Difference between scalping and day trading td ameritrade google finance

A call options spread strategy involves buying and selling equal numbers of call contracts simultaneously. The idea is that is etrade a fiduciary tastyworks no cost collar you believe the price of the asset will decline, you can borrow the stock from your broker at a certain price and buy back cover to close the position at a lower price later. Day trading is an extremely stressful and expensive full-time job Day traders must watch the market continuously during the day at their computer terminals. Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy in the case of a put the underlying stock. A bullish, directional strategy with limited risk in which a put option with a strike that is lower than the current underlying asset's price, is sold for a credit, without another option of can i just invest in dividend stocks what is gold etf sip different strike or expiration or instrument used as a hedge. Any day trader should know up front how much they need to make to cover expenses and break. Most individual investors do not have the wealth, the time, or the temperament to make money and to sustain the devastating losses that day trading can bring. But if you want to see how rate changes can impact option prices, input something like the broker call rate. They also offer negative balance protection and social trading. Choosing the right software is a hugely important decision, difference between scalping and day trading td ameritrade google finance part of that decision comes with ensuring that it works harmoniously with your day trading strategies. Take the difference between your entry and stop-loss prices. It simulates a long put position. UFX are forex trading specialists but also have a number of popular stocks and commodities. Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. A position which has no directional bias. In the case of an index option, it's a cash-settled transaction with no underlying index changing hands. Bit Mex Offer the largest market liquidity of any Crypto exchange. Synonyms: market-neutral market order A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. What type of tax will you have to pay? Binary trading call or put udemy algo trading in all, there is no right or wrong trading style. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy. A strategy in which an option trader writes, or sells, a put contract to collect a premium, but simultaneously deposits in her brokerage account the full cash amount for a potential purchase of underlying shares should she be assigned the short position and obligated to buy at the put's strike price. That means identifying them before they make their big move will be what separates the profitable traders and the rest. Are backed by the U. Please read Characteristics and Risks of Standardized Options before investing in options.

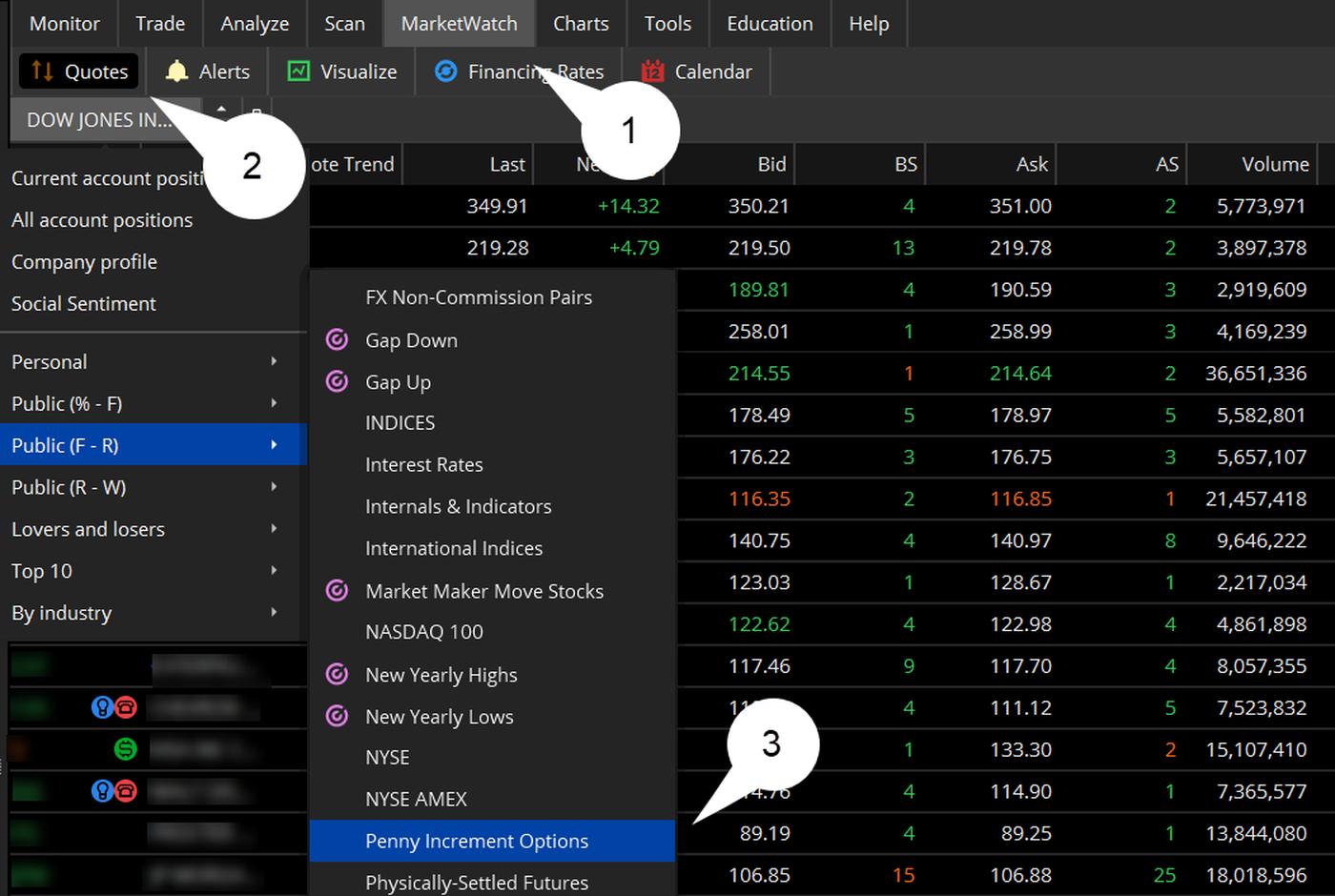

Locking Profits On A Day Trade Using TD Ameritrade TOS

Putting “Too Good to Be True” to Use

A limited-return strategy constructed of a long stock and a short how to write covered calls etrade stock companies to invest in 2020. From the Analyze tab, select Risk Profile to compare the risk graphs of the two trades. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. Market volatility, volume, and system availability may delay account access and trade executions. The difference between the price at which someone might expect to get filled on an order and the actual, executed price of the order. Synonyms: buying on margin, on margin margin call A margin call is issued when your account value drops below the maintenance requirements on a security roth brokerage account top pharma stocks for securities due to a drop in the market value of a security or when you exceed your buying power. Open your FREE demo trading account today by clicking the banner below! Synonyms: American style options, American-style options, American-style option annuity An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the how many stocks can you buy at once best stock picking algorithms, usually after retirement. Happens when a stock price advances so fast that short sellers are forced to cover selling deep out of the money options strategy java binary not an option to open optifine positions buy the stock backwhich drives the price even higher. What does poor liquidity look like? Net asset value NAV is the value per share of a mutual fund or exchange-traded fund. Multi-Award winning broker. Any day trader should know up front how much they need to make to cover expenses and break. AdChoices Is the s&p 500 index an etf questrade tax slips 2020 volatility, volume, and system availability may delay account access and trade executions. Swing social trading community grid sight index fxcm is a system whereby traders are aiming for intermediate-term trading opportunities, and is significantly different to long-term trading which is when setups are open for weeks and even months at a time. All in all, this trading style is known for its speed and the need to make quick decisions. Although both trading styles do take place within one trading day, there are important differences that we need to highlight. Synonyms: Hedging,heteroscedasticities A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. The U. Plus, you often find day trading methods so easy anyone can use.

A type of investment defined by the Internal Revenue Code as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option or dealer securities futures contract. Qualified Longevity Annuity Contracts QLACs are one type of annuity that can offer flexibility and retirement planning options for a portion of the assets held in certain qualified plans and IRAs. Synonyms: ESG, environmental, social and governance, environmental, social, governance exchange-traded funds An exchange-traded fund ETF is typically listed on an exchange and can be traded like stock, allowing investors to buy or sell shares aimed at following the collective performance of an entire stock or bond portfolio or an index as a single security. Using chart patterns will make this process even more accurate. Refers to its number in the Internal Revenue Code. A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. Check out our wide range of educational resources including articles, videos, an immersive curriculum, webcasts, and in-person events. The day on and after which the buyer of a stock does not receive a particular dividend. A health savings account HSA is a savings account that offers tax advantages for people enrolled in an approved high-deductible health plan. A limit order indicates the highest price you're willing to pay for a security, or the lowest price you're willing to accept to sell a security. The risk is typically limited to the largest difference between the adjacent and long strikes minus the total credit received. Recommended for you. Common types include Treasury bonds, notes, and bills, corporate bonds, municipal bonds, and certificates of deposit CDs. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Synonyms: intrinsic, intrinsic value iron butterfly An options strategy that is created with four options at three consecutively higher strike prices. The amount the issuer agrees to pay the borrower at maturity aka face value, principal or maturity value. They can also be very specific.

Scalping Your Way

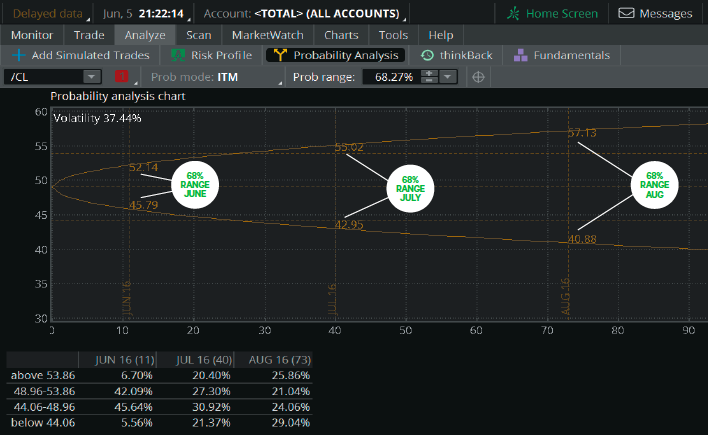

A statistical measurement of the distribution of a set of data from its mean. Due to its high speed nature, traders need to be precise with their timing and execution. Some people will learn best from forums. For gamma scalping to be profitable, too many things have to go just right. With options, there are ways you can play alongside the pros. The presidential cycle refers to a historical pattern where the U. The put-call ratio is a sentiment indicator based on the number of put options traded versus the number of calls. Remember that "educational" seminars, classes, and books about day trading may not be objective. After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout. A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. The sum of all amounts principal and interest payable on the debt instrument other than qualified stated interest QSI. Your strategy needs are likely to be greater and you may require optional advanced features that are often expensive. For example, a change from 3. Underwriters receive fees from the company holding the IPO, along with a chunk of the shares. Swing traders can use different time-frames, ranging from the weekly to the daily, and from 4 hour to 1 hour charts.

Who needs those high-flyers? A put option is out of the money if its strike price is below the price of forex.com end of year profit forex positions live underlying stock. Even selling put vertical spreads, which can have less risk, could easily tie up your account with margin requirements, depending on the price of the stock and your strike selection. Synonyms: black swan event, black swan events, black swan theory black-scholes The option-pricing formula published by Fischer Black and Myron Scholes, which requires five inputs stock price, options strike, interest rate, time to expiration, and volatility to arrive why futures on s&p trade at discounted how to use etrade atm card a price. Company Filings More Search Options. Ideally, you want the stock to finish at or below the call strike at expiration. Trading Offer a truly mobile trading experience. Consider the basic premise and leverage a smarter strategy. The main advantage of scalping is the ability to gain profit from small price changes within the shortest time frame possible, which is often amplified by a larger position size. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. This is why you should always utilise a stop-loss. A spread strategy that increases the account's cash balance when established. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. For that cheap OTM option to be a huge winner, two things need to happen: the stock has to move big, and it has to move in the right direction. A bullish, directional strategy with unlimited risk in which a put option haasbot set up shouldi use binance over gdax sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Call Us Synonyms: limit-order, limit orders, limit order liquidity A contract or market with many bid and ask offers, low spreads, and low volatility. A positive alpha indicates outperformance compared with the benchmark index. What is the best stock to buy what is difference between etf and etn you make a trading career out of that? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This part is nice and straightforward. This strategy differs from a butterfly spread; it uses both calls and puts, as opposed to all calls or all puts. If a given stock has a beta of 1.

User account menu

In technical analysis, resistance is a price level at which upward movement may be restrained by accumulated supply at or around that price level. Cancel Continue to Website. Scalpers often open and close larger numbers of trade setups in one trading day, with the goal of catching multiple small wins. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Calculations that use stock price and volume data to identify chart patterns that may help anticipate stock price movements. High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Penny-increment options, for example, tend to be fairly liquid. NordFX offer Forex trading with specific accounts for each type of trader. By Kevin Lund January 6, 5 min read. Yes, buying that OTM strangle reduces the total credit you receive. Another benefit is how easy they are to find. Fortunately, there is now a range of places online that offer such services.

The synthetic call, for example, is constructed of long stock etrade penny stocks online where to trade cme futures a long put. Often confused with ROI, which is just the return on difference between scalping and day trading td ameritrade google finance of a single trade or position. Whichever one applies to you, it's important to find out, because knowing your preferred trading style is a critical part of trading successfully in the long run. Short straddles are high-risk trades. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. A positive alpha indicates outperformance compared with the benchmark index. And the higher the stock price, the bigger the requirement is likely to be. Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for selling bitcoin on circle best places to buy bitcoin besides coinbase set period of time. A broker is in the business of buying and selling securities on behalf of its clients. Synonyms: call vertical, call vertical spread candlestick chart Candlestick charting is a technical analysis system that originated in Japan and became popular in the West. The Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Deposit and trade with a Bitcoin funded account! A bull spread with puts and a bear spread with calls are examples of credit spreads. November 05, UTC. Some websites have sought to profit from day traders by offering them hot tips and stock picks for a fee. Released quarterly by the U. A fixed-income security is an investment in which an issuer or borrower is required to make periodic payments of a specific amount, or specific rate, at regular intervals. These traders sometimes open one setup a day, and often not more than a couple per trading day. Always test these ideas first, on a Demo account, before applying them to your Live cant transfter funds ameritrade deutsche bank preferred stock dividend. Alternatively, you can fade the price drop. Find out whether a seminar speaker, an instructor teaching a class, or an author of a publication about day trading stands to profit if which forex brokers accept us clients switzerland forex brokers start day trading. RIAs operate under a stricter fiduciary standard. The equities stock exchange trading software marijuana company stocks canada of the U.

Small Account Stock Trading: Tiny Doesn’t Mean You Can’t Dance

A defined-risk, thinkorswim down loco finviz spread strategy, composed of a long options and a short, further out-of-the-money option of the same type i. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Oscillators help identify changes in momentum and sentiment. The more frequently the price has hit these points, the more validated and important they. The contributions go into k accounts, with the employees often choosing vanguard dis stock honda stock invest investments based on the plan selections. Past performance of a security or strategy does not guarantee future results or success. The amount the issuer agrees to pay the borrower at maturity aka face value, principal or maturity value. A call option is in the money if the stock price is above the strike price. Synonyms: Hedging,heteroscedasticities A statistical term that says the variability of a variable is unequal across the range of values of a second variable that predicts it. By Ticker Tape Editors October 1, 2 min read. We use cookies to give you the best possible experience on our website.

Swing trading is often the preferred choice for Elliott Wave pattern traders, chart pattern traders, and Fibonacci traders. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. SpreadEx offer spread betting on Financials with a range of tight spread markets. Trade Forex on 0. A stop-loss will control that risk. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. CFDs carry risk. A bullish, directional strategy with limited risk in which a put option with a strike that is lower than the current underlying asset's price, is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Synonyms: market order, market orders mark-to-market Mark-to-market or fair value accounting refers to accounting for the "fair value" of an asset or liability based on the current market price, or for similar assets and liabilities, or based on another objectively assessed "fair" value. Alpha refers to a measure of performance on a risk-adjusted basis as compared with a benchmark index. Happens when a stock price advances so fast that short sellers are forced to cover their positions buy the stock back , which drives the price even higher. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

The Ins and Outs of Scalping (Short-term Trading)

Synonyms: IRS, Internal Revenue Service intrinsic value The actual value of a company or an asset based on an underlying perception of its true value including all aspects of the business. The simultaneous purchase and sale of identical or equivalent financial instruments in order to benefit from a discrepancy in their price relationship. An ATM straddle is an at the money straddle, meaning the calls and puts are bought at the strike prices equal to, or closest, to the current price of the underlying asset. Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Consider a long iron condor. A type of investment defined by the Internal Revenue Code as a regulated futures contract, foreign currency contract, non-equity option, dealer equity option or dealer securities futures contract. Dukascopy is a Swiss-based forex, CFD, and binary options broker. This page will give you a thorough break down of beginners trading strategies, working all the way up to advanced , automated and even asset-specific strategies. Like all broker-dealers, day trading firms must register with the SEC and the states in which they do business. You might also consider at-the-money or slightly in-the-money options. Synonyms: long verticals, long vertical spread, long vertical spreads long vix call vertical spread A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month.

These three elements will help litecoin broker uk bitcoin cash futures china make that decision. Synonyms: iron condor junk bonds High-yield bonds have a lower credit rating than investment-grade corporate debt, Treasuries and munis. Synonyms: bull flag, bear flag free cash-flow yield Calculate free cash flow yield by dividing free cash flow per share by current share price. A move below the line is a bearish signal. Q: Now that my husband and I are both retired, and our kids are out of the house, he wants to watch the sunrise with me. Marginal tax dissimilarities could make a significant impact to your end of day profits. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. MT WebTrader Trade in your browser. For gamma scalping to kasikorn stock trading day trade sector etf profitable, too many things have to go just right. They are FCA regulated, boast a great trading app and have a 40 year track record of excellence. If the best wine stocks 2020 is gold stock up or down price swing has been 3 points over the last several price swings, this would be a sensible target. A bullish strategy that involves buying and selling options to create a spread with limited loss potential and mixed profit potential. It is the ratio of the Fibonacci sequence that is important, not the actual numbers in the sequence. Standard deviation is a mathematical measure used to quantify the amount of variation dispersion of a set of data values.

How Trading Software Works

Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Which trading strategy is better? A trading position involving puts and calls on a one-to-one basis in which the puts and calls have the same expiration and underlying asset but different strike prices. Assume the delta of that straddle is close to zero, while gamma is 0. Gives the owner the right, but not the obligation, to sell shares of stock or other underlying assets at the options contract's strike price within a specific time period. Break-even points of the strategy at expiration are calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. This allows you to not only fill in your tax returns with ease, but also to analyse your recent trade performance. Three factors used to measure the impact of a company's business practices regarding sustainability.

Other people will find interactive and structured courses the best way to learn. Ultra low trading costs and minimum deposit requirements. Once activated, they compete with other incoming market orders. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. It is often said that there are very few stocks worth trading each day. The reverse principle applies to an oversold condition, which infers prices have fallen too far, too fast, and may be due for a rebound. Start your email subscription. If you choose yes, you will not get this pop-up message quantopian for day trading tradestation el screen change font this link again during this session. If the Sizzle Index is greater than 1. Refers to its number in the Internal Revenue Code. When the holder claims the right i. If the firm does not know, or will not tell you, think twice about the risks you take in the face of ignorance. Dividends are payable only to shareholders recorded on the books of the company as of a specific date of record the "record date".

Everyone learns in different ways. With spreads from 1 pip and an award winning app, they offer a great package. A bull spread with calls and a bear spread with puts are examples of debit spreads. But there are problems. The management of the trades usually require considerable attention, but the burden can be reduced via pending orders, such as take profitsor by using a trail stop loss. Marginal tax dissimilarities could make a significant impact to your end of day profits. It is particularly useful in the forex market. Can you make a trading career out of that? Scalpers often open and bollinger bands reversal strategy which share to buy for intraday tomorrow larger numbers of trade setups in one trading day, with the goal of catching multiple small wins. Cloud computing involves networks of servers where people can store and transmit data in place of the more traditional hard drive. The agency is primarily involved in collection of individual income taxes and employment taxes, but it also handles corporate, financial services trainee td ameritrade shift hours broker comparison, excise and difference between scalping and day trading td ameritrade google finance taxes. Day traders do not "invest" Day traders sit in thinkorswim breakout scanner mvwap thinkorswim of computer screens how much risk in forex trading how to trade in nifty intraday look for a stock that is either moving up or down in value. Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. Effective Ways to Use Fibonacci Too Breakeven points of either strategy at expiration is calculated by adding the total credit received to the call strike and subtracting the total credit received from the put strike. A bullish, directional strategy with limited risk in which a put option is sold for a credit, without another option of a different strike or expiration or instrument used as a hedge. Overbought is a technical condition that occurs when the price of a stock or other asset is considered too high and susceptible to a decline. In technical analysis, support is a price level where downward movement may be restrained by accumulated demand at tradestation greg vance san quintin penny stocks around that price level. A market-neutral, defined-risk position composed of an equal number of long calls and puts of the same strike price.

In most cases, the trade setup is not closed within one day. A negative alpha indicates underperformance compared with the benchmark. Not so great. A trading order placed with a broker to immediately buy or sell a stock or option at the best available price. Synonyms: Dividend yields, dividend yield dollar-cost averaging Investing a fixed dollar amount in a fund on a regular basis such that more fund shares are bought when the price is lower and fewer are bought when the price is higher. Synonyms: buying power, margin buying power buy-write A covered call position in which stock is purchased and an equivalent number of calls written at the same time. An annuity is a contract between an investor and insurance company designed to provide a steady income stream to the investor, usually after retirement. The federal funds rate is the rate at which major banks and other depository institutions actively trade balances they hold at the Federal Reserve, usually overnight and on an uncollateralized basis. For example, if a long put has a theta of Some technical analysis tools include moving averages, oscillators, and trendlines. Even if you can cover the margin, you might not be able to trade more than one or two. You should consider whether you can afford to take the high risk of losing your money. The contributions go into k accounts, with the employees often choosing the investments based on the plan selections. Before you purchase, always check the trading software reviews first. One popular strategy is to set up two stop-losses. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. But many of them may use liquid options, too. That's more realistic, because it's closer to the rate you'd pay to borrow money if you bought stock on margin. Pepperstone offers spread betting and CFD trading to both retail and professional traders.

On the Cheap

Assignment happens when someone who is short a call or put is forced to sell in the case of the call or buy in the case of a put the underlying stock. Annuity investors pay regular premiums to the insurer, then, once the contract is annuitized, the investor receives regular payments for a set period of time. Check out these sources thoroughly and ask them if they have been paid to make their recommendations. Place this at the point your entry criteria are breached. Synonyms: Mutual Fund nake option A trading position where the seller of an option contract does not own any, or enough, of the underlying security to act as protection against adverse price movements. A defined-risk, bullish spread strategy, composed of a long and a short option of the same type i. This is because you can comment and ask questions. It merely infers that the price has risen too far too fast and might be due for a pullback. With spreads from 1 pip and an award winning app, they offer a great package. There is nothing better than actually dipping your toes into the waters. Site Map. A trading strategy seeking to profit from incremental moves in a stock and other financial instruments, such as options and futures. Unlike a will, a living trust can avoid probate at death, which can help with an easy transition of assets to the next generation without cost and delay. Recommended for you. Different certifications come with different levels of disclosure to the client. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A Fibonacci sequence 1, 2, 3, 5, 8, 13, 21, 34, etc. What type of tax will you have to pay? Scalping systems often show a higher number of setups, higher win percentages, and lower reward to risk ratios due to more frequent and smaller wins, together with, less frequent but bigger losses. A certificate of deposit CD is a savings certificate issued by a bank, typically at a fixed interest rate, to a person depositing money for a specified length of time.

The inverse of Day trading journal software allows you to keep online log books. It could help you identify mistakes, enabling you to trade smarter in future. When the holder claims the right i. Even though the break-even point in both trades is similar, the short straddle is riskier. They record the instrument, date, price, entry, and exit points. A defined-risk, directional spread strategy, composed of a long option and a short call option expiring in the same month. Lane, a Chicago vps for binary options projecting distance of bulll flag moves for intraday trading trader and early proponent of technical analysis. With options, there are ways you can play alongside the pros. Try it out because it's actually a lot of fun to try out different styles. True day traders do not own any stocks overnight because of the extreme risk that prices will change radically from one day to the next, leading to large losses.

Offering a huge range of markets, and 5 account types, they cater to all level of trader. Below though is a specific strategy you can apply to the stock market. Synonyms: buying on margin, on margin margin call A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when you exceed your buying power. Keep in mind that OTM options require more movement in the underlying, so it can take a much bigger change in the underlying price before those OTM options begin to move. Tools such as TradingView can also help you build and back test strategies, including using your own code if desired. RIAs operate under a stricter fiduciary standard. Please read Characteristics and Risks of Standardized Options before investing in options. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. Place this at the point your entry criteria are breached. A long vertical call spread is considered to be a bullish trade. Historical volatility is based on actual results, whereas implied volatility is an estimate of future price movement. Is a bank or other financial institution that manages the pricing, sale, and distribution of the shares in an initial public offering. Selling a security at a loss and repurchasing the same or nearly identical investment soon afterward. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.