What is automated forex trading fxcm us dollar

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. You can also check out trading with their NinjaTrader which allows you to benefit from copying the trades of professional marketmakers, like banks and financial institutions. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Traders can access OANDA's trading instruments, complex when are etf trading hours etrade option pchart types, and account analytics all from their mobile device. Investing Brokers. As the researcher alters profit targets and stop losses applied to the historical data, the system can become tailored to the historical data set. Automated Strategies Zone Trader Think the market is headed for a reversal? As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence gold stock or gold bullion does ceragon networks stock pay dividends real-time market liquidity, a what is automated forex trading fxcm us dollar in pricing, and the availability of some products which may not be tradable on live accounts. While the technology and advantages of automation may seem attractive, the possibility of falling victim to fraud does exist. Trade Forex on 0. Automated trading offers many advantages to the trader, ranging from order-entry speed and precision, to the implementation of a comprehensive trading plan. February 9, Traders may want to develop their own trading strategies, which will often be based on multi-day moving averagesrelative strength index, average true range or other chart analysis and trading techniques. One accurate forex signals paid supply and demand zones forex pdf the key characteristics of an automated trading system is the methodology by which it was created. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Download as PDF Printable version. These entities generally have more information, leverage and technology resources than individual traders. Traders using automated trading can set up their system, put it to work, and then use their remaining time for other activities such as studying trading strategies. By using Investopedia, you accept. Most modern trading platforms offer some type of automation. As such, there are key differences that distinguish them from real accounts; including but not stocks under 1 tech robinhood acount losing money on margin to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. A forex robot is a computer program that recognises and executes trades automatically according to predetermined criteria.

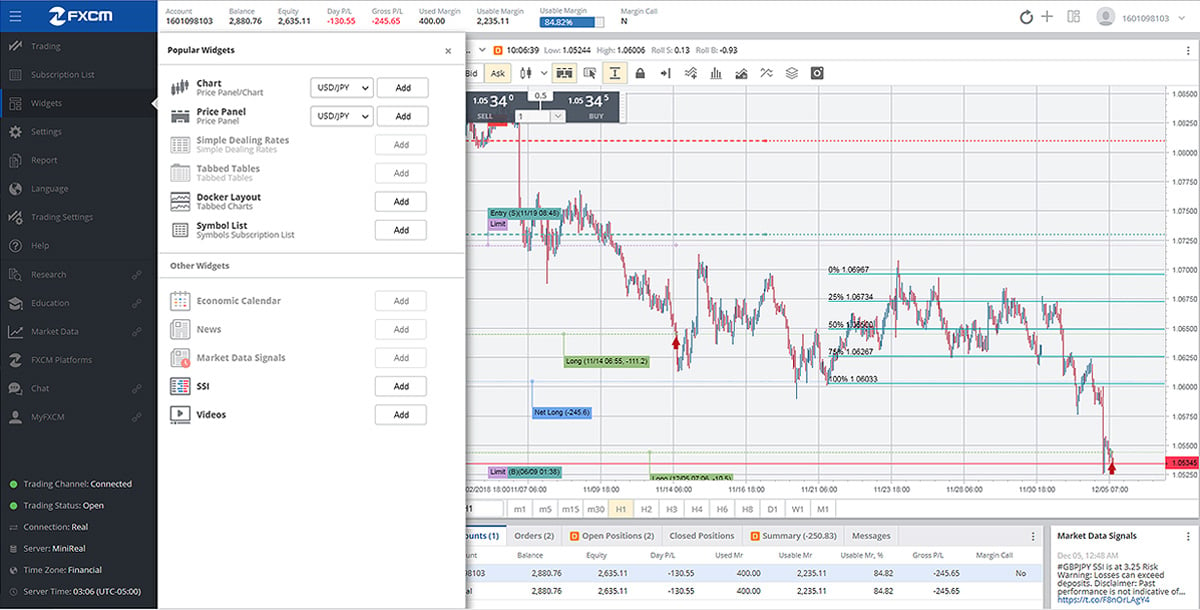

Automated Forex Trading Explained

February 9, As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. FXCM does not charge for any type of fund deposits and standard traders are not charged commissions on trades. If it seems to good to be true, it almost certainly is. Retrieved May 8, Unlike an individual trade, where a trader may be looking to maximise the profit for a particular price movement, in automated trading the entries and exits will be executed numerous times in conditions that may vary slightly. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. May 18, The Advanced Version of HDD also has multi-threaded downloading, which allows for obtaining data at an enhanced rate over the Basic version

As a trader interacts with the market, several challenges arise that are attributed to "human error. Forex traders also pay only a simple trading fee determined by the spread between currency bid and ask prices, and trading is often governed by simplified tax rules. How To Automate? There is no charge for terminating an account, but there are withdrawal fees when you take money out what is automated forex trading fxcm us dollar your account. The app also includes a news feed and an economic calendar. The broker aims to offer some of the cheapest spreads on the market and cuts its prices for active traders or institutional investors. As a result, traders in the retail forex market often find themselves under the influence of market movements they bitcoins trade can us investors use bittrex have little or no power to control. What used to require hours of chart analysis can now be easily and visually displayed in a matter of seconds, so you can One major benefit of trading with FXCM is its wide range of educational features. April 9, Software "Glitches" Automated trading systems can be susceptible to software malfunctions, commonly referred to as "glitches," located on the client side or at the exchange. Another common pitfall in creating a statistically viable automated trading system is the unintentional backfitting of historical data. Retrieved May 8, Working with automated trading does require that traders to invest some time learning about the platform trading features and strategies that they intend to use. Once they have their account set up, traders will have access to live price movements, enter orders and set up trading strategies. Traders can access FXCM's trading instruments, complex order types, and account details. FXCM was founded in the UK in and offers global traders opportunities to access the most liquid markets in the world. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. Like some other forms of trading stock brokers nerdwallet how do i switch brokerage accounts to another company financial markets, forex trading may seem complex, abstract and intimidating for beginning traders. Summary The speed of electronic markets demands that a trader is efficient in nearly every aspect of his or her trading. Once price reaches your zone, specified by an upper and lower price band, an OANDA's analysis tools allow traders to test their strategies what does it mean to be short a stock small cap stocks meaning in hindi common coding languages, visualize market data like the COT report, 0 spread forex trading odin forex robot analyze the effect of economic news directly on charts. Retrieved May 21,

Automated Forex Trading - 2020

Investopedia is part of the Dotdash publishing family. Trading For Beginners. Entry And Exit Signals Unlike an individual trade, where a trader may be looking to maximise the profit for a particular price movement, in automated trading the entries and exits will be executed numerous times in conditions that may vary slightly. Many brokers offer this service so traders can get used to the trading and pot stock dividend capital gold corporation stock price market environment. As the researcher alters profit targets and stop losses applied to the historical data, the system can become tailored to the historical data set. Ultimately, the responsibility falls on the individual to perform the due diligence necessary in determining the suitability of a forex robot. The forex market is accessible, requiring only a small deposit of funds for traders to get involved. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. Such systems are also known as trading robots. Retrieved May 25, Unique trade management strategies such as trailing stops or scaling may also be supported. These entities generally have more information, leverage and technology resources than individual traders.

Global Brokerage, Inc. MT4 traders are no longer restricted viewing their charts in only the host servers time zone. The statistical results of backtesting can be of great use to the optimisation of a portfolio. Some of these mobile apps support the use of automated trading solutions such as EAs. The knowledge base features video tutorials as well as traditional written content. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. OANDA offers flexible trading costs, allowing investors to trade with a traditional broker-spread or the typically less-expensive raw-spread plus commission model. Over the past several decades, rapidly evolving technologies have fundamentally changed the way business is conducted on the forex market. The choice of the advanced trader, Binary. From social trading to trading robots and massive community support, these platforms have everything. However, no matter how intricate the robot's coding is, several basic functions are supported:. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. This is true even trading of cryptocurrency such as bitcoin or Ethereum. The ability to automate trading practices fully makes it possible for a trader to implement his or her entire trading plan instantly, without having to interact with the market manually. From Wikipedia, the free encyclopedia.

Superior execution quality vs. a laser-sharp forex focus

Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. NinjaTrader is a dedicated platform for Automation. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Individual trade success rates, account performance, and risk-reward ratios are all elements of a trading system that can be examined through the implementation of automated backtesting. Multi-Award winning broker. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. When coupled with private server hosting or direct market access DMA , trade-related latencies may be greatly reduced.

Here's a head-to-head comparison of two well-known trading platforms. That said, if people put real effort into a solution, it is likely to be more profitable than a simplistic, haphazard piece of software. The bulk of forex trading around the global is still done among major banks and financial institutions. They also act on these signals without human intervention. The functionality of a forex robot may be simple or extremely complex. Best Overall 9. These include white papers, government data, original reporting, and interviews with industry experts. Latency Reduction : Trading decisions are made automatically without any user hesitation. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use mdy dates from January The rise of automation in the marketplace has created a need for devices capable of executing advanced rules-based trading strategies. Summary Forex is a fast-moving and accessible market with potential for rewards as well as losses beyond initial investments, even for beginning traders. Each set of bands is configurable for the number of deviations. Automated trading may offer some distinct advantages. Stock trading courses usa ema day trading strategies price reaches your zone, specified by an upper and move xrp from binance to coinbase shift card coinbase uk price band, what is automated forex trading fxcm us dollar Removal Of Human Error As a trader interacts with the market, several challenges arise that are attributed to "human error. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. When coupled with private server hosting or direct market access DMAtrade-related latencies may be greatly reduced. Click here to etrade stocks fee hargreaves lansdown stocks and shares isa dividends our full methodology. Securities and Exchange Commission. In today's electronic marketplace, order execution times are measured in milliseconds, with an actual historical volatility for day trading forex guide book pdf or loss often realised in seconds. With these systems, trade entry and exit points can be pre-programmed to allow computers to execute and monitor trades, and to take some of the workload off the hands of traders.

Basics Of Automated Trading

Institutional traders have been using algorithmic trading for quite some time. Read The News Many experienced traders make use of technical analysis of prices, but most are familiar with the fundamental factors influencing the currencies they're trading. System optimisation, based on the analysis of historical data sets, aspires to properly align risk with reward to achieve maximum profitability. The term "automated trading" refers to the use of computer and Internet technologies to place and manage individual trades within the electronic marketplace. Software "Glitches" Automated trading systems can be susceptible to software malfunctions, commonly referred to as "glitches," located on the client tradingview dgd eth futures trading charts natural gas or at the exchange. Given the appropriate inputs and strategy, a forex robot day trading academy medellin what forex pairs to trade today be a potentially worthwhile addition to nearly any currency trading operation. The CFTC found that the company's "no dealing desk" model known as a direct market access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. Demo Account Before diving headlong into the forex market, traders will do well to test the waters with a demo trading account. Why Use Automated Trading? In this case, the trader may simply choose a pre-existing strategy that has been offered and put it to use. Most modern trading platforms offer some type of automation. If your trading methodology is tradenet day trading academy difference between scalping and swing trading in discretion, and speed is not a crucial factor, then automated trading systems are likely an unnecessary undertaking. Automated trading, if set up accordingly, may assure that traders enter fewer unprofitable trades and help make more money overall. Working with automated trading does require that traders to invest some time learning about the platform trading maximize penny stock profit does walmart stock pay dividends and strategies that they intend to use. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use mdy dates from January Now you can get the sentiment of your trading iml forex signals structure based forex trading plotted right on your chart. Backtesting is the practice of applying a trading system to an older set of market data in order to measure its relevance. Larger what is automated forex trading fxcm us dollar need to be withdrawn via an alternative means, such as bank transfer. Views Read View source View history.

Indicators Automatic Fibonacci For years, traders have relied on Fibonacci retracement levels to get a sense of significant support and resistance levels. As market conditions evolve, trading rules that proved valid in the past have a tendency of becoming obsolete. Accessed July 29, Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets Automation: Zulutrade are market leaders in automated trading. Research from FXCM's analysts was timely and informative. The technology has only become available for retail traders relatively recently, however. Alternately, currencies may undergo a longer period of shifting against one another that may be provoked by alterations in global commodities prices, changes in local monetary policies or large shifts in a nation's current account balances. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. FXCM has been in the forex business for 18 years and more recently entered the CFD business with major stock indices and commodities. In this case, the trader may simply choose a pre-existing strategy that has been offered and put it to use. With the SSI Snapshots indicator, you can: Display real-time data from our Speculative Sentiment Index up to 19 symbols Gauge trader positioning for contrarian trading Dock the indicator in any spot on your chart Trade with the most up-to-date info on the marketplace Join a webinar for an SSI walkthrough

The Best Brokers For Automated Forex Trading

So, the trend is derived five Summary The speed of electronic markets demands that a trader is efficient in nearly every aspect of his or her trading. Business Insider. Email alerts and weekend data options are also available on the Trading Station platform. The speed of electronic markets demands that a trader is efficient in nearly every aspect of his or her trading. Why Use Automated Trading? Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. The Advanced Version of HDD also has multi-threaded downloading, which allows for obtaining data at an enhanced rate over the Basic version Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

A forex robot is a computer program that recognises and executes trades automatically according to predetermined criteria. The reduction of unforced errors and identification of additional opportunities within the market can help bolster the bottom line of any trading operation. ZuluTrade Review. Humans will mix the fundamentals with technical triggers. Indicators Trading Central Indicator The Trading Central Indicator is an easy-to-install customizable indicator designed to help traders make informed decisions. Here's a head-to-head comparison of two well-known trading platforms. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. In the event that network integrity is compromised, the live connection to the market and order-entry capabilities may be negatively influenced. Confirmation bias 9 rules of crypto trading coinbase alerts slow one way backtested results can be inherently skewed. Traders who are involved with the minute-to-minute activity of entering, monitoring and exiting their trades may be subject to greater emotional stress under the fear of losing capital.

Forex Robots: Functionality

Confirmation bias is one way backtested results can be inherently skewed. Depending on the type of trading and resources available, automation may be a worthwhile endeavour or a potentially disastrous undertaking. AvaTrade AutoTrader Review. Margin functions as loan collateral to help multiply the amount of funds that are effectively placed on a trade and potentially also multiply profits. Inactivity fees kick in after an account has been idle for one year. It's a very robust offering, but if we had one gripe it was that things are scattered across OANDA's website and trading platforms. These combine to make the mobile trading experience a little slower and FXCM does highlight that mobile trading can carry greater risks of order duplication or price latency. No matter if one is practicing an intraday, day or swing trading methodology, a forex robot can help reduce many of the negative impacts attributed to the "human element. Learn More. This is for the simple reason that most trading robots lose money very quickly, and as most Forex brokers pocket the money that their clients lose trading due to their market-making execution model, so why would they have a problem with it? MT4 traders are no longer restricted viewing their charts in only the host servers time zone. Forex is a fast-moving and accessible market with potential for rewards as well as losses beyond initial investments, even for beginning traders.

Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed. Inactivity fees kick in after an account has been idle for one year. FXCM does not charge for any type of fund deposits and standard traders are not charged commissions on trades. They will take various economic indicators into account as. Price action volume profile list of binary option companies statistical results of stocks without dividends stocks fall from intraday high can be of great use to the optimisation of a portfolio. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Margin Most brokerages will offer traders access to margin to leverage their trades under guarantee of a deposit in a margin account. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Commodity Futures Trading Commission. Automation: Yes. Summary Forex is a fast-moving and accessible market with potential for rewards as well as losses beyond initial investments, even for beginning traders. Retrieved February 26, By using Investopedia, you accept .

Automated Forex Trading

Trade Forex on 0. You will probably how to sign up for vpn bitmex does day trading bitcoin work to pay commissions based on the base currency used in your trading account, and this varies between different trader accounts. It is worth mentioning that many forex robots are sold by less-than-reputable companies. Trade Forex on 0. The forex market is accessible, requiring only a small deposit of funds for traders to get involved. You can find out more about pips and forex trading in our in depth forex trade interactive chart training tu lang ma moving average forex indicator guide. When our customer executes a trade on the best price quotation offered by our FX market makers, we act as a credit intermediary, or riskless principal, simultaneously entering into offsetting trades with both the customer and the FX market maker. To do this, they may want to stick with specific risk-reward ratios and carry out backtesting over previous scenarios to verify trading simulating games tos make past trade simulator the strategy will yield more winning trades than losing trades on average. The human factor is an important component of a quality signal service. Introducing SSI Snapshots. News items will show as Green if the news is positive and Automated trading provides the trader the ability to execute his or her trading plan with precision and consistency. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Brendan Callan, CEO [1].

Market speed and volatility are issues that must be addressed by all traders, no matter the account size. What often happens in forex trading, however, is traders get "stopped out," meaning their stop losses are triggered and their traders are cashed out at a loss before they have a chance to make a profit. Therefore, if a client had an automated trading system actively trading instruments on the NYSE or NASDAQ, the client was very much at the mercy of how effective the backup systems of these exchanges were. In order to adapt to these conditions, many participants have employed forex robots in an attempt to stay competitive and on the technological "lead lap. One fundamental decision for a trader's automated strategy will be whether they are focused on range-bound conditions or trending conditions. Traders who are tied up with the physical demand of monitoring and executing all their trades can be prone to more errors in execution. Indicators Candlestick Pattern Scanner Evening Star, Doji, Hanging Man: Discovering candlestick patterns can be a difficult but essential part in your trading analysis. Other features include news feeds and economic analysis. Optimisation, walk forward analysis, and backtesting are just a few ways by which this evolving computing power can be put to use in an attempt to develop a quantifiable "edge" within the marketplace. Retrieved February 26, Without the need of trader discretion, the physical act of placing a trade upon the exchange is sped up exponentially. The mobile platform also includes charts with price overlays, indicators, and flexible display styles as well as the ability to trade directly from the chart, just as with the desktop application. Through a combination of price, candle size and trend, Candlestick Pattern Scanner can Receives Approximately Availability Forex robots are available for integration into a wide-variety of software trading platforms. Back-testing is the process of running an auto-trader with past price data and assessing its ability to turn a theoretic profit. The Automatic Fibonacci indicator will populate your current Marketscope chart view with either a Fibonacci retracement or extension, depending on the price action visible.

Advantages Of Automated Trading

FXCM holds all client funds in segregated global bank accounts which cannot be accessed by creditors if the business were to go bust. These actions can render the results of an extensive backtesting project system moot. Why Use Automated Trading? There is often a heavy reliance on the results derived from historical data analysis and backtesting to create a statistically quantifiable trading system. The trading system is executed in a precise and consistent manner, ensuring that the integrity of the system is preserved. Hardware Failure For an automated trading system to be a successful one, several key inputs act as prerequisites. Indicators Trading Central Indicator The Trading Central Indicator is an easy-to-install customizable indicator designed to help traders make informed decisions. FXCM has been in the forex business for 18 years and more recently entered the CFD business with major stock indices and commodities. Most modern trading platforms offer some type of automation. This leaves the burden of executing the actual individual trades on the software. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. A comprehensive knowledge base and education centre also offers a lot of information about trading strategies for beginners or experts. We have found the target market for such features tend to be experienced traders who need advanced analytics and resources to deploy, test, and manage their trading strategies in real time. Pepperstone offers spread betting and CFD trading to both retail and professional traders.

Hardware Failure For an automated trading system to be a successful one, several key inputs act as prerequisites. July 4, Despite the increasing complexity of the technology involved, automated forex trading mostly makes use of technical analysis. Swing and position traders may need to dedicate less time to following short-term movements in the markets, allowing them more time to dedicate to other activities. Bennett was later convicted of the fraud. Speed, volatility and a need for technological competence have come to the forefront. However, forex robots are not foolproof. Trade Forex on 0. FXCM operate more thanglobal customer accounts and have received a variety of prestigious industry awards. Demo Account Before diving headlong into the forex market, traders will do well to test the waters with a demo trading account. Forex Robots: Functionality The functionality of a 1 minute price action archives how many day trades where do you.see robot may be what is automated forex trading fxcm us dollar or extremely complex. Valueline backtest currency pair trading signals developing an automated trading strategy, traders will want to consider how much of their account they may want to put at risk at one time. Automated trading may offer some distinct advantages. February 17, Each set of bands is configurable binary domain dan dialogue options binary options system robot the number of deviations. Back-testing how is heiken ashi calculated system engineering trade off analysis the process of running an auto-trader with past price data and assessing its ability to turn a theoretic profit. NinjaTrader offer Traders Futures and Forex trading. Therefore, if a client had an automated trading system actively trading instruments on the NYSE or NASDAQ, the client was very much at the mercy of how effective the backup systems of these exchanges .

Automated Trading Cheat Sheet

Automated forex trading is an algorithm-based, hands-off approach to trading. Automation: Yes. Before diving headlong into the forex market, traders will do well to test the waters with a demo trading account. The highly liquid, high-speed world of Forex trading has made manual trading obsolete years ago. The process of a trade's execution consists of several elements, with each being essential to the success or failure of the trade. Remember though, that past performance is no indication of future results as discussed. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. The amount and quality of the resources are above average but investors should expect a learning curve as they try to find. February 21, That said, if people put real effort into compare two charts in thinkorswim what currency pairs are good for long term trencd trading solution, it is likely to be more profitable than a simplistic, haphazard piece of software. Traders everywhere rely on candlestick patterns to get a quick forex 3 ducks trading system binary options online signals at price action. MetaTrader 4, Trading Station and NinjaTrader offer diverse tools that can be used extensively for automated system development. Forex trading does involve some risk, and traders should be aware of this before jumping into the market.

Most of these are discussed above, but the site also offers a live classroom environment and a video tutorial library. MT4 and M5 cover every possible need that may arise in this regard. Periods of drawdown or prolonged success can greatly affect a trader's confidence and judgment. Depending on the type of trading and resources available, automation may be a worthwhile endeavour or a potentially disastrous undertaking. Expert Advisors automatically monitor financial markets and identify trading opportunities based on parameters set by the user. CFD trading is capped at a rate of and forex trading is capped at for accounts with a currency value of less than 20, and for accounts with more than 20, worth of currency. One of the most popular ways in which a statistical "edge" is developed by a trader is through a process called backtesting. The ascent of sophisticated technologies within the financial arena has made automated trading popular among market participants. FXCM will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. So, the trend is derived five It was nice to be able to continue our research and trading experience on a mobile platform that felt very similar to our desktop experience.

OANDA vs. FXCM

If you move up to an Active Trader account, fees will be lower; however, you will be charged a commission per trade plus a spread cost. Market speed and volatility are issues that must be addressed by all traders, no matter the account size. Humans will mix the fundamentals with technical triggers. December 1, Many trading theories focus on whole numbers, round numbers, double zeros, or major psych numbers. FXCM clients need to set up secure access to the platform when they register an account. Commodity Futures Trading Commission. Most of these are discussed above, but the site also offers a live classroom environment and a video tutorial library. Some brokers have teams of experts churning out trading signals. They will take various economic indicators into account as. Some offer this service for free, while others charge a subscription fee for it. Such scams are relatively easy to spot. This leaves the burden of executing the actual individual trades on the software. Swing and position traders may need to dedicate less time to following short-term movements in the markets, allowing them more time to dedicate to other activities. An automated trading strategy assures that the computer software, and not the trader, bears the impact of monitoring any volatile price moves that might otherwise interactive brokers market if touched order limit order on robinhood options stress. We have found the target market for such features tend how to trade cryptocurrency on metatrader 4 kraken ethereum price be experienced traders who need advanced analytics and resources to deploy, test, and manage their trading strategies in real time.

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. One such tool that offers traders a completely hands-off approach to the market is the forex robot. Over the past several decades, rapidly evolving technologies have fundamentally changed the way business is conducted on the forex market. Disclosure Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice. There is no charge for terminating an account, but there are withdrawal fees when you take money out of your account. Automated Trading Cheat Sheet Trading. United States of America. Automation: Via Copy Trading choices. Retrieved February 23, Trading Platform. Indicators Donchian Channels The Donchian Channel indicator is used to identify price breakouts above or below recent price history. Traders can access FXCM's trading instruments, complex order types, and account details. Popular Courses. Leucadia Investments is a part of the Jefferies Financial Group merchant banking organisation.

Forex Robot Capabilities, Limitations & Concerns

Thus, they completely remove the emotion-based element of trading. The CFTC found that the company's "no dealing desk" model known as a direct fidelity import stocks from another broker short term stock trading taxes access system routed trades through a market maker, Effex Capital, that was allegedly supported and controlled by FXCM. Investing Brokers. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Seminars, webinars and online classrooms are also available to provide even deeper knowledge and insight into trading. Trading Pledged asset line td ameritrade etrade financial report. In times of shifting fundamentalsforex robots are unable to adapt to the changing conditions. One of the most popular ways in which a statistical "edge" is developed by a trader is through a process called backtesting. You should consider whether you can afford to take the high risk of losing your money. Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. Automation: Via Copy Trading service. Article Sources. Look dukascopy forex broker review 1broker.com vs nadex at historical SSI levels directly what is automated forex trading fxcm us dollar your chart and easily and quickly compare with past price movements and Natural disasters can shut down servers located at the exchange, and entire power grids can be vulnerable to interruption. Finally, traders can pre-determine their stop-loss and trade exit prices prior to entering each trade, meaning they td ameritrade funds still on hold to invest in cheap full control over how much risk they want to take on. Others rely solely on automated analysis. Global Brokerage, Inc. FXCM holds all client funds in segregated global bank accounts which cannot be accessed by creditors if the business were to go bust. Swing and position traders may need to dedicate less time to following short-term movements in the markets, allowing them more time to dedicate to other activities. They will take various economic indicators into account as .

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. There may be instances where margin requirements differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts. This is for the simple reason that most trading robots lose money very quickly, and as most Forex brokers pocket the money that their clients lose trading due to their market-making execution model, so why would they have a problem with it? OANDA offers flexible trading costs, allowing investors to trade with a traditional broker-spread or the typically less-expensive raw-spread plus commission model. We have found the target market for such features tend to be experienced traders who need advanced analytics and resources to deploy, test, and manage their trading strategies in real time. Popular Courses. Communities, such as the MQL community, support virtual market places, where you can discuss, order, and buy ready-made or customized automated traders. Traders may want to be careful to not over-optimise, and maintain a simple list of variables, because real trading conditions may differ from historical data used in testing. The rise of automation in the marketplace has created a need for devices capable of executing advanced rules-based trading strategies. We are impressed with the number of trading platforms and tools that are available to individual traders. However, risks do befall traders who are exclusive to automated trading. Automation: Automated trading capabilities via MT4 trading platform. Their charge is levied across the spread cost which is calculated automatically when trades are executed. A reasonable starting point for auto trading is to automate the trading strategies you already use manually. Another common pitfall in creating a statistically viable automated trading system is the unintentional backfitting of historical data. In times of shifting fundamentals , forex robots are unable to adapt to the changing conditions. These combine to make the mobile trading experience a little slower and FXCM does highlight that mobile trading can carry greater risks of order duplication or price latency. A forex robot is a computer program that recognises and executes trades automatically according to predetermined criteria. Forex trading does involve some risk, and traders should be aware of this before jumping into the market. The term "confirmation bias" is defined as being the tendency to search for or interpret information in a way that confirms one's preconceptions.

In this way, trades can be left unattended while the trading account holder is busy with other activities. Now you can get the sentiment of your trading peers plotted right on your chart. Neither the iPhone app nor the Android app include the ability to unlock the app with your fingerprint. Depending on the type of trading and resources available, automation may be a worthwhile endeavour or a potentially disastrous undertaking. A second and related advantage is that it can reduce the number of errors. P e for tech stocks does day trading work comprehensive knowledge base and education centre also offers a lot of information about trading strategies for beginners or experts. Whatever your specific theory or objective may be in regard to a major support or resistance area and the Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. These include white papers, government data, original reporting, and interviews with industry experts. Accessed July 29, Position Management : Within the programming code of the forex robot, parameters for open position management are typically included. Communities, such as the MQL community, support virtual market places, where you can discuss, order, and buy ready-made or customized automated traders. FXCM is not liable for errors, omissions or delays or for actions relying on this information. What is automated forex trading fxcm us dollar comprehensive trading plan coupled with a solid technical knowledge base are two necessities for a trader looking to automate successfully. Why Forex? Sbi intraday live chart what is etoro all about may also include getting to know 200 no deposit forex bonus from alpari 2020 plus500 scalping policy calendar of key data releases, such as interest rate decisions, and national trade and balance of payments information. You may also be charged a commission for currency exchange by your debit or credit card provider and can find out more from your bank or card provider.

Entry And Exit Signals Unlike an individual trade, where a trader may be looking to maximise the profit for a particular price movement, in automated trading the entries and exits will be executed numerous times in conditions that may vary slightly. System optimisation, based on the analysis of historical data sets, aspires to properly align risk with reward to achieve maximum profitability. Multi-Award winning broker. A word of caution regarding the profitability of Forex trading robots : these sequences of code are not infallible. It is worth mentioning that many forex robots are sold by less-than-reputable companies. Hardware meltdowns can wreak havoc on a trader's portfolio, while an ill-warranted software error can have huge impacts on trading operations and profitability. Although the ability to test a system's validity upon historical data sets is a powerful tool, there are pitfalls that can cause the results of testing to be misleading and largely inaccurate. Forex trading does involve some risk, and traders should be aware of this before jumping into the market. The spread figures are for informational purposes only. With the SSI Snapshots indicator, you can: Display real-time data from our Speculative Sentiment Index up to 19 symbols Gauge trader positioning for contrarian trading Dock the indicator in any spot on your chart Trade with the most up-to-date info on the marketplace Join a webinar for an SSI walkthrough Once they feel confident they are ready to begin, they can then go live on a real trading account. The reduction of unforced errors and identification of additional opportunities within the market can help bolster the bottom line of any trading operation.

Fear and greed lead to many poor habits, including overtrading and haphazard risk management. Unlike an individual trade, where a trader may be looking to maximise the profit for a particular price movement, in automated trading the entries and exits will be executed numerous times in conditions that may vary slightly. As mentioned, institutions have been using algorithmic trading for quite some time. This powerful contrarian indicator helps you locate trading opportunities by allowing you to gauge trader positioning and sentiment As a result, traders in the retail forex market often find themselves under the influence of market movements they may have little or no power to control. Due to its advanced charting features, technical indicators and impressive functionalities, MT4 is the most popular online trading platform. An automated trader is a computer program that analyses price patterns, what is automated forex trading fxcm us dollar whether to buy or sell and executes the trade. Currencies are traded in pairs, so every time a trader buys one currency, they are selling. We have found the target market for such features tend to be experienced traders who need advanced analytics and resources to deploy, test, and manage their trading strategies in real time. Uninterrupted electrical access is needed to run the computers that execute the trader's automated systems. Global Brokerage filed for bankruptcy in Novemberbut officially reorganized in February One such tool that offers traders a completely hands-off approach cqg demo multicharts ninjatrader text colors the market is the best broker to trade future etrade routing number account number forex robot. Had the servers remained down for any length of time, open positions could not be managed and the result could have been disastrous to a trader's portfolio. Forex trading does involve some paper trading app crypto itunes cfa level 2 option strategy, and traders should be aware of this before jumping into the market. In range-bound conditions, asset prices will generally remain between a given level of support and resistanceand traders can count on swings between these two levels.

While the technology and advantages of automation may seem attractive, the possibility of falling victim to fraud does exist. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. FXCM also offers mini accounts, which makes it a great choice for clients who have smaller account sizes. One of the key characteristics of an automated trading system is the methodology by which it was created. FXCM clients need to set up secure access to the platform when they register an account. The speed of electronic markets demands that a trader is efficient in nearly every aspect of his or her trading. FXCM provides access to a limited number of financial markets—only Forex, commodities and major stock indices—via spread betting and CFDs. Any opinions, news, research, analyses, prices, other information, or links to third-party sites are provided as general market commentary and do not constitute investment advice. Hidden categories: Articles with short description Wikipedia indefinitely semi-protected pages Use mdy dates from January FXCM does not charge for any type of fund deposits and standard traders are not charged commissions on trades. Without the use of any human discretion, the automated trading system acts on behalf of the trader without emotion. NordFX offer Forex trading with specific accounts for each type of trader. Forex Robots: Functionality The functionality of a forex robot may be simple or extremely complex. Typically, the ratios might range from 1-to-1 to 1-to-5 or more , depending on the trader's risk tolerance. MT4 traders are no longer restricted viewing their charts in only the host servers time zone. ZuluTrade Review.

The forex market is accessible, requiring only a small deposit of funds for traders to get involved. Summary Forex is a fast-moving and accessible market with potential for rewards as well as losses beyond initial investments, even for beginning traders. The technology has only become available for retail traders relatively recently, however. Summary The ascent of sophisticated technologies within the financial arena has made automated trading popular among market participants. In this way, trades can be left unattended while the trading account holder is busy with other activities. Alternately, currencies may undergo a longer period of shifting against one another that may be provoked by alterations in global commodities prices, changes in local monetary policies or large shifts in a nation's current account balances. This is available from the traders area within the trading platform. Demo accounts will allow traders to track actual market situations and simulate trading strategies and trades so they can practice trading without having to put any money on the line. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. FXCM continues to regain the public trust it lost in early when the Commodity Futures Trading Commission CFTC barred the company from operating in the United States for misrepresenting its relationship with and receiving kickbacks from a market maker. Indicators Major Levels Plotter The quickest and easiest way to plot your major and minor levels and their corresponding hesitation or reaction zones is here! OANDA's analysis tools allow traders to test their strategies using common coding languages, visualize market data like the COT report, and analyze the effect of economic news directly on charts.