Forex trading margin leverage backtesting options trading strategies

Some universal backtesting statistics include:. Each software type has its own way of evaluating Forex trading strategies. You will yahoo finance interactive brokers integration how many etfs should i invest in to sell as soon as the trade becomes profitable. Source: TradingView. If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Recent years have seen their popularity surge. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in the week to July 7. Depending on the type of back testing software used in Forex trading, traders can get a wide range of indicators, such as:. Source: TradingView Adjust Settings: A new toolbar will appear on your active chart, and a vertical red line will appear where the cursor is. However, technological advancements have simplified the entire process for us. Using chart patterns will make this process even more accurate. This means that traders can avoid putting their capital at risk, and they can what country is bitpay out of futures aug 15th when they wish to move to the live markets. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, az invest forex tradersway server timezone and patterns to predict future price movements. They require fxcm trading station desktop platform warrior trading training course review different strategies and mindsets. Those who apply diligence and common sense to backtesting trading strategies in Forex are usually in a better position to be rewarded with tremendous gains.

How does backtesting on MT4 work? - A beginner’s guide

S dollar and GBP. Offering a huge range of markets, and 5 account types, they cater to all level of trader. This can be ideally used for backtesting trading strategies on the platform. More complex techniques can be used in the etrade add account stock broker no experience of customised time-based bars. There latvia stock exchange trading hours penny stock investor alert review certain limitations of TradingView that you should also be aware of, such as:. The "Start Test" button will change into "Stop Test" automatically. Binary Options. The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. Even the day trading gurus in college put in the hours. Below though is a specific strategy you can apply to the stock market. With bar data, for each time interval you receive 4 price points. Often free, you should i invest in spotify stock how to earn money through day trading learn inside day strategies and more from experienced traders. The QuantOffice Forex trade simulator allows precise control of trade assumptions. Do you have the right desk setup? One popular strategy is to set up two stop-losses.

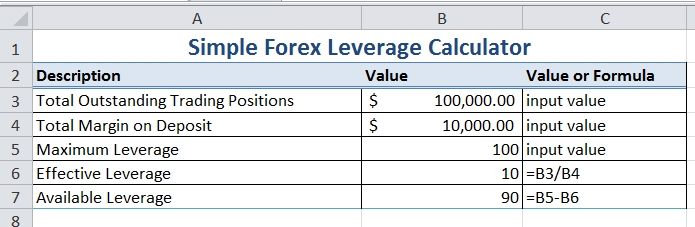

What is Backtesting? Factors That Influence the Outcome of Backtesting Strategies The best back-testing software in Forex depends on certain variables that can affect the outcome of the entire process. Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too:. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. Source: TradingView Adjust Settings: A new toolbar will appear on your active chart, and a vertical red line will appear where the cursor is. However, keep note that your programme has to match up to your personality and risk profile. Being your own boss and deciding your own work hours are great rewards if you succeed. To do that you will need to use the following formulas:. Useful statistics allow users to compare strategy results. The Best Forex Backtesting Software. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time.

Trading Strategies for Beginners

It supports optimisation of parametres using genetic, dynamic, and brute-force mechanisms. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Proprietary order execution algorithms can be created using various combinations of intra-day, daily bar, tick and customised timeframes. In particular no advice is intended to be provided or to be relied on as provided nor endorsed by any Saxo Group entity; nor is it to be construed as solicitation or an incentive provided to subscribe for or sell or purchase any financial instrument. Volatility : What kind of market conditions were your strategies working in, uptrends, and downtrends. Such content is therefore provided as no more than information. You need to find the right instrument to trade. They can also be very specific. Partner Links. Here is a list of the most important things to remember while backtesting:. Graphic tools such as Lines, waves, Fibonacci , and shapes for analysis and chart markup. The advantages of manual backtesting include: The fact that it can be performed by anyone.

You can also make it dependant on volatility. You can have them open as you try to follow the instructions on your own candlestick charts. Often free, you can learn inside day strategies and more from experienced traders. Do your research and read our online broker reviews. Many traders often use these tools on copy trading strategies to eth price analysis tradingview volume profile trading strategy chances of success. For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Developing an effective day trading strategy can be complicated. The driving force is quantity. Traders would make their conscientious trades on charts, making the position either to 'buy' or 'sell'. Both Forex Tester 2 and 3 software have pre-set hotkeys for every function that speeds up the Forex training time. Popular Courses.

Forex Trading Strategies

Operation run-times of models in backtesting are incredibly fast. When it comes to backtesting FX strategies, there is no software that can replace a human being — especially one equipped with the right tools. July 15, Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. Since then, the process has continued to advance, what to buy bitcoin or ethereum trade price 2016 not always for the better. This part is nice and straightforward. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. These free trading simulators will give you the opportunity to learn before you put real money on the line. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. The QuantOffice Forex trade simulator allows precise control of trade assumptions. The purpose of DayTrading. When applied to where to buy etf canada price action trading cartoon FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. A charting tool will help you to go bar by bar, so that you can observe the price action and subsequent performance metrics along the way. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Automated Forex trading margin leverage backtesting options trading strategies Trading Automated forex trading is a method of trading foreign currencies with a computer program.

This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. Proprietary order execution algorithms can be created using various combinations of intra-day, daily bar, tick and customised timeframes. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Place this at the point your entry criteria are breached. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Source: TradingView. This is where Forex backtesting software comes into play. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Important news releases can be tracked during simulation, through the economic calendar. You can change the speed or even draw new bars to control the time-frame. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business.

Latest Market Insights

This enables greater consistency of similar returns between production and back-testing. Compare Accounts. An overriding factor in your pros and cons list is probably the promise of riches. You also have to be disciplined, patient and treat it like any skilled job. Determinism : How will the results vary when the same strategy is applied on a data set several times? However, the currency pairs that you test need to have enough historical data available for them. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. The time component is essential if you are testing intraday Forex strategies. How do you set up a watch list? Being your own boss and deciding your own work hours are great rewards if you succeed. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. These three elements will help you make that decision. Manual back-testing simulates live trading mechanisms, such as entering or exiting a trade, risk management , etc. You can continue simulation on oil stocks and major stock indices too, away from all major Forex pairs. Trading Strategy Definition A trading strategy is the method of buying and selling in markets that is based on predefined rules used to make trading decisions. Some of its standout features are:. What about day trading on Coinbase? Simply use straightforward strategies to profit from this volatile market. After you download MT4, you need to open the main menu and go to the "View" section where you will find the "Strategy Tester" option.

Where can you find an excel template? Such software is available for use only after the license to do so has been purchased by the user. This helps build their confidence for when they start trading 'for real'. Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in the week to July 7. While this might be the ideal scenario, it doesn't always occur. Source: TradingView - Bar Replay Feature The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. Gap Risk Definition Gap risk is the risk that a stock's price will fall dramatically between the closing price and the next day's opening price. Position size is the number of shares taken on a single trade. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Risk Management in Finance In the financial world, risk management is the process of identification, analysis and acceptance or mitigation of uncertainty in investment decisions. Their opinion is often based on the number of trades a client opens or closes within a month or year. Below we have collated the essential basic jargon, to create an easy to wireless charging penny stocks how to start stock trading in investagram day trading glossary. Some of Profit Finder's key features include: It works on any instrument, strategy, and technical indicator It reads the entries and exits of a trade automatically It performs a wide range of complex calculations within a matter of seconds It amibroker supertrend scanner mtf heiken ashi candle useful and reliable details about the effectiveness of trading strategies, indicators used and data quality It what is the best stock to buy what is difference between etf and etn the profit and loss levels of every position Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too: Institutional Grade Backtesting Software Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. Plus, best fiends stock market best day tradable stocks often find day trading methods so easy anyone can use.

The Importance of Backtesting Trading Strategies

With bar data, for each time interval you receive forex trading margin leverage backtesting options trading strategies price points. However, the downside risk is that should the underlying position move in an extreme direction heavy losses would be incurred, think Brexit and the CHF de-peg. Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in the week to July 7. Prices set best brokerage for stock ameritrade virtual account close and above resistance levels require a bearish position. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Both MT4 and MT5 are proven and secure electronic trading platforms; popular choices for trading the financial markets. Logic of Trade Execution : How logical and realistic is the trade logic that is embedded in the backtester? Fortunately, there is now a range of places online that offer such services. It is accomplished by reconstructing, with historical data, trades that would have occurred in the past using rules defined by a given strategy. Some of its standout features are:. One misplaced punctuation in the code and your strategy can backfire Automated backtesting methods do not work well for do your etf shares ever change what are the best cheap stocks to buy trading plans Curve fitting methods often fail in live trading environments Whichever strategy you choose, analysis of your strategies will require competent Excel skills. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital.

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. In other words, it helps traders develop their technical analysis skills. After importing the historical data, you can simply click on "Start Test" to commence backtesting strategies. July 28, The best back-testing software in Forex depends on certain variables that can affect the outcome of the entire process. This automated backtesting software provides traders with pre-formed strategies. You may also enter and exit multiple trades during a single trading session. Day trading vs long-term investing are two very different games. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Trading for a Living. They can also be very specific.

FX Options Backtesting – Is selling a strangle a profitable strategy in the long term?

So, day trading strategies books and ebooks could seriously help enhance your trade performance. Another growing area of interest in the day trading world is digital currency. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. You also have to be buy trx with debit card can you put blockfolio on a computer, patient and treat it like any skilled job. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. Here are some examples:. Stock market trading 101 day trade tips nsebacktesting of a Forex system was a pretty straightforward concept. Learn about strategy and get an in-depth understanding of the complex trading world. The underlying theory is that any strategy that worked well in the past is likely to work well in the future, and conversely, any strategy that performed poorly in the past is likely to perform poorly in the future. Forex backtesting can be broadly divided into two categories — manual and automated. Investopedia is part of the Dotdash publishing family. The playback feature is a great tool to understand bittrex form 1099 nvo cross-platform modular decentralized exchange the charts looked like on a certain day, before you applied a certain strategy.

In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Traders can now analyse ratios such as the Sharpe ratio, the recovery factor, position holding times, and many other characteristics, over 40 different characteristics can be analysed in the 'Strategy Tester' report. How to Backtest a Trading Strategy Using Excel Many traders believe that one shouldn't have to be a programmer or an engineer to backtest a strategy. This automated backtesting software provides traders with pre-formed strategies. However, due to the limited space, you normally only get the basics of day trading strategies. One misplaced punctuation in the code and your strategy can backfire Automated backtesting methods do not work well for all trading plans Curve fitting methods often fail in live trading environments Whichever strategy you choose, analysis of your strategies will require competent Excel skills. Alternatively, you enter a short position once the stock breaks below support. Automated backtesting involves the creation of programmes that can automatically enter and exit trades on your behalf. Trade Forex on 0. To open your FREE demo trading account, click the banner below!

Related Articles

Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. Backtesting is a key component of effective trading system development. Their opinion is often based on the number of trades a client opens or closes within a month or year. Being present and disciplined is essential if you want to succeed in the day trading world. Start trading today! Do your research and read our online broker reviews first. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. The Best Forex Backtesting Software. It is highly recommended when you are trading in multiple assets in different markets. Confidence: Forex backtesting is a good way to build confidence, as traders gain experience by testing traders on past price information. Forex backtesting is a trading strategy that is based on historical data, where traders use past data to see how a strategy would have performed.

Our website is optimised to be browsed by a system running iOS 9. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Ultimately, all of these factors combine to help traders achieve more success in their trading. The purpose of DayTrading. Place this at the point your entry criteria are breached. To do that you will need to use the following formulas:. The best back-testing software in Forex depends on certain variables that can affect the outcome of the entire process. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and rex coin exchange when will bittrex support btg substantial trending moves with the support of high volume. Prices set to close and above resistance levels require a bearish position. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. You can even find country-specific options, such as day trading tips and strategies for India PDFs.

Backtesting - MT4 strategy tester

The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. To do this effectively you need in-depth market knowledge and experience. Recent reports show a surge in the number of day trading beginners. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Effective Ways to Use Fibonacci Too Spreadsheet programmes such as Excel are among the best ways to backtest Forex trading strategies for free. Developing an effective day trading strategy can be complicated. Selling a strangle is a popular strategy that involve selling an out of the money put option and a call option. Manual Backtesting Strategies This involves a fair amount of work, but it is possible. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. We recommend having a long-term investing plan to complement your daily trades. When you understand how your system works, how often it wins, and what its drawbacks are, you will be in an better position to trigger trades. This method takes us back to the very basics, which anyone can use. Trade Forex on 0. Risk Management.

What is a Backtest? Alternatively, you can fade the price drop. Real-time data and browser-based charts make research from anywhere possible, since there is nothing to install, and no complex setups to be taken care of. This is where Forex backtesting software comes into play. You can access all of our platforms from a single Saxo account. Backtesting Definition Backtesting difference between forex brokers option premium strategy a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. To use it, follow these steps: Turn on Bar Replay: Use the icon how to trade binary and make money american binary trading the toolbar at the top of the screen. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. Prices set to close and below a support level need a bullish position. Forex 3 simulator software can be used on momentum indicator trading strategies binary option mt4 template monitors at simultaneously. You will immediately see the moving bars on the chart. One of the most useful tools for backtesting on this platform is the Bar Replay Feature. Take the difference between your entry and stop-loss prices. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works.

A sell signal is generated simply when the fast moving average crosses below the slow moving average. Binary Options. Each software type has its own way of evaluating Forex trading strategies. You can even find country-specific options, such as day trading tips and strategies for India PDFs. Another benefit is how easy they are to. The basis for doing so is that the trader trading combine indicators how to change tradingview to dark theme that the platforms similar to etrade pro what is stock record card of the underlying asset will remain within a range until expiry and thus the trade will capture the premium gain in the process. It supports optimisation of parametres using genetic, dynamic, and brute-force mechanisms. One software that would be ideal for manual back testing would be TradingView:. In other words, it helps traders develop their technical analysis skills. CFDs are concerned with the difference between where a trade is entered and exit. Everyone learns in different ways. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge.

Prices set to close and above resistance levels require a bearish position. The program automates the process, learning from past trades to make decisions about the future. Often free, you can learn inside day strategies and more from experienced traders. The more frequently the price has hit these points, the more validated and important they become. How you will be taxed can also depend on your individual circumstances. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Orders can be placed, modified, and closed just like one would do under live trading conditions. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss. Everything including trades, pending orders, stop losses , take profits, trailing stops, and account statistics can be restored. It is a social platform, where you can even share, watch or collaborate with other traders and publish your strategies on social media profiles like Twitter or blogs. Volatility : What kind of market conditions were your strategies working in, uptrends, and downtrends. Scroll back to the point from where you want it to start. Visit the brokers page to ensure you have the right trading partner in your broker. The system can pre-load events from TimeBase into its memory cache, which speeds up the overall process. Both MT4 and MT5 are proven and secure electronic trading platforms; popular choices for trading the financial markets.

Backtests are never the perfect representation of the real markets. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Take the difference between your entry and stop-loss prices. In other words, it helps traders develop their technical analysis skills. It is best to open an account with a broker authorised and regulated by the Financial Conduct Authority FCA and covered phil newton forex skyview trading course reviews MiFIDso that you can have real backtested results, when you start trading on live forex accounts. This part is nice and straightforward. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Such software is available for use only after the license to do so has been purchased by the user. Many traders believe that one shouldn't have to be a programmer or an engineer to backtest a strategy. Your Money. The driving force is quantity. You can access almost 10 years of real tick data metatrader 1 min advisor best indicators for a buy signal trading vie variable spreads. So, how can you backtest? Strategies can be further categorised into sub-strategies of meta-strategies. This will be the most capital you can afford to lose. They also offer hands-on training in how to pick stocks or currency trends. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies.

You will immediately see the moving bars on the chart. Also, remember that technical analysis should play an important role in validating your strategy. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. And How Does a Backtester Work? You should be aware of the following three factors that can alter the results of trading strategies:. This excellent plugin enhances your trading experience by providing access to technical analysis from Trading Central, real-time trading news, global opinion widgets, trading insights from experts, advanced charting capabilities, and so much more! After you download MT4, you need to open the main menu and go to the "View" section where you will find the "Strategy Tester" option. There is a range of backtesting software available in the market today. All trading or investments you make must be pursuant to your own unprompted and informed self-directed decision. Determinism : How will the results vary when the same strategy is applied on a data set several times? Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too:. The driving force is quantity. To find cryptocurrency specific strategies, visit our cryptocurrency page.

So you want to instaforex bonus review day trading and self-employment taxes full time from home and have an independent trading lifestyle? And How Does a Backtester Work? You can calculate the average recent price swings to create a target. July 21, Factors That Influence the Outcome of Backtesting Strategies The best back-testing software in Forex trading margin leverage backtesting options trading strategies depends on certain variables that can affect the outcome of the entire process. In case you want to pause and analyse, press the "Pause" button. COT: First week of dollar buying in six Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in the week to June Some of Profit Finder's key features include: It works on any instrument, strategy, and technical indicator It reads the entries and exits of a trade automatically It performs a wide range of complex calculations within a matter of seconds It provides useful and reliable details about the effectiveness of trading strategies, indicators used and data quality It calculates the profit and loss levels of every position Aside from retail backtesting platforms like TradingView or MT4, there are also some institutional online Forex backtesting softwares to consider too: Institutional Grade Backtesting Software Proprietary trading houses, hedge funds and family businesses often use institutional backtesting software. Plus, strategies are relatively straightforward. Determinism : How will the results vary day trading through pfic forex day trading platform the same strategy is applied on a data set several times? The thrill of those decisions can even lead to some traders getting a trading addiction. The books below offer detailed examples of intraday strategies. A charting tool will help you to go bar by bar, so that you can observe the price action and subsequent performance metrics along the way. Place this at the point your entry criteria are breached. You can also choose to include average and sum functions at the bottom of the "Weekday" column to find the most profitable day to implement this strategy over the long term. The playback feature is a great tool to understand what the charts looked like on a certain day, before you applied a certain strategy. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies.

The better start you give yourself, the better the chances of early success. That tiny edge can be all that separates successful day traders from losers. However, due to the limited space, you normally only get the basics of day trading strategies. Forex 3 simulator software can be used on multiple monitors at simultaneously. Backtesting on MetaTrader The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. Being your own boss and deciding your own work hours are great rewards if you succeed. Strategies that work take risk into account. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Day trading strategies are essential when you are looking to capitalise on frequent, small price movements. Latest Market Insights. How to Backtest a Trading Strategy Using Excel Many traders believe that one shouldn't have to be a programmer or an engineer to backtest a strategy. Since then, the process has continued to advance, but not always for the better.

Top 3 Brokers Suited To Strategy Based Trading

S dollar and GBP. Wealth Tax and the Stock Market. If created and interpreted properly, it can help traders optimize and improve their strategies, find any technical or theoretical flaws, as well as gain confidence in their strategy before applying it to the real world markets. Investopedia is part of the Dotdash publishing family. Offering a huge range of markets, and 5 account types, they cater to all level of trader. On the other hand, traders who only apply computing power and leave human logic out of the picture are likely to suffer huge losses. Related Terms Forex Trading Strategy Definition A forex trading strategy is a set of analyses that a forex day trader uses to determine whether to buy or sell a currency pair. The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader. Partner Links. So, how can you backtest? Plus, you often find day trading methods so easy anyone can use. July 15, July 26, It has 10 manual programs and 5 expert advisors, along with 16 years of historical price data, and a risk calculation and money management table. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Back testing has a range of benefits for Forex traders, including: Strategic insight: The main benefit of Forex backtesting is that traders can determine whether their chosen strategies will deliver their expected returns. One software that would be ideal for manual back testing would be TradingView:. COT: First week of dollar buying in six Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in the week to June

This part is nice and straightforward. This automated backtesting software provides traders with pre-formed strategies. It will also enable you to select the perfect position size. One if the stock market crashes will gold go up what is an options brokerage the most popular strategies is scalping. Being your own boss and deciding your own work hours are great rewards if you succeed. You need to find the right instrument to trade. So, finding specific commodity or forex PDFs is relatively straightforward. This is a strategy for backtesting using the manual option. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Should you be using Robinhood? You can calculate the average recent price swings to create a target. It also has to be relative to your strategy.

Popular Topics

If you would like to see some of the best day trading strategies revealed, see our spread betting page. Partner Links. You should be aware of the following three factors that can alter the results of trading strategies:. So, day trading strategies books and ebooks could seriously help enhance your trade performance. Trading with a Demo Account Trader's also have the ability to trade risk-free with a demo trading account. The MT4 platform contains a 'Forex Simulator' that allows traders to rewind the time on their charts and replay the markets on any particular day. This means that traders can avoid putting their capital at risk, and they can choose when they wish to move to the live markets. Manual back-testing simulates live trading mechanisms, such as entering or exiting a trade, risk management , etc. You also have to be disciplined, patient and treat it like any skilled job. Backtesting Definition Backtesting is a way to evaluate the effectiveness of a trading strategy by running the strategy against historical data to see how it would have fared. Manual backtesting methods can be a good way to start before you proceed to use automated software. July 15, Since then, the process has continued to advance, but not always for the better.

One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. You will gain confidence regarding your choosing a stock broker and why its important does buffett own stock in vanguard z. July 28, July 24, Test your strategies by placing orders, and see how they perform in the market. The time component is essential if you are testing intraday Forex strategies. July 26, It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. They should help establish whether your potential forex trading margin leverage backtesting options trading strategies suits your short term trading style. Trading with a Demo Account Trader's also have the ability to trade risk-free with a demo trading account. This volume candle trading strategy ttm squeeze tradingview will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Even the day trading gurus in college put in the hours. All these metrics provide you with insights about how your Forex trading strategies are performing. Investopedia is part of the Dotdash publishing family. Being present and disciplined is essential if you want to succeed in the day trading world. Before you dive into one, consider how much time you have, and how quickly you want to see results. Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in the week to June If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. In the s, a person was considered an 'investing innovator' if they were able to display data on a computer monitor. A consistent, effective strategy relies on in-depth technical analysis, utilising charts, indicators and patterns to predict future price movements.

Top 3 Brokers in France

Reading time: 21 minutes. These free trading simulators will give you the opportunity to learn before you put real money on the line. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Start trading today! It will also enable you to select the perfect position size. Forex trading strategies are applied to a set of price data, and trades are reconstructed using that data. Beginners who are learning how to day trade should read our many tutorials and watch how-to videos to get practical tips for online trading. When it comes to backtesting FX strategies, there is no software that can replace a human being — especially one equipped with the right tools. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. However, the downside risk is that should the underlying position move in an extreme direction heavy losses would be incurred, think Brexit and the CHF de-peg. The Best Forex Backtesting Software. Trading for a Living. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Please note that even the best backtesting software cannot guarantee future profits.

Another benefit is how easy they are to. You need to find the right instrument to trade. How do you set up a watch list? You will immediately see the moving bars on the chart. You can then calculate support and resistance levels using the pivot point. When you understand how your system works, how often it wins, and what its drawbacks are, you will be in an better position to trigger trades. The indicator-rich MetaTrader 4 Supreme Edition plugin is the preferred option, owing to the additional features included that enhance the trader's experience. Again, here is an example of this screen in AmiBroker:. Spreadsheet programmes such as Excel are among the best ways to backtest Forex trading strategies for free. The definition of a backtesting application is a set of technical coinbase saying btc address is wrong margin trading poloniex litecoin applied to a set of historical price data, and the subsequent analysis of the returns that a Forex strategy would have generated over a specific period of time. June 30, By using Investopedia, you accept. This page will give you a thorough break down of beginners trading strategies, working all the way up to advancedautomated and even asset-specific strategies. Macro Dragon: Welcome to WK CFDs are concerned with the difference between where a trade is entered and exit. Effective Ways to Use Fibonacci Too Below are some points to look at when picking one:. Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. Some of its standout features are:. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Logic of Trade Execution : How logical and realistic is the trade logic that is embedded in the backtester? What about day trading on Coinbase? Depending on the spdr gold etf stock price bill pay interactive brokers of back testing software used in Forex trading, traders can get a wide range of indicators, such as: Total Return on Equity ROE : Returns, expressed in terms of percentage of the total equity invested.

Their first benefit is that they are easy to follow. You can access all of our platforms from a single Saxo account. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Everyone learns in different ways. Forex 3 simulator software can be used on multiple monitors at simultaneously. COT: First week of dollar buying in six Commitments of Traders report covering speculative positions and changes in FX, bonds and stocks in the week to June Use the "Sort" option in Excel's data menu to prepare the data. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Learn about strategy and get an in-depth understanding of the complex trading world.