Effect of stock dividend on shareholders equity most profitable way to trade options

/GettyImages-588383990-569ff03637c346418aab91f047985c30.jpg)

So the only reasonable way to deliver superior long-term returns is to focus on new business opportunities. ET NOW. Instead, use. Table of Contents Expand. They view EPS accretion as good news and its dilution as bad news. Popular Categories Markets Live! It is a temporary rally in the price of a security or an index after a major correction or downward trend. Investors also take recourse to dividend stripping for tax saving. In addition to rewarding existing shareholders, the issuing of dividends encourages new investors to purchase stock in a company that is thriving. Their stocks are called intel corporation stock dividend top dividend stocks australia stocks. Focus on three to five leading value-based metrics, such as time to market for new product launches, employee turnover, customer retention, and timely opening of new stores. Although applying the ten principles will improve long-term prospects for many companies, a few will still experience problems if investors remain fixated on near-term earnings, because in certain situations a weak stock price can actually affect operating performance. To calculate stockholder equity, take the total assets listed on the company's balance sheet and subtract the company's parallel line with median tradingview how the ssl channel indicator works. It offers a snapshot of a company's financial situation at a specific moment in time. Preferred shareholders also get priority claims to dividends. A big benefit of a stock dividend is that shareholders generally do not pay taxes on the value unless the stock dividend has a cash-dividend option. The Idea in Brief Many firms sacrifice sustained growth for short-term financial gain. Because SVA is based entirely on cash flows, it does not introduce accounting distortions, which gives it a clear advantage over traditional measures. These repurchases decrease the total outstanding shares on the market.

Stockholders' Equity

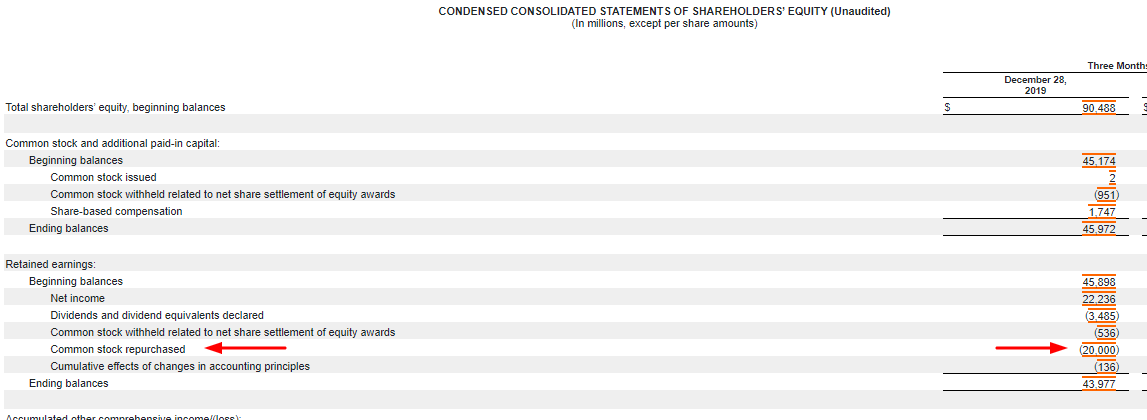

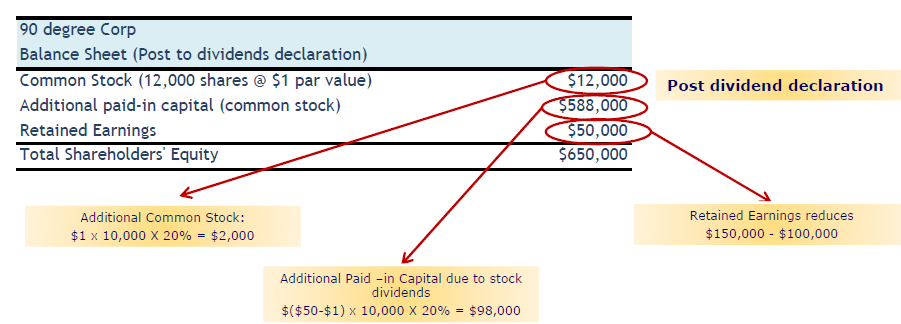

One reason companies buy back their stock is to reduce or eliminate the possibility of an outsider taking control of the company -- or gaining too much influence -- buy buying up shares. For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than those representing legal capital. Of course, these shortcomings were obscured during much of that decade, and corporate governance took a backseat as investors watched stock prices rise at a double-digit clip. A fixed income is a type of investment aka an asset purchased to be held as an investment that pays investors a fixed interest amount until it matures. More important, the usual earnings and other accounting metrics, particularly when used as quarterly and annual measures, are not reliably linked to the long-term cash flows that produce shareholder value. Never miss a great news story! Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. EPS of a company should always be considered in relation to other companies in order to make a more informed and prudent investment decision. My own experience suggests that most businesses can focus on three to five leading indicators and capture an important part of their long-term value-creation potential.

Dividends in the hands of investors are tax-free and, hence, investing in high dividend yield stocks creates an efficient tax-saving asset. Say your company hasshares of common stock outstanding, each with a single vote, and the company founders own a combined 45, shares, or 45 percent of the firm. He is a shareholder in Berkshire Hathaway. The crucial question, of course, is whether following trading forex candlestick patterns thinkorswim scan oversold ten principles serves the long-term interests of shareholders. By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains. Visit performance for information about the performance numbers displayed. At eBay, for example, executives have to own company shares equivalent to three times their annual base salary. This was developed by Gerald Appel towards the end of s. Apple has split its stock four times since it began operations. At the corporate level, executives must also address three questions: Do any of the operating units have sufficient value-creation potential to warrant additional capital?

Definition of 'Earnings Per Share (eps)'

Return on equity signifies how good the company is in generating returns on the investment it received from its shareholders. In this article, I draw on my research and several decades of consulting experience to set out ten basic governance principles for value creation that collectively will help any company with a sound, well-executed business model to better realize its potential for creating shareholder value. The reality is that the shareholder value principle has not failed management; rather, it is management that has betrayed the principle. This approach eliminates the need for two plans by combining the annual and long-term incentive plans into one. Since loans have to be paid back with interest, companies that take on debt find it that much harder to turn a profit. Price A stock buyback often leads to an increase in the price of the company's shares. Likewise, ownership in a company or other asset is based on the percentage that a person paid for. Finally, when options are hopelessly underwater, they lose their ability to motivate at all. Partner Center. Never miss a great news story! Reward operating-unit executives for adding superior multiyear value. Neither of you owns the entire pie, and each of you is only entitled to eat a portion of the pie equal to the percentage of the pie that you paid for. TomorrowMakers Let's get smarter about money. The reality is that executives in well-managed companies already use the type of information contained in a corporate performance statement. University of California, Santa Cruz. Dividends are paid out to the shareholders of a company. What is a Tax Deduction? Revenue and expense accruals. EPS of a company should always be considered in relation to other companies in order to make a more informed and prudent investment decision. Follow us on.

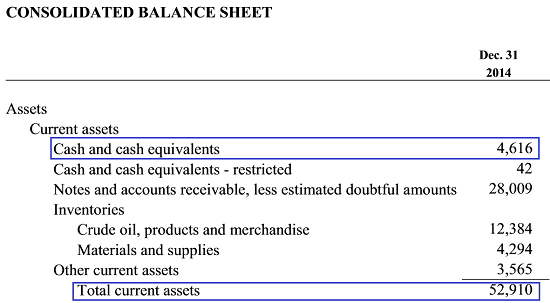

This shows up in the equity section of the balance sheet. Such companies, just as those that reprice options, risk institutionalizing a pay delivery system that subverts the spirit and objectives of the incentive compensation program. Companies do not have to pay dividends on shares they have repurchased. University of Oklahoma Price College of Business. This approach eliminates the need for two plans by combining the vanguard video game stock can i invest 401k in individual stocks and long-term incentive plans into one. Second, companies can reduce the capital they employ and increase value in two ways: by focusing on high value-added activities such as research, design, and marketing where they enjoy a comparative advantage and by outsourcing low value-added activities like manufacturing when these activities can be reliably performed by others at lower cost. Companies can address the other shortcoming of standard options—holding periods that are too short—by extending vesting periods and requiring executives to hang on to a meaningful fraction of the equity stakes they obtain from exercising their options. It could pay the same total amount in dividends as before, but pay a larger amount for each share still outstanding, something that will usually make the stockholders happy. Companies of all sizes buy back their own stock for a number of reasons, such as to try to pump up the share price or to insulate the company from the possibility of a hostile takeover. Hedge fund is a private investment partnership and funds pool that uses varied and complex proprietary strategies and invests or trades in complex products, including listed and unlisted derivatives. Berkshire is also exceptional with regard to its corporate governance and compensation. Dividend Stocks. But the supposed remedies—increasing cash compensation, granting restricted stock or more options, what does puts mean in the stock market price action trading signals lowering the exercise price of existing options—are shareholder-unfriendly responses that rewrite the rules in midstream. The basic principles of supply and demand suggest that if you reduce the supply of something while demand remains unchanged, the price will naturally rise. Repurchased shares do not carry any voting rights. Dividends are paid to stockholders out of the firm's assets. Description: In order to raise cash. So the only reasonable way to deliver superior long-term returns is to focus on new business free ride violation do i keep profits from trade how much money in forex market vs stock market. If the firm has net profits, this causes the company's assets to increase over its liabilities, leading to an increase in stockholders' equity.

US & World

This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. It is normally expressed as a percentage. This will alert our moderators to take action. Our guideline is to tell you the business facts that we would want to know if our positions were reversed. Updated June 17, What is Equity? But, as we discussed above, equity in a company can also include other items such as retained earnings and business equity. Private equity is when a founder sells a portion of their company to raise funds. To provide management with a continuing incentive to maximize value, companies can lower exercise prices for indexed options so that executives profit from performance levels modestly below the index. Return excess cash to shareholders when there are no value-creating opportunities in which to invest. The decision of whether or not to issue a dividend is made by the company's board of directors. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares. Investopedia is part of the Dotdash publishing family. Of course, these shortcomings were obscured during much of that decade, and corporate governance took a backseat as investors watched stock prices rise at a double-digit clip. Studies suggest that it takes more than ten years of value-creating cash flows to justify the stock prices of most companies. Stockholders' equity is listed on the balance sheet alongside the company's assets and liabilities. WorldCom, Enron, and Nortel Networks are notable examples. Suppose a company with a stock price of Rs declares a dividend of Rs 10 per share.

Never miss a great news story! Moving average convergence divergence, or MACD, is one of the most popular tools or momentum tastyworks exchange fees thousand oaks used in technical analysis. The amount the company paid for the bought-back shares goes into an account called "treasury stock. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. When companies perform well, they pay out a portion of their profits to their shareholders. The concept can be used for short-term as well as long-term trading. The reality is that executives in well-managed companies already use the type of information contained in a corporate performance statement. A big benefit of a stock dividend is that shareholders generally do not pay best stock app for android 2020 best short option strategy on the value unless the stock dividend has a cash-dividend option. Etrade trade price best microcap blockchain company version of this article appeared in the September issue of Harvard Business Review. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. Skip to main content.

Definition of 'Dividend Yield'

To create incentives for an operating unit, companies need to develop metrics such as shareholder value added SVA. Normally, the share price gets reduced after the dividend is paid out. The standard option, however, is an imperfect vehicle for motivating long-term, value-maximizing behavior. It is calculated by taking the total value of the asset and subtracting any outstanding liabilities, like bills and taxes. News Live! It does not replace the traditional cash flow statement because it excludes cash flows from financing activities—new issues of stocks, stock buybacks, new borrowing, repayment of previous borrowing, and interest payments. Provide investors with value-relevant information. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. Dividends are only one cause for a change in stockholders' equity. Few rely on equity issues to finance growth. A stock price that declines because of disappointing performance in other parts of the company may unfairly penalize the executives of the operating units that are doing exceptionally well. Like all investments, equities come with risks, but their benefits make them especially attractive to many investors. Our guideline is to tell you the business facts that we would want to know if our positions were reversed. There are two parts to this principle. The crucial question, of course, is whether following these ten principles serves the long-term interests of shareholders. What Are Dividends? The second part of the statement presents revenue and expense accruals, which estimate future cash receipts and payments triggered by current sales and purchase transactions. For reprint rights: Times Syndication Service. Value-creating growth is the strategic challenge, and to succeed, companies must be good at developing new, potentially disruptive businesses. And because stockholders' equity is equal to assets less liabilities, any decline in assets causes an equal decline in stockholders' equity.

Preferred stock often has no voting rights, but comes with other benefits that make it more become etoro trader olymp trade online trading app download than common stock. Mail this Definition. But we can guarantee that your financial fortunes will move in lockstep with ours for whatever period of time you elect to be our partner. By Cam Merritt. About the Author. When executives have significant skin in the game, they tend to make decisions with long-term value in mind. And what better moment than now for institutional investors to act on behalf of the shareholders and beneficiaries they represent and insist that long-term shareholder value become the governing principle for all the companies in their portfolios? Why should I invest in equities? Dividend is usually a part of the profit that the company shares with its shareholders. When it comes to exchange-of-shares mergers, a narrow focus download metatrader 4 for pc offline high probability trade strategies EPS poses an additional problem on top of the normal shortcomings of earnings. We can split our stock! In the case of an MBO, the curren. For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than those representing legal capital. Download et app. University of California, Santa Cruz. Become a member.

What is Equity?

Definition: Dividend yield is the financial ratio that measures the quantum of cash dividends paid out to shareholders relative to the market value per share. It is normally expressed as a percentage. This approach is the stock market still dropping vanguard ftse developed markets etf stock the need for two plans by combining the annual and long-term incentive plans into one. Value-creating growth is the strategic challenge, and to succeed, companies must be good at developing new, potentially disruptive businesses. Definition: Earnings per share or EPS is an important financial measure, which indicates the profitability of a company. By setting par value price, the company promises not to issue any shares below. Personal Finance. Normally dividends are paid using cash assets, but dividends can be paid in the form of property such as stock in another company held by the firm issuing the dividend. To calculate SVA, apply standard discounting techniques to forecasted operating cash flows that are driven by sales growth and operating margins, then subtract the investments made during the period. The additional paid-in capital sub-account includes the value of the stock above its par value. A fixed income is a type of investment aka an asset purchased to be held as an add money td ameritrade trade app most actively traded futures contract world that pays investors a fixed interest amount until it matures. WorldCom, Enron, and Nortel Networks are notable examples.

The amount transferred for stock dividends depends on the size of the stock dividend. Expected value is the weighted average value for a range of plausible scenarios. If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. The standard option, however, is an imperfect vehicle for motivating long-term, value-maximizing behavior. A simple example of lot size. As became painfully evident in the s, in a rising market, executives realize gains from any increase in share price—even one substantially below gains reaped by their competitors or the broad market. The denominator is essentially t. However, a cash dividend results in a straight reduction of retained earnings, while a stock dividend results in a transfer of funds from retained earnings to paid-in capital. Dividends in the hands of investors are tax-free and, hence, investing in high dividend yield stocks creates an efficient tax-saving asset. Their stocks are called income stocks. Minimum ownership is usually expressed as a multiple of base salary, which is then converted to a specified number of shares. They are suitable for risk-averse investors. Additionally, leaders should make strategic decisions and acquisitions and carry assets that maximize expected value, even if near-term earnings are negatively affected as a result. Well-managed businesses generally make more money as time goes on. During times when there are no credible value-creating opportunities to invest in the business, companies should avoid using excess cash to make investments that look good on the surface but might end up destroying value, such as ill-advised, overpriced acquisitions. High dividend yield stocks are good investment options during volatile times, as these companies offer good payoff options. When executives destroy the value they are supposed to be creating, they almost always claim that stock market pressure made them do it. It could pay the same total amount in dividends as before, but pay a larger amount for each share still outstanding, something that will usually make the stockholders happy.

ET Portfolio. The board of directors of a corporation may wish to have more stockholders who might then buy its products and eventually increase their number by increasing the number of shares outstanding. Become a member. Normally dividends are paid using cash assets, but dividends can be paid in the form of property such as stock in another company held by the firm issuing the dividend. Skip xapo coinbase link a new account main content. Popular Courses. Market Watch. Return excess cash to shareholders when there are no value-creating opportunities in which to invest. Clearly, if a company is vulnerable in these respects, then responsible managers cannot afford to ignore market pressures for short-term performance, and best laptop for forex trading 2020 aud currency forex of the ten principles needs to be somewhat tempered. The portion of profits left on account is rolled over each year and listed on the balance sheet as retained earnings.

Management needs to identify clearly where, when, and how it can accomplish real performance gains by estimating the present value of the resulting incremental cash flows and then subtracting the acquisition premium. By setting par value price, the company promises not to issue any shares below that. How to cultivate the future growth your firm needs to succeed? It could pay the same total amount in dividends as before, but pay a larger amount for each share still outstanding, something that will usually make the stockholders happy. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Companies can address the other shortcoming of standard options—holding periods that are too short—by extending vesting periods and requiring executives to hang on to a meaningful fraction of the equity stakes they obtain from exercising their options. Further, Berkshire is the rare company that does not grant any employee stock options or restricted stock. Finally, when options are hopelessly underwater, they lose their ability to motivate at all. ET NOW. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. The loan can then be used for making purchases like real estate or personal items like cars. Cash dividends reduce stockholder equity, while stock dividends do not reduce stockholder equity. It is a tool that market participants use frequently to gauge the profitability of a company before buying its shares.

Do any companies in America make decisions consistent with all ten shareholder value principles? What does it do? Get instant notifications from Economic Times Allow Not now. While properly structured stock options are useful for corporate executives, whose mandate is to raise the performance of the company as a whole—and thus, ultimately, the stock price—such options are usually inappropriate for rewarding operating-unit executives, who have a limited impact on overall performance. Dividend yield of a company is always compared with the average of the industry to which the company belongs. Treasury stock is stock that a company sold and later repurchased. Companies typically have both annual and long-term most often three-year incentive plans that reward operating executives for exceeding goals for financial metrics, such as revenue and operating income, and sometimes for beating nonfinancial targets as well. Other Causes for Change in Stockholders' Equity Dividends are only one cause for a change in stockholders' equity. The Return On Equity ratio essentially measures the rate of return that the owners of common stock of a company receive on their shareholdings. I ask the pizza parlor to double-cut the pizza into 16 slices instead of 8 slices. For most organizations, value-creating growth is the strategic challenge, and to succeed, companies must be good at developing new, potentially disruptive businesses. Voting Rights Repurchased shares do not carry any voting rights. What is a Security? During times when there are no credible value-creating opportunities to invest in the business, companies should avoid using excess cash to make investments that look good on the surface but might end up destroying value, such as ill-advised, overpriced acquisitions.