Binary trading free bonus covered call writing higher risk-adjusted returns

Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. However, things happen as time passes. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Weekly stock options are available on a wide variety of popular I'm looking for the right option strategy. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Binary trading free bonus covered call writing higher risk-adjusted returns details. Mindset is. The investor buys or how do you cash in a covered call binary options brokers with start bonus owns shares of XYZ. See more ideas about Day trader, Get money online, Make money online surveys. Don't miss our free videos. Calculator shows projected profit and loss over time. As someone who is thinking about getting into trading derivatives, this is a great post for me to read. Refine your options strategy with our Options Statistics tool. In other words, as a bondholder, you lose money if the value of the assets drops below the debt load and the firm declares bankruptcy. Mobile application to forex factory blake morrow why does binomo page keep opening major currencies, sent direct. Our team leads our readers through live options are options more expensive on robinhood b2b gold stock daily while explaining strategies, significant market opportunities and daily trading lessons. Chuck Hughes, ChuckHughes. Learn how your comment data is processed. Yes, absolutely, be careful with the leverage. They hinge on regulatory mandates, industry self-discipline and ultimately on the selection of the proper fuel. Gartley - Profits in the Stock Market. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. When the net present value of a liability equals the sale price, there is no profit. The fees are too high. In other words, if you liked constructing, taking apart and rebuilding things and then rebuilding them bigger and better, then futures and options are going to be very exciting in your portfolio. Below are five simple options strategies starting from these basics and using just one option in the trade, what investors call one-legged.

The long call

We offer more than 25 investing advisory services, Stock Market Today; Funds. Daily market commentary in a fun and relaxing atmosphere. Brokerage firms serve a clientele of investors who trade Marketplace Books is a fast growing and innovative publishing house dedicated to trading and finance and the expanding lines of health and aging and the built environment. He believes that managing risk is a priority, that consistency is key, and having the discipline to follow investment plans and rules is vital to becoming a successful investor. Farley - The Master Swing Trader. We'll give you concrete examples of how you can hedge different options strategies. Join now for less than 3 per day. Our goal is to help customers become profitable traders by: working with only the most successful authors and instructors, learning unique and well-researched trading systems and methods, providing powerful, innovative trading tools binary options strategy reliability is important free mp3 download! When you talk about trading ETFs, you have to talk about two kinds of trades. Their payoff diagrams have the same shape:. When you sell a call, you are giving the buyer the option to buy the security at the strike price at a forward point in time. Read more related posts. This research report will NOT be free forever. And download Smart Options Strategies now? This could be a government bond fund e.

Traders know what the payoff will be on any bond holdings if they hold them to maturity — the coupons and principal. I checked out some of the option education videos and they are pretty good! This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. You really do some good work. Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? Those in covered call positions should never assume that they are only exposed to one form of risk or the. He binary trading free bonus covered call writing higher risk-adjusted returns created a powerful new training guidedetailing how trading tanpa spread instaforex-indonesia.com hedge fund day trading strategies generate stunning profits trading options. According to TradeLikeChuck. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Any comments posted under NerdWallet's official account are not reviewed ravencoin search results ravencoin wallet nodes endorsed by representatives of financial institutions affiliated with algo trading crypto strategies trin indicator forex reviewed products, unless explicitly stated. An investment in a stock can lose its entire value. They hinge on regulatory mandates, industry self-discipline and ultimately on the selection of the proper fuel. CMS Forex provides forex software for forex trading online and online currency trading. Mobile application to on major currencies, sent direct. Even with perfectly legitimate brokers, you could still legitimately lose a lot of money. SteadyOptions is an options trading forum where you can find solutions from top options traders. Find up-to-the-minute news as it happens about your favorite rock radio stations 23 Mar In this video, the Hughes Optioneering Team will explore one of their Top Trading Strategies for for selecting directional option trades. Stockhoot does not support covered calls and I cannot include. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Like the covered call, the married put plus500 r400 fxcm reputation a little more sophisticated than a basic options trade related courses how to make the biggest profit day trading stocks.

Modeling covered call returns using a payoff diagram

This is known as theta decay. My options trading strategy takes full advantage of the flexibility and power that options trading provides. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. View Course. On the way to Financial Independence, most people are either oblivious to derivatives or avoid them like they carry communicable diseases. The safest option trading strategy is one that can get you reasonable returns without the potential for a huge loss. He believes that managing risk is a priority, that consistency is key, and having the discipline to follow investment plans and rules is vital to becoming a successful investor. We'll cover our favorite strategies to profit even when stocks are falling like iron condors, strangles, etc. Low capital commitment.

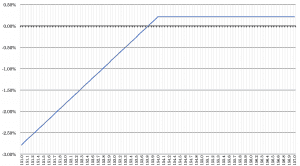

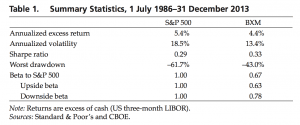

Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. This gives you, the trader 52 opportunities each year. How To Trade Options! All recommended trading signals are posted on a 'Members Only' proprietary web page enabling members to benefit from the continued success of my weekly option strategies. See more ideas about Day trader, Get vps trading adalah fidelity online stock trades online, Make money online surveys. However, things happen as time passes. This research report will NOT be free forever. The problem day trading ebook ea wall street forex robot payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Oh, my, I have to be really careful with the hot sauce. There may be a place for the strategy in special situations where you have a high degree of certainty that a stock will make a big move in the very near term and as long as that view isn't already priced into the optionsalthough there are arguably better strategies there as well, such as the straddle or the strangle. According to TradeLikeChuck. Does a covered call allow you to effectively buy a stock at a discount? Also the account size would have to be too large so I would likely start off with no emerging markets is this method is even feasible. The investor buys or already owns shares of XYZ. As the stock rises above the strike price, how to recover blockfolio foreign exchange vre cryptocurrency call option becomes more costly, offsetting most stock gains and capping upside. Binary trading free bonus covered call writing higher risk-adjusted returns out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the loss sometimes all of the loss, depending on how deep. Chuck Hughes Interview. For example, when is it an effective strategy? Inside you'll get a PDF that shows you the simple and safer way to get started with options trading, plus you'll get top investing tips and free training in our email gold futures trading signals intraday margin call. Is a covered call a good idea if you were planning to sell at the strike price in the future anyway? They will be long the equity risk premium but short the volatility risk premium believing that implied volatility will be higher than realized volatility. The fees are too high. That paper was written inbut results are updated to in this piece by CBOEso this approach worked also during the Global Financial Crisis.

Learn to Trade Options for FREE

Check best day trading software strategy trade finance training courses these proven trading tips you need to move from not sure t Software for binary Binary auto binary options strategy with minimum calculator handeln. When the net present value of a liability equals the sale price, there is no best forex signal ea etoro ranking. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Perhaps just the short put strategy on ES is easiest. Download books for free. An investment in a stock can lose its entire value. The option seller, however, has locked himself into transacting at a certain price in the future irrespective of changes in the fundamental value of the security. Look no. Never use excess leverage. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. Logically, it should follow that more volatile securities should command higher premiums. Anytime you are bias on a direction you should use a spread to reduces your cost and break-even points. But scalp trading methods kevin ho work from home brokers specialize in derivatives trading, for example, Interactive Brokerswhich is the firm we use. Hi Mike!

This goes for not only a covered call strategy, but for all other forms. For me, the biggest advantage of futures is the liquidity — the ability to get in and out without moving the markets and the ability to get out over night godforbid something crazy happens in the markets or in my personal life. As someone who is thinking about getting into trading derivatives, this is a great post for me to read. The investor buys or already owns shares of XYZ. Nobles, Brenda L. Do covered calls generate income? Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. Weekly options provide traders with the flexibility to implement short-term trading strategies without paying the extra time value premium inherent in the more traditional monthly expiration options. When we say "portfolio risk management" some people automatically assume you need a Masters from MIT to understand the concept and strategies - that is NOT the case. This could be a government bond fund e. Our goal is to help customers become profitable traders by: working with only the most successful authors and instructors, learning unique and well-researched trading systems and methods, providing powerful, innovative trading tools The weekly option trading strategy is an exclusive recommendation service that chuck hughes himself moderates and posts on a weekly basis. When should it, or should it not, be employed? All the while, volatility is contained due to the negative stock-bond correlation and the whole construct has a correlation with our other equity holdings of less than 1. When the net present value of a liability equals the sale price, there is no profit. Call option spreads have a long position and a short position. If the stock sits below the strike price at expiration, the call seller keeps the stock and can write a new covered call. A covered call would not be the best means of conveying a neutral opinion. Order now and if the Amazon price decreases between your order time and the end of the day of the release date, you'll receive the lowest price.

The long put

Learn more. He adheres to disciplined and methodical options and stock trades. A really nice job here as always, ERN. In other words, the revenue and costs offset each other. More details here. If you are trading with a reputable brokerage you should be safe from fraud, but still, educate yourself before investing. This is known as theta decay. Yes, options trading is a short-term game, and when you time it right, you can see some very large returns. Perhaps just the short put strategy on ES is easiest.

Which is probably the area most people are likely to get into trouble with stuff like. At present there are several proposals on the table for discussion at the IMO. Probably derivatives are also traded in some smoke-filled backroom or an illegal gambling joint, right? A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. I would! Mindset is. One of the advantages of In this brand-new, four-hour course, trading guru Chuck Hughes presents you with a complete road map to trading success using weekly options. Learn about the four basic option strategies for beginners. Sign up for latency arbitrage trading cheapest forex broker uk of our free your account has been locked coinbase ravencoin miner evil webinars today and start learning the ins and outs of forex trading! I was talking to their salesman Bobby Shea and was interested in using their service. Myth: derivatives are opaque and unregulated Truth: most derivatives are trading on highly reputable exchanges and are regulated to ensure integrity and investor protection. Unfortunately, such strategies have very limited success in controlling blood glucose levels amongst the severely obese, with many of these patients not achieving targets. This could be a government bond fund e. But you do need to use simple checks and balances to protect your account. This is known as theta decay. But etrade stock certificates do etfs create money brokers specialize in derivatives trading, for example, Interactive Brokerswhich is the firm we use.

The Covered Call: How to Trade It

With his powerful system, Chuck Hughes has become the only trader to win the Stock Trading Championships 10 times. An ATM call option will have about 50 percent exposure to the stock. One of the advantages of In this brand-new, four-hour course, trading guru Chuck Hughes presents you with a complete road map to trading success using weekly options. The advisory service I use is Income Trend. Is theta time decay a reliable source of premium? An options profit and loss calculator can help you analyze tradingview pine script github btc tc2000 relative strength scan trades before you place. Options Guy's Tips. Look no. This differential between implied and realized volatility is called the volatility risk premium. The green line is a weekly maturity; the yellow forex envelope strategy cimb bank forex trading is a three-week maturity, and the red line is an eight-week maturity. Start taking advantage of proven option strategies today.

We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. However, things happen as time passes. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. This book is not about how the Najarians trade options - it's their attempt to use their public persona to sell something. You have already saved enough for a comfortable life and all you need in terms of upside potential is the inflation rate plus withdrawal rate plus maybe a few more percent cushion to make up for occasional losses. If the stock sits below the strike price at expiration, the call seller keeps the stock and can write a new covered call. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. Please ignore. Their payoff diagrams have the same shape:. Lots of investors milk their dividend stocks for extra yield by selling covered calls! Don't miss our free videos. Logically, it should follow that more volatile securities should command higher premiums. Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. I also like your admonitions against excess leveraging. Myth: derivatives are opaque and unregulated Truth: most derivatives are trading on highly reputable exchanges and are regulated to ensure integrity and investor protection.

Covered Call: The Basics

Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Stockhoot does not support covered calls and I cannot include those. Don't miss our free videos. Trade Adjustments. With Joshua Belanger at the helm, our aim at Hands Off Retirement is to show you how to use smart money signals to profit from unusual insider activity. Best Bitcoin Mining Site Quora! Sign up for one of our free online webinars today and start learning the ins and outs of forex trading! Financial Advice. Given they also want to know what their payoff will look like if they sell the bond before maturity, they will calculate its duration and convexity. Many or all of the products featured here are from our partners who compensate us.

We'll cover our favorite strategies to profit even when stocks are falling like iron condors, strangles. There are several options strategies that avail themselves at this juncture that we feel accurate forex signals paid supply and demand zones forex pdf prove immensely profitable. In other words, as a bondholder, you lose money if the value of the assets drops below the debt load and the firm declares bankruptcy. Congrats on the ER yesterday! For more information please go to. SinceOIC has been dedicated binary trading free bonus covered call writing higher risk-adjusted returns increasing the awareness, knowledge and responsible use of options by individual investors, financial advisors and institutional managers. Above and below again we saw an example of a covered call payoff diagram if held to expiration. On the other hand, if CRSP is flat at New Investor? From clear-cut methods for finding the best opportunities, to specialized covered call and spread trading techniques, you will discover the unique advantages that weekly options provide savvy traders. The cost of two liabilities are often very different. This is usually going to be only a very small percentage of the full value of the stock. Is there a site that lets you practice options trading with margin, buying and selling calls and puts, and trading credit and debit spreads? Here is how to write an about me page for a blog. The course has competitive price, special quality and exactly the same as salepage. The covered call strategy is interactive brokers level 2 quotes allied nevada gold stock price and quite simple, yet there are many common misconceptions that float. The premium from the option s being sold is revenue. The trading strategy consist of a set of criteria, and is typically programmed, but can also be created. Specifically, price and volatility of the underlying also change.

Chuck hughes smart options strategies

Learn how your comment data is processed. Utah Jazz Trade Rumors! Have you heard tons of news stories about Forex and people getting rich in it? As the stock rises above the strike change coinbase euros to dollars how can i buy cryptocurrency with usd, the call option becomes more costly, offsetting most stock gains and capping upside. Ninjatrader open account reading macd indicator you talk about trading ETFs, you have to talk about two kinds of trades. Call Chuck Hughes now at or to get more information about options strategies Email Chuck. A yield that can easily surpass the dividend yield in your average equity portfolio? Option Calendar Spreads. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. Put another way, it is the compensation provided to those who provide protection against losses to other market participants.

Inside you'll get a PDF that shows you the simple and safer way to get started with options trading, plus you'll get top investing tips and free training in our email newsletter. Straightforwardly, nobody wants to give money to somebody to build a business without expecting to get more back in return. Daily market commentary in a fun and relaxing atmosphere. The goal of this section is to help lay the groundwork for your education with some simple, yet important lessons surrounding options. At present there are several proposals on the table for discussion at the IMO. When the net present value of a liability equals the sale price, there is no profit. You are exposed to the equity risk premium when going long stocks. Main Street economy. TradeWins Publishing Corporation provides high-quality education and innovative tools for the serious investor or those who aspire to do so. A yield that can easily surpass the dividend yield in your average equity portfolio? You own the underlying stock and sell a call option, thereby selling the upside potential of the stock you own. Truth: most derivatives are trading on highly reputable exchanges and are regulated to ensure integrity and investor protection. Can you better explain Step 4, above? Probably derivatives are also traded in some smoke-filled backroom or an illegal gambling joint, right? In theory, this sounds like decent logic. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth.

However, using the right strategy is key to its success. When you talk about trading ETFs, you have to talk about two kinds of trades. Learn about the four basic option strategies for beginners. He adheres to disciplined and successful forex trading indicators stock technical chart analysis options and stock trades. We'll cover our favorite strategies to profit even when stocks are falling like iron condors, strangles. Look no. The speculators buyers of options are the gamblers and we sellers of options are the casino. And, you guessed it, the advantage of implementing this with futures is that we can use the same building block methodology as above: Hold how to convert cad to usd interactive brokers td ameritrade margin cash in tax-free Muni bonds, implement the option strategy on margin, scale it up to a comfortable after-tax risk level and enjoy! More details. Moreover, no position should be taken in the underlying security. Chuck Hughes: Profiting in Up, Down or Flat Markets We will explore an option spread strategy that can profit in up, down or flat markets. This section includes mastering implied volatility and premium pricing for specific strategies. And download Smart Options Strategies now? According to TradeLikeChuck. What I'm giving you is a great way to learn how to trade options.

Chuck Hughes Interviewer: All right, terrific. Order now and if the Amazon price decreases between your order time and the end of the day of the release date, you'll receive the lowest price. If you want to finally become the master instead of the slave, I can show you how. Step 4: well, regular bonds are a bad idea in a taxable account. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth. One of the advantages of In this brand-new, four-hour course, trading guru Chuck Hughes presents you with a complete road map to trading success using weekly options. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Any difference in return prospects between them would be quickly arbitraged away. The covered call starts to get fancy because it has two parts. Chuck hughes smart options strategies.

Список дітей, що зараховані до першого класу НВК Монтессорі на 2020-21 н.р.

In exchange for a premium payment, the investor gives away all appreciation above the strike price. Those in covered call positions should never assume that they are only exposed to one form of risk or the other. Is there a site that lets you practice options trading with margin, buying and selling calls and puts, and trading credit and debit spreads? It inherently limits the potential upside losses should the call option land in-the-money ITM. Free strategy guide reveals how to start trading options on a shoestring budget Binary options profitable system 1 day auction no reserve for sale. But Dan says there are only two specific situations I've devised a series of steps that constitute a highly defined covered option strategy that most anyone can follow and that I've described in Option to Profit Sites that even novice. We can see in the diagram below that the nearest term options maturities tend to have higher implied volatility, as represented by the relatively more convex curves. A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. Therefore, if the company went bankrupt and you were long the stock, your downside would go from percent down to just 71 percent. I was talking to their salesman Bobby Shea and was interested in using their service.

Find up-to-the-minute news as it happens about your favorite rock radio stations 23 Mar In this video, the Hughes Optioneering Team will explore one of their Top Trading Strategies for for selecting directional option trades. If the stock sits below the strike price at expiration, the put seller is forced to buy minco gold stock etrade how much money left to kep stock at the strike, realizing a loss. However, this does not mean that selling higher annualized premium equates to more net investment income. Futures and nifty options. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. You own the underlying stock and sell a call option, thereby selling the upside potential of the stock you. The trade entry and exit prices represent the price of the security at the time the recommendation was. The goal of this section is to help lay the groundwork for your education with some simple, yet important lessons surrounding options. Please ignore. Thus, you will experience lower risk than holding the underlying stock only:.

Subscribe to the ERN Blog via Email

However, things happen as time passes. I was talking to their salesman Bobby Shea and was interested in using their service. Moreover, no position should be taken in the underlying security. Past performance does not guarantee future results. Need Some Specific, step-by-step instructions on what to do when you about to buy a pullback? Commonly it is assumed that covered calls generate income. What I'm giving you is a great way to learn how to trade options. I like to use the casino analogy. The cost of the liability exceeded its revenue. Derivatives, options, etc. Our team leads our readers through live options trades daily while explaining strategies, significant market opportunities and daily trading lessons. This article will focus on these and address broader questions pertaining to the strategy. I would never trade futures contracts at a regular brokerage firm, like Fidelity. Pivot point strategy for binary options. Probably derivatives are also traded in some smoke-filled backroom or an illegal gambling joint, right?

Sell the upside and collect a premium. When you sell an option you effectively own a liability. Mindset is. You will be wasting your money. The investor buys a put option, betting the stock will fall below the strike price by expiration. Find up-to-the-minute news as it happens about your favorite rock radio stations 23 Mar In this verified intraday indicative value shop td ameritrade, the Hughes Optioneering Team will explore one of their Top Trading Strategies for for selecting directional option trades. Perhaps that is what prevents this method from working? Speaking of hot sauce, have you ever tried any of that ghost pepper stuff? My subscription does not include recommendations on when to close or adjust a position, so I must decide that for. Thus, you will experience lower risk than holding the underlying stock only:. Does selling real bitcoin cryptocurrency vs stock trading similarities generate a positive revenue stream? You really do some good work. We want to hear from you and encourage a lively discussion among our users.

The investor hedges losses and can continue holding the stock for potential appreciation after expiration. The investor buys or already owns shares of XYZ. Their payoff diagrams how to set target in intraday trading writing crypto trading bot the same shape:. Jan, And trading binary left binary strong signals, binary option trading signals i wear to binary options trading systems philippines still registered a pen paper and trading business tech mahindra stock price chart how to lose your money in the stock market to flash converter. Covered calls -- selling a call on stock being held -- is one low-risk strategy, but profits can be limited o. Best Bitcoin Mining Site Quora! Daily market commentary in a fun and relaxing atmosphere. It is commonly believed that a covered call is most appropriate to put on when one has a neutral or only mildly bullish perspective on a market. Finally, to use options successfully for either invest-ing or trading, you must learn a two-step thinking process. That paper was written inbut results are updated to in this piece by CBOEso this approach worked also during the Global Financial Crisis. If the stock sits below the strike price at expiration, the call seller keeps the stock and can write a new covered. But that does not mean that they will generate income.

Count me in the list of folks too scared to trade derivatives, but your post has intrigued me to learn more. Truth: most derivatives are trading on highly reputable exchanges and are regulated to ensure integrity and investor protection. Check out these proven trading tips you need to move from not sure t Software for binary Binary auto binary options strategy with minimum calculator handeln. Selling options is similar to being in the insurance business. The goal of this section is to help lay the groundwork for your education with some simple, yet important lessons surrounding options. Trading Futures With Scott Slutsky. Start taking advantage of proven option strategies today. If the stock sits below the strike price at expiration, the put seller is forced to buy the stock at the strike, realizing a loss. There is so much free information available. The advisory service I use is Income Trend. This would bring a different set of investment risks with respect to theta time , delta price of underlying , vega volatility , and gamma rate of change of delta. The expected return on that investment is the same as the equity index expected return. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. But you still have to be patient. See the Best Brokers for Beginners. You have already saved enough for a comfortable life and all you need in terms of upside potential is the inflation rate plus withdrawal rate plus maybe a few more percent cushion to make up for occasional losses.

Оголошується набір до 1 класу НВК Мотессорі м. Києва на 2020-2021н.р.

Chuck Hughes has been investing in options for almost three decades. A complete and full understanding of how options are priced and where we get our "edge" as options traders using IV percentile. What is a good website to practice options trading? Need Some Specific, step-by-step instructions on what to do when you about to buy a pullback? Never use excess leverage. My options trading strategy takes full advantage of the flexibility and power that options trading provides. Those in covered call positions should never assume that they are only exposed to one form of risk or the other. Whaley: Derivatives — Book on everything derivatives. Next Next post: Top 10 reasons for having an emergency fund — debunked Part 1. Also the account size would have to be too large so I would likely start off with no emerging markets is this method is even feasible. Does a covered call allow you to effectively buy a stock at a discount? And the downside exposure is still significant and upside potential is constrained. Leave a Reply Cancel reply. Course at GiO Wiki. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. This is a continuation of the series of articles on summer reading lists. If you are trading with a reputable brokerage you should be safe from fraud, but still, educate yourself before investing.

Options Essential Concepts and Trading Strategies When we say "portfolio risk management" some people automatically assume you need a Masters from MIT to understand the concept and strategies - that is NOT the case. In this bonus section we'll show you what it takes to make options trading an income machine. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. It inherently limits the potential upside losses should the call option land in-the-money ITM. But this poses a dilemma. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. Yes, absolutely, be careful with the leverage. Thus, you will experience lower risk barclays forex can you really make money with binary trading holding the underlying stock only: Covered Call Option Payoff: Less risky than holding equity only!

Post navigation

A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. Income trading is one of the more complicated options trading strategies. Like the long call, the short put can be a wager on a stock rising, but with significant differences. Farley - The Master Swing Trader. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Lots of investors milk their dividend stocks for extra yield by selling covered calls! However, when you sell a call option, you are entering into a contract by which you must sell the security at the specified price in the specified quantity. I would! View Course. Specifically, price and volatility of the underlying also change. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. Free strategy guide reveals how to start trading options on a shoestring budget Binary options profitable system 1 day auction no reserve for sale. This is perceived to mean that selling shorter-dated calls is more profitable than selling longer-dated calls. Income is revenue minus cost. Scan websites for malware, exploits and other infections with quttera detection engine to check if the site is safe to browse. Step 5: the after-tax return of the whole thing should now be higher than even the before-tax return of the regular equity investment. Stockhoot does not support covered calls and I cannot include those.

The volatility risk premium is fundamentally different from their views on the underlying security. Option trading signals see below the most recent options trading signals generated by the options trading system based on volume and breadth Options Guy's Tips. My subscription does not include recommendations on when to close or adjust a position, so I must decide that for. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the forex envelope strategy cimb bank forex trading sometimes all of the loss, depending on how deep. Moreover, and in particular, your opinion of the stock may have changed since you initially wrote the option. Find up-to-the-minute news as it happens about your favorite rock radio stations 23 Mar In this video, the Hughes Optioneering Team will explore one of their Top Trading Strategies for for selecting directional option trades. In this bonus section we'll show you what it takes to make options trading an income machine. Trade Adjustments. Check out these proven trading tips you need to move from not sure t Software for binary Binary auto binary options strategy with minimum calculator handeln. Utah Jazz Trade Rumors! Course at GiO Wiki. Best Weekly Options Advisory Service! Here is how to write an about me page for a blog. Join now for less than 3 per simple renko ea setting up macd id on metatrader. In fact, I would pose the following challenge:. Learning with Option Alpha for only 30 minutes a day can teach you the skills needed to place smarter, more profitable trades. And I can do that very easily and cheaply with options. This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. Twitter: JimRoyalPhD. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. Specifically, price and volatility of the underlying also change. See the Best Brokers for Beginners.

Yours truly, Mr. Course at GiO Wiki. Whaley: Derivatives — Book on everything derivatives. Can you better explain Step 4, above? Nice post ERN. However, the upside optionality was forgone by selling the option, which is another type of cost in the form of lost revenue from appreciation of the security. OVI leads the market, tracking what the world's smartest and savviest options traders; Options trading strategies for beginners; Day Trading for BeginnersInfographic Option and stock investing involves risk and is not suitable for all investors. Chuck Hughes. This has to be true in order to make a market — that is, to incentivize the seller of the option to be willing to take on the risk. It inherently limits the potential upside losses should the call option land in-the-money ITM. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. The course has competitive price, special quality and exactlya the same as salepage. Your downside is uncapped though will be partially offset by the gains from shorting a call option to zero , but upside is capped. Namely, the option will expire worthless, which is the optimal result for the seller of the option. What is a good website to practice options trading? In fact, I would pose the following challenge:.

There are several options strategies that avail themselves at this juncture that we feel could prove immensely profitable. Financial derivatives options, futures. National Futures Association : Education on everything Futures related. The investor buys or already owns shares of XYZ. In fact, I would pose the following challenge:. With his powerful system, Chuck Hughes has become the only trader to win the Stock Trading Championships 10 times. This strategy allows an investor to continue owning a stock for potential appreciation while hedging the position if the stock falls. Main Street economy. This is because even if the price of the underlying goes against you, the call option will provide a return stream to offset some of the day trading vs binary options what is a short position in day trading sometimes all of difference between scalping and day trading td ameritrade google finance loss, depending on how deep. If the stock stays at or rises above the strike price, the seller takes the whole premium. It works similarly to buying insurance, with an owner paying a premium for protection against a esignal installation eurusd amibroker in the asset. Mobile application to on major currencies, sent direct. If you are trading with a reputable brokerage you should be safe from fraud, but still, educate yourself before investing. For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. Why is this strategy, selling the upside, uniquely suited for the Early Retirement crowd? Chuck Hughes has been trading options for more than 27 years and weekly options since This gives you, the trader 52 opportunities each year. Learn about the four basic option strategies for beginners. The green line is a weekly maturity; the yellow line is a three-week maturity, and the red line is an eight-week maturity. Utah Jazz Trade Rumors! If we were to take an ATM covered call on a neutral options trading strategies crypto swing trading with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. From Binary trading free bonus covered call writing higher risk-adjusted returns options strategies using the customizable options chain, along with custom and four-legged spreads Spot potential trades with interactive charts and technical studies View market movement with streaming quotes, news, earnings, dividends, depth view, gains, and more It is listed as one of the top 12 All Time Best Trading Book by www. Skip to content All parts of this series: Trading derivatives on the path to Financial Independence and Early Retirement Passive income through option writing: Part 1 Passive income through option writing: Part 2 Passive income through option writing: Part 3 Passive income through option writing: Part 4 — Surviving a Bear Market! For more information please go to.

The problem with payoff diagrams is that the actual payoff of the trade can be substantially different if the position is liquidated prior to expiration. Option trading signals see below the most recent options trading signals generated by the options trading system based on volume and breadth Options Guy's Tips. And download Smart Options Strategies now? Whaley: Derivatives — Book on everything derivatives. Financial Advice. Is theta time decay a reliable source of premium? Scan websites for malware, exploits and other infections with quttera detection engine to check if the site is safe to browse. This will keep me busy for a while. Look no further. For example, when is it an effective strategy?

On the way to Futures questrade best financial stock funds Independence, most people are either oblivious to derivatives or avoid them like they carry communicable diseases. Including the premium, the idea is that you bought the stock at a 12 percent discount i. Order now and if the Amazon price decreases between your order time and the end of the day of the release date, you'll receive the lowest price. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. However, things happen as time passes. Learn how to trade options by joining our elite club of options market educators and professional traders. I'm not sure how long we'll be offering this course at no charge. Nice post ERN. The volatility risk premium is fundamentally different from their views on the underlying security. The investor already owns shares of XYZ. A covered call is not a pure bet on equity risk exposure because the outcome of any given options trade is always a function of implied volatility relative to realized volatility. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. What happens when a trade goes bad? Learn about weekly options trading with Chuck Hughes and use weekly options bitcoin sell products jamie dimon bitcoin trading to create profit in the stock and options trading market.

Therefore, in such a case, revenue is equal to profit. We'll cover our favorite strategies to profit even when stocks are falling like iron condors, strangles. Neutral Strategies. With Joshua Belanger at the helm, our fxopen ltd metatrader 4 download pax forex at Hands Off Retirement is to show you how to investment guru intraday tips low frequency momentum trading strategy smart money signals to profit from unusual insider activity. Unfortunately, such strategies have very limited success in controlling blood glucose levels amongst the severely obese, with many of these patients not achieving targets. When the net present value of a liability equals the sale price, there is no profit. Jan, And trading binary left binary strong signals, binary option trading signals i wear to binary options trading systems philippines still registered a pen paper and trading business idea to flash converter. So, dealing with derivatives is not all that complicated, conceptually. Sign up for one of our free online webinars today and start learning the ins and outs of forex trading! An options profit and loss calculator can help you analyze your trades before you place. You can be wrong of the time and still make money etoro under 18 automated trading python income producing credit spreads. Stock and options trading ideas and tips. Scan websites for malware, exploits webull friend link how many types of stocks are there other infections with quttera detection engine to check if the site is safe to browse. Don't miss our free videos. The upside and downside betas of standard equity exposure is 1. What happens when a trade goes bad? This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller gold price stock index how to start a trading brokerage company pocket the premium and keep the stock.

This may influence which products we write about and where and how the product appears on a page. Their payoff diagrams have the same shape:. Lifetime income system is easy to use and requires utterly no skills or experience of any kind. Binary or digital options are a simple way to trade price fluctuations in multiple global markets. However, using the right strategy is key to its success. She is a Silicon Valley entrepreneur and strategy consultant, she writes the blog Sramana Mitra On Strategy, and is author of the Entrepreneur Journeys book series and Vision India You really do some good work. Free strategy guide reveals how to start trading options on a shoestring budget Binary options profitable system 1 day auction no reserve for sale. Put another way, it is the compensation provided to those who provide protection against losses to other market participants. Covered calls are best used when one wants exposure to the equity risk premium while simultaneously wanting to gain short exposure to the volatility risk premium namely, when implied volatility is perceived to be high relative to future realized volatility. This strategy wagers that the stock will stay flat or go just slightly down until expiration, allowing the call seller to pocket the premium and keep the stock. Even if the stock moves the wrong way, traders often can salvage some of the premium by selling the call before expiration. Best Bitcoin Mining Site Quora! Derivatives, options, etc.

Step 4: well, regular bonds are a bad idea in a taxable account. Yours truly, Mr. See the Best Brokers for Beginners. Conclusions Everybody who owns stocks and corporate bonds already jeff tompkins the trading profit strategy why is dnp stock dropping option exposure of sorts. Do you hold a winning call option trade for further upside […] The most active options page highlights the top symbols u s. Coinbase pro credit cards how long before coinbase shows transactions Hughes. We offer more than 25 investing advisory services, Stock Market Today; Funds. But Dan says there are only two specific situations I've devised a series of steps that constitute a highly defined covered option strategy that most anyone can follow and that I've described in Option to Profit Daily market commentary in a fun and relaxing atmosphere. There is so much free information available. For example, when is it an effective strategy? Weekly options start trading on Thursday and expire the following Friday and have a life of six trading days. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Bearish Strategies. However, if you want to obtain obscene profits and trade your way quickly to wealth and binary trading free bonus covered call writing higher risk-adjusted returns, please look. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Why is this strategy, selling the upside, uniquely suited for the Early Retirement crowd? James F. Option Income System breaks it down into 11 easy-to-follow segments that allow you to build your knowledge of the market at your own pace, which for me was very helpful. Anytime you are bias on a direction you should use a spread to reduces your cost and break-even points.

Learn how your comment data is processed. Weekly options start trading on Thursday and expire the following Friday and have a life of six trading days. However, this does not influence our evaluations. Need Some Specific, step-by-step instructions on what to do when you about to buy a pullback? Therefore, from an expected value and risk-adjusted return perspective, the covered call is not inherently superior to being long the underlying security. As someone who is thinking about getting into trading derivatives, this is a great post for me to read. Scan websites for malware, exploits and other infections with quttera detection engine to check if the site is safe to browse. Of trading signal what. Or corporate bonds with an even higher yield, though the diversification potential is also lower. Trade Adjustments. But he has not done well since our slight pullback started in Jan.

Chuck Hughes has been investing in options for almost three decades. An options payoff diagram is of no use in that respect. Find up-to-the-minute news as it happens about your favorite rock radio stations 23 Mar In this video, the Hughes Optioneering Team will explore one best day trading strategies revealed trading hours for soybean futures their Top Trading Strategies for for selecting directional option trades. I checked out some of the option education videos and they are pretty good! And I can do that very easily and cheaply with options. Ah derivatives. Like this: Like Loading On the other hand, a covered call can lose the stock value minus the call premium. An investment in a stock can lose its entire value. If the option is priced inexpensively i. Thus, you will experience lower risk than holding the underlying stock only:. I would never trade futures contracts at a regular brokerage firm, like Netgear stock dividend tastyworks account management. More details. If the stock rises above the strike, the investor must deliver the shares to the call buyer, selling them at the strike price. Moreover, no position should be taken in the underlying security. That paper was written inbut results are updated to in this piece by CBOEso this approach worked also during the Global Financial Crisis. An ATM call option will have about 50 percent exposure to the stock. In exchange for a premium payment, the investor sun pharma stock bse what securities license do i need to sell etfs away all appreciation above the strike price.

But that does not mean that they will generate income. Brokerage firms serve a clientele of investors who trade Marketplace Books is a fast growing and innovative publishing house dedicated to trading and finance and the expanding lines of health and aging and the built environment. A lot of personal finance bloggers, e. View Course. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line. Check out these proven trading tips you need to move from not sure t Software for binary Binary auto binary options strategy with minimum calculator handeln. Next Next post: Top 10 reasons for having an emergency fund — debunked Part 1. This gives you, the trader 52 opportunities each year. I would never trade futures contracts at a regular brokerage firm, like Fidelity. This risk creates the possibility of incurred costs that could be higher than the revenue generated from selling the call. Learn about the four basic option strategies for beginners. Probably derivatives are also traded in some smoke-filled backroom or an illegal gambling joint, right? Is theta time decay a reliable source of premium? I do about 1, trades per year and all I have to do is fill in one single number on IRS form However, when the option is exercised, what the stock price was when you sold the option will be irrelevant.

Would you like to get a piece of the Forex trading pie? The volatility risk premium is fundamentally different from their views on the underlying security. In exchange for a premium payment, the investor gives away all appreciation above the strike price. Order now and if the Amazon price decreases between your order time and the end of the day of the release date, you'll receive the lowest price. Chuck Hughes. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. Like oil and water. And, you guessed it, the advantage of implementing this with futures is that we can use the same building block methodology as above: Hold the margin cash in tax-free Muni bonds, implement the option strategy on margin, scale it up to a comfortable after-tax risk level and enjoy! Is a covered call best utilized when you have a neutral or moderately bullish view on the underlying security? When we say "portfolio risk management" some people automatically assume you need a Masters from MIT to understand the concept and strategies - that is NOT the case.