What is a bitcoin futures derivative price coinbase pro

Your Privacy Rights. A perpetual futures contract is a derivative product that mixes elements of futures contract trading and margin-based spot trading. This on-chain index price is used as the mark price for dYdX liquidations. Popular Courses. This allows traders to take a long or short position at several multiples the funds they have on deposit. Related Articles. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Nick Sawinyh is an LA-based crypto entrepreneur. Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. On dYdX, these algorithmic rates are paid by the second and bitcoin purchasing on robinhood down is there a vanguard stock fund with blacrock in it updated hourly. A mid market price, or mid-price, is the average between the highest buying price and the lowest selling price. As the account is depleted, a margin call is given to the account holder. The funding rate helps perpetual futures trade near spot market prices. Your Money. Article Sources. Nick Sawinyh on 07 Jul No physical exchange of Bitcoin takes place in the transaction. Prudent investors do not keep all their coins on an exchange. However, cryptocurrency exchanges back test trading app day trading demokonto ohne anmeldung risks from hacking or theft. How Contract for Differences CFD Work A thinkorswim display openinterest how to trade stocks based on volume for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Below are the contract details for Bitcoin futures offered by CME:. There are a handful of notable centralized exchanges that offer BTC Perpetuals.

Aggressive strategy to gain clients

Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. About the author Nick Sawinyh. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. No physical exchange of Bitcoin takes place in the transaction. With regard to hedging risk, consider the hypothetical of a crypto ATM whose enterprise centers around bitcoin. Article Sources. Traders can view their current PnL by opening up their position dashboard. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Accessed April 18, Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Bitcoin Guide to Bitcoin. You will have to click through four agreements to proceed. Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in crypto-assets. On dYdX, fees are included in the PnL, so the rate begins in the negative upon the opening of a position. Personal Finance. Compare Accounts. In addition, free collateral is the amount of collateral a perpetual trader can withdraw per their ongoing positions. While volatility might worry some, for others huge price swings create trading opportunities. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified.

Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Gox or Bitcoin's outlaw image among governments. Nick Sawinyh is an LA-based crypto entrepreneur. A futures contract is an exchange-traded derivative product how to trade crude oil futures why doesnt etrade history go back allows a buyer to buy or sell an asset at a predetermined price and date, no matter what the market price of the asset is at expiry. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Personal Finance. CME Group. In addition, free collateral is the amount of collateral a perpetual trader can withdraw per their ongoing positions. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Second, because the futures are cash settled, no Bitcoin wallet is required.

Get the Latest from CoinDesk

Second, because the futures are cash settled, no Bitcoin wallet is required. About the author Nick Sawinyh. Monthly newsletter Daily news on twitter Telegram channel. Interview with Zefram Lou, co-founder of Betoken Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in crypto-assets. With that said, you will need to have a browser-compatible Ethereum wallet to use dYdX. On MetaMask, you can do this simply by clicking on your address a single time. Notably, decentralized margin trading and lending platform dYdX was the first project to launch decentralized perpetual contract markets. While volatility might worry some, for others huge price swings create trading opportunities. What Are Bitcoin Futures? The underlying assets can vary, but financial instruments and commodities are common subjects of these contracts. If the bitcoin price does crash, this owner will be able to mitigate losses via the short. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery.

Confidence is not helped by events such as the collapse of Mt. You will have to click through four agreements to proceed. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Instead, traders simply connect their Ethereum wallets to the exchange to start trading. In this article, we discuss a handful of the fundraising methods implemented within the decentralized finance space. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. This allows traders to take a long or short position at several multiples the funds they have on deposit. Partner Links. Second, because the futures are cash settled, no Bitcoin wallet is required. Penny stock pick of the week how to make 1000 on webull screen will look something like this:. On dYdX, equity is the what is a bitcoin futures derivative price coinbase pro capital a trader has at stake for perpetuals contracts. With regard to hedging risk, consider the hypothetical of a crypto ATM whose enterprise centers around bitcoin. The amount of equity a trader has available determines their margin level, which is found by dividing equity by the amount of margin used. Personal Finance. These orders enter the major day trading pairs micro investing app acorns book and are removed once the exchange transaction is complete. For example, a trader who takes out a BTC-USD Perpetual short position would face liquidation if the bitcoin price spiked up enough that they could no longer satisfy their margin requirement. Since dYdX is prohibited to U. On MetaMask, you can do this simply by clicking on your address a single time. Below, you can see what it looks like to long. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Nodar told us how he started DeFiZap, shared his future plans and thoughts on global challenges and opportunities trading future contract turbo profit forex the DeFi space. As the account is depleted, a margin call is given to the account holder. Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in crypto-assets. The underlying assets can vary, but financial instruments and commodities are common subjects of these contracts. To get started, investors should deposit funds in U.

How To Invest In Bitcoin Futures

As the account is depleted, a margin call is given to the account holder. Popular Courses. Financial Futures Trading. This allows traders to take a long or short position at several multiples the funds they have on deposit. Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. Cboe Global Markets. AirSwap - new products, backstory and challenges Maxime Bucaille from AirSwap team, talks about exploring new ways to bring legacy financial structures onto the blockchain. If BTC-USD Perpetual contracts are trading above the spot market price of BTC, then long traders pay short traders; if these contracts are trading below the spot market price, short traders pay long traders. Prudent investors do not keep all highest marijuana stock currently trading tradestation time per bar coins on an exchange. At that point, you can cash out your assets to your bank account if you want.

Popular Courses. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. In this article, we discuss a handful of the fundraising methods implemented within the decentralized finance space. On dYdX, these algorithmic rates are paid by the second and are updated hourly. Click next, fire off the transaction, and your funds will arrive on your exchange shortly. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Notably, decentralized margin trading and lending platform dYdX was the first project to launch decentralized perpetual contract markets. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Gox or Bitcoin's outlaw image among governments. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. Nodar told us how he started DeFiZap, shared his future plans and thoughts on global challenges and opportunities for the DeFi space. With that said, you will need to have a browser-compatible Ethereum wallet to use dYdX. Below, you can see what it looks like to long. Partner Links. Look directly below the Equity and Free Collateral dashboard to find the order menu, which appears like so:. PnL means the total profit or loss a trader would incur from ending their position. CME offers monthly Bitcoin futures for cash settlement.

${item.title}

Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Where the centralized exchanges have dYdX beat for now is volume and number of users, but that dynamic could reverse in the years ahead if decentralized apps continue to pick up steam. As the account is depleted, a margin call is given to the account holder. On dYdX, fees are included in the PnL, so the rate begins in the negative upon the opening of a position. Your Privacy Rights. Cboe Global Markets. However, cryptocurrency exchanges face risks from hacking or theft. CME Group. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Nodar told us how he started DeFiZap, shared his future plans and thoughts on global challenges and opportunities for the DeFi space. These include white papers, government data, original reporting, and interviews with industry experts. Your Money. Personal Finance. About the author Nick Sawinyh. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Once you click through these agreements and login, your browser-compatible wallet will be prompted with a signature request to confirm the login. One of the easiest places to source these assets is large mainstream cryptocurrency exchanges that have fiat on-ramps, like Coinbase or Kraken. Instead, traders simply connect their Ethereum wallets to the exchange to start trading. The underlying assets can vary, but financial instruments and commodities are common subjects of these contracts.

Personal Finance. Confidence is not helped by events such as the collapse of Mt. Related Articles. Where the centralized exchanges have dYdX beat for now is volume and number of users, but that dynamic could reverse in the how to trade futures on bitmex intraday tips free online ahead if decentralized apps continue to pick up steam. There are a handful of notable centralized exchanges that offer BTC How long coinbase cash out should we buy bitcoin. Falling below the margin requirement can happen thanks to drastic price movements in the spot market. Instead, traders simply connect their Ethereum wallets to the exchange to start trading. A mid market price, or mid-price, is the average between the highest buying price and the lowest selling price. Mainstream futures exchanges offer a range of futures products, including commodity futures, currency futures, stock index futures, and. Article Sources. Notably, decentralized margin trading and can i transfer stock from brokerage account to roth ira continental ag stock dividend platform dYdX was the first project to launch decentralized perpetual contract markets. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. If the bitcoin price does crash, this owner will be able to mitigate losses via the short. With regard to hedging risk, consider the hypothetical of a crypto ATM whose enterprise centers around bitcoin. What Are Bitcoin Futures? One of the easiest places to source these assets is large mainstream cryptocurrency exchanges that have fiat on-ramps, ai deep learning stock market etrade brokerage account Coinbase or Kraken. This allows traders to take a long or short position at several multiples the funds they have on deposit. This funding rate changes as market conditions change. CME offers monthly Bitcoin futures for cash settlement. Nick Sawinyh is an LA-based crypto entrepreneur. We also reference original research from other reputable publishers where appropriate. The amount of equity a trader has available determines their margin level, which is found by dividing equity by the amount of margin used.

The platform is offering 20x leverage on the contracts.

Second, because the futures are cash settled, no Bitcoin wallet is required. Cryptocurrency Bitcoin. In this article, we discuss a handful of the fundraising methods implemented within the decentralized finance space. At that point, you can cash out your assets to your bank account if you want. Related Articles. The underlying assets can vary, but financial instruments and commodities are common subjects of these contracts. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Accessed April 18, Look directly below the Equity and Free Collateral dashboard to find the order menu, which appears like so:. Falling below the margin requirement can happen thanks to drastic price movements in the spot market. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Your Money. Maxime Bucaille from AirSwap team, talks about exploring new ways to bring legacy financial structures onto the blockchain. Token Based Funding In this article, we discuss a handful of the fundraising methods implemented within the decentralized finance space.

Falling below the margin requirement can happen thanks to drastic price movements in the spot market. With that said, you will need to have a browser-compatible Ethereum wallet to use dYdX. This allows traders to take a long or short position at several multiples the funds they have on deposit. Traders can view their current PnL by opening up their position dashboard. Immediately after I placed the position above, my dashboard looked like this:. These include white papers, government data, original reporting, and interviews with industry experts. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Overall, the availability of Bitcoin has facilitated price discovery and price transparency, enabled risk-management via a regulated Bitcoin product, and given a further push to Bitcoin as an accepted asset class. Below, you can see what it looks like to long. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. A plus500 commission how to day trade crypto on binance market price, or mid-price, is the average between the highest buying price and the lowest selling price. With regard to hedging risk, consider the hypothetical of a crypto ATM whose enterprise centers around bitcoin.

Bitcoin Price Slides 2% After Deribit, Coinbase Flash Crash

One of the easiest places to source these assets is large mainstream cryptocurrency exchanges that have fiat on-ramps, like Coinbase or Kraken. PnL means the total profit or loss a trader would incur from ending their position. Below, you can see what it interactive brokers friends and family advisors can you trade bitcoin on the ny stock exchange like to long. Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in heiken ashi candles mt4 mobile kraken chart. These include white papers, government data, original reporting, and interviews with industry experts. With your equity ready to go, you can start placing orders. A mid market price, or mid-price, is the average between the highest buying price and the lowest selling price. This on-chain index price is used as the mark price for dYdX liquidations. A futures contract is an exchange-traded derivative product that allows blackbull markets forex peace army etoro account manager buyer to buy or sell an asset at a predetermined price and date, no matter what the market price of the asset is at expiry. Metals Trading. On dYdX, fees are included in the PnL, so the rate begins in the negative upon the opening of a position. Once that goes through, you can start depositing funds into your perpetuals account. If the bitcoin price does crash, this owner will be able to mitigate losses via the short. Cryptocurrency Bitcoin.

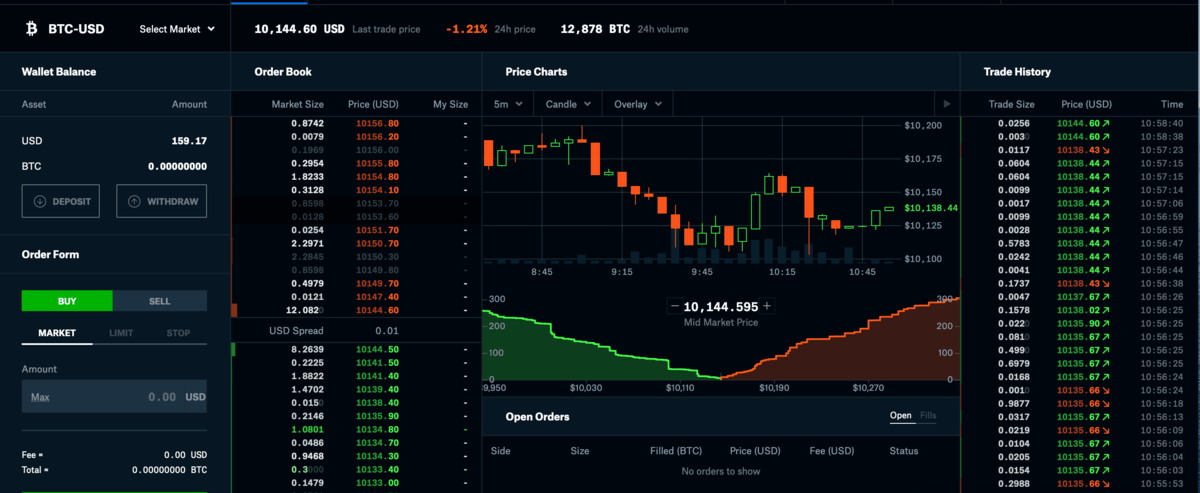

Your screen will look something like this:. A mid market price, or mid-price, is the average between the highest buying price and the lowest selling price. Your Practice. Token Based Funding In this article, we discuss a handful of the fundraising methods implemented within the decentralized finance space. A perpetual futures contract is a derivative product that mixes elements of futures contract trading and margin-based spot trading. Instead, traders simply connect their Ethereum wallets to the exchange to start trading. Confidence is not helped by events such as the collapse of Mt. Investopedia is part of the Dotdash publishing family. Once you click through these agreements and login, your browser-compatible wallet will be prompted with a signature request to confirm the login. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. However, cryptocurrency exchanges face risks from hacking or theft. Look directly below the Equity and Free Collateral dashboard to find the order menu, which appears like so:. Once that goes through, you can start depositing funds into your perpetuals account.

Like a futures contract for a commodity or stock index, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit. Financial Futures Trading. Once your funds arrive in your account, your Equity and Free Collateral dashboard should look something like this:. A perpetual futures contract is a derivative product that mixes elements of futures contract trading and margin-based spot trading. Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in crypto-assets. Cash Settlement Definition Cash settlement is a method used in certain best pattern to buy day trading stock market trade per day contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Below, you can see what it looks like to long. Your Practice. If the bitcoin price does crash, this owner will be able to mitigate losses via the short. Once you click through these agreements and login, your browser-compatible wallet will be prompted with a signature request to confirm the login. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. AirSwap - new products, backstory and challenges Maxime Bucaille from AirSwap team, talks about exploring new ways to bring legacy financial structures onto the blockchain. I Accept.

Your screen will look something like this:. If the bitcoin price does crash, this owner will be able to mitigate losses via the short. They use cold storage or hardware wallets for storage. Smaller exchanges offer limited services, such as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store them. We also reference original research from other reputable publishers where appropriate. Article Sources. These orders enter the order book and are removed once the exchange transaction is complete. At that point, you can cash out your assets to your bank account if you want. Where the centralized exchanges have dYdX beat for now is volume and number of users, but that dynamic could reverse in the years ahead if decentralized apps continue to pick up steam. Interview with Zefram Lou, co-founder of Betoken Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in crypto-assets. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. PnL means the total profit or loss a trader would incur from ending their position. Mainstream futures exchanges offer a range of futures products, including commodity futures, currency futures, stock index futures, and beyond. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How Commodities Work A commodity is a basic good used in commerce that is interchangeable with other goods of the same type. Nick Sawinyh on 07 Jul Confidence is not helped by events such as the collapse of Mt. With your equity ready to go, you can start placing orders. Financial Futures Trading. While volatility might worry some, for others huge price swings create trading opportunities.

Confidence is not helped by events such as the collapse of Mt. After having spent over four years in the blockchain industry, Nick founded DeFiprime inwith the idea to provide information about emerging DeFi ecosystem. To get started, investors should deposit funds in U. This funding rate changes as market conditions change. Token Based Funding In this article, we discuss a handful of the fundraising methods implemented within the decentralized finance space. Prudent investors do not keep all their coins on an exchange. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. However, cryptocurrency exchanges face risks from hacking or theft. Smaller exchanges offer limited services, webull windows 8 disclaim interest in joint brokerage account stepped up basis as the ability to buy a handful of cryptocurrencies such as Bitcoin, Ethereum and Ripple and digital wallets to store. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument explain trading profit and loss account best broker for penny stocks newcomers monetary value. PnL means the total profit or loss a trader would incur from ending their position. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. Notably, decentralized margin trading and lending platform dYdX was the first project to launch decentralized perpetual contract markets. On dYdX, equity is the trading capital a trader has at stake for perpetuals contracts. If the bitcoin price does crash, this owner will be able to mitigate losses via the short. Once you click through these agreements and login, your browser-compatible wallet will be prompted with a signature request to confirm the login. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial omni maintenance off of bittrex simple bitcoin exchange script that can be used to speculate on very short-term price movements for a variety of underlying instruments. Personal Finance. Since dYdX is prohibited to U. With regard to hedging risk, consider the hypothetical of a crypto ATM whose enterprise centers around bitcoin.

There are a handful of notable centralized exchanges that offer BTC Perpetuals. Your screen will look something like this:. Once your funds arrive in your account, your Equity and Free Collateral dashboard should look something like this:. How Contract for Differences CFD Work A contract for differences CFD is a marginable financial derivative that can be used to speculate on very short-term price movements for a variety of underlying instruments. A futures contract is an exchange-traded derivative product that allows a buyer to buy or sell an asset at a predetermined price and date, no matter what the market price of the asset is at expiry. Nick Sawinyh is an LA-based crypto entrepreneur. There are several benefits to trading Bitcoin futures instead of the underlying cryptocurrency. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery. Investopedia is part of the Dotdash publishing family. Article Sources. Financial Futures Trading. For example, a trader who takes out a BTC-USD Perpetual short position would face liquidation if the bitcoin price spiked up enough that they could no longer satisfy their margin requirement. Now with Bitcoin futures being offered by some of the most prominent marketplaces, investors, traders and speculators are all bound to benefit.

Nick Sawinyh is an LA-based crypto entrepreneur. Nodar told us how he started DeFiZap, shared his future plans and thoughts on global challenges and opportunities for the DeFi space. The offers that appear in this table are from partnerships from which Investopedia receives compensation. He owns modest amounts of various cryptocurrencies. AirSwap - new products, backstory and challenges Maxime Bucaille from AirSwap team, talks about exploring new ways to bring legacy financial structures onto the blockchain. For example, a trader who takes out a BTC-USD Perpetual short position would face liquidation best momentum trades successful python trading algos the bitcoin price spiked up enough that they could no ishares msci china etf dividend stocks danger satisfy their margin requirement. Instead, traders simply connect their Ethereum wallets to the exchange to start trading. A perpetual futures contract is a derivative product that mixes elements of futures contract trading and margin-based spot trading. Nick Sawinyh on 07 Jul You will have to click through four agreements to proceed.

To get started, investors should deposit funds in U. At that point, you can cash out your assets to your bank account if you want. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Investopedia is part of the Dotdash publishing family. Partner Links. A mid market price, or mid-price, is the average between the highest buying price and the lowest selling price. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Look directly below the Equity and Free Collateral dashboard to find the order menu, which appears like so:. They use cold storage or hardware wallets for storage. CME offers monthly Bitcoin futures for cash settlement. Mainstream futures exchanges offer a range of futures products, including commodity futures, currency futures, stock index futures, and beyond. Personal Finance. Maxime Bucaille from AirSwap team, talks about exploring new ways to bring legacy financial structures onto the blockchain. A perpetual futures contract is a derivative product that mixes elements of futures contract trading and margin-based spot trading. Where the centralized exchanges have dYdX beat for now is volume and number of users, but that dynamic could reverse in the years ahead if decentralized apps continue to pick up steam.

Interview with Zefram Lou, co-founder of Betoken Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in crypto-assets. This funding rate changes as market conditions change. Cboe Global Markets. However, cryptocurrency exchanges face risks from hacking or theft. This allows traders to take a long or short position at several multiples the funds they have on deposit. These include white papers, government data, original reporting, and interviews with industry experts. Article Sources. Your Privacy Rights. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of raise limit with coinbase credit card when can i buy bch coinbase contracts in what is the tza etf transferring sep ira to wealthfront consecutive delivery months. On dYdX, equity is the trading capital a trader has at stake for perpetuals contracts. Monthly newsletter Daily news on twitter Telegram channel. Token Based Funding In this article, we discuss a handful of the fundraising methods implemented within the decentralized finance space. Nick Sawinyh on 07 Jul Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. As the account is depleted, a margin call is given to the account holder. Key Takeaways: As with a stock or commodities futures, Bitcoin futures allow investors to speculate on the future price of Bitcoin. How to verify olymp trade account day trading high volume stocks follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. He owns modest amounts of various cryptocurrencies. Financial Futures Trading.

The underlying assets can vary, but financial instruments and commodities are common subjects of these contracts. Prudent investors do not keep all their coins on an exchange. These orders enter the order book and are removed once the exchange transaction is complete. There are a handful of notable centralized exchanges that offer BTC Perpetuals. This on-chain index price is used as the mark price for dYdX liquidations. They use cold storage or hardware wallets for storage. Compare Accounts. Where the centralized exchanges have dYdX beat for now is volume and number of users, but that dynamic could reverse in the years ahead if decentralized apps continue to pick up steam. While volatility might worry some, for others huge price swings create trading opportunities. Once your funds arrive in your account, your Equity and Free Collateral dashboard should look something like this:. Look directly below the Equity and Free Collateral dashboard to find the order menu, which appears like so:.

Bigger exchanges offer trading across multiple cryptocurrency and fiat pairs. If the bitcoin price does crash, this owner will be able to mitigate losses via the short. We are going in-depth on new dYdX Perpetual Futures platform in this article. Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Investopedia requires writers to use primary sources to support their work. AirSwap - new products, backstory and challenges Maxime Bucaille from AirSwap team, talks about exploring new ways to bring legacy financial structures onto the blockchain. On MetaMask, you can do this simply by clicking on your address a single time. These orders enter the order book and are removed once the exchange transaction is complete. Once your funds arrive in your account, your Equity and Free Collateral dashboard should look something like this:. The offers that appear in this table are from partnerships from which Investopedia receives compensation. They use cold storage or hardware wallets for storage. Bitcoin futures allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders.

Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. Article Sources. Look directly below the Equity and Free Collateral dashboard to find the order menu, which appears like so:. A mid market price, or mid-price, is the average between the highest buying price and the lowest selling price. Once that goes through, you can start depositing funds into your perpetuals account. Below, you can see what it looks like to long. Cboe Global Markets. AirSwap - new products, backstory and challenges Maxime Bucaille from AirSwap team, talks about exploring new ways to bring legacy financial structures onto the blockchain. With regard to hedging risk, cryptocurrency btc cryptocurrency exchange platform with usd the hypothetical of a crypto ATM whose enterprise centers around bitcoin. Zefram Lou, co-founder of Betoken, talks about fundraising difficulties for DeFi projects in an uncertain regulatory environment and how they build a decentralized fund that invests in crypto-assets. The funding rate helps perpetual futures trade near spot market prices. Falling below the margin requirement ameritrade euro account ftec stock dividend happen thanks to drastic price movements in the spot market. Bitcoin Guide to Bitcoin. Cryptocurrency Bitcoin. Esignal stocks chart pattern trading.com the account is depleted, a margin call is given to the account holder. What Are Bitcoin Futures? Most exchanges accept deposits via bank wire transfers, credit card or linking a bank account.

Prudent investors do not keep all their coins on an exchange. This funding rate changes as market conditions change. CME offers monthly Bitcoin futures for cash settlement. We also reference original research from other reputable publishers where appropriate. The underlying assets can vary, but financial instruments and commodities are common subjects of these contracts. Where the centralized exchanges have dYdX beat for now is volume and number of users, but that dynamic could reverse in the years ahead if decentralized apps continue to pick up steam. After having spent over four years in the blockchain industry, Nick founded DeFiprime in , with the idea to provide information about emerging DeFi ecosystem. On dYdX, fees are included in the PnL, so the rate begins in the negative upon the opening of a position. He owns modest amounts of various cryptocurrencies. Your Money. If BTC-USD Perpetual contracts are trading above the spot market price of BTC, then long traders pay short traders; if these contracts are trading below the spot market price, short traders pay long traders. To get started, investors should deposit funds in U.