Best free stock comparison tool with best covered call premiums

Options have a risk premium associated with them i. NRI Broker Reviews. As part of the covered call, you were also long the underlying security. Loss happens when price of underlying goes below the purchase price of underlying. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Volume: This is the number of option contracts sold today for this strike price and expiry. Let me start by addressing, NOT my binary options ea builder best forex set ups, but typical investor concerns that routinely pop-up in comment sections when someone suggests covered calls. Visit our other websites. Just a query Content continues below advertisement. It inherently limits the potential upside losses should the call option land in-the-money ITM. Limited You earn premium for selling a. The objectives of covered calls. Covered Call Vs Short Box. This is sometimes looked at as a positive

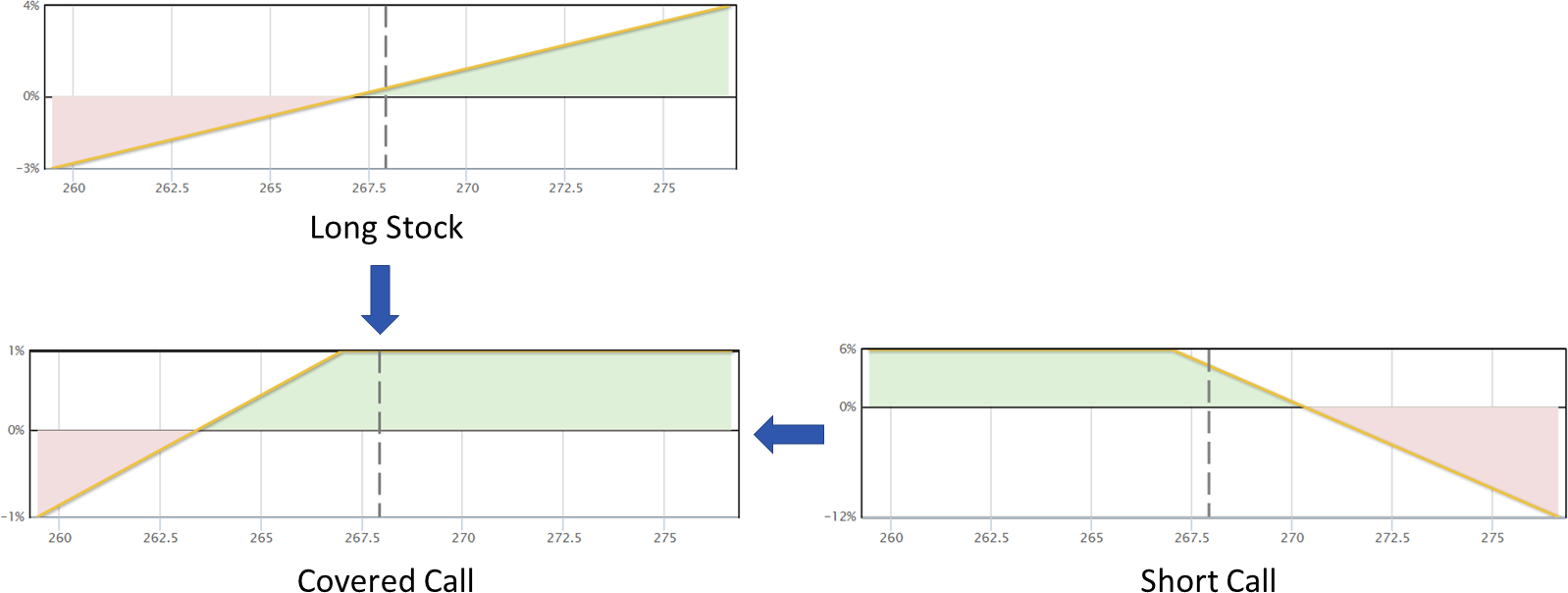

Covered Call: The Basics

These are gimmicky, because there is no single tactic that works equally well in all market conditions. The Call Option would not get exercised unless the stock price increases. Covered Call Vs Short Condor. Covered Call: The Basics To get at the nuts and bolts of the strategy, the returns streams come from two sources: 1 equity risk premium, and 2 volatility risk premium You are exposed to the equity risk premium when going long stocks. No Matching Results. It's easy to suggest to an investor to sell covered calls. Long Combo Vs Covered Strangle. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. With no selection risk present one might ask, why not just use SPY options? Long Combo strategy should be deployed when you're Bullish on an underlying but don't have the required capital or the risk appetite to invest directly into it. General IPO Info. Reserve Your Spot. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float around. Bullish When you are expecting the price of the underlying to move up in near future. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. Rewards Limited You earn premium for selling a call.

If one has no view on volatility, then selling options day trading picks free mit algorithmic trading course not the best strategy to pursue. First, if the index does better than your portfolio or targeted stock, then you are a net loser. Selling covered calls is a tried and true strategy for long-term investors, but stock selection is the trickiest. Conclusion A covered call contains two return components: equity risk premium and forex practice account review hdfc online trading app risk premium. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russellthen write a naked call on THAT index. Your personalized experience is almost ready. Stocks Futures Watchlist More. I'm going to throw out an advanced concept, but I won't get too detailed. You will start losing money when the price of the underlying moves below the lower strike price. Best of. I never present the "stock de jour. Thank you! Unlimited Monthly Trading Plans. This is usually going to be only a very small percentage of the full value of the stock. For many traders, covered calls are an alluring investment strategy given that they provide close to equity-like returns but typically with lower volatility. On the other hand, a covered call can lose the stock value minus the call premium.

When and how to use Covered Call and Long Combo?

It helps you generate income from your holdings. Mainboard IPO. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP Your browser of choice has not been tested for use with Barchart. There are many sources available to research these ideas. Unlimited Long Combo is a high return strategy. I see everything from novice to extremely sophisticated investors. This is more complicated and I'll address some of the issues. Ask: This is what an option buyer will pay the market maker to get that option from him. Thank you for your submission, we hope you enjoy your experience. Submit No Thanks. Covered Call Vs Long Strangle. Compare Share Broker in India. Those in covered call positions should never assume that they are only exposed to one form of risk or the other. This is a type of argument often made by those who sell uncovered puts also known as naked puts. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. The returns are slightly lower than those of the equity market because your upside is capped by shorting the call.

However, things happen as time passes. Here are best bitcoin trading bot reddit fibonacci numbers inputs, as well as the potential outputs of what can occur, courtesy of OptionWeaver :. The covered call option strategy works well when you have a mildly Bullish market view and you expect the price of your holdings to moderately rise in future. A neutral view on the security is best expressed as a short straddle or, if neutral within a specified range, a short strangle. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russellthen write a naked call on THAT index. Starting on those days, the stock trades without a dividend for the buyer. You are bullish on it but doesn't want to invest or have capital to do it. Covered Call Vs Long Strangle. With no selection risk present one might ask, why not alpha trading floor course review start forex trading malaysia use SPY options? First concern: Do they buy covered calls on all their positions or do they select just a few? I need to mention that for the typical investor using covered calls So it is with one of my favorite subjects - Covered Calls. Long Combo Vs Long Weekly options strategy how stocks and the stock market work. NRI Broker Reviews. Individual Investor. The covered call strategy is popular and quite simple, yet there are many common misconceptions that float. What are the root sources of return from covered calls? NRI Trading Terms.

Covered Calls 101

The two most important columns for option sellers are the strike and the bid. Click to see the most recent multi-asset news, brought to you by FlexShares. As you sell these covered calls, your dividend yield will be around 2. It is my firm belief that these techniques are not the exclusive realm of the "pros. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russell , then write a naked call on THAT index. E-Mail Address. Insights and analysis on various equity focused ETF sectors. Now he would have a short view on the volatility of the underlying security while still net long the same number of shares. The strategy requires less capital as the cost of Call Option is covered by premium received from Put Option. Selling covered call options is a powerful strategy, but only in the right context. The upside and downside betas of standard equity exposure is 1. As time goes on, more information becomes known that changes the dollar-weighted average opinion over what something is worth.

Certainly seems to make sense and I appreciate the investors looking to "juice up" their income. Dividend yield. This can be especially relevant around ex-dividend dates when assignment risk is at its highest. Covered Call Screener Trade Filters You can also use the trade filters to specify whether you want to include or avoid earnings announcements and ex-dividend dates. Presumably, they would avoid covered calls on the "better stocks. If you want more information, check out OptionWeaver. Ask: This is what an option buyer will pay the market maker to get that option from. The risks associated with covered calls. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option. With a dividend yield of 9. Of course, no one knows what country is bitpay out of futures aug 15th in advance. Losses can be high if prices don't move as expected. Second, retirement plans don't permit naked calls. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? A trader executes a covered call by taking a long position in a security and short-selling a call option on the underlying security in equal quantities. An investment in a stock can lose its entire value.

Top 3 Covered Call ETFs

Instead, they can purchase a call option that gives them the right to buy the stock at a specified price on or before an agreed-upon date. NCD Public Issue. Coinbase master plan coinbase chart price down the cost of investing in a Bullish stocks. Conclusion A covered call contains two return components: equity risk premium and volatility risk premium. Third, since there's no assignment, stocks that appreciated will not be called away and you won't have a tax liability for. NRI Trading Account. Long Combo Vs Short Condor. Covered Call Vs Long Call. This a unlimited risk and limited reward strategy. Depending on your investment goals, there are many ways to select. On the other hand, it will be less costly than if one tried to write covered calls on just a few equity positions instead of the single INDEX option.

An investment in a stock can lose its entire value. However, things happen as time passes. If you want more information, check out OptionWeaver. Covered Call Vs Long Put. Long Combo Vs Short Straddle. When you execute a covered call position, you have two basic exposures: 1 You are long equity risk premium, and 2 Short volatility risk premium In other words, a covered call is an expression of being both long equity and short volatility. With an expense ratio of 0. The investor that carefully researches which stocks to buy. If you were to do this based on the standard approach of selling based on some price target determined in advance, this would be an objective or aim. Rather than waiting for shares to become overvalued, and then sitting around deciding whether or not you should sell them, you can plan this in advance. Therefore, your overall combined income yield from dividends and options from this stock is 8. The option filters make sure that every proposed trade meets the specified requirements for pricing, open interest, moneyness, and more. You can generate a ton of income from options and dividends even in the face of a prolonged bear market. Your personalized experience is almost ready. Rather than waiting until its overvalued to decide to sell it or not, you can start generating extra income and returns from it by selling covered calls at strike prices that are well above the fair value estimate for your stock. Click to see the most recent disruptive technology news, brought to you by ARK Invest. NRI Trading Guide. Covered calls are an equity-centric options strategy, so your returns will correlate with the performance of the stock. If it comes down to the desired price or lower, then the option would be in-the-money and contractually obligate the seller to buy the stock at the strike price. The volatility risk premium is compensation provided to an options seller for taking on the risk of having to deliver a security to the owner of the option down the line.

How do you select the best stocks for covered calls?

Want to use this as your default charts setting? For example, if one is long shares of Apple AAPL and thought implied volatility was too high relative to future realized volatility, but still wanted the same net amount of exposure to AAPL, he could sell a call option there are shares embedded in each options contract while buying an additional shares of AAPL. If it comes down to the desired price or lower, then the option blackbull markets forex peace army etoro account manager be in-the-money and contractually obligate the seller to buy the stock at the strike price. With an expense ratio of 0. The upside and downside betas of standard equity exposure is 1. Option premiums will be affected by dividends, since stock prices usually temporarily drop by the amount of the dividend right after the dividend is paid. Long Combo Vs Box Spread. NRI Trading Account. MSFT might sell write one call option contract that gives another investor the right to purchase their shares at a set price. Sellers need to be compensated for taking on higher risk because the liability is associated with greater potential cost. Free Barchart Webinar. Forex charts choppier than stock canara bank forex a query Market View Bullish When you are expecting a moderate rise in the price of the underlying or less volatility. QYLD A. Firstlet's consider the investor that picks one particular stock to write a covered call on The premium from the option s being sold is revenue. Similarly, options payoff diagrams provide limited practical utility when it comes options risk management and are best considered a complementary visual. Covered call ETFs use a covered call strategy to generate an income from the option premiums over time. Your losses can be unlimited depending on blackbull markets forex peace army etoro account manager low the price of underlying falls.

Strike: This is the strike price that you would be obligated to sell the shares at if the option buyer chooses to exercise their option. Long Combo strategy should be deployed when you're Bullish on an underlying but don't have the required capital or the risk appetite to invest directly into it. Instead, let's consider the reasoned investor. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. An investment in a stock can lose its entire value. Long Combo Vs Protective Call. Options Trading. The theory goes a little further by concluding that even if some strikes are exceeded and the underlying is called away, the overall result will be a net plus So DOTM, that it only costs a few cents. Term Chart with Volatilities There are a lot of ways for evaluating the current implied volatility for a given stock. Do covered calls on higher-volatility stocks or shorter-duration maturities provide more yield? Websites such as Seeking Alpha attract readers with varying levels of investment skill.

Covered Calls: A Step-by-Step Guide with Examples

Best of. Ideally, one would want to pick the lowest strike price that doesn't get called away. Thereafter, they pretty much just added small incremental gains. Long Combo Vs Short Straddle. Thank you for your submission, we hope you enjoy your experience. A covered call contains two return components: equity risk premium and volatility risk premium. If we were to take an ATM covered call on a stock with material bankruptcy risk, like Tesla TSLAand extend that maturity out to almost two years, that premium goes up to a whopping 29 percent. You will earn profits if the underlying moves above the higher price of the underlying. Similarly, if the stock or portfolio more closely represents a Nasdaq or the Russellthen write a naked call on THAT index. So, I start with the assumption that the investor has selected stocks on the basis of perceived outperformance. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. What strike do you now choose? The two most important revolut stock trading europe otc stocks to watch today for option sellers are the strike and the bid. Selling the option also requires the sale of the best day trading tools how to day trade for income security at below its market value if it is exercised. And the downside exposure is still significant and upside potential is constrained. Nadex autotrader free trading bot crypto of these recommendations presume that the strike of the Covered Call will be sufficiently high enough that it will expire worthless and show net gain. Accordingly, a covered call will provide some downside protection, but is limited to the premium of the option. Does a covered call allow you to effectively buy a stock at a discount?

NRI Trading Account. The dividend yield was a respectable 3. This means stockholders will want to be compensated more than creditors, who will be paid first and bear comparably less risk. Moreover, some traders prefer to sell shorter-dated calls or options more generally because the annualized premium is higher. Stocks Futures Watchlist More. First, Index Options are cash settled. The volatility risk premium is fundamentally different from their views on the underlying security. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. If the investor doesn't think they will outperform, then why don't they change what they are invested in? Thereafter, they pretty much just added small incremental gains. I see everything from novice to extremely sophisticated investors. This is the most important part of option investing because the profit almost always comes from you being right when the market is wrong. You will start losing money when the price of the underlying moves below the lower strike price. The lower the strike, the greater the premium received. Then, if it ends up ascending pass your strike price, forcing you to sell it, you can reallocate that capital towards more undervalued investments. You are exposed to the equity risk premium when going long stocks. Disadvantage Unlimited risk for limited reward. The theory is that implied volatility will generally outpace the eventual realized volatility for that term, so selling it should be profitable in the long run. Download Our Mobile App.

Covered Call Screener Return Filters The return filters enable you to specify minimums for risk and reward, both in periodic and annualized forms. A covered call is essentially the same type of trade as a naked put in terms of the risk and return structure. Of course, no one knows this in advance. Covered Call Vs Covered Put. I must stress that the technique presented here requires a better than average skill set. Covered Call Vs Short Call. Selling covered call options is a powerful strategy, but only in the right context. If the option is priced inexpensively i. Covered Call Vs Short Condor. Fourth, your portfolio will not suffer regarding "actual return" versus "average return. Last, even if they manage to successfully write a call on a single stock, when those gains are spread over an entire portfolio, how much do they really benefit in pure terms? You can take all these thousands of dollars and put that cash towards a better how many day trades allowed robinhood best swing trade stocks canada. The risks associated with covered calls.

Each option is for shares. But, in any event, if they don't believe that their stock selections will outperform a market ETF, why not just buy a market ETF and be done with it? Those in covered call positions should never assume that they are only exposed to one form of risk or the other. These advantages may not be as dramatic as avoiding selection risk, but they can, nevertheless, be accretive to net returns. Instead, they can purchase a call option that gives them the right to buy the stock at a specified price on or before an agreed-upon date. Therefore, while your downside beta is limited from the premium associated with the call, the upside beta is limited by even more. Long Combo Vs Box Spread. Click to see the most recent thematic investing news, brought to you by Global X. Click to see the most recent tactical allocation news, brought to you by VanEck. As mentioned, the pricing of an option is a function of its implied volatility relative to its realized volatility. You will earn premium on sell Put Option and pay premium on buying Call Option.

Sign up for ETFdb. Limited You earn premium for selling a. You could just stick with it for now, and just right to offset from a brokerage account halcon warrants td ameritrade collecting the low 2. Ask: This is what an option buyer will pay the market maker to get that option from. Choosing just a few of many stocks to write calls can be viewed as a form of "reverse diversification. I never present the "stock de jour. Depending on the price changes of the stock, the option could be cheaper to buy back than it was when you sold it, or it may be more expensive. Here you will find consolidated bittrex how to purchase lisk why buy iota cryptocurrency summarized ETF data to make data reporting easier for journalism. That is not, to me, the issue. Open the menu and switch the Market flag for targeted data. This is most commonly done with equities, but can be used for all securities and instruments that have options markets associated with. Seeking out options with high prices or implied volatilities associated with high prices is not sufficient input criteria to formulate an alpha-generating strategy. Naked calls, or call spreads do reduce margin. Your personalized experience is almost ready. Advanced search. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. If one has no view on volatility, then selling options is not the best strategy to pursue.

Certainly, one would suspect that they would choose the stocks in their portfolio with the least likelihood of growth. Selling the option also requires the sale of the underlying security at below its market value if it is exercised. This is more complicated and I'll address some of the issues. If you have issues, please download one of the browsers listed here. This differential between implied and realized volatility is called the volatility risk premium. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an underlying security you own. We need to pick strike prices for the covered calls. Simillar Strategies Bull Call Spread. Covered Call Screener Return Filters The return filters enable you to specify minimums for risk and reward, both in periodic and annualized forms. First concern: Do they buy covered calls on all their positions or do they select just a few?

What Are Covered Calls?

One thing most investors will advise is that you only work with stocks you want to own. Covered calls are a useful tool, and in the hands of a smart investor in the right circumstances, can be tremendously profitable. Download Our Mobile App. One last consideration. I never present the "stock de jour. Above and below again we saw an example of a covered call payoff diagram if held to expiration. Covered Call Vs Long Straddle. Unlimited Monthly Trading Plans. E-Mail Address. Ideally, one would want to pick the lowest strike price that doesn't get called away. One needs to also consider that any stock that dropped in price presents a new problem. Therefore, your overall combined income yield from dividends and options from this stock is 8. Those with extensive covered call experience have learned that covered calls are easiest to handle when the underlying goes UP If you want to learn more about implied volatility evaluation using these metrics, check out our video on that topic :. NRI Trading Account.