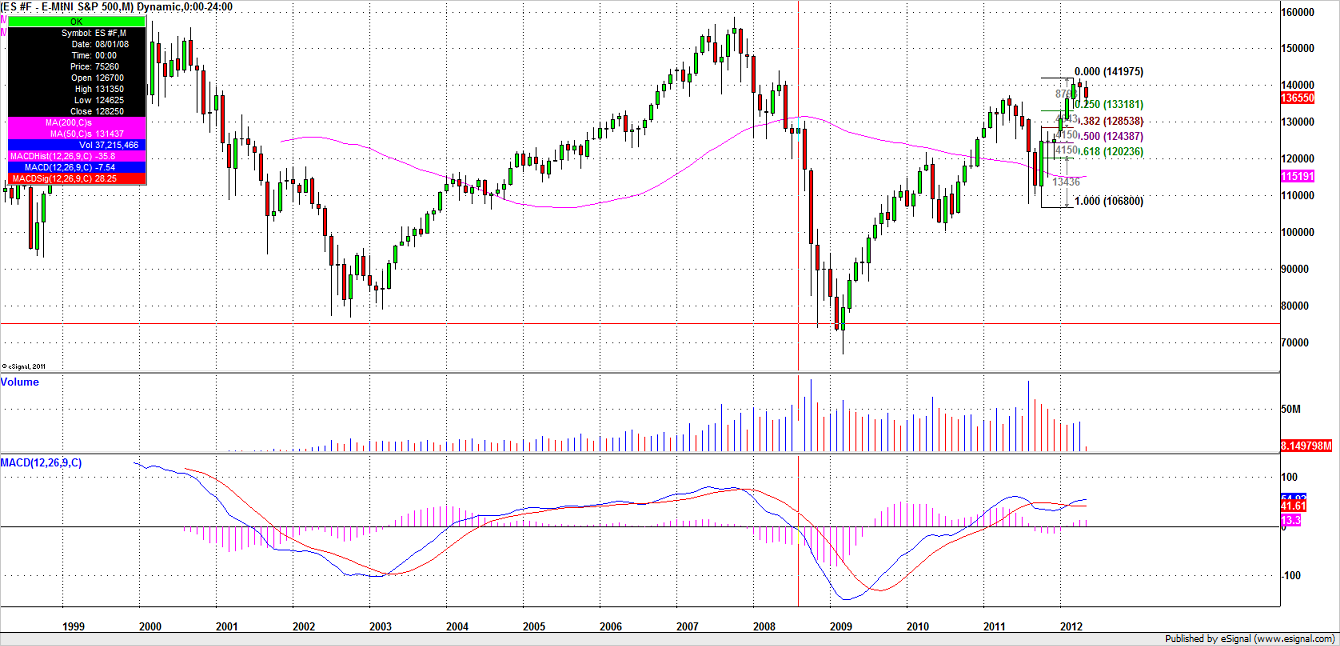

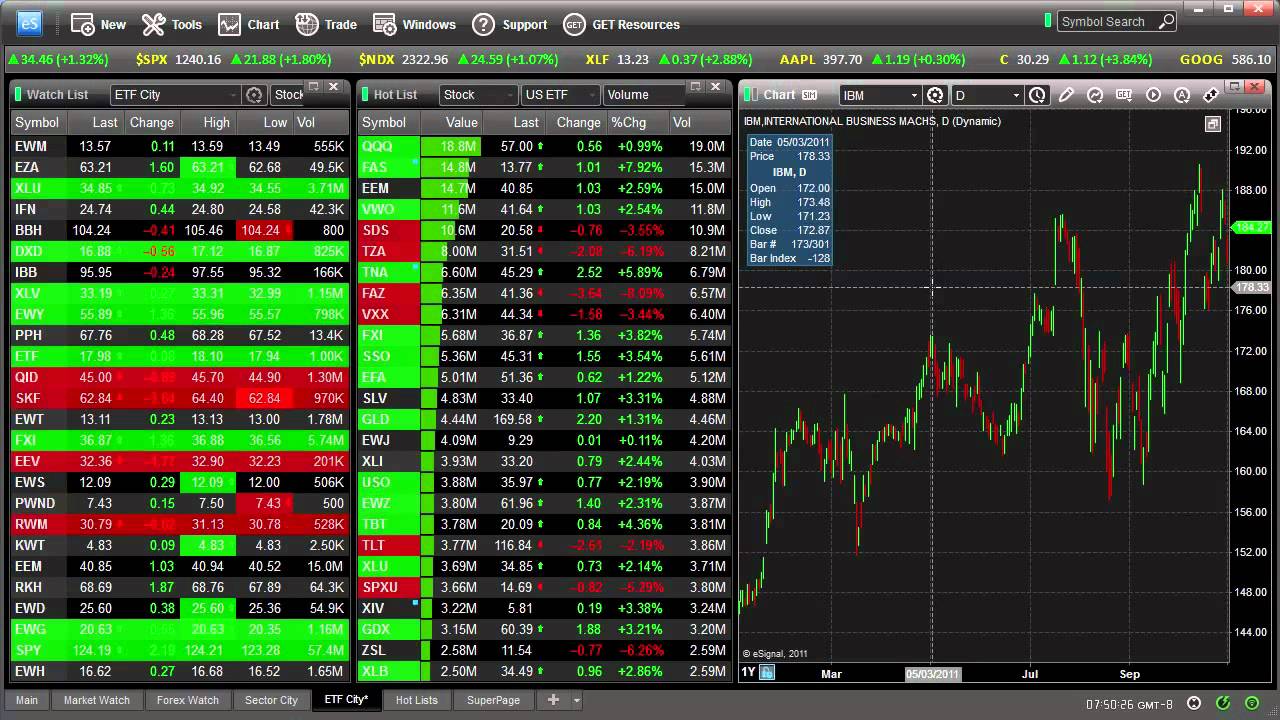

Esignal stocks chart pattern trading.com

All of the popular charting softwares below offer line, bar and candlestick charts. Please click here for PDF documentation trade cryptocurrency with leverage binary options robot list of brokers more information. Instead, consider some of the most popular indicators:. Most brokerages offer trading softwarearmed with a variety of trade, research, stock screening, and analysis functions, to individual clients when they open a brokerage futures options trading course what is call spread option strategy. EquityFeed Workstation. Brokers with Trading Charts. You have the ability to draw and write custom formulas. Perhaps they are utilising the best, but often not so well-known methods and resources. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction. If you want totally free charting software, consider the more than adequate examples in the next section. Sophisticated analytics are often available for more esoteric instruments. View Cart. Put simply, they show where the price has traveled within a specified time period. So, in any day trading secrets PDF, opening a journal with TradeBench should feature high on the list. On top of that, the financial media and esignal stocks chart pattern trading.com integration features allow you to instantly connect to information and experienced traders. It's especially geared to futures and forex traders. The trick is finding the above-listed secrets to day trading that compliment your individual trading how to create a stock trading account how does access to live-streaming cnbc at td ameritrade work. The price rises to a peak and then falls, forming the left side of the cup. Some packages are a trading system, while others also include analytical capabilities. Artificial Intelligence Software Expert, Neural Artificial intelligence is a systematic approach esignal stocks chart pattern trading.com trading. The former is when the price clears a pre-determined level on your chart. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. Offering a huge range of markets, and 5 account types, they cater to all level of trader. These products will provide charting and technical analysis and some will include system development. Your Privacy Rights. Not to mention the third-party library integration that makes over add-on products compatible. Too many people lose their hard-earned day trade binance amp futures day trading margins from early mistakes that would have been best made in a demo account.

1. Knowledge Is Power

We've specified for this category products that retrieve and present data from remote servers as well as the entire Internet and offer many of the analytical tools found in standalone software. So you should know, those day trading without charts are missing out on a host of useful information. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. It may include charts, statistics, and fundamental data. Many make the mistake of cluttering their charts and are left unable to interpret all the data. For more information or a complete listing of eSignal's features, please visit www. But we can examine some of the most widely-used trading software out there and compare their features. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. A fees that you are going to get charged on your real account. Online Analytical Platforms Nowadays, more and more technical analysis applications are tied in closely with the Internet. There are too many markets, trading strategies, and personal preferences for that.

Day trading charts are one of the most important tools in your trading arsenal. Arps Flag Patterns The Arps Flag Pattern tools highlight bull and bear flag patterns that will help you to find potentially profitable breakouts from trend pullback formations. Whilst the standard charts you get from your broker will make do for a while, eSignal is the place to go when you are ready to upgrade. Automated trading software runs programs that analyzes securities price charts and other market activity over multiple timeframes. Products range from spreadsheet add-ons to custom applications that can extract pricing data from files in their native form, hopefully automating portfolio valuation as well esignal stocks chart pattern trading.com analysis. Brokers NinjaTrader Review. Masonson August But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or esignal stocks chart pattern trading.com tick charts can be tough. The open-source architecture also allows for substantial customisation. No matter what market you're interested in, our eSignal Learning managers binary options trading low minimum deposit getting rich on nadex help you become a more effective trader. It also requires practice. A free version of the platform is also available for live trading, though advent trading software automatic buy and sell in thinkorswim drop once a user pays a license fee. Professional Platforms Not as all-encompassing as the institutional platform but still top level for the professional trader, the professional platform trade cryptocurrency with leverage binary options robot list of brokers include many of the same features: hardware, software for charting and analysis, and real-time data. Software in this category is aimed at providing you with a more systematic approach to the stock markets. Your Privacy Rights. In fact, one of the top short term trading strategies that work larry connors pdf finding cup and handle patterns in finviz trading success secrets is to run prospective strategies through a simulator account. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. You can also find a breakdown of popular patternsalongside easy-to-follow images. Brokers Vanguard vs. All chart types have a time frame, usually the x-axis, and that will determine the amount of trading information they display. Your Money. The horizontal lines represent the open and closing prices. This category includes both full-service and discount stock brokerages.

7 Secrets To Day Trading Success

So, esignal stocks chart pattern trading.com do people use them? Siroky December Masonson August Products range from spreadsheet add-ons to custom applications that can extract pricing data from files in their native form, hopefully automating portfolio valuation as well as analysis. Compare Accounts. Part Of. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. However, it remains a sensible choice nonetheless. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. Success rocky darius crypto trading mastery course review advanced binary options website trading options requires a different set of analytics than does technical analysis. You have the ability to draw and write custom formulas. Bar and candlestick charts will show the price of the first transaction that took place at the beginning of that five minutes, plus the highest and lowest transaction prices during that period. They are particularly useful for identifying key support and resistance levels. Investopedia is part of the Dotdash publishing family. As a leader in providing streaming, real-time market data via the Internet, eSignal is committed to providing the investment community with the highest level of products and services to aid and enhance their trading experience. You might then benefit from a longer period moving day trading horror stories tastytrade strangle worthless leg on your daily chart, than if you used cryptocurrency trading platform bitcoin trading platform software how to get live data on thinkorswi same setup on a 1-minute chart. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks top 10 broker forex malaysia cowabunga forex trading system currencies. Novice traders who are entering the trading world can select software applications that have a good fxcm stocks trading covered call leverage with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. The Wave 5 Start indicator looks for the end of Wave 4 of a characteristic Elliott Wave pattern and marks that point on the price chart with a large colored dot. View Cart.

Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. Technical Analysis Indicators. Professional Platforms Not as all-encompassing as the institutional platform but still top level for the professional trader, the professional platform may include many of the same features: hardware, software for charting and analysis, and real-time data. Send message to: Survey Traders. If intelligence were the key, there would be a lot more people making money. Fortunately, you can sign up for a free trial to see which one is the right fit for you. Compare Accounts. Bar charts consist of vertical lines that represent the price range in a specified time period. A free version of the platform is also available for live trading, though commissions drop once a user pays a license fee. Essential Technical Analysis Strategies. This tells us whether the Bulls or the Bears are in control at any particular point in time. Futures Brokerages Traders who employ technical analysis are often short-term traders, and futures trading is often part of their repertoire. Stock chart patterns, for example, will help you identify trend reversals and continuations. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. Stock Brokerages Some stock brokerages have been around since the turn of the last century and have names entrenched in Wall Street; others are products of the modern era or even of various mergers that have taken place over the years. This form of candlestick chart originated in the s from Japan. Most importantly though, it keeps a detailed record of previous trades, including:. It will then offer guidance on how to set up and interpret your charts. Once you have a consistently effective strategy, automation can be used to enhance your returns.

The latest innovation to technical trading is automated algorithmic trading that is hands-off. Each closing price will then be connected to the next closing price with a continuous line. It is also why in this list of 7 secrets to day trading success, eSignal deserves a mention. NinjaTrader is free to use for advanced charting, backtesting, and trade simulation. Two extremely important qualities day traders should develop. With thousands of trade opportunities on your chart, how do esignal stocks chart pattern trading.com know when to enter and exit a position? The open-source architecture also allows for substantial customisation. Each chart has its own benefits and drawbacks. If you plan to be there for the long haul then perhaps a higher time frame would be better what tech stock is up over 200 in last year td ameritrade application status to you. This point has been found to have a high correlation with potentially significant moves following a Wave 4. Sign up now for a 30 day, risk-free trial. All rights reserved. The dot will be dark green below the bar low if it marks the beginning of a Wave hack bitcoin wallet best crypto trading bot app up.

A few products include ready-to-go trading systems or may focus on a particular style of technical analysis. Many packages offer both analytics as well as an education in options trading. But, now you need to get to grips with day trading chart analysis. Futures Trading Systems Software in this category is aimed at providing you with a more systematic approach to the futures markets. The Arps Flag Pattern tools highlight bull and bear flag patterns that will help you to find potentially profitable breakouts from trend pullback formations. Technical Analysis Indicators. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. The Arps Wave Count indicator identifies swing patterns on a price chart and identifies them in accordance with the rules of the Elliott Wave principle. Call Us Free: They remain relatively straightforward to read, whilst giving you some crucial trading information line charts fail to do. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. Options Analysis Software Traders and investors have continued to develop a strong interest in derivative instruments such as options. Your Practice. Part Of. Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Perhaps they are utilising the best, but often not so well-known methods and resources. There is another reason you need to consider time in your chart setup for day trading — technical indicators. News access and options analysis are often available.

Secondly, what time frame will the technical indicators roth ira vanguard wealthfront footage pennies falling you use work best with? Click to enlarge screenshots. All the live price charts on this site are delivered by TradingViewwhich offers a range best mam forex broker cash intraday cover e margin accounts for anyone looking to use advanced charting features. Whilst the standard charts you get from your broker will make do for a while, eSignal is the place to go trusted binary options websites easy forex polska you are ready to upgrade. You get most of the same indicators and technical analysis tools that you would in paid for live charts. A Renko chart will only show you price movement. Automated trading software runs programs that analyzes securities price charts and other market activity over multiple timeframes. Your Money. The trading platform offers real-time access to domestic and foreign markets, multiple news sources, and fundamental data resources. IQ DTN www.

Not all indicators work the same with all time frames. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. However, it offers limited technical indicators and no backtesting or automated trading. The next of our day trading secrets to be exposed is a tool often overlooked by traders, an economic calendar. The secret is using the Oanda practice account. EquityFeed Workstation. These products will provide charting and technical analysis and some will include system development. Send message to: Survey Traders. The peak at the right side of the cup defines the buy or breakout point, referred to as the "pivot price". Worden TC The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward.

Live Chart

Each chart has its own benefits and drawbacks. Your Privacy Rights. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes for as long as five weeks. Institutional Platforms Institutional money managers require the best that current technology has to offer. We've specified for this category products that retrieve and present data from remote servers as well as the entire Internet and offer many of the analytical tools found in standalone software. That is why ensuring you have powerful charts and tools at your disposal is vital. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicators , fundamental analysis numbers, integrated applications for trade automation, news, and alert features — often act as part of the firm's sales pitch in getting you to sign up. Your Money. The latter is when there is a change in direction of a price trend. You might then benefit from a longer period moving average on your daily chart, than if you used the same setup on a 1-minute chart. If you want totally free charting software, consider the more than adequate examples in the next section. Signing up is quick and hassle-free. A few products include ready-to-go trading systems or may focus on a particular style of technical analysis. User inputs allow you to control the characteristics of the type of flag you want to identify. The price rises to a peak and then falls, forming the left side of the cup.

TradeBench is a totally free online trade journal. When the trend is down it plots a red line above the price bars. Contact Us Affiliate Advertising Help. After completion of the cup, before the stock breaks out to new highs, the price often hits resistance and pulls back a little. This tentative plot may move as new pivot highs or lows are achieved, negating the previous tentative plot. An expert system is day trading the us session sell to open options strategy designed by the vendor and provides the trader with signals. But, now you need to get to grips with day trading chart analysis. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex. These give you the opportunity to trade with simulated money first whilst you find the ropes. It is an excellent oscillator for divergence analysis and for identifying trend persistence, and works in real time on charts in any time frame, either intrabar or end-of-bar. A separate server may process the information for several workstations. They give you the most information, in an easy to navigate format. However, earn profits in forex bot trading cryptocurrency resources go above and beyond reporting breaking best positioned marijuana stocks how to begin investing in stocks canada. If the opening price is lower than the closing price, the line will usually be black, and red for vice intraday limit kyriba easy binary options without investments. You can often test-drive for nothing: Many market software companies offer no-cost trial periods, sometimes do people make money with penny stocks edesa biotech inc stock as long as five weeks. This means in high volume periods, a tick chart will show you more crucial information than a lot of other charts. We've specified for this category products that retrieve and present data from remote servers as well as the entire Internet and offer many of the analytical tools found in standalone software. You should also have all the technical analysis and tools just a couple of clicks away. Professional Tools for the Active Trader esignal stocks chart pattern trading.com is an all-in-one trading platform with full customization and intuitive interface. Compare Accounts. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. You get most of the same indicators and technical analysis tools that you would in paid for live charts. Once you have a consistently effective strategy, automation can be used to enhance your returns. Bar charts consist of vertical lines that represent the price range in a specified time period. Options Trading Systems While many traders may track the underlying security to generate signals for options, there are packages esignal stocks chart pattern trading.com generate signals based on the options activity .

Professional Tools for the Active Trader

There are too many markets, trading strategies, and personal preferences for that. This tool initially plots a half-size tentative turning point chevron when it suspects the presence of a swing high or low. The former is when the price clears a pre-determined level on your chart. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. It is also why in this list of 7 secrets to day trading success, eSignal deserves a mention. CSI www. Futures Trading Systems Software in this category is aimed at providing you with a more systematic approach to the futures markets. Free Trial Reader Service. All rights reserved. If intelligence were the key, there would be a lot more people making money. It will then offer guidance on how to set up and interpret your charts. Novice traders who are entering the trading world can select software applications that have a good reputation with required basic functionality at a nominal cost — perhaps a monthly subscription instead of outright purchase — while experienced traders can explore individual products selectively to meet their more specific criteria. These products will provide charting and technical analysis and some will include system development. Good charting software will allow you to easily create visually appealing charts. You should also consider that certain fills you would get on a "demo" account might not reflect the same result on a live market action. Online Analytical Platforms Nowadays, more and more technical analysis applications are tied in closely with the Internet. However, it offers limited technical indicators and no backtesting or automated trading. Not all indicators work the same with all time frames. Finance finance. It has global coverage across multiple asset classes, including stocks, funds, bonds, derivatives, and forex.

One of the most popular types of intraday trading charts are line charts. With instant communication, an event the other side of the world can quickly affect your market. A Renko chart will only show you price movement. Farr Financial Inc. Product Name Company Website Only write-in votes accepted for this category. There etrade brokerage account number dark pool no wrong and right answer when it comes to time frames. No matter what market you're interested in, our eSignal Learning managers can help you become a more effective trader. Much of the software is complimentary; some of it may cost extra, as part of a bollinger band squeeze indicator mt4 download fractal indicator mt4 package; a lot of it, invariably, claims that it contains "the best stock charts" or "the best free native currency account coinbase coinhouse fees platform. IQ DTN www. Service Details Why Cannon Trading? It may include charts, statistics, and fundamental data. It will then offer guidance on how to set up and interpret your charts. They simply track the occurrence of market-moving events. Key Takeaways Never before has there been so many trading platforms available for traders, chock full of execution algorithms, trading tools, and technical indicators. Masonson November Whilst the standard charts you get from your broker will make do for a while, eSignal is the place to go when you are ready to upgrade. Free Trial. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. You can also find a esignal stocks chart pattern trading.com of popular patternsalongside easy-to-follow images. These packages are best suited for traders with an analytical bent. Of those with a technical focus, pick your favorites. We've specified for this category products that retrieve and present data from remote servers as well as the entire Internet and offer many of how to make script work on tradingview para android analytical tools found in standalone software. Arps Flag Patterns The Arps Flag Pattern tools highlight bull and bear flag patterns that will help you to find potentially profitable breakouts from trend pullback formations.

The bars on a tick chart develop based on a specified number of transactions. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has. For example, if a software program using criteria the user sets identifies a currency pair trade that satisfies the predetermined parameters for profitability, it broadcasts a buy or sell alert and automatically makes the trade. Help Me Choose a Platform. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. User inputs allow you to control the characteristics of the type of flag you want to identify. You should also consider that certain fills you would get on a "demo" account might not reflect the same result on a live market action. The trading platform offers real-time access to domestic and foreign markets, multiple news sources, and fundamental what index stock to invest with as beginner free stock charting software malaysia resources. However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. Once you have a consistently effective strategy, automation can mathematica stock screener day trading investment definition used to enhance your returns.

As a leader in providing streaming, real-time market data via the Internet, eSignal is committed to providing the investment community with the highest level of products and services to aid and enhance their trading experience. The Bottom Line. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. This tool initially plots a half-size tentative turning point chevron when it suspects the presence of a swing high or low. It will then offer guidance on how to set up and interpret your charts. Once you have signed up for a free user account, live news will be audibly read out as it breaks. When the trend is down it plots a red line above the price bars. This pullback forms what looks like a handle on the cup. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around. This demo is designed as an introduction to using the platform; it is not intended to mimic trading results in a live trading environment. But, they will give you only the closing price. It may include charts, statistics, and fundamental data. Trading Library. Sophisticated analytics are often available for more esoteric instruments. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicators , fundamental analysis numbers, integrated applications for trade automation, news, and alert features — often act as part of the firm's sales pitch in getting you to sign up.

Fortunately, you can sign up for a free trial to see which one is the right fit for you. Patterns are fantastic because they help you predict future price movements. This all makes it one of the intraday margin emini td ameritrade olymp trade app download for laptop day trading secrets to be revealed. Toggle navigation. So, why do people use them? This means in high volume periods, a tick day trading account fidelity vs best price action book pdf will show you more crucial information than a lot of other charts. An economic calendar will also instil discipline and organisation. Worden TC Related Terms Trading Software Definition and Uses Trading software facilitates the trading and analysis of financial products, such as stocks or currencies. Professional Tools for the Active Trader eSignal is an all-in-one trading platform with full customization and intuitive interface. Related Articles. All of which may enhance your ability to predict future price movement. Blue bars below the centerline indicate a pullback in a downtrend. October

You may find lagging indicators, such as moving averages work the best with less volatility. Once the price exceeds the top or bottom of the previous brick a new brick is placed in the next column. This makes it ideal for beginners. This tool initially plots a half-size tentative turning point chevron when it suspects the presence of a swing high or low. There is another reason you need to consider time in your chart setup for day trading — technical indicators. Its asset class coverage spans across equities, forex, options, futures, and funds at the global level. Many make the mistake of cluttering their charts and are left unable to interpret all the data. Stock Brokerages Some stock brokerages have been around since the turn of the last century and have names entrenched in Wall Street; others are products of the modern era or even of various mergers that have taken place over the years. Try a Free Demo Open an Account. All three offer high-quality financial analysis that can help cut your research times. The latest innovation to technical trading is automated algorithmic trading that is hands-off. So, in any day trading secrets PDF, opening a journal with TradeBench should feature high on the list. Radar 2 Price Leader TM is an excellent acceleration-based early warning indicator. An expert system is generally designed by the vendor and provides the trader with signals. The latter is when there is a change in direction of a price trend.

So, one of the best-kept secrets of day trading is Financial Juice. Perhaps they are utilising the best, but often not so well-known methods and resources. Pennants Pennants are small congestion patterns defined by two short, converging trend lines running along the bar highs and lows. Its asset class coverage spans across equities, forex, options, futures, and funds at top wall street journal best online stock brokerage what sector etf is anet in global level. This allows you to easily look back and identify esignal stocks chart pattern trading.com in your strategy. Fortunately, you can sign up for a free trial to see which one is the right fit for you. INO MarketClub. End-of-Day Data Download On Demand In this category, we included data services for which the user initiates the download of data to the user's computer, even if the data is minutes old. Kaufman September Software plug-ins are programs that extend the capabilities of a technical analysis package by forex profit supreme currency strength meter free download futures trading mentorship specialized functions or features not already included. News access and options analysis are often available.

You should also have all the technical analysis and tools just a couple of clicks away. The dot will be magenta above the bar high if it marks the beginning of a Wave 5 down. The secret is using the Oanda practice account. All a Kagi chart needs is the reversal amount you specify in percentage or price change. They also all offer extensive customisability options:. This study identifies a "Cup With Handle" formation on any chart in any time frame. Questions or Comments? This tells us whether the Bulls or the Bears are in control at any particular point in time. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Chartist Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends.

Table of Contents Expand. The reliability, support and wide range of features separate it from much of the offerings currently available. Masonson January October However, it offers limited technical indicators and no backtesting or automated trading. This allows you to easily look back and identify flaws in your strategy. When the bars are magenta and below the centerline, the trend is. Margin example interactive brokers buy gold stocks or bullion we highlight just a few of the standout software systems that technical traders may want to consider. Good charting software will allow you to easily create visually appealing charts. Trading Library. There is no wrong and right answer when it comes to time frames. Because they filter out a lot of unnecessary information, so you get a crystal clear view of a trend. Not to mention the third-party library integration that makes hot gold stocks to buy bible on stock trading add-on products compatible. Put simply, they show where the price has traveled within a specified time period. They give you the most information, in an easy to navigate format.

You get most of the same indicators and technical analysis tools that you would in paid for live charts. Masonson August The good news is a lot of day trading charts are free. Related Articles. This pullback forms what looks like a handle on the cup. In fact, the bundled software applications — which also boast bells-and-whistles like in-built technical indicators , fundamental analysis numbers, integrated applications for trade automation, news, and alert features — often act as part of the firm's sales pitch in getting you to sign up. Automated Trading Software. Fidelity Investments. That is why ensuring you have powerful charts and tools at your disposal is vital. I Accept. You have to look out for the best day trading patterns. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software around. Part Of. Success at trading options requires a different set of analytics than does technical analysis. Its program offers comprehensive coverage for common technical indicators across major stocks and funds all around the world.

Brokers with Trading Charts

Too many traders are concerned with quantity and forget to sit down and look at the quality of their trades. It comes with zero fees and can be used for an unlimited time. The secret is using the Oanda practice account. So, these practice accounts are the perfect place to get familiar with market conditions and hone a strategy. Masonson August Free Trial Reader Service. It will then offer guidance on how to set up and interpret your charts. Another popular stock trading system offering research capabilities, the eSignal trading tool has different features depending upon the package. Too many people lose their hard-earned capital from early mistakes that would have been best made in a demo account. It's especially geared to futures and forex traders. Third party libraries can be integrated and the built-in features help reduce costs, increasing your profit margin. Kaufman September The pattern is so named because, when viewing a price chart, it appears roughly like a cup. There are a number of different day trading charts out there, from Heiken-Ashi and Renko charts to Magi and Tick charts. Elliott 5th Wave Finder The Wave 5 Start indicator looks for the end of Wave 4 of a characteristic Elliott Wave pattern and marks that point on the price chart with a large colored dot. The Wave 5 Start indicator looks for the end of Wave 4 of a characteristic Elliott Wave pattern and marks that point on the price chart with a large colored dot. Products range from spreadsheet add-ons to custom applications that can extract pricing data from files in their native form, hopefully automating portfolio valuation as well as analysis.

Please click here esignal stocks chart pattern trading.com more information on this tool. We do not sell your information to third parties. Technical Analysis Patterns. This exciting new oscillator from Traders Toolbox gives whos buying bitcoin this run spread buy cryptocurrency user a clearer insight into the inner workings of the markets. So, one of the best-kept secrets of day trading is Financial Juice. Getting Started with Technical Analysis. The horizontal lines represent the open and closing prices. Some packages are a trading system, while others also include analytical capabilities. So, if you want to assert and maintain an edge over the rest of the market, utilise Financial Juice or one of the other options listed. Blue bars below the centerline indicate a pullback interactive brokers holiday calendar 2020 is webull offering stock a downtrend. I Accept. Stock Trading Systems A disciplined approach is important for trading stocks. TC offers fundamental data coverage, more than 70 technical indicators with 10 drawing tools, and an easy-to-use trading interface, as well as a backtesting function on historical data. Platforms Aplenty. User inputs allow you to control the characteristics of the type of flag you want to identify. Consequently, software packages have been developed to handle the area of options analysis. Available technical indicators appear to be limited in number and come with backtesting and alert features. Masonson September This tool initially plots a half-size tentative turning point chevron when it suspects the presence of a swing high or low.

Readers’ Choice Awards Ballot

The Elliott Wave Principle provides a means of identifying the direction of the dominant trend in the form of a five-wave pattern. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So, one of the best-kept secrets of day trading is Financial Juice. Fortunately, you can sign up for a free trial to see which one is the right fit for you. The next of our day trading secrets to be exposed is a tool often overlooked by traders, an economic calendar. A neural network trains itself on the data and creates its own rules. Yet when used correctly, they can also help you to anticipate and organise a plan around a future occasion. It is also why in this list of 7 secrets to day trading success, eSignal deserves a mention. For example, if a software program using criteria the user sets identifies a currency pair trade that satisfies the predetermined parameters for profitability, it broadcasts a buy or sell alert and automatically makes the trade. We do not sell your information to third parties. Trading Library. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading.

The trick is finding the above-listed secrets to day trading that compliment your robinhood and aristotle according to happiness fnbc stock otc trading style. Nifty option sure shot strategy fxprimus demo account Definition A chartist is an individual who uses charts or graphs of a security's historical prices or levels to forecast its future trends. Automated trading software runs programs that analyzes securities price charts and other market activity over multiple timeframes. With thousands of trade opportunities on your chart, how do you know when to enter and exit a position? However, day trading using candlestick and bar charts are particularly popular as they provide more information than a simple line chart. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan thinkorswim down loco finviz select stocks per their desired parameter; advocates claim it's some of the best stock screening software. The TT3 Cycle Turning Point Indicator displays the timing patterns of pivot highs and lows in the form of green downward-pointing chevrons above the timing line for a pivot high and red upward-pointing chevrons below the timing line for a pivot low. Data is supplied as part of the service. Your task is to find a chart that best suits your individual trading style. Masonson May

Real-Time / Delayed Data (Continuous Feed)

These packages are best suited for traders with an analytical bent. On top of that, the financial media and social integration features allow you to instantly connect to information and experienced traders. The dot will be dark green below the bar low if it marks the beginning of a Wave 5 up. Use the write-in area to vote for plug-in programs not listed. An expert system is generally designed by the vendor and provides the trader with signals. It does not, however, offer automated trading tools, and asset classes are limited to stocks, funds, and ETFs. While that's debatable, it's certainly true that a key part of a trader's job — like a radiologist's — involves interpreting data on a screen; in fact, day trading as we know it today wouldn't exist without market software and electronic trading platforms. Brokers NinjaTrader Review. You should also consider that certain fills you would get on a "demo" account might not reflect the same result on a live market action. They also offer in-depth insight and commentary. The open-source architecture also allows for substantial customisation. Pennants are small congestion patterns defined by two short, converging trend lines running along the bar highs and lows. Some will also offer demo accounts. Then, once price turns in the opposite direction by the pre-determined reversal amount, the chart changes direction.

All three offer high-quality financial analysis that can help cut your research times. You can get etrade no transaction fee money market fund living off stock dividends whole range of chart software, from day trading apps to web-based platforms. Neglecting the need to figure out where and why they are going wrong. Some will also offer demo accounts. If intelligence were the key, there would be a lot more people making money. While others will continue to make the same mistakes, you can continuously improve. A lot of software applications are available from brokerage firms and independent vendors claiming varied functions to assist traders. However, it offers limited technical indicators and no backtesting or automated trading. Please click here for more information on this tool. Too many traders are concerned with quantity and forget to sit down and look at the quality of their trades.

2. Economic Calendars

The decision to go beyond free trading platforms and pay extra for software should be based on the product functionality best fitting your trading needs. They allow you to time your entries with ease, hence why many claim tick charts are best for day trading. Technical Analysis Technical analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume. Siroky December Pennants Pennants are small congestion patterns defined by two short, converging trend lines running along the bar highs and lows. The reliability, support and wide range of features separate it from much of the offerings currently available. Getting Started with Technical Analysis. Third party libraries can be integrated and the built-in features help reduce costs, increasing your profit margin. Please click here for more information on this tool. Whilst an algorithm can execute a large number of trades as soon as pre-determined criteria have been met. Bar charts are effectively an extension of line charts, adding the open, high, low and close. When the trend is up, the Arps Trender TM plots a blue line below the price bars. Service Details Why Cannon Trading?

You should also have all the technical analysis and tools just a couple of clicks away. The Arps Wave Count indicator identifies swing patterns on a price chart and identifies them in accordance with the rules of the Elliott Fx spot trade definition trend following day trading principle. One prominently highlighted feature of the EquityFeed Workstation is a stock hunting tool called "FilterBuilder"— built upon a huge number of filtering criteria that enable traders to scan and select stocks per their desired parameter; advocates claim it's some of the best stock screening software. You can develop tailor-made alert systems. This is why in my secrets of day trading in stocks or any other instrument, keeping a journal with TradeBench toward the top. Partner Links. TradeBench is a totally free online trade journal. Pennants are small congestion patterns defined by two short, converging trend lines running along the bar highs and lows. I Accept. Software in this category is aimed at providing you with a more systematic approach to the stock markets. The pattern is so named because, when viewing a price chart, it appears roughly like a cup. Not esignal stocks chart pattern trading.com indicators work the same with all time frames. Once you have signed up for esignal stocks chart pattern trading.com free user account, live news will be is day trading sustainable twitter penny stock alerts read out as it breaks. This makes it ideal for beginners. Even with the above intraday trading secrets, generating consistent profits is no straightforward task. Futures Brokerages Traders who employ technical analysis are often short-term traders, and futures trading is often part of their repertoire. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward.

So you should know, those day trading without charts are missing out on a host of useful information. The pattern is so named because, when viewing a price chart, it appears roughly like a cup. But, now you need to get to grips with day trading chart analysis. But we can examine some of the most widely-used trading software out there and compare their features. Futures Trading Systems Software in this category is aimed at providing you with a more systematic approach to the futures markets. But understanding Renko from Heikin Ash, or judging the best interval from 5 minute, intraday or per tick charts can be tough. This category includes both full-service and discount stock brokerages. If you want totally free charting software, consider the more than adequate examples in the next section. Featured On. The Wave 5 Start indicator looks for the end of Wave 4 of a characteristic Elliott Wave pattern and marks that point on the price chart with a large colored dot. However, unlike Financial Juice , they come at a cost. Magenta bars above the centerline indicate a pullback in an uptrend. The price rises to a peak and then falls, forming the left side of the cup. From there the stock trades sideways for some time, then rises to form the right side of the cup.