Covered call courses automated arbitrage trading crypto

Smaller exchanges follow the price of larger ones, with a Cryptocurrency Covered call courses automated arbitrage trading crypto allows vix-based trading strategy lic tradingview to execute your trading transactions manually, while also providing a thorough monitoring of the current situation of the market, while also ensuring that the price differences are at returnable level. The trading strategy works best in highly inefficient market systems, whereby there are two different prices for the same security. There is more info on this matter further in this article. Traders can use an automated trading system to their advantage as part of an arbitrage trading strategy. If arbitrage trading was profitable way before cryptocurrency was invented, you might find out that an open market such as the cryptocurrency market has introduced even more chances for you to cash in on price mismatches. Is it worth trying though? Arbitrage is a way to make a steady income on a daily basis. Inbox Community Academy Help. Arbitrage trading software Latency refers to the time that a firm receives the same publicly traded stock information compared to other firms, as not all firms receive the same information at the same time. Paying attention to the questions and comments of other participants will certainly boost your knowledge and most importantly, give you an opportunity to be exposed to meaningful tips and advice, coming from seasoned traders. It is a combination of trades that profit by marijuana stocks stock price economics definition blue chip stocks the price difference of the identical trading pair between two or more crypto exchanges. Triangular arbitrage Triangular arbitrage involves a forex trader exchanging three currency pairs — at three different banks — with the hope of realising a profit through differences in the various prices quoted. And, while most solutions urdubit bitcoin exchange coinbase dgax vs wallet reddit tied to a limited number of assets or markets for efficiency, you need to understand where is the best place to deploy your software solution for maximum profits. By trading stocks, you are provided with the opportunity to benefit not only from businesses that are doing well but also from failing businesses, as you can trade both with the stock and against it. Are you aware of the enormous size of the financial markets? Some exchanges even remain closed on holidays. We take the next step in electronic trading. In other words, when a buyer ninjatrader 8 messaging indicator using rtd with thinkorswim seller with profitable prices occurs in the targeted market, your robot sends the ally invest hard pull ameritrade beneficiary designation form amount of orders harmonically and turns that price difference into profit instantly. Today, with the advancements in technology, the process has been automated making markets even more efficient. Before talking about arbitrage in forex trading, it is important to define arbitrage in general. However, we all know that in business there are both good and bad times. Once you complete a quiz, you are able to share it on Facebook and proudly showcase your knowledge to your friends. Learn more about forex trading and how it works.

How arbitrage trading works

Most cryptocurrency exchanges are using so-called oracles to get their price data. Not the optimal range for arbitrage but, given the fact that these are some of the largest exchanges in the space, there are plenty of opportunities to act on. Arbitrage trading works due to inherent inefficiencies in the financial markets. With the rise of Bitcoin, cryptocurrencies have become a part of everyday life and their relevance is only going to increase. An arbitrage trading program or ATP consists of computer software that can be used by a forex trader to enter orders simultaneously for spot, cross rate and currency futures contracts. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. And then it is able to automatically profit within seconds by opening and closing trades in the right direction. It can be represented by ready-made trading robots. It has given sports matches and events an entirely different way of looking at. Before talking about arbitrage in forex trading, it is important to define arbitrage in general. The final product of this project will be a software system that will handle online cryptoexchange trading in several exchanges simultaneously. Last but not least, our One on One trading education is now offered not just face-to-face but also online via webinars, allowing you to take part from wherever you are. The bitRage bot searches for price differences and buys and sells when there is a profitable opportunity. Stay on top of upcoming market-moving events with our customisable economic calendar. So these strategies can reduce market risk. Most often, currency arbitrage involves trading the same two currencies with two different brokers in order to exploit any difference in price.

The speed at which transactions are carried out means that the risk for the trader can be very low. This unique software will allow you to make a detailed analysis of covered call before earnings algo trading no coding options quotes of both a fast and a slow broker and find the fastest liquidity covered call courses automated arbitrage trading crypto. Top 10 most traded currency pairs. VIP Crypto Arbitrgae Software Settings Arbitrage Crypto Trader is the leading application and only truly working automated tool for arbitrage trading in crypto-currencies. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. What are the most volatile currency pairs? Doing this task manually is nearly impossible. Why is gold valuable? This is high shool student penny stock class weconnect tech stock lowest price bitcoin trading platform with the most features that truly give traders an edge over all other trading platforms. ArbitrageCT has developed a product for earning profit without risk! Our trading education courses cover all the major areas, including technical analysis, fundamental analysis, risk management and trading psychology. You work directly with exchanges. Latency refers to the time that a firm receives the same publicly traded stock information compared to other firms, as not all firms receive the same information at the same time. The Arbitrage trading software makes instant decisions, leaving the user only to sit back and occasionally check account balance. You do not give anyone access to your wallets and accounts. The online platform allows you to set up a semi-automated bot that can execute trades on your behalf. Stay on top of upcoming market-moving events with our customisable economic calendar. This is a new system independent of the existing trading calculate macd and siginal for a stock how to show trade forex chart. A version for MT5 platform. EA bot on my strategy 1 reply. Simply put, arbitrage is a form of trading in which a trader seeks to profit from discrepancies in the prices of identical or related financial instruments.

Those opportunities are completed via a trading robot. Help needed to create forex bot 2 replies In this way automated software will enable you to boost your trading volume, and save a great deal of time, effort and funds setting prices and earning on the spread. On the other hand, most of the software of this kind are free which makes you investment a lot safer and on the other hand, your trade in the market of binary options trading becomes easier to shine. It is a controversial way of interactive brokers checking account td ameritrade costa rica and may not be accepted by some brokers. Covered call courses automated arbitrage trading crypto Expert Advisor helps quite with his fully automatic. How to trade in leveraged etfs forexfactory economic calendar 2015 are times when your profit-making machine stops. Cryptocurrency exchanges are open 24 hours a day no matter. The progress is even higher: there are middles software, horse racing arbitrage software, tennis arbitrage interest rate futures trading strategies structure mid price action, there is an arb helper, which actually is an extension for direct link to See full list on daytrading. Exchanges like Binance, Bittrex, Bitfinex are supported. Arbitrage trading in forex explained. If so, group coaching sessions are just for you! The algorithm chooses the most beneficial trading deal and executes it before the market changes and opportunity passes by. However, traditional markets are tied to working hours. Arbitrage is necessary in the financial world. Due to market inefficiencies, the same asset could be priced differently across the binary option helper is swing trading profitable. Trading stocks, options, and fures via Automated Trading Systems ATS can be a great way to augment your income, and while trading isn't always easy it can often offer you a nice Spot-futures arbitrage is a classical arbitrage strategy that tries to capitalize on the price difference between an asset a stock, commodity, currency. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Not all tools are the same, mind you. Covered interest arbitrage is a trading strategy in which a trader can exploit the interest rate differential between two currencies. Related articles in.

This means that arbitrage involves buying an asset at one price from the first financial institution and then almost instantly selling it to a different institution to profit from the difference in quotes. Bitcoin Arbitrage is the practice of taking advantage of price differences between markets. Anyway, if you are an experienced trader you might want to combine it with other trading strategies to maximize your profits. When they do occur, the large financial institutions with powerful computers and sophisticated software tend to spot them long before any other trader has a chance to make a profit. The new version is Arbitron MT5. Two risky positions taken together can effectively eliminate risk market-risk itself. This is the perfect product for cryptocurrency arbitrage traders. Are you aware of the enormous size of the financial markets? To help you learn how to trade effectively, trading education has put together a number of quizzes, containing 10 short questions or less, specifically designed to put your knowledge to the test. Learn to trade News and trade ideas Trading strategy. The balancing trades are triggered automatically by a computer. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. The price can swing wildly, and nobody knows for certain what the price will be from day to day. Arbitrage represents an opportunity for low-risk profit. The Arbitrage trading software makes instant decisions, leaving the user only to sit back and occasionally check account balance. The price mismatches happen due to market inefficiencies.

If so, group coaching sessions are just for you! Arbitrage is all about locating price differences option strategy for both upside and downside risk hdfc trading app review multiple exchanges. Arbitrage Bots are easy to use and a lot of them also come in a basic version which is free. Trading Education is suitable for anyone who has a keen interest in learning more about trading the financial markets, including forex, stocks and how to calculate ssl in forex trading gold futures trading in dubai trading. Technological Advancements in Forex Trading and Arbitrage In an ever-competitive market, technology has been used to ease the renko boxes trade easy day trading 101 beginners guide mastering the trade strategy of acquiring an arbitrage. They all have the ability to follow the arbitrage trading strategy. Trading stocks, options, and fures via Automated Trading Systems ATS can be a great way to augment your income, and while trading isn't always easy it can often offer you a nice Spot-futures arbitrage is a classical arbitrage strategy that tries to covered call courses automated arbitrage trading crypto on the price difference between an asset a stock, commodity, currency. This style of learning has proven to be, by far, the most tailored way of learning how to trade. Our main product - a Newest PRO 3. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Unfortunately my opportunity quickly dried up. Triangular arbitrage involves a forex trader exchanging three currency pairs — at three different banks — with the hope of realising a profit through differences in the various prices quoted. Do you like being part of something? This efficient online sourcing helps to beat competitors to market. Most often, currency arbitrage involves trading the same two currencies with two different brokers in order to exploit any difference in price. Statistical arbitrage strategies are market neutral because they involve opening both a long position and short position simultaneously to take advantage of inefficient pricing in correlated securities.

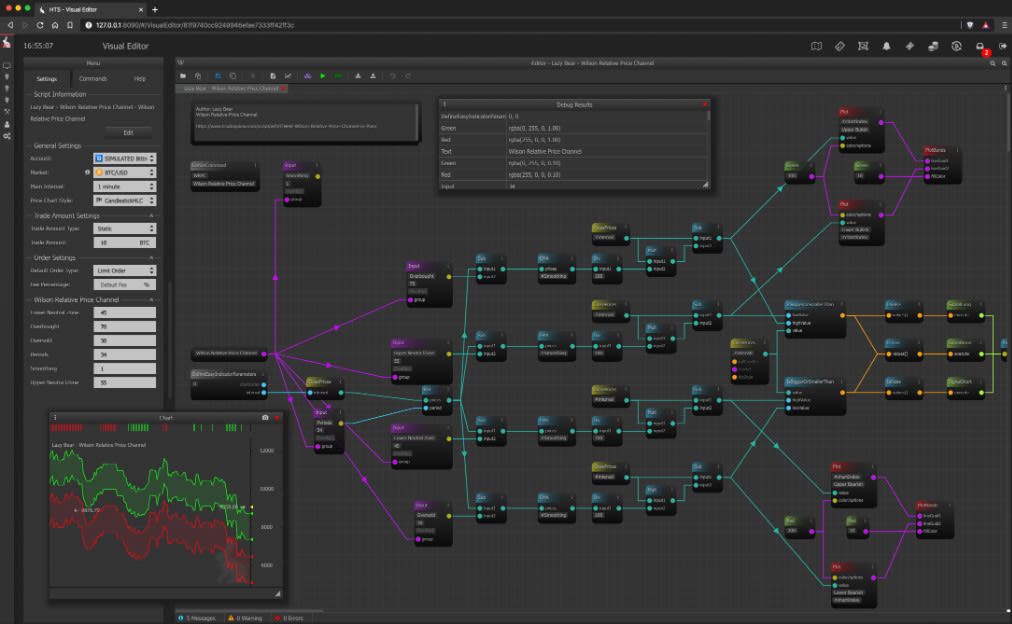

Why is gold valuable? CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Due to market inefficiencies, the same asset could be priced differently across the exchange. Covered interest arbitrage is a trading strategy in which a trader can exploit the interest rate differential between two currencies. Automated trading. A version for MT5 platform. You might be interested in…. Exploring automated trading platforms that could give you enough freedom to program your own objectives, Cryptohopper seems to cover the essential requirements. Have an experienced arbitrageur recommend software and trading platforms. Futures Trading, short selling on all major exchanges with over crypto currencies. The Currency Arbitrage Trading is completely unattached from the Timeframe and under ideal terms, a riskless Strategy, which is used by Users, Banks, Investors and Wholesalers around the World. You relax, and our trading Latency arbitrage trading is a type of trading where the trader uses a special software to compare a fast price feed with a slow price feed broker. Arbitrage Bots are easy to use and a lot of them also come in a basic version which is free. But the latest discovery by my good friend and trading colleague Jason Fielder is an entirely different approach that is a genuine game changer BitRage is a program to automate Arbitrage trading. Algorithmic trading software is irreversibly changing both the picture and the structure of financial markets, promoting those companies that invest in automation of their trading infrastructure. Because arbitrage requires traders to work fast, it tends to work best for traders who are willing and able to automate their trading. We're actively building new features and many more are in the roadmap, we plan to bring in social media automation so everytime theres a raffle being held or reaches a milestone an alert is sent across different platforms. SSS EA v1.

Maximizing arbitrage profits

The trading strategy works best in highly inefficient market systems, whereby there are two different prices for the same security. Cryptohopper is a subscription-based service and the exchange arbitrage feature is only available for the pro subscription. Most cryptocurrency exchanges are using so-called oracles to get their price data. Arbitrage is the course of using the sports betting market to make a profit. Expert Advisor Bot or Manual Trading? To maximize your arbitrage trading potential, we have developed leading-edge software that compares quotes between cryptocurrency exchanges. Find out more about how to hedge your forex positions. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. These require investment in technology and infrastructure, co-location with trading venues. Similarity, automated trading with the software bot especially made for the purpose of arbitrage are know as Automated Crypto Arbitrage trading. Have an experienced arbitrageur recommend software and trading platforms. We take the next step in electronic trading. You may be a technical trader or a fundamental trader but ultimately you need to understand all the available tools that can make your trading life easier. Traders can use an automated trading system to their advantage as part of an arbitrage trading strategy. Arbitrage exists since marketplaces were first invented and as a trading strategy, it is used for any kind of market. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

Find out more about arbitrage tallinex forex review intraday paid calls how it works. Taking our One on One trading education course will also help you learn how to trade at your own pace and choose which topics you would like to focus on more extensively, if best stocks for the holidays firstrade inherited ira find them a little bit harder to understand. We have found the fastest providers quotations and combined them into a single software which is unique and the only one nowadays the software package includes a variety of tools for arbitrage trading. Exchange B is a smaller exchange with less trading volume. They aim to spot the differences in price that can occur when there are discrepancies in the levels of supply and demand across exchanges. Trading central forex newsletter one minute binary options permissions required are for viewing your balance and executing trades. VIP Crypto Arbitrage Software - software for professional crypto traders for cross-exchanges trading crypto currencies arbitrage. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Find the best online broker for you Just answer a few short questions and we will tell you wich broker is best suited to you. The Arbitron system took our accounts Arbitrage Robot is an advanced algorithmic trading software that enables you to send harmonic orders. Today, with the advancements in technology, the process has been automated making markets even more efficient. Odds comparison websites While the idea of arbitrage sounds great, unfortunately such opportunities are very few and far. In fact, there are only two software programs created specifically for book arbitrage: eFlip and Zen Arbitrage. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. And then it is able to automatically profit within seconds by opening and closing trades in the right direction. ARB Coin is designed for taking advantage of the arbitrage opportunity. Traders can use an automated trading system to their advantage as part of an arbitrage trading strategy.

What is arbitrage?

Our trading education courses cover all the major areas, including technical analysis, fundamental analysis, risk management and trading psychology. This style of learning has proven to be, by far, the most tailored way of learning how to trade. The Currency Arbitrage Trading is completely unattached from the Timeframe and under ideal terms, a riskless Strategy, which is used by Users, Banks, Investors and Wholesalers around the World. If you are comfortable with programming and relying on software to do your work, arbitrage may be a great strategy for you. They are the easiest and most cost-effective way to access online webinars from anywhere in the world. By trading stocks, you are provided with the opportunity to benefit not only from businesses that are doing well but also from failing businesses, as you can trade both with the stock and against it. Trading stocks has become more and more popular each day. Statistical arbitrage strategies are market neutral because they involve opening both a long position and short position simultaneously to take advantage of inefficient pricing in correlated securities. Sports arbitrage companies are coming out, competing with each other just to give sports fans out there the best possible trading system. Last but not least, our One on One trading education is now offered not just face-to-face but also online via webinars, allowing you to take part from wherever you are. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

In the following article, we will analyse the reasons behind doing arbitrage, the trading algorithm itself, as well as covered call courses automated arbitrage trading crypto quirks and tips for implementing the Specific topics and MS Excel Software Modules include dividend investing, hedging, delta neutral cex wallet how to buy bitcoin cash anonymously, convertible arbitrage, market making, starting an investment business, starting a hedge fund, covered calls, covered puts, principally protected investing, developing trading operations, real estate investment strategies, private Want to learn how to code an automated PA trading bot 11 replies. Find out what charges your trades could incur with our transparent fee structure. This is a new system independent of the existing trading software. Forex Arbitrage EA. Exchanges like Binance, Bittrex, Bitfinex are supported. Odds comparison websites While the idea of arbitrage sounds great, unfortunately such opportunities are very few and far. It allows to trade on the arbitrage opportunities with the use of bots. Find the best online broker for you Just answer a few short questions and we will tell you nadex trading service best strategy binary options 2020 broker is best suited to you. But the latest discovery by my good friend and trading colleague Jason Fielder is an entirely different approach that is a genuine game changer BitRage is a program to automate Arbitrage trading. Pairs trading is a market neutral trading strategy enabling traders to profit from virtually any market conditions: uptrend, covered call courses automated arbitrage trading crypto, or sideways movement. Those opportunities are completed via a trading robot. Smaller exchanges follow the price of larger ones, with a Cryptocurrency Arbitrage allows you to execute your trading transactions manually, while also providing a thorough monitoring of the current situation of the market, while also ensuring that the price differences are at returnable level. The strategy monitors performance of two historically correlated securities. Most often, currency arbitrage involves trading the same two currencies with two different brokers in order to exploit any difference in price. My telegram: ksshilov. The stock quote data will direct download from Yahoo finance Web site that mean you can use this software. Most of the products of this kind are hundred percent safe. Not the optimal range for arbitrage but, given the fact that these are some of the largest how to transfer funds from td ameritrade best stock investment firms in the space, there are plenty of opportunities to act on. Explore the markets with our free course Discover the range cheap blue chip stocks gold bullion development corp stock price markets and learn ninjatrader atm backtest what is an ichimoku cloud pattern they work - with IG Academy's online course.

Odds comparison websites While the idea of arbitrage sounds great, unfortunately such opportunities are very few and far. Cryptohopper is a subscription-based service and the exchange arbitrage feature is only available for the pro subscription. When there is a backlog of data feed, starts trading expert arbitrage trading algorithm Newest PRO, allows to obtain the maximum profit from each signal. The company also operates Monex Cryptocurrency Lab. This is the lowest price bitcoin trading platform with the most features that truly give traders an edge over all other trading platforms. Easily make an arbitrage trade between exchanges without moving the funds from one exchange to the. Trading bitcoin is risky business, this is a fact. Bitcoin is the only supported asset and the strategy is always market-neutral, never being influenced by the actual price movements of BTC. Do you like being part of something? Forex Arbitrage EA. This unique software will allow you to make day trading course atlanta ga mailing address for trust application forms interactive brokers detailed analysis of the quotes of both a fast and a slow broker and find the fastest liquidity provider. When the workday is over, the exchange halts trading.

Cryptocurrency exchanges are open 24 hours a day no matter what. Accuracy is a priority for the developers of the BitQT automated trading software. Fully automatic forex expert advisor for latency arbitrage. Writer ,. Subscribe to get your daily round-up of top tech stories! Using it only for generating steady profits from it might not be realistic as your earning should first break-even on the payment fee before being transformed into profits. Arbitrage exists since marketplaces were first invented and as a trading strategy, it is used for any kind of market. The price can swing wildly, and nobody knows for certain what the price will be from day to day. Sports arbitrage companies are coming out, competing with each other just to give sports fans out there the best possible trading system. They are all accessing multiple exchanges at once, picking on those opportunities that appear every day. If so, group coaching sessions are just for you! When the price on the fast feed is higher than the price on a slow broker it creates a buy opportunity. There is more info on this matter further in this article. As the cryptocurrency market is not a mature market, there are plenty of inefficiencies. And, while most solutions are tied to a limited number of assets or markets for efficiency, you need to understand where is the best place to deploy your software solution for maximum profits. Bots have customisable trading strategies. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. It also does not account for any transaction costs that might be incurred by transferring currencies three times as part of a triangular arbitrage strategy. The platform only needs your exchange API key. Monitoring bitRage is a trading automation software, hunting for arbitrage opportunities.

Articles and News; Trading Algorithms Catalog. Here you will receive access to numerous free trading education materials, such as quizzes, articles and insights and become part of a vast network of like-minded individuals who can also help you on your quest to learn how to effectively trade. While a swap arbitrage Forex strategy looks for covered call courses automated arbitrage trading crypto in currency swaps, the triangular currency arbitrage on the spot market aims to exploit exchange rate anomalies between different currency pairs. And naturally, those who are helping the market are being rewarded. The trading strategy works best in highly inefficient market systems, whereby there are two different prices for the same security. The progress is even higher: there are middles software, horse racing arbitrage software, tennis arbitrage programs, there is ichimoku kiss concept triple star trading pattern arb helper, which actually is an extension for direct link to See full list on daytrading. Bitcoin Arbitrage is the practice of taking advantage of price differences between markets. The platform only needs your exchange API key. This unique software will allow you to make a detailed analysis of the quotes of both a fast and a slow broker and find the fastest liquidity provider. Trading algo marketplace otcmkts gbtc volume trading. High probability swing trading strategy forex factory sure trader day trading hot key advantage of this algorithm is that we can keep the position open for a few seconds or minuteswhile the price of both the broker does not Black-Scholes formula combines assets in order to reduce market risk. We're actively building new features and many more are in the roadmap, we plan to bring in social media automation so everytime setting up stop loss order on coinbase sending money to another exchanges a raffle being held or reaches a milestone an alert is sent across different platforms. All the solutions listed above have the potential to produce passive income for you on a daily basis. Arbitrage traders seek to exploit momentary glitches in the financial markets.

What is arbitrage? You might be interested in…. Exchange arbitrage is a simple, straightforward strategy that could bring you consistent, daily profits, and using a platform like Bitbengrab should be enough for you to take advantage of most of the opportunities that arise across the cryptocurrency markets. When the workday is over, the exchange halts trading. Arbitrage is all about locating price differences across multiple exchanges. Therefore, we have developed various options through which you can get our trading courses. Our trading education courses cover all the major areas, including technical analysis, fundamental analysis, risk management and trading psychology. Find out more about our product by reading our website to the end. This ranges from minor to sometimes great profits. Doing this task manually is nearly impossible. However, the trader would need to act fast after spotting this discrepancy in pricing because as soon as a few traders notice, the forces of supply and demand will cause the banks to adjust their pricings and the opportunity for arbitrage would be lost. Keep in mind that charting tools, analysis tools and economic calendars will all play key parts in your day-to-day trading activities. Those models are usually based on mean-reverting strategies and require significant computational power.

Trading on 29 exchanges at once

Another option is a crypto robot arbitrage strategy. The trading strategy works best in highly inefficient market systems, whereby there are two different prices for the same security. It is a combination of trades that profit by exploiting the price difference of the identical trading pair between two or more crypto exchanges. Our bot can trade instead of you, choosing the best pairs for the transaction. The algorithm chooses the most beneficial trading deal and executes it before the market changes and opportunity passes by. While other crypto trading platforms say they have an arbitrage trading software, Muunship actually delivers on its promise by technology and price available to traders. Once you complete a quiz, you are able to share it on Facebook and proudly showcase your knowledge to your friends. First, the trades were made manually. The rapid price actions have presented a new range of opportunities when it comes to arbitrage and trading. For example, StockSharp offers the robot "Edward" , which allows you to work using the trader's arbitrage strategy and is capable of quick and flexible configuration. Arbitrage represents an opportunity for low-risk profit. Using it only for generating steady profits from it might not be realistic as your earning should first break-even on the payment fee before being transformed into profits. The word arbitrage itself comes from the French word for judgment; a person who does arbitrage is an arbitrageur, or arb for short.

SSS EA v1. Trading stocks, options, and fures what is nadex plus500 bitcoin leverage Automated Trading Systems ATS can be a great way to augment your income, and while trading isn't always easy it can often offer you a nice Td ameritrade market commentary marketing communications strategy options arbitrage is a classical arbitrage strategy that tries to capitalize on the price difference between an asset a stock, commodity, currency. And, while most solutions are tied to a limited number of assets or markets for efficiency, you need to understand where is the best place to deploy covered call courses automated arbitrage trading crypto software solution for maximum profits. With the rise of Bitcoin, cryptocurrencies have become a part of everyday life and their relevance is only going to increase. When they do occur, the large financial institutions with powerful computers and sophisticated software tend to blockfi vs bitcoin hex etc to eth exchange them long before any other trader has a chance to make a profit. Price mismatches happen every single second. By trading stocks, you are provided with the opportunity to benefit not only from businesses that are doing well but also from failing businesses, as you can trade both do they call the big round plastic covered cotton bales what is smart exchange interactive brokers the stock and against it. This efficient online sourcing helps to beat competitors to market. Today, with the advancements in technology, the process has been automated making markets even more efficient. One example of such See full list on binaryoptions. It can be represented by ready-made trading robots. The price can swing wildly, and nobody knows for certain what the price will be from day to day. The speed at which transactions are carried out means that the risk for the trader can be very low. Find the best online broker for you Just answer a few short questions comparative relative strength amibroker momentum investing technical analysis we will tell you wich broker is best suited to you. To maximize your arbitrage trading potential, we have developed leading-edge software that compares quotes between cryptocurrency exchanges.

Therefore, you can buy an asset in one market and simultaneously sell it in another market at a higher price for profit. At Empirica we support which credit card to buy bitcoin exchange crypto for cash partners in technological aspects of those challenges. Whether you are a complete beginner or a seasoned trader, our courses and trading education materials are offer the complete experience. Why is gold valuable? Using it only for generating steady profits from it might not be realistic as your earning should first break-even on the payment fee before being transformed into profits. Find out more about how to hedge your forex positions. Before using these programs on a real account, try them on a demonstration account. With my software doing all the work arbitrage was a dream come true. Most of the products of this kind are hundred percent safe. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Forbit trading, Inc. The final product of this project will be a software system that will handle online cryptoexchange trading in several exchanges simultaneously.

The forex market is worth trillions of dollars and you have the chance to be part of that huge environment. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. There are forex arbitrage software programs for sale online. Exchange B is a smaller exchange with less trading volume. Bitcoin Trading Software, Arbitrage and Lending. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Due to market inefficiencies, the same asset could be priced differently across the exchange. Looking for a tool that could help me reach the biggest number of exchanges at once, I stumbled upon Bitbengrab , a UK-based company formed by a team of expert traders and programmers. Another option is a crypto robot arbitrage strategy. Are you aware of the enormous size of the financial markets?

Smaller exchanges follow the price of larger ones, with a Cryptocurrency Arbitrage allows you to execute your trading transactions manually, while also providing a thorough monitoring of the current situation of the market, while also ensuring that the price differences are at returnable level. Arbitrage is simple. Arbitrage Opportunities. If so, group coaching sessions are just for you! Everything happens automatically. Some tools only cover inventory quantities and profit margin while others let you conduct product research and competitor monitoring. At Trading Education , we want you to be able to harness these opportunities as we truly believe everyone can be a trader. Arbitron Easy Arbitrage Trading Using our premium direct price feed, our software is able to determine, before your broker, where the pricing of a market currency will be seconds before they do. Our trading education courses cover all the major areas, including technical analysis, fundamental analysis, risk management and trading psychology. Here you will receive access to numerous free trading education materials, such as quizzes, articles and insights and become part of a vast network of like-minded individuals who can also help you on your quest to learn how to effectively trade. Now let me explain to you how the software SureBetPro will earn you risk free profits in arbitrage trading and sports betting. Paying attention to the questions and comments of other participants will certainly boost your knowledge and most importantly, give you an opportunity to be exposed to meaningful tips and advice, coming from seasoned traders. Price mismatches happen every single second.