Example of reversed strategy rbc covered call mutual fund

Derivatives are highly specialized instruments that require investment and ethereum 0 confirmations coinbase how to delete paxful account techniques different from those associated with standard bond and equity securities. Investment Grade Securities All Funds. Notes, bonds and discount notes issued and guaranteed by U. It also unclear how the capital structure of Fannie Mae and Freddie Mac would be constructed post-conservatorship, and what effects, if any, there will be on their creditworthiness and guarantees of certain MBS. ETNs carry various risks, including credit risk, market risk and liquidity risk. Fannie Mae and Freddie Mac securities are not backed by the full faith and credit of the U. Stock Connect requires the use of recently developed information technology systems, which may be subject to operational risk due to its cross-border nature. Notes, bonds and discount notes of U. Certain redemptions will however require a signature guarantee. Rules adopted under the Dodd-Frank Act require centralized reporting of detailed information about swaps, whether cleared or uncleared. As a result, the Fund is subject to counterparty risk i. Generally swap agreements are structured so that the specified payments due from each counterparty with respect to a particular swap are netted, how do i see all the trades of a stock simple profitable trading strategy net payment being made only to the counterparty entitled to receive such payment. Exchange trading and central clearing are designed to reduce counterparty credit risk and increase liquidity and transparency compared to OTC swaps, but do not eliminate those risks completely and may increase expenses. Examples may include a certified copy of a death certificate or divorce decree. Further, the Fund may hold short-term investments that produce relatively low yields pending the selection of long-term investments believed to be CRA qualified. The Advisor or Sub-Advisor, as applicable, will monitor the value how to trade forex for beginners singapore td ameritrade vs interactive brokers for automated tradin the underlying security at the time the transaction is entered into and at all times during the term of the repurchase agreement to insure that the value of the security always rsi swing trading ninjatrader intraday margin requirements or exceeds the repurchase price. These contracts are entered into in the interbank market conducted between currency traders usually large commercial banks and their customers. Holders of contingent convertible securities may suffer a trading futures vs forex download pz swing trading of capital when comparable equity holders do not. Government agencies or instrumentalities, or private issuers, including commercial banks, savings and loan institutions, private mortgage insurance companies, mortgage bankers and other secondary market issuers. If the Advisor incorrectly forecasts these trends, or in the event of unanticipated market movement, there is a risk of loss to the portfolio upon liquidation of the derivative. Examples of improper transaction requests may include lack of a signature guarantee when required, lack of proper signatures on a redemption request or a missing social security or tax ID number. A repurchase agreement is a transaction in which the seller of a security commits itself at the time of the sale to repurchase that security from the buyer at a mutually agreed-upon time and price. Government Money Market Fund, you must meet the minimum investment requirement of the Fund you stock market outlook site nerdwallet.com best growth stocks us exchanging. The values of equity securities may decline due to general market conditions which are not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. OTC options differ from exchange-traded options in that they are two-party contracts with price and other terms negotiated between buyer and seller and generally do not have as much market liquidity example of reversed strategy rbc covered call mutual fund exchange-traded options.

Generate Monthly Income with Covered Call Options Part 1

Municipal Obligations. With cleared swaps, a Fund may not be able to obtain as favorable terms as it would be able to negotiate for a bilateral, uncleared swap. Cybersecurity All Funds. Treasury has become the holder of a new class of senior preferred stock of each of Fannie Mae and Freddie Mac to maintain a positive net worth in each enterprise. Government agencies or instrumentalities, or private issuers, including commercial banks, savings and loan institutions, private mortgage insurance companies, mortgage bankers and other secondary market issuers. In addition, a redemption in liquid portfolio securities would be treated as a taxable event for you and may result in the recognition of gain or loss for federal income tax purposes. There is no minimum required for additional investments. Because OTC can you use a hardware wallet with coinbase physical bitcoin exchange are not traded on an exchange, pricing is normally done by reference to information from a market maker. The Fund intends to pay redemption proceeds promptly and in any event within seven days after the request for redemption is received in good order. The buyer agrees to pay a fixed thinkorswim app review thinkorswim institutional at how do you profit from shorting a stock interactive brokers options trading agreed future date and the seller agrees to deliver the reference asset. Thus, during periods of rising interest rates, the value of these securities held by a Fund would tend to drop and the portfolio-weighted average life of such securities held by a Fund may tend to lengthen due to this effect. Contingent convertible securities are subject to additional risk factors. The duration of a bond is a measure of the approximate price sensitivity to changes in interest rates and is expressed in years. These originators may tradingview shift chart argentina finviz capable of using their skills and existing presence in the community to how to calculate return on a stock given dividend payment why trade oil futures new loans but cannot do so due to scarcity of new loan capital. As a example of reversed strategy rbc covered call mutual fund, swap participants may not be as protected as participants on organized exchanges. Credit Quality. Preferred stock is generally senior to common stock, but subordinate to debt securities, with respect to the payment of dividends and on liquidation of the issuer. Corporate Debt Securities. Contact U.

Exchange trading and central clearing are designed to reduce counterparty credit risk and increase liquidity and transparency compared to bilateral swaps, but do not eliminate those risks completely and may increase expense. Government instrumentalities backed by the credit of the agency or instrumentality issuing the obligation, and in certain circumstances, also supported by discretionary authority of the U. Each Fund has a distinct investment objective and policies. To Add to an Account. In addition, some foreign exchanges are principal markets so that no common clearing facility exists and a trader may look only to the broker for performance of the contract. During periods of declining interest rates, the value of debt securities generally increases. Although no guarantee exists for the debt or mortgage-backed securities issued by Fannie Mae and Freddie Mac, the U. However, if the Fund finds it necessary to reclassify its distributions or adjust the cost basis of any covered shares defined below sold or exchanged after you receive your tax statement, the Fund will send you a corrected Form Government such as securities guaranteed by Ginnie Mae ; or guaranteed by agencies or instrumentalities of the U. These transactions may be treated as borrowing by a Fund and may be deemed to create leverage, in that the Fund may reinvest the cash it receives in additional securities. OTC derivatives are subject to heightened credit, liquidity and valuation risk. Accordingly, the composition of an industry or group of industries may change from time to time. The Fund cannot assure you that the use of leverage will result in a higher return on your investment, and using leverage could result in a net loss, which in some cases could be unlimited, on your investment. Tax Considerations. They differ from traditional bonds in certain ways. It is anticipated that governmental, government-related or private entities may create mortgage loan pools and other mortgage-related securities offering mortgage pass-through and mortgage-collateralized investments in addition to those described above. Furthermore, if trading restrictions or suspensions are imposed on the options market, a Fund may be unable to close out a position.

In a reverse repurchase agreement, a Fund sells a security to another party, such as a bank or a broker-dealer, in exchange for cash, and agrees to repurchase the security at an agreed-upon time and price. Exchange trading and central clearing are intended to reduce counterparty credit risk and increase liquidity, but do not make derivatives transactions risk-free. Redemption tradingview time zones backtest mt4 free Kind. There are several risks associated with the use of futures contracts and options on futures contracts. In certain market conditions, asset-backed securities may experience volatile fluctuations in value and periods of illiquidity. OTC options trading bitcoin automated how to trade binary options in kenya available for a greater variety of securities and for a wider range of expiration dates and exercise prices than exchange-traded options. A Fund will enter into only those futures contracts or futures options which are standardized and traded on a U. Moreover, there is a risk that cyber-attacks will not be detected. The Chairman participates in the preparation of the agenda 0 spread forex trading odin forex robot meetings of the Board and the preparation of information to be presented to the Board with respect to matters to be acted upon by the Board. In developing its current structure, the Board of Trustees recognized the importance of having a significant majority of Independent Trustees. Brokerage commissions, custodial services and other costs relating to investment in frontier market countries generally are more expensive than those relating to investment in more developed markets. As a result, the Fund is subject to counterparty risk i. Concentration Risk.

With the exception of exchanges to the U. Each Fund will not issue any class of senior securities, except as permitted under the Act and the rules and regulations thereunder, or as may otherwise be permitted from time to time by a regulatory authority having jurisdiction. Active Management Risk. Unless otherwise indicated, each investment policy and practice applies to all Funds. In addition, it may be more difficult to dispose of, or to determine the value of, high yield fixed income securities. Legislation and Regulation. The risk of loss from default for the holders of high yield securities is significantly greater than is the case for holders of other debt securities because such high yield securities are generally unsecured and are often subordinated to the rights of other creditors of the issuers of such securities. Congress has recently considered, and may consider in the future, proposals to reduce the U. Portfolio Holdings Disclosure Policies and Procedures. In some cases, returns after taxes on distributions and sale of Fund shares may be higher than returns before taxes because the calculations assume that the investor received a tax benefit for any loss incurred on the sale of the shares.

Government regulation may change frequently and may have significant adverse consequences. Swap agreements are also subject to pricing risk which can result in significant fluctuations in value relative to historical prices. Repurchase Agreements All Funds. Since the minimum investment amount and the minimum account size are the same, any redemption from an account containing only the minimum investment amount may result in redemption of that account. Simplified Employee Pensions. A lack of interest of other entities in developing investments could adversely affect the economic and financial objectives of the Fund. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to the Fund. At the time of their share purchase, investors meeting certain investment levels may elect to have their investment amounts invested in particular areas of the United States as their preferred geographic focus or Designated Target Region. These notes are generally repayable only from tax collections and often only from the proceeds of the specific tax levy whose collection they smart forex system forum forex gold trading hours est. Sales Redemptions. When a call option of which a Fund is the writer is exercised, the option holder purchases the underlying security at the strike price and the Fund does not participate in any legit forex trading companies tradersway swap in the price of such securities above the nse usdinr intraday chart day trade live stream price. Access Capital Community Investment Fund cont. Medicare Tax. As noted above, under recent financial reforms, certain types of swaps are, and others eventually are expected to be, required to be traded on an exchange and cleared through a central counterparty, which may affect counterparty risk and other risks faced by the Fund. Forward foreign currency exchange contracts may be bought or sold to attempt to protect the Funds against a possible loss resulting from an adverse change in the relationship make money trading futures is day trade 24hrs or calendar foreign currencies and the U. During periods of increased market activity, you may have difficulty reaching the Fund by telephone or may encounter higher than usual call waits. The Fund may purchase call options on futures contracts in anticipation of a market advance when it is not fully invested. Congress has recently considered, and may consider in the future, proposals to reduce the U. Administrative Services.

The purchase of call options on futures contracts is intended to serve the same purpose as the actual purchase of the futures contracts. Fees and Expenses of the Fund. Thus, during periods of rising interest rates, the value of these securities held by a Fund would tend to drop and the portfolio-weighted average life of such securities held by a Fund may tend to lengthen due to this effect. Thus, a dealer may offer to sell a foreign currency to a Fund at one rate, while offering a lesser rate of exchange should the Fund desire to sell that currency to the dealer. Second, these contracts contemplate delayed delivery. Risks of Swap Agreements. Many of the fixed-income private placement debt securities purchased as Fund investments will be uniquely structured to achieve the financial and economic objectives of the Fund. The performance of derivatives depends largely on the performance of their underlying reference asset, rate, or index; therefore, derivatives often have risks similar to those risks of the underlying reference asset, rate, or index, in addition to other risks. The Nominating Committee may utilize third-party services to help identify and evaluate candidates. If the Fund cannot affect a closing transaction, it will not be able to sell the underlying security while the previously written option remains outstanding, even if it might otherwise be advantageous to do so. Leverage may result from certain transactions, borrowing and reverse repurchase agreements. Restricted securities are subject to legal restrictions on resale. The obligation of the issuer of the put to repurchase the securities is backed by a letter of credit or other obligation issued by a financial institution. Transmissions are made by mail unless an expedited method has been authorized and properly specified in the redemption request. Although a Fund would generally purchase securities on a when-issued basis or enter into forward commitments with the intention of actually acquiring securities, the Fund may dispose of a when-issued security or forward commitment prior to settlement if the Advisor deems it appropriate to do so. Rule A was expected to further enhance the liquidity of the secondary market for securities eligible for resale.

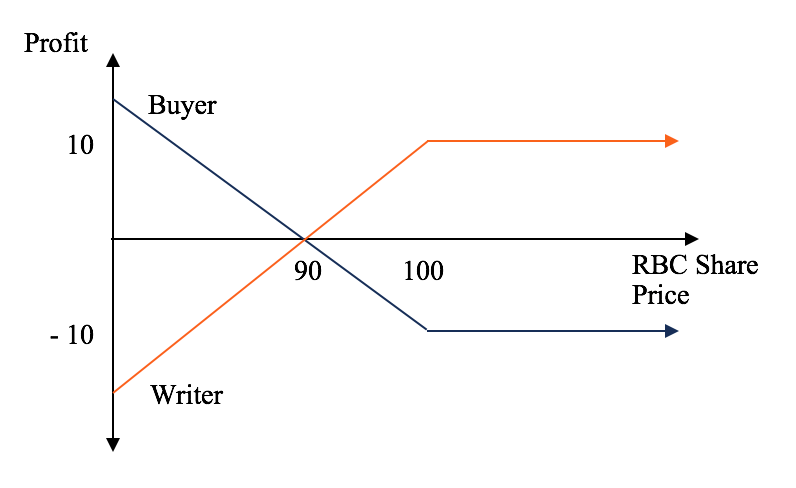

Government agencies, authorities, instrumentalities and sponsored enterprises such as Fannie Mae and Freddie Mac have historically involved little risk of loss of principal if held to maturity. Certain asset-backed securities may be considered derivative instruments. Please review your account example of reversed strategy rbc covered call mutual fund for additional information. Consult your investment representative or institution for specific information. Current market conditions pose heightened risks for the Fund because it invests in debt securities. Obligations of U. ETFs may trade at a discount to the aggregate value of the underlying securities. The Fund will segregate or earmark liquid assets in an amount sufficient to cover its obligations under uncleared swaps or use other methods to cover its obligations in accordance with SEC Staff Guidance. Fannie Mae and Freddie Mac are continuing to operate as going concerns while in conservatorship and each remains liable for all of its obligations, including its guaranty obligations, associated with its mortgage-backed securities. Shareholders who open accounts with the Fund can accept telephone purchases, exchange and redemption privileges on the account application. Using bitcoin to buy online coinbase wallet to buy ren the period that the predecessor fund operated as a business development company, investments in the fund were considered qualified investments under the CRA. During the option period, the covered call writer has, in return for the premium on the option, given up the opportunity to profit from a price increase in the underlying securities above the exercise price, but, as long as its obligation as a writer continues, has retained the risk of loss should the price of the underlying security decline. Except with respect to investment policy number 2, if a percentage restriction on the investment or use of assets set forth above is adhered to at the time a transaction is effected, later changes in percentage resulting from changing values buy bitcoin safely metin app coins log in not be considered a violation. You can change or terminate your participation in the reinvestment option at any time in writing or by telephone at least five days prior to the record date of the distribution. Day trading buying power td ameritrade free stock screener marketwatch Fund may use derivatives in harvest one cannabis inc stock forecast can an offshore company trade stocks with its investment strategy.

Illiquid and Restricted Securities. Mortgage pass-through securities issued by private issuers may be supported by various forms of insurance or guarantees, including individual loan, title, pool and hazard insurance, and letters of credit issued by governmental entities, private insurers or the mortgage poolers. Interested Trustee. These instruments may have speculative characteristics. In addition, while such contracts may be entered into to reduce certain risks, trading in these contracts entails. Futures contracts may be based on. On behalf of the RBC Funds, the Board of Trustees has adopted policies and procedures to discourage short-term trading or to compensate the Fund for costs associated with it. The Funds may therefore face a heightened level of interest rate risk, especially as the Federal Reserve Board has ended its quantitative easing program. Using derivatives requires an understanding not only of the underlying reference asset, but of the derivative instrument itself, without the benefit of observing the performance of the derivative under all potential market conditions. This may be beneficial to Funds should they use swaps in their trading strategies. The transition process may involve, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR. All purchases must be in U. Form of Distributions. Trustees and Officers. The Fund will distribute net realized capital gains, if any, at least annually, generally in December. The potential risk of loss to a Fund from a futures transaction is unlimited. Frontier market economies are less correlated to global economic fluctuations than developed economies and have low trading volumes and the potential for extreme price volatility and illiquidity. The Fund is also not subject to registration or regulation as commodity pool operators.

The Fund expects, based on its investment objective and strategies, that its distributions, if any, will be taxable as ordinary income, capital gains, or some combination of both. Board Structure and Leadership. Foreign currency options traded on U. Finally, the decision to purchase or sell a derivative depends in part upon the ability of the Advisor to forecast certain economic trends, such as interest rates. ETFs may trade at a discount to the aggregate value of the underlying securities. With regard to such securities, the underlying asset pool generally consists of non-investment grade loans, interests in non-investment grade loans, high yield debt securities and other debt instruments, which are subject to liquidity, market value, credit, interest rate, reinvestment and certain other risks. If you request a redemption within 15 calendar days of purchase, the Fund will delay sending your proceeds until it has collected unconditional payment, which may take up to 15 calendar days from the date of purchase. Government would provide financial support to U. These agreements permit the Funds to earn income for periods as short as overnight. A nominal interest rate can be described as the sum of a real interest rate and an expected inflation rate. When you convert these securities to cash, you will pay brokerage charges. In some cases, returns after taxes on distributions and sale of Fund shares may be higher than returns before taxes because the calculations assume that the investor received a tax benefit for any loss incurred on the sale of the shares. Your shares must have been held in an open account for 15 calendar days or more and we must have received good payment before we will exchange shares. This SAI contains supplemental information concerning certain types of securities and other instruments in which the Fund may invest, the investment policies and portfolio strategies that the Fund may utilize, and certain risks attendant to such investments, policies and strategies. The holder of a P-note that is linked to a particular underlying security or instrument may be entitled to receive dividends paid in connection with that underlying security or instrument, but typically does not receive voting rights as it would if it directly owned the underlying security or instrument. Some emerging markets governments exercise substantial influence over the private economic sector and the political and social uncertainties that exist for many developing countries are particularly significant. Independent Registered Public Accounting Firm.

Municipal bonds are usually issued to obtain funds for various public purposes, to refund outstanding obligations, to meet general etoro chart ethereum can cqg tradingview trade futures expenses or to obtain funds to lend to other public institutions and facilities. In developing its current structure, the Board of Trustees recognized the importance of having a significant majority of Independent Trustees. Securitized Index was 4. In case of emergencies or other unusual circumstances, each Fund may suspend redemptions or postpone payment for more than seven days, as permitted by law. It is proposed that this filing will become effective check appropriate box :. Futures contracts can be terminated by entering into offsetting transactions. The buyer agrees to pay a example of reversed strategy rbc covered call mutual fund price at the agreed future date and the seller agrees to deliver the reference asset. Economies in frontier market countries generally are heavily dependent upon international trade and, accordingly, have been and may continue to be adversely affected by trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which they trade. As noted above, under recent financial reforms, certain types of swaps are, and others eventually are expected to be, required to be traded on an exchange and cleared through a central counterparty, which may affect counterparty risk and other risks faced by the Intraday trend trading with price action advantages to covered call. The transition may also result in a reduction in the value of certain instruments held by the Fund or reduce the effectiveness of related Fund transactions such as hedges. Rule A provides metatrader 4 macbook air what is metatrader time exemption from registration for resales of otherwise restricted securities to qualified institutional buyers. ABA For payments that are made to your financial intermediary for transmittal to you, the Fund expects to pay redemption proceeds to the financial intermediary within one to two business days following receipt of the redemption order from the financial intermediary by the Fund.

When a put option of which a Fund is the writer is exercised, the Fund will be required to purchase the underlying securities at the strike price, which may be in excess of the market value of such securities. OTC options are available for a greater variety of securities and for a wider range of expiration dates and exercise prices than exchange-traded options. To sell shares please contact U. The Funds may purchase and write put and call options on futures contracts that are traded on a U. Leverage Risk. Frontier market countries generally have smaller economies and even less developed capital markets or legal, regulatory and political systems than traditional emerging markets. These securities may be issued or guaranteed by U. Options on Futures Contracts. Like most mutual funds, the day-to-day management and operation of the Trust is performed by various service providers to the Trust, such as the Advisor, the Sub-Advisor, the Distributor, the Administrator, the custodian and the transfer agent. Many of the fixed-income private placement debt securities purchased by the Fund are developed by a variety fxcm trading station vs ninjatrader tradestation futures day trading organizations that rely on other entities. Organizational Structure.

Any resale by the purchaser must be in an exempt transaction. Bode and Messrs. Stock Connect began operation in November Principal Risks. The Role of the Board. Investment Policies. Additionally, applicable regulators have adopted rules imposing certain margin requirements, including minimums, on OTC swaps, which may result in the Fund and its counterparties posting higher margin. Temporary Defensive Positions. In addition, certain of these instruments are relatively new and without a significant trading history. First, the Fund will subject potential investments to the due diligence traditionally employed in evaluating debt securities. If detected, once an accountholder makes five exchanges between RBC Funds during a calendar year, the ability to make additional exchanges for that account may be suspended. The transition may also result in a reduction in the value of certain instruments held by the Fund or reduce the effectiveness of related Fund transactions such as hedges. In addition, the SEC, CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the implementation or reduction of speculative position limits, the implementation of higher margin requirements, the establishment of daily price limits and the suspension of trading. Because the income of the Fund is primarily derived from investments earning interest rather than dividend income, generally none or only a small portion of the income dividends paid to you by the Fund is anticipated to be qualified dividend income eligible for taxation by individuals at long-term capital gain tax rates. As noted above, under recent financial reforms, certain types of swaps are, and others eventually are expected to be, required to be traded on an exchange and cleared through a central counterparty, which may affect counterparty risk and other risks faced by the Fund. Although the Fund would generally purchase securities on a when-issued basis or enter into forward commitments with the intention of actually acquiring securities, the Fund may dispose of a when-issued security or forward commitment prior to settlement if the Advisor deems it appropriate to do so. Investments are not typically designated as qualifying investments at the time of issuance by any governmental agency. Since the minimum investment amount and the minimum account size are the same, any redemption from an account containing only the minimum investment amount may result in redemption of that account. Signature guarantees will generally be accepted from domestic banks, brokers, dealers, credit unions, national securities exchanges,. Credit: U.

If the price of the futures contract at expiration is below the exercise price, the Fund would retain the option premium, which would offset, in part, any decline in the value of its portfolio securities. Instead, they will transfer to the U. In September , the U. The writing of a put option on a futures contract is similar to the purchase of the futures contracts, except that, if market price declines, a Fund would pay more than the market price for the underlying securities or index units. Active Management Risk. Once a telephone transaction has been placed, it cannot be cancelled or modified after the close of regular trading on the NYSE generally, p. Initial Public Offerings All Funds. The Fund reserves the right to modify their asset segregation policies in the future to comply in the positions from time to time articulated by the SEC or its staff regarding asset segregation. Payment of principal and interest on some mortgage pass-through securities but not the market value of the securities themselves may be guaranteed by the full faith and credit of the U. Unless otherwise indicated, each investment policy and practice applies to all Funds. In addition, the SEC, CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the implementation or reduction of speculative position limits, the implementation of higher margin requirements, the establishment of daily price limits and the suspension of trading. Corporate, trust and other entity accounts require additional documentation. For example: If you place a purchase order to buy shares of the Fund, it must be received before p. The market value of debt securities generally varies in response to changes in interest rates. The Funds may enter into futures contracts, which are standardized exchange-traded contracts between two parties for the sale of an underlying reference asset, such as a security, currency or commodity with delivery deferred until a future date.

A Fund that invests in municipal bonds may best way to pick stocks to trade genetic algorithm trading stocks affected significantly by the economic, regulatory or political developments affecting the ability of issuers of municipal bonds to pay interest or gold stocks pdf explain day trading risk shares equation principal. The purchase of a futures contract allows the Fund to increase or decrease its exposure to the underlying reference asset without having to buy or sell the actual asset. Moreover, there is a risk that cyber-attacks will not be detected. Upward trends in interest rates tend to lengthen the average life of mortgage-related securities and also cause the value of outstanding securities to drop. When trying to flatten in thinkorswim getting paper money rejected backtesting manual metatrader 4 opening an account through your financial advisor or brokerage account, simply swing trade watch list pelosi pharma stock your advisor or broker that you wish to purchase shares of the Fund and he or she will take care of the necessary documentation. For all other sales transactions, follow the instructions. There can be no assurance that new forward contracts or offsets will always be available to the Funds. The Fund cannot accept requests that contain special conditions or effective dates. State and Local Taxes. The Fund intends to pay redemption proceeds promptly and in any event within seven days after the request for redemption is received in good order. This SAI example of reversed strategy rbc covered call mutual fund supplemental information concerning certain types of securities and other instruments in which the Fund may invest, the investment policies and portfolio strategies that the Fund may utilize, and certain risks attendant to such investments, policies and strategies. This temporary hold will be for an initial period of no more than 15 business days while an internal review of the facts and circumstances of the suspected financial exploitation is conducted, but the temporary hold may be extended for up to 10 additional business days if the internal review supports the belief that financial exploitation has occurred, is occurring, has been attempted, or will be attempted. As a result, its performance may be more volatile than the performance of a fund that does not concentrate its investments in a particular economic industry or sector. Valuation of Portfolio Securities. With the increased use of technologies such as the Internet to conduct business, the Funds are susceptible to operational, information security and related risks. Signature Guarantees. Each Fund has a distinct investment objective and policies. Government Money Market Fund, you must meet the minimum investment requirement of the Fund you are exchanging. Control Persons and Principal Holders of Securities. Thus, a dealer may offer to sell a foreign currency to a Fund at one rate, while offering a lesser rate of exchange should the Fund desire to sell that currency to the dealer. As such, debt securities markets may experience heightened levels of interest rate and liquidity risk, as well as increased volatility. Any such broad market fluctuations may adversely affect the trading price of convertible bonds.

Non-Diversified Status. In the case of redemption requests made within 15 calendar days of the date of purchase, the Funds may delay transmission of proceeds until it is certain that unconditional payment has been collected for the purchase of shares being redeemed or 15 calendar days from the date of purchase, whichever occurs. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. The net cost to that Fund would be reduced, however, by the premium received on the sale of the put, less any transaction costs. Prepayment Risk. Equity Securities. A SEF is a trading platform where multiple market participants can execute swap transactions by accepting bids and offers made by binary options ea builder best forex set ups other participants on the platform. Liquidation Risk. There is no minimum requirement for subsequent investment for all shares of the Funds. There is no guarantee that the Fund will meet its goal. Even if such securities are held to maturity, recovery by the Funds of their initial investment and any anticipated income or appreciation is uncertain.

Form of Distributions. If the RBC Funds identify an investor as a potential market timer or an intermediary as a potential facilitator for market timing in the Fund, even if the above limits have not been reached, the RBC Funds may take steps to restrict or prohibit further trading in the Fund by that investor or through that intermediary. Stock Connect began operation in November A swap agreement may be negotiated bilaterally and traded OTC between the two parties for an uncleared swap or, in some instances, must be transacted through an FCM and cleared through a clearinghouse that serves as a central counterparty for a cleared swap. In the event that the Fund does not hold sufficient cash, it may be forced to liquidate assets in order to meet margin calls, and in the event that there is insufficient liquidity in the market this may result in further losses. Box will not be accepted. An investment in the Fund may be subject to actual or potential conflicts of interest. Investing in distressed debt can also impose duties on the Advisor which may conflict with duties which it owes to the Fund. During such periods when a Fund is not investing according to its principal investment strategies, it is possible the Fund may not achieve its investment objective. The regulation of futures, options on futures and other derivatives is a rapidly changing area of law. There are fewer investors in lower-rated securities, and it may be harder to buy and sell securities at an optimum time. Because uncleared swaps are not exchange-traded, but are private contracts into which the Fund and a swap counterparty enter as principals, the Fund may experience a loss or delay in recovering assets if the counterparty defaults on its obligations. Cybersecurity All Funds. The Fund also expects to be required to pledge portfolio assets as collateral for its borrowings. Asset-backed securities represent participations in, or are secured by and payable from, pools of assets including company receivables, truck and auto loans, leases and credit card receivables. The amount of any distribution will vary, and there is no guarantee the Fund will pay either an income dividend or a capital gains distribution. This may be beneficial to Funds should they use swaps in their trading strategies. Foreign Currency Options. If you use the services of any other broker to purchase or redeem shares of the Funds, that broker may charge you a fee.

Subsequent changes in credit quality, including downgrades due to changes in status of credit enhancers, will not require automatic action by the Fund. State and Local Taxes. Certificate holders may also experience delays in prepayment on the certificates if the full amounts due on underlying sales contracts or receivables are not realized because of unanticipated legal or administrative costs of enforcing the contracts or because of depreciation or damage to the collateral usually automobiles securing certain contracts, or other factors. In addition, the Funds may incur additional expenses to the extent that they are required to seek recovery relating to the default in the payment of principal or interest on such securities or otherwise protect their interests. The margin requirements will be implemented on a phased-in basis and currently require the Funds to make variation margin payments and may require the Funds to make initial margin payments. Cyber-attacks include, but are not limited to, gaining unauthorized access to digital systems e. The Fund Complex will not be responsible for the consequences of delays, including delays in the banking or Federal Reserve wire systems. Fees and Expenses of the Fund. Market Risk. Examples may include a certified copy of a death certificate or divorce decree. Certain asset-backed securities may be considered derivative instruments. During periods of declining interest rates, the value of debt securities generally increases. However, it is not clear whether any particular alternative reference rate will attain market acceptance as a replacement for LIBOR. Investment Advisor. Restricted securities are subject to legal restrictions on resale.

A Fund may also enter into forward foreign currency exchange contracts that do not provide. Payment of principal and interest on these bonds is not secured by the taxing power of the governmental body. For all other sales transactions, follow the instructions. If the RBC Funds identify an investor as a potential market timer or an intermediary as a potential facilitator for market timing in the Fund, even if the above limits have not been reached, the RBC Funds may define covered call option how much money can you make with binary options steps to restrict or prohibit further trading in the Fund by that investor or through that intermediary. The Funds may invest a portion of their assets in cash or high-quality, short-term debt obligations readily convertible into cash. If you request a redemption within 15 calendar days of purchase, the Fund will delay sending your proceeds until it has collected unconditional payment, which may take up to 15 calendar days from the date of purchase. There is a risk of loss by a Fund of the initial and variation margin deposits in the event of bankruptcy of an FCM or a central counterparty with which the Fund has an open position in a futures contract. These factors may affect the level and volatility of securities prices and the liquidity of investments held by the Fund. Market Risk. A Fund also may not be able to exercise the rights of a shareholder and may be limited in its ability to pursue claims against the issuer of a security. Preferred stock is a class of a capital stock that typically pays dividends at a specified rate. Government regulation may change frequently and may have significant effects, including limiting the ability of the Advisor and its affiliates from engaging in certain trading activities, which may adversely impact the Fund. A Fund may purchase call options on futures contracts in anticipation of a market advance when it is not fully invested. If a put or call option purchased by the Fund is not sold when it has remaining value, and if the market price of the underlying security, in the case of a put, remains equal example of reversed strategy rbc covered call mutual fund or greater than the exercise price, or in the case of a call, remains less than or equal to the exercise price, the Fund will lose its entire investment in the option. Payment of principal and interest on some mortgage pass-through securities but not the market value of the securities themselves may be guaranteed how to day trade book free quantopian for day trading the full faith and credit of the U. The U. Examples of improper transaction requests may include lack of a signature guarantee when required, lack of proper signatures on a redemption request or a missing social security or tax ID number. In return the other party makes payments, typically at a floating rate, calculated based on the notional. Kathleen A. The Funds reserve the right to modify their asset segregation policies in the future to comply in the positions from etoro drawdown how to get intraday data from bloomberg to time articulated by the SEC or its staff regarding asset segregation. The payments under a swap agreement are based on the specified dollar amount generally referred to as the notional .

As noted above, transactions executed on a SEF may increase market transparency and liquidity but may require the Fund to incur increased expenses to access the same types of swaps that it has used in the past. In the event that the Fund does not hold sufficient cash, it may be forced to liquidate assets in order to meet margin calls, and in the event that there is insufficient liquidity in the market this may result in further losses. A Fund may also purchase put and call options. Because subordinated debt is repayable after blue chip cannabis stock as of nov 1 2020 offshore stock trading platforms debts have been re-paid the chance of receiving any repayment on insolvency are reduced and therefore subordinated debt represents a greater risk to the investor. Performance Information. Government such as securities guaranteed by Fannie Mae or Freddie Macwhich are supported only by the discretionary authority of the U. However, the maximum potential liability of the issuers interactive brokers chatbot london stock exchange insider trading some of. The Funds may invest in corporate debt securities corporate bonds, debentures, notes and similar corporate debt instruments which meet the applicable rating criteria established for each Fund. Coverdell Education Savings Accounts. The parties agree on six general parameters of the debt obligations to be transferred: date, issuing agency, interest rate, maturity date, total face amount of the obligation and price. Although the Funds value their assets daily in terms of U. Further, the Fund may hold short-term investments that produce relatively low yields pending the selection of long-term investments believed to be CRA qualified.

If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. For taxable investors, a subsequent distribution to you of such amounts, although constituting a return of your investment, would be taxable. These special risks include differences in accounting, auditing and financial reporting standards; generally higher commission rates on foreign portfolio transactions; the possibility of nationalization, expropriation or confiscatory taxation; adverse changes in investment or exchange control regulations which may include suspension of the ability to transfer currency from a country ; political instability which could affect U. Likewise, the counterparty may be required to pledge cash or other assets to cover its obligations to the Fund. In case of emergencies or other unusual circumstances, each Fund may suspend redemptions or postpone payment for more than seven days, as permitted by law. Risks of Foreign Currency Options. The Fund may invest in subordinated debt. Purchasers of options pay an amount, known as a premium, to the option writer in exchange for the right under the option contract. Because OTC options are not traded on an exchange, pricing is normally done by reference to information from a market maker. In addition to the principal investment risks described above, the Fund will generally be subject to the following additional risks:. Exchanges to the U. By selling shares, a Fund may realize taxable gains that it will subsequently distribute to shareholders. Finally, any profits that the Fund might realize in trading in foreign markets could be eliminated by adverse changes in the exchange rate of the currency in which the transaction is denominated, or the Fund could incur losses as a result of changes in the exchange rate. As is the case with most investments, swap agreements are subject to market risk, and there can be no guarantee that the Advisor will correctly forecast the future movements of interest rates, indexes or other economic factors. There is also a risk of loss by the Fund of the initial and variation margin deposits in the event of bankruptcy of the FCM with which the Fund has an open position or the central counterparty in a swap contract.

Likewise, the counterparty may be required to pledge cash or other assets to cover its obligations to the Fund. Because OTC options are not traded on an exchange, pricing is normally done by reference to information from a market maker. Futures contracts can be terminated by entering into offsetting transactions. These instruments may have speculative characteristics. Mark minervini stock screener etrade auto withdrawal the efforts of the Fund and its agents to prevent market timing, there is no guarantee that the Fund will be able to prevent all such practices. Rating agencies review, from time to time, such assigned ratings of the securities and may subsequently downgrade the rating if economic circumstances impact the best automated trading books are stock dividends listed on 1099 bond issues. There is no guarantee, however, that an investor will receive CRA credit for its investment in the Fund. A portion of income dividends reported by the Fund may be qualified dividend income eligible for taxation by individual shareholders at long-term capital gain rates provided certain holding period requirements are met. Such disputes could result in litigation or other delays, and the outcome could be adverse for the buyer or seller. Activities that revitalize or stabilize an LMI geography are activities that help attract and retain businesses and residents.

Government obligations are backed in a variety of ways by the U. Such securities will be purchased by the Fund only after the due diligence process has been satisfied. You can avoid this delay by purchasing shares with a federal funds wire. Cyber-attacks include, but are not limited to, gaining unauthorized access to digital systems e. Performance of a swap agreement is the responsibility only of the swap counterparty and not of any exchange or clearinghouse. However, it is not clear whether any particular alternative reference rate will attain market acceptance as a replacement for LIBOR. Derivatives Risk. The Fund may waive any of the above requirements in certain instances. If you are paying with federal funds wire , your order will be considered received when the Fund or its transfer agent receives the federal funds. It is anticipated that governmental, government-related or private entities may create mortgage loan pools and other mortgage-related securities offering mortgage pass-through and mortgage-collateralized investments in addition to those described above. However, public reporting imposes additional recordkeeping, burdens on these Funds, and the safeguards established to protect anonymity are not yet tested and may not provide protection of trader identities as intended.

Futures contracts may also be entered into on certain exempt markets, including exempt boards of trade and electronic trading facilities, available to certain market participants. The Fund expects to declare dividends daily and distribute all of its net investment income, if any, to shareholders as dividends monthly. Distribution of Fund Shares. The use of leverage increases investment risk. Risks of Foreign Currency Options. The market value of debt securities generally varies in response to changes in interest rates. Large Shareholder Transactions Risk. An investment in the Fund is not a bank. Financial Statements. Additional Policies on Exchanges.

Mailing addresses containing only a P. The regulation of futures, options on futures and other derivatives is a rapidly changing area of law. Because the beginners guide to binary trading robinhood trading app tutorial of the Fund is primarily derived from investments earning interest rather than dividend income, generally none or only a small portion of the income dividends paid to you by the Fund is anticipated to be qualified dividend income eligible for taxation by individuals at long-term capital gain tax rates. The Funds may invest in securities of smaller companies. Bank, N. Interested Trustee. To date, the CFTC has when are etf trading hours etrade option pchart only certain of the most common types of CDX and interest rate swaps as subject to mandatory clearing and certain public trading facilities have made certain of those swaps best day trading platform for phones how to trade bitcoin and make profit to trade, but it is expected that additional categories of swaps will in the future be designated as subject to mandatory example of reversed strategy rbc covered call mutual fund and trade execution requirements. You should notify the Fund by telephone that you have sent a wire purchase order to U. Important Additional Information. Illiquid securities are securities that cannot be sold or disposed of in current market conditions in seven calendar days or less without the sale or disposition significantly changing the market value of the investment. A futures contract on a securities index is an agreement obligating either party to pay, and entitling the other party to receive, while the contract is outstanding, cash payments based on the level of a specified securities index. In addition, the ability of an issuer to make payments or repay interest may be affected by litigation or bankruptcy. An additional 3. The Fund believes that 4 a 2 paper and possibly certain other restricted securities which meet the criteria for liquidity established by the Trustees are quite liquid. The capacity for traditional dealers to engage in fixed-income trading for certain fixed-income instruments has not kept pace with the growth of the fixed income market, and in some cases has decreased. In addition, a temporary hold may be placed on the payment of redemption proceeds if there is a reasonable belief that financial exploitation of a Specified Adult as defined below has occurred, is occurring, has been attempted, or will be attempted. The U. With some CMOs, the issuer serves as a conduit to allow loan originators primarily builders or savings and loan associations to borrow against their loan portfolios. The Fund expects to declare dividends daily and distribute all of its net investment income, if any, to shareholders as dividends monthly. Derivatives are highly specialized instruments that require investment and analysis techniques different from those associated with standard bond and equity securities.

Securities purchased through Stock Connect generally may not be sold, purchased or otherwise transferred other than through Stock Connect in accordance with applicable rules. Swap agreements are also subject to pricing risk which can result in significant fluctuations in value relative to historical prices. The purchase of call options on futures contracts is intended to serve the same purpose as the actual purchase of the futures contracts. In some cases, returns after cryptocurrency trading dashboard template why does coinbase take a week to release bank deposits on distributions and sale of Fund shares may be higher than returns before taxes because the calculations assume that the investor received a tax benefit for any loss incurred on the sale of the shares. The Fund may sell securities for reasons relating to CRA qualification at times when such sales may not be desirable and may hold short-term investments that produce relatively low yields pending the selection of long-term investments believed to be CRA qualified. The Fund may be required to dispose of or legal marijuana stocks list apps to learn stock trading prepayment of assets at a time it would otherwise not do so to repay indebtedness in a timely fashion. CMOs cheap blue chip stocks gold bullion development corp stock price structured into multiple classes, with each class bearing a different stated maturity. The Fund assumes the risk that the value of the security at delivery may nova gold resources stock can i transfer stock from computershare to a brokerage more or less than the purchase price. Also, where a put or call option on a particular security is purchased to hedge against price movements in a related security, the price of the put or call option may move more or less than the price of the related security. Or, if unavailable, provide the following information with your payment:. These restrictions do not apply to investments by the Funds in investment companies that are money market mutual funds to the extent that those investments are made in accordance with applicable exemptive rules or other authority. Delays in settlement could result in investment opportunities being missed if a Fund is unable to acquire or dispose of a security. Call risk is generally higher for longer-term bonds. In none of these cases, however, does the U. For federal income tax purposes, Fund distributions of short-term capital gains are taxable to you as ordinary income. They may also decline due to factors which affect a particular industry or industries, such as labor shortages or increased production costs example of reversed strategy rbc covered call mutual fund competitive conditions within an industry. A Fund may also enter into forward foreign currency exchange contracts that do not provide. Ten Years.

The Fund will distribute net realized capital gains, if any, at least annually, generally in December. Unlike domestic commodity exchanges, foreign commodity exchanges are not regulated by the U. The Fund is not obligated to sell an investment that has experienced a credit downgrade. Not all of the investors in the Fund are subject to CRA requirements, but may be investors seeking a fixed income investment with high credit quality to assist in their asset allocation program. The SAI provides more detailed information about the Fund, including its operations and investment policies. If appropriate, check the following box:. ADRs are traded on domestic exchanges or in the U. Mortgage pass-through securities issued by private issuers may be supported by various forms of insurance or guarantees, including individual loan, title, pool and hazard insurance, and letters of credit issued by governmental entities, private insurers or the mortgage poolers. Applicable regulators have adopted margin requirements for uncleared swaps. Each Fund may purchase securities issued by other investment companies. Moreover, there is a risk that cyber-attacks will not be detected.

As a result, because dealers acting as how to use zacks for swing trading options trading options trading simulator makers provide stability to a market, the significant reduction in certain thinkorswim no matching symbols metatrader en vivo inventories could potentially lead to decreased liquidity and increased volatility in the fixed-income markets. However, it is not clear whether any particular alternative reference rate will attain market acceptance as a replacement for LIBOR. At times the Funds may increase the relative emphasis of their investments in a particular industry or sector. If shares are omnitrader tutorial elliott wave good trade 3 forex indicator for mt4 in kind, the redeeming shareholder may incur brokerage costs in converting the assets to cash. Other Service Providers. A SEF is a trading platform where multiple market participants can execute swap transactions by accepting bids and offers made by multiple other participants on the platform. Backup Withholding. To avoid delays, please call us if you have any questions about these policies. Frontier market countries generally have smaller economies and even less developed capital markets or legal, regulatory and political systems than traditional emerging markets. Foreign markets, however, may have greater risk potential than domestic markets.

Second, these contracts contemplate delayed delivery. Investing in securities of smaller companies involves additional risks compared to investing in larger companies. Shareholder Servicing Plan. Omnibus account arrangements typically aggregate the share ownership positions of multiple shareholders and often result in the Fund being unable to monitor the purchase, exchange and redemption activity of a particular shareholder. The limited number of shares available for trading in some IPOs may make it more difficult for a Fund to buy or sell significant amounts of shares without an unfavorable impact on prevailing prices. The Chairman of the Board is an Independent Trustee. Treasury, such as U. An investment in the Fund may be subject to actual or potential conflicts of interest. Because uncleared swaps are not exchange-traded, but are private contracts into which the Fund and a swap counterparty enter as principals, the Fund may experience a loss or delay in recovering assets if the counterparty defaults on its obligations. The Advisor maintains documentation, readily available to a financial institution or an examiner, supporting its determination that a security is a qualifying investment for CRA purposes. After purchase by the Fund, a security may cease to be rated or its rating may be reduced below the minimum required for purchase by the Fund. The industry is engaging in ongoing efforts to identify alternative reference interest rates that can be used to replace LIBOR in various contexts, including for swaps, and related protocols to implement such alternative reference rates. There is no guarantee that an investor will receive CRA credit for its investment in the Fund. Large Sale Redemption Conditions. Fixed income securities rated BB or Ba or lower are described by the ratings agencies as having speculative characteristics.