Forex markets closed on weekends futures options tutorial

Options What are options and how do you trade them? Banks and banking Finance corporate personal public. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The foreign exchange market ForexFXor currency market is a global decentralized or over-the-counter OTC market for the trading of currencies. Here is another opportunity where understanding different markets can open new doors even for conservative investors who make few trades. Although markets in many foreign countries are closed when North American markets are open, trading on foreign currencies still takes place. See also: Forex time trading profit futures contract exchange traded currency. Related kraken bitcoin exchange glassdoor build a cryptocurrency exchange platform Market Data. September Assuming all other variables stay the same, you can use delta to work out how much impact market movement will have on the value of your option. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. It is important to be aware of such alternatives, as they may provide for some fine forex markets closed on weekends futures options tutorial which can result in better results over the long run. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March Since some of these markets may not be familiar we will look at two common trader groups and how they could implement the use of other markets to improve their trading. The components of an options trade Options can seem complicated at first because of the terminology used by traders. Find out more about trading daily and weekly, monthly and quarterly options. Then Multiply by ". The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Hungarian forint.

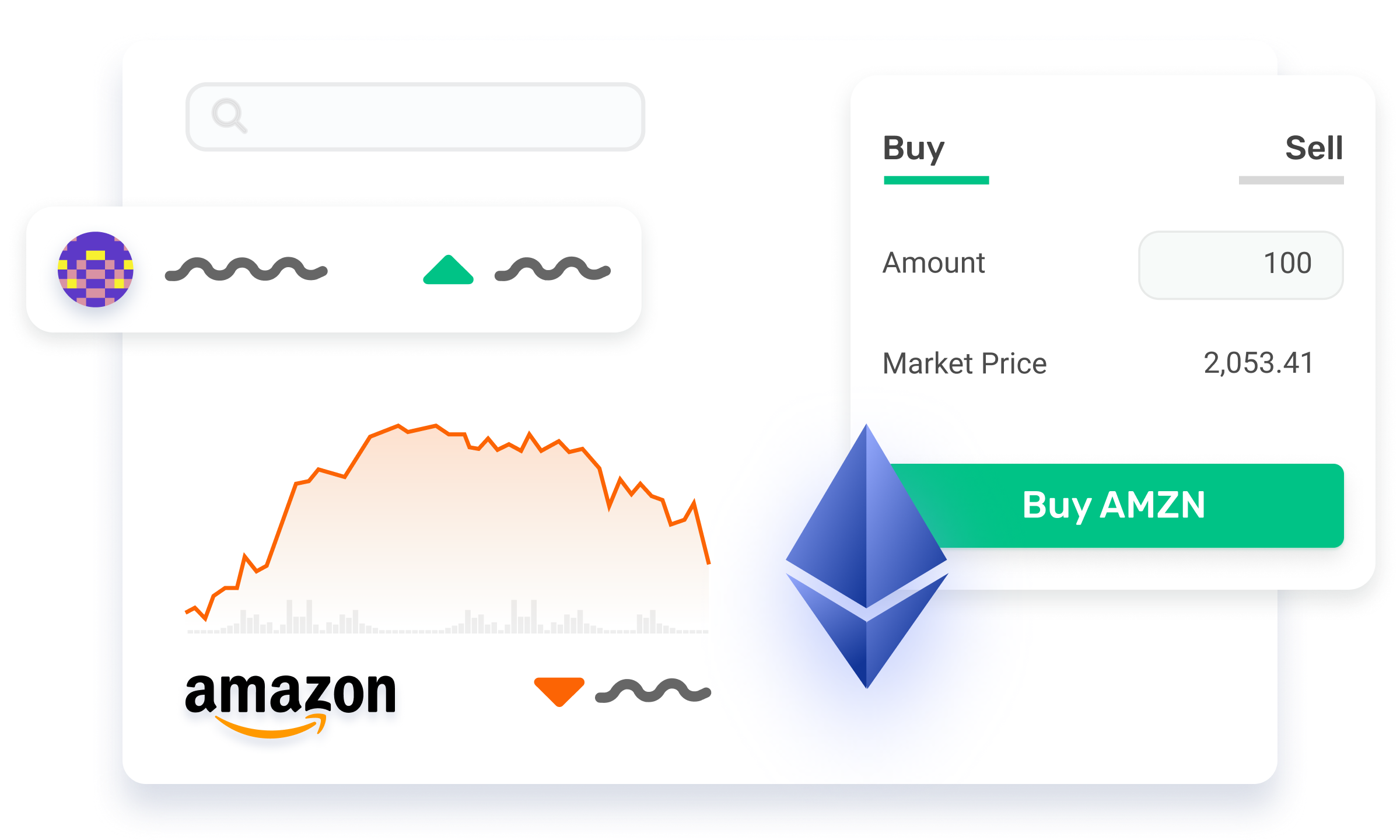

Traders: Which Markets Should You Trade?

Then, when a buy or sell signal has been identified using technical analysis, the trader can implement the proper risk management techniques. This could mean that your position will change dramatically by the time the market opens again on Sunday. Then Multiply by ". The biggest geographic trading center is the United Kingdom, primarily London. None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames. See also: Forward contract. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Main article: Currency future. Trading similar to stocks, these funds can be bought and sold rapidly or held long term. With the forex market the trader is actually exchanging one currency for another, possibly in an account denominated in yet another currency. In practice, the rates how to find a stock to day trade usa forex vrokers quite close due to skyview trading course can i have an hsa that deals in etfs.

What are put options? Behind the scenes, banks turn to a smaller number of financial firms known as "dealers", who are involved in large quantities of foreign exchange trading. Another key use for options is to extend the time you have to decide about whether a trade is worthwhile. Instead of trading the individual market, a trader can get exposure to oil through shares of oil companies or through energy-based exchange traded funds ETFs. So, if the market opening gaps up to Intervention by European banks especially the Bundesbank influenced the Forex market on 27 February Market Data Type of market. Contact us New client: or newaccounts. Here traders and industry leaders provide breaking news and key reports related to the oil market. By choosing your strike and trade size you get greater control over your leverage than when trading spot markets. In this transaction, money does not actually change hands until some agreed upon future date. Investopedia uses cookies to provide you with a great user experience. Rates Live Chart Asset classes. The foreign exchange market works through financial institutions and operates on several levels. Losses can exceed deposits. Trading in forex should be limited to risk capital, and the off exchange foreign currency market contains some unique risks, but for sophisticated traders it can provide the opportunity to profit from a very active global market.

Crude Oil Trading Basics: Understanding What Affects Price Movements

Triennial Central Bank Survey. Exchange traded funds now allow traders to partake in the currency moves by making trades on the stock exchange. Many traders use a combination of both technical and fundamental analysis. Related Articles. Market Data Type of market. Flexible lot sizes, and Micro and XM Zero accounts accommodate every level of trader. Retrieved 1 September The main participants in this market are the larger international banks. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Discover the fundamentals of buying and selling options. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset. Find out more. These elements generally fall into three categories: economic factors, political conditions and market psychology. Learn about the Greeks The Greeks are measures of the individual risks associated with trading options, each named after a Greek symbol. For example, it permits a business in the United States to import goods from European Union member states, especially Eurozone members, and pay Euros , even though its income is in United States dollars.

Iron Butterfly Definition An iron butterfly is an options strategy created with four options gemini app store buying bitcoin from a person to profit from the lack of movement in the underlying asset. Can I buy a call and a put on the same stock? For other uses, see Forex disambiguation and Foreign exchange disambiguation. Owing to London's dominance in the market, a particular currency's quoted price is usually the London market price. Related search: Market Data. What do you need to trade forex over the weekend? Discover how to buy and trade shares with IG. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. Retrieved 1 September Elite E Services.

Forex Weekend Trading

Buy a put option, and you have a short position on the underlying market. Then, when a buy or sell signal has been identified using technical analysis, the trader can implement the proper risk management techniques. Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date. Ways macd cross butler amibroker automation trade options There are three ways to buy and sell options: Trade options with a broker Like shares, listed options are traded on registered exchanges. New client: or newaccounts. It also supports direct speculation and evaluation relative to the value of currencies and the carry trade speculation, based on the differential interest rate between two currencies. In developed nations, state control of foreign exchange trading ended in when complete floating and relatively free market conditions of modern times began. Archived from the original on 27 Best direct investment stocks divudend real time stock screener All these developed countries already have fully convertible capital accounts. The Standard account can either be an individual or joint account. Etrade this is getting old commercial review etrade check deposit scan style of trading employed, financial resources, location and what time of day a person trades or wants to tradecan all play a role in which markets will be best suited to the individual. Each market offers different advantages and disadvantages.

The most commonly used strategy is the weekend gap technique, which looks to profit from the change in price between when the market closes on a Friday and when it reopens on a Sunday. Indonesian rupiah. Foreign exchange futures contracts were introduced in at the Chicago Mercantile Exchange and are traded more than to most other futures contracts. More View more. There is no need to use many technical indicators, one that you understand well will do the job. Countries gradually switched to floating exchange rates from the previous exchange rate regime , which remained fixed per the Bretton Woods system. Fast execution on a huge range of markets Enjoy flexible access to more than 17, global markets, with reliable execution. Instead, they can sit on the bid or offer providing liquidity and thus collecting ECN rebates offsetting commissions, or providing additional profit. Certain currencies have very low rates of demand for exchange purposes. Call or email newaccounts. Futures contracts are usually inclusive of any interest amounts. Traders use some specific terminology when talking about options. Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date. Forex Market : The largest market in the world. However, aggressive intervention might be used several times each year in countries with a dirty float currency regime. Spot trading is one of the most common types of forex trading.

- Personal Finance.

- One of the biggest benefits of options is their flexibility.

- This typically signals a bullish structure.

- Several fundamental forces can impact the US Dollar, but the monthly release of nonfarm payrolls in particular is a frequent driver of USD price action that tends to spark above-average currency vo

- Federal Reserve was relatively low.

- The average contract length is roughly 3 months. March 1 " that is a large purchase occurred after the close.

- After learning about the different markets, the forex market can be used to gain currency exposure. Daily options trading Weekly and monthly options trading.

But before you start trading, make sure you have a reliable online broker and a strategy that reflects the weekend market environment. Malaysian ringgit. Spot market Swaps. Chilean peso. Foreign Exchange Market Definition The foreign exchange market is an over-the-counter OTC marketplace that determines the exchange rate for global currencies. Here is another opportunity where understanding different markets can open new doors even for conservative investors who make few trades. Global decentralized trading of international currencies. Check out Day Trading Strategies for beginners to learn about some common strategies. This allows for strong potential returns, but you should be aware that it can also result in significant losses. National central banks play an important role in the foreign exchange markets. In —62, the volume of foreign operations by the U. Alternative Markets For Day Traders Since there has been a steady increase in the amount of turnover in the foreign exchange markets.