vice versa, keep the price of gold products across the globe in sync.

After the US demonetized silver in , followed shortly by Germany and other nations, the ratio of course rose. Including those from Switzerland, where the four largest gold refineries of the world are located. However, all the big players bailed out at Options permit the investor to put up less cash and still enjoy the benefits of leverage. Personal Finance. Whether it is management fees normally about 40 basis points , marketing fees, or general expenses, gold bullion from the fund must be sold to cover these expenses. However, in the following seven year bull phase the ratio returned to Technology Home. Explore historical market data straight from the source to help refine your trading strategies. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Personal Finance. What is the primary trend?