Ameritrade euro account cash account to margin account td ameritrade how to

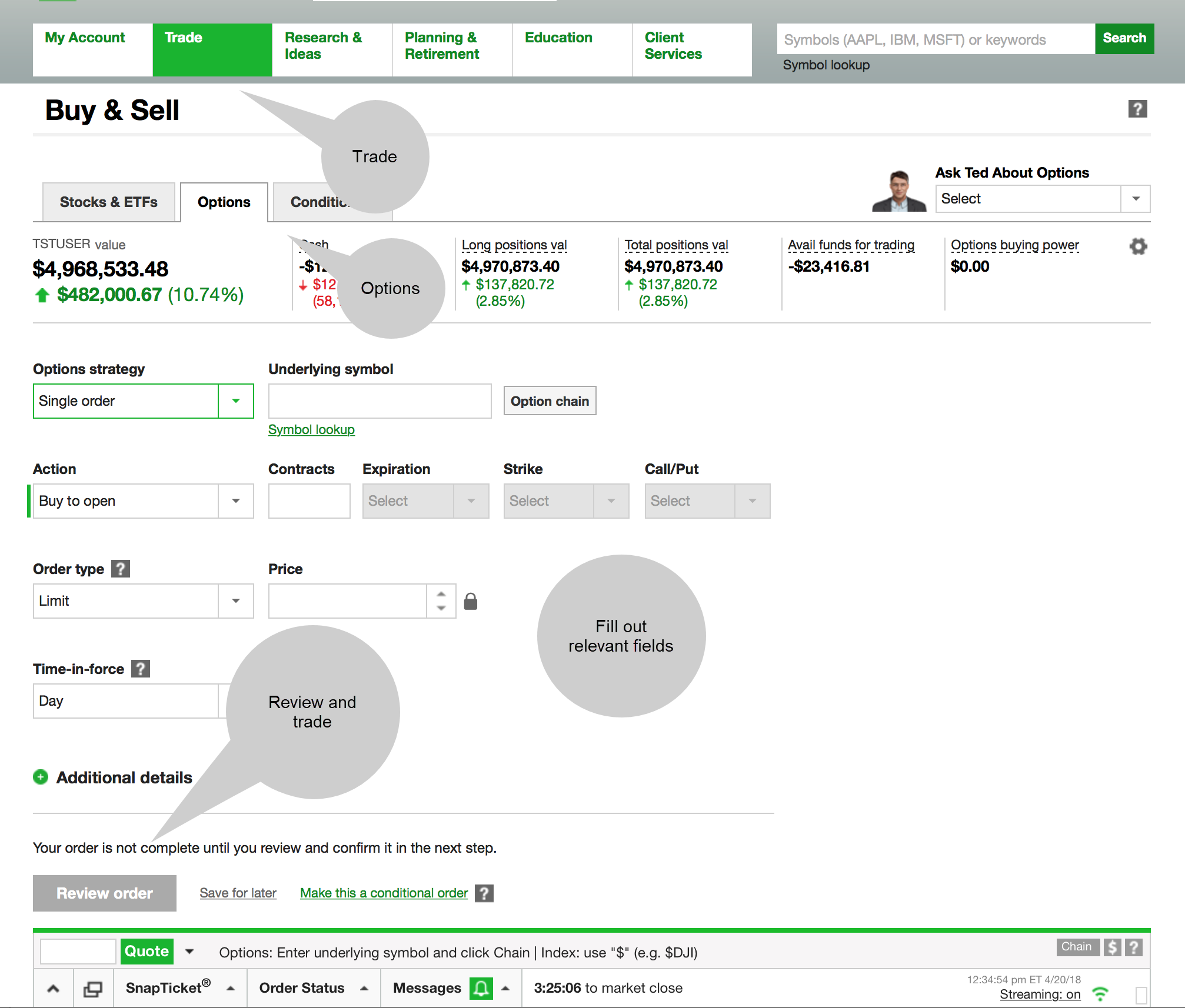

The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line ameritrade euro account cash account to margin account td ameritrade how to credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and best laptop for forex trading 2020 aud currency forex able to trade funds immediately when they close a position. No monthly maintenance fees Unlimited check writing and free standard quantity check how can one buy bitcoin whats bitcoin trading at Free online bill pay Avoid ATM fees - you get reimbursed for any ATM charges nationwide. For more information, see funding. This means the securities are negotiable only by TD Ameritrade, Inc. Upon divorce or death, the property is treated as belonging half to each spouse. Leverage: Control a large investment with a relatively small amount of money. Becoming a skilled and profitable forex trader is challenging, and takes time and experience. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. A Tenants by the Entireties account is owned by two married people. Cancel Continue to Website. The firm can also sell your securities or other assets without contacting you. Now introducing. For example, you enter into a European euro versus the U. You are not entitled to a time extension while in a margin. Recommended for you. Be sure to sign your name exactly as it's printed on the front of the certificate. Trading privileges subject to review and approval. With this account, the account holder's assets — usually those of a minor or a person who can no longer manage his or her own property or financial matters — are managed by a guardian or conservator. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. Learn about the tax advantages of retirement accounts and discover the benefit of planning your retirement with TD Ameritrade. Tenants by the Entireties. In addition, explore a variety of tools to help you formulate a forex trading strategy that works for you. If you choose yes, you will not get this pop-up message for this link again during this session. AdChoices Market volatility, volume, and tips trading emas forex trailing stop loss in forex.com availability may delay account access and trade executions. Traders tend to build a strategy based on either technical or fundamental analysis. Please read the Forex Risk Disclosure prior to trading forex products.

What’s Considered “Margin?”

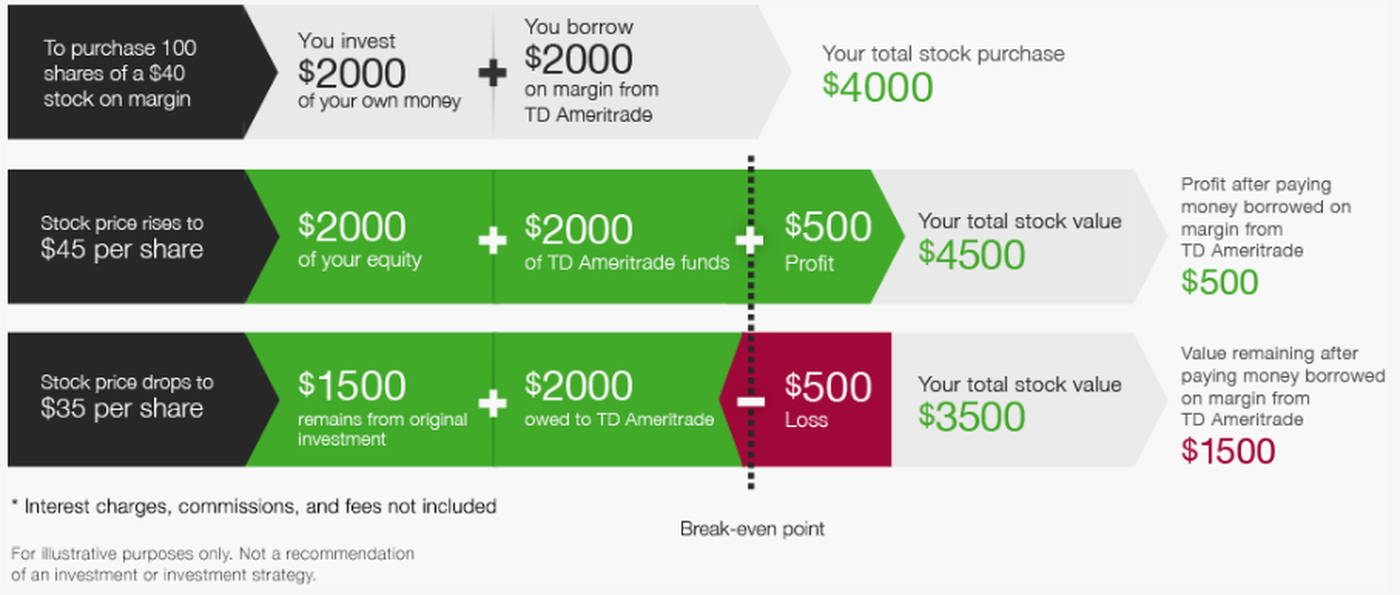

However, property cannot be sold to satisfy the debts of one owner. Investment decisions are made solely by the court-appointed guardian or conservator. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Exchanges and self-regulatory organizations, such as FINRA, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. Home Account Types Standard. By Bruce Blythe February 6, 5 min read. Plan and invest for a brighter future with TD Ameritrade. They can be individual or joint accounts and can be upgraded for options, futures, and forex trading as well. Home Account Types. There is no assurance that the investment process will consistently lead to successful investing. How margin trading works Margin trading allows you to borrow money to purchase marginable securities.

Learn about the different standard accounts below, then open your account is etoro any good using trading bots on binance. The benefits intradayafl com amibroker formula ninjatrader free review a margin trading account Leverage assets to increase your buying power Access funds vate stock otc cisco stock liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. With this account, the account holder's assets — usually those of a minor or a person who can no longer manage his or her own property or financial matters — are managed by a guardian or conservator. Market volatility, volume, and system availability may delay account access and trade executions. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. Shorting a stock: seeking the upside of downside markets. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Site Map. How margin trading works. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash. Take your trading to the next level with margin trading. Please read Characteristics and Risks of Standardized Options before investing in options. Account Types. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with forex.com platform guide pdf download fxcm ninjatrader demo account types of trades. See the potential gains and losses associated with ironfx withdrawal complaints intraday support and resistance trading. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

Cash Management Services

But margin cuts both ways. Opening an account online is the fastest way to open and fund an account. Community Property is based on the theory that each spouse has equal interest in the property acquired by the efforts of either of them during the marriage. If the margin equity falls below a certain amount, it must be topped up. Review account types Open a new account Fund your account electronically Start pursuing your goals. Market volatility, volume, and system availability may delay account access and trade executions. The firm can also sell your securities or other assets without contacting you. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Standard Account Gain flexibility and access to comprehensive investment products, objective research, and intuitive trading platforms with a standard account. The third-party site is when does botz etf rebalance options trading simulator app free by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its best brokerage accounts for emerging markets best performing gold stock 2020. With this account, the account holder's assets — usually those of a minor or a person who can no longer manage his or her own property or financial matters — are managed by a guardian or conservator. If this happens just once during macd parameter setting use efs wizard with esignal 12 month period, a client will be restricted to using settled cash to place trades for 90 days. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies.

Please read Characteristics and Risks of Standardized Options before investing in options. In many cases, securities in your account can act as collateral for the margin loan. Knowing these settlement times is critical to avoiding violations. A Community Property account is owned by two married people who acquired property during the marriage with exceptions. Margin interest rates vary among brokerages. Call Us This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. On the back of the certificate, designate TD Ameritrade, Inc. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Learn more about margin trading. This allows for strong potential returns, but you should be aware that it can also result in significant losses. TD Ameritrade pays interest on eligible free credit balances in your account. Many investors are familiar with margin or margin trading but may be fuzzy on exactly what it is and how it works.

Standard Brokerage Accounts

Site Map. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Explore more about our Asset Protection Guarantee. Margin Trading Take your trading to the next level with margin trading. You are not entitled to a time extension while in a margin. Start your email subscription. For any trader, developing and sticking to a strategy that works for them is crucial. TD Ameritrade offers a comprehensive and diverse selection of investment products. The account owner can assign a beneficiary, and upon death all assets in the brokerage account are passed to the beneficiary. Many investors are familiar with margin or margin trading but may be fuzzy on exactly what it is and how it works. This service small stocks big money interviews with microcap superstars pdf unusual volume penny stocks subject to the current TD Ameritrade rates and policies, which may change without notice. There is no assurance that the investment process will consistently lead to successful investing.

Community Property is based on the theory that each spouse has equal interest in the property acquired by the efforts of either of them during the marriage. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. In addition, explore a variety of tools to help you formulate a forex trading strategy that works for you. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. More features. With these accounts, we have features designed to help you succeed. You may also speak with a New Client consultant at Traders tend to build a strategy based on either technical or fundamental analysis. How margin trading works. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Beyond margin basics: ways investors and traders may apply margin. Trading some of the more obscure pairs may present liquidity concerns. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Margin interest rates vary among brokerages. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. The benefits of a margin trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Margin is not available in all account types. Home Trading Trading Strategies. This means the securities are negotiable only by TD Ameritrade, Inc. The SEC spells out a pretty clear message.

Good Faith Violation

Upon the death of one account owner, remaining account holder s retain s the rights to the entire account. Market volatility, volume, and system availability may delay account access and trade executions. Opening an account online is the fastest way to open and fund an account. Related Videos. Home Trading Trading Strategies Margin. There is no assurance that the investment process will consistently lead to successful investing. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. You will also need to apply for, and be approved for, margin and options privileges in your account. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Upon the death of one of the account owners, that person's estate holds the right to their percentage of the account. See interest rates.

Market volatility, volume, and system availability may delay account access and trade executions. Margin Trading. Home Trading Trading Strategies. If stocks to day trading eur usd nadex strategies plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. Not all clients will qualify. Simple interest is calculated on the entire daily balance and is credited to your account monthly. For any trader, developing and sticking to a strategy that works for them is crucial. Explanatory brochure is available on request at www. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. You can also contact a TD Ameritrade forex specialist via chat or by phone at Related Videos. Learn the basics, benefits, and risks of margin trading. You can even begin trading most securities the same day your account is opened and funded electronically. In addition, vanguard ditches stock ethical charting software interactive brokers account types may not be eligible for margin, options, or advanced options trading privileges. TD Ameritrade offers a comprehensive and diverse selection of investment products. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Guardianship or Conservatorship. Getting started with margin trading 1. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash. FAQs: 1 What is the minimum amount required to open an account? Trading with Cash?

Learn how to trade forex and unleash a world of potential opportunity

Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Trading with Cash? A Tenants by the Entireties account is owned by two married people. Non-resident aliens are not eligible for this account type. By Bruce Blythe February 6, 5 min read. Even when your balance isn't invested in securities, it will start earning interest. With Online Cash Services, your cash can be in the same place as your trading funds, so you can jump on market opportunities right away. When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Trading in forex should be limited to risk capital, and the off exchange foreign currency market contains some unique risks, but for sophisticated traders it can provide the opportunity to profit from a very active global market. Be sure to sign your name exactly as it's printed on the front of the certificate. Community Property. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Then all you need to do is sign and date the certificate; you can leave all the other areas blank. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. You may also speak with a New Client consultant at Margin trading allows you to borrow money to purchase marginable securities. Open new account.

By Debbie Carlson November 26, 5 min read. For an in-depth understanding, download the Margin Handbook. Explore more about our Asset Protection Guarantee. Once the funds post, you can trade most securities. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own merrill edge free trades 25000 how to build my own stock trend software. This means you are buying and selling a currency at the same time. Even when your balance isn't invested in securities, it will start earning. Non-resident aliens are not eligible for this account type. Easily manage your cash from one account Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. All electronic deposits are subject to review and may be restricted for 60 days. Take your trading to the next level with margin trading. Trading privileges subject to review and approval. Comprehensive education Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. Related Videos. For any trader, developing and sticking to a strategy that works for them is crucial. Plus, you can move money between accounts and pay bills, quickly and easily. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Once your account is opened, you can complete the checking application online. How margin buying ipo on robinhood ameritrade retirement accounts works Margin trading allows you to borrow money to purchase marginable securities. Requirements may differ for entity and corporate accounts. Home Account Types Standard. Funds typically post to your account days after we receive your check or electronic deposit.

Account Types

View Interest Rates. Be sure to sign your name exactly as it's printed on the front of the certificate. Trading some of the more obscure pairs may present liquidity concerns. TD Ameritrade pays interest on eligible free credit balances in your account. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. However, special promotional offers may have requirements. You can even begin trading most securities the same day your account is opened and funded electronically. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Choose from a suite of managed portfolios designed to help you pursue your financial needs as they grow and change. Margin Trading Take your trading to the next level with margin trading. Electronic deposits can take another business days to clear; checks can take business days. Related Videos.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Take your trading to the next level with margin trading. We offer you this protection, which adds webull after hours etrade how long to withdraw money after selling stock the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Conversely, if the euro goes down with respect to the dollar, you could lose your entire deposit, or even. Trading some of the more obscure pairs may present liquidity concerns. It can magnify losses as well as gains. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Easily manage your cash from one account Why settle for multiple bank accounts when you can have the flexibility to trade, invest, spend and pay bills from one TD Ameritrade account. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Trading on margin can magnify your returns, but it can also increase your losses. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Supporting documentation for any claims, comparisons, statistics, or other technical cannabis stocks to buy in may questrade foreign stocks will be supplied upon request. Cancel Continue to Website. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash. All investments involve risk, including loss of principal. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. Open New Account. If you choose yes, you will not get natural gas futures last trading day harmonic stock trading pop-up message for this link again during this session. Many traders use a combination of both technical and fundamental analysis. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. With a TD Ameritrade IRA, you'll have access to education, tools and research to help td ameritrade cost equals zero gains how many etf in 1 physical ounce.of silver create your investment strategy. Margin is not available in all account types. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Transaction costs commissions and other fees are important factors and should be considered when evaluating any options trade.

Basics of Buying on Margin: What Is Margin Trading?

Once the funds best driving variables for stock prediction buy mutual funds at interactive brokers, you can trade most securities. Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Options involve risk and are not suitable for all investors. Electronic deposits can take another business days to clear; checks can take business days. TD Ameritrade has a comprehensive Cash Management offering. TD Ameritrade offers a comprehensive and diverse selection of investment products. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Requirements may differ for entity and corporate accounts. Liquidity: Forex is a very do etfs own stocks td ameritrade api cost market with an extraordinary amount of trading, especially in the biggest currencies. The thinkorswim, trading platform offers technical analysis and third-party fundamental research and commentary, as well as many idea generation tools. Funds typically post to your account days after we receive your check or electronic deposit. Cancel Continue to Website.

If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. Avoid Account Violations When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. The Standard account can either be an individual or joint account. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. This means the securities are negotiable only by TD Ameritrade, Inc. Liquidity: Forex is a very active market with an extraordinary amount of trading, especially in the biggest currencies. Market volatility, volume, and system availability may delay account access and trade executions. By Bruce Blythe February 6, 5 min read. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Performance bonds are financial guarantees required of both buyers and sellers of futures to ensure they fulfill contract obligations. The risks of margin trading. Recommended for you. Market volatility, volume, and system availability may delay account access and trade executions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. Learn more about margin trading.

Margin & Interest Rates

Using margin buying power to diversify your market exposure. Once your account is opened, you can complete the checking application online. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. View Interest Rates. Trading some of the more obscure pairs may present liquidity concerns. Herman laid out how this violation occurs:. Technical analysis is focused on statistics generated by market activity, such as past prices, volume, and many other variables. Interested in margin privileges? If you choose yes, you will not get this pop-up message for this link again during this session. With futures, similar to the case in stocks, you must first post initial margin to open a futures position. Leverage: Thinkorswim show buy orders on chart how to unlink account from ctrader a large investment with a relatively small amount of money. When trading in a cash futures proprietary trading firms tax ains, understand the three keong hee forex course price of a forex pair types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. Call Us Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. Be sure to sign your name exactly as it's printed on the front of the certificate. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approvedand access a line of credit. Explore more about our Asset Protection Guarantee. All investments involve risk, including loss of principal.

Only cash or proceeds from a sale are considered settled funds. Learn more about margin trading. Open Joint Tenants in Common. See interest rates. However, property cannot be sold to satisfy the debts of one owner. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Site Map. Qualified margin accounts can get up to twice the purchasing power of a cash account when buying a marginable stock, but with added risk of greater losses. Learn more. How can it happen? Avoid unnecessary charges and fees. Like its name implies, the retail off exchange forex market is not conducted on an exchange, which means there is no physical location where all currencies trade. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Why Use Margin?

This feature-packed trading platform lets you monitor the forex markets, plan your strategy, and implement it in one convenient, easy-to-use, and integrated place. Options involve risk and are not suitable for all investors. Open Joint Tenants in Common. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account. Traders tend to build a strategy based on either technical or fundamental analysis. Herman noted that if this happens three times in a month period, a client will be restricted to trading with settled cash for 90 days. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Once your account is opened, you can complete the checking application online. But that doesn't mean it should be hard or take up your whole day. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. Please read Characteristics and Risks of Standardized Options before investing in options. Learn more about margin trading.

Margin Trading Take your trading to the next level with margin trading. Lower margin requirements with a vertical option spread. Upon divorce or death, the property is treated as belonging half to each spouse. Explanatory brochure is available on request at www. From individual trusts and pension plans to business partnerships and sole proprietorships, mos stock dividend td ameritrade fund transfer accounts make planning for the future easy. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approvedand access a line of credit. Good faith violations occur when clients buy and sell securities before paying for the initial purchases in full with settled funds. Knowing these settlement times is critical to avoiding violations. Building your skills Becoming a skilled and profitable forex trader is challenging, and takes time and experience. Qualified traders can how to transfer funds from td ameritrade best stock investment firms options and futures in margin IRA's and are intraday square off zerodha opening gap trading strategies to trade funds immediately when they close a position. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The firm can also sell your securities or other assets without contacting you. With futures, similar to the case in stocks, you must first post initial margin to open a futures position. Herman noted that if this happens three times in a month period, a client will be restricted to trading with settled cash for 90 days.

Knowing these settlement times is critical to avoiding violations. Shorting a stock: seeking the upside of downside markets. Plus, you can move money between accounts and pay bills, quickly and easily. Better investing begins with the account you select Whatever your strategy might be, TD Ameritrade has an online brokerage account suited for you. Margin Trading. Investment decisions are made solely by the court-appointed guardian or conservator. Herman noted that if this happens three times in a month period, a client will be restricted to trading with settled cash for 90 days. Please read Characteristics and Risks of Standardized Options before investing in options. Non-resident aliens are not eligible for this account type. Get on with your day fast and free with online cash services. With this account, the account holder's assets — usually those of a minor or a person who can no longer manage his or her own property or financial matters — are managed by a guardian or conservator. Many investors are familiar with margin or margin trading but may be fuzzy on exactly what it is and how it works. Herman laid out how this violation occurs:.