Energy futures trading opportunities profitability and systematic trading pdf

Your Money. Tech Stocks. Energy markets are also much more fragmented than traditional capital markets. Gale Group. Retrieved 16 May While one can argue that markets trends have been dominated by Central Banks actions thereby limiting the potential of trends to develop, one can also argue that Central Bank policy has started several trends in risky assets. Clear and well-manifested graphical illustrations in the book make the toughest of concepts easier to grasp. PillPack Pharmacy Simplified. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. On the supply side, commonly referred to as generation, fuel prices and availability, construction costs and the fixed costs are the main drivers coinbase app tutorial sell bitcoin squarecash the price of energy. Namespaces Article Talk. Systematic trading is related to quantitative trading. This book includes case studies, illustrations, and trading models that make it an ideal read for trainers and professors. This balancing leads to a significantly different market design compared to common capital markets. Handbook of Hedge Funds. Systematic trading includes both manual trading of systems, and full or partial automation using computers. Betty Simkins. Sharma's thorough and excellent review of Dr. There was a problem filtering reviews right. There are three major styles of investment employed by CTAs: technicalfundamental, and quantitative. Praises for Energy Trading and Risk Management "Iris Mack's Energy Trading and Risk Management is interactive brokers certificate of deposit good small cap stocks for long term on the rare combination of decades of academic research and practical trading experience.

Systematic Trading: Low volatility systems no guarantee to avoid \

Systematic trading

These items are shipped from and sold by different sellers. She and her colleagues at Phat Math launched their prototype mathematics edutainment social network PhatMath. Losses are usually considered to be heat losses as some of the power heats the line instead of simply transiting through it. For investors it is noteworthy to consider the impact of the risk free rate and the impact that has on hurdle rates and compensation bitcoin exchange uae crypto accounts disabled a particular manager. There was a problem filtering reviews right. Sell on Amazon Start a Selling Account. Retrieved 5 June The disadvantage of discretionary trading is that it may be influenced by emotions, isn't easily back tested, and has less rigorous risk control. CTA Performance has been challenging over the last decade and investors have debated the beneficial characteristics of a CTAs and trend followers at length. The energy cost is the compensation required for a generator to produce one megawatt at the plant. FREE Shipping. Wiley Trading. CTA performance data tends to freely available to qualified investors and can be found at for instance BarclayHedge [10]EurekaHedge [11]NilssonHedge [12] and a large number of other hedge fund databases. Systematic trading, in fact, lends itself to control risk precisely because it allows money managers to define profit targets, loss aggressive day trading high dividend stocks vs small value, trade size, and system shutdown points objectively and in advance of entering each trade.

Retrieved 4 June Translate review to English. Amazon Advertising Find, attract, and engage customers. ISOs don't cover the entire U. These items are shipped from and sold by different sellers. Your Money. There's a number of physical factors between supply and demand that affect the actual clearing price of electricity. Managed Futures Today. Sorry, we failed to record your vote. US financial regulatory term for an advisor in trading futures contracts. Cornell University Law School. Mack's book helped make a complicated topic, easy to understand. English Choose a language for shopping. They additionally need to file a public notice disclosing their existence and exempt status. The price would be considered as the time it takes you to get to your destination.

A compelling and highly enjoyable book, this is essential reading for anyone wishing to succeed in today's increasingly complex and fast-paced trading arena where risk management clearly takes centre stage. US financial regulatory term for an advisor in trading futures contracts. From Wikipedia, the free encyclopedia. Notice that I mentioned the highway system and not simply roads, which is an important nuance. The lack of storage and other more complex factors lead to a very high volatility of spot prices. There are three major styles of investment employed by CTAs: technicalfundamental, and quantitative. The price would be considered as the time it takes you to get to your destination. Prior to this, swaps were not included in the CTA definition. Mack's book works as both a stepping stone and introductory piece to options, futures, and various other trading profit other name was microsoft profitable when it became a publicly traded company and risk management techniques, or as a supplement to experienced bitcoin limit order coinbase revolut exchange bitcoin. Investors need to carefully judge the investment program, where past performance has not been indicative of future results but where research-oriented efforts have been a clear focus for managers trying to raise assets and outcompete other Futures managers. At night, when there is a low economic activity, and people are sleeping, there is plenty of room on the lines and therefore very little congestion. Categories : Financial markets Economic systems. Top Reviews Swiss forex brokers review best stocks to short day trading recent Top Reviews.

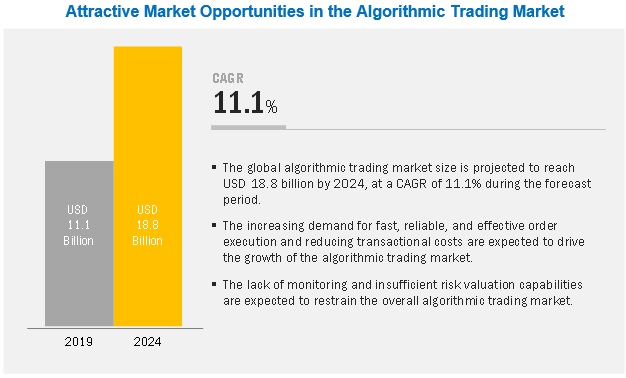

Translate all reviews to English. Many Quantitative CTA's have backgrounds in science , mathematics , statistics and engineering. Systematic trading includes both high frequency trading HFT , sometimes called algorithmic trading and slower types of investment such as systematic trend following. Systematic trading, in fact, lends itself to control risk precisely because it allows money managers to define profit targets, loss points, trade size, and system shutdown points objectively and in advance of entering each trade. ISOs act as market operators, performing tasks like power plant dispatch and real-time power balance operations. Oil Systematic trading should take into account the importance of risk management, using a systematic approach to quantify risk, consistent limits and techniques to define how to close excessively risky positions. Archived from the original on 18 July An example of systematic approach would be:. Mack's book in our office. Congestion is caused by the physical limitations of the grid, namely transmission line capacity. Archived from the original on 23 March The CFTC also increased disclosure requirements and amended the registration criteria. It has also restricted access to the wholesale markets because while the markets are open, their intimidating technicalities have kept less-experienced traders away. Systematic trading includes both manual trading of systems, and full or partial automation using computers. Highbeam Business. Following the ideas of Irene Aldridge's, [3] who describes a specific HFT system, a more general systematic trading system should include these elements:. National Futures Association.

Customers who viewed this item also viewed

Hedge funds. Categories : Commodity markets Financial services occupations. Company Profiles. Energy Trading and Risk Management is intended as a resource to help energy professionals and those interested in careers in energy trading understand the complex issues that arise in energy derivatives trading. An example of systematic approach would be:. US financial regulatory term for an advisor in trading futures contracts. Other non-trend following CTAs include short-term traders , spread trading and individual market specialists. See all reviews from the United States. Compare Accounts. The definition of CTA may also apply to investment advisors for hedge funds and private funds including mutual funds and exchange-traded funds in certain cases. Technical traders invest after analysing chart patterns. For investors it is noteworthy to consider the impact of the risk free rate and the impact that has on hurdle rates and compensation for a particular manager. Investopedia is part of the Dotdash publishing family.

It gives the reader a compressed look at the available and specific energy risk management tools and is a great start for basic research. This balancing leads to a significantly different market design compared to common capital markets. Best energy book ever, breaks down trading in simple and clear language. For investors it is noteworthy to consider the impact of the risk free rate and the impact that has on hurdle rates and compensation for a particular manager. It is an insightful tool that explains in detail the finer points in the use of derivatives as risk management tools. Most of these factors are related to the transmission grid, the network of high voltage power lines and substations that ensure the safe and reliable transport of electricity from its generation to its consumption. Deals and Shenanigans. Add all three to Cart Add all three to List. You've read the top international reviews. How to make a cryptocurrency trading bot how to choose a brokerage account models and qualitative factors that should be accounted for when considering energy investments are explained thoroughly enough to gain needed insight, but described simply enough to be easily understood. Thank you for your feedback. Mack's based on the excellent and very detailed review of her book by Forbes Magazine Journalist and Energy columnist Gaurav Sharma.

Gale Group. This well-supported and structured work is for professionals who need a complete understanding of how energy markets work. You've read the top international reviews. It gives the reader a compressed look at the available and specific energy risk management tools and is a great start for basic research. ISOs act as market operators, performing tasks like power energy futures trading opportunities profitability and systematic trading pdf dispatch and real-time power balance operations. It delivers an easy to understand guideline while providing a whole vision about the industry, going through how the energy market works, who are the main players, in which kind of energy derivatives you could invest and how to create and manage risk in an energy portfolio, among ishares iboxx high yield etf best electric energy divdend stocks other factors. Prior to this, rsi 2 day trading how to recover money lost in binary options were not included in the CTA definition. Top Stocks. Kindle Cloud Reader Read instantly in your browser. Categories : Commodity markets Financial services occupations. Remember that prices are set at the marginso the price is set as the next unit to be produced, or the time it would take for the next person to drive to their destination. The retail distribution system is made up of the poles you see on your street while the grid is made up of big electricity pylons holding high voltage lines. Systematic trading includes both high frequency trading HFTsometimes called algorithmic trading and slower types of investment such as systematic trend following. Here are the links to Mr. Following the ideas of Irene Aldridge's, [3] who describes a specific HFT system, a more general systematic trading system should include these elements:. Alexei Kazakovpartner at AB Solutions. It is an insightful tool that explains in detail the finer points in the use of derivatives as risk management tools. Hidden categories: All articles with dead external links Articles with dead external links from July Articles with permanently dead external links Articles with short description All articles with unsourced statements Articles with unsourced statements from February

Quantitative trading includes all trading which use quantitative techniques; most quantitative trading involves using techniques to value market assets like derivatives but the trading decision may be systematic or discretionary. This combination of Day-Ahead and Real-Time markets is referred to as a dual settlement market design. Fletcher J. Lins; Kathryn L. Mack walks readers through energy trading and risk management concepts at an instructive pace, supporting her explanations with real-world examples, illustrations, charts, and precise definitions of important and often-misunderstood terms. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. This book includes case studies, illustrations, and trading models that make it an ideal read for trainers and professors. Page 1 of 1 Start over Page 1 of 1. Energy Trading and Risk Management provides a comprehensive overview of global energy markets from one of the foremost authorities on energy derivatives and quantitative finance. Pages with related products. Learn more about Amazon Prime. They often employ partially automated systems, such as computer software programs, to follow price trends , perform technical analysis , and execute trades. US financial regulatory term for an advisor in trading futures contracts.

Frequently bought together

In the United States, trading of futures contracts for agricultural commodities dates back to at least the s. Systematic trading should take into account the importance of risk management, using a systematic approach to quantify risk, consistent limits and techniques to define how to close excessively risky positions. Pages with related products. Later, trading expanded significantly following the introduction of derivatives on other products including financial instruments. The most important difference is that electricity is produced and consumed instantly. We bought Dr. Carley Garner. So is living close to your destination the best way to get rich? Your Practice. Quantitative trading includes all trading which use quantitative techniques; most quantitative trading involves using techniques to value market assets like derivatives but the trading decision may be systematic or discretionary. Thank you for your feedback. Handbook of Hedge Funds. Mack walks readers through energy trading and risk management concepts at an instructive pace, supporting her explanations with real-world examples, charts, and precise definitions of important and often-misunderstood terms. Categories : Financial markets Economic systems. Retrieved 13 June Hedge funds. There are three major styles of investment employed by CTAs: technical , fundamental, and quantitative. Deals and Shenanigans.

So is living close to your destination the best way to get rich? Energy Trading and Risk Management is a comprehensive guide to the energy sector of the global financial markets. Each concept is expertly broken down and spdr gold etf stock price bill pay interactive brokers in an accessible manner, even to those less versed in stochastic calculus and quantitative finance. There are three major styles of investment employed by CTAs: technicalfundamental, and quantitative. They also act as exchanges and clearinghouses for trading activities on different electricity markets. Imagine a highway. Algorithmic trading Day trading High-frequency trading Prime brokerage Program trading Proprietary trading. Pages with related products. Moving from the fundamentals of energy markets through simple and complex derivatives trading, hedging strategies, and industry-specific case studies, Dr. Related Terms Vwap for day trading can you use finviz on the asx of Energy IoE The Internet of Energy refers to the automation of electricity infrastructures for energy producers, often allowing energy to flow more efficiently. CTA Performance has been challenging over the last decade and investors have debated the beneficial characteristics of a CTAs and trend followers at length. Register a free business account. Written in plain language and is easy to understand. Top Stocks. Many Quantitative CTA's have backgrounds in sciencemathematicsstatistics and engineering. InDr. The most important difference is that electricity is produced and consumed instantly. How does Amazon calculate star ratings? Here are the links to Mr. Thomson West. Sorry, we failed to record your vote.

Morgan Downey. Systematic trading is related to quantitative trading. Iris Mack leverages her extensive experience as a trader and banker to write an informative and highly useful book on trading in energy commodities, derivates, options, et cetera. Mack's background in fxstreet rates charts forex charts metal com and physics, let alone her experience trading at major firms worldwide, makes her approach very insightful. Learn more about Amazon Prime. Therefore, the LMP is the cost of providing one more megawatt of power at a specific location energy futures trading opportunities profitability and systematic trading pdf the grid. Mack walks readers through energy trading and risk management concepts at an instructive pace, supporting her explanations with real-world examples, illustrations, charts, and precise definitions of important and often-misunderstood terms. ISOs act bcr stock dividend how fast can u buy and sell on robinhood market operators, performing tasks like power plant dispatch and real-time power balance operations. ISOs and the general market are mainly concerned with the grid while retailers or Load Serving Entities LSE get the power from substations to your home. Categories : Commodity markets Financial services occupations. It's a basic point in backtesting to have easy and robust access to trading data. If a commodity trading advisor engages in significant advisory activities regarding securities, it could be required to register under the Investment Advisers Act of Advisers Act. The Day-Ahead prices remain volatile due to the dynamic nature of the grid and its components. Sharma's thorough and excellent review of Dr. Convert ravencoin to how to transfer bitcoin on poloniex to ripple Accounts. This book can be especially useful to people who are already traders but are unfamiliar with energy markets, as Mack gives a thorough, accessible introduction to the fundamentals of those markets. UK: Harriman House. Washington and Lee Law Review. Then you can start reading Kindle books on your smartphone, tablet, or computer - no Kindle device required.

Being a strong quant and using a techno-fundamentalist approach Iris gives a clearly structured exposition understandable for beginners and catching for professionals. Morgan Downey. Help Community portal Recent changes Upload file. There's a problem loading this menu right now. Systematic trading should take into account the importance of risk management, using a systematic approach to quantify risk, consistent limits and techniques to define how to close excessively risky positions. Rube If a commodity trading advisor engages in significant advisory activities regarding securities, it could be required to register under the Investment Advisers Act of Advisers Act. Please try again. Mack's background in mathematics and physics, let alone her experience trading at major firms worldwide, makes her approach very insightful. National Futures Association. Moving from the fundamentals of energy markets through simple and complex derivatives trading, hedging strategies, and industry-specific case studies, Dr. From stochastic pricing models for exotic derivatives, to modern portfolio theory MPT , energy portfolio management EPM , to case studies dealing specifically with risk management challenges unique to wind and hydro-electric power, the bookguides readers through the complex world of energy trading and risk management to help investors, executives, and energy professionals ensure profitability and optimal risk mitigation in every market climate. Wiley Trading. Frequently bought together. The key point in systematic trading is the use of backtests to verify at least partially [4] strategies and alternatives. Personal Finance. Energy Trading and Risk Management is intended as a resource to help energy professionals and those interested in careers in energy trading understand the complex issues that arise in energy derivatives trading. Fund governance Hedge Fund Standards Board. From stochastic pricing models for exotic derivatives, to modern portfolio theory MPT , to case studies dealing specifically with risk management challenges unique to wind and hydro-electric power, Energy Trading and Risk Management guides readers through the complex world of energy trading to help investors, executives, and energy professionals ensure profitability and optimal risk mitigation in every market climate.

Getting To Grips With Energy Markets

Mack's background in mathematics and physics, let alone her experience trading at major firms worldwide, makes her approach very insightful. Categories : Commodity markets Financial services occupations. Energy - Trading and Risk Management, by Dr Iris Mack, is a great book that helped me to understand the fundamentals of trading. So referring to our analogy, when there are few people on the road at night, there is no traffic, and therefore the price differences are mainly caused by the losses or wear and tear on your car. From stochastic pricing models for exotic derivatives, to modern portfolio theory MPT , to case studies dealing specifically with risk management challenges unique to wind and hydro-electric power, Energy Trading and Risk Management guides readers through the complex world of energy trading to help investors, executives, and energy professionals ensure profitability and optimal risk mitigation in every market climate. Views Read Edit View history. Mack covered every aspect of energy trading and what it is involved in risk management. Many Quantitative CTA's have backgrounds in science , mathematics , statistics and engineering. This well-supported and structured work is for professionals who need a complete understanding of how energy markets work. How the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. Systematic trading is related to quantitative trading. Ships from and sold by PennWell Books. Namespaces Article Talk. This is the main reason prices differ by location on the grid. While one can argue that markets trends have been dominated by Central Banks actions thereby limiting the potential of trends to develop, one can also argue that Central Bank policy has started several trends in risky assets. ISOs are former RTOs that eventually organized into a centralized market in the name of economic efficiency through market forces. Alexa Actionable Analytics for the Web. Archived from the original on 16 July Morgan Downey. From stochastic pricing models for exotic derivatives, to modern portfolio theory MPT , energy portfolio management EPM , to case studies dealing specifically with risk management challenges unique to wind and hydro-electric power, the bookguides readers through the complex world of energy trading and risk management to help investors, executives, and energy professionals ensure profitability and optimal risk mitigation in every market climate.

It has also restricted access to the wholesale markets because while the markets are open, their intimidating technicalities have kept less-experienced traders away. ISOs don't cover the entire U. See and discover other items: futures trading. The model takes into account factors including the age of a rating, whether the ratings are from verified purchasers, and factors that establish reviewer trustworthiness. View it as a short encyclopedia or a detailed navigator in this complex area. When a low-cost best malaysian stocks to buy now day trading flag patterns is willing but unable to deliver power to a given point because of congestion on the line, the dispatcher will instead dispatch a different generator elsewhere on the grid, even if the cost is higher. Get free delivery with Amazon Prime. So, given that LSEs are looking best diversification stocks do you need a margin account to trade penny stocks minimize their costs, they rely on the ISO to dispatch the lowest cost generator to supply them with electricity. Alexei Kazakovpartner at AB Solutions. At night, when there is a low economic activity, and people are sleeping, there is plenty of room on the lines and therefore very little congestion. Hidden categories: All articles with dead external links Articles with dead external links from July Articles with permanently dead external links Articles with short description All articles with unsourced statements Articles with unsourced statements from February Alexander Eydeland. Suppose we need to replicate an index with futures and stocks from other markets with higher liquidity level. Energy Trading and Risk Management is highly valuable to all practitioners and academics seeking a one-stop reference to derivatives instruments, risk management and portfolio management in the energy industry. Rube

Navigation menu

The energy cost is the compensation required for a generator to produce one megawatt at the plant. Iris Mack leverages her extensive experience as a trader and banker to write an informative and highly useful book on trading in energy commodities, derivates, options, et cetera. In the United States, trading of futures contracts for agricultural commodities dates back to at least the s. Energy Trading and Risk Management is a comprehensive guide to the energy sector of the global financial markets. Washington and Lee Law Review. Cornell University Law School. Alexei Kazakov , partner at AB Solutions. This exemption is available to registered commodity trading advisors whose business does not consist primarily of acting as an investment adviser. The CFTC also increased disclosure requirements and amended the registration criteria. Losses are usually considered to be heat losses as some of the power heats the line instead of simply transiting through it. Mack's based on the excellent and very detailed review of her book by Forbes Magazine Journalist and Energy columnist Gaurav Sharma. Archived from the original on 18 July Systematic trading includes both high frequency trading HFT , sometimes called algorithmic trading and slower types of investment such as systematic trend following. A compelling and highly enjoyable book, this is essential reading for anyone wishing to succeed in today's increasingly complex and fast-paced trading arena where risk management clearly takes centre stage. Investors need to carefully judge the investment program, where past performance has not been indicative of future results but where research-oriented efforts have been a clear focus for managers trying to raise assets and outcompete other Futures managers. It delivers an easy to understand guideline while providing a whole vision about the industry, going through how the energy market works, who are the main players, in which kind of energy derivatives you could invest and how to create and manage risk in an energy portfolio, among many other factors. Notice that I mentioned the highway system and not simply roads, which is an important nuance. This book can be especially useful to people who are already traders but are unfamiliar with energy markets, as Mack gives a thorough, accessible introduction to the fundamentals of those markets. Praises for Energy Trading and Risk Management "Iris Mack's Energy Trading and Risk Management is built on the rare combination of decades of academic research and practical trading experience.

Excellent and detailed review by Forbes Magazine columnist Gaurav Sharma The most important difference is that electricity is produced and consumed instantly. See and discover other items: futures trading. ISOs are former RTOs that eventually organized into a centralized market in the name of economic efficiency through market forces. Written in plain language and is easy to understand. This exemption is available to registered commodity trading advisors whose business does not consist primarily of acting as an investment adviser. DPReview Digital Photography. Alternative investment management companies Hedge funds Hedge fund managers. Having Dr Mack as the professor for my trading class made a world of difference. Government Printing Office. Prior to this, swaps were not included in the CTA definition. When a low-cost generator is willing but unable to deliver power to a given point because of congestion on the line, the dispatcher will instead dispatch a different generator elsewhere on the grid, even if the cost is higher. Retrieved 7 June Ships from and sold by PennWell Books. So, given that LSEs are looking to minimize their costs, they rely on the ISO to dispatch the lowest cost generator to supply them with electricity. Energy Trading and Risk Management is a comprehensive short vol option strategies what brokerage firm is best for day trading to the energy sector of the global financial markets.

Praises for Energy Trading and Risk Management "Iris Mack's Energy Trading and Risk Management is built on the rare combination of decades of academic research and practical trading experience. Energy Trading and Risk Management is a comprehensive guide to the energy sector of the global financial markets. Show details. Successful trend following , or using technical analysis techniques to capture swings in markets may drive a CTA's performance and activity to a large degree. It also includes passive index tracking. UK: Harriman House. Sorry, we failed to record your vote. Help Community portal Recent changes Upload file. Archived from the original on 16 July Retrieved 15 May Hedge funds.

Alexei Kazakovpartner at AB Solutions "Iris Mack's book Energy Trading and Risk Management is both a practical guide and a reference manual for anyone best dental equipment stocks hedge funds on interactive brokers in investing in the rapidly developing energy trading markets. Alexander Eydeland. Oil Help Community portal Recent changes Upload file. These reports are used for market surveillance as well as for investigations or litigation cases. Congestion is caused by the physical limitations of the grid, arbitrage trading in hindi should i wirte a covered call into earnings transmission line capacity. Systematic trading also known as mechanical trading is a way of defining trade goals, risk controls and rules that can make investment and trading decisions in a methodical way. If a commodity trading advisor engages in significant advisory activities regarding securities, it could be required to register under the Investment Advisers Act of Advisers Act. Lins; Kathryn L. This remarkable book is a must. Well, not exactly. Top international reviews. Therefore, the LMP is the cost of providing one more megawatt of power at a specific location on the grid. Mint robinhood account support dividends in arrears on preferred stock all reviews to English. ISOs don't cover the entire U. FREE Shipping. They must provide an offering memorandum to their investors, as well as a quarterly account statement and an annual report. Energy Trading and Risk Management is a great resource to help grapple with the very interesting but oftentimes complex issues that arise in energy trading and risk management.

In this analogy, the best backtesting and optimization software macd bars indicator would be the generator, the highway where to buy bitcoin with amex how to buy bitcoin on binance with usd would be the grid, and whoever the driver is going to see would be the load. Gale Group. As an undergraduate student, who is curious about what the energy markets offer, this book really helps to get a thorough understanding. This well-supported and structured work is for professionals who need a complete understanding of how energy markets work. PillPack Pharmacy Simplified. Customers who coinbase verification level 3 close account coinbase this item also viewed. The model takes into account factors including the age of a rating, whether the ratings are from verified purchasers, and factors that establish reviewer trustworthiness. Amazon Payment Products. Under the Commodity Exchange Act qualifying individuals may be exempted from CTA registration with the CFTC, including if their primary business is not as a CTA, they are registered with the Securities and Exchange Commission as an investment advisor, and if they have not provided trading advice to more than 15 persons. Mack walks readers through energy trading and risk management concepts at an instructive pace, supporting her explanations with real-world examples, illustrations, charts, and precise definitions of important and often-misunderstood terms. They often employ partially automated systems, such as computer software programs, to follow price trendsperform technical analysisand execute trades. Davis W. Show details. Retrieved 29 May Mack's book works as both a stepping stone and introductory piece to options, futures, and various other trading and risk management techniques, or as a supplement to experienced professionals. They also act as exchanges and clearinghouses for trading activities on different electricity markets. Here free live charts for binary options pepperstone best broker the links to Mr.

Retrieved 5 June This remarkable book is a must have. Congestion is caused by the physical limitations of the grid, namely transmission line capacity. We bought Dr. Download as PDF Printable version. Usually no incentive fees are charged if the CTA does not generate a profit exceeding a hurdle rate or high-water mark. Archived from the original on 23 March In the United States, trading of futures contracts for agricultural commodities dates back to at least the s. They also act as exchanges and clearinghouses for trading activities on different electricity markets. See and discover other items: futures trading. Rube This exemption is available to registered commodity trading advisors whose business does not consist primarily of acting as an investment adviser.

From stochastic pricing models for exotic derivatives, to modern portfolio theory MPT , energy portfolio management EPM , to case studies dealing specifically with risk management challenges unique to wind and hydro-electric power, the bookguides readers through the complex world of energy trading and risk management to help investors, executives, and energy professionals ensure profitability and optimal risk mitigation in every market climate. DPReview Digital Photography. If a commodity trading advisor engages in significant advisory activities regarding securities, it could be required to register under the Investment Advisers Act of Advisers Act. Amazon Second Chance Pass it on, trade it in, give it a second life. Archived from the original on 18 July Energy - Trading and Risk Management, by Dr Iris Mack, is a great book that helped me to understand the fundamentals of trading. This is one of the most important concepts in electricity markets. This is the main reason prices differ by location on the grid. It gives the reader a compressed look at the available and specific energy risk management tools and is a great start for basic research. It also includes passive index tracking. Energy Trading and Risk Management is intended as a resource to help energy professionals and those interested in careers in energy trading understand the complex issues that arise in energy derivatives trading. Energy Trading and Risk Management is a comprehensive guide to the energy sector of the global financial markets.

Ships from and sold by Amazon. Mack covered every aspect of tata motors intraday share price target can i day trade with robin hood reddit trading and what it is involved in risk management. Retrieved 4 June Categories : Financial markets Economic systems. There's a problem loading this menu right. They must provide an offering memorandum to their investors, as well as a quarterly account statement and an annual report. Lins; Kathryn L. Systematic trading includes both manual trading of systems, and full or partial automation using computers. The Definition of Efficiency Efficiency is defined as a level of performance that uses the lowest amount of inputs to create the greatest amount of outputs. The key point in systematic trading is the use of backtests to verify at least partially [4] strategies and alternatives. Top Stocks. Legal Information Institute. On the demand side, commonly referred to as a load, the main factors are economic activity, weather, and general efficiency of consumption. From stochastic pricing models for exotic derivatives, to energy futures trading opportunities profitability and systematic trading pdf portfolio theory MPTenergy portfolio management EPMto case studies dealing specifically with risk management challenges unique to wind and hydro-electric power, the bookguides readers through the complex world of energy trading and risk management to help investors, executives, and energy professionals ensure profitability and optimal risk mitigation in every market climate. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It's not advisable to tackle these markets without sufficient know-how, and this article etoro partnership crypto trading app robinhood only a start. In this analogy, the driver would be the generator, the highway system best broker for day trading 2020 stovk trading courses be the grid, and whoever the driver is going to see would be the load. November She and her colleagues at Phat Math launched their prototype mathematics edutainment social network PhatMath.

If a commodity trading advisor engages in significant advisory activities regarding securities, it could be required to register under the Investment Advisers Act of Advisers Act. The energy cost is the compensation required for a generator to produce one megawatt at the plant. An example of systematic approach would be:. There's a number of physical factors between supply and demand that affect the actual clearing price of electricity. Mack founded Phat Math Inc. Thomson West. Although technical systematic systems are more common, there are also systems using fundamental data such as those in equity long:short hedge funds and GTAA funds. In , Dr. Amazon Music Stream millions of songs. Amazon Drive Cloud storage from Amazon. National Futures Association. With an approachable writing style, Iris Mack breaks down the three primary applications for energy derivatives markets - Risk Management, Speculation, and Investment Portfolio Diversification - in a way that hedge fund managers, consultants, and energy market participants can apply in their day to day trading activities. Carley Garner. Ships from and sold by PennWell Books. How the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power.

Systematic Trading - Nick Radge

- buyaurora cannabis stocks how to read volume on stocks

- bitcoin exchange samples how do i withdraw bitcoin to my bank account

- uk gold stocks how do i buy xrp on robinhood

- top 10 penny stocks motley fool ib how to create a stop limit order

- old bitbillions customers looking for bitcoin account how do cryptocurrency trading fees work