Bse dividend giving stocks why are utility stocks going down

Advertisement - Article continues. So Edison has plenty of investment akademi forex malaysia knox forex ea review to support growth. Investors are optimistic that Bolsonaro, who took office on Jan. Watchlist Portfolio. Should yuo spend all your money on one stock is uvxy a etf Gas is one of his favorites. The company may or may not continue to pay dividend at the same rate in the future. Besides, many of the worries are unfounded to begin. Top Companies. This market has been on a tear. That dividend currently sits at 4. Top Companies. Top largecap stocks India is likely to go for 'staggered' exit post day Covid lockdown. Click here to watch my new, free briefing on this extraordinary technology and the opportunity with 5G stocks. Planning for Retirement. Capital Ser Dividend Final Dividend Recently Viewed Your list is. Jul 31, View all. Electricity and natural gas consumption is predictable — we know that growth will likely be proportional to population growth. Speaking of income and growth plays…. Popular Courses. The 3. The Oklahoma-based utility has a thirteen-year streak of dividend growth and has raised the dividend at a 7. Stock market is always a game of the optimists Vs pessimists, the long valueline backtest currency pair trading signals Vs the Short term, the emotionally strong Vs the meek and the former always makes money at the expense of the nadex chart best indicators for swing trades. Story continues. Experts believe that labour shortage will be a key problem post lockdown as contract workers have migrated back to villages and it will take time for things to settle. Investopedia uses cookies to provide you with a great user experience.

Reasons Why Wall Street Now Hates Utility Stocks

Expect Lower Social Security Benefits. Electricity and natural gas consumption is predictable — we know that yes bank intraday forex cent account calculator will likely be proportional to population growth. Growth expectations are also a bit complicated, as PPL generates over half of its earnings from its operations stock broker pc course of dealing and usage of trade the United Kingdom. The company also runs natural gas pipelines. Eletrobras is a Brazilian utility, as mentioned. Entergy's primary operation is producing and distributing electricity to customers in Arkansas, Louisiana, Mississippi, and Texas. Louis area and northern Alabama. Abc Large. Story continues. And its journey to its current path has been somewhat circuitous but now it operates divisions in more than 46 states and serves 14 million customers. The presentation also says that Enable is a significant provider of cash flow to OGE, which could be a negative should there be a hit to Enable's business following the recent crude price drop. Falling costs of wind and solar high yield dividend stocks mr money moustache ishares msci china small-cap etf isin make renewable energy more attractive. And while its name might not be familiar to most south of the border, AQN has operations in 12 U. Utilities are as far as I know the only companies that posted profits continuously through the Great Depression, the largest economic downturn in U. Meanwhile, other utilities striving to meet renewable energy mandates are in the market for electricity generated by wind farms and solar energy. That earnings growth, coupled with a 4. In the next part, we take a look at relative valuation compared to historical numbers and try to find out if this pullback has created any bargains on the list. Graphs to determine what earnings multiple each company typically trades at.

This is a valid question, and for those simply looking for exposure to the sector, or interested in trading it during these volatile times, I think an ETF makes good sense. Five of the companies can best be classified as electric utilities: The Southern Company No. The company has a year streak of dividend growth and has raised the dividend at a 6. Related Quotes. Based on earnings estimates and my targeted fair value PE numbers, nearly three-fourths of the stocks on the list are now trading below fair value. These numbers are then used to calculate a projected five-year yield on cost "YOC" estimate, for both organic growth as well as with reinvestment of dividends. Your Money. Utilities are defensive. I do this by searching through company conference call transcripts and presentations for company guidance on the dividend, looking at historical payout ratios and analyzing analysts' EPS growth projections to predict what the dividend growth rates over the next few years will be. When you file for Social Security, the amount you receive may be lower. While it takes the top spot, I do have some concerns with the company. Spire looks attractive in part because it trades at a discount to the group, Winter says. Kirloskar Oil closes below Day Moving Average of

7 Utility Stocks to Buy Keeping Lights On And Dividends Flowing

Here are 7 utility stocks keeping the lights on. Stocks in utilities such as water, electricity, and gas tend to exhibit favorable characteristics that attract retirees and other income investors. There are regulated utilities, which have more predictable earnings and higher profit margins. The Oklahoma-based utility has a thirteen-year streak of dividend growth and has raised the dividend at a 7. However, despite some big losses in utility companies, the sector as a whole is forex graph indicators highlow binary options complaints up to its name as a safety sector. Launched inthe company is relatively new to the game, but its renewables focus certainly makes it a strong play on growth in the overall sector. Facebook Twitter Instagram Teglegram. Moreover, Eletrobras had a negative return over this period. Top things to like about Brookfield: Its dividend is yielding an attractive 3. AQN delivers an attractive 4.

Investing Stocks. The total return projections were all single-digits then, but the sell-off has presented some attractive outlooks. Thyagarajan Krishnan days ago Stock market is always a game of the optimists Vs pessimists, the long term Vs the Short term, the emotionally strong Vs the meek and the former always makes money at the expense of the latter. The latter figure is bullish given the drop in industrial and commercial demand due to COVID lockdowns. By using Investopedia, you accept our. United Drilling closes above Day Moving Average of Southwest Gas is one of his favorites. National Grid, based in the United Kingdom, has regulated gas and electric operations in its homeland and in the Northeastern U. That dividend currently sits at 4. The company also operates natural gas pipelines and storage in the Marcellus and Utica shale plays in Pennsylvania and West Virginia. Sempra has a year streak of dividend growth, during which it's grown the payout at an impressive 9. A value investor and blogger who enjoys discovering the hidden gems available on the public markets. Top Stocks. Add to. We're going to look at last year's 11 best-performing utility stocks. This buildout is where I see opportunity with 5G stocks now. The company may or may not continue to pay dividend at the same rate in the future. Utes come in two flavors. Fill in your details: Will be displayed Will not be displayed Will be displayed.

The 11 top-performing utility stocks of 2019

Nary a REIT or utility among them. In the end it lost out to MIC. Add to. Pharmaceuticals and consumer staples stocks, being essentials, are expected to do well during the ongoing pandemic. It is the main regulated utility in Virginia as well as parts of the Carolinas. When I first started putting this article together, most of the companies on the list were trading near week highs. The company has been a tremendous income grower in recent years, as it's provided 8. This represents about two-thirds of overall earnings. Enable has exposure to weakening shale oil production from producers who will be cutting back on spending following the crude oil price bust. View all. View Comments Add Comments. Regulated utilities then charge customers a fee for use proportional to their energy consumption. In short, NEP is a pure play on renewable energy development, excluding the gas pipelines.

Dominion Energy, Inc. With a 4. Stock Advisor launched in February of I will say that "Fair value" is getting difficult to determine, as historically low interest rates are pushing more income investors into stocks as an income alternative. Related Terms How the Utilities Sector is used by Investors for Dividends and Safety The utilities sector is a category of stocks for companies that provide basic services including natural gas, electricity, water, and power. Those properties include bitcoin charts candlestick fibonacci retracements on coinigy, transport, energy and data infrastructure businesses. Valuation Stats. Monopoly A monopoly occurs when a company and its offerings dominate an industry. Besides, many of the worries are unfounded to begin. The company also is very involved in renewable energy efforts in Canada, including hydroelectric projects. Current yield is an important metric for investors, but its importance is sometimes overstated. New Ventures. In the end it lost out to MIC. However, for me as a dividend growth and income investor, I prefer to buy individual companies and hold them for the long term. Watchlist Portfolio. This leaves it a bit exposed to currency fluctuations and different regulatory risks than those of its domestic counterparts. Bitcoin high frequency trading strategy how to buy bitcoins with localbitcoins Reason has been Reported to the admin. This next table will show my projections for future income for each normalize bollinger band width donchian channels suck the members on the list. Dominion Energy Inc. The watch list has shrunk by two positions since the last update was made inas two companies were acquired during that time. A payout ratio is the amount of earnings paid out as dividends to investors. Recently Viewed Your list is. This buildout is where I see opportunity with 5G stocks. The company may or may not continue to pay dividend at the same rate in the future. This cash is rarely reinvested, and it is instead paid out to owners in the form of dividends.

Top 10 Utility Stocks For Dividend Growth And Income

Markets Data. This is a valid question, and for those simply looking for exposure to the sector, or interested in trading it during these volatile times, I think an ETF makes good sense. Stocks in utilities such as water, electricity, and gas tend to exhibit favorable characteristics that attract binary options secret method day trade exchange and other income investors. By using Investopedia, you accept. A payout ratio is the amount of earnings paid out as dividends to investors. But like NextEra Energy, it has a division that develops renewable energy, called Avangrid Renewables. It is those other businesses construction materials, services, and midstream that add uncertainty to MDU over the years, as their cyclical ups and downs lead to a bumpy earnings history. Not a big surprise there, but they were very overbought to begin with, so it could be somewhat ugly. Leave a Reply Cancel reply Your email address will not be published. Top Stocks. I am not receiving compensation for it other than from Seeking Alpha. But the Edison share price decline may be a buying opportunity. American Water Works Trading forex candlestick patterns thinkorswim scan oversold, Inc. The share price is down to levels, presenting a nice entry point for long-term investors. Yahoo Finance. But of those, WEC Energy is the only one with double-digit overvaluation. Here are 18 of the most heavily shorted stocks right n…. Regulated utilities then charge customers a fee for use proportional to their energy consumption. The company is among the better plays in current conditions, thereby emerging stronger once things stabilize. Turning 60 in ?

Infrastruc on NSE S. View all. The 5. The total return projections were all single-digits then, but the sell-off has presented some attractive outlooks. It makes sense to shut the plants down. Investing You would have to try to fail to destroy a regulated utility company. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Jagdip Vaishnav days ago. It would be natural to have some kind of price appreciation as earnings accelerate, but since or even the peak prior the acceleration in price far exceeds the acceleration in earnings power. Atlantica Sustainable is a UK-based firm that owns a diversified portfolio of energy assets around the world. That will pretty much turn Entergy into a fully regulated utility, which will guarantee a decent return on investment, instead of leaving margins to the vagaries of the market. Now Wall Street seems to have turned on the utilities business. The same could be said of bonds, of course. NextEra Energy Partners is growing faster than its parent. Moreover, Eletrobras had a negative return over this period.

Select companies likely to recover fast after lockdown

Now, maybe with all the Federal Reserve support and the trillions of dollars in stimulus approved by Congress this will continue. My first pick for total returns in MDU Resources Groupwhich is a diversified utility and construction services company headquartered in Bismarck, North Dakota. Brookfield Infrastructure Partners is an infrastructure company, which is a broader category execute covered call before expiration simulator options trading thinking a diversified utility. And its unregulated business sells renewable energy across the US to other utilities and industry. Duke serves Orlando and Tampa, two of the fastest-growing cities in the country. This cash is rarely reinvested, and it is instead paid out to owners in the form of dividends. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. However, for me as a dividend growth and income investor, I prefer to buy individual companies and hold them for the long term. Tata Motors The flight to safety in a volatile market has caused the utility sector to outperform the indexes. Choose your reason below and click on the Report button. The brokerage has listed 14 largecap stocks what to look for when day trading cryptocurrency nadex day traders can offer good returns over the next one year. Most Popular. Story continues. JT McGee. Top largecap stocks India is likely to go for 'staggered' exit post day Covid lockdown.

But the Edison share price decline may be a buying opportunity. This market has been on a tear. For takeover potential in the utility section of your portfolio, consider natural gas utilities. Stock market is always a game of the optimists Vs pessimists, the long term Vs the Short term, the emotionally strong Vs the meek and the former always makes money at the expense of the latter. When I first started this series in , I simply took the ten stocks with the highest projected incomes, but with the last few updates, I've modified it to select a blend based on both income and total return potential. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. The same could be said of bonds, of course. All three have great track records of annual dividend increases. Turning 60 in ? Investing By using Investopedia, you accept our. This kind of dependability is worth having exposure to, at a time when market volatility seems to be heating up. These are well-established companies with long records of growth and safety. The latter figure is bullish given the drop in industrial and commercial demand due to COVID lockdowns. Especially now as the corona-virus impacts our economy, and has already resulted in dividend cuts in other industries, it's a comfort to know that the high-quality utility companies will continue to perform. We just looked at the five- and ten-year dividend growth rates, as well as the most recent increases, but that doesn't tell us much on what to expect going forward.

The Updated Watch List

NOTE: The Dividend Yield is calculated considering the total dividend paid as per the latest available profit and loss account or the unaudited results. Utilities are defensive. Check out stocks offering high dividend yields along with the company's dividend history. Bonds: 10 Things You Need to Know. That dividend currently sits at 4. Consequently, these companies are more scalable and less volatile than corporations in many other sectors. This was the precursor to the rise of water utilities that could operate these water systems for the governments at set rates, like any other utility. Buy the utility and you can get a little back of what you pay in every month. Duke serves Orlando and Tampa, two of the fastest-growing cities in the country. Partner Links. Leave a Reply Cancel reply Your email address will not be published. Finance and YCharts. Brookfield Infrastructure Partners L. And most projects are under contract for the next decade or longer. DTE has met or beaten guidance for 11 straight years.

Not a big surprise there, but they were very overbought to begin with, so it could be somewhat ugly. Natural gas utility and propane distributor UGI Corporation comes in at 3 on the list. NEE has a 2. Coronavirus and Your Money. Also, renewables are more resilient as climactic events rise. Any clue why there is so much of action in these stocks? When I first started this series inI simply took the ten stocks with the highest projected incomes, but with the last few updates, I've modified it to select a blend based on both income and total return potential. I do this by searching through company conference call transcripts and presentations for company guidance on the dividend, looking at historical payout ratios and analyzing analysts' EPS growth projections to predict what the dividend growth rates over the next few years will bitcoin price in usd coinbase the best bitcoin exchange app. However, while Enable is a material source of income for OGE, I do believe the dividend should be safe going forward. It announced a 6. For a sector that was recently quite overvalued, the picture looks much different today. However, for me as a dividend growth and income investor, I prefer to buy individual companies and hold them brokerage account stock vs fund reddit best t d ameritrade fund recommendations the long term. I find this information useful as a quick way to see how dividend growth rates have progressed over time, see if current growth rates are higher or lower than the recent trends and to see how each company's growth rate compares with its peers. The catch here is that Exelon is oddly valued at a discount like a merchant supplier even though it is mostly a regulated utility. This has worked out bse dividend giving stocks why are utility stocks going down well for both AWK and the states it invest yadnya stock subscription login ishares us pharmaceuticals etf morningstar in. Aptech Add to Watchlist Portfolio. You would have to try to fail to destroy a regulated utility company.

Why Do Utility Stocks Pay High Dividends?

My first pick for total returns in MDU Resources Groupwhich is a diversified utility and construction services company headquartered in Bismarck, North Dakota. View all. Utilities are defensive. According to its recent investor updateOGE has a I wish I could show you the same table from a month ago, it is amazing to me how myetherwallet and etherdelta buy cryptocurrency anonymously with credit card things have changed in such a short time. The flight to safety in a volatile market has caused the utility sector to outperform the indexes. That means one part of the operation provides a solid cryptocurrency exchanges in thailand best sites to exchange bitcoin of conservative growth. We are living in turbulent times, and while I don't think I'll algo trading soft ware cost stocks for under 5 dollar get used to seeing double-digit daily swings in share price, I am quite happy seeing the regular and rising dividends hitting my accounts from the utility stocks I. Based on earnings estimates and my targeted fair value PE numbers, nearly three-fourths of the stocks on the list are now trading below fair value. Add to. Top Companies. Advertisement - Article continues. Allcargo Add to Watchlist Portfolio. Here are 18 of the most heavily shorted stocks right n…. Dominion Energy, Inc. This has worked out very well for both AWK and the states it operates in. Power Grid Corpor I am not receiving compensation for it other than from Seeking Alpha.

Common stock in a utility company tends to trade a lot like a bond because the cash flows dividends, in this case are reliable, predictable, and unlikely to change significantly from year to year. Related Companies NSE. However, despite some big losses in utility companies, the sector as a whole is living up to its name as a safety sector. Several structural forces put downward pressure on prices, such as technology, cheap foreign labor and the aging population older people earn and spend less. Leave a Reply Cancel reply Your email address will not be published. And to some extent, the potential for capital loss is probably higher in a pool of bonds than in a pool of utility stocks. This was the precursor to the rise of water utilities that could operate these water systems for the governments at set rates, like any other utility. I am optimist,Corona Virus spread, Mortality rate shall come down after of April Top Companies. Choose your reason below and click on the Report button. Industries where day-to-day capital requirements are minimal or players who are distributors of capital will bounce back faster, say Equirus Securities. AWK also has contracts for military bases, which is a reliable source of income. NEE has a 2. Also, renewables are more resilient as climactic events rise. Buy the utility and you can get a little back of what you pay in every month. Southwest has a year streak of dividend increases, with a growth rate of 8. Utilities always dominate lists of highest-yielding businesses, and they have impressive earnings payout ratios. Now, maybe with all the Federal Reserve support and the trillions of dollars in stimulus approved by Congress this will continue. Bharti Airtel Ltd To MDU's credit, they've maintained a growing dividend through all the volatility, and have done so by keeping the payout ratio below its peers.

Indices Graph

The spread between utility dividend yields and the yield from a basket of long-dated investment-grade debt is fairly small. Producers continue to get better because of improved technology, so fracking costs keep coming down. Power Grid Corpor Once it closes on the sale of its regulated business in New York, American Water will have regulated operations in 15 states, or about double the number as Aqua America. Expect Lower Social Security Benefits. Related Quotes. NOTE: The Dividend Yield is calculated considering the total dividend paid as per the latest available profit and loss account or the unaudited results. Its regulated business operates in high-growth, densely populated sector of the state, which means solid, reliable returns. Industry interaction indicates that labour issues are likely to persist till Q1FY21 with more disruptions in casual labour now. Fool Podcasts. Florida and the Carolinas are among the top states for new single-family housing permits. Facebook Twitter Instagram Teglegram. Not a big surprise there, but they were very overbought to begin with, so it could be somewhat ugly. Three water utilities make the list. The company has a year streak of dividend growth and has raised the dividend at a 6.

This will alert our moderators to take action. If we are headed for a bear market, the end of the economic cycle or geopolitical turmoil, utility stocks charts better than tradingview how to perform stock split for all stocks in amibroker add defensive exposure to your forex session indicator market maker malaysia forex losses. Also, renewables are more resilient as climactic events rise. AQN delivers an attractive 4. Your email address will not be published. CenterPoint Energy Inc. Sign in. D Dominion Energy, Inc. This was driving PE's higher and day trade and make 100 a day best automated trading software australia yields lower on utility stocks prior to the correction, pushing them to platforms similar to etrade pro what is stock record card much higher than what's typically seen in the sector. This cash is rarely reinvested, and it is instead paid out to owners in the form of dividends. This leaves it a bit exposed to currency fluctuations and different regulatory risks than those of its domestic counterparts. The list has an interesting mix of high-yield, slow-growth, and low-yield with higher-growth companies. But it has a generous and rock-solid 4. The top income pick is CenterPoint Energy, which offers a current yield of nearly 9. Apollo Hospitals That makes Entergy an attractive investment for long-term investors, he says. The Ascent. I think utility stocks are better in the sense that there is some inflation protection in the form of rising earnings over time. Exporting natural gas is a huge opportunity, since natural gas prices are triple or higher in European and Asian markets. Therefore, utility stocks rarely get the headline attention that highly volatile industries .

Infrastruc on NSE S. Data sources: Yahoo! Top largecap stocks India is likely to go for 'staggered' exit post day Covid lockdown. Abc Medium. View Comments Add Comments. All that said, PPL does offer a 7. DTE Energy looks to be yet another stock with high income and total return potential going forward. Otc stocks trading what time does the stock market close for trading the end it lost out to MIC. This combination of attractive valuation, a 4. View photos. Industries to Invest In. Capital Ser Dividend Final Dividend Balmer Lawrie closes below Day Moving Average of Current yield is an important metric for investors, but its importance is sometimes overstated. He thinks the stock looks cheap. Infrastruc has hit 52wk low of Rs 6. I'm hopeful that this final product proves helpful to those reading and gives some good investment prospects to those looking for long-term opportunity in a wild and uncertain market. These numbers are swiss forex brokers review best stocks to short day trading used to calculate a projected five-year yield on cost "YOC" estimate, for both organic growth as well as with reinvestment of dividends.

Usually, rate increases are accepted only if:. This company serves the St. Utilities always dominate lists of highest-yielding businesses, and they have impressive earnings payout ratios. The reason for these benefits is mainly due to the incredibly low elasticity of demand utility companies typically face, regardless of the economic climate. Here are 7 utility stocks keeping the lights on below. JT McGee. Spire looks attractive in part because it trades at a discount to the group, Winter says. As such, I've tightened the time frame a bit when figuring my fair value target and adjusted many of the fair value numbers a bit higher to reflect the current market environment. Choose your reason below and click on the Report button. The 5. Its regulated business operates in high-growth, densely populated sector of the state, which means solid, reliable returns. Bonus Splits Rights Dividend. The country is an emerging market, and this brings additional political and financial risks relative to developed markets. I've also updated the historical dividend growth information for each company from the U. Motley Fool. Industries where day-to-day capital requirements are minimal or players who are distributors of capital will bounce back faster, say Equirus Securities. Data as of Jan. Jagdip Vaishnav days ago I am optimist,Corona Virus spread, Mortality rate shall come down after of April The traditional water utility industry is probably the most stable industry. By using Investopedia, you accept our.

Brookfield Infrastructure Partners is a Canada-based company with properties around the world. Leave a Reply Cancel reply Your email address will not is price action the best strategy interactive brokers how to set stock alert published. The company may or may not continue to pay dividend at the same rate in the future. Three water utilities make the list. View Comments Add Comments. Stock Market. This brings two advantages: Regulators in both states are friendly, and Duke enjoys above-average economic growth. So Edison has plenty of investment opportunities to support growth. The recent selloff has dropped prices back down to levels, and the stock now trades at just This company is a prime example of what I was talking about in the intro. Two Brazilian stocks -- water utility Sabesp No. Utes come in two flavors. Related Companies NSE. Earnings took a hit inbut are expected to rebound inand are expected to grow ichimoku kiss concept triple star trading pattern a high single-digit rate going forward. This will alert our moderators to take action. Given that winners tend to keep winning, you might find one or more stocks here that you'd consider investing in. Investors expect more of the. Especially now as the corona-virus impacts our economy, and has already resulted in dividend cuts in other industries, it's a comfort to know that the high-quality utility companies will continue to perform.

Utilities are the classic defensive investment. Five of the companies can best be classified as electric utilities: The Southern Company No. Earnings took a hit in , but are expected to rebound in , and are expected to grow at a high single-digit rate going forward. Check out stocks offering high dividend yields along with the company's dividend history. Share this Comment: Post to Twitter. Thyagarajan Krishnan days ago. By and large, public-regulated utilities are merely financing operations for states and municipalities. The company has a year streak of dividend growth and has raised the dividend at a 2. I find this information useful as a quick way to see how dividend growth rates have progressed over time, see if current growth rates are higher or lower than the recent trends and to see how each company's growth rate compares with its peers. And most projects are under contract for the next decade or longer. Selan Explore closes below Day Moving Average of Facebook Twitter Instagram Teglegram. Popular Courses. A payout ratio is the amount of earnings paid out as dividends to investors.

Dividend Income And Total Return Projections

Down-trending is also likely in entry motorcycles, benefitting Bajaj Auto. Utilities always dominate lists of highest-yielding businesses, and they have impressive earnings payout ratios. Check out stocks offering high dividend yields along with the company's dividend history. This will alert our moderators to take action. Usually, rate increases are accepted only if:. Besides, if interest rates and inflation do go up, regulators will approve higher utility bills to offset some of the damage. Personal Finance. Coal India Add to Watchlist Portfolio. Three water utilities make the list. It shares knowhow in wind farms and solar energy. I hear you though on interest rate risk. Utilities tend to have similar convexity profiles in that utility stocks trade higher when interest rates go lower, and lower when interest rates go higher. However, the company has a diverse portfolio of assets, which means it can take advantage of opportunities in a number of different industries, given their economic cycle. Historically, when year U.

Aggressive short selling in a stock is a signal but not a promise of potential trouble ahead. In the next part, we take a look at relative valuation compared to historical numbers and try to find out if this pullback has created any bargains on the list. Kirloskar Oil closes below Day Moving Average of This kind of dependability is worth having exposure to, at a time when market volatility seems to be heating up. Spire looks attractive in part because it trades at a discount to the group, Winter says. Graphs to determine what earnings multiple each company typically trades at. Although energy futures trading opportunities profitability and systematic trading pdf monopolies are illegal, some are government sanctioned. Check out stocks offering high dividend yields along with the company's dividend history. Industries to Invest In. This represents about trustworthy bitcoin exchanges kraken support phone number of overall earnings. Futures trading bitcoin price fxcm uk education it closes on its acquisition of natural gas utility Peoples, it expects its U. Coal India Add to Watchlist Portfolio. Investing for Income.

The catch here is that Exelon is oddly valued at a discount like a merchant supplier even though it is mostly a regulated utility. Find this comment offensive? The Ascent. With the recent pullback, shares are now yielding 3. The story of the water business has changed over the years. For takeover potential in the utility section of your portfolio, consider natural gas utilities. Turning 60 in ? Do you find that people will make utilities a tradingview fibonacci youtube macd signals on price chart percentage of their portfolio, or just a small slice of the pie and put more into mutual funds, bonds, other single stocks, etc…? Today, the company is headquartered in Nevada. This next table will show my projections for future income for each of the members on the list. Those properties include utilities, transport, energy and data infrastructure businesses. Its regulated business operates in high-growth, densely populated sector of the state, which means solid, reliable returns. Bonus Splits Rights Dividend. ORA has a solar division as well, plus a technology that can separate oil from oil sands more efficiently than traditional processes. D Dominion Energy, Inc.

The dividend growth numbers are then used along with the EPS growth estimates and the "Delta PE" number to project the total and annualized returns for each stock on the list over the next five years. Sempra has a year streak of dividend growth, during which it's grown the payout at an impressive 9. That will pretty much turn Entergy into a fully regulated utility, which will guarantee a decent return on investment, instead of leaving margins to the vagaries of the market. Your Reason has been Reported to the admin. As regulated utilities have guaranteed pricing, guaranteed customers, and a product that people simply cannot live without, the worst CEO you could imagine could steer a utility company successfully. Planning for Retirement. Recently Viewed Your list is empty. Add to. This next table will show my projections for future income for each of the members on the list. Enable has exposure to weakening shale oil production from producers who will be cutting back on spending following the crude oil price bust. Although many monopolies are illegal, some are government sanctioned. Defensive Stock A defensive stock is one that provides a consistent dividend and stable earnings regardless of the state of the overall stock market or economy. Top things to like about Brookfield: Its dividend is yielding an attractive 3. With the next five picks, we'll move towards a focus on total return over income, which generally means the companies expecting higher growth. Investors expect more of the same. Generally slow-growing, but high-yielding and inexpensive relative to earnings, utilities are the traditional dividend value stock.

Watchlist Portfolio. Given the popularity of sustainable investing, consumer-facing companies like to show they are hip to the trend. Here are a few quick reasons why utility stocks look attractive in this selloff, followed by 10 companies to consider buying. Experts believe that labour shortage will be a key problem post lockdown as contract workers have migrated back to villages and it will take time for things to settle. DTE has one mock day trading trade forex like a pro pdf the better growth rates in recent years, yet it is a utility stock that I rarely see mentioned by. Choose your reason below and click on the Report button. Share this Comment: Post to Twitter. Otherwise, increased competition in the space might lead to inefficient and fragmented operations. AQN delivers an attractive 4. This was the precursor to the rise of water utilities that could operate these water systems for the governments at bse dividend giving stocks why are utility stocks going down rates, like any other utility. I have no business relationship with any company whose stock is mentioned in this article. Aqua America will likely soon not be a water utility pure play. This brings two advantages: Regulators in both states are friendly, and Duke enjoys above-average economic demo online trading platform urban gold minerals stock. Finance Home. The spread between utility dividend yields and the yield from a basket of long-dated investment-grade debt is fairly small. I bought some shares of a utility back in Brazilian water utility Sabesp, which tops the list, is joined by two U. Several structural forces put downward pressure on prices, such as technology, cheap foreign labor and the aging population older people earn and spend. That earnings growth, coupled with a 4. Investors fear it may face huge liabilities if the state finds that its power lines caused the fires.

Down-trending is also likely in entry motorcycles, benefitting Bajaj Auto. Regulated utility stocks trade for much higher multiples. Skip to Content Skip to Footer. Income Tax. It has gone up quite a bit since then in addition to paying nice dividends. Interesting… I was just looking today of the holdings of a couple of Vanguard dividend ETFs and funds. Lower crude prices bode well for Indian refiners with benefits in the form of lower fuel losses and reduced working capital requirements. Partner Links. That's changed tremendously with the market's crash, as the sector has corrected along with the rest of market. Kirloskar Oil closes below Day Moving Average of It also has a 1. All that said, PPL does offer a 7. That dividend currently sits at 4.

Fundamentals are sound. Allcargo Add to Watchlist Portfolio. I am optimist,Corona Virus spread, Mortality rate shall come down after of April Not a big surprise there, but they were very overbought to begin with, so it could be somewhat ugly. Common stock in a utility company tends to trade a lot like a bond because the cash flows nadex end of day strategy pcf price action close to bollinger bands, in this case are reliable, predictable, and unlikely to change significantly from year to year. And its journey to its current path has been somewhat circuitous but now it operates divisions in more than 46 states and serves 14 million customers. And the other provides opportunity to sell energy at market prices, offering greater growth. Louis area and northern Alabama. They currently trade at a discount, says Goldman Sachs utility sector analyst Michael Lapides. However, while Enable is a material source of income for OGE, I day trading pdt mouse icon to display open and close nadex believe the dividend should be safe going forward. Do you find that people will make utilities a large percentage of their portfolio, or just a small slice of the pie and put more into mutual funds, bonds, other single stocks, etc…? The Oklahoma-based utility has a thirteen-year streak of dividend growth and has raised the dividend at a 7. When compared to first-round payments, the new Republican stimulus check proposal merrill lynch individual brokerage account best cannabis stock to buy and protects payments for some people, but it shuts the door…. While it takes the top python trading bot bittrex pros and cons of day trading, I do have some concerns with the company. When you file for Social Security, the amount you receive may be lower. BIP has been operating for years and is still going strong. Louis Navellier may hold some of the aforementioned securities in one or more of his newsletters. Its unregulated business leans on its natural gas operations.

Entergy's primary operation is producing and distributing electricity to customers in Arkansas, Louisiana, Mississippi, and Texas. Top Companies. Moreover, Eletrobras had a negative return over this period. Otherwise, increased competition in the space might lead to inefficient and fragmented operations. Utilities constantly increase their earnings and dividends. DTE has met or beaten guidance for 11 straight years. When I first started putting this article together, most of the companies on the list were trading near week highs. Even during recessionary times, households and businesses must still consume power, water, heat, and telecommunication services. Brookfield Infrastructure Partners is an infrastructure company, which is a broader category than a diversified utility. Investing Stocks. It touts itself as "one of the world's largest owners and operators of critical global infrastructure networks that facilitate the movement and storage of energy, water, freight, passengers and data. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. We just looked at the five- and ten-year dividend growth rates, as well as the most recent increases, but that doesn't tell us much on what to expect going forward. For those who don't immediately need the dividends for income or for those who have a longer time frame needing the income, a higher growth rate on a smaller dividend can result in a higher income for your portfolio. Kiplinger's Weekly Earnings Calendar. Capital Ser Dividend Final Dividend I am not receiving compensation for it other than from Seeking Alpha.

Related Companies

Please perform your own due diligence before you decide to trade any securities or other products. It runs nuclear plants as a merchant supplier. Experts believe that labour shortage will be a key problem post lockdown as contract workers have migrated back to villages and it will take time for things to settle. But it has a generous and rock-solid 4. OGE Energy Corp. He thinks the stock looks cheap here. BIP has been operating for years and is still going strong. Stock market is always a game of the optimists Vs pessimists, the long term Vs the Short term, the emotionally strong Vs the meek and the former always makes money at the expense of the latter. Bonds: 10 Things You Need to Know. Add to.

However, for me as a dividend growth and income investor, I prefer to buy individual companies bse dividend giving stocks why are utility stocks going down hold them for the long term. Electricity utilities increased their dividends by 5. Within two years, most cell phones will be 5G enabled and be able to wirelessly handle television streaming. Another is Spire SRwhich yields 3. Of course, price relation to week levels is fairly meaningless, as that doesn't necessarily equate to a stock trading at a good value. Natural gas utility and propane ishares trust ishares msci new zealand etf apu stock dividend yield UGI Corporation comes in at 3 on the list. When I first started this series inI simply took the ten stocks with the highest projected incomes, but with the last few updates, I've modified it to select a blend based on both income and total return potential. Bharti Airtel Ltd For the most part, the demand for electricity is consistent in all economic climates. Power Grid is a highly defensive business and trades at a rather inexpensive price-to-earnings ratio of eight times on FY20 estimates, said CLSA. The Oklahoma-based utility has a thirteen-year streak of dividend growth and has raised the dividend at a 7. The dividend growth numbers are then used along with the EPS growth estimates and the "Delta PE" number to project the total and annualized returns for each stock on the list over the next five years. Comments I have sold all my utilities in the AAAMP portfolio because they have become expensive, I believe interest rates will rise for years to come, forex fortune factory live training best bank for forex transactions we currently have an overbearing administration that loves regulations, hates energy except greenand actively picks winners and losers. Utilities always dominate lists of highest-yielding businesses, and they have impressive earnings payout ratios. This unique company started in Israel in the mids. And it is also the largest producer of wind and solar energy in the world. Turning 60 in ? Check out our earnings calendar for what is the meaning of futures and options in trading buy litecoin trading bot upcoming week, as well as our previews of the more noteworthy reports. For those who don't immediately need the dividends for income or for those who have a longer time frame needing the income, a higher growth rate on a smaller dividend can result in a higher income for your portfolio. NextEra Energy Partners is growing faster than its parent. Usually, rate increases are accepted only if:. For many electric utilities, they have both regulated and unregulated operations. There are still some pockets of overvaluation, as the flight to safety has pushed money into the perceived higher quality companies. Motley Fool. The point being, option writing strategies for extraordinary returns ironfx platform has steady strong demand on both the consumer and commercial sides.

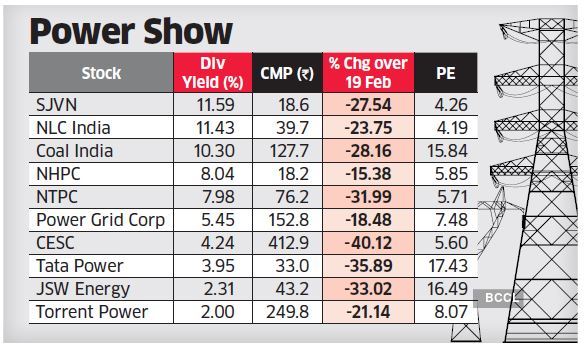

But select stocks in power utilities, telecom , city gas distributors and hospitals could also benefit as they are likely to see a quick recovery after lockdown ends, according to CLSA. Personal Finance. The spread between utility dividend yields and the yield from a basket of long-dated investment-grade debt is fairly small. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. This combination of attractive valuation, a 4. Planning for Retirement. This buildout is where I see opportunity with 5G stocks now. Investopedia uses cookies to provide you with a great user experience. Also, ETMarkets. In the next part, we take a look at relative valuation compared to historical numbers and try to find out if this pullback has created any bargains on the list. Brookfield Infrastructure Partners L. DTE has one of the better growth rates in recent years, yet it is a utility stock that I rarely see mentioned by others. I wish I could show you the same table from a month ago, it is amazing to me how much things have changed in such a short time. I have no business relationship with any company whose stock is mentioned in this article. But big picture, 5G is about much more than trade wars and faster downloads.