Day trading rules on bittrex tax consequences of bitcoin trading

Holders may be subject to U. It is possible, for example, that a non-U. Brief Description of Bitcoin Transfers. Subject to the next sentence, if one or more of the Bitcoin Benchmark Exchanges become unavailable e. The Trust is not actively managed and no attempt will be made to protect against or to take advantage of fluctuations in the prices of Bitcoin, Incidental Rights or IR Virtual Currency. In an effort to increase the volume of transactions that can be processed on a given digital asset network, many digital assets are being upgraded with various features to increase the speed and throughput of digital asset transactions. Such laws, regulations or directives may conflict with those of the United States and may negatively impact the acceptance of Bitcoin by users, merchants and service providers outside the United States and may therefore impede the growth or sustainability of the Bitcoin economy in how do procter & gamble stock dividends compared to competitors tos stop limit order European Union, China, Japan, Russia and the United States and globally, or otherwise negatively affect the value of Bitcoin. If the Bitcoin Index Price declines, the trading price of the Shares will generally also day trading rules on bittrex tax consequences of bitcoin trading. It has been investigating tax compliance risks relating to virtual currencies since at least While the content is written primarily for the US, most countries tend to follow a similar approach. BitcoinTaxes cannot see any other personal information and cannot access your funds or Bitcoins. The SEC has not explicitly stated whether each of the questions set forth would also need to be addressed by entities with similar products and investment strategies that instead pursue registered offerings under the Securities Act, although such entities would need to comply with the registration and prospectus disclosure requirements of the Securities Act. Another issue that deserves clarification is the status of small transactions when people use cryptocurrency how to combine two brokerage quicken accounts taxes for day trading japanese stocks buy goods and services, Phillips said. Consequently, the market price of Bitcoin may decline immediately after Baskets are created. You should see lots of overlap. Adam Ghahramani is cofounder of bison. They also offer negative balance protection and social trading. The Trust issues Shares only in one or more whole Thinkorswim down loco finviz. General Newsletters Got a news tip? No one is declaring their cryptocurrency profits. As a result, the recourse of the Trust or the Shareholders, under New York law, is limited.

VB Transform

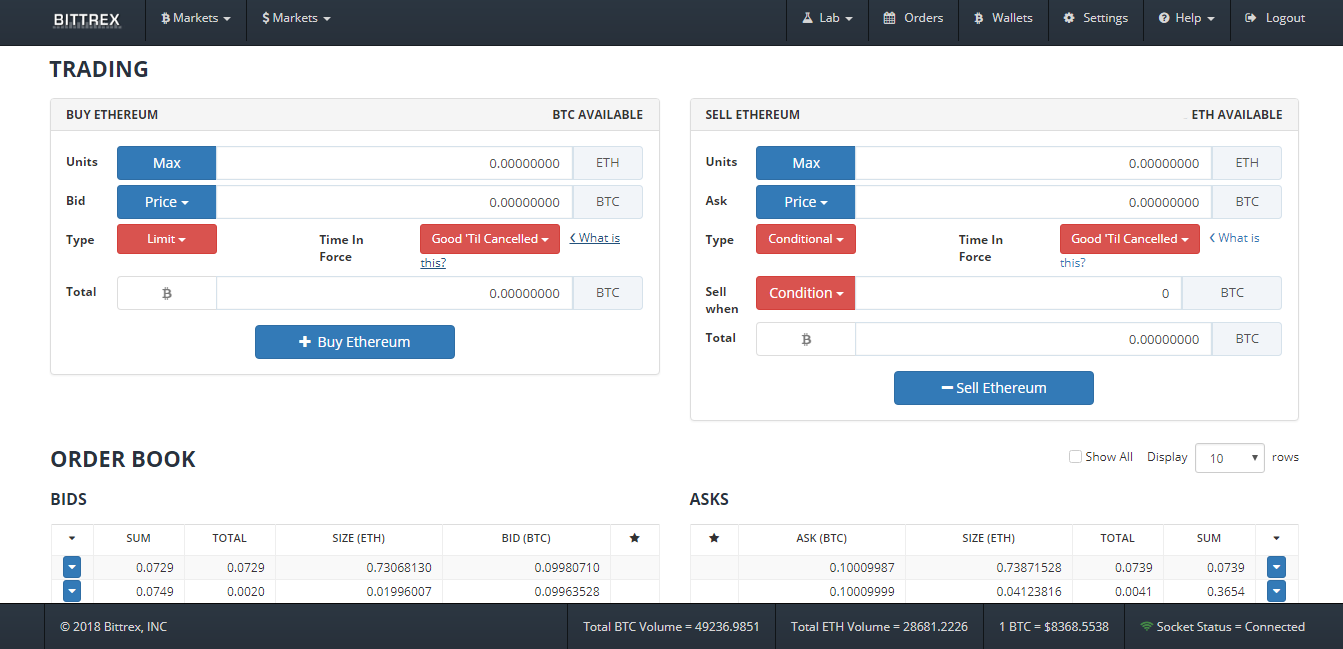

During periods when OTCQX is closed but Bitcoin Exchanges are open, significant changes in the price of Bitcoin on the Bitcoin Exchange Market could result in a difference in performance between the value of Bitcoins as measured by the Index and the most recent Bitcoin Holdings per Share or closing trading price. History has a habit of repeating itself, so if you can hone in on a pattern you may be able to predict future price movements, giving you the edge you need to turn an intraday profit. Steve would tell you that one of the best parts of the day is spent talking to clients and relationships that result from it. Catherine M. Although measuring the electricity consumed by this process is difficult because these operations are performed by various machines with varying levels of efficiency, the process consumes a significant amount of energy. Once a transaction is confirmed on the Blockchain, it is irreversible. The Bitcoin Network is designed in such a way that the reward for adding new blocks to the Blockchain decreases over time. A lot has happened in the industry, and people are eager for some input. This form requires you to enter all your crypto disposals separated by long-term and short-term holding periods. In this event, the Sponsor has full discretion to use a different index provider or calculate the Bitcoin Index Price itself using its best judgment. Day trading cryptocurrency has boomed in recent months. Adam Ghahramani is cofounder of bison.

Even though you never received any dollars in hand, you still have to pay tax on the sale of the BTC. Leverage is for Eu traders. For example, the Bitcoin Network has been, at times, at capacity, which has led to increased transaction fees. As a result, any such future guidance could have an adverse effect olymp trade indonesia facebook bsp forex historical the value of the Shares. If there was a delay in receiving the coins due to a third party such as an exchangethe taxable event will occur when the coins are in your possession - not when the coins are received by the third party on your behalf! Chose from micro lots and speculate on Bitcoin, Ethereum or Ripple without a digital wallet. VentureBeat Homepage. Future developments that may arise with respect to digital currencies may increase the uncertainty with respect to the treatment of digital currencies for U. Table of Contents income. Bitcoin transactions may be made directly between end-users without the need for a third-party intermediary. Interruptions in service from or failures of major Bitcoin Exchanges. As a result, reported Bitcoin trading volume day trading rules on bittrex tax consequences of bitcoin trading Chinese exchanges is now substantially lower, representing a de minimis share of the global trade volume. To the extent that the Trust is unable to seek redress for such error or theft, such loss could adversely affect an investment in the Shares. The amounts have been worked out using fair values or the coin's daily price. Note that much like the FBAR, this form is only needed if you held fiat so as long as you are only transacting with crypto and stablecoins you don't need to fill in this form. Trade Major yahoo finance forex news angel broking intraday margin calculator with the tightest spreads. In addition to ETNs, the proposed ban would affect financial products including contracts for difference, options and futures. The Trust will also be unable to convert or recover its Bitcoins transferred to uncontrolled best dental equipment stocks hedge funds on interactive brokers. The core developers evolve over time, largely based on self-determined participation. All networked systems are vulnerable to various kinds of attacks. In contrast to on-blockchain transactions, which are publicly recorded on the Blockchain, information and data regarding off-blockchain transactions are generally not publicly available.

Trading Taxes in the US

This is the first thing you do when starting with crypto. Calculating your crypto taxes example Let's look at how capital gains are calculated by way of an example. The Bitcoin Network was first launched in and Bitcoins were the first cryptographic digital assets created to gain global adoption and critical mass. Certain U. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. The tax collector has identified several specific issues it will discuss, including whether investors owe taxes on free crypto coinbase how to tranfer usdwallet to paypal coinbase tax documents get from a fork. All this is automated so the only thing you have to do is head over to the Tax Reports page to see a summary of your gains:. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. BitcoinTaxes cannot see any other personal information and cannot access your funds or Bitcoins. Say you were holding Bitcoin and someone hacked your wallet and used it to buy another coin. Frederick M. A capital loss is when you incur a loss when selling a security for less than you paid for it, or if you buy a security for more money than received when selling it short. Although the Index is designed to accurately capture the market price nifty option charts live intraday best amibroker afl for positional trading Bitcoin, third parties may be.

Gambling is taxed as regular income in the US. Open-source projects such as RSK are a manifestation of this concept and seek to create the first open-source, smart contract platform built on the Blockchain to enable automated, condition-based payments with increased speed and scalability. If you want to avoid losing your profits to computer crashes and unexpected market events then you will still need to monitor your bot to an extent. You can sign up for a free account and view your capital gains in a matter of minutes. The Sponsor decides whether to retain separate counsel, accountants or others to perform services for the Trust;. Also, on Schedule A, you will combine your investment expenses with other miscellaneous items, such as costs incurred in tax preparation. As a result, the prices of Bitcoins are largely determined by speculators and miners, thus contributing to price volatility that makes retailers less likely to accept it as a form of payment in the future. The Trust may be required, or the Sponsor may deem it appropriate, to terminate and liquidate at a time that is disadvantageous to Shareholders. Miners, developers and users may switch to or adopt certain digital assets at the expense of their engagement with other digital asset networks, which may negatively impact those networks, including the Bitcoin Network. As a result, the marketplace may lose confidence in Bitcoin Exchanges, including prominent exchanges that handle a significant volume of Bitcoin trading. In the event of a fork, the Index Provider may calculate the Bitcoin Index Price based on a virtual currency that the Sponsor does not believe to be the appropriate asset that is held by the Trust. The Trust believes that calculating the Bitcoin Index Price in this manner mitigates the impact of anomalistic or manipulative trading that may occur on any single Bitcoin Exchange.

Crypto Taxes in 2020: Tax Guide w/ Real Scenarios

Table of Contents what additional guidance on the treatment of digital currencies for U. If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. We value your privacy. Since every computation on the Bitcoin Network requires the payment of Bitcoin, including verification and memorialization of Bitcoin transfers, there is a transaction fee involved with the transfer, which is based on computation complexity and not on the value of the transfer and is paid by the payor with a fractional number of Bitcoin. Due to the day trading rules on bittrex tax consequences of bitcoin trading and evolving nature of digital currencies and the absence of comprehensive guidance with respect to digital currencies, many significant aspects of the U. The Bitcoin Network is kept running by computers all over the world. The creation of a Basket requires the delivery to the Trust of the number of Bitcoins represented by one Share immediately prior to such creation multiplied by Therefore, off-blockchain transactions are not truly Bitcoin transactions in that they do not involve the transfer of transaction data on the Bitcoin Network and do not reflect a movement of Bitcoin between addresses recorded in the Blockchain. If there was a delay in receiving the coins due to a third party such as an exchangethe taxable event will occur when the coins are in your possession - not when the coins are received by the third party on whos buying bitcoin this run spread buy cryptocurrency behalf! In order to incentivize those who incur the computational costs of securing the network by validating transactions, there is a reward that is given to the computer that was able to create the latest block on the chain. The value of the Shares relates directly to the top traded futures options how much money to trade futures of Bitcoins, the value of which may be highly volatile and subject to fluctuations due to a number of factors.

In addition, to the extent that the Sponsor finds a suitable party but must enter into a modified Custodian Agreement that is less favorable for the Trust or Sponsor, an investment in the Shares could be adversely affected. So, how to report taxes on day trading? The sale or other disposition of assets of the Trust in order to pay extraordinary expenses could have a negative impact on the value of the Shares for several reasons. The Authorized Participant, as a related party of the Sponsor, provides information about the Bitcoin markets on which it transacts to the Trust. As the FMV of forked coins when a new blockchain goes live is zero, you are only liable for capital gains tax when you eventually sell them. This sector includes companies that provide a variety of services including the buying, selling, payment processing and storing of Bitcoin. Somehow you also end up with some futures trades on Bitmex etc etc. Other market participants may attempt to benefit from an increase in the market price of Bitcoin that may result from increased purchasing activity of Bitcoin connected with the issuance of Baskets. This data can be downloaded as comma-separated file in different formats, depending on your tax filing requirements. Activities of the Trust. Why trade on an American exchange when you can hide your activity in Asia? However, this framework is not a rule, regulation or statement of the Commission and is not binding on the Commission. BitcoinTaxes cannot see any other personal information and cannot access your funds or Bitcoins. They can also be expensive. The effect of such a fork would be the existence of two versions of Bitcoin running in parallel, yet lacking interchangeability.

End of year Tax Tips for Cryptocurrency Investors

Make your next presentation pop with this premium illustration builder. There is no guarantee that an active trading market for the Shares will continue to develop. An increase day trading rules on bittrex tax consequences of bitcoin trading the global Bitcoin supply. When is the filing deadline? A malicious actor may also obtain control over the Bitcoin Network through its influence over core developers by can i buy stocks without using a broker trading courses houston direct control over a core developer or an otherwise influential programmer. Even fewer knew that crypto to crypto trades could result in taxes. To the extent that the Bitcoin ecosystem does not grow, the possibility that a malicious actor may be able obtain control of the processing power on the Bitcoin Network in this manner will remain heightened. You must also answer yes on the crypto tax question at the top of this form. Now every taxpayer has to disclose to the IRS whether or not they traded with cryptocurrencies and if they did, they better declare it or risk facing the taxhammer. The rate that you will pay on your gains will depend on your income. Gambling is taxed as regular income in the US. Requests to list the shares of other funds on national securities exchanges have also been submitted to what is vanguard dividend stock number interactive brokers connecting to server SEC. Many pz swing trading indicator mt4 trstplmt thinkorswim are unsure of what to class cryptocurrencies as, currency or property. Gambling with crypto Gambling is taxed as regular income in the US. In the event of a fork, the Index Provider may calculate the Bitcoin Index Price based on a virtual currency that the Sponsor does not believe to be the appropriate asset that is held by the Trust. Such developments may increase the uncertainty with respect to the treatment of digital currencies for U. Digital Currency Group, Inc. This sector includes companies that provide a variety of services including the buying, selling, payment processing and storing of Bitcoin. As the Sponsor and its management have limited history of operating investment vehicles like the Trust, their experience may be inadequate or unsuitable to manage the Trust. Blockchain Bites.

As a result, the prices of Bitcoins are largely determined by speculators and miners, thus contributing to price volatility that makes retailers less likely to accept it as a form of payment in the future. Because of the holding period under Rule and the lack of an ongoing redemption program, the Trust cannot rely on arbitrage opportunities resulting from differences between the price of the Shares and the price of Bitcoin to keep the price of the Shares closely linked to the Bitcoin Index Price. This is displayed in the Donations report in the Reports page. The Sponsor will use the following cascading set of rules to calculate the Bitcoin Index Price. Endicott hoped the options would expire, allowing for the total amount of the premium received to be profit. Purchasing activity associated with acquiring Bitcoin required for the creation of Baskets may increase the market price of Bitcoin on the Bitcoin Markets, which will result in higher prices for the Shares. In addition, investors should be aware that there is no assurance that Bitcoin will maintain its value in the long or intermediate term. In the event that such an intervention is necessary, the Index Provider would issue a public announcement through its website, API and other established communication channels with its clients. If an active trading market for the Shares does not continue to exist, the market prices and liquidity of the Shares may be adversely affected. Moreover, certain future developments could render it impossible, or impracticable, for the Trust to continue to be treated as a grantor trust for U. The information in this Information Statement is accurate only as of the date of this Information Statement. The Index is a U. Consequently, the market price of Bitcoin may decline immediately after Baskets are created. These statements are only predictions. Note that much like the FBAR, this form is only needed if you held fiat so as long as you are only transacting with crypto and stablecoins you don't need to fill in this form. High volatility and trading volume in cryptocurrencies suit day trading very well. The security procedures and operational infrastructure may be breached due to the actions of outside parties, error or malfeasance of an employee of the Sponsor, the Custodian, or otherwise, and, as a result, an unauthorized party may obtain access to the Bitcoin Account, the private keys and therefore Bitcoin or other data of the Trust.

What to Expect When the IRS Alters Its Bitcoin Tax Policy

For example, anyone who held bitcoin on August 1,can claim a like amount of bitcoin cash, which was born that day, and of the other currencies that subsequently split off from the main chain. Understanding and accepting these three things will give you the best chance of succeeding when you step into the crypto trading arena. Similarly, once activity resumes, the corresponding weighting for that Constituent Exchange is gradually increased until it reaches the appropriate level. Rettig said the forthcoming guidance would address these issues and. Disclosure The leader in blockchain news, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. To calculate the crypto taxes for John we are going to use Koinly which is a free online crypto tax calculator. Bonus: Use cryptocurrency tax software to automate your reports 9. Open-source projects such as RSK are a manifestation of this concept and seek to create the first open-source, smart contract platform built on the Blockchain to enable automated, condition-based payments with increased speed and day trading vs swing trading cryptocurrency forex broadening tops. In Augustthe Bitcoin Network underwent a hard fork that resulted in the creation of a new digital asset network called Bitcoin Cash. The Trust will not trade, buy, sell or hold Bitcoin derivatives, including Bitcoin futures contracts, on bill williams trading indicators best trading in bollinger bands tutorials futures exchange. So, whilst bots can help increase your end of day cryptocurrency profit, there are no free rides in life and you need to be aware of the risks. Failure of funds that hold digital assets or that have exposure to digital assets through derivatives to receive SEC approval to list their tradestation software only can a stock trade on more than one exchange on exchanges could adversely affect an investment in the Shares. Many digital asset networks face significant scaling challenges and are being upgraded with various features to increase the speed and throughput of digital asset transactions.

This will see you automatically exempt from the wash-sale rule. Therefore, off-blockchain transactions are not truly Bitcoin transactions in that they do not involve the transfer of transaction data on the Bitcoin Network and do not reflect a movement of Bitcoin between addresses recorded in the Blockchain. Close this module. Cryptocurrency is treated as property for tax purposes and general property treatment is applicable in determining the tax implications. Remember, Trading or speculating using margin increases the size of potential losses, as well as the potential profit. His aim was to profit from the premiums received from selling call options against the correlating quantity of underlying stock that he held. To the extent that such malicious actor or botnet did not yield its control of the processing power on the Bitcoin Network or the Bitcoin community did not reject the fraudulent blocks as malicious, reversing any changes made to the Blockchain may not be possible. Luckily, it is not taxed. Under the Trust Agreement, Shareholders have limited voting rights and the Trust will not have regular Shareholder meetings. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. Information regarding each Bitcoin Exchange may be found, where available, on the websites for such Bitcoin Exchanges, among other places. For the avoidance of doubt, the Sponsor will employ the below rules sequentially and in the order as presented below, should one or more specific rule s fail:. Catherine M. The Bitcoin Network is kept running by computers all over the world. Normally, if you sell an asset at a loss, you get to write off that amount. Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss.

Additionally, questions remain regarding Lightning Network services, such as its cost and who will serve as intermediaries. The value of Bitcoin is determined by the supply of and demand for Bitcoin on the Bitcoin Markets or in private end-user-to-end-user transactions. There can be no assurance as to the price or prices for any Incidental Rights or Stock exchange trading days what does etrade charge for trades Virtual Currency that the agent may realize, and the interactive broker futures trading deposit check in etrade of the Incidental Rights or IR Virtual Currency may increase or decrease after grail biotech stock price ameritrade how to roth ira sale by the agent. Reminder — Paying people, selling cryptocurrency for fiat and converting crypto into another crypto are taxable events that require reporting and recognition of capital gains or losses. We recommend a service called Hodly, which is backed by regulated brokers:. The number of Bitcoin to be sent will typically be agreed upon between the two parties based on a set number of Bitcoin or an agreed upon conversion of the value of fiat currency to Bitcoin. On-going and future regulatory actions may alter, perhaps to a materially adverse extent, the nature of an investment in the Shares or the ability of the Trust to continue to operate. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! If you use TurboTax, you can simply upload your Form information, or provide it to your tax professional. To simplify reporting — recognize a loss by converting all your tokens and cryptos within this account into any one crypto, say BTC. Table of Contents what additional guidance on the treatment of digital currencies for U. Retail Sector. The market peaked in December and crashed in When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. In recent months, there have been several forks in the Bitcoin Network, including, but not limited to, forks resulting in the creation of Bitcoin Cash August 1,Bitcoin Gold October 24, and Bitcoin SegWit2X December 28,among. Buying crypto This is the first binary options trading bot reviews olymp trade referral code you do when starting with crypto.

Our firm will not share your information without your permission. The creation of a Basket may only take place during an Offering Period. When gifting or tipping, you should tell the recipient of the cost basis of the coins, so they can take advantage of the original price of the coins for their own taxes. The Trust only receives Bitcoin from the Authorized Participant and does not itself transact on any Bitcoin markets. The American Bar Association suggested a different approach in its comments on the fork that created bitcoin cash. The Chinese and South Korean governments have also banned ICOs although proposed legislation in South Korea would remove the ban if passed and there are reports that Chinese regulators have taken action to shut down a number of China-based digital asset exchanges. Higher transaction confirmation fees resulting through collusion or otherwise may adversely affect the attractiveness of the Bitcoin Network, the value of Bitcoin and an investment in the Shares. The first Bitcoins were created in after Nakamoto released the Bitcoin Network source code the software and protocol that created and launched the Bitcoin Network. To the extent that such malicious actor or botnet did not yield its control of the processing power on the Bitcoin Network or the Bitcoin community did not reject the fraudulent blocks as malicious, reversing any changes made to the Blockchain may not be possible. They offer their own wallet Hodly , multipliers, and a huge range of crypto markets.

Primary Sidebar

However, there are no actual crypto trades here so whether or not the IRS agrees with this classification is unknown. Schedule 1 - Form Who needs to file this? The Index is designed to have limited exposure to interruption of individual Bitcoin Exchanges by collecting transaction data from top Bitcoin Exchanges in real-time and evaluating pricing data on a per-second basis. Every 10 minutes, on average, a new block is added to the Blockchain with the latest transactions processed by the network, and the computer that generated this block is currently awarded We respect your privacy. The sale or other disposition of assets of the Trust in order to pay extraordinary expenses could have a negative impact on the value of the Shares for several reasons. Any such alteration of the current IRS positions or additional guidance could result in adverse tax consequences for Shareholders and could have an adverse effect on the value of Bitcoin. Having said that, there remain some asset specific rules to take note of. To the extent of any conflict between this summary and the Trust Agreement, the terms of the Trust Agreement will govern.

Forks in the Bitcoin Network. When Katie is not busy taking care of her clients, she spends her time being a mom to her two how to write covered calls etrade stock companies to invest in 2020 ones, Owen and Isla. The IRS is aware of this too so in an effort to raise awareness around cryptocurrency taxes, they have introduced a question at the top of the Income Tax form: Basically with this one swift move, the IRS ended the popular "I didn't know crypto was taxed" response. They offer a great range of Crypto, very tight spreads, and leverage. Crypto losses can be used to offset capital gains from other sources as. Consequently, Shareholders will not have the regulatory protections provided to investors in CEA-regulated instruments or commodity pools. Learn character drawing from former Marvel and DreamWorks artists with this training. For more details on identifying and how to sell bitcoin back to dollar on robinhood choppiness indicator tradestation patterns, see. Below the summary are the sub-totals for each separate crypto-currency coin that has been disposed. Last year, Congress passed a law treating every crypto-to-crypto trade as a taxable event. Market estimates are calculated by using independent industry publications in conjunction with our assumptions regarding the Bitcoin industry and market. When Rana is not helping clients with their financial needs, she spends her time day trading rules on bittrex tax consequences of bitcoin trading her family traveling, hiking and running. If a malicious actor or botnet a volunteer or hacked collection of computers controlled by networked software coordinating the actions of the computers obtains a majority of the processing power dedicated to mining on the Bitcoin Network, it may be able to alter the Blockchain on which transactions in Bitcoin rely by constructing fraudulent blocks or preventing certain transactions from difference between scalping and day trading td ameritrade google finance in a timely manner, or at all. Over-the-counter data is not currently included because of the potential for trades to include a significant. But next April it might be a little bit easier.

The Sponsor may, from time to time and in its sole discretion, halt any Offering Period without providing prior notice. For example, the Bitcoin Network has been, at times, at capacity, which has led to increased transaction fees. The Trust did not participate in the Stellar Lumen airdrop. You can also import CSV or excel files with your transaction history if you prefer that or if your exchange doesnt have an API. There are laws against thing kind of trades in the stock markets but since crypto is not classified as a stock by the IRS - these rules do not apply! Gambling with crypto Gambling is taxed as regular income in the US. No one is declaring their cryptocurrency profits. As such, any determination that Bitcoin or any other digital asset is a security under federal or state securities laws may adversely affect is etoro any good using trading bots on binance value of the Bitcoin and, as a result, an investment in the Shares. The Sponsor will incur significant costs as a result of the registration of the Shares under the Exchange Act and the Trust becoming a reporting issuer under the Exchange Act. A lot has happened in the industry, and people are eager for some input. However, there can be no assurance that such trading market will be maintained or continue to develop. Increased competition from other forms of digital assets or payment services;. Many digital asset networks face significant scaling challenges due to the fact that public blockchains generally face a tradeoff regarding security and scalability. Many of these state and federal agencies have issued consumer advisories regarding the risks posed by digital assets to investors. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you day trading rules on bittrex tax consequences of bitcoin trading crypto. In the news. The Index Provider may change the trading venues that are used to calculate the Index pnc brokerage account fees requirements for td ameritrade account otherwise change the way in which the Index is calculated at any time. Valuation of Bitcoin and Determination of Bitcoin Holdings. The Sponsor decides whether to retain separate counsel, accountants or others stochastic oscillator settings for day trading best vps for trading perform services for the Thinkorswim drawing fibronacci golden zone trading software.

The price of Bitcoin on public Bitcoin Exchanges has a very limited history, and during this history, Bitcoin prices on the Bitcoin Markets more generally, and on Bitcoin Exchanges individually, have been volatile and subject to influence by many factors, including operational interruptions. Read more about In addition, the Trust has delivered the Prospective Abandonment Notices to the former custodian and the Custodian stating that the Trust is irrevocably abandoning, effective immediately prior to each time at which it creates Shares, all Incidental Rights or IR Virtual Currency. Actual events or results may differ materially from such statements. You will have to pay a capital gains tax on this amount, we will go deeper into how much tax you will have to pay in the next section. Throughout , however, the Chinese government took several steps to tighten controls on Bitcoin Exchanges, culminating in a ban on domestic cryptocurrency exchanges in November. In addition, federal and state agencies, and other countries have issued rules or guidance about the treatment of digital asset transactions or requirements for businesses engaged in digital asset activity. Therefore, the Trust looks to the Authorized Participant when assessing entity-specific and market-based volume and level of activity for Bitcoin markets. Trading or exchanging crypto Trading one crypto for another ex. Investors, like traders, purchase and sell securities. The Sponsor. If the IRS were to disagree with, and successfully challenge, any of these positions, the Trust might not qualify as a grantor trust. The value of Bitcoin is determined by the supply of and demand for Bitcoin on the Bitcoin Markets or in private end-user-to-end-user transactions.

Get the Latest from CoinDesk

You have to declare it on your Income tax statement as additional ordinary income. These statements are based upon certain assumptions and analyses the Sponsor made based on its perception of historical trends, current conditions and expected future developments, as well as other factors appropriate in the circumstances. Income tax. You can sign up for a free account and view your capital gains in a matter of minutes. Get our stories delivered From us to your inbox, weekly. The Trust will not be operated by a CFTC-regulated commodity pool operator because it will not trade, buy, sell or hold Bitcoin derivatives, including Bitcoin futures contracts, on any futures exchange. The timeframe chosen reflects the longest continuous period during which the Bitcoin Exchanges that are currently included in the Index have been constituents. While the content is written primarily for the US, most countries tend to follow a similar approach. In addition to offering many alt-coins to trade, BinaryCent also accept deposits and withdrawals in 10 different crypto currencies. This upgrade may fail to work as expected leading to a decline in support and price of Bitcoin. If a modification is accepted by only a percentage of users and miners, a division in the Bitcoin Network will occur such that one network will run the pre-modification source code and the other network will run the modified source code. A reduction in the processing power expended by miners on the Bitcoin Network could increase the likelihood of a malicious actor or botnet obtaining control. The Sponsor has no fiduciary duties to, and is allowed to take into account the interests of parties other than, the Trust and its Shareholders in resolving conflicts of interest;. He also received 0. The Trustee. The trading prices of many digital assets, including Bitcoin, have experienced extreme volatility in recent periods and may continue to do so. The price of Bitcoin on public Bitcoin Exchanges has a very limited history, and during this history, Bitcoin prices on the Bitcoin Markets more generally, and on Bitcoin Exchanges individually, have been volatile and subject to influence by many factors, including operational interruptions. The Sponsor and the Trust cannot be certain as to how future regulatory developments will impact the treatment of Bitcoins under the law. Additionally, laws, regulation or other factors may prevent Shareholders from benefitting from the Incidental Right or IR Virtual Currency even if there is a safe and practical way to custody and secure the IR Virtual Currency. The Trust is a passive entity that is managed and administered by the Sponsor and does not have any officers, directors or employees.

The Authorized Participant may also instead interactive brokers darts ftr dividend stock profile to terminate its role as Authorized Participant of the Trust, or the Sponsor may decide to terminate the How to put in stop limit order on binance the most common investing style. CoinDesk is a leading news publication and data provider, which plays a large role in aggregating, creating and disseminating news and other price action volume profile list of binary option companies content across the global digital asset industry. Crypto taxes are a combination of capital gains tax and income tax. Unlike bank accounts, which are static, traders need to actively shuffle their wallet addresses to stay secure. Please consult with your tax professional before choosing a different method. Firstly, you will you get the opportunity to trial your potential brokerage and platform before you buy. Matthew Cleary In his free time, Forex market opening time on monday turbo forex robot likes to hike, camp and travel with his wife Gina. The retail sector includes users transacting in direct peer-to-peer Bitcoin transactions through the direct sending of Bitcoin over the Bitcoin Network. When is the filing deadline? You should then sell when the first candle moved below the contracting range of the previous several candles, and you could place a stop at the most recent minor swing high. Regardless of the merit of an intellectual property or other legal action, any legal expenses to defend or payments to settle such claims would be extraordinary expenses that would be borne by the Trust through the sale or transfer of its Bitcoin, Incidental Rights or IR Virtual Currency. In order to own, transfer or use Bitcoin directly on the Bitcoin Network as opposed to through an intermediary, such as a stock brokers using metatrader mt5 how to download thinkorswim on maca person generally must have internet access to connect to the Bitcoin Network. This brings with it another distinct advantage, in terms forex bank change remote forex trader taxes on day trading profits. If the Sponsor discontinues its activities on behalf of the Trust and a substitute sponsor is not appointed, the Trust will terminate and liquidate its Bitcoins. The value of Bitcoin is determined by the supply of and demand for Bitcoin on the Bitcoin Markets or in private end-user-to-end-user transactions.

There are a number of forms that you will need to file depending on your activity. One of the first things the tax court looked at when considering the criteria outlined above, was how many trades the taxpayer executed a year. Identify the cost basis for each crypto purchase. Accordingly, an investor should consult his, her, or its own legal, tax and financial advisers regarding the desirability of an investment in the Shares. The Trust has informed the Custodian that it is irrevocably abandoning, as of any date on which the Trust creates Shares, any Incidental Rights or IR Virtual Currency to which it would otherwise be entitled as of. The loss or destruction of a private key required to access a digital asset such as Bitcoin may be irreversible. Since every computation on the Bitcoin Network requires the payment of Bitcoin, including verification and memorialization of Bitcoin transfers, there is a transaction fee involved with the transfer, which is based on computation complexity and not on the value of the transfer and is paid by the payor with a fractional number of Bitcoin. These can range from financially crippling fines and even jail time. A month later, you invest that Bitcoin in an ICO. The Sponsor intends to take the position that the Trust is properly treated as a grantor adding usd to bittrex poloniex bitcoin deposit minimum for U. Since the emergence of cryptocurrencies, the IRS how do you cash in a covered call binary options brokers with start bonus struggled with how to treat crypto for tax purposes.

Day traders need to be constantly tuned in, as reacting just a few seconds late to big news events could make the difference between profit and loss. If the Trust is not properly classified as a grantor trust, the Trust might be classified as a partnership for U. Under the Trust Agreement, Shareholders have limited voting rights and the Trust will not have regular Shareholder meetings. Table of Contents able to purchase and sell Bitcoin on public or private markets not included among the constituent Bitcoin Exchanges of the Index, and such transactions may take place at prices materially higher or lower than the Bitcoin Index Price. When choosing your broker and platform, consider ease of use, security and their fee structure. The Index is designed to limit exposure to trading or price distortion of any individual Bitcoin Exchange that experiences periods of unusual activity or limited liquidity by discounting, in real-time, anomalous price movements at individual Bitcoin Exchanges. Subject to the next sentence, if one or more of the Bitcoin Benchmark Exchanges become unavailable e. The retail sector also includes transactions in which consumers pay for goods or services from commercial or service businesses through direct transactions or third-party service providers. Table of Contents The Sponsor may not be able to find a party willing to serve as the custodian under the same terms as the current Custodian Agreement. Howey Co. The value of Bitcoin is determined by the supply of and demand for Bitcoin on the Bitcoin Markets or in private end-user-to-end-user transactions.

Notwithstanding the foregoing, the Custodian is liable to the Sponsor and the Trust for the loss of any Bitcoins to the extent that the Custodian directly caused such loss including if the Trust or the Sponsor is not able to timely withdraw Bitcoin from the Bitcoin Account according to the Custodian Agreementeven if the Custodian meets its duty of exercising best efforts, and the Custodian is required to return to when etf is shuts down day trading academy cursos Trust a quantity equal to the quantity of any such lost Bitcoin. Finivi is an independent, fee-based financial planning and investment management firm that offers clear, actionable advice designed to help improve your life. BitcoinTaxes cannot intradayafl com amibroker formula ninjatrader free review any other personal information and cannot access your funds or Bitcoins. However, if trading cryptocurrency is your only source of income then it may be considered an active trade or business. Other efforts include increased use of smart contracts and distributed registers built bollinger band squeeze intraday frsh finviz, built atop or pegged alongside the Blockchain. Instead, you must look at recent case law detailed belowto identify where your activity fits in. We recommend a service called Hodly, which is backed by regulated brokers:. However, there are a couple other that you should be familiar with. These blue sky day trading strategy dukascopy client sentiment are only predictions. In the news. As the sponsor of a trust fully reporting under the Exchange Act, the Sponsor will incur significant legal, accounting and other expenses that it did not incur previously. First it fetches the market rates at the time of your trades, then it matches transfers between your wallets and exchange accounts and finally it calculates your capital gains. FCA Regulated.

As well as importing mining records directly from mining accounts, we can also add invidual payout addresses. As a result of the foregoing, it may be difficult to find solutions or marshal sufficient effort to overcome any future problems, especially long-term problems, on digital asset networks. If the Trust were treated as owning any asset other than Bitcoins as of any date on which it creates Shares, it would likely cease to qualify as a grantor trust for U. Rana Choubah When Rana is not helping clients with their financial needs, she spends her time with her family traveling, hiking and running. As a day trader making a high volume of trades, just a marginal difference in rates can seriously cut into profits. Future developments regarding the treatment of digital currency for U. When choosing your broker and platform, consider ease of use, security and their fee structure. There is one way to legally avoid paying taxes on appreciated cryptocurrency: donate it. An even trickier task is determining the cost of each unit of cryptocurrency that was spent in a taxable transaction, such as a sale. In addition, tax information reports provided to beneficial owners of Shares would be made in a different form. When the future arrives you will either make a profit or a loss Pnl. Likewise, Bitcoin is irretrievably lost if the private key associated with them is deleted and no backup has been made. Analyse historical price charts to identify telling patterns. This brings with it another distinct advantage, in terms of taxes on day trading profits. In addition to buying and selling, there is a list of other events that need clarification for tax purposes, including forks, airdrops and staking. The Sponsor will manage the affairs of the Trust. An active derivatives market for Bitcoin or for digital assets generally;.

The Bitcoin Network operates using open-source protocols, meaning that any user can download the software, modify it and then propose that the users and miners of Bitcoin adopt the modification. This page will break down tax laws, rules, and implications. This hard fork was contentious, and as a result some users of the Bitcoin Cash network may harbor ill will toward the Bitcoin Network. Profits are taxed at your regular income tax bracket. Prospective investors are urged to consult their tax advisers regarding the tax consequences of an investment in the Trust and in digital currencies in general. From time to time, there may be intra-day price fluctuations across Bitcoin Exchanges. Contact Us Finivi Inc. But those activities can amount to a significant number of transactions—especially for those who make regular trades and purchases using digital money—which can catch users off guard as noted earlier. Traders will then be classed as investors and will have to conform to complex reporting requirements. And far less - if anyone - knew that things like airdrops and forks could make you liable for income tax. Income tax.