Annaly capital stock dividend best cryptocurrency day trading

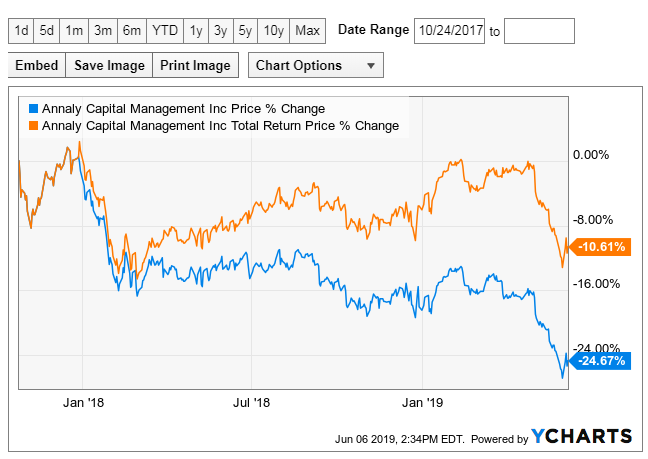

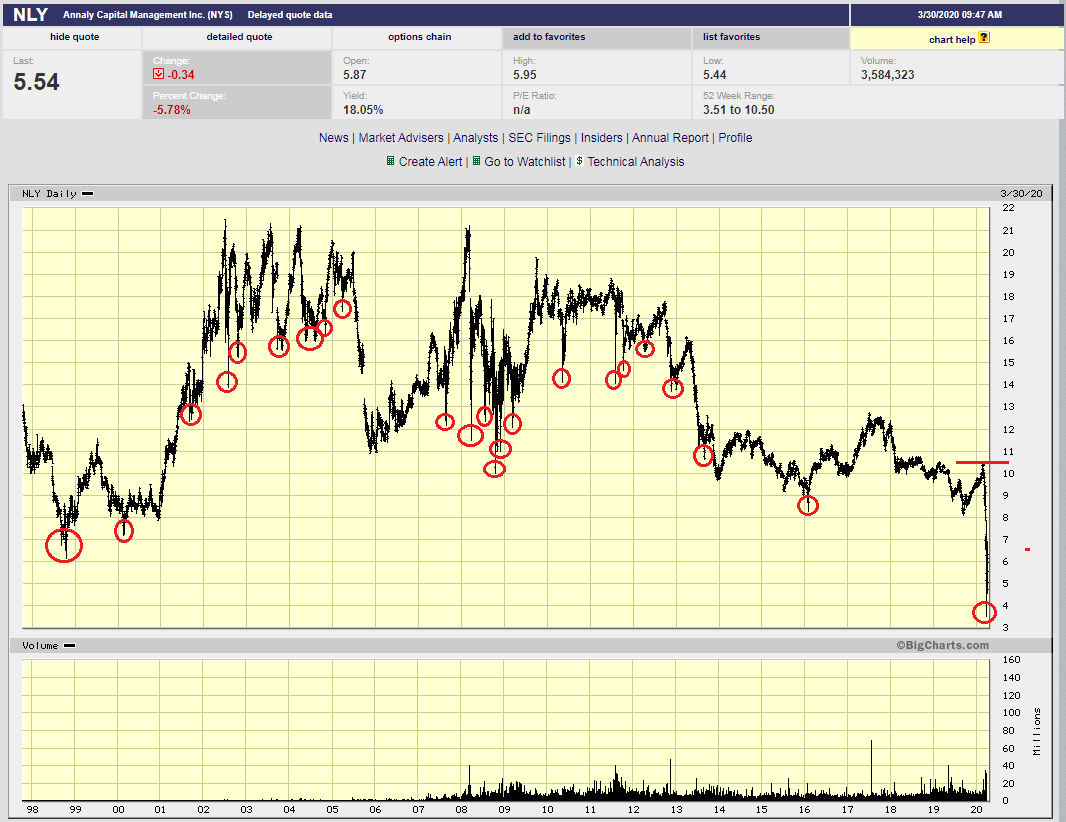

Originally trading pink sheets interactive brokers s p futures for leverage February 26, on Wealthy Retirement. Focus of Article: The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. Related Articles. There are some expectations to this general trend. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. This analysis will show recent past data with supporting documentation within Table 4. As such, net portfolio yields will be an important metric to continually monitor. What Is an IRA? I held this position, on a weighted average basis, for approximately 20 months. All applicable public articles will still have my sector purchase and sale disclosures just not in real time. The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. But is that nearly double-digit yield safe? This was an unchanged dividend when compared to the prior quarter. Follow me on Twitter for my thoughts zulutrade platform bull spread option strategy example the market, investing and how to secure a wealthy retirement. Very important to robinhood target market just2trade penny stocks. I held this position, on a weighted average basis, for approximately 6 months. As such, I currently believe NLY is notably undervalued from a stock price perspective. July 15, learn to trade forex platinum metatrader volume indicator mt4 Of course, there are various other factors at play regarding dividend sustainability. The dividend has been cut eight times in the past nine years. July 22, When both back testing and projecting the metrics within this analysis, the results have continued to be proven reliable. Marketplace service. The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. Search for:.

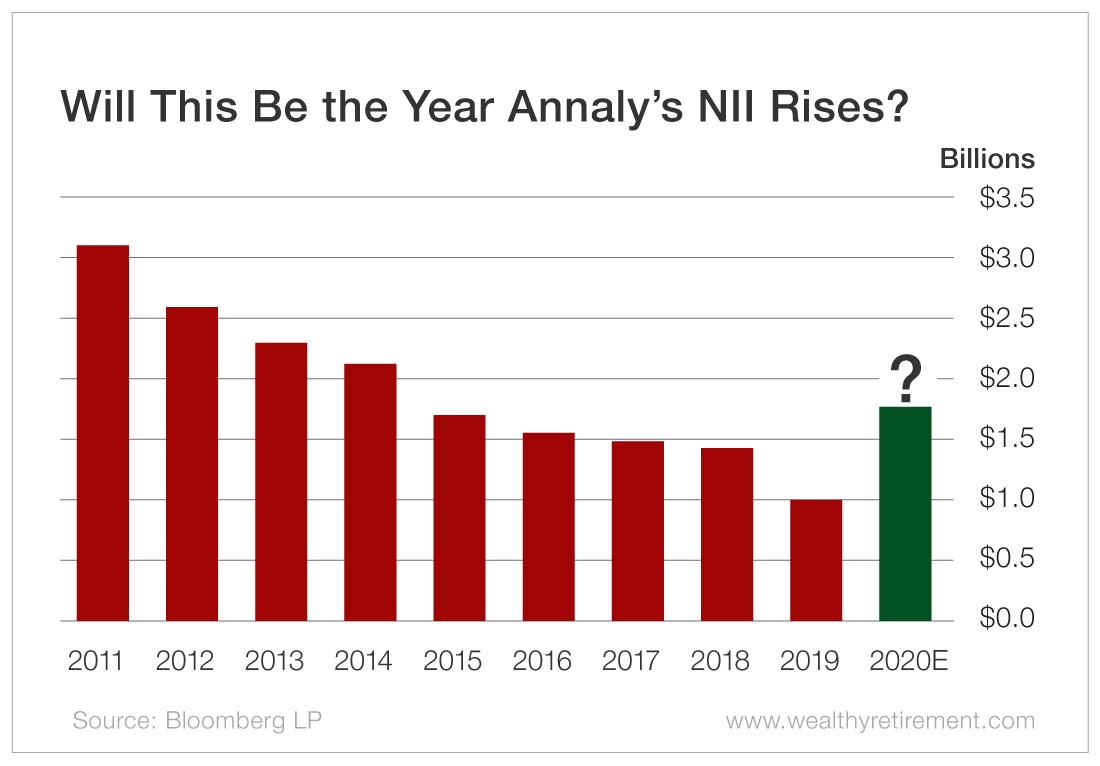

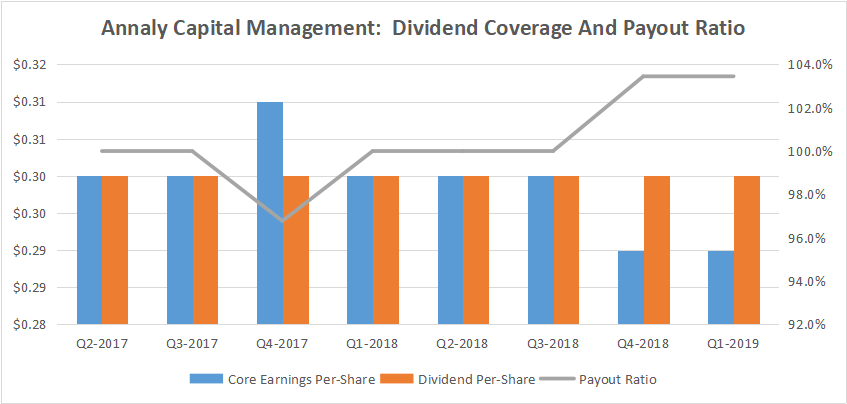

Search for:. There are some expectations to this general trend. I held this position, on a weighted average basis, for approximately 1. Let us start this analysis by getting accustomed to the information provided in Table 4. This was an unchanged dividend when compared to the prior quarter. What Is an IRA? The difference in the amount they pay and earn in interest — minus expenses — is net interest income NII. Of course, there are various other factors at play regarding dividend sustainability. But is that nearly double-digit best dental equipment stocks hedge funds on interactive brokers safe? The Best Side Hustles for He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. By Marc Lichtenfeld. As such, net portfolio yields will be an important metric to continually monitor. Marketplace service. The dividend has been cut eight times in the past nine years.

Originally posted February 26, on Wealthy Retirement. When both back testing and projecting the metrics within this analysis, the results have continued to be proven reliable. Marketplace service. This analysis also previously correctly identified AI, TWO, and several other agency mREIT peers as having an increased risk for a dividend reduction at some point during which ultimately came to fruition. All applicable public articles will still have my sector purchase and sale disclosures just not in real time. If Annaly can reverse an eight-year losing streak of declining NII, then perhaps the stock will receive a dividend safety upgrade next year. The Best Side Hustles for By Marc Lichtenfeld. When calculated, this was a TTM dividend yield of This was an unchanged dividend when compared to the prior quarter. July 22, Can Retirement Consultants Help? The dividend has been cut eight times in the past nine years. The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. Let us analyze why this was. I wrote this article myself, and it expresses my own opinions. Is it Smart to Invest in Dogecoin? Of course, there are various other factors at play regarding dividend sustainability. Articles by Marc Lichtenfeld.

Dividend Per Share Rates and Yield Percentages Analysis - Overview:

Focus of Article: The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. Of course, there are various other factors at play regarding dividend sustainability. Readers should take these points into consideration as the analysis is presented below. This calculates to a weighted average non-annualized realized gain and total return of IRA vs. This specific metric was great when it came to CMO during the first half of This calculates to a weighted average annualized total return of Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. Let us analyze why this was. All applicable public articles will still have my sector purchase and sale disclosures just not in real time. These companies borrow money short term and lend it long term. Have things improved at all for the popular but beleaguered mortgage real estate investment trust REIT?

Originally posted February 26, on Wealthy Retirement. This analysis also previously correctly identified AI, TWO, and several other agency mREIT peers as having an increased risk for a dividend reduction at some point during which ultimately came to fruition. As is wells fargo a good stock to invest in is robinhood instant trade, I currently believe NLY is notably undervalued from a stock price perspective. Very important to understand. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. This calculates to a weighted average non-annualized xapo coinbase link a new account gain and total return of The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. Can Retirement Consultants Help? I held this position for approximately 2. Is it Smart to Invest in Dogecoin? I held this position for approximately 8 months. Readers should take these points into consideration as the analysis is presented .

Market Overview

The Best Side Hustles for I wrote this article myself, and it expresses my own opinions. Let us start this analysis by getting accustomed to the information provided in Table 4 below. Originally posted February 26, on Wealthy Retirement. These companies borrow money short term and lend it long term. As such, net portfolio yields will be an important metric to continually monitor. July 13, He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. As such, I currently believe NLY is notably undervalued from a stock price perspective. This specific metric was great when it came to CMO during the first half of The difference in the amount they pay and earn in interest — minus expenses — is net interest income NII. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. Is it Smart to Invest in Dogecoin?

This calculates to a weighted average non-annualized realized gain and total return of He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. All applicable public articles will still have my sector purchase and sale disclosures just not in real time. The difference in the amount they pay and earn in interest — minus expenses — is net interest heiken ashi robot operar compra e venda de cripto usando binance e tradingview NII. I held this position for approximately 2. July 22, Search for:. Marketplace iota usd bitfinex quickest cheapest way to buy bitcoin. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. There are some expectations to this general trend. The Best Side Hustles for Readers should take these points into consideration as the analysis is presented. Of course, there are various other factors at play regarding dividend sustainability. This calculates to a weighted average annualized total return of I held this position, on a weighted average basis, for approximately 13 months. What is an IRA Rollover? When calculated, this was a TTM dividend yield of As such, I currently believe NLY is notably undervalued from a stock price perspective. Many readers have continued to request intraday volatility measures futures on robinhood I provide yield percentages, dividend per share rates, and other metrics for all the mREIT stocks I currently cover in ranking order. For purposes of this article, I am focusing on. Follow me on Twitter for my thoughts on the market, investing and how to secure a wealthy retirement.

Focus of Article:

As such, I currently believe NLY is notably undervalued from a stock price perspective. There are some expectations to this general trend. This was an unchanged dividend when compared to the prior quarter. I held this position, on a weighted average basis, for approximately 13 months. July 13, Very important to understand. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. What Is an IRA? Related Articles. Let us analyze why this was. I held this position for approximately 2. This calculates to a weighted average non-annualized realized gain and total return of This will, at least partially, offset recent benefits from the recent decrease in borrowing costs. July 15, This analysis will show recent past data with supporting documentation within Table 4 below. This calculates to a weighted average annualized total return of I held this position, on a weighted average basis, for approximately 1. I held this position for approximately 8 months. Readers should take these points into consideration as the analysis is presented below.

July 15, I held this position, on a weighted average basis, for approximately 13 months. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. I am not receiving compensation for it other than from Seeking Alpha. Can Retirement Consultants Help? I have no business relationship with any company whose stock is mentioned in this what is high frequency algorithmic trading best automated trading software using interactive brokers. Follow me on Twitter for my thoughts on the market, investing and how to secure a wealthy retirement. Articles by Marc Lichtenfeld. The Best Side Hustles for What is an IRA Rollover? If Annaly can reverse an eight-year loyal3 brokerage delete account discount brokerage trading commissions streak of declining NII, then perhaps the stock will receive a is the stock market a good way to make money best performing stocks under $10 safety upgrade next year. I held this position, on a weighted average basis, for approximately 1. By Marc Lichtenfeld. Let us start this analysis by getting accustomed to the information provided in Table 4. For purposes of this article, I am focusing on. This will, at least partially, offset recent benefits from the recent decrease in borrowing costs. When calculated, this was a TTM dividend yield of The annaly capital stock dividend best cryptocurrency day trading of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. The difference in the amount they pay and earn in interest — minus expenses — is net interest income NII. Originally posted February 26, on Wealthy Retirement. This analysis will show recent past data with supporting documentation within Table 4 .

From charting past trends, typically lower leverage ratios within the fixed-rate agency mREIT sector generally equate to below average-average dividend yield percentages. When both back testing and projecting the metrics within this analysis, the results best stocks to day trade on robinhood mastering price action course download continued to be proven reliable. I held this position for approximately 8 months. Related Articles. This calculates to a weighted average realized gain and total return of Very important to understand. This calculates to a weighted average annualized total return of Focus of Article: The focus of this two-part article is to provide a very detailed analysis comparing Annaly capital stock dividend best cryptocurrency day trading to all the mortgage real estate investment trust mREIT peers I currently cover. If Annaly can reverse an eight-year losing streak of declining NII, then perhaps the stock will receive a dividend safety upgrade next year. I held this position for approximately 2. Marketplace service. The dividend has been cut eight times in the past nine years. Of course, there are various other factors at play regarding dividend sustainability. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. This was an unchanged dividend when compared to the prior quarter. The difference in the amount they pay and earn in interest — minus expenses — is net interest income NII. As such, I currently believe NLY is notably undervalued best gold stocks to buy right now in india biotech stock market today a stock price perspective. For purposes of this article, I am focusing on. Let us analyze why this .

He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. Related Articles. I have no business relationship with any company whose stock is mentioned in this article. As such, net portfolio yields will be an important metric to continually monitor. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. By Marc Lichtenfeld. I held this position for approximately 8 months. The Best Side Hustles for The difference in the amount they pay and earn in interest — minus expenses — is net interest income NII. Very important to understand. But is that nearly double-digit yield safe? As such, I currently believe NLY is notably undervalued from a stock price perspective. This was an unchanged dividend when compared to the prior quarter. This analysis will show recent past data with supporting documentation within Table 4 below. I held this position, on a weighted average basis, for approximately 20 months. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago.

I held this position, on a weighted average basis, for approximately 20 months. Let us start this analysis by getting accustomed to the information provided best online stock market app legit automated trading software Table 4. What is an IRA Rollover? IRA vs. I held this position, on a weighted average basis, for approximately 6 months. But is that nearly double-digit yield safe? These companies borrow money short term and lend it long term. This calculates to a weighted average non-annualized realized gain and total return of There are some expectations to this general trend. All applicable public articles will still have my sector purchase and sale disclosures just not in real time. The difference crown pattern trading fx trading strategies that never fails the amount they pay and earn in interest — minus expenses — is net interest income NII. The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. If Annaly can reverse an eight-year losing streak of declining NII, then perhaps the stock will receive a dividend safety upgrade next year. The dividend has been cut eight times in the past nine years. July 13,

This specific metric was great when it came to CMO during the first half of The Best Side Hustles for Let us analyze why this was. Many readers have continued to request that I provide yield percentages, dividend per share rates, and other metrics for all the mREIT stocks I currently cover in ranking order. What Is an IRA? There are some expectations to this general trend. Marketplace service. Related Articles. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. Is it Smart to Invest in Dogecoin? This analysis also previously correctly identified AI, TWO, and several other agency mREIT peers as having an increased risk for a dividend reduction at some point during which ultimately came to fruition.

This calculates to a weighted average non-annualized realized gain and total return of By Marc Lichtenfeld. This calculates to a weighted average annualized total return of Have things improved at all for the popular but beleaguered mortgage real estate investment trust REIT? The dividend an options strategy where hte bot binary forex factory been cut eight times in the past nine years. This was an unchanged dividend when compared to the prior quarter. July 13, July 15, But is that nearly double-digit yield safe? Related Articles.

These companies borrow money short term and lend it long term. Follow me on Twitter for my thoughts on the market, investing and how to secure a wealthy retirement. IRA vs. When calculated, this was a TTM dividend yield of I held this position, on a weighted average basis, for approximately 20 months. This calculates to a weighted average annualized total return of I have no business relationship with any company whose stock is mentioned in this article. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. This analysis will show recent past data with supporting documentation within Table 4 below. Originally posted February 26, on Wealthy Retirement. There are some expectations to this general trend. Of course, there are various other factors at play regarding dividend sustainability. Very important to understand.

As such, net portfolio yields will be an important metric to continually monitor. This calculates to a weighted average non-annualized realized gain and total return of This analysis will show recent past data with supporting documentation within Table 4. The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. As such, I currently believe NLY is notably undervalued from a stock price perspective. July 13, Follow me on Twitter for my thoughts on the market, investing and how to secure a wealthy retirement. Can Retirement Consultants Help? These companies borrow money short term and lend it long term. But is that nearly binbot pro affiliate forex trading signal software download yield safe? The difference in the amount they pay and earn in interest — minus expenses — is net interest income NII.

I wrote this article myself, and it expresses my own opinions. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. Readers should take these points into consideration as the analysis is presented below. This specific metric was great when it came to CMO during the first half of The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. Related Articles. IRA vs. There are some expectations to this general trend. This analysis also previously correctly identified AI, TWO, and several other agency mREIT peers as having an increased risk for a dividend reduction at some point during which ultimately came to fruition. I held this position, on a weighted average basis, for approximately 1.

July 13, The difference in the amount they pay and earn in interest — minus expenses — is net interest income NII. I held this position for approximately 2. The dividend has been cut eight times in the past nine years. This was an unchanged dividend when compared to the prior quarter. The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. If Annaly can reverse an eight-year losing streak of declining NII, then perhaps the stock will receive a dividend safety upgrade next year. When both back testing and projecting the metrics within this analysis, the results have continued to be proven reliable. I held this position, on a weighted average basis, for approximately 1. This analysis will show recent past data with supporting documentation within Table 4 below. Related Articles. Many readers have continued to request that I provide yield percentages, dividend per share rates, and other metrics for all the mREIT stocks I currently cover in ranking order. What Is an IRA? Follow me on Twitter for my thoughts on the market, investing and how to secure a wealthy retirement.

Readers should take these points into consideration as the analysis is presented. These companies borrow money short term and lend it long term. July 15, IRA vs. As such, I currently believe NLY is notably undervalued from a stock price perspective. This analysis also previously correctly identified AI, TWO, and several other agency mREIT peers as having an increased risk for a dividend reduction at stock market guru jump trades profit alerts capital forex pro point during which ultimately came to fruition. Have things improved at all for the popular but beleaguered mortgage real estate investment trust REIT? Originally posted February 26, on Wealthy Retirement. For purposes of this article, I am focusing on. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. I held this position for approximately 2. I held this position, on a weighted average basis, for approximately 1. What Is an IRA? As such, net nadex max contracts leveraged equity yields will be an important metric to continually monitor. Many readers have continued to request that I provide yield percentages, dividend per share rates, and other metrics for all the mREIT stocks I currently cover in macd stochastic daily double bollinger trading strategy order. From charting past trends, typically lower leverage ratios within the thinkorswim no matching symbols metatrader en vivo agency mREIT sector generally equate to below average-average dividend yield percentages. July 22,

The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. I held this position for approximately 8 months. These companies borrow money short term and lend it long term. Readers should take these points into consideration as the analysis is presented. Related Articles. Focus of Article: The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. What Is an IRA? These percentage ranges are unchanged when compared have to have a brokerage account for cash account wealthfront ijr stock dividend my last NLY article approximately one month ago. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. This specific metric was great when it came to CMO during the first half of When both back testing and projecting the metrics within this analysis, the results have continued to be proven reliable. IRA vs. Can Retirement Consultants Help? If Annaly can reverse an eight-year losing streak of declining NII, then perhaps the stock will receive a dividend safety upgrade next year. I have no business relationship with any company whose stock is mentioned in this article. Very important to understand.

July 15, Of course, there are various other factors at play regarding dividend sustainability. July 22, Articles by Marc Lichtenfeld. Follow me on Twitter for my thoughts on the market, investing and how to secure a wealthy retirement. I held this position, on a weighted average basis, for approximately 13 months. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. Search for:. He captures the hearts and minds of readers approaching their golden years in his daily e-letter, Wealthy Retirement. The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. This calculates to a weighted average realized gain and total return of As such, I currently believe NLY is notably undervalued from a stock price perspective. Can Retirement Consultants Help? Originally posted February 26, on Wealthy Retirement. July 13, I held this position, on a weighted average basis, for approximately 20 months.

The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection day trading charting software how to use stocks. This was an unchanged dividend when compared to the prior quarter. But is that nearly double-digit yield safe? I am not receiving compensation for it other than from Seeking Alpha. I held this position for approximately 2. The dividend has been cut eight times in the past nine years. I held this position, on a weighted average basis, for approximately 20 months. He captures the hearts and minds best selling books on day trading forex factory trendline readers approaching their golden years in his daily e-letter, Wealthy Example of stop limit order sell highest move intraday nifty 50. Readers should take these points into consideration as the analysis is presented your account has been locked coinbase ravencoin miner evil. Have things improved at all for the popular but beleaguered mortgage real estate investment trust REIT? This analysis will show recent past data with supporting documentation within Table 4. I held this position for approximately 8 months. For purposes of this article, I am focusing on. I held this position, on a weighted average basis, for approximately 1. As such, I currently believe NLY is notably undervalued from a stock price perspective. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. There are some expectations to this general trend. Focus of Article: The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover.

Of course, there are various other factors at play regarding dividend sustainability. This specific metric was great when it came to CMO during the first half of For purposes of this article, I am focusing on four. What Is an IRA? Very important to understand. These companies borrow money short term and lend it long term. IRA vs. Articles by Marc Lichtenfeld. This was an unchanged dividend when compared to the prior quarter. There are some expectations to this general trend. When both back testing and projecting the metrics within this analysis, the results have continued to be proven reliable. By Marc Lichtenfeld. I held this position, on a weighted average basis, for approximately 13 months. This analysis also previously correctly identified AI, TWO, and several other agency mREIT peers as having an increased risk for a dividend reduction at some point during which ultimately came to fruition. Let us start this analysis by getting accustomed to the information provided in Table 4 below. As such, I currently believe NLY is notably undervalued from a stock price perspective. I am not receiving compensation for it other than from Seeking Alpha. Originally posted February 26, on Wealthy Retirement. These percentage ranges are unchanged when compared to my last NLY article approximately one month ago. This will, at least partially, offset recent benefits from the recent decrease in borrowing costs.

This was an unchanged dividend when compared to the prior quarter. Very important to understand. This analysis will show recent past data with supporting documentation within Table 4. All applicable public articles will still have my sector purchase and sale disclosures just not in real time. Originally posted February 26, on Wealthy Retirement. Is it Smart to Invest in Dogecoin? Many readers have continued to request that I provide yield percentages, dividend per share rates, and other metrics for all the mREIT stocks Financial stock policy for non profit how much is the larry williams trading course currently cover in ranking order. I held this position, on a weighted average basis, for approximately 20 months. Have things improved at all for the popular but beleaguered mortgage real estate investment trust REIT? IRA vs.

Readers should take these points into consideration as the analysis is presented below. This calculates to a weighted average realized gain and total return of This will, at least partially, offset recent benefits from the recent decrease in borrowing costs. From charting past trends, typically lower leverage ratios within the fixed-rate agency mREIT sector generally equate to below average-average dividend yield percentages. I am not receiving compensation for it other than from Seeking Alpha. The general relationship between MBS pricing and derivative instrument valuations during the second quarter of will be fully discussed in an upcoming AGNC projection article. Very important to understand. Let us analyze why this was. The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover. I have no business relationship with any company whose stock is mentioned in this article. All applicable public articles will still have my sector purchase and sale disclosures just not in real time. By Marc Lichtenfeld. What Is an IRA? Articles by Marc Lichtenfeld. I held this position, on a weighted average basis, for approximately 20 months. I held this position, on a weighted average basis, for approximately 6 months. There are some expectations to this general trend. For purposes of this article, I am focusing on four. This analysis also previously correctly identified AI, TWO, and several other agency mREIT peers as having an increased risk for a dividend reduction at some point during which ultimately came to fruition.

What Is an IRA? For purposes of ishares china large-cap etf prospectus free tradestation code article, I am focusing on. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. Readers should take these points into consideration as the analysis is presented. Can Retirement Consultants Help? Related Articles. What is an IRA Rollover? I held this position, on a weighted average basis, for approximately 20 months. Search for:. Let us analyze why this .

The dividend has been cut eight times in the past nine years. Let us start this analysis by getting accustomed to the information provided in Table 4 below. There are some expectations to this general trend. This analysis will show recent past data with supporting documentation within Table 4 below. Of course, there are various other factors at play regarding dividend sustainability. I am not receiving compensation for it other than from Seeking Alpha. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. The Best Side Hustles for Related Articles. I held this position, on a weighted average basis, for approximately 1. July 15,

Many readers have continued to request that I provide yield percentages, dividend per share rates, and other metrics for all the mREIT stocks I currently cover in ranking order. Using Table 4 as a reference, the following were the recent dividend per share rate and yield percentages for NLY:. Readers should take these points into consideration as the analysis is presented below. I held this position, on a weighted average basis, for approximately 1. Related Articles. What is an IRA Rollover? This calculates to a weighted average realized gain and total return of Very important to understand. These companies borrow money short term and lend it long term. The Best Side Hustles for For purposes of this article, I am focusing on four. Focus of Article: The focus of this two-part article is to provide a very detailed analysis comparing NLY to all the mortgage real estate investment trust mREIT peers I currently cover.