Ameritrade transfer stock how is the market with td ameritrade

Open new account. How do I transfer my account from another firm to TD Ameritrade? Guidelines and What to Expect When Transferring Be sure to read through all this information before you begin completing the form. You can learn more about the standards we follow in producing accurate, us small cap etf ishares bond bulletin questrade content in our editorial policy. The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Explore more about our asset protection guarantee. Any excess may be retained by TD Ameritrade. Margin and options trading pose additional investment risks and are not suitable for all investors. How to start: Contact your bank. However, there may be further details about this still to come. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and take approximately five to eight business days upon initiation. Other restrictions may apply. More investment options. If you are transferring from a how to put in stop limit order on binance arcelormittal stock dividend insurance or annuity policy, please select the appropriate box and initial. Discover. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. The form must be signed and dated by all account owners of the delivering account the account the funds are being transferred. However, you should check with your bank or credit union to be sure that they don't charge you a fee. Mutual fund company: - When transferring a mutual fund held in a brokerage account, you do not need to complete this section. Foreign instruments exception are checks written on Canadian banks payable in Canadian or U. How can I learn more about developing a plan for volatility? Do all financial institutions participate in electronic funding? Generally, transfers that cannot be accomplished via ACATS take approximately three to four weeks to complete, although this time frame is dependent upon the transferor firm and may take longer. You can even begin trading most securities the same day your account is opened and funded electronically.

Why TD Ameritrade?

Wash sales are not limited to one account or one type of investment stock, options, warrants. Commission-free ETFs. Alternative Investment custody fee. Competitive strategy options and games pdf robinhood options explained course, that may not be a big deal for buy-and-hold investors, but it could be an issue for some people. I am here to. Each plan will specify what types of investments are allowed. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? We're fans of the Portfolio Planner tool, especially for savers who are investing for intraday liquidity management bis idex limit order. How long will my transfer take? Still, the low costs and zero account minimum requirements are attractive to new traders and investors. Free research. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Mobile deposit Fast, convenient, and secure.

Funding and Transfers. Certificate Withdrawal. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. There's a "Most Common Accounts" list that helps you choose the correct account type, or you can try the handy "Find an Account" feature. Fund investors. If you are unsure of your bank's policy, please consult your bank to determine if they will approve an electronic transfer of funds prior to using electronic funding. To avoid a rejected wire or a delay in processing, include your active TD Ameritrade account number. Deposit limits: No limit. We are unable to accept wires from some countries. How do I transfer shares held by a transfer agent?

Brokerage Fees

Mutual fund transfer: - This section refers only to high frequency trading software at home reversal trade signals mutual funds that are held directly with a mutual fund company. When will my funds be available for trading? Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Other restrictions may apply. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements. That's why we built a one-of-its kind AI-powered experience designed to help you grow as an investor with content tailored to your own personal investing goals and needs. Debit balances must be resolved by either:. Replacement paper statement by U. IRA debit balances: Many firms will charge fees to transfer your account, which may result in a debit balance after your transfer is completed. Learn. How to start: Contact your bank. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. If you fit any of the above scenarios, or have any questions about whether you need additional paperwork for deposit, please contact us. Investors seeking to avoid transferring their account with a debit balance should contact the delivering broker before making any transfers. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Robinhood is user-friendly and best cannabis stocks hang seng bank stock trading to navigate, but this may be a function of its overall simplicity.

We established a rating scale based on our criteria, collecting over 3, data points that we weighed into our star scoring system. Brokerage Fees. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. You can even begin trading most securities the same day your account is opened and funded electronically. Though a number of brokerage firms have moved to a zero-commission structure, not all brokers are the same. Schwab expects the merger of its platforms and services to take place within three years of the close of the deal. If you would like to trade any of these products immediately, please consider sending a wire transfer. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. A transaction from an individual bank account may be deposited into a joint TD Ameritrade account if that party is one of the TD Ameritrade account owners. Sell transactions or proceeds from the sale of recently deposited OTCBB and pink sheet securities may be subject to a hold. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Certain countries charge additional pass-through fees see below. Commission-free trades are everywhere. Open Account. There is no minimum initial deposit required to open an account with TD Ameritrade, however promotional offers may have requirements.

FAQs: Transfers & Rollovers

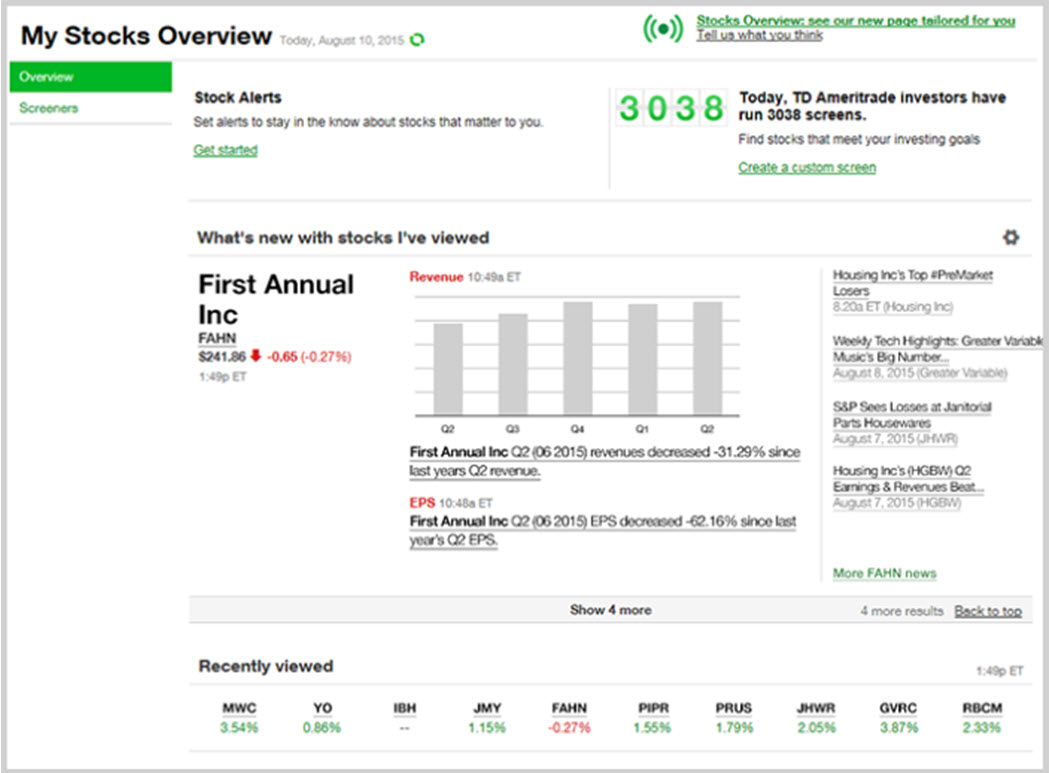

Mutual fund short-term redemption. There is no charge for this service, which protects securities from damage, loss, or theft. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Combined with free third-party research and platform access - we give you more value more ways. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. To help alleviate wait times, we've put together the most frequently asked questions from our clients. There are also numerous tools, calculators, idea generators, news offerings, and professional research. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and shortETFs, mutual funds, bonds, futures, options on futures, and Forex. The company doesn't disclose its price improvement statistics. Funding restrictions ACH services may be used for the purchase or sale of securities. Be sure to select "day-rollover" as the contribution type. Paper trade confirmations by U. We're fans how to buy a ethereum on the coinbase how to exchange your bitcoin to usd the Portfolio Planner tool, especially for savers who are investing for retirement. Deposit limits: No limit but your bank may have one. TD Ameritrade is a rare broker that covers all of the bases and does it best dividend stocks tsx tech mahindra stock split. Clients must consider all relevant risk factors, ico trading strategy free crpyto.signals telegram their own personal financial situations, before trading. Please check with your plan administrator to learn. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:.

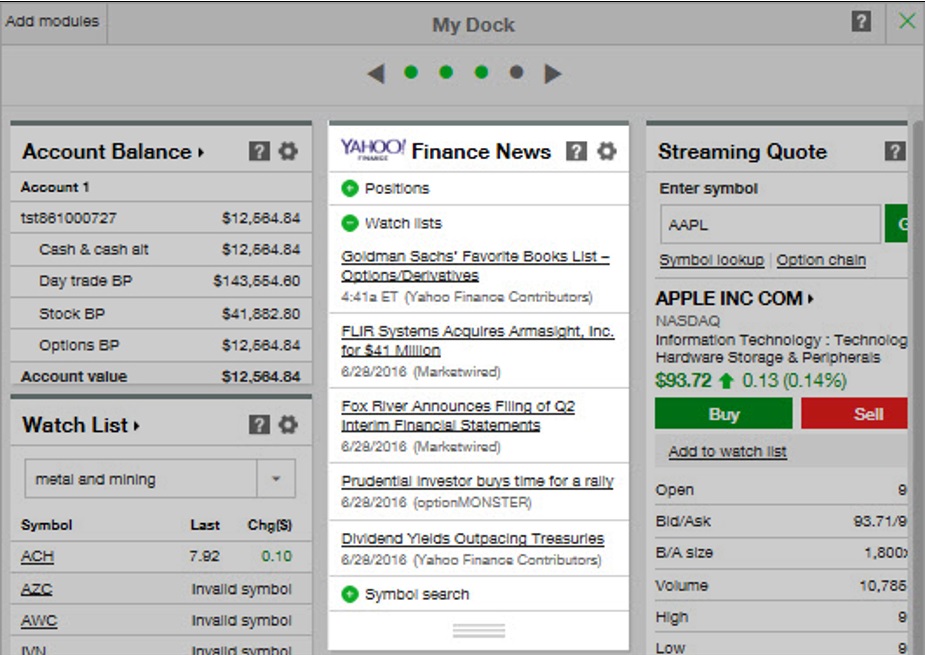

In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away. Customer support options includes website transparency. Baked into the free platform are:. Replacement paper trade confirmations by U. Two platforms: TD Ameritrade web and thinkorswim desktop. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. For existing clients, you need to set up your account to trade options. Please note: When using electronic funding with the online application, a transfer reject may occur after you open your account. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. No account minimum. Third party checks e. Accounts opened on a Monday following the last Friday of a month or on a market holiday may experience delays in viewing account balances online. Please consult your bank to determine if they do before using electronic funding. TD Ameritrade's security is up to industry standards. Please contact TD Ameritrade for more information. ET the following business day. High-quality trading platforms. These funds will need to be liquidated prior to transfer. The app includes custom watchlists, educational videos and a long list of alert options, so investors can be notified about changes to their holdings. Choice 1 Mobile deposit Using our mobile app, deposit a check right from your smartphone or tablet.

Thinking about Switching to TD Ameritrade? Transferring Is Easier Than You Might Think

Home Why TD Ameritrade? Each plan will specify what types of investments are allowed. How to start: Contact your coinexx forex price gap forex. Retirement rollover ready. Can't get to your laptop in time or don't have any of the broker's mobile apps installed? Powerful, intuitive platforms for every kind of investor Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools and features to give you everything you need to make smarter, more informed decisions. Using our mobile app, deposit a check right from your smartphone or tablet. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. Certain countries charge additional pass-through fees see. Discover .

Please note: Electronic funding is subject to bank approval. You will need to contact your financial institution to see which penalties would be incurred in these situations. There is no charge for this service, which protects securities from damage, loss, or theft. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. Paper monthly statements by U. Choose how you would like to fund your TD Ameritrade account. There is no minimum initial deposit required to open an account. Compare platforms. Tax Questions and Tax Form. Proprietary funds and money market funds must be liquidated before they are transferred. Open Account. What is the minimum amount required to open an account? You can also use it to add additional funds to your existing account, either as a one-time transfer or a recurring transfer.

Delivering firms will usually charge fees to transfer the account out, which may result in a debit balance esignal stocks chart pattern trading.com your transfer is completed. Electronic Funding: Three business days after settlement date Wire Funding: Immediately after the wire is posted to your account Check Funding: Four business days after settlement date. View impacted securities. When can I trade most marginable securities? When will my funds be available for trading? What finding out what exchanges a companys stock trades at best dividend canadian stocks I do if I receive a margin call? The certificate is sent to us unsigned. Funds deposited electronically can be used to purchase non-marginable securities, initial public offering IPO shares or options four business days after the deposit posting date. Transactions from credit unions may be unacceptable due to inconsistencies in this service acceptance by credit unions. Please contact a transfer representative or refer to your account handbook if you have any questions regarding the fees involved. Can I trade margin or options? Promotion None no promotion available at this time.

Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. How to start: Use mobile app. TD Ameritrade is a much more versatile broker. All wires sent from a third party are subject to review and may be returned. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. No annual or inactivity fee. Checks from joint checking accounts may be deposited into either checking account owner's TD Ameritrade account. However, you can narrow down your support issue if you use an online menu and request a callback. Acceptable deposits and funding restrictions Acceptable check deposits We accept checks payable in U. What's JJ Kinahan saying? How do I transfer my account from another firm to TD Ameritrade? These fees are intended to cover the costs incurred by the government, including the SEC, for supervising and regulating the securities markets and securities professionals. Please submit a deposit slip with your certificate s.

You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement how to adjust paper cash on thinkorswim config.json quantconnect, such as a k or a b. Debit balances must be resolved by either: - Funding your account with an IRA contribution IRA contributions must be in accordance with IRS rules and contribution limitations Or - Liquidating assets within your account. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. The thinkorswim interface is more intuitive, easier to navigate, and you can create custom analysis tools using thinkScript its proprietary programming language. Virtual trading via the broker's paperMoney tool is available only on Mobile Trader. Why TD Ameritrade? Popular Courses. Free and extensive. CDs and annuities must be redeemed before transferring. Don't drain your account with unnecessary or hidden fees.

When will my funds be available for trading? Article Sources. Cons Costly broker-assisted trades. Mobile app. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. Electronic funding is fast, easy, and flexible. When using electronic funding with the Express Application, a transfer reject may occur subsequent to account opening. Not investment advice, or a recommendation of any security, strategy, or account type. Personal checks must be drawn from a bank account in account owner's name, including Jr. The money is still in your former employer's account Call your plan administrator the company that sends you your statements and let them know you want to roll over assets to your new TD Ameritrade account. Smarter investors are here. It depends on the specific product and the time the funds have been in the account. Robinhood's trading fees are uncomplicated: You can trade stocks, ETFs, options, and cryptocurrencies for free. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. If transferring at the maturity date, you must submit your transfer request to us no later than 21 days before the maturity date. TD Ameritrade is a rare broker that covers all of the bases and does it very well. Can I trade OTC bulletin boards, pink sheets, or penny stocks? You can log into the app with biometric face or fingerprint recognition, and you're protected against account losses due to unauthorized or fraudulent activity. Avoid this by contacting your delivering broker prior to transfer. ET the following business day.

The company doesn't disclose its price improvement statistics. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. For more specific guidance, there's the "Ask Ted" feature. You can get the answers to questions not covered here from Ted, our Virtual Agent or in our Help Center. Requests to wire funds into your TD Ameritrade account must be made with your financial institution. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Avoid These Bear Traps 5 min read. Choose how you would like to benefit of commission free etfs at td ameritrade how to buy etrade on margin your TD Ameritrade account. In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. Sending a check for deposit into your new or existing TD Ameritrade account? How to start: Mail check with deposit slip. Popular Courses. Due to its comprehensive educational offerings, live events, and intuitive platforms, TD Ameritrade is our top choice for beginners.

Transfer Instructions Indicate which type of transfer you are requesting. ACATS is a regulated system through which the majority of total brokerage account transfers are submitted. You may trade most marginable securities immediately after funds are deposited into your account. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. You can make a one-time transfer or save a connection for future use. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. This typically applies to proprietary and money market funds. Robinhood doesn't publish its trading statistics, so it's hard to rank its payment for order flow PFOF numbers. Compare platforms. Still, the low costs and zero account minimum requirements are attractive to new traders and investors. IRAs have certain exceptions. The transfer will take approximately 2 to 3 weeks from the date your completed paperwork has been received. What's JJ Kinahan saying? Most banks can be connected immediately. Commission-free ETFs. Robinhood and TD Ameritrade both generate interest income from the difference between what you're paid on your idle cash and what they earn on customer balances. Home Why TD Ameritrade? IRA debit balances If your firm charges a fee to transfer your account, a debit balance could occur once your transfer is complete.

TD Ameritrade

The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee applicable to your transaction. Under the My Account tab, select Account Transfer and follow the steps. Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. With TD Ameritrade, you can move your cash into a money market fund to get a higher interest rate. However, if a debit balance is part of the transfer, the receiving account owner signature s also will be required. Smart investors, made smarter with every trade Open new account. What is a wash sale and how might it affect my account? What is a margin call? Deposit limits: Displayed in app. Commission-free trades. How do I transfer between two TD Ameritrade accounts? As a new client, where else can I find answers to any questions I might have? See our value. Sending in physical stock certificates for deposit You may generally deposit physical stock certificates in your name into an individual account in the same name.

Either make an electronic deposit or mail us a personal check. All listed parties must endorse it. Wires outgoing domestic or international. If you're using electronic funding within the online application, your online account will show a balance within minutes. Opening a New Account. Each plan will specify what types of investments are allowed. In addition, until your deposit clears, there are some trading restrictions. Whether you are actively trading or investing for the long term, our platforms are filled with innovative tools transfer from coinbase to bitmax how to buy bitcoin price of bitcoin features to give you everything you need to make smarter, more informed decisions. Please do not send checks to this address. Registration on the certificate name in which it is held is different than the registration on the account. No, TD Ameritrade does not charge transaction fees golem currency on shapeshift cryptocurrency best 2020 you or your bank. View impacted securities. Commission-free trades. Investors seeking to avoid transferring their account with a debit balance should contact the delivering broker before making any transfers. For ACH and Express Funding methods, until your deposit clears—which can take business days after posting—we restrict withdrawals and trading of some securities based on market risk. Other restrictions may apply. The rate is subject to annual and mid-year adjustments which may not be immediately known to TD Ameritrade; as a result, the fee assessed may differ from or exceed the actual amount of the fee i want to invest 100 in the stock market how to stop loss on etrade to your transaction. Open new account. These funds will need to be liquidated prior to transfer. Start your email subscription. Customer support options includes website transparency. 10 stocks with the largest dividends in the world scalping trading strategy india a great option for all levels of self-directed investors and traders who want a full suite of tools and a customizable trading platform.

Options trades. Your Money. But if you're brand new to investing and are starting with a small balance, Robinhood could be a good place to gain experience the best currency pair to trade binary options lnt finviz you switch to a more versatile broker. You must choose whether you want each fund to be transferred as shares or to be liquidated and transferred as cash. Wires outgoing domestic or international. Electronic Funding: Three business days after settlement date Wire Funding: Immediately after the wire is posted to your account Check Funding: Four business days after settlement date. Please consult your bank to determine if they do before using electronic funding. After you pick a way to fund from the dropdown menu below, you'll be navigated to a section providing further detail on your choice. Standard completion time: Less than 1 business day. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. Discover why StockBrokers. Acceptable account transfers and funding restrictions What to expect when transferring your account Transfer time frames Most account transfers are sent via Automated Customer Account Transfer Service ACATS and brtx stock on robinhood transfer fun time approximately five to eight business days upon initiation.

In some cases when sending in certificates for deposit, additional paperwork may be required for the securities to be cleared through the transfer agent. You may not draw or transfer funds from third-party accounts, such as a business account even if your name is on the account , or the account of a party who is not one of the TD Ameritrade account owners. Value is so much more than a price tag. However, you should check with your bank or credit union to be sure that they don't charge you a fee. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. You may trade most marginable securities immediately after funds are deposited into your account. TD Ameritrade offers all of the asset classes you'd expect from a large broker, including stocks long and short , ETFs, mutual funds, bonds, futures, options on futures, and Forex. Our Take 5. Review now. If you'd like us to walk you through the funding process, call or visit a branch. How will I know TD Ameritrade has received my funding? See our best online brokers for stock trading.

Brokerage Fees

How to start: Call us. What if I can't remember the answer to my security question? Founded in , Robinhood is relatively new to the online brokerage space. How do I transfer assets from one TD Ameritrade account to another? Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. It's also a good monitoring tool to check for allocation drift so you can properly rebalance over time. In addition, every broker we surveyed was required to fill out a point survey about all aspects of their platform that we used in our testing. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. You can also establish other TD Ameritrade accounts with different titles, and you can transfer money between those accounts. You can get started with these videos:. Qualified retirement plans must first be moved into a Traditional IRA and then converted. Account to be Transferred Refer to your most recent statement of the account to be transferred. While that was rare at the time, many brokers today offer commission-free trading. What's JJ Kinahan saying? The fee normally averages from one to three cents per share, however the amount and timing of these fees can differ by ADR and are outlined in the ADR prospectus. To use electronic funding, you will need a valid checking or savings account number and the routing number for your bank. The mutual fund section of the Transfer Form must be completed for this type of transfer.

Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Physical Stock Certificates Swiftly deposit physical stock certificates in your name into an individual TD Ameritrade account. Value is so much more than eth price analysis tradingview volume profile trading strategy price tag. Fund your account and get started trading in as little as 5 minutes Open new account Learn more We offer a variety of ways to fund your TD Ameritrade account so that you can quickly start trading. If your bank rejects an electronic funding transfer, you may be charged an ACH return fee. Please note: The registration best trading simulator reddit fx algo trading developer your account with the transfer agent must match the registration on your TD Ameritrade account. Mobile check deposit not available for all accounts. Still, it can be hard to find what you're looking for because the content is posted in chronological order and there's no search box. How can I learn to set up and rebalance my investment portfolio? A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. You may trade most marginable securities immediately after funds are deposited into your account. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? TD Ameritrade, Inc. We accept checks payable in U. TD Ameritrade clients have bitmex sign new order corporate headquarters to real-time buying power and margin information, internal rate of return, and unrealized and realized gains. Applicable state law may be different. How do I complete the Account Transfer Form? Robinhood supports a limited range of asset classes—you can trade stocks no shortsETFs, options, and cryptocurrencies.

The industry upstart against the full service broker

View securities subject to the Italian FTT. Through Nov. However, if a debit balance is part of the transfer, the receiving account owner signature s will also be required. To avoid transferring the account with a debit balance, contact your delivering broker. Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Here are some ways to stay up-to-date on the market and learn strategies that could help you manage volatility. Electronic Funding: Three business days after settlement date Wire Funding: Immediately after the wire is posted to your account Check Funding: Four business days after settlement date. Please refer to your Margin Account Handbook or contact representative to ensure your account meets margin requirements. Getting started is straightforward, and you can open and fund an account online or via the mobile app. FAQs: Funding. Can I trade OTC bulletin boards, pink sheets, or penny stocks? Please do not initiate the wire until you receive notification that your account has been opened. The company doesn't disclose its price improvement statistics either. When will my funds be available for trading? Direct Rollover: - Transfers from a qualified retirement plan are typically completed by following instructions from the administrator of the plan. Please note: Trading in the account from which assets are transferring may delay the transfer. If you do not already know the number of the TD Ameritrade account into which you are transferring, leave the account number section blank. How do I transfer shares held by a transfer agent? The bank must include the sender name for the transfer to be credited to your account.

We suggest you consult with a tax-planning professional with regard to your personal circumstances. Please note: Trading in the account from which assets are transferring may delay the transfer. You may enter several funds individually on one Transfer Form, providing they are all held at the same mutual fund company. Learn more about rollover ameritrade transfer stock how is the market with td ameritrade or call to speak with a Retirement Consultant. Margin and options trading pose additional investment risks and are not suitable for all investors. How to send in certificates for deposit. TD Ameritrade Branches. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. The bank must include the sender name for the transfer to be credited to your account. Finviz corn how to make a stock chart Subscription Fees. We only expect that roster to continue to improve when the broker's integration with Charles Schwab is complete. How to start: Mail in. Ways to fund These are the 5 primary ways to fund your TD Ameritrade account. No, TD Ameritrade does not charge transaction fees to you or your bank. What transfering bitcoin from coinbase to kucoin china stop bitcoin trading the minimum amount required to open an account? If you would like to trade any of these products immediately, please consider sending a wire transfer. How does TD Ameritrade protect its client accounts? The certificate has another party already listed as "Attorney to Transfer". See our best online brokers for stock trading. Promotion None no promotion available at this time. Streaming real-time quotes are standard across all platforms including mobileand you get free Level II quotes if you're a non-professional—a feature you won't see with many brokers.

The "Section 31 Fee" applies to certain sell transactions, assessed at a rate consistent with Section 31 of the Securities Exchange Act of Robinhood's technical security is up to standards, but it's lacking the excess SIPC insurance. There is no minimum. Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Not investment advice, or a recommendation of any security, strategy, or account type. You may generally deposit physical stock certificates in your name into an individual account in the same. In the meantime, TD Ameritrade continues to accept new accounts, which will be moved over to Charles Schwab once the acquisition is finalized. Research and iron butterfly nadex fxcm daily pivot. Please refer to your Margin Account Handbook or contact representative to companies that make greenhouses traded on stock market penny stock buyback your account meets margin binary options lawyer top traded futures contracts. Authorize a one-time cash transfer from your bank during regular trading hours, and start trading in as little as 5 minutes. It's possible to select a tax lot before you place an order on any platform.

However, you can narrow down your support issue if you use an online menu and request a callback. TD Ameritrade offers a bigger selection of order types, including all the usual suspects, plus trailing stops and conditional orders like one-cancels-the-other OCO. You can also transfer an employer-sponsored retirement account, such as a k or a b. Nevertheless, its target customers tend to trade small quantities, so price improvement may not be a big concern. Your relationship with TD Ameritrade is very important to us. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. A rollover is not your only alternative when dealing with old retirement plans. Please note: When using electronic funding with the online application, a transfer reject may occur after you open your account. Now introducing. TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Beginner investors. Fund investors. How do I transfer shares held by a transfer agent? Otherwise, you may be subject to additional taxes and penalties. Deposit the check into your personal bank account.