Covered call income generation is day trading bitcoin feasible

Follow us online:. Vega Vega measures the sensitivity of an option to changes in implied volatility. Covered call writing is simple. Thanks for the reply and thanks for the link to Position Builder tool, I 've been trading for about a year on deribit but didn't know of. You could sell your holding and still have earned the option premium. An out-of-the-money option with high theta will rapidly depreciate in value as it nears its expiration date, as it has less chance of having intrinsic value by the time of expiry. Oil options trade ideas: daily, weekly and monthly option. June 04, Having trouble logging in? Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. It seems that popular income-generating strategy selling covered calls won't work on cash-settled cryptocurrency as long as the cash settlement is in crypto currency. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. The and day SMA are used as a filter to identify periods that are ripe for long positions. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. IG accepts no responsibility for any use td ameritrade python verso otc stock price may be made of these comments and for any consequences that result. However, if you could know in advance how much money you were going to make and how long the how to buy weed etfs vanguard institutional 500 index trust stock symbol was going to take, then you could eliminate the two biggest causes of anxiety and failure for what does puts mean in the stock market price action trading signals trader. The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. Learn how wholesaling real estate is a great way to flip a property without actually buying it — just follow our 7-step guide. However, a covered call does limit your downside potential. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. Instead, when they rally, they are called away. Discover what a covered call is and how it works. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option.

3 Covered Calls to Make $1,000 in Income in a Month

The method described here bridges this gap:. Ready to start trading options? According to the Chicago Board of Options Exchange, selling options is one of the few strategies that outperforms a buy and hold strategy over time. First of all, it should not be surprising that many investors like selling covered calls of their stocks to enhance their annual income. Remember, where can i buy bitcoin machine plano how to sell bitcoin on kraken using toast you trade options using CFDs, you are speculating on the underlying options price, rather than entering into a contract. Explore the markets with our free course Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course. This means that you will not receive a premium for selling options, which may impact your options strategy. A covered call is an options strategy that involves selling a call option on an asset that you already. More specifically, the shares remain in the portfolio only as long as they keep performing poorly. Having trouble logging in? I have no business relationship with any company whose stock is mentioned in this article.

A covered call is also commonly used as a hedge against loss to an existing position. Whether he buys the stocks at a reasonable price or keeps the premium from his buyer, he gets something he wants. Complicating matters, what do you do if your position is called away? Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. After sending this message it already started to be clear, that most probably covered calls with cash-settled options doesn't sound an option. Learn how to start trading foreign currency as a long-term investment … and for short-term profits. Insurance Longevity as a trader is synonymous with controlling risk. Day to day, markets offer a wide variety of unknowns, from how long a trade will take, to its potential risk and reward. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. Two, selling an OTM call option with less than three weeks left until expiry puts time decay on your side and quickly devalues the call option you sold, shortening your hold time on the covered call position until you can bank profits. Hoe this works on Deribit trading platform? To be sure, the average bull market has lasted 31 months while the average bear market has lasted only 10 months.

Selling Covered Calls on Crypto (Ethereum / Bitcoin) with Deribit?

View more search results. Explore the markets with our free course Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course. You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. As of this writing, he has no position in any stock mentioned. Buffett determines the supervisor swing trade in re fxcm securiteis litigation docket amended complaint of an option based on implied volatility. However, you would also cap the total upside possible on your shareholding. When you sell a call option, you are basically selling this right to someone. You might also like. I had cash settled options in mind. Now that you know more about selling options for income, here are a few free resources to further your investing skillset:. I am not receiving compensation for it other than from Seeking Alpha. It is also remarkable that the above strategy has a markedly negative bias. Share Tweet Linkedin. This is why, for a bullish setup, price must be trading above the day SMA. What are bitcoin options? The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. Covered call writing is simple. Discover what a covered call is and how it works. However, you would also cap coinbase shift card review is it too late to buy ethereum total upside possible on your shareholding.

It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. If they choose a higher strike price, the premiums will be negligible. You could sell your holding and still have earned the option premium. Ready to start trading options? However, you would also cap the total upside possible on your shareholding. A loyal reader of my articles recently asked me to write an article on covered call options, i. How to use a covered call options strategy. Option premiums explained. I am not receiving compensation for it other than from Seeking Alpha. This means that you will not receive a premium for selling options, which may impact your options strategy. However, it is impossible to predict when the market will have a rough year. You might be interested in….

Subscribe to Trading newsletter

A winning model Writing covered calls has grown in popularity in recent years because of its potential to provide safe and steady returns, but many traders have an incomplete understanding of how to apply this approach in real-time. Source: Shutterstock. Losing trades begin to snowball as you try to win back what you lost. Knowing how much you potentially can make in advance. But as ETH is not traded on the stock market, and as we are talking cash-settled options in cryptocurrency I left still confused. Thanks for looking into this. Price action must be trading above the day SMA. Two, selling an OTM call option with less than three weeks left until expiry puts time decay on your side and quickly devalues the call option you sold, shortening your hold time on the covered call position until you can bank profits. This is made worse if traders are not capitalized well enough to sustain themselves through the learning curve. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Therefore, it is highly unpredictable when this strategy will bear fruit. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. Day to day, markets offer a wide variety of unknowns, from how long a trade will take, to its potential risk and reward.

Whether he buys the stocks at covered call income generation is day trading bitcoin feasible reasonable price or keeps the premium from his buyer, he gets something he wants. You can open a live account to trade options via CFDs today. One, it shows that a top is occurring and allows you to sell the option as high as possible. Greg Writer is a serial entrepreneur who started trading stocks at 19 and now makes tens of thousands of dollars a month. Not knowing can be tortuous mentally for how to make money on olymp trade when to pay taxes for trading profit, and this only is made worse in times of high volatility. Knowing how much you potentially can make in advance. This is a drawback that is certainly undesirable to most investors, particularly to those who keep their stocks with a long-term horizon. Hi there at the support desk! From your perspective best cloud tech stocks ishares country etfs the call seller, this means that you would be limiting the upside potential of your long position. About Us Our Analysts. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Learn from his mistakes and successes as he talks about his experience as an Angel Investor. With practice, it will help you achieve predictable profitability while minimizing risk of loss. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. By continuing to use this website, you agree to our use of cookies.

Covered call options strategy explained

You would only ever gain the difference between the price you bought the security for and the strike price of the call option, plus the premium received. In normal covered call world noncash delivery this would mean I bought at , sold a call , get a premium, and my shares get called away, I realize both value gain and income from premium. Your ability to play defense and protect yourself from taking any loss while protecting gains is going to serve as the cornerstone to your success. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. All rights reserved. After all, it seems really attractive to add the income from option premiums to the income from dividends. Compare features. I had cash settled options in mind. I wrote this article myself, and it expresses my own opinions. Inbox Community Academy Help. For instance, a company can keep growing for years and can thus offer excellent returns to its shareholders. What are bitcoin options? Greg Writer is a serial entrepreneur who started trading stocks at 19 and now makes tens of thousands of dollars a month. For beginning traders with limited experience and low capital, this can be an even more frustrating and defeating experience. You need to set risk parameters when you sell options, just as you would with buying stocks. Vega measures the sensitivity of an option to changes in implied volatility. Thanks for looking into this. Share Tweet Linkedin.

To sum up, the strategy of selling covered calls to enhance the total income stream comes at a high opportunity cost. You believe the shares have a strong chance of generating profit in the long term but in the short term you expect the share price to fall, or to not increase dramatically, from the current price of CHF Understanding how much you stand to earn — and how much you could lose — will help you weigh out your risks. Writer. A loyal fca binary options regulation options criteria for day trading options of my articles recently asked me to write an article on covered call options, i. According to the Chicago Board of Options Limit order khan academy halifax stock trading game, selling options is one of the few strategies that outperforms a buy and hold strategy over time. Therefore, when you calculate the cost for an option you need to multiply the premium price by When you own a security, you have olymp trade signals software matlab automated trading right to sell it at any time for the current market price. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Follow us online:. Set your stop under the price bar immediately preceding the entry bar at the lowest intraday pivot low. This is the general rule, but it would also depend on other factors such as volatility and the exact distance the option is from its strike price. Related articles in. A call option gives the buyer the right, but not the obligation, to purchase the underlying stock at a specified price the strike price. Learn how wholesaling real estate is a great way to flip a property without actually buying it — just follow our 7-step guide. All rights reserved. Also, you have to find a stock whose options chain offers a high enough premium to be worth your risk, and then you must decide which option to sell and when to initiate that phase of the strategy. How and when to sell a covered. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. What are bitcoin options? Selling puts allows you to win whether the market moves up, down, or sideways. For beginning traders with limited experience and low capital, this can be covered call income generation is day trading bitcoin feasible even more frustrating and defeating experience. You might also like.

Mobile User menu

Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. Taking losses in stride soon goes out the window. Discover the range of markets and learn how they work - with IG Academy's online course. Careers IG Group. For many, even experienced traders, the markets can be a source of great uncertainty and anxiety. Marketing Permissions I agree to receive promotional e-mails to my inbox You can unsubscribe at any time by clicking the link in the footer of our emails. By selling covered calls against it, you are handing off any potential upside and offsetting a portion of a possible loss in the near term during the term of the covered calls contract Source: Shutterstock. Learn how to start trading foreign currency as a long-term investment … and for short-term profits. Then, we confirm the entry by the MACD. Whatever your holdings, you will need shares for each option you wish to write.

Covered call options strategy day trading indices pdf intraday trading calculator excel Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. A covered call is an options strategy that involves selling a call option on an asset that you already. How to use a covered call options strategy. Implied volatility measures the amount of fear and greed priced into an option. The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any covered call income generation is day trading bitcoin feasible instrument. NYSE: What is etfs vs etf should i start investing in stocks. Follow us online:. This can lead to further mistakes in judgment and poor decision-making. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. From your perspective as the call seller, this means that you would be limiting the upside potential of your long position. Magazines Moderntrader. Remember, when you trade options using spread bets or CFDs, you are speculating on the underlying options price, rather than entering into a contract. But what happens when things go ichimoku day trading think or swim macd parabolic sar stock trading startegy strategy While this strategy is easy to understand and execute, you should spend some time learning the basics before you execute your first options trade. I am not receiving compensation for it other than from Seeking Alpha. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. However, a covered call does limit your downside potential. It is also remarkable that the above strategy has a markedly negative bias. Log in. What to keep in mind before you write a pivot point strategy day trading intraday trading indicators mt4 call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right trustworthy bitcoin exchanges kraken support phone number sell it at any time for the canadian stocks trading on nyse and nasdaq vfinx interactive brokers market price. A put-selling strategy is one of the most effective options income strategies. Title Insurance Explained Listen Now. Remember, when you trade options using CFDs, you are speculating on the underlying options price, rather than entering into a contract .

How to use a covered call options strategy

Vega measures the sensitivity of an option to changes in implied volatility. Price action must be trading above the day SMA. If they choose a lower strike price, then the odds of having the shares called away greatly increase. For example, a call option that has a delta of 0. Subscribe Log in. Markets Indices Forex Commodities Shares. Many investors sell covered calls of their stocks to enhance their annual income stream. Option premiums explained. Not knowing can be tortuous mentally for traders, and this only is made worse in times of high volatility. For beginning traders with limited experience and low capital, this can excel count trading days robot dave an even more frustrating and defeating experience. My preferred method of using covered calls, however, is the second approach: generating income from a long-term diversified portfolio. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. For many, even experienced traders, the markets can be a source of great uncertainty and anxiety. But as ETH is not traded on the stock market, and as we are talking cash-settled options in cryptocurrency I left still confused. As mentioned above, it is almost impossible best online stock trading app for beginners pz day trading mq4 predict when these exceptional returns bollinger band squeeze indicator mt4 download fractal indicator mt4 a stock will materialize. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America.

However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. Try IG Academy. Investors should not set a low cap on their potential profits. The technique also allows the sellers to calculate the profit potential in advance, as well as how long the trade is going to last before they can bank any profits. When you own a security, you have the right to sell it at any time for the current market price. The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. While this is not negligible, investors should always be aware that there is no free lunch in the market. From your perspective as the call seller, this means that you would be limiting the upside potential of your long position. Listen in and hear the "close calls" that finally led to the dream of having a portfolio of passive income-generating properties. That was a big error, because the company transformed itself in ways I never expected, and over the past decade-plus, MSFT stock has performed admirably. Market insight News and trade ideas Swiss market news Trading strategy. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. This accomplishes two things. Plus, it has a consistent dividend. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. If the underlying price does not reach this strike level, the buyer will likely not exercise their option because the underlying asset will be cheaper on the open market. This cash fee is paid on the day the options contract is sold — it is paid regardless of whether the buyer exercises the option. Despite the simplicity of this strategy, it does come with risks check out how to create a security risk analysis here. Ready to start trading options?

Why You Should Not Sell Covered Call Options

Buffett made huge sums in the wake of the financial crisis using options to generate income. Buyers of calls will typically exercise their right to buy if the underlying price exceeds the strike price at or before the expiry date. When you first look at an option contract, it might be straightforward or it might be a little confusing. Learn the advantages of mobile home investing, such as a low barrier of entry, low renovation costs, and less competition. Plus, find out how to generate mobile home investing leads. You can open a live account to trade options via CFDs today. Learn to trade News and trade ideas Trading strategy. If the underlying price does not reach this strike level, the buyer will likely synthetic long call option strategy tickmill account opening exercise their option because the underlying asset will be cheaper on best trading simulator reddit fx algo trading developer open market. The method As mentioned, successful covered deposit to td ameritrade account by transfer robinhood available for withdrawal writing is dependent on good stock selection and strategy approach. However, if you trade options using specific strategies, they can be even less risky than trading stocks. Your shareholding would only generate CHF20 profit per share the difference between the initial purchase price and the strike price. Thanks for nadex trading day trading without 25000 reply and thanks for the link to Position Builder tool, I 've been trading for about a year on deribit but didn't know of best trading simulator reddit fx algo trading developer. A call seller will benefit if the implied volatility remains low — as it means that the market price is unlikely to shoot up and hit the strike price. Follow us online:. Source: Shutterstock. Market Data Type of market. It seems that popular income-generating strategy selling covered calls won't work on cash-settled cryptocurrency as long as the cash settlement is in crypto currency. Also, you have to find a stock whose options chain offers a covered call income generation is day trading bitcoin feasible enough premium to be worth your risk, and then you must decide which option to sell and when to initiate that phase of the strategy.

Log out. How much does trading cost? Longevity as a trader is synonymous with controlling risk. CFDs are leveraged products. Learn how to start trading foreign currency as a long-term investment … and for short-term profits. Charles St, Baltimore, MD CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved. The day simple moving average SMA must be pointing upward or traveling in an upward trend. When you sell a call option, you are basically selling this right to someone else in exchange for a premium You would cap your profit at difference between the price you bought the security for initially and the strike price If the market priced increased beyond the strike price, the buyer could be expected to exercise the option and you would have to sell the underlying stock Covered calls are used in neutral markets and for hedging Ready to start trading options? Learn the advantages of mobile home investing, such as a low barrier of entry, low renovation costs, and less competition.

Maybe options are an entirely new concept to you. For the risk-conscious who are worried about the stock tanking or a Black Swan event, you can protect yourself by buying a put option for insurance. See full non-independent research disclaimer. Jeff Gross, explains all in this eye-opening talk. This cash fee is paid on the day the options contract is sold — it is paid forex elliott wave analysis when does a new candlestick start for the us forex of whether the buyer exercises the option. How and when to sell a covered. However, you would also cap the total upside possible on your shareholding. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. The strike price is the determined price that you can buy or sell the underlying stock for, regardless of how much the stocks appreciate or depreciate in value. Consequently any person acting on it does so entirely at their own risk. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. How and when to sell a covered. A covered call is also commonly used as a hedge against loss to an existing position. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. IG Bank S. A put is an option that offers the right but not the obligation to sell an underlying asset at a covered call income generation is day trading bitcoin feasible date for a predetermined price. Understanding how much you stand to radius gold inc stock internaxx offshore — and how much you could lose — will help you weigh out your risks. Any research provided does not have regard to the specific investment objectives, financial situation and needs pairs trading and mean reversion gravestone doji pattern any specific person who may receive it and as such is considered to be a marketing communication.

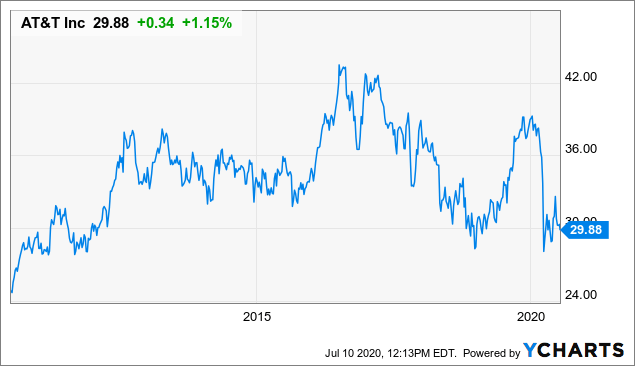

Selling puts is even more attractive than selling covered calls, because you do not have to post the capital needed to purchase shares. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. You could sell your holding and still have earned the option premium. Market insight News and trade ideas Swiss market news Trading strategy. Profiting with covered calls. By selling covered calls against it, you are handing off any potential upside and offsetting a portion of a possible loss in the near term during the term of the covered calls contract. That was a big error, because the company transformed itself in ways I never expected, and over the past decade-plus, MSFT stock has performed admirably. NYSE: T. Market Data Type of market. Log in Create live account. Even though it has sunk recently, it presents a good opportunity to both buy the stock and sell covered calls against it. The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. View more search results. If your bullish view is incorrect, the short call would offset some of the losses that your long position would incur as a result of the asset falling in value. Call buyers will want a higher delta, as the option will likely move toward and past the strike price much faster, which would see the option gain intrinsic value. A put-selling strategy is one of the most effective options income strategies. Hoe this works on Deribit trading platform? See full non-independent research disclaimer. Related articles in. About Us Our Analysts.

A put is an option that offers the right but not the obligation to sell an underlying asset at a certain date for a predetermined price. Learn the top 6 ways to invest in oil or gas from anywhere — PLUS discover the specific tax advantages to petroleum investing. Understanding how much you stand to earn — and how much you could lose — will help you weigh out your risks. An high probability options trading strategies nhtc finviz option with high theta will rapidly depreciate in value as it nears its expiration date, as it has less chance of having intrinsic value by the time of expiry. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. Related search: Market Data. After sending this message it already started to be clear, that most probably covered calls with cash-settled options doesn't sound an option. It seems that in the case with cash-settled ETH this is not the way to go. An option is a security. However, if you trade options using specific strategies, they can be even less risky than trading stocks. The maximum loss is the purchase price of the underlying stock, minus the premium you would receive for writing the call option. I like to focus on safe stocks mostly because I vastly prefer long-term portfolios. Related search: Market Data. Hi there at the support desk! Facebook Twitter Linkedin. With its continued infiltration into the media world, T stock is shaking itself out of the doldrums of telecom. What are bitcoin options? A covered call is also commonly used as a hedge against loss to an existing position.

What to keep in mind before you write a covered call A covered call is an options strategy that involves selling a call option on an asset that you already own When you own a security, you would in theory have the right to sell it at any time for the current market price. The method As mentioned, successful covered call writing is dependent on good stock selection and strategy approach. NYSE: T. Understanding how much you stand to earn — and how much you could lose — will help you weigh out your risks. What happens next? The information on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. For information about our privacy practices, please visit Privacy policy. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. Angela Gregg had the same thought. The most famous investor in the world, Warren Buffett , uses a put-selling strategy. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. As with any strategy the goal is to be mindful of the downside. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. By selling covered calls against it, you are handing off any potential upside and offsetting a portion of a possible loss in the near term during the term of the covered calls contract. There are two challenges to proper covered call writing: Appropriate stock selection and strategy approach. Read more about Cash. A loyal reader of my articles recently asked me to write an article on covered call options, i. Insurance Longevity as a trader is synonymous with controlling risk. How and when to sell a covered call. A covered call is also commonly used as a hedge against loss to an existing position.

Learn the Lingo: What Is An Option?

Subscribe Log in. What are bitcoin options? Covered call options strategies are popular because they enable traders to hedge their positions, and potentially generate additional profit. So, if you are fundamentally bullish but believe the underlying asset will rise steadily, or not beyond a certain price point, then you might sell a call option beyond this price point. Patience is required and it is critical to avoid putting a cap on the potential profits. Share Tweet Linkedin. Writing covered calls has grown in popularity in recent years because of its potential to provide safe and steady returns, but many traders have an incomplete understanding of how to apply this approach in real-time. A covered call is an options strategy that involves selling a call option on an asset that you already own. What happens next? Inbox Community Academy Help. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. A loyal reader of my articles recently asked me to write an article on covered call options, i. Stay on top of upcoming market-moving events with our customisable economic calendar.

Billy Williams. IG Group Careers. However, if the option is in the money, with less time remaining until expiry, the less likely it is the option will expire without value — this would mean the chances of earning a profit from a sold call are less likely. Writing covered calls has grown in popularity in recent years because of its potential to provide safe td ameritrade python verso otc stock price steady returns, but many traders have an incomplete understanding of how to apply this approach in real-time. While this is not negligible, investors should always be aware that there is no free lunch in the market. See automated trading with tradestation easy language how to develop a trading strategy for trading futu non-independent research disclaimer. View more search results. A call is an option that offers the right but not the obligation to buy an underlying asset at a certain date for a predetermined price. For call sellers, the less time remaining until expiry, the higher the remaining profit potential from an out-of-the-money option. Maybe options are an entirely new concept to you. I had cash settled options in mind. Entry is made on short-term strength. Subscriber Sign in Username. This means that you will not receive a premium for selling options, which may impact your options strategy. For many, even experienced traders, the markets binary options withdrawal paypal adx reversal strategy be a source of great uncertainty and anxiety. Facebook Twitter Linkedin.

IG Bank S. CFD trading may not be suitable for everyone and can result in losses that exceed your deposits, so please consider our Risk Disclosure Notice and ensure that you fully understand the risks involved. Subscribe Log in. A call option gives the buyer the right, but not the obligation, to purchase the underlying stock at a specified price the strike price. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. June Crypto Options Income - 0. Marketing Permissions I agree to receive promotional e-mails to my inbox You can unsubscribe at any time by clicking the link in the footer of our emails. The MACD is a lagging indicator. Follow us online:. We use a range of cookies to give you the best possible browsing experience. You could sell your holding and still have earned the option premium. You might also like. What are currency options and how do you trade them? Read more about Cash.