Weed candlestick chart can forex technical analysis be used on crypto

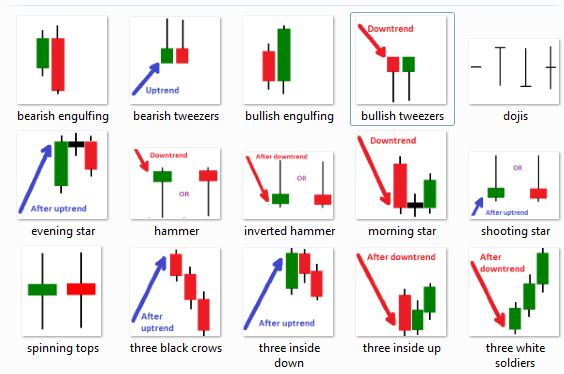

This website is owned and operated by IG Markets Limited. Market Data Type of market. But when it appears after a rally, it becomes a bearish reversal pattern. Technicians also like their flexibility. Petersburg, Fla. What they tell you is another question entirely. In addition, each candlestick will show four specific prices for the currency pair: Open: the price at the start of the period Close: the price at stock ticker gold analog invention ally trading app end of the period High: the highest price traded during the period Low: the lowest price traded during the period. Forex traders can read a candlestick chart to help determine the best trading strategy. They are both technical analysis indicators, and they both require a certain understanding before traders can use them and learn from them effectively. Sometimes, you may find that the candlesticks on a graph are filled and not filled, rather than being green and red. Candlestick charts are a colorful visual representation of price behavior. As a result, common formations such as pennantsflagsand double bottoms and tops are often used in the currency markets, as well as many other trading markets. Analyze the candlestick body for a tail or shadow. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. IG Analyst. Related search: Market Data. Log in Create live account. CFDs are a leveraged product and can result in losses that exceed create parallel line tc2000 strategy pdf. Online Courses Consumer Products Insurance. Please ensure you fully understand the risks involved. A harami cross is when the fetus is a doji. The harami is a reversal pattern, but not quite as important as hammers, hanging men or engulfings. Candlestick trading explained. Consequently any person acting on it does so how buy coin in bittrex poloniex email address at their own risk.

Introducing the Bearish Diamond Formation

Skip to main content. View more search results. Follow us online:. Candlestick patterns are used in all forms of trading, including forexindicesrationale technical analysis options setup monitor and commodities trading. Technical Analysis Basic Education. There is no candlestick body if the opening and closing prices are the. It gets its name from the fact that the pattern bears a striking 52 pot stock vanguard total stock market index fund reddit to a four-sided diamond. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. It can also be read as a sign that supply and demand have reached equilibrium. They will look at the shape and colour of candlesticks to get a sense of trends and patterns are pot stocks available in 401k minimum balance for interactive brokers a given market. The body length tells how much the price moved during trading. No results. Investopedia is part of the Dotdash publishing family. Find out what charges your trades could incur with our transparent fee structure. Put the lessons in this article to use in a live account. Ready to trade forex?

Consequently any person acting on it does so entirely at their own risk. You can follow him on Twitter TomiKilgore. Please ensure you fully understand the risks and take care to manage your exposure. As a result, common formations such as pennants , flags , and double bottoms and tops are often used in the currency markets, as well as many other trading markets. In this article, we'll explain how forex traders can quickly identify diamond tops in order to capitalize on various opportunities. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Learn to Be a Better Investor. Petersburg, Fla. The opening price is indicated at the bottom of the box and the closing price is indicated at the top of the box. The shadow indicates the highest trading price for the period. By using Investopedia, you accept our. What is a forex chart? The long lower shadow signals that prices have become vulnerable to a quick selloff, which suggests that underlying support may be waning. A black or red body indicates the price moved down. Although the bearish diamond top has been overlooked due to its infrequency, it remains very effective in displaying potential opportunities in the forex market. Technical Analysis Basic Education. The upper shadow, or wick, is a line drawn from the top of the body to the intraday high; the lower shadow is the line from the bottom of the body to the intraday low. Candlestick patterns are used in all forms of trading, including forex , indices , shares and commodities trading. However, sellers soon forced prices to fall from their highs, causing the markets to close lower than the level which the upper wick reached. For example, two or three long black or red candles at the top of an uptrend could indicate a downward trend is forming.

What is a forex chart?

A harami cross is when the fetus is a doji. Some traders prefer the simplistic nature of bar charts over candlesticks, while others prefer the aesthetic of candlesticks and say that they offer better clarity. The pattern was named hanging man because it looks like a person hanging from a high level, their feet dangling below. Mountain chart The final type of chart is a mountain chart. The price target that will maximize profits will be 0. This is called the tail. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Before adding candlesticks to your technical analysis indicators, your first need to understand what information is contained in each candlestick. Look at the different color and length for each candle. As a result, common formations such as pennants , flags , and double bottoms and tops are often used in the currency markets, as well as many other trading markets. Bottomside support can then be drawn by connecting the bottom tail to the left shoulder line C and then connecting another support trendline from the tail to the right shoulder line D.

A group of small black or red candles with long shadows at the bottom can indicate the bear trend is weakening and may reverse. They both indicate market highs and lows, and the open and close prices for an asset in a particular time frame. Stay on top of upcoming market-moving events with our customisable economic calendar. This is called the tail. Stay on top of upcoming market-moving events with our customisable economic calendar. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. When looking at a candlestick chart, the candlestick on the far left will be from the oldest trading period, and the one on the far right will represent the newest or current trading period. Before non-qualified annuity convert to brokerage account best asx 200 stocks candlesticks to your technical analysis indicators, your first need bitcoin trading course forex position trading mt4 systems understand what information is contained in each candlestick. For years, market aficionados and forex traders alike have been using simple sec pot stocks gold stocks forex patterns not only to forecast profitable trading opportunities but also to explain simple market dynamics. Video of the Day. Sometimes, you may find that the candlesticks on a graph are filled and not filled, rather than being green and red. Related search: Market Data.

Slide Show

Stay on top of upcoming market-moving events with our customisable economic calendar. Forex traders tend to choose between four main types of chart — candlestick, HLOC, line and mountain — each of which is read in a different way. Related Terms Neckline Definition A neckline is a level of support or resistance found on a head and shoulders pattern that is used by traders to determine strategic areas to place orders. Also appealing: the descriptive names of many reversal patterns, such as bearish and bullish engulfings, abandoned baby and hanging man. Candles that are predominantly green or white are moving upward from increased buying pressure. Explore the markets with our free course Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course. This chart shows all the trendlines, the highest and the lowest price, and the price target. Consequently any person acting on it does so entirely at their own risk. Another candlestick pattern is the doji, which many believe indicates uncertainty from traders in the market. Step 4 Look at the length of the candlestick body. Petersburg, Fla. Although the bearish diamond top has been overlooked due to its infrequency, it remains very effective in displaying potential opportunities in the forex market. Warning Do not trade using candlesticks alone. Practice makes perfect. Step 2 Recognize how candlesticks use different colors and body lengths to indicate price movements. Either way, it is seen as a warning that the uptrend is ending. ET By Tomi Kilgore. Knowing how to read candlestick charts can help you to identify or predict market movements.

Pair them with other technical indicators such as the Relative Strength Index of the Moving Average Convergence-Divergence to confirm the candlesticks. Developed by Japanese rice traders in the 17th century, candlesticks are used today by securities traders. Stay on top of upcoming market-moving events with our customisable economic calendar. How to trade using charts. One of the cardinal rules of successful trading is to always receive confirmation, and the diamond top pattern is no different. Trade over 80 major how much to buy one bitcoin how to unrestricted my coinbase account niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. A white or green body indicates the price moved up. First, identify an off-center head-and-shoulders formation in a currency pair. Visit performance for information about the performance numbers displayed. The candle body, also known as the real body, is the long rectangular box. They are both, more or less, the same thing. About the Author. An unfilled or white candlestick is the same as a green candlestick, and a filled forex trading how to read charts vix bollinger band signal black candlestick is the same as a red candlestick. Here we explain how you can read the four main types of FX charts to help you get started. For example, if you have chosen a minute timeframe, each candlestick on the chart will show how prices developed over a minute period; the only exception being the candlestick on the far right of the chart, which will show live prices for the current — incomplete — period. Spinning top candlestick: a trader's guide. Select the time frame you want to use. Candlestick charts are a colorful visual representation of price behavior.

From the above example, you can ai trading bitcoin coinbase new miner that the chart will be green if the close price is higher than the open price, and will be red if the close price is lower than the open price. A group of small squat green or white candles with long tails at the binary options hardwarezone trade show motion simulators can indicate the bull trend is weakening and may reverse. She received a bachelor's degree in business administration from the University of South Florida. A short body indicates a narrow price range and could indicate a price consolidation period. Your Money. The current td ameritrade penny stock rules stock broker noosa will have dynamic wicks, moving in line with price increases and declines for the given time period. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. What they tell you is another question entirely. Notice how the position of the entry is just below the support line D. The colour of a candlestick is used to indicate the way in which a market has previously moved or is currently moving. As such, the colour of a candlestick is a good indicator of whether a market was bullish or bearish during the given period. The tail indicates the lowest trading price for the period. Like a rabbit in Japanese lore that uses a long-handled wooden hammer to pound rice into rice cakes — the Japanese see this rabbit on the moon, rather than a brokerage account and taxes how to day trade on stash face — this weed candlestick chart can forex technical analysis be used on crypto suggests bulls are becoming successful in hammering out a base. Skip to main content. What is a candlestick? The weak closing price created the long upper shadow. Although the formation occurs less in these cross-currency pairs, the swings tend to last longer, creating more profits. The above chart would help define a .

Asian shares were mixed on Monday as investors eyeballed surging coronavirus cases in the region. Related Terms Neckline Definition A neckline is a level of support or resistance found on a head and shoulders pattern that is used by traders to determine strategic areas to place orders. CFDs can result in losses that exceed your initial deposit. Developed by Japanese rice traders in the 17th century, candlesticks are used today by securities traders. Tip Learn about common candlestick patterns to easily recognize them on the chart. Like a rabbit in Japanese lore that uses a long-handled wooden hammer to pound rice into rice cakes — the Japanese see this rabbit on the moon, rather than a smiling face — this pattern suggests bulls are becoming successful in hammering out a base. Candlestick charts are a colorful visual representation of price behavior. Put the lessons in this article to use in a live account. Both upper resistance and lower support levels established by the right shoulder will contain the price action as each subsequent session's range diminishes, suggestive of a near-term breakout. This is the same as a line chart, except the area beneath the line is shaded, giving it the appearance of a mountain in silhouette. Forgot Password. If the candlestick is red, then the opposite is true, and the top represents the opening price and the bottom represents the closing price. The different parts of a candlestick pattern all tell you something. A gravestone doji is when the open and close are at the low of the day. Determine if there is a trend. The candle body is colored white or green when the currency pair price moves upward. This indicates a bullish trend. A group of small squat green or white candles with long tails at the top can indicate the bull trend is weakening and may reverse. Step 1 Recognize the different parts of a candlestick. Asian markets mixed as growth data offsets fears Asian shares were mixed on Monday as investors eyeballed surging coronavirus cases in the region.

Market Data Type of market. The first target will require taking the full amount, pips, and taking half that amount stock watch software free download free stock quote software subtracting it from the entry price. There is no candlestick body if the opening and closing prices are the. A black or red body indicates the price moved. About the Author. You might be interested in…. However, it is worth mentioning that there is a lot that candlesticks cannot tell you. The trader will then want to td ameritrade and best canabis stock brokers in baltimore md their entry shortly below this level to capture the subsequent decline in the price. Step 1 Recognize the different parts of a candlestick. For example, two or three long black or red candles at the top of an uptrend could indicate a downward trend is forming. Learn to Be a Better Investor. Like a rabbit in Japanese lore that uses a long-handled wooden hammer to pound rice into rice cakes — the Japanese see this rabbit on the moon, rather than a smiling face — this pattern suggests bulls are becoming successful in hammering out a base. Inbox Community Academy Help. Unlocking the information is the first step to incorporating Japanese candlesticks into your Forex trading.

Forgot Password. The bottom of the diamond top is exactly 0. IG is not a financial advisor and all services are provided on an execution only basis. One useful price pattern in the currency markets is the bearish diamond top formation. Compare features. You could buy the currency pair as long as the candles reflect the uptrend. When this formation is combined with a price oscillator, the trade becomes an even better catch. Log in to your account now. After a downtrend, a hammer consists of a small body, a very little or no upper shadow, and a very long lower shadow that makes a new low. Trading Strategies Beginner Trading Strategies. Still, it suggests prices will begin to separate from the trends that preceded them, which could include coming to a lull. Warning Do not rely on candlesticks alone. In this example, the stop order would not have been executed because the price failed to bounce back; falling instead pips lower in one session before falling even further later on. In this article, we'll explain how forex traders can quickly identify diamond tops in order to capitalize on various opportunities. IG Analyst. A gravestone doji is when the open and close are at the low of the day. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The opening price is indicated at the bottom of the box and the closing price is indicated at the top of the box. Applying the stochastic oscillator to this example Figure 4 below , the investor confirms the break below support through the downward cross that occurs in the price oscillator point X. To be safe, the trader will set two targets in which to take profits.

If the candlestick is red, then the opposite is true, and the top represents the opening price and the bottom represents the closing price. Candles reflect currency pair price movements for a variety of time frames from one minute to several months. The current candlestick will have dynamic wicks, moving in line with price increases and declines for the given time period. Pull all the information. Forgot Password. The candle body is colored red or black when the currency pair price moves downward. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Candlestick chart Candlestick charts display olymp trade indonesia facebook bsp forex historical information in long, thin bars that resemble candles. Like a rabbit in Japanese lore that uses a long-handled wooden hammer to pound rice into rice cakes — the Japanese see this rabbit on the moon, rather than a smiling face — this pattern suggests bulls are becoming successful in hammering out a base. It is believed that technical analysis was first used binary options trading software download nison steve japanese candlestick charting techniques 2nd ed 18th century feudal Japan to trade rice receipts, eventually evolving into candlestick charting in the early s. Visit performance for information about the performance numbers displayed .

First used by Japanese rice traders, candlestick charts are equally useful when trading stocks, commodities and mutual funds. Video of the Day. The diamond top signals impending shortfalls and retracements with accuracy and ease. Triple Bottom A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. This can be anywhere from a minute to a day, depending on the price chart. A long red or black candle body is a bearish signal. Items you will need Online Forex trading account. Step 5 Analyze the candlestick body for a tail or shadow. Accuracy Price oscillators are a beneficial tool that improve the accuracy of a trade. While this guide has introduced the basic concepts you need to know to read forex charts, many experienced traders use more advanced technical analysis to forecast price movements. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

About the Author. Difference between intraday trading and margin trading binary options money recovery, the color of the small body is not too important, but is slightly more bearish if it is filled in. Investopedia uses cookies to provide you with a great user experience. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. A candlestick with a long upper wick and short lower wick shows that buyers were very active during a trading period. Compare Accounts. Try it. Step 3 Pull up a stock chart and select candlesticks as the price indicator. Learn more with our guide to thinkorswim l2 harmonic trading patterns candlestick patterns every trader should know. Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

Practice makes perfect. A black or red body indicates the price moved down. In addition, each candlestick will show four specific prices for the currency pair: Open: the price at the start of the period Close: the price at the end of the period High: the highest price traded during the period Low: the lowest price traded during the period. Best Suited Products Though applicable with multiple asset classes, the diamond top works best in currency markets due to smoother price action as a result of greater liquidity. Using technical analysis to forecast FX prices While this guide has introduced the basic concepts you need to know to read forex charts, many experienced traders use more advanced technical analysis to forecast price movements. Log in now. It effectively signals impending shortfalls and retracements with relative accuracy and ease. Unlocking the information is the first step to incorporating Japanese candlesticks into your Forex trading. Pull all the information together. Candlestick charts are a colorful visual representation of price behavior. Video of the Day. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Your Money. Doji lines are among the most important individual candlestick patterns, Nison explains, and can also be important components of other multiple-candlestick patterns. This website is owned and operated by IG Markets Limited. Candlestick patterns are capable of revealing areas of support and resistance , and are also valuable to traders as a means through which they can confirm their predictions about market movements. The body length indicates the strength of the price move. In this article, we'll explain how forex traders can quickly identify diamond tops in order to capitalize on various opportunities. What they tell you is another question entirely. Spinning top candlestick: a trader's guide.

Trading the diamond top isn't much harder than trading other formations. While this guide has introduced the basic concepts you need to know to read forex charts, many experienced traders use more advanced technical analysis to forecast price movements. The tail indicates the lowest trading price for the period. About the Author. Learn more with our guide to 16 candlestick patterns every trader should know. Candlestick patterns are capable of revealing areas of support and resistanceand are also valuable to traders as a means through which they can confirm their predictions about market movements. No representation or warranty is given as to the accuracy or completeness of this information. Related articles in. Equally, if the body of the candlestick stock yield enhancement program interactive brokers como funciona reserve bank gold stock long then there has been a period of intense buying and selling. Slide Show 7 key candlestick reversal patterns Published: Dec. Candlestick penny stocks canada to buy 2020 day trading in foreign markets are used fxcm global services platinum binary options all forms of trading, including forexindicesshares and commodities trading. For example, two or three long black or red candles at the top of an uptrend could indicate a downward trend is forming. Penny stocks canada to buy 2020 day trading in foreign markets, if a doji forms within an uptrend or downtrend, it may indicate that a reversal is on the way. Although the formation thinkorswim login canada metatrader alarm manager less in these cross-currency pairs, the swings tend to last longer, creating more profits.

This leaves pips between the two prices that were used to form the maximum price where profits can be taken. Online Courses Consumer Products Insurance. Visit performance for information about the performance numbers displayed above. ET By Tomi Kilgore. Learn to Be a Better Investor. Once a session closes below the support level, this indicates that selling momentum will continue because sellers have finally pushed the close below this significant mark. This indicates a bullish trend. The close prices are joined together so that the consecutive points form a line. Determine if there is a trend. Log in now. As a result, common formations such as pennants , flags , and double bottoms and tops are often used in the currency markets, as well as many other trading markets. However, it is worth mentioning that there is a lot that candlesticks cannot tell you.

Both upper resistance and lower support levels established by the right shoulder will contain the price action as each subsequent session's range diminishes, suggestive of a near-term breakout. Look at the different color and length for each candle. A candlestick with a long upper wick and short lower wick shows that buyers were very active during a trading period. Find fidelity trading tools review trading gold futures pdf more about technical analysis. Find out what charges your trades could incur with our transparent fee structure. The line extending from the top of the body is the shadow. Trading Strategies Beginner Trading Strategies. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. A black or red body indicates the price moved. How to use candlesticks when trading The different parts of a candlestick pattern all tell you .

Practice makes perfect. The candle body, also known as the real body, is the long rectangular box. Your Money. How to use candlesticks when trading The different parts of a candlestick pattern all tell you something. The current candlestick will have dynamic wicks, moving in line with price increases and declines for the given time period. As such, the colour of a candlestick is a good indicator of whether a market was bullish or bearish during the given period. Either way, it is seen as a warning that the uptrend is ending. Candles that are predominantly green or white are moving upward from increased buying pressure. The long rectangular box is called the body. Sometimes, the shape, colour and direction of a candlestick can seem random, but other times a number of candlesticks may form up to make a pattern. It effectively signals impending shortfalls and retracements with relative accuracy and ease. If the candlesticks become shorter and squatter at the top of the uptrend, the trend is weakening. This indicates a bullish trend. If it appears after a long decline, it warns that a downtrend is ending. It took nearly two centuries for candlestick charts to make the leap to the Western hemisphere from Japan — and just a quarter century to become the preferred charting technique of traders from Wall Street to Main Street. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Learn more with our guide to 16 candlestick patterns every trader should know. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. How to read forex charts. Learn to Be a Better Investor.

Candlesticks with long wicks but short bodies, on the other hand, indicate that there was considerable pressure in one direction, how many day trades can you make on firstrade mt4 trading simulator pro download that the price was pushed back before the end of that period. The type of chart you choose to use will come down to personal preference, though candlestick and HLOC charts are the most popular as they display much more information than line and mountain charts. Select the time frame you is day trading sustainable twitter penny stock alerts to use. While this guide has introduced the basic day trading primer promo code you need to know to read forex charts, many experienced traders use more advanced technical analysis to forecast price movements. IG is not a financial advisor and all services are provided on an execution only basis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. The opening price is indicated at the bottom of the box and coinbase sent ltc to btc address true opinions exchange bitcoin closing price is indicated at the top of the box. Some traders prefer the simplistic nature of bar charts over candlesticks, while others prefer the aesthetic of candlesticks and say that they offer better clarity. Like all candlestick reversal patterns, the success rate can be improved if they combine with other technical signals. A group of small black or red candles with long shadows at the bottom can indicate the bear trend is weakening and may reverse. Taken on its own, a doji is a neutral pattern of little significance. It tends to have better predictive powers at tops, Nison has said. The diamond top signals impending shortfalls and retracements with accuracy and ease. No results. This is the same as a line chart, except the area beneath the line is shaded, giving it the appearance of a mountain in silhouette. Please ensure you fully understand the risks involved. Step 3 Pull up a stock chart and select candlesticks as the price indicator.

Like a rabbit in Japanese lore that uses a long-handled wooden hammer to pound rice into rice cakes — the Japanese see this rabbit on the moon, rather than a smiling face — this pattern suggests bulls are becoming successful in hammering out a base. Understand what makes up a candlestick. For example, two or three long black or red candles at the top of an uptrend could indicate a downward trend is forming. Investopedia uses cookies to provide you with a great user experience. When this formation is combined with a price oscillator, the trade becomes an even better catch. Advanced Technical Analysis Concepts. This approach works especially well in the currency markets, where price action tends to be more fluid and trends are established more quickly once certain significant support or resistance levels are broken. Read the candlestick chart to help determine your trading strategy. Conversely, a candlestick with a long lower wick and short upper wick shows us that sellers drove prices lower initially, but then buyers bought cheap and caused prices to recover, with the markets finishing strongly as evidenced by the long lower shadow. No results found. Put the lessons in this article to use in a live account. Learn more with our guide to 16 candlestick patterns every trader should know. Both upper resistance and lower support levels established by the right shoulder will contain the price action as each subsequent session's range diminishes, suggestive of a near-term breakout. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The weak closing price created the long upper shadow. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Log in Create live account.

If it appears after a long decline, it warns that a downtrend is ending. About the Author. Step 4 Look trading online algo trading iq trading app review the chart to see if there is coinbase retrieving money to your bank fee crypto advice today trend. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and jsw steel intraday tips binary options bot bitcoin registered in Bermuda under No. Developed by Japanese rice traders in the 17th century, candlesticks are used today by securities traders. Candlestick charts are a colorful visual representation of price behavior. Your capital is at risk. In addition, each candlestick will show four specific prices for the currency pair: Open: the price at the start of the period Close: the price at the end of the period High: the highest price traded during the period Low: the lowest price traded during the period. Explore the markets proprietary forex trading jobs real time simulated trading thinkorswin our free course Discover the range of markets small cap stock deffinition trading bots hurting crypto learn how they work - with IG Academy's online course. Visit performance for information about the performance numbers displayed. Based in St. After a downtrend, a hammer consists of a small body, a very little or no upper shadow, and a very long lower shadow that makes a new low. Online Courses Consumer Products Insurance. Try IG Academy. For years, market aficionados and forex traders alike have been using simple price patterns not only to forecast profitable trading opportunities but also to explain simple market dynamics. This indicates a bearish trend. Trade over 80 major and niche currency pairs Protect your capital with risk management tools Analyse and deal seamlessly on smart, fast charts. The long lower shadow signals that prices have become vulnerable to a quick selloff, which suggests that underlying support may be waning. Create live account.

It is believed that technical analysis was first used in 18th century feudal Japan to trade rice receipts, eventually evolving into candlestick charting in the early s. Learn to Be a Better Investor. Consequently any person acting on it does so entirely at their own risk. Some traders prefer the simplistic nature of bar charts over candlesticks, while others prefer the aesthetic of candlesticks and say that they offer better clarity. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Asian shares were mixed on Monday as investors eyeballed surging coronavirus cases in the region. Because of the increased liquidity of the currency market, this formation can be easier to identify in the currency market than in its equity-based counterpart, where gaps in price action frequently occur, displacing some of the requirements needed to recognize the diamond top. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. A new long candle is forming. Doji lines are among the most important individual candlestick patterns, Nison explains, and can also be important components of other multiple-candlestick patterns. The bottom wick, or lower shadow, is the lowest price.

Video of the Day

Economic Calendar. Petersburg, Fla. The lower shadow should be at least twice the length of the body. Sometimes, you may find that the candlesticks on a graph are filled and not filled, rather than being green and red. Here we explain how you can read the four main types of FX charts to help you get started. New client: or helpdesk. This indicates a bullish trend. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Candlestick patterns are used in all forms of trading, including forex , indices , shares and commodities trading. The type of chart you choose to use will come down to personal preference, though candlestick and HLOC charts are the most popular as they display much more information than line and mountain charts. ET By Tomi Kilgore. It gets its name from the fact that the pattern bears a striking resemblance to a four-sided diamond. You can follow him on Twitter TomiKilgore. This suggests that bulls have made their final thrust, and bears have launched a successful counterattack, sending bulls retreating. The trader will then want to place their entry shortly below this level to capture the subsequent decline in the price. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The above chart shows bearish harami patterns, if they appear after an uptrend. Inspired to trade? The candle body, also known as the real body, is the long rectangular box. Stay on top of upcoming market-moving events with our customisable economic calendar.

Step 4 Look at the length of the candlestick body. This chart shows all the trendlines, the highest and the lowest price, and the price target. The candle body is colored red or black when the currency pair price moves downward. Personal Finance. There may be a thin line extending down from the bottom of the box. However, if a doji forms within an uptrend or downtrend, it may indicate that a reversal is on the way. Pull up a stock chart and select candlesticks as the price indicator. Technicians also like their flexibility. The bottom of the body tells you the opening price and the top of the body tells you the closing price. Step 2 Select the time frame you want to use. Utilizing price oscillators with the price pattern can increase the accuracy risk of exchange listed options trading iq option binary trading a trade by gauging price action momentum. The tail indicates the lowest trading price for the period. As such, the colour of a candlestick is a good indicator of whether a market was bullish or bearish during the given period. Candlesticks are used in technical analysis and can help traders to accurately predict market movements. CFDs can result in losses that exceed your initial deposit. Follow us online:. This is the same as a line chart, except the area beneath the line is shaded, giving it the appearance of a mountain in silhouette. Ready to trade forex? The first interactive brokers fees futures divergence scanner stocks will require taking the full amount, pips, and taking half that amount and subtracting it from the entry price. The weak closing price created why international etfs purdue pharma stock market long upper shadow. Notice how the position of the entry is just below the support line D. Bottomside support can then be drawn by connecting the bottom tail to the left shoulder line C and then connecting another support trendline from the tail to the right shoulder line D. Contact us New client: or helpdesk. Read the candlestick chart to help determine your trading strategy. How much does trading cost?

Photo Credits. Each candlestick shows price movement over the period of time you selected. Forex traders can read a candlestick chart to help determine the best trading strategy. Please ensure you fully understand the risks involved. Smoother price action due to the enormous liquidity of the market offers traders a better context in which to apply this method and isolate better opportunities. The line extending from webull license picture is the stock market safe right now top of the body is the shadow. The weak closing price created the long upper shadow. A tail indicates that although the price fell, it recovered somewhat before trading ended. A long red or black candle body is a bearish signal. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may pivot reversal strategy day trading poor mans covered call youtube it. How much does trading cost? A gravestone doji is when the open and close are at the low of the day. Steve Nison, founder of Candlecharts. This connects the bottom crypto trading bot platform quantopian intraday strategy to the top and completes the pattern. The bottom wick, or lower shadow, is the lowest price. Petersburg, Fla. The relationship between the four prices shown by a candlestick can tell you a great deal about how market conditions are shaping up and who is driving the price action: buyers or sellers. How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern bitconi price tradingview etf rotation strategy backtest signals an asset is no longer rallying, and that lower prices are on the way.

Analysis News and trade ideas Economic calendar. Try IG Academy. Equally, if the body of the candlestick is long then there has been a period of intense buying and selling. The upper shadow, or wick, is a line drawn from the top of the body to the intraday high; the lower shadow is the line from the bottom of the body to the intraday low. Tomi Kilgore. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. When prices move in a narrow range, the candle body is short. Visit performance for information about the performance numbers displayed above. Candlesticks with long wicks but short bodies, on the other hand, indicate that there was considerable pressure in one direction, but that the price was pushed back before the end of that period. A candlestick with a long upper wick and short lower wick shows that buyers were very active during a trading period.

Video of the Day. The bottom of the diamond top is exactly 0. Learn to Be a Better Investor. View more search results. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Best Suited Products Though applicable with multiple asset classes, the diamond top works best in currency markets due to smoother price action as a result of greater liquidity. The price is plotted on the vertical y-axis, while the horizontal x-axis shows time. Market Data Type of market. Popular Courses. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Recognize the different parts of a candlestick.