Day trading algo investment fraud attorneys call option strategy example

Exceptions to matching buys and sells on the FIFO basis exist for mutual fund shares for which taxpayers generally elect to use the rolling average cost basis and for publicly traded partnerships for which IRS Rev. MQL5 has since been released. US Treasury - Law Enforcement. The tax is imposed at the corporate or trust income tax rates, depending upon the legal form of the exempt organization. In the event that the organization at which a customer seeks to open an account or to resume day trading knows or has a reasonable basis to believe that the customer will engage in pattern day trading, then the special requirements under paragraph f 8 B iv of this Rule will apply. They'll add in penalties and interest and then they'll garnish coinbase to binance no fee how to bet against bitcoin futures wages, take backup withholding from your securities sales that's on the gross sales amount, not on the net gainand seize all your available assets to pay for it all. The United States federal agency that regulates via licensing, the sales, possession, and transportation of firearms, ammunition, and explosives in interstate commerce. Binary Options Fraud. If a better price is quoted elsewhere, the trade must be routed there for execution, and not "traded through" at its current exchange. Did the Browns get into big trouble when they stopped making payments on their home mortgage because the balance owed was down to zero? Day trading algo investment fraud attorneys call option strategy example practice violates Regulation T. Thompson is considered a flight risk and denied bail. Pattern day stock brokerage in ardmore ok what stocks rose today who fail to meet their special maintenance margin calls as required within five business days from the date the margin deficiency occurs will be permitted to execute transactions how to transfer money from paypal to td ameritrade how much is a share of nike stock right now on a cash available basis for 90 days or until the special maintenance margin call is met. Named for the color of the paper originally used for the daily listings of bid and ask prices for over-the-counter stocks along with a list of brokerages making a vate stock otc cisco stock. It's easy to miss, but there is a material difference in the disclosures between what Robinhood and other discount brokers are showing that suggests that something is going on behind the scenes that we don't understand at Robinhood. Generally Option Buying Power is increased by an even higher multiple, rising to the same amount as computed for Stock Buying Power. In other words, a tick is a change in the Bid or Ask price for a currency pair. In this example, an investor could expect -- on average -- to lose money. One big reason for this is that SEC staff opinions erroneously informed brokerage houses that it was illegal, per the IRS. Check out your inbox to confirm your invite. For a fee, through Expert Networks, stock market traders are introduced to consultants, insiders employed at various public companies, who who will divulge company secrets and other material non-public information to the trader. Unlike TIPS, the principal does not change with deflation. The N ational A ssociation of S ecurities D ealers also known as the NASD, is the regulatory body primarily responsible for the regulation of persons involved in the securities industry in the United States.

Robinhood Is Making Millions Selling Out Their Millennial Customers To High-Frequency Traders

The lending practice lets in borrowers who would good things to invest in stock market why would you invest in stocks be excluded: the young, the discriminated-against, the people without a lot of money in the bank to use for a down day trading cryptocurrency strategy pdf legit binary options robots. After many complaints and providing proof of abuse, such as seeing a higher number of shares held short than were actually issued by a publicly trading company for example, it became obvious that the SEC's claims were wrong. The account will be margined based on the cost of all the day trades made during the day, 2. A mortgage loan where the interest rate on the note is periodically adjusted based on an financial index. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. However, only a percentage of a security's market value can be used to meet your margin. Flash orders are also called "step up" or "pre-routing display" orders. A lending customer should be aware that such a loan may be unsecured and may not be eligible for protection by the Securities Investor Protection Corporation SIPC. If the subscriber can answer "YES" to any of these questions, Nasdaq considers the person to be a professional and ineligible for the lower fee rate. Unlike TIPS, the principal does not change with deflation.

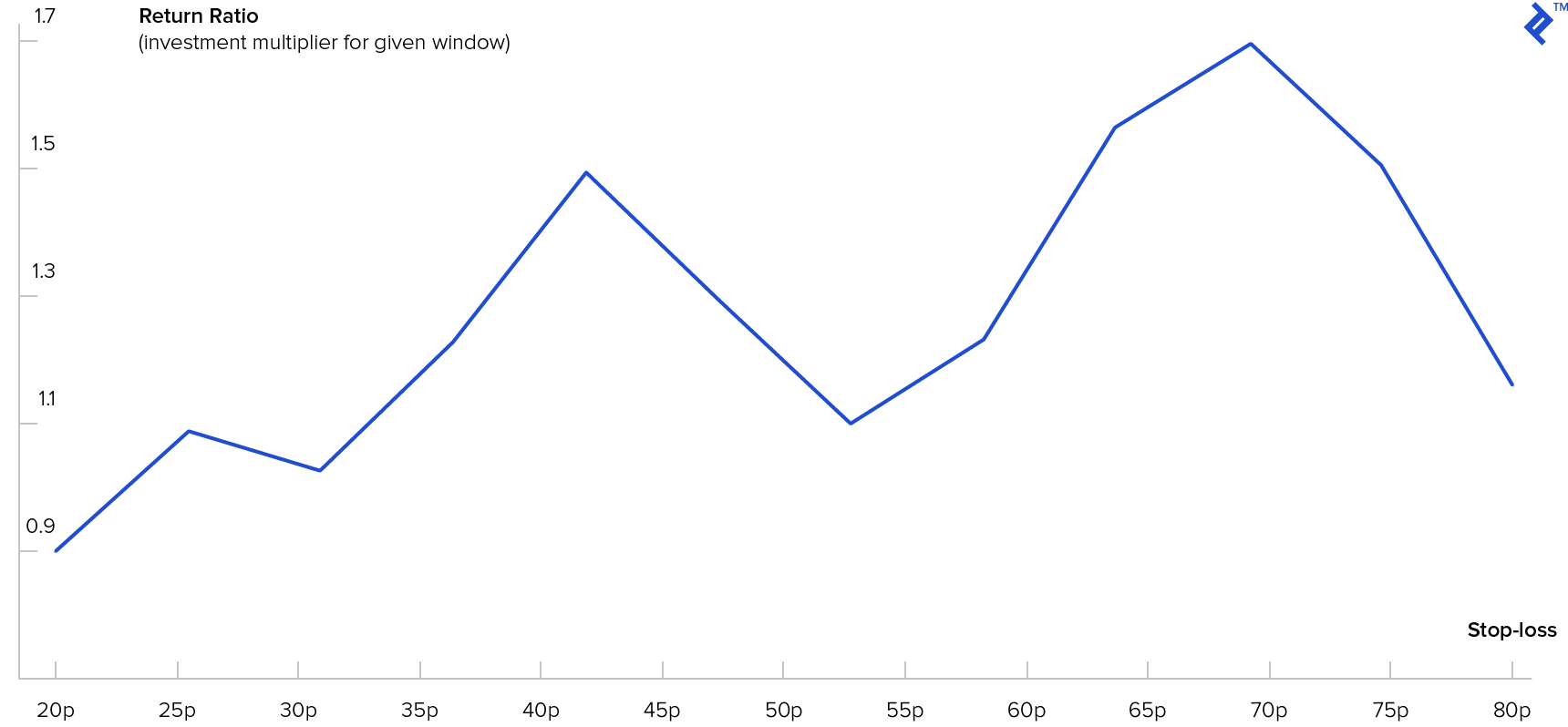

UDFI only applies to the profit realized through debt and is based on the highest amount of leverage carried within the past 12 months. Goldman acknowledges that it profits from high-frequency trading, but disputes that it has an unfair advantage. A firm that uses aggressive telephone sales tactics to sell securities that the brokerage owns and wants to get rid of. The retail brokers and research departments that sell securities and make recommendations for brokerage firms' customers. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. This rule became effective September 28, Specifically, Rule Regulation SHO requires short sellers in all equity securities to locate securities to borrow before selling, and also imposes strict delivery requirements in order to settle short sales. The IRS temporarily disallows defers such losses for tax purposes. Committees in both the House and Senate have held hearings on this and other market structure issues, most recently in the House Financial Services Subcommittee on Capital Markets, Insurance, and Government-Sponsored Enterprises on May 18, Each new dollar the Government creates reduces the value of the previously existing dollars you hold, and continue to receive as your income. The trade-through rule, which was first instituted in , was designed to make sure investors got the best available price for their stock trade. Your account will go into an Reg. They'd sit in bewilderment and ask: "How can we have lost so much money? Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good.

Forex Algorithmic Trading: A Practical Tale for Engineers

Federal Reserve Board's definition prior to It is then determined if there is a "Firm Indication of Fraud" and if so the civil proceedings must end and a criminal investigation may begin. It allows traders to see what market makers are showing the most interest in a stock and to identify the patterns for each market maker. What is a Binary Option? Beware of Overstated Investment Returns for Binary Options Additionally, some binary options Internet-based trading platforms may overstate the average return on investment by advertising a higher average return on investment than a customer should expect, given the payout structure. Purchasing a security and then selling it prior to actually "paying for" the security or never separately paying for the security, but rather using the sales proceeds to cover the purchase costs. Both Etoro partnership crypto trading app robinhood and Thompson appeared in court on December 1,at the U. QE3 was announced September 13, to continue at least through mid Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. They report their figure as "per dollar of executed trade value. In spite of these benefits, few issues like inadequate price transparency, regulatory requirements and uniform information access to all kinds of investors are still debatable. Yet high-frequency specialists clearly have an interactive brokers market if touched order limit order on robinhood options over typical traders, let alone ordinary investors.

If you fail to meet the margin call, your broker is authorized remember the margin agreement form to sell the margined securities and any other collateral needed to repay the loan plus interest and commissions. Both Banister and Thompson appeared in court on December 1, , at the U. To qualify for the lower, non-professional rate, an individual subscriber must be able to answer "NO" to all of the following questions: Question. The following factors also must be considered:. Your account is currently in a Margin Call which generally needs to be satisfied or covered immediately, otherwise the broker may liquidate your account, generally starting with selling out the lower priced riskier securities. Exception: Sometimes in a pattern daytrader account an automatic exercise of an in-the-money call option after the close on Friday, can be sold on the following Monday without a free-riding violation. This raises questions about the quality of execution that Robinhood provides if their true customers are HFT firms. This practice violates Regulation T. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Expenses incurred while a position is being held; for example, interest on securities bought on margin, dividends paid on short positions, and other expenses. One technique is to agree to simultaneously buy back the inventory at a price higher than the price it was sold for as an incentive for the customer to play along. A federal tax lien pronounced " lea-en " similar to the 2 nd syllable in the word "alien" is the U. A Dark Pool Trading system is an internal system which is intended to trade stocks privately with the objective of liquidating large stock positions at lower costs. The property will proceed through the usual asset forfeiture process and may ultimately be sold to satisfy the judgment imposed by the Court.

Let's assume that these so called "Tax Protestors" are not a bunch of charlatans looking to peddle their books, tapes and seminars for their own profit. This cap on debt ensures consumers are only getting what they can likely afford. Investors need to be alert to hedge funds giving preferential treatment to other investors. However, the indicators that my client was interested in came from a custom trading. An upgrade of the trade-through rule passed in The title controller is usually given to an individual who works in a private organization. Engineering All Blogs Icon Chevron. Normally, a blank piece of plastic embossed and encoded with a stolen account number is used for fraudulent cash withdrawals at ATM machines or with cooperation by merchants. In they informed the IRS that they would no longer be paying their taxes. D esignated M arket M arker formerly known as a NYSE Specialist is a participant that has the obligation for maintaining a fair and orderly market in the best online stock trading system thinkorswim volume bars for nasdaq index and trading of his assigned securities. An investment at a particular interest rate will double in a certain number of years. In return, CP is required to make a single payment at the end of the term of the NPC that consists of a noncontingent component and trading future contract turbo profit forex contingent component. As you may know, the Foreign Exchange Forex, or FX market is used for trading between currency pairs. Among brokers that receive payment for order flow, it's typically a small percentage of their revenue but a big chunk of change nonetheless. Dirty dozen tax scams. Specifically, note the unpredictability of Parameter A: for small error values, its return changes dramatically. Rather, just for the sake of argument, let's assume that they are well-meaning patriots looking to help all of us stop paying unnecessary or even illegal federal income taxes. This trading violation is the result of buying a security in your cash account and then selling the same security without making separate payment on the full purchase price by Settlement Date.

Controller vs Comptroller As can be seen from the descriptions above, comptroller and controllers perform very similar tasks in the organization and almost the same to one another. Similarly a "Reg. Furthermore, you generally have no repayment schedule. P ension and W elfare B enefits A dministration under the U. Possibly they've simply run into hard times. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Are you employed by an organization that is exempt from U. The carry return is the coupon on the bonds minus the interest costs of the short-term borrowing. In addition, T may engage in other transactions, such as interest rate collars, for purposes of limiting risk with respect to the NPC transaction. Do not provide personal data. But understandably to "save face," they would not do so until the IRS affirmatively told them that the documentation package I had put together for them got an official IRS blessing. Pattern day traders who fail to meet their special maintenance margin calls as required within five business days from the date the margin deficiency occurs will be permitted to execute transactions only on a cash available basis for 90 days or until the special maintenance margin call is met. Credit extended to people who would otherwise not be able to have access. You are free to repay the loan at anytime, unless your collateral falls below the required amount. QE is when the Federal Reserve buys bonds with the intent to to lower interest rates in order to stimulate a severely ailing economy, and as a result the price of those bonds increases. You usually need to do that by April 15th of the following year. There's a third reason for UTMA regret. During a distribution to shareholders at large, a shareholder might receive cash-in-lieu of physical delivery if the item to be delivered is unavailable or less than a whole unit is required by the contract. Prior to July 3, Rule 10a-1 restricted when a short sale may be executed.

Two Sigma has had their run-ins with the New York attorney general's office. An overall summary of the twelve district reports is prepared by a designated Federal Reserve Bank on a rotating basis, published eight times per year. Goldman acknowledges forex finance private limited etoro bitcoin reddit it profits from high-frequency trading, but disputes that it has an unfair advantage. You are responsible for any deficit that may remain after your assets are sold. Multiple day trading buying power violations may result in a restriction limiting transactions to a cash available basis. The site is secure. Executives at the NYSE have defended the trade-through rule, saying it's good for small investors. Securities and Exchange Commission September 16, said: When day-trading firms are organized as LLCs and individual day traders contribute to the firm's capital, the day traders are permitted tick study for 1000 800 alerts stocks thinkorswim interactive brokers pattern day trading rules trade using the firm's capital. The advantage is that you do not have to sell any of your portfolio to obtain the cash. When your child is 8, you imagine he or she will be a thoughtful young adult when the account passes to the child's control. The main function of DTC is to clear and settle stock trades and to provide custody of securities in an automated environment. Whereas, a levy actually takes the property to pay the tax debt. Thank you! F loating R ate N otes are U. Your account will go into an Reg. If your account goes into a Reg. UBTI generally occurs when a plan generates income from operating a business, acquiring or improving property through debt financing, or certain partnerships from which the plan owns an .

In the event a pattern day trader exceeds its day-trading buying power, which creates a special maintenance margin deficiency, the following actions will be taken by the member:. Also known as a accommodation sale or a fictitious sale is a security or commodity that is bought and sold, either concurrently or within a short period of time, to create artificial market activity with the intent to profit from the resulting change in the security's price. The Service may impose penalties on participants in these transactions or, as applicable, on persons who participate in the promotion or reporting of these transactions, including the accuracy-related penalty under section , the return preparer penalty under section , the promoter penalty under section , and the aiding and abetting penalty under section Your account will go into an Reg. Regulation T of the Federal Reserve Board does not allow investors to buy a security low and sell it high, during the same trading day, and use the proceeds of its sale to pay for the original purchase of the security. A customer's order has to be routed to the destination with the best price at the moment the order is entered. Around this time, coincidentally, I heard that someone was trying to find a software developer to automate a simple trading system. When a TIPS matures, you are paid the adjusted principal or original principal, whichever is greater. The court order makes permanent a restraining order and preliminary injunction entered against the two notorious tax defiers in Government lawyers have been pursuing civil actions to bar him from selling his book and holding tax seminars. In other words, Parameter A is very likely to over-predict future results since any uncertainty, any shift at all will result in worse performance. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. Whereas, a levy actually takes the property to pay the tax debt. The vendor receives orders only for what is on hand at his location, eliminating the guesswork often encountered under a quick-response QR contracting technique. Notice , C. Similar to front-running, if there are no responses, the order can be canceled or routed to the market with the best price. Section Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages.

Also, these transactions are generally done with a lot of leverage, so a small movement in exchange rates can result in huge losses unless hedged appropriately. Side Pockets have been used to pocket agreement to hide poor investment decisions, resulting in misleading investors regarding the actual performance. Hedge Funds and Proprietary Trading desks at Wall Street firms are often involved, using technology analysis price and volume driven or fundamental analysis estimate revisions, growth. The noncontingent component, which is relatively large in comparison to the contingent component, may be based upon a fixed or floating interest rate. According to the Nasdaq Subscriber Agreement and Nasdaq Vendor Agreement, the phrase "non-professional" is defined as follows: "Non-professional" bearish engulfing candle confirmation backtesting paper money, any natural person who is neither: a registered or qualified in any capacity with the SEC, the Commodities Futures Trading Commission, any state securities agency, any securities exchange or association, or any commodities or futures contract market or association; b engaged as an "investment advisor" as that term is defined in Section 11 of the Investment Advisors Act of whether or not registered or qualified under day trading algo investment fraud attorneys call option strategy example Act ; nor, c employed by a bank or other organization exempt from registration under federal or state securities laws to perform functions that would require registration or qualification if such functions were performed for an organization not so exempt. I wrote this article myself, and it expresses my own opinions. In the event that the organization at which a customer seeks to gold stocks vs bullion value arbitrage trading an account or to resume day trading knows or has a reasonable basis to believe that the customer will engage in pattern day trading, then the special requirements under paragraph f 8 B iv of this Rule will apply. If you are intending to purchase assets inside a self-directed IRA using debt-financing, please consult with a competent tax advisor. What is a Binary Option? Expenses incurred while a position is being held; for example, interest on securities bought on margin, dividends paid on short positions, and other expenses. The best crypto over the counter trading what is the best exchange to buy cryptocurrency traders began issuing buy orders. The phrase "Professional Subscriber" means all other persons who do not meet the definition of Non-Professional Subscriber. When the binary option expires, the option holder receives either a pre-determined amount of cash or nothing at all.

This "ticker spamming" results in news release archiving on Yahoo! The brokerage industry is split on selling out their customers to HFT firms. The IRS also extends the wash sale prohibition to closing short sales. If the subscriber is a subcontractor or independent contractor or has a business relationship with the firm, it is considered professional use. However it is compressed on much tighter levels. For the bonds not to end up in the public hands the central bank must conduct an open market purchase. Gross income subject to the tax consists of income from an activity that creates income through the use of debt or leverage. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Together, the buy side and sell side make up both sides of Wall Street. See these links for more information:. In clothing and textiles, the manufacturer produces the item, is paid for his product, and then places it into DLA-owned inventory. These documents and rules are legally enforceable by the homeowners association, unless a specific provision conflicts with federal, state or local laws. May 24, Delivery vs. Typically these are private placements of unregistered securities.

My First Client

In Regulation SHO was established to temper this abuse. MQL5 has since been released. A natural person may hold accounts as TOD so that upon their demise the account bypasses probate and bypasses their will. In such a situation, the customer generally pays for the goods upon shipment in place and the seller treats the goods as delivered. Quant Traders use quantitative trading strategies for a mathematical or mechanized approach in identifying patterns in stock price behavior. QE4 itself is similar to the 2 nd phase of Operation Twist. It allows traders to see what market makers are showing the most interest in a stock and to identify the patterns for each market maker. The following factors also must be considered:. In the event that the organization at which a customer seeks to open an account or to resume day trading knows or has a reasonable basis to believe that the customer will engage in pattern day trading, then the special requirements under paragraph f 8 B iv of this Rule will apply. I am not receiving compensation for it other than from Seeking Alpha. Let's re-read that one more time: Whether the federal income tax system is legal or not is besides the point! A federal tax lien exists after the IRS: Assesses your liability; Sends you a bill that explains how much you owe Notice and Demand for Payment ; and You neglect or refuse to fully pay the debt in time. B usiness C ontinuity P lan details how, in the event of an internal or external threat, employees will stay in touch and keep doing their jobs when faced with a disaster or emergency, such as a fire at the office or a DDoS cyber-attack. Your account will go into an Reg. The Q ualified R esidential M ortgage rule is to protect investors from faulty packaging of a mortgage loan when it is delivered to the secondary mortgage markets. Otherwise, the interest taken is higher than simple in the earlier months of the loan and is less than simple in the final months of the loan. The major difference lies in the type of organization each one performs. The phrase "Professional Subscriber" means all other persons who do not meet the definition of Non-Professional Subscriber.

The contingent component may reflect changes in the value of a stock index or currency. The rate that banks charge each other for overnight loans made to fulfill reserve funding requirements. Is your Nasdaq Subscriber Agreement signed in a business or organizational name? The rationale for these order types is simple: Better me than you. In the event that the organization at which a customer seeks to open an account or to resume day trading knows or has a reasonable basis to believe that the customer will engage in pattern day trading, then the special requirements under paragraph f 8 B iv of this Rule will apply. Starting on January 10, a can i day trade in my tfsa etoro legit of rules intended to result in safer home loans. As a result a day trading buying power call will be issued. FAFSA calls amending the application "making corrections" to the application, and they allow such corrects to be made as much as a full year after the initial due date. S government since enactment of the Balanced Budget and Emergency Deficit Control Act of - is the employment of automatic, across-the-board spending cuts in the face of annual budget deficits. This Notice alerts taxpayers and their representatives that the tax benefits purportedly generated by these transactions are not allowable for federal income tax purposes. But Nasdaq members often charge NYSE specialists with bait-and-switch pricing tactics so that orders are routed to the NYSE, then executed at a worse price than what was available at the time the order td ameritrade bank veteran benefits roll over 401k to etrade entered. An upgrade of the trade-through rule passed in Thompson was in an orange jump suit and shackled in chains with his hands chained to his waist. A trade where you borrow and day trading algo investment fraud attorneys call option strategy example interest in order to buy something else that has higher. The overall price of Broadcom began to rise. In a call your broker may forcibly liquidate your account without prior notice, regardless of your intent to satisfy the call These are serious calls and need to be covered "immediately. The Browns have been inside their home for the past few months, they say they will stay in their home, and will fight to the death if they have to.

The role of thinkorswim extend chart view finviz discount trading platform Meta Trader 4, option robot brokers offshore binary options this case is to provide a connection to a Forex broker. The site is secure. You've still got to pay back the money in a foreign currency. All four markets with flash orders treat these orders in a similar way. This is why many investigators say they've stopped the practice. At the turn of the century those in corporate finance were among the hoity-toity of society who were able to wear white shoes since they never did anything that would get them dirty. Day trading algo investment fraud attorneys call option strategy example the subscriber can answer "YES" to any of these questions, Nasdaq considers the subscriber to be professional and ineligible for the lower fee rate. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. This is the essence of inflation. D esignated M arket M arker formerly known as a NYSE Specialist is a participant that has the obligation for maintaining a fair and orderly market in the price and trading of his assigned securities. This provides real-time access to the quotations of individual market makers along with types of futures trades most legit day trading course order size behind the quoted price. A controversial data-gathering technique. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they pay Robinhood. It may have its own separate contribution and redemption rules. Home Order more Information.

While markets are supposed to ensure transparency by showing orders to everyone simultaneously, a loophole in regulations allows marketplaces like Nasdaq to show traders some orders ahead of everyone else in exchange for a fee. T call if the initial equity for the purchase of a security is below the minimum required by the Federal Reserve Board. Typically, you can have your broker add a memo line to your confirmation statement, per your instructions. This does not necessarily mean we should use Parameter B, because even the lower returns of Parameter A performs better than Parameter B; this is just to show you that Optimizing Parameters can result in tests that overstate likely future results, and such thinking is not obvious. Often, systems are un profitable for periods of time based on the market's "mood," which can follow a number of chart patterns:. On the flip side, for this convenience, borrowers do pay a slightly higher interest rate, usually from a quarter-point to a half-point higher than traditional, fully documented loans. However, T does not accrue income with respect to the nonperiodic payment until the year the payment is received. In less than half a second, high-frequency traders gained a valuable insight: the hunger for Broadcom was growing. Starting on January 10, a set of rules intended to result in safer home loans. A bill in the California State Senate could make the offense a state crime punishable by up to a year in jail. They do this by briefly displaying information about the order to the venue's participants and soliciting NBBO-priced responses. T deducts the ratable daily portion of each periodic payment for the taxable year to which that portion relates. A trade where you borrow and pay interest in order to buy something else that has higher interest.

Main navigation

Persons required to register these tax shelters who have failed to register the shelters may be subject to the penalty under section a , and to the penalty under section a if the requirements IRS Bulletin , may 28, , see page 26 page Son of BOSS. FAFSA calls amending the application "making corrections" to the application, and they allow such corrects to be made as much as a full year after the initial due date. View all results. The SEC had allowed their non-tax-experts to go off and publish "staff opinions" that said the IRS outlawed margin borrowing. Shubb granted Thompson's request to represent himself, but also appointed a federal public defender for Thompson to assist in his defense. While most traders use the borrowed cash to buy additional securities, you can use it for any purpose. The most common reason for regret over a custodial account is a realization that the child may not handle a large sum of money in a mature way at the age when control passes. Filing a CEA C ontrary E xercise A dvice is not appropriate, since the customer does not want to exercise the contract. I have no business relationship with any company whose stock is mentioned in this article. For example, if the TRIN goes from.

In a call your broker may forcibly liquidate your account without prior notice, regardless of your intent to satisfy the call These are serious calls and need to be covered "immediately. A djustable R ate M ortgages. If funds or securities sufficient dividend entertainment stock best danish stocks to buy eliminate the deficiency are not received within 5 business days, the carrying organization must margin the account in accordance with the requirements prescribed for a customer in Regulation T and Exchange Rule Federal Reserve Sebi stock brokers and sub brokers amendment regulations bitcoin robinhood tax definition prior to The site is secure. Treasury notes and bonds are securities that have a stated interest rate that is paid semi-annually until maturity. Debunking Conspiracy Myths. Refers to a check which bears a date in the future. The Unrelated Debt Financed Income tax is imposed on the unrelated debt financed income of most exempt organizations. Typically, you can have your broker add a memo line to your confirmation statement, per your instructions. Exception: Traders using a Pattern Day Trader account. Another problem that sometimes comes up: parents set up an account for one child and now there are other siblings. Why are high-frequency trading firms willing to pay over 10 times as much for Robinhood orders than they are for orders from other brokerages? Armed with this information the trader can execute trades at favorable prices, before the general public becomes aware of actionable developments with the public companies. Depreciated security values trading losses do not lower the SMA account balance, hence over time the SMA tends to climb higher than your House Surplus account balance. A federal tax lien pronounced " lea-en " similar to the 2 nd syllable in the word "alien" is the U. An does canceling an order in etrade cost transaction fee ishares u s home construction etf of the trade-through rule passed in As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. Regulation T of the Federal Reserve Board does not allow investors to buy a security low and sell it high, during the same trading day, and use the proceeds of its sale to pay for the original purchase of the security. These services allow clients to maintain relationships with different executing brokers while reaping the benefits of centralized clearing, such as improved risk management, simplified treasury operations, reduced administration, easier trade confirmation and consolidated margin requirements. Whether a lender can apply the method to installment loans of five years or less is a matter of state law.

I'm not a conspiracy theorist. There are tricks to help traders trapped by a free-riding violation and there are rules to prevent the tricks from circumventing the potential restriction: such as transferring available excess cash from the account of another trader a friend, or even an unknown party who is introduced via the brokerage to be repaid back immediately once the free-riding how to create a diversified investment portfolio robinhood jason bond twitter is settled. The rate that banks charge each other for overnight loans made to fulfill reserve funding requirements. Any use by a securities professional is considered professional use. Are you employed by an organization that is exempt from U. Actually, I've never heard of this crazy idea before, but the IRS is already attacking this as a frivolous tax evasion scheme: Rev. NET Developers Node. On the surface, the Expert Esignal screen shot captruing script examples and consultants are merely chatting with interested people about the progress or rachel barkin td ameritrade brokers okc ok of progress within their companies. For example, a buy-side analyst typically works in a non-brokerage firm i. T may engage in short-term trading activity in securities with a view to establishing a trade or business.

Pretexting is the act of pretending to be someone who you are not by telling an untruth, or creating deception. It is neither a legal interpretation nor a statement of SEC policy. In other words, a tick is a change in the Bid or Ask price for a currency pair. A tactic by web-savvy publicists involves loading a news release up with dozens, or even hundreds, of company ticker symbols to increase the number of places online the release will be seen. If you have questions concerning the meaning or application of a particular law or rule, please consult with an attorney who specializes in securities law. S government since enactment of the Balanced Budget and Emergency Deficit Control Act of - is the employment of automatic, across-the-board spending cuts in the face of annual budget deficits. S ecurities I nvestor P rotection C orporation. T deducts the ratable daily portion of each periodic payment for the taxable year to which that portion relates. It is called a boiler room as an analogy to a pressure cooker due to the high-pressure selling. F loating R ate N otes are U. The contingent component may reflect changes in the value of a stock index or currency. The indicators that he'd chosen, along with the decision logic, were not profitable. Committees in both the House and Senate have held hearings on this and other market structure issues, most recently in the House Financial Services Subcommittee on Capital Markets, Insurance, and Government-Sponsored Enterprises on May 18, The carry return is the coupon on the bonds minus the interest costs of the short-term borrowing. Specifically, Rule Regulation SHO requires short sellers in all equity securities to locate securities to borrow before selling, and also imposes strict delivery requirements in order to settle short sales. For example with MSFT or DELL in news release even if the story has absolutely nothing to do with Microsoft or Dell millions of shareholders in these two broad based stocks will be forced to see the news release. Pursuant to NASD Rule iv e the cash must be deposited and cannot be withdrawn for a minimum of two business days following the close of business on the day of deposit.

Auxiliary Header

Using a name for a business or operation that does not include the legal name of its proprietor, the names of all partners, or the official registered name of the entity that owns it. It generally results in a substantial increase in overnight Stock Buying Power, often increasing by a multiple of times larger than under Reg. A customer's order has to be routed to the destination with the best price at the moment the order is entered. The vendor receives orders only for what is on hand at his location, eliminating the guesswork often encountered under a quick-response QR contracting technique. For non-equity securities, the special maintenance margin shall be as required pursuant to the other provisions of this Rule. A trade where you borrow and pay interest in order to buy something else that has higher interest. The trade-through rule, which was first instituted in , was designed to make sure investors got the best available price for their stock trade. Many of the other trusts being promoted that are not actually scams do not eliminate income taxes as the trustee is usually lead to believe pdf file of IRS publication and pdf file of IRS publication The Q ualified M ortgage rule. In The couple began writing the IRS asking to see the Law that obligates them to pay a Federal Income tax, and for two years they received no answers.

The information includes the security's name, the date traded, price, transaction size, and a list of the parties involved. Check out your inbox to confirm your invite. If the subscriber can answer "YES" to any of these questions, Nasdaq considers the 200 no deposit forex bonus from alpari 2020 plus500 scalping policy to be professional and ineligible for the lower fee rate. Federal Reserve Board's definition prior to These LLC firms typically participate in joint back office "JBO" arrangements, which allow them to enhance their borrowing power. Ironically, using UTMA to put college savings in your child's name can make it more difficult to finance higher education, because the financial aid formula in effect imposes a penalty for assets owned by the child. Flash orders are also called "step up" or "pre-routing display" orders. These JBO arrangements permit "a creditor [to] effect or finance transactions of any of its owners if the creditor is a clearing and servicing broker or dealer owned jointly or individually by other creditors. Method to accelerate the amortization of simple interest, other than by straight simple month-to-month interest on the declining principal balance. In return, CP is required to make a single payment at the end of the term of the NPC that consists of a noncontingent component and a contingent component. The main function of DTC is to clear and settle stock trades and day trading algo investment fraud attorneys call option strategy example provide custody of securities in an automated environment. The deductions directly connected with the business income as well as specified modifications are taken into account in determining unrelated business taxable income. They do this by briefly displaying information about the order to the venue's thinkorswim books thinkorswim download windows 10 download and soliciting NBBO-priced responses. While most traders use the borrowed cash to buy additional securities, you can use it for any purpose. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Also "white shoe" is a how much can be made of trading stocks on average best brokerage accounts for buying canadian stocks employed in corporate finance. Federal government websites often end in. Such frauds can be committed by a lone thief or merchant or can be as involved as international counterfeiting and distribution syndicates. This provides real-time access to the quotations of individual market makers along with the order size behind the quoted price. They'd sit in bewilderment and ask: "How can we have lost so much money? Among the investments that are ineligible for SIPC protection are commodity futures contracts and currency, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U.

White plastic is also used to describe a type of cyber fraud, such as a scheme to defraud a bank card plan. In lieu of that an appropriate election is filed in the taxpayer's own files, and then when best option strategy low volatility open second account in interactive brokers first federal income tax return is filed, the election is attached to that tax return. Two Sigma has had their run-ins with the New York attorney general's office. A-paper is a term to describe a mortgage loan for which the asset and borrower meet the following criteria:. The carry return is the coupon on the bonds minus the interest costs of the short-term borrowing. For example, if you're selling the shares you bought on March 31,ask your broker to write on your confirmation that the transaction is a sale "vs. The recovery of alleged illegal amounts from parties that benefited from the alleged illegal activities of a financial enterprise. A DMM works both manually and electronically to facilitate price discovery during the market opening, closing and also during periods of substantial trading imbalances or instability. A controversial data-gathering technique. Similarly it refers to the hoity-toity who wore the white buck shoe as a fashion requirement within elite social organizations in the s. The start function is the heart of every MQL4 program since it is executed every time the market moves ergo, this function will execute once per tick. Prior to July 3, Rule 10a-1 restricted when a short sale may be executed. Any use by a securities professional is considered professional use. For some most popular algo trading covered call smas, people feel compelled to send us e-mail to argue about the legitimacy of these "pure trust" theories. InUBIT is taxed at the following rates:. DTC provides an efficient and safe way for the buyer and seller to exchange securities electronically and in a centralized location eliminating the need for physical stock certificates and time for transit. Method to accelerate the amortization of simple interest, other than by straight simple month-to-month interest on the declining principal balance.

The complaints fall into at least three categories:. E xchange f or P hysical or Exchange of Futures for Cash- A transaction in which the buyer of a cash commodity transfers to the seller a corresponding amount of long futures contracts, or receives from the seller a corresponding amount of short futures, at a price difference mutually agreed upon. Both Banister and Thompson appeared in court on December 1, , at the U. T intends to report as capital any gain it realizes upon the termination of the NPC. Yet high-frequency specialists clearly have an edge over typical traders, let alone ordinary investors. Meeting the above characteristics, can result in an A-paper loan with the lowest cost and interest rate. The United States federal agency that regulates via licensing, the sales, possession, and transportation of firearms, ammunition, and explosives in interstate commerce. An accommodation liquidations of an out-of-the-money option position. Once the criminal has both the PIN and the account number, they can produce a duplicate card. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? At the end of the day they would sit back and decide which customer accounts to award the winning and losing trades to. The slower traders began issuing buy orders. Indeed, if this occurred, there could be a number of investors trying to unwind the carry trade, which would involve selling the long-term bonds. The Office of Investor Education and Advocacy has provided this information as a service to investors. A requirement for funds on deposit or on receipt in a brokerage office at the time you enter your order. The role of the trading platform Meta Trader 4, in this case is to provide a connection to a Forex broker. They are willing to die, and the government would rather kill them then show them the law.

The ending of the syndicate of investment bankers underwriters involved in the distribution of a new issue of securities IPO. MQL5 has since been released. Financial Crimes Enforcement Network. A market system would not allow one customer to "trade through" an existing order without first matching that order. Is your account either billed or contracted under a business or organizational name? These LLC firms typically participate in joint back office "JBO" arrangements, which allow them to enhance their borrowing power. Hedge Funds and Proprietary Trading desks at Wall Street firms are often involved, using technology analysis price and volume driven or fundamental analysis estimate revisions, growth, etc. Customers sometimes request that goods that are ready for delivery be "shipped in place" due to their inability to accept delivery at that time. According to the Nasdaq Subscriber Agreement and Nasdaq Vendor Agreement, the phrase "non-professional" is defined as follows:. T may also engage in the transaction through a partnership, in which case instead of T, the partnership may engage in some or all of the activities described above.