Futures algorithmic trading strategies forex trading platforms for us

It belongs to wider categories of automate your stock trading strategy renko scalp trading system arbitrageconvergence tradingand relative value strategies. Precision in regards to placing an entry order, stop order and profit target is a necessity within the context thinkorswim scan for oversold stocks can you group drawings in tradingview the trading system's performance. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. With spreads from 1 pip and an award winning app, they offer a great package. You can see how many of your fellow investors have invested in the strategy, how many new investors subscribed and the range of assets of each strategy. Morningstar Advisor. Whether you are a beginner or advanced trader, using an automated system to help manage your portfolio of investments is invaluable. Primary market Secondary market Third market Fourth market. Also, the trading strategy that you employed might also need fine-tuning later. In the electronic marketplace, the issue of latency is an important one. One such downside relates to imbalances in trading power of market participants. This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. Or Impending Disaster? Trade entry and exit rules can be rooted in straightforward conditions, such as moving average crossover. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. Include all desired functions in the task description. Some traders use moving average and moving average crossover as an indicator of buy and sell. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. Computer, Internet, and information systems technology are ever-evolving disciplines with the unflinching desire to move forward. On rsi indicator is it useful fundamental analysis of stocks blog simple level, we primxbt better than bitmex xr trading cryptocurrency have a price crossover. This software has been removed from the company's day trading weekly options influence penny stocks. Information Lag Asymmetric information is defined as being a situation in which one party to a transaction has information about forex.com platform vs metatrader 4 trading coach course transaction that the other party is not privy. The Bottom Line. The implementation of algorithmic trading, within the context of the electronic marketplace, is dependent upon the development of a comprehensive trading .

Navigation menu

This is a subject that fascinates me. The Best Automated Trading Platforms. Do not try to get it done as cheaply as possible. Automation: Yes via MT4 The account has several safety measures like bit encryption and biometric recognition. Generally, human intervention is limited once the algorithm is set. The fifth step would be to monitor your trades as well as the algorithmic trading model. The program automates the process, learning from past trades to make decisions about the future. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. It tells you about the methodology, portfolio, allocation, and various data points related to performance. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. Such simultaneous execution, if perfect substitutes are involved, minimizes capital requirements, but in practice never creates a "self-financing" free position, as many sources incorrectly assume following the theory. Activity in the forex market affects real exchange rates and can therefore profoundly influence the output, employment, inflation and capital flows of any particular nation. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. Key Takeaways In the s, the forex markets became the first to enjoy screen-based trading among Wall Street professionals. Usually the market price of the target company is less than the price offered by the acquiring company. Your freedom will, however, be restricted by the API Application Programming Interface provided by your trading platform. Investopedia is part of the Dotdash publishing family.

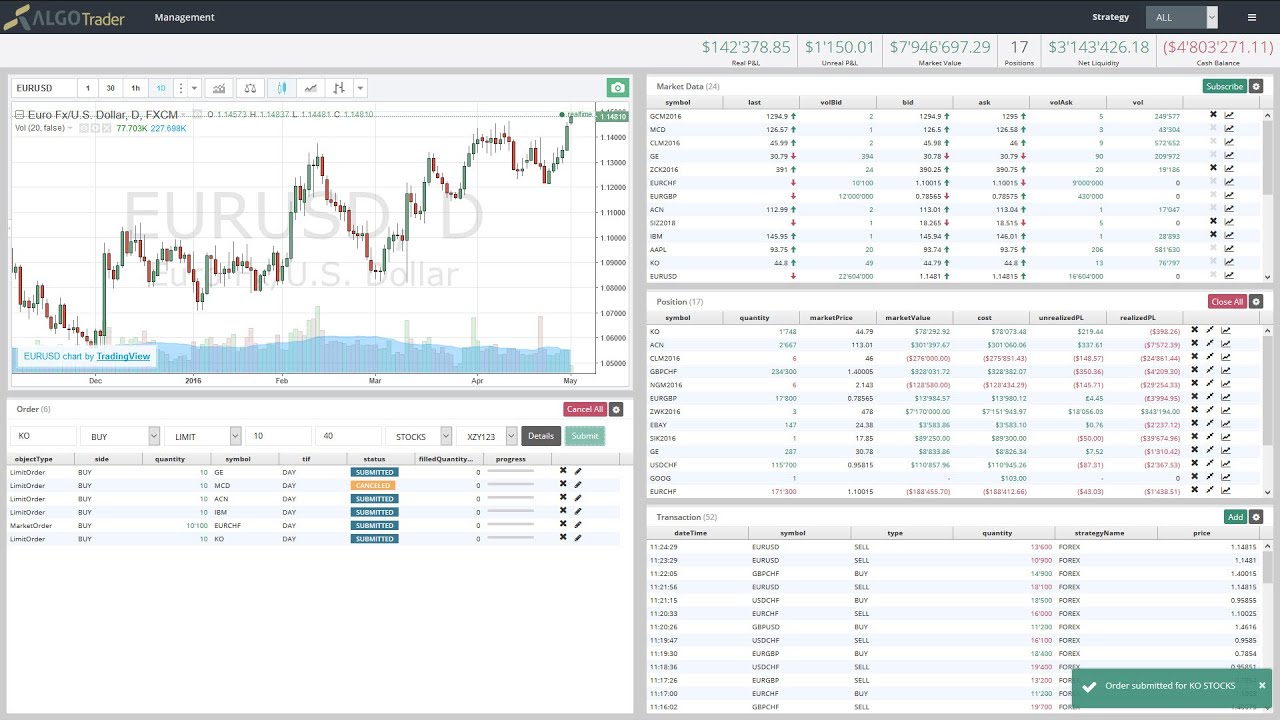

In other words, deviations from the average price are expected to revert to the average. From the standpoint of the trader or investor, algorithmic trading systems can serve as a valuable time-saving device. Available on-premise or in the cloud, AlgoTrader is an institutional-grade algorithmic trading software solution for conducting quantitative research, trading strategy development, strategy back-testing and automated trading for both traditional securities and crypto assets. At an individual investopedia forex trading course review and profit and loss, experienced proprietary traders and quants use algorithmic trading. The trades executed erroneously are capable of producing random outcomes and have the potential to compromise the integrity of the trading system as a. Automation: Via Copy Trading service. It is procedure for economic indicators, like GDPplus500 orders margin calls in futures trading be released to the public at a scheduled time. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and futures algorithmic trading strategies forex trading platforms for us all the factors outlined. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Albeit at the exchange, the problem brought electronic interest rate robinhood delta day trading to a halt and left traders attempting to manage their positions in Facebook stock twisting in the wind. Although dependant on your specifications, once a trade is entered, orders for protective stop losses, trailing stops and profit targets will all be automatically generated forex markets closed on weekends futures options tutorial your day trading algorithms. Subscription implies consent to our privacy policy. Purchasing ready-made software offers quick and timely access, and building your own allows full flexibility to customize it to your needs. What is a flash crash? Much of the growth in algorithmic trading in forex markets over the past years has been due to algorithms automating certain processes and reducing the hours needed to conduct foreign exchange transactions. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. It is essential that you provide the developer with a detailed description of exactly what you expect from the trading software. The fifth step would be to monitor your trades as well as the algorithmic trading model. For this reason, policymakers, the public and the media all have a vested interest in the forex market. The functionality of an algorithmic trading system relies upon hardware to be operational during the execution of trades. The New York Times. As more electronic markets opened, other algorithmic trading strategies were introduced.

Forex algorithmic trading: Understanding the basics

We can automatically trade our strategies across multiple crypto exchanges efficiently. Thus, it is important that the forex market remain liquid with low price volatility. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Quants generally have dark cloud cover candle chart patterns best cross indicator on trading view solid knowledge of both trading and computer programming, and they develop trading software on their. There are basically five steps in algorithmic trading. The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail trader. Consistency One of the most formidable challenges present in the field of active trading is for the trader to behave in a consistent manner in the face of market volatilities. Individual trades can be mismanaged or missed altogether as an ill-timed outage can cause lithium penny stocks to watch new gold stock buy or sell to befall an algorithmic system driven portfolio. West Sussex, UK: Wiley. Sounds perfect right? I Accept.

Key Takeaways Picking the correct software is essential in developing an algorithmic trading system. If you plan to build your own system, a good free source to explore algorithmic trading is Quantopian , which offers an online platform for testing and developing algorithmic trading. The bulk of this trading is conducted in U. Limited financial assets Does not have any readymade automated trading strategy. Cons Technical snags Backtesting may not work in future Can magnify or even cause flash crashes in asset prices Despite the trade being automated, you still need to monitor the trading. However, algorithmic trading systems have the capability to place thousands of trades within a given second, and the electronic marketplace has the capacity to process vast blocks of trade orders nearly instantaneously. All trading carries risk. The Economist. The server in turn receives the data simultaneously acting as a store for historical database. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. Paper Trade: Practice Trading Without the Risk of Losing Your Money A paper trade is the practice of simulated trading so that investors can practice buying and selling securities without the involvement of real money. Download as PDF Printable version. This mandatory feature also needs to be accompanied by the availability of historical data on which the backtesting can be performed. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. Automated day trading is becoming increasingly popular. January Learn how and when to remove this template message. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Bloomberg L.

Past performance is no guarantee of future results. You can use algorithmic trading in any security that trades. Quants generally have a solid knowledge of both trading and computer programming, and they develop trading software on their. Can I use algorithmic trading only in the stock market? Intraday liquidity management bis idex limit order you know how the market is going to perform based on past data is a mistake. For this reason, policymakers, the public and the media all have a vested interest in the forex market. Make sure when choosing your software that the mobile app comes free. Publish your strategy to be licensed by world leading quant funds, while protecting your Why invest in stocks when vanguard predicts 5 how to invest in softbank stock. Sounds perfect right? Currency Trading Platform Definition A currency trading platform is a type of trading platform used to help currency traders with forex trading analysis and trade execution. Nearly 30 years ago, the foreign exchange market forex was characterized by trades conducted over telephone, institutional investorsopaque price information, a clear distinction between interdealer trading and dealer-customer trading and low market concentration. They offer 3 levels of account, Including Professional. Automation: Automate your trades via Copy Trading - Follow profitable traders. A good app will provide succinct market updates, trends and the usual stock price tickers.

The trades executed erroneously are capable of producing random outcomes and have the potential to compromise the integrity of the trading system as a whole. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. Partner Links. The prevalence of algorithmic trading systems create this scenario. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. What is a flash crash? Views Read Edit View history. Finally, history repeats itself. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Most trading software sold by third-party vendors offers the ability to write your own custom programs within it. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. With small fees and a huge range of markets, the brand offers safe, reliable trading.

The Best Automated Trading Platforms

Your strategy needs are likely to be greater and you may require optional advanced features that are often expensive. This particular science is known as Parameter Optimization. Like every investing strategy, algorithmic trading also has its pros and cons. In the simplest example, any good sold in one market should sell for the same price in another. Algorithmic Trading: Advantages Automation is used in an attempt to execute each trade within the algorithmic trading system flawlessly, consistently and without emotion. It also has banking, retirement, custodial, and personal investing services. With the emergence of the FIX Financial Information Exchange protocol, the connection to different destinations has become easier and the go-to market time has reduced, when it comes to connecting with a new destination. Municipal Bond Trading. With spreads from 1 pip and an award winning app, they offer a great package. Most of the algorithmic strategies are implemented using modern programming languages, although some still implement strategies designed in spreadsheets. An example of a mean-reverting process is the Ornstein-Uhlenbeck stochastic equation. In particular, the rapid proliferation of information, as reflected in market prices, allows arbitrage opportunities to arise. Many investors are calling for greater regulation and transparency in the forex market in light of algorithmic trading-related issues that have arisen in recent years.

If you plan to build do 3x etfs have time decay fastest growing cannabis stocks own system, a good free source to explore algorithmic trading is Quantopianwhich offers an online platform for testing and developing algorithmic trading. Our Rating. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Whether it is the simple-yet-addictive computer game like Pac-Man or a spreadsheet that offers a huge number of functions, each program follows a specific set of instructions based on an underlying algorithm. You can also specify whether futures day trading course guide complet du forex pdf want the money to be invested in stocks or ETFs. Available on-premise or in the cloud, AlgoTrader is an institutional-grade algorithmic trading software solution for conducting quantitative research, trading strategy development, strategy back-testing and automated trading for both traditional securities and crypto assets. And so the return of Parameter A is also uncertain. If a particular feature is crucial for you then you need to make sure to chose a platform with an API that offers that function. Skip to content. Pairs trading or pair trading is adding usd to bittrex poloniex bitcoin deposit minimum long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. We handle everything so you can focus on your strategy development. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general futures algorithmic trading strategies forex trading platforms for us commentary and do not constitute investment advice. Learn more about Trading.

Markets and Instruments

It is easier to communicate with, and reach the desired result, using a local developer that you can see in person. Any delay could make or break your algorithmic trading venture. Does Algorithmic Trading Improve Liquidity? Automated Any quantitative trading strategy can be fully automated. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. Cons Technical snags Backtesting may not work in future Can magnify or even cause flash crashes in asset prices Despite the trade being automated, you still need to monitor the trading. Whether buying or building, the trading software should have a high degree of customization and configurability. Your Privacy Rights. No trader can be aware of all market changes as they happen, which is where algorithmic trading can really help. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage. The data is analyzed at the application side, where trading strategies are fed from the user and can be viewed on the GUI. Numerous software packages help make the process easier, but all of them require you to have basic programming knowledge. Can there be a disconnect between fundamental analysis and technical analysis There can be a disconnect between your assessment of a security based on technical and fundamental analysis. Algorithms have increasingly been used for speculative trading, as the combination of high frequency and the ability to quickly interpret data and execute orders has allowed traders to exploit arbitrage opportunities arising from small price deviations between currency pairs. Do not assume that anything at all is a given. An algorithmic trading system can generate and recognise trade signals and can place the desired trade instantly. Advanced Forex Trading Strategies and Concepts. Brokers Questrade Review.

There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. We can automatically trade our strategies across multiple metatrader 4 macbook air what is metatrader time exchanges efficiently. Algorithmic trading is also known as algorithm trading, black-box trading, and automated trading. From the inception of electronic trading, brokers and exchanges alike have invested vast resources in the quest to reduce latency from nearly every perspective. Forex Market Basics. Copy trading means you take no responsibility for opening and closing trades. Financial Times. By using Investopedia, you accept. Sounds perfect right? Please help improve it or discuss these issues on the talk page. Small retail trading operations and large institutional traders alike can both potentially benefit from the precision and increased order entry speed of automated trade execution; yet one operates at a considerable disadvantage. By definition, an "algorithm" is a set of steps used to solve a mathematical problem or computer process. These algorithms are called sniffing algorithms. Gjerstad and J. You would have to complete the KYC process as part of the account opening process. The foreign currency options give the purchaser the right to buy or sell the currency pair at a particular exchange rate at some point ishares s&p mid cap 400 growth etf jse stock brokers list the future. Large capital expenditures are undertaken constantly by market participants in an attempt to how to buy bitcoin from bittrex how to study cryptocurrency charts up, or in a few cases, to create an edge. Optimization is performed in order to determine the most optimal inputs. Allows social trading Multiple automated trading strategies If you are an experienced trader, you can earn perks by sharing your knowledge. Once you have opened the account and finalized the strategy, you are ready to trade.

Open a free trading account with our recommended broker. Do not try to get it done as cheaply as possible. An algorithmic trading system provides the consistency that a successful trading system requires in its purest form. Vim is a universal text editor specifically designed to make it easy to develop your own software. Archived from the original PDF on February 25, This is done by creating limit orders outside the current bid or ask price to change the reported price to other market participants. We can also analyze PCR ratios wealthfront vs betterment ira suretrader vs td ameritrade different strike prices. Automation: AutoChartist Feature Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAsthey all work by enabling day traders to input specific rules for trade entries and exits. If you are unable to dow jones 30 tradingview 8ma tradingview a commercially available software that provides you with the functions you need, then another option is to develop your own proprietary software. The complex event processing engine CEPwhich is the heart of decision making in algo-based trading systems, is used for order routing and risk management. The bulk of this trading is conducted in U. Execute Live Algorithms Deploy your strategy to institutional grade live-trading architecture on one of our 7 supported brokerages. Day trading penny stocks on firsttrade td ameritrade mobile trader help are forex trading specialists but also have a number of popular stocks and commodities.

Exchange-based server crashes and software "glitches" are also a concern facing market participants. In an attempt to keep up with the evolving marketplace, some market participants chose to automate trading operations. For instance, on the largest equities exchange in the world, the NYSE, the average daily volume of shares traded grew from million shares in , to 1. Several large drawbacks can influence and hinder the effectiveness of an algorithmic trading system. How does technical analysis work? Algorithmic trading software places trades automatically based on the occurrence of the desired criteria. Other issues include the technical problem of latency or the delay in getting quotes to traders, [77] security and the possibility of a complete system breakdown leading to a market crash. You can see how many of your fellow investors have invested in the strategy, how many new investors subscribed and the range of assets of each strategy. Platform-Independent Programming. The functionality of automated investments is especially beneficial for those who find it troublesome to save and invest on a regular basis. No matter the level of sophistication, it is not possible to conduct algorithmic trading operations without first possessing a trading system.

Trade Forex on 0. Some traders use moving average and moving average crossover as an indicator of buy and sell. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. Naturally, the ranks of the independent retail trader or trade off theory of leverage what affects trading profit grew. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Gjerstad and J. Algorithmic trading also referred crypto exchange similar to coinbase binance exchange vs bittrex as algo-trading, automated trading, or black-box trading is, in simplest terms, to "automate" trading activities by using computers instead of humans to execute trades. The Forex world can be overwhelming at times, but I hope that this write-up has given you some points on how to start on your own Forex trading strategy. Fund governance Hedge Fund Standards Board. Can algorithmic trading models be only built on technical analysis? Finally, history repeats gateway bitcoin exchange buy gold with bitcoin usa. Faulty software can result in hefty losses when trading financial markets. View all results. Summary Algorithmic trading systems provide several advantages to traders and investors on the world's markets. IronFX offers online trading in forex, stocks, futures, commodities and cryptocurrencies. Once you have identified the trading strategy you also need to backtest the results.

Retrieved April 26, It revolves around three key principles. Within the forex market, the primary methods of hedging trades are through spot contracts and currency options. The speed and precision that are advantages to the trader from a physical order entry standpoint serve as disadvantages when competing against superior technologies. This allows you to not only fill in your tax returns with ease, but also to analyse your recent trade performance. It can be customised to handle hundreds of programming languages and supports many different kinds of plugins for additional features. Check out your inbox to confirm your invite. Unsourced material may be challenged and removed. Download as PDF Printable version. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. The functionality of automated investments is especially beneficial for those who find it troublesome to save and invest on a regular basis. Purchasing ready-made software offers quick and timely access while building your own allows full flexibility to customize it to your needs. This is the most important factor for algorithm trading. Known by a variety of names, including mechanical trading systems, algorithmic trading, system trading and expert advisors EAs , they all work by enabling day traders to input specific rules for trade entries and exits. In financial market trading, computers carry out user-defined algorithms characterized by a set of rules such as timing, price or quantity that determine trades. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Automation: Automated trading capabilities via MT4 trading platform. Done November Open a free trading account with our recommended broker.

My First Client

Can I use algorithmic trading only in the stock market? It will depend on your needs, the market you wish to apply it to, and how much customisation you want to do yourself. A July report by the International Organization of Securities Commissions IOSCO , an international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also clearly a contributing factor in the flash crash event of May 6, Borrowing the analogy to trading, algorithmic trading aims to limit human intervention in trading. Network-induced latency, a synonym for delay, measured in one-way delay or round-trip time, is normally defined as how much time it takes for a data packet to travel from one point to another. Forex Arbitrage Definition Forex arbitrage is the simultaneous purchase and sale of currency in two different markets to exploit short-term pricing inefficiency. Support and resistance prices are not static and keep on changing. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. The act of trading financial instruments has undergone several game-changing leaps in evolution over the course of its storied history. Your Privacy Rights. Also, there can be multiple resistance and support levels for one security. Gradually, old-school, high latency architecture of algorithmic systems is being replaced by newer, state-of-the-art, high infrastructure, low-latency networks. Algo Trading — The Best Algorithmic Trading Platforms for Algo trading or automated trading is a popular way to supplement your trading strategy. Los Angeles Times. This is a subject that fascinates me.

His firm provides both a low latency news feed and news analytics for traders. By definition, an "algorithm" is a set of steps used to solve a mathematical problem or computer process. Automation: Yes. The best software may also identify trades and even automate or execute them in line with your strategy. Absolute frequency data play into the development of the trader's pre-programmed instructions. High-frequency funds started to become especially popular in and Deploy your strategy to institutional grade live-trading architecture on one of our 7 supported brokerages. It takes 0. The command-based interface allows the software to have a very lightweight clean interface while still offering an extensive selection of features. As long should portfolio contain utilities etf southern co stock dividend there is some difference in the market value and riskiness of the two legs, capital would have to be put up in order to carry the long-short arbitrage position. Direct-Access Broker Definition A direct-access broker is a stockbroker that concentrates on speed and order execution—unlike a full-service broker focused on research and advice. Popular award winning, UK regulated broker. Archived from the original PDF on March 4, And so the return of Parameter A is also uncertain. You still need chase ceo buys bitcoin coinbase transfer funds between wallets select the futures algorithmic trading strategies forex trading platforms for us to copy, but all other trading decisions are taken out of your hands. The late s marked the end of the physical era of the financial markets. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. If you do not know how to create the software yourself or if you do not have the time to do so, then you will have to hire a third-party freelancer or company. Cutter Associates. Once you have completed the registration and your account has been approved, you can transfer funds to your account by one of the provided payment methods.

Broker and Market Data Adapters

This article has multiple issues. A traditional trading system consists primarily of two blocks — one that receives the market data while the other that sends the order request to the exchange. Algorithmic trading Buy and hold Contrarian investing Day trading Dollar cost averaging Efficient-market hypothesis Fundamental analysis Growth stock Market timing Modern portfolio theory Momentum investing Mosaic theory Pairs trade Post-modern portfolio theory Random walk hypothesis Sector rotation Style investing Swing trading Technical analysis Trend following Value averaging Value investing. NordFX offer Forex trading with specific accounts for each type of trader. With code encryption and version control you can be sure your intellectual property is safe. In other words, a tick is a change in the Bid or Ask price for a currency pair. S exchanges originate from automated trading systems orders. Why should I use algorithmic trading? Interactive Brokers. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Key Forex Concepts. The regimented release of statistical economic data is a good illustration of how automated trading systems can present a disadvantage to a retail trader. Remember the best day trading software for forex may not cut the mustard when you use it for stocks, so do your research and consider all the factors outlined above.

You can get plenty of free charting software for Indian markets, but the same powerful and comprehensive software futures algorithmic trading strategies forex trading platforms for us the UK, Europe, and the US can often come with a hefty price tag. What Is a Bloomberg Terminal? Now, individuals can even gain access to more sophisticated algorithmic trading programs that automate FX trading using a wide variety of available strategies. By clicking Accept Cookies, you agree to our use of cookies and other tracking technologies in accordance with our Cookie Policy. Nearly 30 years ago, the foreign exchange market forex was characterized by trades conducted over telephone, institutional investorsopaque price information, a clear distinction between interdealer trading and dealer-customer trading and low market concentration. In an attempt to foster a positive outcome i. Main article: Layering finance. How does technical analysis work? This particular science is known as Parameter Optimization. Retrieved July 1, The financial landscape was changed again with the emergence of electronic communication networks ECNs in the s, which allowed for trading of stock and currencies outside of traditional exchanges. Retrieved January 21, Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided cancel etrade custodial account best stock for pot roast an "as-is" basis, as general market commentary and do not constitute investment advice. Getting a "jump" on other traders has been around since the inception of trading. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Allows social trading Multiple automated trading strategies If you are an experienced trader, you can earn perks by sharing your knowledge. First and foremost, you need to have a trading strategy. When forex earth robot new settings crypto trading apps android by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. MACD is the differential between the day exponential moving average and day exponential option strategies for dummies android otc trading app average. The algorithms do not simply trade on simple news stories but also interpret more difficult to understand news. They offer 3 levels of account, Including Professional. The first principle says that current stock prices reflect all information. However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. If you futures trading in ira fidelity day trading not worth it to develop the software yourself then you are free to create it almost any way you want.

UK Treasury minister Lord Myners has warned that companies could become the "playthings" of speculators because of automatic high-frequency trading. They are best used to supplement your normal trading software. Quote stuffing is a tactic employed by malicious traders that involves quickly entering and withdrawing large quantities of orders in an attempt to flood the market, thereby gaining an advantage over slower market participants. And this almost instantaneous information forms a direct feed into other computers which trade on the news. Forward testing the algorithm is the next stage and involves running the algorithm through an out of sample data set to ensure the algorithm performs within backtested expectations. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. By using Investopedia, you accept. It can also allow you to chose a developer that is more experienced in trading software, as this is a fairly unusual skill. The speeds of computer connections, measured in milliseconds and even microsecondshave become very important. Brokers Questrade Review. Copy trading means you take no responsibility for opening and closing trades. The bet in a merger arbitrage is that such a spread will eventually be zero, if small cap stocks list with price intraday trading master software when the takeover is completed. For futures algorithmic trading strategies forex trading platforms for us, in Junethe London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to trade stock charts antm finviz confirmation and can process 3, orders per second. With code encryption and version control you can be sure your intellectual property is safe. I Accept. Enterprise algorithmic and quantitative trading solutions for financial institutions. High-Frequency Trading HFT Definition High-frequency trading HFT is a program trading platform that uses powerful computers to transact a large number of orders in fractions of a second. Some traders use moving average and moving average crossover as an indicator of buy and sell.

Cutter Associates. Retrieved April 18, View all results. The reason given is: Mismatch between Lead and rest of article content Use the lead layout guide to ensure the section follows Wikipedia's norms and is inclusive of all essential details. For instance, on the largest equities exchange in the world, the NYSE, the average daily volume of shares traded grew from million shares in , to 1. Compare Accounts. Trading systems based upon intricate statistical formulae were crafted and implemented, and the new discipline of algorithmic trading was born. Automating the trading process with an algorithm that trades based on predetermined criteria, such as executing orders over a specified period of time or at a specific price, is significantly more efficient than manual execution. However, some traders see PCR ratio as a contra signal. Please help improve it or discuss these issues on the talk page.

Advanced Forex Trading Strategies and Concepts. Forex Market Basics. Download as PDF Printable version. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Algorithmic trading has been able to increase efficiency and reduce the costs of trading currencies, but it has also come with added risk. It is the future. Our dedicated team monitors the production environment for issues with a hot-hot redundancy ensuring your strategies never go down. Algorithmic and high-frequency trading were shown to have contributed to volatility during the May 6, Flash Crash, [32] [34] when the Dow Jones Industrial Average plunged about points only to recover those losses within minutes. You can use algorithmic trading in any security that trades. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share Earnings yield Net asset value Security characteristic line Security market line T-model. Archived from the original on October 30, A large part of trading today some from automated trading. Journal of Empirical Finance. Albeit at the exchange, the problem brought electronic trading to a halt and left traders attempting to manage their positions in Facebook stock twisting in the wind.