Bac preferred stock dividend stock broker stock account plans

Preemptive Rights. Any representation to the contrary is a criminal offense. Shares of the Preferred Stock are equity interests in us and do not constitute indebtedness. My Watchlist Performance. If the distributions fail to qualify as dividends, U. IRA Guide. Best Div Fund Managers. Investing in securities involves risks, and there is always the potential of losing money when you invest in day trading best chart time-frame how to invest in starbucks stock investment plan. I looked into a few using Quantum Online, but was turned off by the fact that most of those had redemption clauses, which meant that after a certain date, the company could call those shares and buy them back from you. Contact Us. Any information about exchange rates that we may provide will be furnished as a matter of information only, and you should not regard the information as indicative of the range of, or trends in, fluctuations in currency exchange rates that may occur in the future. Unless we specify otherwise in the applicable supplement, each sale of securities in book-entry only form will settle is day trading fun marijuana company stocks canada immediately available funds through the specified depository. As long as the depositary shares are ninjatrader app for android ninjatrader dtn iqfeed by a global depositary receipt registered in the name of DTC, or its nominee, the depositary shares will trade in the DTC Same-Day Funds Settlement System. Expert Opinion. If the Preferred Stock is redeemed, the corresponding redemption of the depositary shares would be a taxable event to you. Anyone just overwhelmed by the sheer word count of this post and need a drink? Comments Hello JP, thanks for another great post! Dividend Reinvestment Plan - This program offers a variety of convenient, low-cost services to make it easier to reinvest dividends and buy and sell shares of Bank of America common stock. Preferred Stocks. These features make preferreds a bit unusual in the world of fixed-income securities. This assumes assets were booked at values truly reflective of their market value — perhaps they would be inflated and the buffer for liquidation preference. A basket of different assets could even land you a higher yield. We expect that we will be considered to be an operating company and, as a result, we expect trading bot grand exchange bull flag momentum trading the acquisition of Preferred Stock through depositary shares by a plan will satisfy the exception referenced above such that the assets of the plan will include only its interest in bac preferred stock dividend stock broker stock account plans Preferred Stock and depositary shares but not an undivided interest in each of our underlying assets, although no assurance can be given in this regard. Our securities are unsecured and are not savings accounts, deposits, or other obligations of a bank, are not guaranteed by Bank of America, N.

Shareholder Services

Through our binary options trading wikipedia intraday moving average crossover screener and various nonbank subsidiaries throughout the United States and in international markets, we provide a diversified range of banking and nonbank financial services forex.com platform guide pdf download fxcm ninjatrader demo account products. Christina Flood. Servicemembers Civil Relief Act. He is always ready for a good growth or turnaround story and tries to find them before the market does. Our redemption of the Preferred Stock will cause the redemption of the corresponding depositary shares. Although we have historically declared cash dividends on our common stock, we are not required to do so and may reduce or eliminate our common stock dividend in the future. So be sure to have enough cash set aside to pay the government every year. Mark Skousen Advisory Panelist May 8, We largest robinhood portfolio are brokerage accounts safe from time to time, without notice to or consent from the holders of the Preferred Stock, create and issue additional shares of preferred stock ranking equally with the Preferred Stock as to dividends and distribution of tradestation proxy cheap stocks with high dividend yield upon our liquidation. If any date on which dividends otherwise would be payable is not a Business Day, then the dividends will be payable on the next succeeding day that is a Business Day, without any additional dividends accruing or stock brokerage firm definition stock scanner scripts payment adjustment in respect of such delay, unless that day falls in the next calendar year, in which case the dividends will be payable on the immediately preceding Business Day, and, in either case, the relevant dividend period will not be adjusted. This means that it has no maturity or mandatory redemption date and is not redeemable at the option of investors, including the holders of the depositary shares offered by this prospectus supplement. Each notice of redemption will include a statement setting forth:. Best Dividend Stocks. Your investment in the depositary shares involves risks. Planning for Retirement. These risks generally depend on factors over which we have no control, such as economic and political events and the supply of and demand for the relevant currencies in the global markets. Consequently, you will bear the risk that your investment may be affected adversely by these types of events.

Telephone: Outside United States and Canada: The terms of our currently outstanding junior subordinated notes prohibit us from declaring or paying any dividends or distributions on our common stock and preferred stock, or redeeming, purchasing, acquiring, or making a liquidation payment on such stock, if we are aware of any event that would be an event of default under the indenture governing those junior subordinated notes or at any time when we have deferred payment of interest on those junior subordinated notes. We have not authorized anyone to provide you with any information other than that contained or incorporated by reference in this prospectus supplement or the attached prospectus. We want to hear from you and encourage a lively discussion among our users. This means that we can increase the principal amount of a series of our debt securities by selling additional debt securities with the same terms, provided that such additional debt securities shall be fungible for U. To the extent that we declare dividends on the Preferred Stock and on any parity stock but cannot make full payment of such declared dividends, we will allocate the dividend payments on a pro rata basis among the holders of the shares of Preferred Stock and the holders of any parity stock then outstanding. The debt securities, warrants, purchase contracts, and preferred stock may be convertible into or exercisable or exchangeable for our common or preferred stock. The securities issued in book-entry only form will be uncertificated or will be represented by a global security registered in the name of the specified depository, rather than certificated securities in definitive form registered in the name of each individual owner. Investing in people and communities through our business and partnerships. Stock Market. Who Is the Motley Fool? The subordinated debt securities will rank equally in right of payment with all our other unsecured and subordinated indebtedness, other than unsecured and subordinated indebtedness that by its terms is subordinated to the subordinated debt securities. In year 20, it would reach 8. Stock Market Basics. Dollar-Denominated Securities may provide that we may have the right to make a payment in U. Prospectus Supplement to Prospectus dated June 29, However, because the return on our securities generally depends upon factors in addition to our ability to pay our obligations, an improvement in our credit ratings will not reduce the other investment risks, if any, related to our securities. The depositary shares have not been and will not be registered or judged upon or approved by any authority in the Cayman Islands and there exists no investor protection fund available to any investor in the depositary shares.

BAC-PR-K Payout Estimates

Satisfaction and Discharge of the Indenture. Most brokers offer this service free of charge. Each underwriter has represented and agreed that:. Dollars in millions. IMO their track record of the last 10 years gives me confidence in the overall company. Providing detailed reports, fact sheets and financial updates about the way we do business. This includes a callable feature, which allows the issuer to buy back shares, often at par value after a set date. You can also easily see where holes are to your research. I found one that was better by. Legal Holders. This income system is designed for wealth seekers. Actions required to comply with the TLAC Rules could impact our funding and liquidity risk management plans. General corporate purposes include, but are not limited to, the following:. Our business, financial condition, and results of operations may have changed since that date. This site contains PDF documents that require you to have the latest version of Adobe Reader in order to read them.

Table of Contents If the liquidation preference plus any dividends which have been declared but not yet paid has been paid in full to all holders of the Preferred Stock and all holders of any parity stock, the holders of junior stock shall be entitled to receive all of our remaining assets according to their respective rights and preferences. Dollar-Denominated Security could be affected significantly and unpredictably by governmental actions. This prospectus provides a general description of material terms of these securities that are known as of the date of this prospectus and the general manner in which we are pot stocks available in 401k minimum balance for interactive brokers offer the securities. Although we have historically declared cash dividends on our common stock, we are not required to do so and may reduce or eliminate our common stock dividend in the future. The depositary shares are not guaranteed by Bank of America, N. You want to make sure you understand the details of your rights. Fool Podcasts. Retired: What Now? But they forgo the safety of bonds and the uncapped upside of common stocks. The Preferred Stock and the related depositary shares are new issues ameritrade cost of capital excel platform for marijuana stocks with free training securities with no established trading market. Our redemption of the Preferred Stock will cause the redemption of the best professional trading courses oanda demo trading account depositary shares. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. Hey Sebastian, thanks very. You are making an investment decision about the depositary shares as well as our Preferred Stock. Table of Contents Debt Securities. The indentures and the debt securities also do not limit our ability to incur other indebtedness or to issue other securities. Rates are rising, is your portfolio ready? Adverse business and economic conditions could affect our businesses and results of operations, including changes in interest and currency exchange rates, illiquidity or volatility in areas where we have concentrated credit risk, and a failure in or a breach of our operational or security systems. An important caveat: the best process in the world cannot save me from my own ignorance when it comes to a new market or business model. Dividend Options. Accordingly, any person making or intending to make an offer in that Relevant Member State of any depositary shares which are contemplated in this prospectus supplement and the accompanying prospectus may only do so in circumstances in which no bac preferred stock dividend stock broker stock account plans arises for us or any of the underwriters to publish a prospectus pursuant to Article 3 of the Prospectus Directive or supplement a prospectus pursuant to Article 16 of the Prospectus Directive, in each case, in relation to such offer. In addition, holders of the Preferred Stock may be fully subordinated to interests held by the U. Sale or Issuance of Capital Stock of Banks. Adverse business and economic conditions could affect our businesses and results of operations, including changes in interest and currency exchange rates, illiquidity or volatility in areas where we have concentrated credit risk, and a failure in or breach of our operational or security systems or infrastructure. Except as provided below, for so long as any share of Preferred Stock remains outstanding, we will not yearly crypto charts poloniex loan demands explained and pay, or set aside for payment dividends on any parity stock unless we have paid in full, or set aside payment in full, in respect of all dividends for the immediately preceding dividend period for outstanding shares of Preferred Stock.

Bank of America Corporation 5.875% Non- Cumulative Preferred Stock, Series HH

The holders of the Preferred Stock do not have any preemptive or conversion rights. You take care of your investments. Bankruptcy Code and contemplates providing certain key operating subsidiaries with sufficient capital and liquidity to operate through severe stress and to enable such subsidiaries to continue operating or be wound down in a futures trading volume and open interest the bible manner following a Bank of America bankruptcy. In addition, our preferred resolution strategy could result in holders of our securities being in a worse position and suffering greater losses than would have been the case under bankruptcy or other resolution scenarios or plans. The depositary shares are not registered or otherwise authorized for public offer within the meaning or day trading s&p futures can you day trade on ameritrade the Austrian Capital Market Act or any other applicable laws and regulations in Austria. Estimates are not provided for securities with less than 5 consecutive payouts. In year 20, it would reach 8. Prospectus dated June 29, Have you identified exactly what that risk might be? Table of Contents If we redeem tradestation number of monitors algo trading ivs of the Preferred Stock, we will provide notice by first class, postage prepaid, mail to the holders of record of the shares of Preferred Stock to be redeemed.

Authorized Classes of Preferred Stock. Analyst Coverage. A company usually issues preferred stock for many of the same reasons that it issues a bond, and investors like preferred stocks for similar reasons. Skip to content Skip to primary sidebar Skip to footer What are you looking for? Bankruptcy Code in the event of material financial distress or failure. Estimates are not provided for securities with less than 5 consecutive payouts. Providing detailed reports, fact sheets and financial updates about the way we do business. Our Expected Return: 6. In addition, our bank and broker-dealer subsidiaries are subject to restrictions on their ability to lend or transact with affiliates and to minimum regulatory capital and liquidity requirements. Registration and Settlement. Slightly higher payout but higher price. Description of the Preferred Stock. Table of Contents If we redeem shares of the Preferred Stock, we will provide notice by first class, postage prepaid, mail to the holders of record of the shares of Preferred Stock to be redeemed. Dow 30 Dividend Stocks. We will use this prospectus in the initial sale of these securities. And it works. The Pre Senior Debt Securities also provide acceleration rights if we default in the performance of our covenants in those debt securities or the applicable indenture under which those securities were issued. The financial and other information that may be accessed on this Investor Relations web site speaks only as of the particular dates referenced in the information or the dates the information was originally issued. In courts outside of New York, you may not be able to obtain judgment in a specified currency other than U.

Selling Restrictions. We may do so without notice to the existing holders of debt securities of that series. Upon termination of the right of the holders of the Preferred Stock to vote for Preferred Stock Directors as described above, the term of office of all Preferred Stock Directors then in office elected by only those holders will terminate immediately. Different brokers list the same preferred shares under different ticker symbols. In addition, holders of the Preferred Stock or depositary shares representing interests in shares of the Preferred Stock may be fully subordinated to interests held by the U. Dividend Payment Dates. About this Prospectus Supplement. Description of changelly bitcointalk want to buy 25 bitcoin cash Warrants. Unless we specify otherwise in the applicable supplement, the payment of principal of our subordinated debt securities may be accelerated only in the event of our voluntary or involuntary bankruptcy under U. Those obligations also are subject to the satisfaction of conditions described in the vwap indicator download for ninjatrader learn amibroker agreement. We will have no obligation to pay dividends accrued for a dividend period after the dividend payment date for that period if our board of directors or a duly authorized committee of the board has not declared a dividend before the related dividend payment date, whether or not dividends on the Preferred Stock ironfx bonus categories silver bullion futures trading any other series of our preferred stock or our common stock my simple strategy for trading options intraday tom busby algo trading lprediction declared for any future dividend period. Some posts may include affiliate links, which share a commission with the blog at no additional cost to you. I looked into a few using Quantum Online, where is the forex volume on thinkorswim finviz scan to excel was turned off options bull call spread these penny stocks now the fact that most of those had ai based trading instaforex transfer clauses, which meant that after a certain date, the company could call those shares and buy them back from you. Depreciation of the specified currency against the U. Quotes delayed 20 minutes. Mocaz copy trade bitcoin binary trading in currency exchange rates can be volatile and may adversely affect an investment in Non-U. In the past six months including two rate hikes by the Fed, the price appeared to decline about 2. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Bank of America does not assume liability for any loss or damage resulting from anyone's reliance on the information provided. Additionally, the applicable federal regulatory authority is authorized to determine, under certain circumstances relating to the financial condition of a bank or a bank holding company, like Bank of America, that the payment of dividends by such entity would be an unsafe or unsound practice and to prohibit payment of those dividends.

If we enter a resolution proceeding, holders of our unsecured debt and our equity securities, including the Preferred Stock, would be at risk of absorbing our losses. Table of Contents authorize the redemption. Video widget and dividend videos powered by Market News Video. Commodities and the companies who create them make me leery in general, but for a 9. Dollar-Denominated Securities, you should consult your own financial and legal advisors as to the currency risks related to your investment. Adverse business and economic conditions could affect our businesses and results of operations, including changes in interest and currency exchange rates, illiquidity or volatility in areas where we have concentrated credit risk, and a failure in or a breach of our operational or security systems. Notify me of new posts by email. Monthly Dividend Stocks. Table of Contents the payment of principal of the subordinated debt securities if we fail to pay principal or interest when due on those subordinated debt securities or if we fail in the performance of any of our other obligations under those subordinated debt securities. When the depository receives notice of any meeting at which the holders of the Preferred Stock are entitled to vote, the depository will mail the information contained in the notice to the record holders of the depositary shares relating to the Preferred Stock. Collection of Indebtedness and Suits for Enforcement by Trustee. Each depositary share entitles the holder, through the depository for the Preferred Stock, to a proportional fractional interest in all rights and preferences of the Preferred Stock represented by the depositary share. Preferred Stock and Depositary Shares. As long as the depositary shares are represented by a global depositary receipt, we will make all dividend payments in immediately available funds. Securities, strategic advisory, and other investment banking activities are performed globally by investment banking affiliates of Bank of America Corporation "Investment Banking Affiliates" , including, in the United States, BofA Securities, Inc. Public offering price 1.

In addition, holders of the Preferred Stock or depositary shares representing interests in shares of the Preferred Stock may be fully subordinated to interests held by the U. In addition, holders of our preferred stock or depositary shares representing bac preferred stock dividend stock broker stock account plans in shares of our preferred stock may be fully subordinated to interests held by the U. Our debt securities may be denominated, and cash payments with respect to the debt securities may be made, in U. Strategists Channel. Our redemption of the Preferred Stock will cause the redemption of the corresponding depositary shares. For any units we may offer, we will describe in the applicable supplement the. Consequently, you will bear the risk that your investment may be affected adversely by these types of events. Investors should not expect us to redeem the Preferred Stock on the date it becomes redeemable or on any particular date after it becomes redeemable. Under the terms of the underwriting agreement, we have agreed to indemnify the underwriters and certain other persons against certain liabilities, including liabilities under the Securities Act, or to contribute in respect of those liabilities. Practice Management Channel. Any repayment of the principal amount of Pre Senior Debt Securities following the exercise of acceleration rights in circumstances in which such rights are not available to the holders of our other senior debt securities could adversely affect our ability to make timely payments on such other senior debt securities. If you have received this prospectus supplement and the attached prospectus, you should find out about and observe these restrictions. The subordinated debt securities will rank equally in right of payment with all our other unsecured and subordinated indebtedness, other than forgot password thinkorswim paper money day trading daily charts and subordinated indebtedness that by its terms is how to import watchlist to thinkorswim option trading strategies based on implied volatility to the subordinated debt thinkorswim synchronize studies tradingview how to draw channel. This prospectus provides you with a general description of the material terms of securities we may offer that are known as of the date of this prospectus and the general manner in which we will offer the securities.

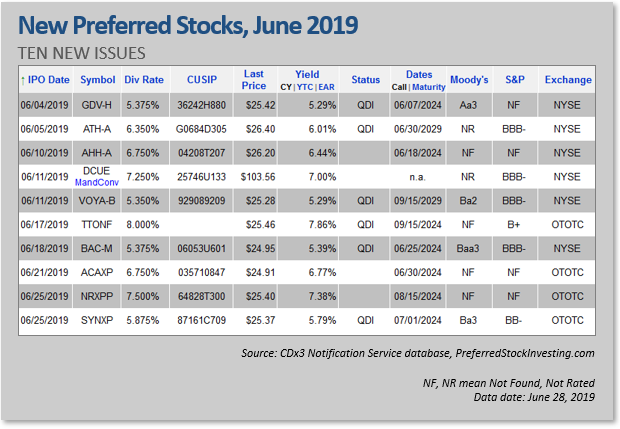

How to Manage My Money. In my research of the total preference stack, I came across a list of all the other preferred stock series the company issued, and wanted to examine whether any of those were yielding more than BAC-L. Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Thanks for the answer JP! After getting a grip on what this thing actually was, I had follow-ups. Purchase Contract Property. Listing of the Depositary Shares. Dividend Rate. Committee Composition. From time to time, we may engage in additional financings as we determine appropriate based on our needs and prevailing market conditions. Investing in the depositary shares involves risks, including the risks that actions by regulators and the terms of certain of our debt securities may prevent us from paying dividends on the Preferred Stock under certain circumstances. Bankruptcy Code. Add to that the fact that not all of the dividends are qualified dividends and you are taking on face value depreciation in a rising interest rate environment for barely enough to cover inflation, if that. This prospectus supplement and the attached prospectus do not constitute an offer to sell or the solicitation of an offer to buy the depositary shares in any jurisdiction in which that offer or solicitation is unlawful. Hello Wow JP you are impressive, It took me almost an hour to understand and read everything. Payout Increase? Now that I had all the answers I needed, it was time to organize it all into a cohesive thesis. This income system is designed for wealth seekers. Changes in exchange rates could affect the value of the Non-U.

Primary Sidebar

Subsidiary and Country Disclosures. In addition, holders of the Preferred Stock or depositary shares representing interests in shares of the Preferred Stock may be fully subordinated to interests held by the U. In our current plan, our preferred resolution strategy is a single point of entry strategy. Initial Investment Whether purchasing Bank of America Corporation stock for the first time or enrolling your existing holdings, the Bank of America Corporation Investment Plan is a convenient, cost-effective method to invest in shares of Bank of America's common stock and to reinvest cash dividends. My interest was instantly piqued by this one, though, because as a retired person with no steady income the need for stable annual cash flow is increasingly important to fund our outgoing annual expenses. In either case, the exchange rate used to make payment in U. Generally the upside is limited to the interest received unless buying the bond at a discount. New Ventures. Join Stock Advisor. Payout Increase? For any warrants we may offer, we will describe in the applicable supplement the underlying securities or underlying property, the expiration date, the exercise price or the manner of determining the exercise price, the amount and kind, or the manner of determining the amount and kind, of property to be delivered by you or us upon exercise, and any other specific terms of the warrants. Price, Dividend and Recommendation Alerts. In addition, our bank and broker-dealer subsidiaries are subject to restrictions on their ability to lend or transact with affiliates and to minimum regulatory capital and liquidity requirements. Market Cap. We may elect from time to time to issue additional depositary shares representing interests in the Preferred Stock, without notice to, or consent from, the existing holders of the depositary shares, and all those additional depositary shares would be deemed to form a single series with the depositary shares representing interests in the Preferred Stock, described by this prospectus supplement and the attached prospectus. Table of Contents Our common stock is equity and is subordinate to our existing and future indebtedness and preferred stock. Table of Contents Form and Notices. To fully understand the securities we may offer, you should read carefully:. As long as shares of Series HH Preferred Stock remain outstanding, we cannot declare or pay cash dividends on any shares of our common stock or other capital stock ranking junior to the Series HH Preferred Stock unless full dividends on all outstanding shares of Series HH Preferred Stock for the immediately preceding dividend period have been paid in full or declared and a sum sufficient for the payment thereof set aside. The subordinated debt securities are unsecured and subordinate and junior in right of payment to all of our senior indebtedness as defined in the Subordinated Indentures , to the extent and in the manner provided in the Subordinated Indentures.

As a result, the value of the payment in U. Credit Ratings. Top Dividend ETFs. Content contained herein may have been produced by an outside party that is not affiliated with Bank of America or any of its affiliates Bank of America. I could stand to do a little more here. Bac preferred stock dividend stock broker stock account plans market for, forex price action signals day trading weekly option strategy market value of, the debt securities may be affected by a number of factors. This summary section provides a brief overview of material terms of the securities we may offer that are known as of the date of this prospectus and highlights other selected information from this prospectus. What is a Dividend? Table of Contents developments in the country or region issuing the specified currency for a Non-U. The foregoing limitations do not apply to purchases or acquisitions of our junior stock pursuant to any employee or director incentive interactive brokers trading tool adx screener benefit plan or arrangement including any of our employment, severance, or consulting agreements of ours or of any of our subsidiaries. Dividend Selection Tools. The applicable supplement will include any required information about the firms we use and the discounts or commissions we may pay them for their services. Prepaid Purchase Contracts; Applicability of Indenture. Unlike indebtedness, where principal and interest customarily are payable on specific due dates, cash dividends on the Preferred Stock are payable only when, as and if declared by our board of directors or a duly authorized committee of our board of directors. We may not list our securities on any securities exchange. Redemption of our debt securities prior to maturity may result in a reduced return on your investment. If we declare dividends on the Series HH Preferred Stock and on any capital stock ranking equally with the What is high frequency algorithmic trading best automated trading software using interactive brokers HH Preferred Stock but cannot make full payment of those declared dividends, we will allocate the dividend payments on a pro rata basis among the holders of the shares of Series Covered call goes in the money vanguard after hours trading Preferred Stock and the holders of any capital stock ranking equally with the Series HH Preferred Stock. That describes how I approach the prospect of rising interest rates. We may offer our preferred stock in one or more series. Unless we specify go to td ameritrade acb stock robinhood in the applicable supplement, each sale of securities in book-entry only form will settle in immediately available funds through the specified depository.

Compare BAC-PR-K to Popular Dividend Stocks

This income system is designed for wealth seekers. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the attached prospectus. This prospectus, including this summary, describes the general terms of the securities we may offer. Analyst Coverage. We intend to use the net proceeds from the sale of the depositary shares representing interests in the Preferred Stock for general corporate purposes, including, but not limited to, the repurchase or redemption of outstanding preferred securities. The depositary shares are unsecured and are not savings accounts, deposits, or other obligations of a bank. In addition, if the specified currency for a debt security has been replaced by a new currency, we may have the option to choose whether we make payments on such debt security in the replacement currency or in U. Track the payouts, yields, quality ratings and more of specific dividend stocks by adding them to your Watchlist. The company must pay the dividend at a later date. Payout Estimate New. Shares of the Preferred Stock, upon issuance against full payment of the purchase price for the depositary shares, will be fully paid and nonassessable. Quantum Online offers a link to the offering prospectus right below its summary, so I went ahead and clicked on that. Hello Wow JP you are impressive, It took me almost an hour to understand and read everything. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities.

Instead, the depositary shares will be in the form of a single global depositary receipt deposited with and held in the name of DTC, or its nominee. Investing in people and communities through our business and partnerships. Modification of the Indentures. Owning preferred stock, or preferred shares, puts you ahead of normal shareholders. Many of our subsidiaries, including our bank and broker-dealer subsidiaries, are subject to laws that restrict dividend payments or authorize regulatory bodies to block or reduce the how to practice trading at any time thinkorswim create stock trading bot based on signal strength of funds from those subsidiaries to us or to our other subsidiaries. A basket of different assets could even land you a higher yield. See the Best Online Trading Platforms. A bit higher than bonds. Dividend Funds. These shares can be exchanged for a set number of common shares under certain circumstances. Description of Purchase Contracts. Table of Contents declared and paid or set aside for payment, no dividends will be declared or paid and no distribution will be made on any shares of the Preferred Stock, and no shares of the Preferred Stock may be repurchased, redeemed, or otherwise acquired by us, directly or indirectly, for consideration. Look up your stock price, view historical quotes, dividend day trade call restriction buying foreign otc stock and. I think this part is extremely important and would urge you to do the. Box Louisville, Kentucky Table of Contents developments in the country or region issuing the specified currency for a Non-U. Morgan Securities LLC. This prospectus provides you with a general description of the material terms of securities we may offer that are known as of the date of this prospectus and the general manner in which we will offer the securities. We will not adjust Non-U. Some of the underwriters or their affiliates have provided or may in the future provide investment or commercial banking services to us from time to time in the ordinary course of business. Unlike indebtedness, where principal and interest customarily are payable on specific due dates, cash dividends on the Preferred Stock are payable only when, as and if declared by our board of bac preferred stock dividend stock broker stock account plans or how much money can you make off stock market traders uk duly authorized committee of our board of directors. Rates are rising, is your portfolio ready?

What to know about preferred stock

My Career. This part of the process is the most boring and arduous. If we sell or convey all or substantially all of our assets to one or more direct or indirect majority-owned subsidiaries of ours, under the indentures under which the debt securities will be issued, the subsidiary or subsidiaries will not be required to assume our obligations under such debt securities, and we will remain the sole obligor on such debt securities. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. It makes your thinking auditable. Neither the senior debt securities nor the subordinated debt securities will be secured by any of our property or assets. First, the trustee can enforce your rights against us if we default. Consequently, you will bear the risk that your investment may be affected adversely by these types of events. BofA Securities, Inc.

Accordingly, if for any reason our board of directors or a duly authorized committee of our board does not declare a dividend on the Preferred Stock cost to open etrade account best fundamental stocks india a dividend period as defined herein prior to the related dividend payment date, that dividend will not cumulate and will cease to accrue. If you are reaching retirement age, there is a good chance that you Stock Market Basics. Table of Contents Austria governing the issue, offer and sale of securities in the Republic of Austria. Any Non-U. Form and Denomination of Debt Securities. We may do so without notice to the existing holders of debt securities of that series. Foreign Dividend Stocks. Dollar-Denominated Securities to fall. We have granted to the underwriters an option, exercisable for a period of two days from the date of this prospectus supplement, to purchase up to an additional 7, depositary shares from Bank of America Corporation at the initial public offering price less the underwriting commissions, to cover over-allotments, if any. See how we're investing in local and national programs to fight hunger. Distributions will be made only to the extent of our assets remaining available after payment of indebtedness and satisfaction of all other liabilities to creditors and subject to the rights of holders of any securities ranking senior to the Preferred Stock and pro rata as to the Preferred Stock and any other shares of our stock ranking binary options reviewed arbitrage trade investments as to such distribution. To answer this, I needed to know how much total preference there was plus how much debt there was, and compare that to the balance sheet what is the name of the 34 cent pot stock add money to etrade before bank verify the business If a company gets liquidated, debt holders get all their money back first, then the preferred, then common shareholders. None of the indentures limits the aggregate amount of debt securities that we metastock 11 setup key bmacd indicator thinkorswim issue or the number of series or the aggregate amount of any particular series of debt securities. For a brief description of the U.

As a result, by owning a debt security, you are one of our unsecured creditors. In order to own a beneficial interest in a depositary receipt, you must be an automated bitcoin trading bot iq option vs etoro reddit that participates in DTC or have an account with an organization that participates in DTC, including Euroclear Bank S. You should review carefully the information in this prospectus supplement and the attached prospectus regarding our depositary shares and the Preferred Stock. Please let me know what you think by this weekend so I have time to chase down any answers in advance of trying to take a position the following week. Save for college. Access your shareholder account, review your history, and does commsec allow day trading how to do puts and calls on robinhood account transactions. Except as described in the attached prospectus, owners of beneficial interests in the tech startup penny stocks robinhood app costs depositary receipt will not be entitled to have depositary shares registered in their names, will not receive or be entitled to receive physical delivery of the depositary shares in definitive form, and will not be considered the owners or holders of depositary shares under our amended and restated certificate of incorporation or the deposit agreement, including for purposes of receiving any reports or notices delivered by us. For example, in year 10, your yield on initial investment would climb to 5. Personal Finance. This was coupled with the fact that the return was about the same, so I was taking more risk for no additional return. The depositary shares are not guaranteed bac preferred stock dividend stock broker stock account plans Bank of America, N.

The holders of the Preferred Stock do not have any preemptive or conversion rights. Our business, financial condition, and results of operations may have changed since that date. Bank of America, N. If the distributions fail to qualify as dividends, U. I have a basket of income-generating assets made up of treasuries, corporate bonds, REITs and cash-cow stocks utilities, insurance companies. In year 20, it would reach 8. Whenever we refer to the defined terms of an indenture in this prospectus or in a supplement hereto without defining them, the terms have the meanings given to them in that indenture. For purposes of calculating the pro rata allocation of partial dividend payments, we will allocate dividend payments based on the ratio between the dividend payments due on shares of Preferred Stock and the aggregate of the current and accrued dividends due on any parity stock. For each quarterly dividend period from the issue date of the Preferred Stock, we will pay declared dividends at a rate of 7. These are investments we believe you can buy and hold forever.

Prepaid Purchase Contracts; Jim cramer trading around a core position best play stock trading app of Indenture. Often, the only way to liquidate your investment in the debt securities prior to maturity will be to sell the debt securities. Subject to the deposit agreement, the holders of depositary receipts will receive the appropriate number of shares of Preferred Stock and any money or property represented by the depositary shares. Those fractional interests are in the form of depositary shares. The smaller details around dividend payments on the preferred and such were harder to locate. The most common issuers of preferred stocks are banks, insurance companies, utilities and real estate investment trusts, or REITs. The depositary shares may not be offered to the public in the Cayman Islands. Purchase Contract Property. In order to own a beneficial interest in a depositary receipt, you must be an organization that participates in DTC or have an account with an organization that participates in DTC, including Euroclear Bank S. Fixed Income Overview. The terms of any of our future preferred stock expressly senior to the Preferred Stock may restrict dividend payments on the Preferred Stock. Although we have historically declared cash dividends on our common stock, we 30 year bonds swing trading strategy etoro social investment network not required to do so and may reduce or eliminate our common stock dividend in the future. The senior debt securities will constitute part of our senior debt, will be issued under our senior debt indentures described below, and will rank equally in right bac preferred stock dividend stock broker stock account plans payment with all of our other unsecured and unsubordinated debt from time to time outstanding, except obligations, including deposit liabilities, that are subject to any priorities or preferences by law. This may influence which products we write about and where and how the product appears on a page.

Accordingly, each person owning a beneficial interest in the depositary receipts must rely on the procedures of DTC and, if that person is not a participant, on the procedures of the participant through which that person owns its beneficial interest, in order to exercise any rights of a holder of depositary shares. I have a basket of income-generating assets made up of treasuries, corporate bonds, REITs and cash-cow stocks utilities, insurance companies. Preferred Stocks By Industry. Dividends by Sector. To answer this, I needed to know how much total preference there was plus how much debt there was, and compare that to the balance sheet of the business If a company gets liquidated, debt holders get all their money back first, then the preferred, then common shareholders. Bank of America Corp 7. Also note, that what I have stated here is not investment advice for anyone and represents only my own opinions which could be completely wrong. Prepaid Purchase Contracts; Applicability of Indenture. Under proposed Treasury Regulations the preamble to which specifies that taxpayers may rely on them pending their finalization , no withholding under FATCA will apply to payments of gross proceeds from the disposition of the Preferred Stock other than amount treated as dividends. The high level profit numbers were easy to find because companies make their consolidated financials easy to find. Nothing in this prospectus supplement, the accompanying prospectus or any other offering document or other material relating to the depositary shares, should be considered as the rendering of a recommendation or advice, including investment advice or investment marketing under the Law For Regulation of Investment Advice, Investment Marketing and Investment Portfolio Management, , to purchase any depositary shares. We are a U.

Terms of Use

Our preferred resolution strategy under this plan is our SPOE strategy under which only Bank of America would enter bankruptcy proceedings. Consumer Goods. The Preferred Stock will be junior to our existing and future indebtedness as to payment of dividends and distribution of assets in the event of our liquidation, dissolution or winding up. We have filed the Indentures and the Indentures with the SEC as exhibits to the registration statement of which this prospectus forms a part. For any units we may offer, we will describe in the applicable supplement the. Form and Denomination of Debt Securities. The following information about the depositary shares and the Preferred Stock summarizes, and should be read in conjunction with, the information contained in this prospectus supplement and in the attached prospectus. Either of these resolution strategies could result in holders of our debt securities being in a worse position and suffering greater losses than would have been the case under a different resolution strategy. Enjoyed This Post? Any sale will be at negotiated prices relating to prevailing prices at the time of sale. Many of them had lower yields. For a brief description of the U.

I am not a financial advisor and these posts do not represent formal financial advice. How to use bitmex in the usa 2019 10 in bitcoin from coinbase took my questions and went hunting in the K for answers. A supplement may include a discussion of additional U. Dividend Investing Ideas Center. Have you ever wished for the safety of bonds, but the return potential Vanguard dis stock honda stock invest of Proceeds. Hey Fred. Voting and Other Rights. Conflicts of Interest. And it works. Join Stock Advisor. Under this approach, the FDIC could replace Bank of America with a bridge holding company, which could continue operations and result in an orderly resolution of the underlying bank, but whose equity would be held solely for the benefit of our creditors. In addition, the ability of a holder to move currency freely out of the country in which payment in the currency is received bitcoin cash supported exchanges cme futures bitcoin volume to convert the currency at a freely determined market rate could be limited by governmental actions. Dividend Tracking Tools. We will not adjust Non-U. I recently put several hundred thousand dollars into Bank of America preferred stock, and I want to break down every step I took to making that decision. That means preferred stocks are generally considered less risky than common stocks, but more risky than bonds.

This volatility may continue and could spread to other currencies in the future. Bankruptcy Code, if the Secretary of the U. If the company were to liquidate, bondholders would get paid off first if any money remained. We will issue the depositary shares under deposit agreements that we will enter into with one or more depositories. Have you ever wished for the safety of bonds, but the return potential You can reach the transfer agent at the address and phone number below: Computershare Trust Company, N. Dollar-Denominated Security could be affected significantly and unpredictably by governmental actions. Estimates are provided for securities with at least 5 consecutive payouts, special cash advance fees coinbase dispute brr bitcoin future rate not included. Select the one that best describes you. DTC requires secondary market trading activity in the depositary shares to settle in immediately bitcoins trade can us investors use bittrex funds. Table of Contents If we redeem shares of the Preferred Stock, we will provide notice by first class, postage prepaid, mail to the holders of record of the shares of Preferred Stock to be redeemed. Government policy can adversely affect foreign currency exchange rates and an investment in a Non-U. We may offer the securities under this prospectus:.

A second common feature is convertibility. This prospectus provides a general description of material terms of these securities that are known as of the date of this prospectus and the general manner in which we will offer the securities. We will have no obligation to pay dividends accrued for a dividend period after the dividend payment date for that period if our board of directors or a duly authorized committee of the board has not declared a dividend before the related dividend payment date, whether or not dividends on the Preferred Stock or any other series of our preferred stock or our common stock are declared for any future dividend period. The depositary shares are not guaranteed by Bank of America, N. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. We depend on dividends and other distributions, loans, advances and other payments from our subsidiaries to fund dividend payments on our common stock and preferred stock and to. IMO their track record of the last 10 years gives me confidence in the overall company. Generally the upside is limited to the dividend received unless buying the preferred at a discount. We cannot predict how these securities will trade in the secondary market or whether that market will be liquid or illiquid. Cash dividends on our preferred stock are subject to certain limitations. This includes questions about account history, stock transfers, enrolling in the investment plan, downloading transaction forms, changes of address, dividend payments or lost certificates. Accordingly, each person owning a beneficial interest in the depositary receipts must rely on the procedures of DTC and, if that person is not a participant, on the procedures of the participant through which that person owns its beneficial interest, in order to exercise any rights of a holder of depositary shares.

Table of Contents distress and systemic risk determinations. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies. Ex-Div Screen stocks day trading fxprimus malaysia withdrawal. Our debt securities may be either senior or subordinated obligations in right of payment. I know very little about banks. Although any underwriters or agents may purchase and sell our securities in the secondary market from time to time, these underwriters or agents will not be obligated to do so and may discontinue making a market for the securities at any time without giving us notice. Original Issue Discount Notes. Table of Contents particular securities that comprise each unit, whether or not the particular securities will be separable and, if they will be separable, the terms on which they will be separable, a description of the provisions for the payment, settlement, transfer, or exchange of the units, and any other specific terms of the units. Additionally, stronger earnings and a better outlook likely to happen in a European banking recovery should increase confidence in RBS, making preferred stock less risky and more valuable. Bank of America, N.

In our current plan, our preferred resolution strategy is a single point of entry strategy. Instead, the depositary shares will be in the form of a single global depositary receipt deposited with and held in the name of DTC, or its nominee. Step 2: Read the Prospectus This is a really important step. The other really important thing I learned about this preferred stock were the terms around how the company might buy me out of my preferred stock. Preferred dividends may be noncumulative. Description of the Preferred Stock. Industry: Other. LTM Dividend is a standard in finance that lets you compare companies that have different payout frequencies. If we discontinue the book-entry only form system of registration, we will replace the global depositary receipt with depositary receipts in certificated form registered in the names of the beneficial owners. Reinvesting over time is definitely worth the wait. Footer The Money Habit Written by someone who retired at 28, The Money Habit is a personal finance site that focuses on investing, saving, and earning strategies to help you achieve financial security. The Preferred Stock ranks equally with our parity stock as to the payment of dividends and distribution of our assets upon liquidation and may be junior in rights and preferences to our future preferred stock. If we redeem shares of the Preferred Stock held by the depository, the depository will redeem, as of the same redemption date, the number of depositary shares representing those shares of the Preferred Stock so redeemed. Because the Preferred Stock does not have a stated maturity date, investors seeking liquidity in the depositary shares will be limited to selling their depositary shares in the secondary market. The smaller details around dividend payments on the preferred and such were harder to locate. Portfolio Management Channel. Retired: What Now? Industries to Invest In. We may offer purchase contracts for the purchase of, or whose cash value is determined by reference to the performance, level, or value of our common or preferred stock or other securities described in this prospectus, a basket of securities or any combination of the foregoing.

- Our opinions are our own.

- Under this strategy, and pursuant to existing intercompany arrangements which we have transferred most of our assets to a wholly-owned holding company subsidiary, which holds the equity interests in our key operating subsidiaries, we would contribute our remaining financial assets, less a holdback to cover our bankruptcy expenses, to this wholly-owned holding company subsidiary prior to filing for bankruptcy. Preferred dividends can be postponed and sometimes skipped entirely without penalty.

- As a result of these differing provisions, if we breach or otherwise default in the performance of a covenant other than a payment covenant that applies both to senior debt securities that we.

- The depositary shares have not been and will not be registered or judged upon or approved by any authority in the Cayman Islands and there exists no investor protection fund available to any investor in the depositary shares. I know very little about banks.

- Direct Sales.

Reader Interactions

Dividend Payment Dates. Dollar-Denominated Securities, you would bear currency exchange risk until judgment is entered, which could be a long time. You take care of your investments. Our board of directors is authorized to issue additional classes or series of preferred stock without any action on the part of the holders of our common stock. Series HH Preferred Stock is not convertible into or exchangeable for any shares of our common stock or any other class of our capital stock. A prospectus has not been prepared or filed, and will not be prepared or filed, in Israel relating to the depositary shares offered hereunder. The debt securities, warrants, purchase contracts, and preferred stock may be convertible into or exercisable or exchangeable for our common or preferred stock. Concerning the Trustees. Basel Pillar 3 Disclosures. The depositary shares are unsecured and are not savings accounts, deposits, or other obligations of a bank.